IT Operations Analytics Market Size, Share, Trends and Forecast by Type, Application, Deployment, End Use, and Region, 2025-2033

IT Operations Analytics Market Size and Share:

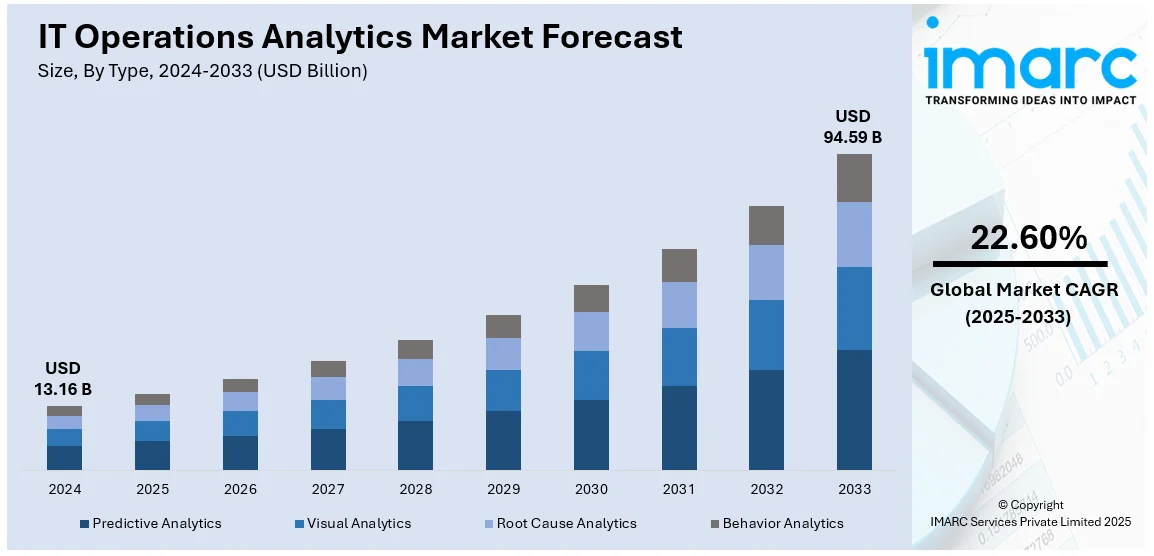

The global IT operations analytics market size was valued at USD 13.16 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 94.59 Billion by 2033, exhibiting a CAGR of 22.60% from 2025-2033. North America currently dominates the market, holding a market share of over 37.4% in 2024. The market is primarily driven by the rising IT infrastructure complexity, growing adoption of cloud technologies, increasing demand for real-time analytics, the proliferation of big data and internet of things (IoT), and significant advancements in artificial intelligence (AI) driven tools.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.16 Billion |

| Market Forecast in 2033 | USD 94.59 Billion |

| Market Growth Rate (2025-2033) | 22.60% |

The global market is primarily influenced by the increasing complexity in IT environments, fueled by the proliferation of hybrid and multi-cloud infrastructures, which increased the demand for advanced analytics to ensure operational efficiency. Also, the growing adoption of artificial intelligence (AI) and machine learning (ML) technologies within IT operations analytics (ITOA) solutions enables predictive and prescriptive analytics, which facilitates market expansion. According to a survey conducted by LogicMonitor in 2024, 81% of enterprises plan increased AI investment in ITOps, with 68% leveraging AI for anomaly detection, 63% achieving proactive operations, and 59% exceeding ROI expectations. Future trends include AI convergence with IoT and edge computing, along with growing adoption of explainable AI to enhance trust and decision-making. Moreover, rising digital transformation trends across industries requiring more secure IT operations to address changed business demands, is providing an impetus to the market.

The United States stands out as a key regional market, driven by the augmenting demand for end-user experience enhancements with minimal downtime and smooth performance of applications. For example, with increasing threats and the requirement to enhance security measures against them, several organizations have adopted ITOA for the detection of anomalies and response to incidents. For example, on August 5, 2024, IBM introduced generative AI enhancements to its Threat Detection and Response Services, integrating the Cybersecurity Assistant built on its watsonx platform. This innovation accelerates threat investigations by 48%, streamlines operational tasks, and enhances SOC efficiency with AI-driven insights and automation. It empowers security teams to proactively address threats, improving response times and strengthening overall security posture. The growth is further supported by increasing practices of DevOps, which highlights more agility and continuous monitoring practices. Apart from this, compliance requirements for regulatory and other service-level agreements ensure continued investment in ITOA technologies.

