Italy Construction Market Report by Product (Heavy and Civil Engineering, General Construction), Sector (Urban, Rural), Category (New, Renovation), End User (Public, Private), and Region 2026-2034

Italy Construction Market Overview:

The Italy construction market size reached USD 2,15,705.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,68,319.0 Million by 2034, exhibiting a growth rate (CAGR) of 2.38% during 2026-2034. The increasing government infrastructure investments, urbanization trends, rising focus on renovation, favorable energy efficiency initiatives, surging demand for residential and commercial properties, and the adoption of advanced construction technologies are some of the major key factors impelling the market demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2,15,705.2 Million |

|

Market Forecast in 2034

|

USD 2,68,319.0 Million |

| Market Growth Rate 2026-2034 | 2.38% |

Access the full market insights report Request Sample

Italy Construction Market Trends:

Increased government infrastructure investments

Recognizing the critical role of infrastructure in economic development, the Italian government has launched numerous initiatives to modernize and expand the country's infrastructure. These initiatives include large-scale projects such as the development of transportation networks, including highways, railways, and airports, as well as the enhancement of public utilities like water and energy systems. Along with this, Italy is doubling down on its infrastructure with an unprecedented investment of €447.8 billion, marking a historic milestone for the nation. The emphasis is on improving road networks, which include major projects like the Messina Bridge, and developing high-speed rail networks, which will eventually connect major cities like Genoa to Milan, Verona to Padua, and ultimately Bari. These initiatives stimulate economic activity, create jobs, and improve connectivity and accessibility, thereby strengthening the market demand.

Emphasis on renovation and energy efficiency

Italy has a large stock of aging buildings that require modernization to meet current safety standards and improve energy efficiency. To promote the renovation of residential and commercial properties, the government has implemented a number of incentives and tax relief programs. For instance, the Superbonus 110% initiative provides substantial tax deductions for energy efficiency improvements and seismic retrofitting. This initiative has led to a surge in renovation projects across the country. Additionally, there is an increasing demand for green buildings that incorporate sustainable design principles and energy-efficient technologies. This trend is driven by both regulatory requirements and growing environmental awareness among consumers and businesses. The push for energy efficiency and sustainable construction practices is fostering innovation in building materials and techniques, further encouraging the market growth.

Adoption of advanced construction technologies

The construction industry is increasingly integrating digital tools and innovative technologies to enhance productivity, efficiency, and safety. Building Information Modeling (BIM) is becoming a standard practice, allowing for better project planning, design, and management. BIM facilitates collaboration among stakeholders and helps in identifying potential issues early in the project lifecycle, reducing costs and delays. Additionally, technologies such as prefabrication and modular construction are gaining traction, enabling faster and more cost-effective construction processes. Drones are being used more often for site surveying and monitoring, and robotics is being used more often for jobs like pouring concrete and laying bricks. These technologies improve accuracy, reduce labor costs, and enhance safety on construction sites, thereby aiding in market expansion.

Italy Construction Market News:

- In February 2024, Italy announced its plans to construct the world's longest suspension bridge, featuring a 3,660m overall length and a 3,300m single suspended span. The bridge will have a 600-meter-wide navigation channel and be supported by two towers that are 399 meters tall. The goal of this massive project is to break the current record for suspension bridges worldwide.

Italy Construction Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product, sector, category, and end user.

Product Insights:

To get detailed segment analysis of this market Request Sample

- Heavy and Civil Engineering

- Bridges

- Roads

- Railways

- Airports

- Others

- General Construction

- Residential

- Houses

- Apartments

- Others

- Commercial

- Hotels

- Offices

- Hospitals

- Malls/Multiplexes

- Educational Institutes

- Others

- Industrial

- Chemical and Pharmaceutical

- Metal and Category Processing

- Textiles

- Oil and Gas

- Others

- Residential

The report has provided a detailed breakup and analysis of the market based on the product. This includes heavy and civil engineering (bridges, roads, railways, airports, and others) and general construction [residential (houses, apartments, and others), commercial (hotels, offices, hospitals, malls/multiplexes, educational institutes, and others), and industrial (chemical and pharmaceutical, metal and category processing, textiles, oil and gas, and others)].

