IT Services Market Size, Share, Trends and Forecast by Service Type, Enterprise Size, Deployment Mode, End Use Industry, and Region, 2025-2033

IT Services Market Size and Trends:

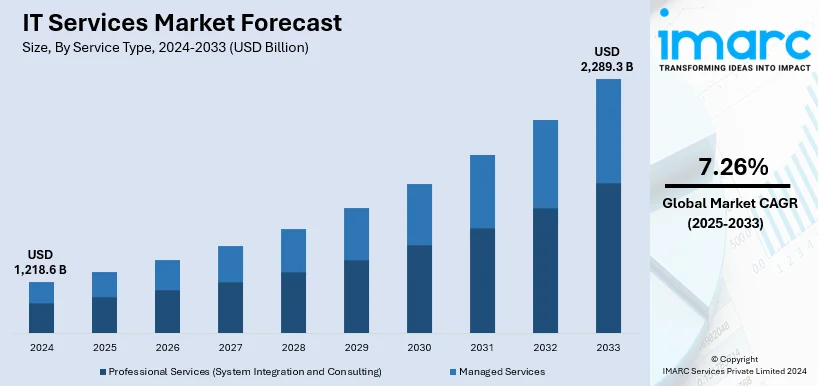

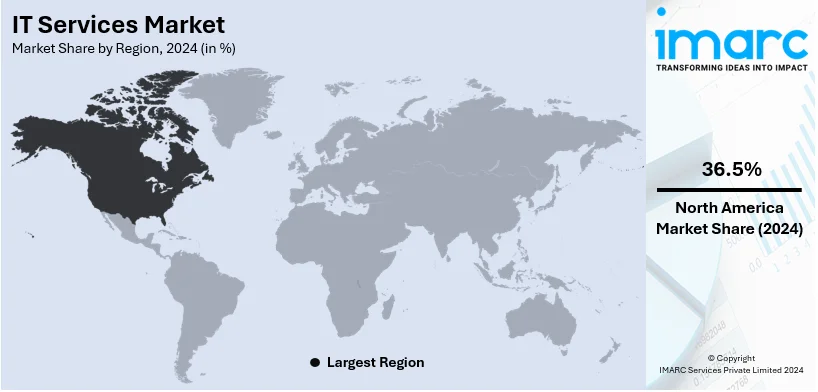

The global IT services market size was valued at USD 1,218.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,289.3 Billion by 2033, exhibiting a CAGR of 7.26% during 2025-2033. North America currently dominates the market, holding a significant market share of 36.5% in 2024. Because of its strong technological infrastructure, widespread use of cutting-edge technologies like cloud computing and artificial intelligence (AI), and plenty of top international IT companies, North America leads the world IT service market share. Its status as the biggest regional market is further reinforced by high demand from industries like retail, healthcare, and finance as well as major investments in innovations and digital transformation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,218.6 Billion |

| Market Forecast in 2033 | USD 2,289.3 Billion |

| Market Growth Rate 2025-2033 | 7.26% |

Rapid adoption of cutting-edge technologies like cloud computing, AI, and the Internet of Things (IoT), which improve operational efficiency and scalability for organizations, is positively influencing the IT service market growth. The need for IT consulting, implementation, and managed services is increasing as a result of the growing digital transformation projects in a variety of industries, including healthcare, banking, and retail. The market is expanding because of the growing requirement for strong cybersecurity solutions brought on by an increase in cyberthreats. Additionally, the need for IT infrastructure modernization and support services is increasing due to the growth of remote working trends. The market for IT services is growing rapidly due to ongoing advancements in data analytics, automation, and software development as well as the requirement for new technologies to be integrated seamlessly.