IT Operations Analytics Market Trends:

Integration of Observability Platforms

The integration of observability platforms in IT operations is a significant trend shaping the market dynamics, as it provides end-to-end visibility across applications, infrastructure, and network layers. It integrates metrics, logs, and traces to ensure a unified view of performance. This holistic approach helps teams correlate data from disparate sources, identify root causes faster, and optimize resource utilization. Observability platforms change for dynamic environments like Kubernetes and serverless architectures so organizations can manage their complexity in real time. The convergence of observability and analytics is reshaping how enterprises monitor and improve their IT ecosystems, thereby strengthening market demand. For example, on December 17, 2024, Groundcover integrated its eBPF-based observability platform with OpenTelemetry, broadening the insights into performance, user behavior, and errors. This integration allows users to use distributed tracing to follow service interactions while employing eBPF for the collection of very detailed information, such as user IDs, device types, and error messages, all in one place.

Automation through AIOps

Automation of IT operations through artificial intelligence (AI) is positively impacting the market growth. Artificial intelligence for IT operations (AIOps) platforms automate mundane tasks, detect anomalies, and forecast probable failures using AI and machine learning (ML). It provides insights at unprecedented speed. Moreover, AIOps help in self-healing systems by automating workflows in incident response, reducing the time spent on downtime, and enhancing service reliability. With IT environments becoming increasingly complex, the necessity of automation in smoothing operations is on the rise, as it enables IT teams to focus on strategic activities rather than just troubleshooting in reactive modes. For example, on October 15, 2024, startup Keep raised USD 2.5 Million in a pre-seed round for its AIOps platform designed to assist IT operations teams in managing and reducing alert fatigue. The platform integrates data from multiple infrastructure services and observability tools, providing enriched alerts with additional context to streamline incident management. This platform addresses the increasing demand for intelligent solutions to optimize IT operations in complex environments.

Growing Adoption of Cloud-Native ITOA Solutions

Cloud computing prompted ITOA vendors to develop cloud-native solutions. These solutions handle scale, elasticity, and complexity in multi-cloud and hybrid-cloud environments. Cloud-native ITOA tools leverage microservices, serverless computing, and container orchestration frameworks. It allows for smooth integration with the providers of cloud services to enable continuous analytics as applications scale or migrate. Besides this, these solutions generally offer on-demand scalability and lower operational overhead, keeping up with the trend in the modernization of the IT environment and optimization of cost in an increasingly cloud-first world. For instance, on November 4, 2024, HCLTech announced plans to open its fifth global AI/Cloud Native Lab in Singapore, which is expected to be operational in 2025. The Singapore Economic Development Board is supporting the lab and will aim at accelerating AI initiatives for regional enterprises, offering integrated AI and Generative AI solutions.

IT Operations Analytics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global IT operations analytics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, deployment, and end use.

Analysis by Type:

- Predictive Analytics

- Visual Analytics

- Root Cause Analytics

- Behavior Analytics

Predictive analytics leads the market with around 39.2% of market share in 2024. Predictive helps organizations predict and address problems before they become too complex. Advanced algorithms and machine learning (ML) models help predict and analyze vast amounts of historical and real-time data to identify patterns, forecast potential disruptions, and optimize resource allocation. This proactive approach not only reduces system downtime but also enhances operational efficiency and user experience, which are critical factors in a competitive market. As businesses increasingly adopt cloud computing, IoT, and complex IT infrastructures, the demand for predictive capabilities grows, ensuring scalability and reliability. Furthermore, its ability to provide actionable insights aligns with the rising focus on data-driven decision-making, positioning predictive analytics as a cornerstone in the expansion of the market.

Analysis by Application:

- Asset Performance Management

- Network Management

- Security Management

- Log Management

Network management leads the market in 2024, as it allows companies to preserve smooth connections as well as optimize performance and preempt and solve impending problems. As businesses are adopting hybrid and cloud-based infrastructures, the demand for advanced network management tools has increased. These tools provide real-time visibility, analytics-driven insights, and automation capabilities, enabling enterprises to identify network bottlenecks and reduce downtime. The growing reliance on data-driven decision-making drives the adoption of network management applications as they facilitate predictive analytics and improve operational efficiency. Furthermore, the proliferation of IoT devices and edge computing increases the demand for robust network management that can deal with the volume of data and interconnected systems. By integrating with ITOA platforms, network management solutions help the market grow through increased scalability, security, and operational reliability.

