Italy Gift Cards Market Size, Share, Trends and Forecast by Product, Card Type, Application, End User, and Region, 2026-2034

Italy Gift Cards Market Size and Share:

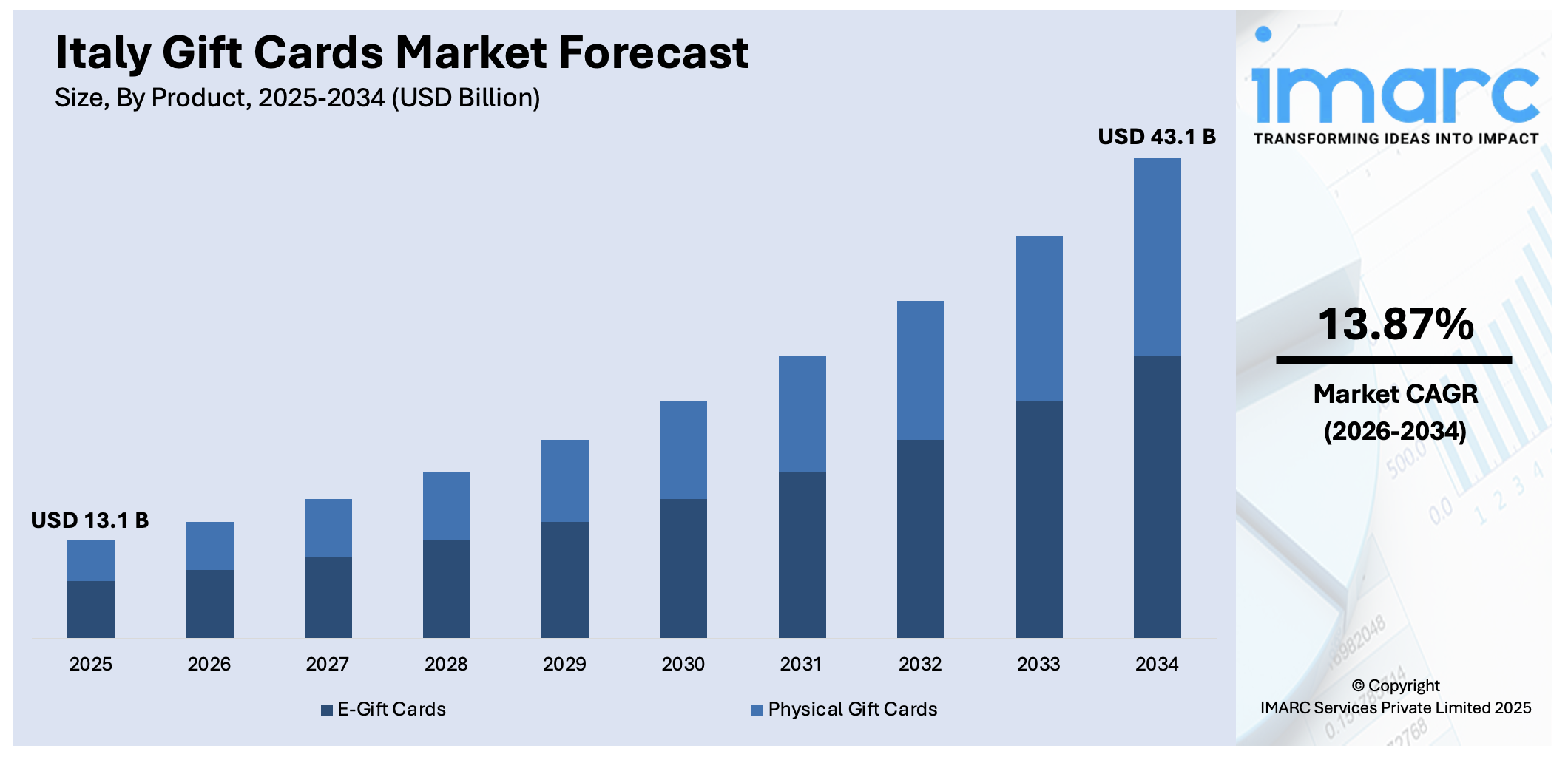

The Italy gift cards market size was valued at USD 13.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 43.1 Billion by 2034, exhibiting a CAGR of 13.87% during 2026-2034. The increasing consumer preference for personalized and convenient gift options, the rise of e-commerce platforms, growing corporate incentives and rewards programs, and the rising flexibility of gift cards for various occasions are some of the major factors propelling the Italy gift cards market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 13.1 Billion |

|

Market Forecast in 2034

|

USD 43.1 Billion |

| Market Growth Rate 2026-2034 | 13.87% |

In Italy, there is a steady rise in demand for gift cards that offer both convenience and customization. Consumers increasingly prefer gifting methods that save time and reduce the risk of mismatched purchases. Gift cards provide recipients with the ability to choose products or services according to their personal preferences, making them a more thoughtful and practical option. This shift is particularly evident during seasonal festivals and life events where gifting is a common tradition. The growing appeal of gift cards also aligns with changing consumer habits that prioritize freedom of choice and simplified transaction processes. As digital lifestyles become more prominent, people are drawn to gifting solutions that can be quickly purchased and shared. This has led retailers to focus on enhancing their gift card offerings, both in design and in user experience. Features like customizable values, secure digital delivery, and multi-platform usage are being emphasized. The trend reflects broader consumer behavior where practicality, immediacy, and personalization guide purchasing decisions.

To get more information on this market Request Sample

As more consumers turn to digital platforms for both daily and occasional purchases, the use of gift cards is rising in parallel. E-commerce websites often promote gift cards as simple and accessible gifting tools, which are easy to buy, send, and redeem without any physical contact. This suits the modern shopping behavior where speed and ease matter. The ability to instantly deliver a gift card online enhances its appeal, especially for last-minute gifting needs. Businesses are also using digital gift cards as incentives and rewards, further widening their use cases. While traditional payment preferences still exist in parts of Italy, the momentum is clearly shifting toward digital formats. This has encouraged improvements in digital infrastructure and payment systems that support secure and fast transactions, further propelling the market growth.

