Italy Bottled Water Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Packaging Type, and Region, 2025-2033

Italy Bottled Water Market Overview:

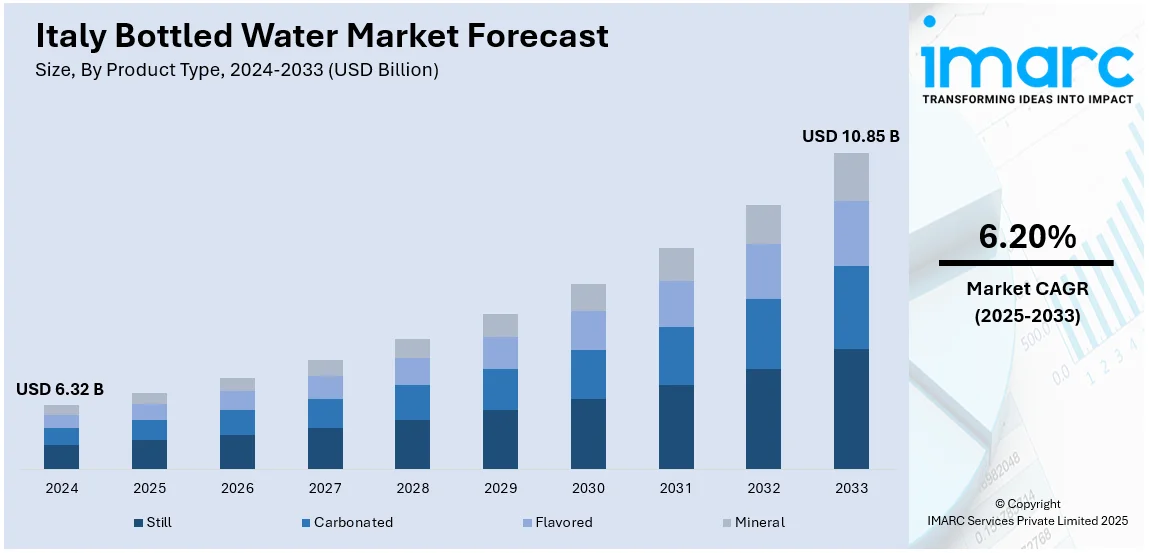

The Italy bottled water market size reached USD 6.32 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.85 Billion by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033. The increasing health consciousness among consumers, rapid product premiumization and growing concerns about tap water quality are some of the key factors influencing the Italy bottled water market share. Additionally, continual packaging innovation, increasing export opportunities, and strong marketing strategies are propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.32 Billion |

| Market Forecast in 2033 | USD 10.85 Billion |

| Market Growth Rate (2025-2033) | 6.20% |

Italy Bottled Water Market Trends:

Rising health consciousness among consumers

The rising awareness about health maintenance among individuals significantly influences the Italy bottled water market growth. As individuals prioritize their health, there is a marked preference for water, particularly mineral water, over beverages containing artificial sweeteners. Mineral water, recognized as a pure source of hydration, offers essential minerals and nutrients. There is a growing trend among young consumers towards adopting healthier lifestyles and eschewing drinks perceived as detrimental to health. The perception that bottled water undergoes rigorous regulatory and filtration processes enhances its appeal, suggesting superior safety and quality compared to tap water. Consequently, companies are positioning their bottled water products as health-enhancing, thereby fostering a positive market outlook.

Emerging innovations in packaging

Companies are focusing on creating unique, functional, and sustainable packaging solutions that appeal to a broad range of consumers. Lightweight, easy-to-handle bottles are becoming more common, offering greater convenience and portability, which is positively influencing the Italy bottled water market outlook. Moreover, eco-conscious packaging including biodegradable and reusable bottles, is gaining popularity as consumers increasingly demand sustainable alternatives. Packaging innovation also extends to design, with aesthetically pleasing and ergonomically designed bottles that appeal to premium and health-focused consumers. Additionally, packaging innovation is helping to reduce production and transportation costs, making bottled water more affordable for consumers while maintaining profitability for manufacturers. By focusing on packaging improvements, bottled water companies are meeting consumer expectations for both practicality and environmental responsibility, contributing to market growth.

