IT Asset Disposition Market Size, Share, Trends and Forecast by Service, Asset Type, Enterprise Size, Industry Vertical, and Region, 2025-2033

IT Asset Disposition Market Size and Share:

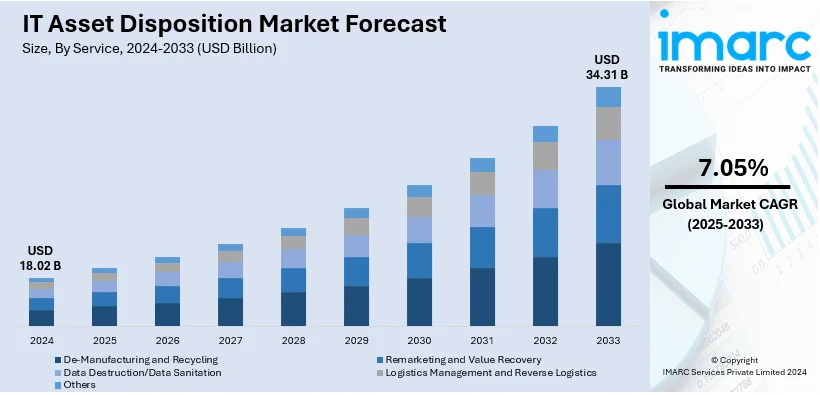

The global IT asset disposition market size was valued at USD 18.02 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 34.31 Billion by 2033, exhibiting a CAGR of 7.05% from 2025-2033. North America currently dominates the market in 2024 with a significant IT asset disposition market share of 35.0%. The increasing stringency of e-waste regulations, the augmenting demand for environmentally responsible IT asset disposal methods, rising concerns regarding data security, and the growing need for secure data destruction and cost recovery from retired IT assets, along with the implementation of corporate sustainability initiatives are some of the major factors driving the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 18.02 Billion |

| Market Forecast in 2033 | USD 34.31 Billion |

| Market Growth Rate (2025-2033) |

7.05%

|

The IT asset disposition (ITAD) market is growing due to the increasing need for secure disposal of outdated IT equipment to protect sensitive data and meet regulatory requirements. Several 2024 industry reports highlight a rise in e-waste, rising five times faster than documented recycling efforts. Data security concerns are significant, with cases like Josh Frantz uncovering over 300,000 personal files on 85 used devices. ITAD solutions address this by securely erasing or destroying data, mitigating risks of breaches, which averaged USD 4.45 Million per incident in 2023. Additionally, continual technological advancements driving frequent IT upgrades, rising environmental awareness, stricter government regulations, and the push for circular economy practices are fueling demand for ITAD services worldwide. Notably, on February 7, 2024, Quantum Lifecycle Partners LP announced the expansion of its operations with the launch of a new IT Asset Disposition (ITAD) facility in Edmonton, Alberta. This facility will enhance the company’s capabilities in responsible electronics recycling and secure IT asset management. The expansion reflects Quantum's commitment to sustainability and growth in Canada's technology lifecycle services sector.

The United States is a key regional market and is primarily driven by stringent data privacy laws like the CCPA and HIPAA, mandating secure handling of obsolete IT equipment. Rapid technological advancements and frequent IT infrastructure upgrades are significantly increasing e-waste volumes, fueling IT asset disposition market demand services. Growing awareness of corporate sustainability goals and responsible e-waste management are further propelling the market. Non-compliance penalties and the rising adoption of certified ITAD solutions for material recovery and cost-saving benefits are also driving growth. On December 21, 2024, ERI, a leading US-based e-waste recycling and IT asset disposition (ITAD) company was recognized as a Representative Vendor in the 2024 Gartner Market Guide for IT Asset Disposition (ITAD). This acknowledgment highlights ERI's commitment to providing sustainable, secure, and compliant ITAD solutions. The company is celebrated for its leadership in e-waste recycling and data protection services across the ITAD industry.

IT Asset Disposition Market Trends:

Rising Stringent E-Waste Regulations

The increasing implementation of strict environmental regulations mandating proper disposal and recycling of electronic waste are pushing organizations to adopt ITAD services to comply with legal requirements. Billions of dollars-worth of critically valuable resources were dissipated and thrown away. Precisely 1% of rare earth element need is met by e-waste recycling. The production of electronic waste globally is increasing at a rate five times higher than that of recorded e-waste recycling; the UN's fourth Global E-waste Monitor (GEM) revealed recently. The 62 Million Tons of e-waste produced in 2022 would fill 1.55 Million 40-tonne trucks, approximately enough trucks to form a bumper-to-bumper line encircling the equator, as described by ITU and UNITAR. Presently, less than one quarter (22.3%) of the year's e-waste mass was recorded as having been adequately collected and recycled in 2022, leaving USD 62 Billion worth of recoverable natural resources unexplained for and rising pollution hazards to communities globally. Worldwide, the annual generation of e-waste is rising by 2.6 Million Tons annually, on track to reach 82 Million Tons by 2030, a further 33 % increase from the 2022 figure. This is further augmenting the IT asset disposition market statistics significantly.