Italy Gift Cards Market Trends:

Consumer Preference for Convenience and Personalization

Gift cards have gained popularity in Italy as they simplify the gifting process while offering a tailored experience. By enabling recipients to select items or services of their choice, gift cards provide both ease and personalization, which resonates strongly during festive seasons and celebratory events. This blend of convenience and flexibility makes them an appealing option for modern consumers. A noteworthy development occurred in June 2022 when Apple revamped its gift card offerings in several European countries, including Italy. The updated version unified earlier cards like the iTunes and Apple Store variants into a single, multipurpose option. It is available in both physical and digital formats and can be purchased in standard denominations such as EUR 25, 50, or 100, or with a custom value. Virtual cards, often preferred for their speed and ease, are delivered directly to the recipient's inbox within minutes, aligning perfectly with the growing demand for digital convenience.

Growth of E-commerce Platforms

The expansion of online retail in Italy is playing a significant role in boosting the digital gift card segment. As more consumers turn to e-commerce for convenience and variety, platforms are increasingly integrating gift cards into their offerings, further propelling the Italy gift cards market growth. This creates an efficient and quick gifting alternative that matches the pace of digital lifestyles. Online gift card purchases and redemptions are streamlined and accessible, enhancing their attractiveness. According to the International Trade Administration, approximately 85% of Italians use the internet, and nearly 40 Million engage in online shopping. In 2022, Italy's e-commerce market generated roughly EUR 76 Billion in revenue, although inflation partially influenced this figure. Despite this growth, Italy still trails behind other European nations in broadband access, and many small businesses struggle to invest in digital infrastructure upgrades. Furthermore, the country continues to lean on cash, with 44% of transactions still conducted in cash during 2022, reflecting a gradual but ongoing transition to digital payments.