The United States has emerged as a major region in the market because of an increasing number of businesses across all key sectors namely manufacturing, retail, healthcare, and finance is engaging in digital changes. Firms are investing in the latest technologies, such as big data analytics, cloud computing and artificial intelligence (AI), in a bid to streamline their operations and gain benefit over their competitors. The concern for IT service goes higher as well with the increased focus on cybersecurity aimed at tackling ever-growing cyberthreats. There is also a rising demand for robust IT resources, assistance, and managed services due to the shift to remote and hybrid models in many workplaces. There are also major IT companies in the country and constant research and development (R&D) expenditures stimulate innovations and expansion of markets. The growth of the market is also enhanced by government initiatives that promote digitization of the country as well as advancements in 5G and IoT technologies. The IMARC Group’s report shows that the United States managed services market is expected to reach USD 171.7 Billion by 2033.

IT Services Market Trends:

Escalating demand for digital transformation

Rapid technological advancements are compelling businesses to embark on digital transformation journeys to remain competitive, which is supporting the IT services market share. Trends like 5G, Blockchain, AR, and AI, are prompting organizations to recognize the imperative of evolving their operations, processes, and customer interactions through technology. Moreover, the amount of data generated worldwide is increasing significantly. To optimally utilize these data reserves, IT service providers must develop smart IT services and platforms. IT services providers are guiding companies through this transition, offering expertise in areas, such as software modernization, data analytics, and cloud integration, thereby bolstering the market growth.

Rising cybersecurity concerns

With the expanding digital ecosystems, the risks associated with cyber threats and data breaches are also rising. Moreover, the growing number of data breaches, cost concerns over product customization, and data migration are some of the reasons posing a threat to the market outlook. Moreover, increasing cases of trusted insider threats are augmenting the need for robust IT cybersecurity solutions to mitigate the risking of insider trading and disclosure of confidential information to the employees. Additionally, the growing emphasis on cybersecurity compliance and regulations is further catalyzing the demand for specialized IT services that provide protection against cyber threats.

Increasing adoption of cloud computing

IT cloud services are witnessing significant growth due to the massive cloud deployments across the end-user industries. Enterprises are seeking to leverage the scalability, flexibility, and cost savings offered by cloud platforms. As a result, the IT services market demand related to cloud strategy, migration, and management is bolstering. Additionally, companies are transforming towards implementing hybrid cloud in their business operations. So, key players are offering cloud services that enable enterprises to efficiently manage their hybrid multi-cloud infrastructure. Furthermore, cloud computing can make it easier for modern businesses to connect their apps across different types of cloud systems. It can automate the process, management, and observability of application connectivity in public and private clouds. This helps companies manage their infrastructure, even when it's spread out across different cloud setups.

IT Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global IT services market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on service type, enterprise size, deployment mode, and end use industry.

Analysis by Service Type:

- Professional Services (System Integration and Consulting)

- Managed Services

Professional services (system integration and consulting) stand as the largest component in 2024, holding 64.0% of the market. Professional services cater to businesses seeking expert guidance in navigating complex technology landscapes, ensuring seamless integration of diverse systems, and optimizing operations for efficiency. Moreover, with the implementation of the General Data Protection Regulation (GDPR), NIST Cybersecurity Framework is compelling businesses to opt for IT professional services for regulatory adherence. This addresses the increasing demand for professional services to support digital transformation initiatives.

Analysis by Enterprise Size:

- Small and Medium-sized Enterprises

- Large Enterprises

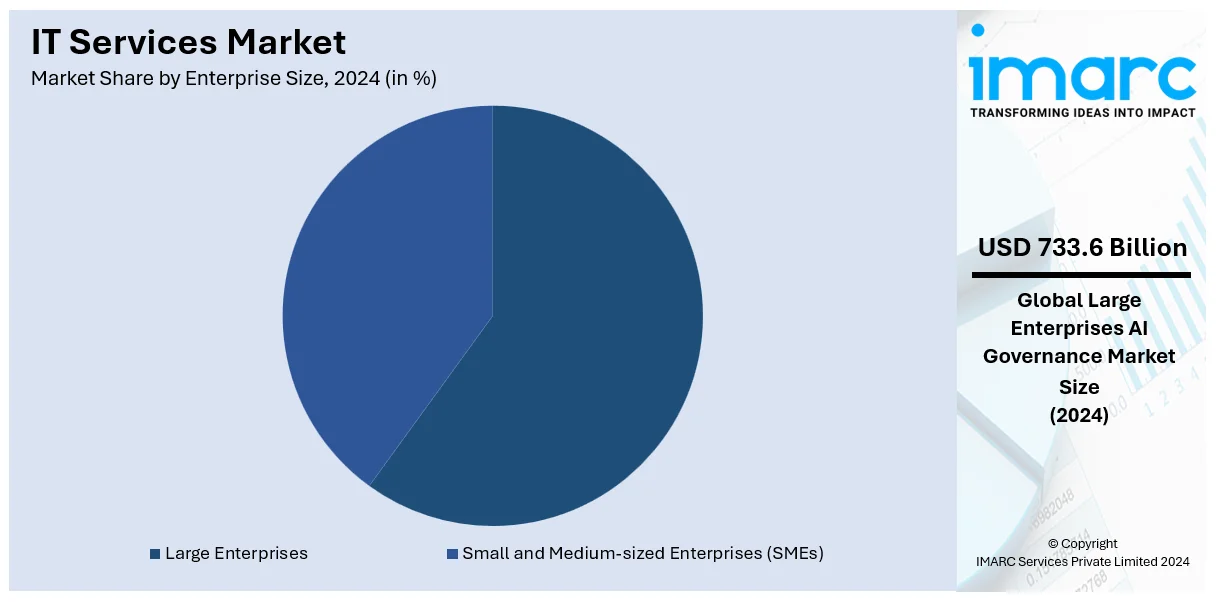

As per the IT services market trends, large enterprises lead the industry with 60.2% of market share in 2024. Large enterprises with complex infrastructures require specialized services, such as managed services and cybersecurity solutions, to optimize their extensive operations and safeguard critical data. The rising need for seamless communication, cloud integration, and advanced analytics is propelling the adoption of IT services. Various large enterprises are signing deals with IT service providers to reduce software costs and enable their employees to become familiar with professional service types quickly, which is supporting the market growth.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

According to the IT services market forecast, cloud-based leads the industry with 54.6% of market share in 2024. The cloud-based model offers scalability, flexibility, and remote accessibility, aligning with the growing preference for agile operations and cost-effective solutions. Moreover, large businesses are rapidly adopting cloud services due to on-demand availability. Additionally, the expanding use of cloud services is supported by improved security, automatic updates, and accessibility from any location. This deployment model's dominance is further supported by the growth of remote work, digital transformation projects, and cutting-edge cloud services like multi-cloud and hybrid cloud.

Analysis by End Use Industry:

- BFSI

- Telecommunication

- Healthcare

- Retail

- Manufacturing

- Government

- Others

Because of its crucial reliance on cutting-edge technologies for operations, customer engagement, and regulatory compliance, the BFSI sector is the largest end-use industry in the market. IT services are used by financial institutions for risk management, fraud detection, digital banking, and smooth transaction processing. The demand for IT solutions is driven by the industry's requirement for strong cybersecurity to safeguard sensitive data. Furthermore, the industry's reliance on IT services is increased by the emergence of fintech technologies, mobile banking, and customized consumer experiences. The drive for digital transformation and growing regulatory requirements solidify BFSI's position as the industry leader for IT services.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounts for the largest market share of 36.5% as per the IT services market outlook. Because of its sophisticated technological infrastructure, early adoption of cutting-edge technologies like cloud computing, artificial intelligence (AI), and big data, and the presence of significant international IT corporations, North America dominates the market. Significant investments in digital transformation across sectors like healthcare, finance, and retail are supported by the region's robust economy. The market is expanding due to the high demand for cybersecurity solutions brought on by an increase in cyberthreats. Furthermore, the extensive use of IoT and 5G technologies fosters innovation and connectivity. North America's position as the largest market for IT services is strengthened by the government's support for digital projects and its strong emphasis on research and development (R&D) activities.