Analysis by Deployment:

- On-Premises

- Cloud

Cloud based leads the market with around 64.2% of market share in 2024. With the rapid trend toward hybrid and multi-cloud infrastructures, cloud-based ITOA solutions create integrated, centralized monitoring throughout diversified environments. This deployment model supports real-time data collection and analytics that empower businesses to proactively manage IT operations, improve performance, and respond to issues in a much shorter time. The accessibility of cloud-based tools, along with low upfront infrastructure costs, made them especially attractive to small and medium-sized enterprises (SMEs). Advances in artificial intelligence (AI) and machine learning (ML) within cloud platforms also boost their ability to predict and mitigate operational risks. The emerging trend of remote work and digital transformation initiatives also accelerates the demand for cloud-based ITOA solutions, thus making them vital for achieving efficient and resilient IT operations.

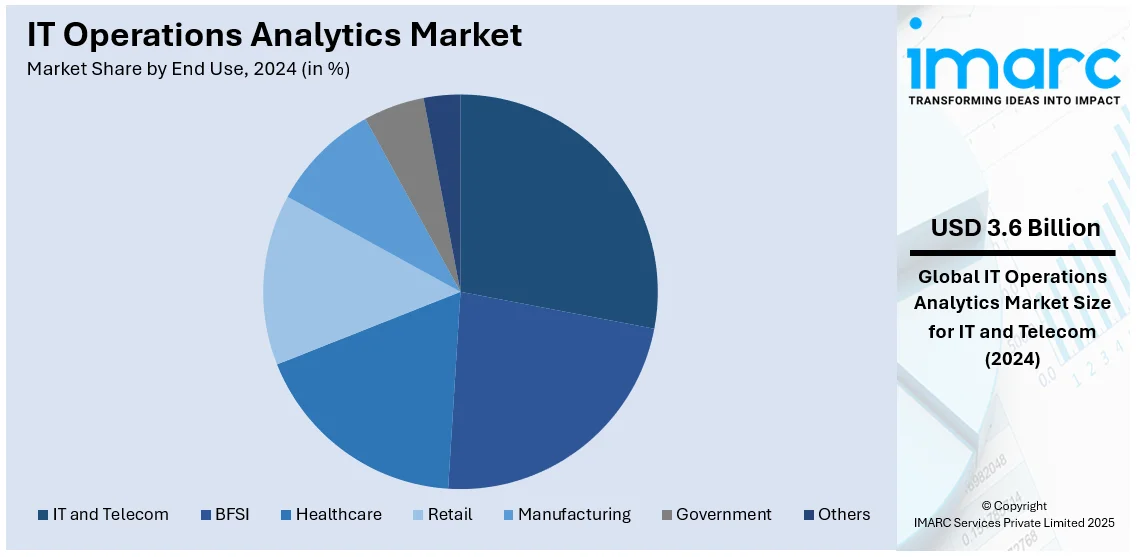

Analysis by End Use:

- BFSI

- Healthcare

- Retail

- Manufacturing

- Government

- IT and Telecom

- Others

IT and telecom lead the market with around 27.5% of market share in 2024. IT and telecom rely heavily on complex, large-scale networks, and systems. These organizations need advanced analytics to monitor, manage, and optimize their IT infrastructure so that service delivery remains uninterrupted, and operations are smooth. With the growth of data volumes due to the adoption of 5G, IoT, and edge computing, IT and telecom companies adopt ITOA solutions to manage real-time data processing, detect anomalies, and predict system failures. Investment in automation and predictive analytics drive the sector's focus on reducing operational costs while improving service quality. Moreover, the increasing demand for cybersecurity and compliance in IT and telecom infrastructures further emphasizes the adoption of sophisticated ITOA platforms, which further solidifies their role in market expansion.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America accounted for the largest market share of over 37.4% due to the progressive technological infrastructure of the region, high adoption of the digital transformation strategy, and the presence of key players. Organizations in the United States and Canada are heavily investing in modernizing IT infrastructures, using analytics to maximize operational efficiency and improve decisions. The region's cloud adoption, big data analytics, and artificial intelligence (AI) trends further increase the demand for ITOA solutions as they allow enterprises to have effective management of complex IT environments. Furthermore, the requirement for cybersecurity and regulatory compliance is enhancing the adoption of advanced analytics tools to monitor and secure IT operations. North America is characterized by a strong economy, high internet penetration, and an innovation-driven culture that makes it a leader in driving advancements and growth in the global IT operations analytics market landscape.