Italy Gift Cards Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Italy gift cards market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product, card type, application, and end user.

Analysis by Product:

- E-Gift Cards

- Physical Gift Cards

Italy’s increasing reliance on digital transactions has made e-gift cards highly popular, especially among younger consumers. Online shopping growth, ease of customization, and instant delivery make them an attractive choice. Many Italian retailers now integrate e-gift card features into mobile apps and loyalty systems. During holidays or emergencies, customers opt for digital gifting as a fast, practical solution. They’re also gaining traction in employee rewards, thanks to remote work setups. Rising digital literacy, smartphone usage, and the appeal of contactless options post-COVID have all contributed to a sharp rise in the use of e-gift cards across retail and corporate settings.

As per the Italy gift card market outlook, physical gift cards retain strong cultural relevance in Italy, especially among older age groups and during traditional celebrations. Italians often prefer the tangibility and perceived value of a physical card when presenting gifts for weddings, baptisms, or birthdays. Retailers use them as promotional tools, prominently displayed near cash counters to encourage impulse purchases. Their continued presence in both large stores and boutique outlets ensures that they remain a consistent revenue stream, balancing innovation with familiarity in the Italian gifting culture.

Analysis by Card Type:

- Closed-loop Card

- Open-loop Card

Closed-loop cards redeemable only at specific brands or stores are popular in Italy due to their usefulness in building customer loyalty. Retailers frequently issue them during seasonal promotions, offering added value or cashback benefits. Consumers often prefer them for trusted outlets, such as supermarket chains or clothing brands. They also serve as effective tools for limiting spend categories, making them ideal for corporate gifting or teenage use. Their brand-specific focus makes them an efficient channel for increasing customer retention and fostering brand exclusivity in a competitive market.

Open-loop gift cards are gaining momentum in Italy due to their flexibility and wide usability across stores and services. Operated through financial networks like Visa or Mastercard, they appeal to users seeking freedom of choice. Often used in formal gifting or reward settings, they serve as cash alternatives without security concerns. Corporate buyers favor them for employee rewards and client gifts due to their universal acceptance. Their growing presence in online and offline retail is steadily expanding their role in Italy’s digital payment ecosystem.