Key Regional Takeaways:

United States IT Services Market Analysis

In 2024, United States accounts for 73.90% of the total North America IT services market share. The IT services market in the US is driven by the increasing adoption of cloud computing, artificial intelligence (AI), and automation across various industries. As businesses continue to digitalize, the demand for IT services to support data storage, cybersecurity, and system integration is increasing. Furthermore, the growing reliance on big data analytics for business insights is creating a need for specialized IT services to manage and process vast amounts of information. The US market is also experiencing significant growth due to advancements in 5G technology, which enables innovative applications across sectors like healthcare, finance, and retail. Additionally, the growing focus on cybersecurity amid rising cyber threats is rising the need for robust IT security solutions. With a highly competitive business environment and a strong technology infrastructure, companies in the US are increasingly turning to managed services providers and cloud service providers to maintain business continuity, enhance operational efficiency, and achieve scalability.

Europe IT Services Market Analysis

The European IT services market is being propelled by several key drivers, including the increasing adoption of cloud computing, data analytics, and artificial intelligence (AI). Organizations across various sectors are increasingly turning to IT service providers to facilitate digital transformation initiatives and improve operational efficiency. As businesses strive to remain competitive, the growing demand for IT outsourcing and managed services is becoming prominent, allowing organizations to focus on core competencies while leveraging the expertise of IT service providers. Furthermore, the rising importance of cybersecurity, driven by stringent data protection regulations, such as GDPR, is catalyzing the demand for specialized IT security services. The region is also witnessing significant investments in automation and robotics, which are driving demand for software solutions and system integration services. The growing trend toward Industry 4.0, along with the shift towards remote work and e-commerce, is also creating the need for IT infrastructure management services. Additionally, the European market is witnessing strong government initiatives to promote digital innovation and smart city developments, which further enhance the demand for IT services.

Asia Pacific IT Services Market Analysis

The IT services market in the Asia-Pacific (APAC) region is expanding rapidly, driven by digital transformation initiatives across both developed and emerging economies. Key factors include the accelerated adoption of cloud technologies and enterprise mobility solutions, particularly in countries like China, India, and Japan. Increasing internet penetration is driving the demand for IT services related to mobile applications, e-commerce, and digital payment platforms. Additionally, the growing emphasis on cybersecurity and the integration of AI-driven solutions into various industries are supporting the market growth. The region’s focus on smart cities and IoT applications is catalyzing the demand for IT infrastructure and services. The dynamic business environment and government support for technology innovations further enhance the demand for IT services, particularly in sectors like manufacturing, retail, and healthcare.

Latin America IT Services Market Analysis

The Latin American market is expanding very quickly owing to the fact that various industries are being increasingly digitized due to the growing internet accessibility and access to mobile devices. Another key driver is the growth of e-commerce in the region which is increasing the need for IT services associated with online payment and transactions. Furthermore, this region is experiencing greater expenditure in cybersecurity as companies seek to safeguard critical information. Technology-led initiatives are also being promoted by the governments in the region especially in education, health care, and manufacturing. The shift towards mobile banking and the usage of digital payment applications is bringing exciting prospects for companies providing IT services in the market.

Middle East and Africa IT Services Market Analysis

The growth of IT services in the Middle East and Africa has been exponential, owing to the continued uptake of digital transformation in key industries like oil and gas, healthcare, and finance. Cloud services, IOT, and big data innovations are providing new avenues for IT services and solution providers. In addition, the region’s investment in smart cities, technology-led government programs, and increasing demand for cybersecurity are enhancing the market expansion. Demand for IT managed services and security solutions which provide elevated levels of IT operational effectiveness is increasing as organizations in MEA further embrace more IT infrastructure as well as digital solutions.