Key Regional Takeaways:

United States IT Operations Analytics Market Analysis

The United States is a significant region in the North America IT operations analytics with the market share of 84.70%, as it hosts many of the world's leading technology companies and startups, ensuring constant innovation in analytics tools and solutions. For example, on November 5, 2024, IOTA Software secured USD 10.4 Million in Series A2 funding, led by Altira Group, with participation from Aramco Ventures, Oxy Technology Ventures, and Second Avenue Partners. This investment facilitates the expansion of IOTA's engineering, product, and customer success teams, as well as enhancements to its technology infrastructure and marketing strategies. IOTA's cloud-native platform consolidates critical business and operations data, enabling industrial enterprises to optimize performance and enable informed decisions. The region offers an abundant setting for ITOA technologies, with a developed IT infrastructure and extensive utilization of cloud computing, artificial intelligence, and machine learning. The growing complexity of IT environments and the requirement for real-time data insights have driven demand across finance, healthcare, and retail industries. Regulatory requirements for data management and security further highlight the need for sophisticated analytics solutions. In addition, an established ecosystem of skilled professionals and robust research and development (R&D) investments amplify the U.S. role in shaping global ITOA trends.

Europe IT Operations Analytics Market Analysis

Europe is a crucial region in the market due to the mature technology ecosystem and a significant focus on compliance and data governance. In the region, highly regulated industries like banking, healthcare, and telecommunications are shifting data platforms to cloud-based, which requires IT operations analytics (ITOA) for optimizing data management and operational processes in a cloud environment. For example, on December 26, 2024, BBVA announced its transition of the European data platform to Amazon Web Services (AWS). This strategic move aims to enhance the bank's data management capabilities, improve operational efficiency, and accelerate the development of innovative financial solutions. By leveraging AWS's cloud infrastructure, BBVA seeks to strengthen its position in the competitive financial services sector. With continuous digital transformation projects, many European nations have taken up the technologies of cloud, IoT devices, and AI-driven analytics. This builds a solid requirement for more advanced IT management solutions. Established technology clusters across the UK, France, and Germany accelerate innovative developments, further facilitating the adoption of ITOA. Furthermore, the sustainable and smart city projects pursued by the European Union enhance data complexity, which demands analytics in optimizing IT infrastructures. A combination of regulatory drivers and technological advancements in Europe justifies its importance in the global ITOA market.

Asia Pacific IT Operations Analytics Market Analysis

Asia Pacific stands out as the fast-expanding market with the region's diversified, expanding economies. According to the International Data Corporation report, generative AI is significantly transforming IT operations (ITOps) across the Asia/Pacific region. Nearly 43% of surveyed organizations are exploring generative AI applications, and 55% of financial and telecom firms investing in 2023. The technology enhances operational efficiency, mitigates risks, and automates workflows, especially in cost-sensitive environments. IDC also emphasized the growing adoption of predictive analytics, AIOps, and hybrid cloud management, driven by the region's digital-first business strategies. Due to increased investments in digital infrastructures and an enormous rate of smart device penetration in countries like China, India, Japan, and South Korea, large volumes of data are produced, necessitating insights from IT operations analytics for enterprises. Significant drivers for analytics solutions in the region are burgeoning e-commerce, telecommunications, and manufacturing sectors. Another factor is the growth in 5G networks, and improvements in artificial intelligence (AI) and machine learning (ML) significantly contribute to the adoption of ITOA technologies. Most organizations in the Asia Pacific are using analytics to improve scalability and enhance agility in operations, which mirrors the region's importance in determining global market trends and innovation in ITOA.

Latin America IT Operations Analytics Market Analysis

Latin America is emerging in the IT operations analytics market due to its continuously growing digital economy and increase in adoption of automation and data-driven decision-making. Businesses from these sectors, like manufacturing, retail, and financial services, embrace ITOA to optimize IT performance with reduced costs and enhance their customer experiences. Advanced analytics for complex infrastructures, such as hybrid IT and cloud migration, also have seen an increased need in this region. The new startups and strategic partnerships between companies are developing in countries like Brazil, Mexico, and Chile to help the innovation in analytics solutions designed for regional needs. For example, on September 6, 2024, TRAX Analytics announced a strategic partnership with Comnet to expand its operations in Latin America. The partnership focuses on delivering advanced IoT and smart infrastructure solutions to enhance business efficiencies in the region. This collaboration highlights the increasing demand for innovative IT and analytics solutions in the Latin American market. Additionally, a rising focus in Latin America on operational resilience, driven by economic fluctuations and competition, has been driving enterprises to utilize real-time insights. These developments highlight the region's increasing importance in the global ITOA landscape as it seeks to bridge digital transformation gaps.