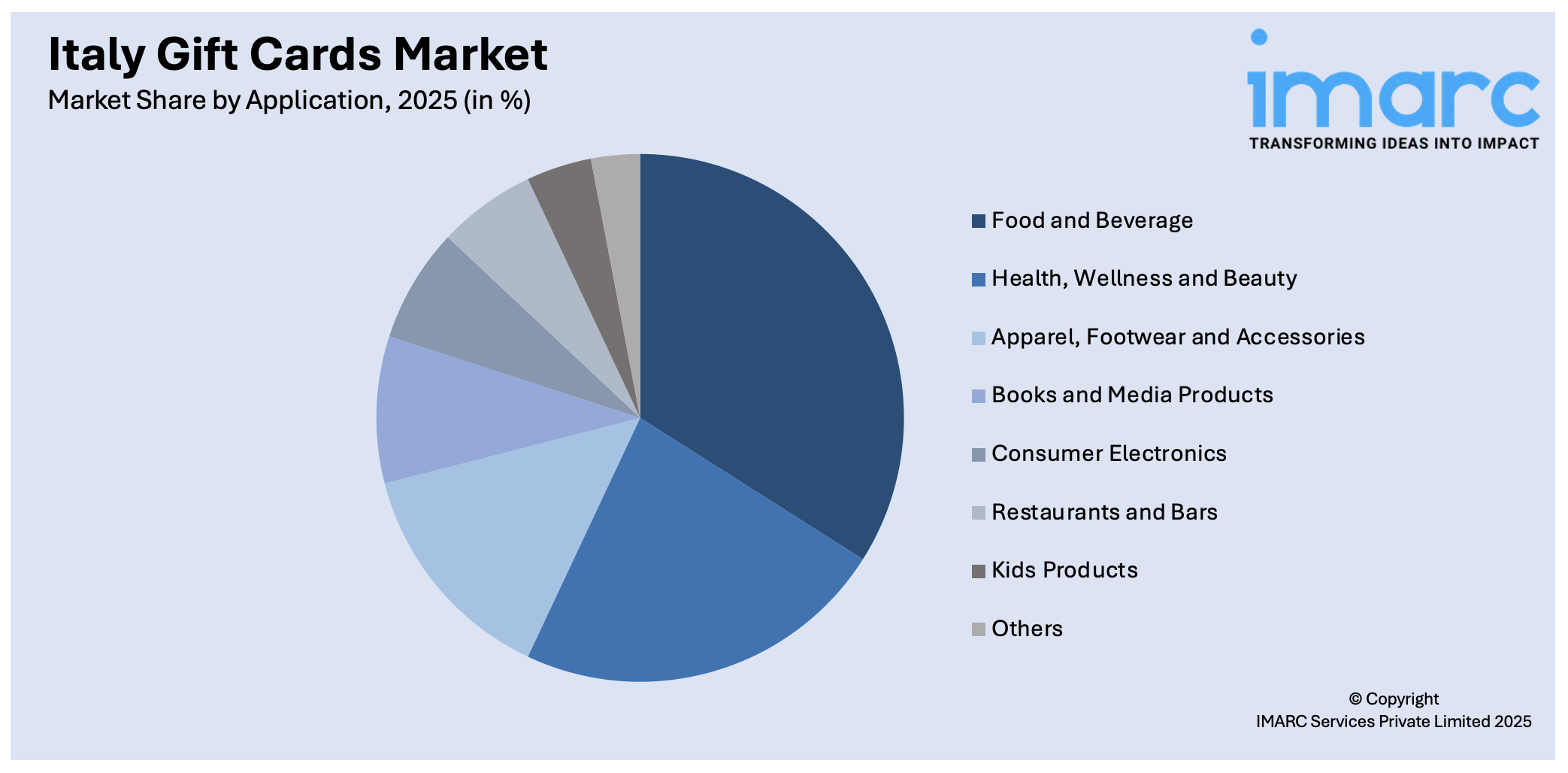

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Food and Beverage

- Health, Wellness and Beauty

- Apparel, Footwear and Accessories

- Books and Media Products

- Consumer Electronics

- Restaurants and Bars

- Kids Products

- Others

Gift cards for food and beverage purchases have become highly popular in Italy, where dining culture is deeply rooted. Supermarkets, gourmet stores, and delivery platforms use them as loyalty tools and seasonal gifts. Many families purchase these cards for household needs, while corporates distribute them during festive bonuses. As food inflation drives value-seeking behavior, prepaid cards offer budgeting benefits. Younger consumers also gift these cards for casual social occasions or to support local producers.

The growing wellness culture in Italy is fueling demand for gift cards in the health and beauty sectors. Spas, gyms, pharmacies, and skincare brands use them to attract experience-focused customers. Italians are gifting wellness packages massages, fitness plans, beauty kits to friends and family, especially during holidays. These cards are also popular as thank-you gestures or employee rewards. With increased awareness of mental health and physical well-being, demand has extended into supplements, organic products, and fitness gear. Retailers use curated bundles tied to gift cards to boost sales. Beauty and wellness gift cards offer aspirational value, making them ideal for self-care-oriented gifting.

Fashion-forward consumers in Italy are driving gift card demand in the apparel and accessories space. Clothing chains and boutique outlets alike promote cards during seasonal sales, especially Christmas and Easter. Shoppers prefer giving gift cards to allow recipients to choose sizes or styles, reducing return rates. Young consumers and teens receive them for birthdays or milestones. Corporate buyers also use fashion gift cards in incentive schemes, aligning rewards with personal preferences and lifestyle choices.