Competitive Landscape:

To stay ahead of the competition, major firms in the IT services sector are concentrating on innovations, digital transformation, and strategic alliances. To improve service offerings, they are making significant investments in cutting-edge technologies like blockchain, cloud computing, AI, and machine learning (ML). Targeting new markets and industries, many are extending their worldwide reach through partnerships and mergers and acquisitions (M&A). Growing cyber dangers are increasing the focus on cybersecurity services, and businesses are creating cutting-edge solutions to protect critical data. To satisfy a range of customer needs, they are also concentrating on hybrid and multi-cloud techniques. Personalized services and round-the-clock assistance are examples of customer-centric strategies that are becoming more valued. To increase operational effectiveness and cut expenses, these players are also utilizing automation and data analytics.

The report provides a comprehensive analysis of the competitive landscape in the IT services market with detailed profiles of all major companies, including:

- Accenture plc

- Capgemini SE

- Cisco Systems Inc.

- Cognizant

- Dell Technologies Inc.

- HCL Technologies Limited

- Hewlett Packard Enterprise Company

- Infosys Limited

- Microsoft Corporation

- TATA Consultancy Services Limited

- Toshiba Corporation

- Wipro Limited

Latest News and Developments:

- September 2024: IBM has expanded its consulting services to help clients optimize Oracle's cloud applications and generative AI. Research from the IBM Institute for Business Value projects 89% rise in compute costs by 2025, with 42% of executives concerned about a lack of AI expertise. In response, IBM is deploying a global network of certified consultants skilled in Oracle technologies and IBM's watsonx AI platform to address these challenges.

- May 2024: SolarWinds has announced the launch of SolarWinds® AI, a generative AI engine designed to enhance IT operations and assist tech professionals in managing modern digital environments. Developed under the company’s new AI by Design framework, SolarWinds® AI prioritizes privacy, security, and reliability while advancing AI capabilities for IT management.

- February 2024: Skyhigh Security launched the addition of managed & professional IT services to its Altitude Partner Program. These professional services will help companies complete their product development and resell SkyHigh Security solutions.

IT Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered |

|

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Deployment Modes Covered | On-premises, Cloud-based |

| End Use Industries Covered | BFSI, Telecommunication, Healthcare, Retail, Manufacturing, Government, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture plc, Capgemini SE, Cisco Systems Inc., Cognizant, Dell Technologies Inc., HCL Technologies Limited, Hewlett Packard Enterprise Company, Infosys Limited, Microsoft Corporation, TATA Consultancy Services Limited, Toshiba Corporation, Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the IT services market from 2019-2033.

- The IT services market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the IT services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

IT services encompass a range of solutions provided to businesses and individuals to optimize, manage, and support technology systems. They include consulting, software development, infrastructure management, cloud computing, cybersecurity, and technical support. They can improve efficiency, enhance data security, and enable digital transformation, helping organizations leverage technology to achieve operational goals and maintain a competitive edge.

The IT Services market was valued at USD 1,218.6 Billion in 2024.

IMARC estimates the global IT Services market to exhibit a CAGR of 36.5% during 2025-2033.

Key market trends leading the IT services market include the rapid adoption of advanced technologies like cloud computing, AI, and IoT, along with increasing digital transformation initiatives across industries. The growing demand for cybersecurity solutions, rise of remote work, and need for scalable, cost-effective IT infrastructure is offering a favorable market outlook.

Professional services (system integration and consulting) represent the largest segment these services are essential for implementing, integrating, and optimizing IT solutions tailored to meet complex organizational needs.

Large enterprises account for the majority of the market share due to its extensive IT infrastructure and services to support diverse operations, ensuring efficiency and scalability.

Cloud-based exhibits a clear dominance in the market on account of its flexibility, scalability, and cost-effectiveness, meeting the evolving needs of modern businesses.

BFSI holds the biggest market share driven by its reliance on IT services for digital banking, cybersecurity, and regulatory compliance.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global IT Services market include Accenture plc, Capgemini SE, Cisco Systems Inc., Cognizant, Dell Technologies Inc., HCL Technologies Limited, Hewlett Packard Enterprise Company, Infosys Limited, Microsoft Corporation, TATA Consultancy Services Limited, Toshiba Corporation, Wipro Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)