Middle East and Africa IT Operations Analytics Market Analysis

The Middle East and Africa region emerges as a high-growth region for IT operations analytics as more digital transformation initiatives and advanced technologies are being adopted across the region. Governments, as well as enterprises within the region, are increasing their investments in smart cities and expanding cloud infrastructures. Notably, on December 20, 2024, Saudi Arabia, in partnership with the World Bank, implemented its "Cloud First" policy to drive digital transformation, enhance public services, and stimulate economic growth. By establishing robust strategies and forming global partnerships, the Kingdom is effectively addressing challenges such as skill shortages and data localization, thereby creating a sustainable, cloud-driven ecosystem. This initiative aims to transition 50% of public agencies to cloud services by 2025 and achieve 80% adoption by 2030. This transition requires advanced tools like ITOA to monitor, analyze, and optimize cloud-based IT infrastructures effectively. With rapid urbanization and fast-growing penetration of mobile and internet services, data generation soars high, which warrants analytics to optimize IT operations. Industries such as oil and gas, telecommunication, and banks also enable use of ITOA for better and more efficient operational performances and sophisticated IT environment management. The dynamic market for tailored ITOA applications in the MEA continues to grow steadily.

Competitive Landscape:

The IT operations analytics market is highly competitive due to the rapid proliferation of advanced technologies, along with increased complexities in IT environments. In line with this, companies and other key players in the industry are focused on developing innovative solutions with the integration of artificial intelligence, machine learning, and big data analytics to provide the demand for real-time insights and automation. Companies are improving their predictive analytics, observability, and AIOps capabilities in accordance with rising operational challenges to create differentiation in their offerings. Investments in R&D, partnerships, and the cloud-native scenery are also features of the marketplace, reflecting the shift toward hybrid and multi-cloud strategies. For instance, on September 25, 2024, Splunk announced that it is rapidly integrating with technology from Cisco to ensure seamless activity between their platforms while providing higher-level threat detection capabilities. Leveraging Cisco's networking skills and Splunk's data analytics proficiency, the integration would improve security and observability for organizations. The partnership expects to provide customers with better insights and streamlined operations in managing their IT infrastructures. This dynamic environment fosters continuous innovation to cater to diverse industry needs.

The report provides a comprehensive analysis of the competitive landscape in the IT operations analytics market with detailed profiles of all major companies, including:

- BMC Software, Inc.

- ExtraHop Networks

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Precisely Holdings, LLC

- Pure Storage, Inc

- Splunk LLC

- Zoho Corporation Pvt. Ltd

Latest News and Developments:

- December 26, 2024: Microsoft introduced AIOpsLab, an open-source AI framework for developing, testing, and enhancing AIOps agents for cloud environments. Supported by Azure AI Agent Service, AIOpsLab features an intermediary interface, workload and fault generator, and observability layer to simulate real-world scenarios and refine agent performance. It supports tasks like incident detection, localization, root cause diagnosis, and mitigation. Designed for developers and researchers, AIOpsLab aims to standardize and improve AIOps capabilities and is freely available on GitHub under the MIT license.

IT Operations Analytics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Predictive Analytics, Visual Analytics, Root Cause Analytics, Behavior Analytics |

| Applications Covered | Asset Performance Management, Network Management, Security Management, Log Management |

| Deployments Covered |

On-Premises, Cloud |

| End Uses Covered | BFSI, Healthcare, Retail, Manufacturing, Government, IT and Telecom, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East, Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Brazil, Mexico |

| Companies Covered | BMC Software, Inc., ExtraHop Networks, Hewlett Packard Enterprise Development LP, International Business Machines Corporation, Precisely Holdings, LLC., Pure Storage, Inc., Splunk LLC, Zoho Corporation Pvt. Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the IT operations analytics market from 2019-2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global IT operations analytics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the IT operations analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global IT operations analytics market was valued at USD 13.16 Billion in 2024.

The global IT operations analytics market is estimated to reach USD 94.59 Billion by 2033, exhibiting a CAGR of 22.60% from 2025-2033.

The global market is driven by the increasing complexity of IT infrastructures, which necessitates advanced tools for monitoring and managing systems. The growing adoption of cloud-based solutions and virtualization has amplified the need for real-time analytics to ensure seamless operations, which also facilitates market growth.

North America currently dominates the global IT operations analytics market. The dominance is driven by the early adoption of advanced analytics technologies, a robust IT infrastructure, and the presence of leading technology companies offering innovative solutions.

Some of the major players in the global IT operations analytics market include BMC Software, Inc., ExtraHop Networks, Hewlett Packard Enterprise Development LP, International Business Machines Corporation, Precisely Holdings, LLC, Pure Storage, Inc, Splunk LLC, and Zoho Corporation Pvt, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)