Books and media products remain a valued option for Italian consumers who want to give personalized gifts without guessing preferences. Popular during exam seasons, holidays, and birthdays, these cards cater to students, readers, and content consumers. Both physical bookstores and online platforms like Amazon or IBS use gift cards to boost prepaid sales. Parents often use them to encourage reading among children. Given Italy’s strong literary culture and rising demand for digital media, these cards balance educational value and entertainment.

Consumer electronics-focused gift cards are thriving due to Italy’s rising tech adoption and love for gadgets. Smartphones, accessories, gaming gear, and smart home devices are top recipients of such cards. They are commonly gifted to teens, students, and professionals during birthdays, graduations, or promotions. Retailers use them to increase store footfall, particularly during major sales like Black Friday. They also allow recipients to combine cards for larger purchases, adding perceived value.

Restaurants and bars widely used dining gift cards, blending convenience with cultural value. Local eateries, café chains, and high-end restaurants offer them as prepaid experiences. Popular for anniversaries, date nights, and casual gifting, these cards help businesses attract repeat visits. Food delivery services also issue them as promotional tools. The hospitality sector leverages gift cards to rebuild customer engagement post-pandemic. Many bars and bistros tie them to curated tasting events or chef specials, adding experiential appeal.

Parents and relatives in Italy increasingly use gift cards for kids products to navigate varying preferences in toys, games, and educational items. These cards are commonly gifted during birthdays, holidays, or religious celebrations like baptisms and First Communions. Toy retailers and baby care brands use them to drive prepaid footfall. Educational app stores and learning platforms also issue digital cards for subscriptions or in-app purchases. Gift cards simplify gifting for extended family members and help avoid repeat or unsuitable gifts.

Analysis by End User:

- Retail

- Corporate

Retail gift cards dominate Italy’s gifting landscape due to their wide consumer reach and seasonal demand. Supermarkets, fashion outlets, bookstores, and department stores drive usage through gift card promotions and bundled offers. Shoppers use them during Christmas, Easter, and school openings. Retailers design custom cards aligned with marketing campaigns, boosting brand recall. Many brands integrate cards with loyalty programs, improving customer retention. Consumers find retail cards helpful for budgeting or splitting larger purchases. As multi-brand stores and online platforms expand, retail gift cards continue to attract a steady stream of both new and repeat buyers across Italy’s evolving retail scene.

Corporates are increasingly adopting gift cards as tools for employee rewards, customer appreciation, and festive bonuses. Companies find them efficient for tax-advantaged gifting under set thresholds. Open-loop and category-specific cards offer flexibility and are perceived as more personal than cash. They are used in wellness incentives, performance recognition, or end-of-year gifts. With rising focus on employee satisfaction and non-cash rewards, corporate demand is rising across sectors. Vendors offer bulk purchases with personalization, making them ideal for SMEs and large enterprises alike.

Regional Analysis:

- Northwest

- Northeast

- Central

- South

- Others

The Northwest region, including Milan and Turin, is Italy’s commercial and financial hub, contributing significantly to gift card sales. High retail density, urban affluence, and strong digital infrastructure support both e-gift and physical card transactions. Fashion and tech retailers in Milan drive premium card sales, especially during Fashion Week or Christmas. Corporates in this region use cards extensively for employee incentives. The presence of global brands and large retail chains encourages wider card variety. E-commerce penetration is high, pushing digital card use. As reflected in the Italy gift cards market forecast, the Northwest remains the country’s most mature and innovation-driven region for gift card adoption.

Northeast Italy, home to cities like Venice, Verona, and Bologna, combines tourism, manufacturing, and cultural vibrancy, creating diverse demand for gift cards. Tourists frequently purchase dining and experience gift cards, especially around festivals. Locals use cards across fashion outlets, bookstores, and food chains. Businesses in this industrial zone also use prepaid cards for blue- and white-collar employee bonuses. Universities in Bologna and Padua contribute to youth-driven demand, especially for digital media and apparel cards. The mix of urban and semi-urban retail development supports both modern and traditional card formats. Local businesses have also embraced gift cards to support post-pandemic recovery.