Sector Insights:

- Urban

- Rural

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes urban and rural.

Category Insights:

- New

- Renovation

The report has provided a detailed breakup and analysis of the market based on the category. This includes new and renovation.

End User Insights:

- Public

- Private

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes public and private.

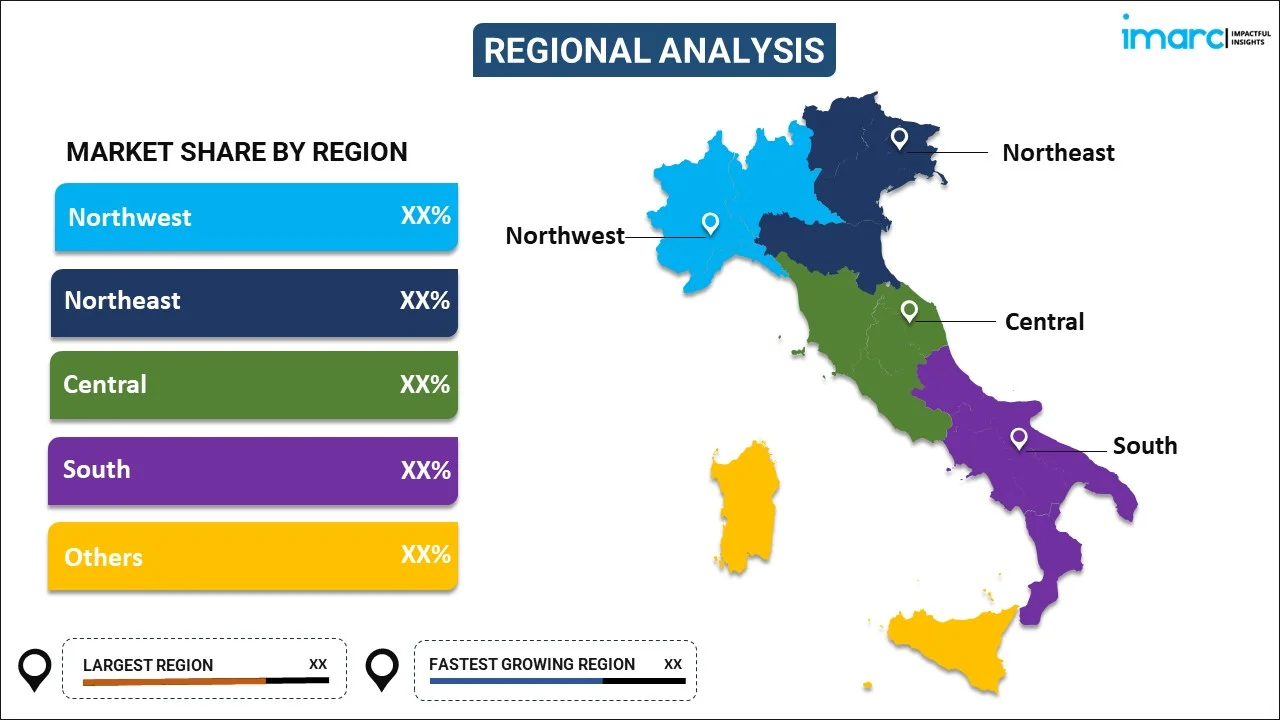

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Construction Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Sectors Covered | Urban, Rural |

| Categories Covered | New, Renovation |

| End Users Covered | Public, Private |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy construction market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Italy construction market?

- What is the breakup of the Italy construction market on the basis of product?

- What is the breakup of the Italy construction market on the basis of sector?

- What is the breakup of the Italy construction market on the basis of category?

- What is the breakup of the Italy construction market on the basis of end user?

- What are the various stages in the value chain of the Italy construction market?

- What are the key driving factors and challenges in the Italy construction?

- What is the structure of the Italy construction market and who are the key players?

- What is the degree of competition in the Italy construction market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy construction market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy construction market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)