Marketing and branding strategies

Brands are leveraging various advertising platforms to promote the health benefits, purity, and unique qualities of their bottled water products. Campaigns often focus on the natural origin of the water, its mineral content, or its eco-friendly packaging to appeal to health-mindful and environmentally conscious individuals. Sponsorships of sports events, collaborations with wellness influencers, and engaging social media campaigns are also common tactics used to target younger consumers who prioritize fitness and sustainability. Additionally, the leading brands are placing an enhanced emphasis on the product quality, using branding elements such as sleek designs and premium packaging to attract higher-income consumers willing to spend more on high-quality water. By continuously investing in strong marketing efforts, companies not only maintain customer loyalty but also attract new buyers. These strategies are key in a competitive market where differentiation is crucial for capturing consumer attention.

Italy Bottled Water Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, distribution channel, and packaging type.

Product Type Insights:

- Still

- Carbonated

- Flavored

- Mineral

The report has provided a detailed breakup and analysis of the market based on the product type. This includes still, carbonated, flavored, and mineral.

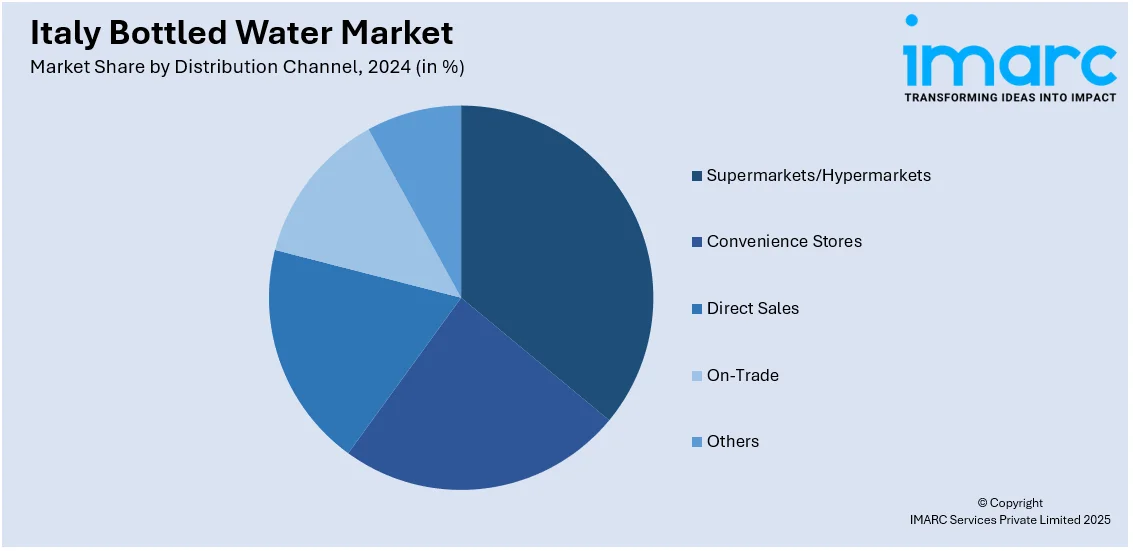

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, direct sales, on-trade, and others.

Packaging Type Insights:

- PET Bottles

- Metal Cans

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes pet bottles, metal cans, and others.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Bottled Water Market News:

- In May 2023, Acqua Sant'Anna, an Italian mineral water company, announced to upgrade its bottling capacity with Krones' ErgoBloc L technology, enabling the filling of both carbonated and non-carbonated water at high speeds. The company installed two new lines in its Vinadio plant, expanding its production to meet growing demand. These advancements highlight Acqua Sant'Anna's commitment to innovation and efficiency in water bottling.

Italy Bottled Water Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still, Carbonated, Flavored, Mineral |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Direct Sales, On-Trade, Others |

| Packaging Types Covered | PET Bottles, Metal Cans, Others |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy bottled water market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy bottled water market on the basis of product type?

- What is the breakup of the Italy bottled water market on the basis of distribution channel?

- What is the breakup of the Italy bottled water market on the basis of packaging type?

- What are the various stages in the value chain of the Italy bottled water market?

- What are the key driving factors and challenges in the Italy bottled water market?

- What is the structure of the Italy bottled water market and who are the key players?

- What is the degree of competition in the Italy bottled water market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy bottled water market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy bottled water market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy bottled water industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)