Central Italy, including Rome and Florence, offers a blend of tourism, heritage retail, and government employment. Gift cards for books, fashion, and wellness are popular among urban families and professionals. Government institutions and corporates in Rome use them for employee and stakeholder gifting. Florence’s art and culture scene creates niche demand for experience and boutique gift cards. The tourism industry pushes cards for museums, restaurants, and guided services. Students and academics also fuel demand in university cities. The central region’s balanced economy and cultural leaning make it a consistent contributor to national gift card trends across retail and experience-based sectors.

Southern Italy, covering Naples, Bari, and surrounding areas, is witnessing the gradual adoption of gift cards as digital infrastructure improves. Traditional gifting culture is giving way to modern practices, especially among youth. Prepaid cards for food, electronics, and health products are gaining popularity. Regional chains and supermarkets are expanding card offerings to attract budget-conscious shoppers. While physical cards still dominate due to local preferences, digital adoption is increasing in urban pockets. Gift cards also help families manage expenses and serve as controlled spending tools. Tourism and remittance-backed gifting contribute to market growth, making the South an emerging area for future expansion.

Others regions like Sicily and Sardinia, and smaller provinces with niche markets. Here, gift card adoption is slower but rising, aided by local retailer promotions and digital access. Tourism is a major driver, with restaurants, spas, and adventure operators offering prepaid experiences. Government schemes or NGOs sometimes distribute gift cards for essential supplies. Younger populations returning from mainland cities bring digital habits, supporting e-gift card growth. Local retail chains are also launching region-specific cards with cultural themes. Though smaller in volume, these areas present untapped potential, especially through mobile-based platforms and tourism-led gifting initiatives.

Competitive Landscape:

The report provides a detailed competitive landscape analysis, examining market structure, leading player positions, and strategic initiatives contributing to success. It includes tools like a competitive dashboard and company evaluation quadrant to highlight key strengths and focus areas. Full profiles of major companies are featured, outlining core strategies, market share, and recent developments to aid informed decision-making.

Latest News and Developments:

- March 2025: Klarna partnered with Blackhawk Network (BHN) to expand its Gift Card Store into Italy, Germany, and The Netherlands. This followed successful launches in the US and UK. The partnership offered consumers flexible payment options for a wide selection of global and local brand gift cards.

- January 2025: Bahrain-based Investcorp announced it would acquire Italian payments company Epipoli from Bregal Milestone and founder Gaetano Giannetto. Investcorp planned to support Epipoli's European growth, focusing on CRM, loyalty programs, gift cards, and prepaid cards.

- December 2024: Edenred completed the acquisition of IP’s energy cards business in Italy. The deal enhanced Edenred's offerings in gift cards, alongside EV solutions and fleet management tools.

Italy Gift Cards Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | E-Gift Cards, Physical Gift Cards |

| Card Types Covered | Closed-loop Card, Open-loop Card |

| Applications Covered | Food and Beverage, Health, Wellness and Beauty, Apparel, Footwear and Accessories, Books and Media Products, Consumer Electronics, Restaurants and Bars, Kids Products, Others |

| End Users Covered | Retail, Corporate |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy gift cards market from 2020-2034.

- The Italy gift cards market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key markets within the region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy gift cards industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Italy gift cards market was valued at USD 13.1 Billion in 2025.

The Italy gift cards market is projected to exhibit a CAGR of 13.87% during 2026-2034, reaching a value of USD 43.1 Billion by 2034.

Key factors driving the Italy gift cards market include rising e-commerce adoption, growing demand for cashless transactions, increasing use during holidays and special occasions, corporate gifting trends, and expanding digital payment infrastructure. Personalization and flexible redemption options also enhance consumer interest and market penetration.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)