Increasing Data Security Concerns

The growing need to securely erase sensitive data from obsolete IT assets drives demand for ITAD services that ensure data destruction and prevent information breaches. According to the industry report, there were 2,365 cyberattacks in 2023 with 343,338,964 victims. 2023 experienced a 72% growth in data breaches since 2021, which clenched the last record. A data breach costs USD 4.45 Million on average. Email is the most usual point for malware, with approximately 35% of malware conveyed by email in 2023. 94% of organizations have reported incidents involving email security. Business email compromises accounted for USD 2.7 Billion in losses in 2022. Information security jobs are projected to grow by 32% between 2022 and 2032 thus positively impacting the IT asset disposition market outlook.

Growing Corporate Sustainability Initiatives

The increasing focus of companies on sustainable practices, including environmentally responsible disposal methods for IT assets, to meet corporate social responsibility goals and enhance their green credentials. For instance, in June 2022, in a continuing effort to foster innovation in the IT asset disposition (ITAD) industry, Apto Solutions launched its new Environmental Impact Reporting Tool, providing firms real-time data specifically designed to help in ESG reporting. An enlargement of their present proprietary Pulse platform, the tool enables customers to see the amount of greenhouse gas emissions saved from reuse and recycling schemes with Apto, savings that can be effortlessly taken in account into an organization's broader ESG efforts.

IT Asset Disposition Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global IT asset disposition market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on service, asset type, enterprise size, and industry vertical.

Analysis by Service:

- De-Manufacturing and Recycling

- Remarketing and Value Recovery

- Data Destruction/Data Sanitation

- Logistics Management and Reverse Logistics

- Others

Data destruction/data sanitation leads the market share in 2024 with a share of over 28.9%. The growing data security and privacy concerns are crucial due to the abundance of sensitive information stored on IT assets, necessitating secure data destruction or sanitation during asset disposal, or repurposing to prevent data breaches and comply with privacy regulations. Compliance requirements, such as GDPR or HIPAA, are mandating proper data sanitization before retiring or repurposing IT assets, thereby fueling the IT asset disposition market growth. Additionally, organizations prioritize reputation management by employing data destruction services to safeguard against potential data leaks or breaches, protecting their brand image. For instance, in March 2024, IBM announced its global launch of Blancco-based IBM Data Erasure Services. Now, IBM consumers globally can govern end-of-life data and decommissioned hardware more firmly and ethically than ever.

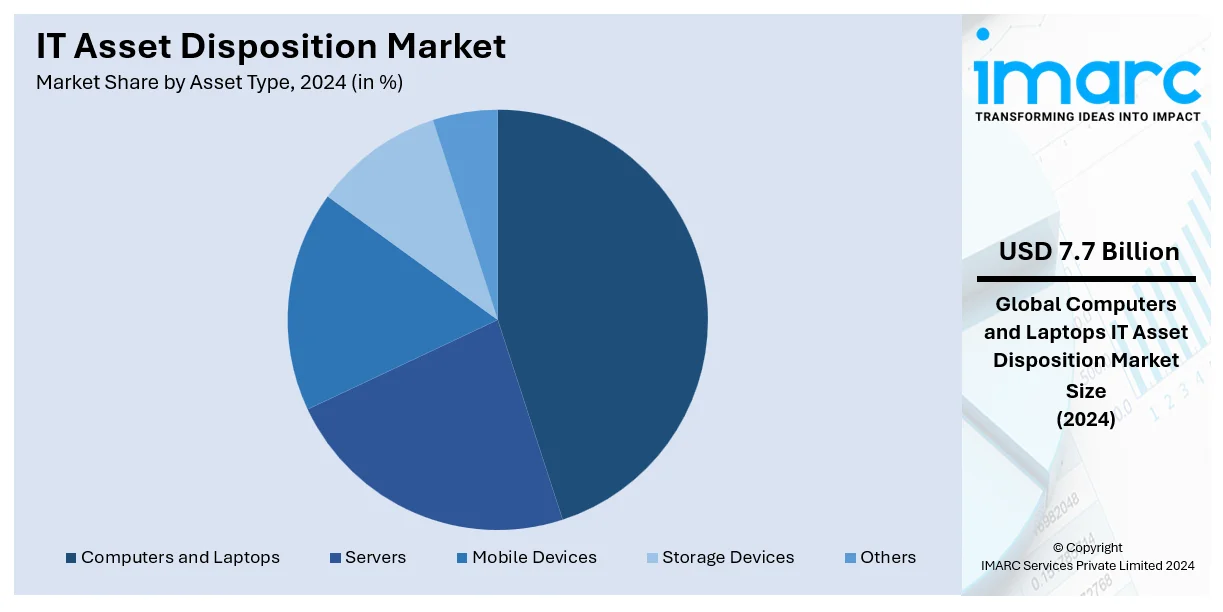

Analysis by Asset Type:

- Computers and Laptops

- Servers

- Mobile Devices

- Storage Devices

- Others

Computers and laptops dominate the IT asset disposition market share in 2024 with a considerable share of 42.5%. This segment is primarily driven by the continuous advancements in computer and laptop technology that necessitate regular upgrades and replacements. Organizations prioritize the secure disposal of computers and laptops to protect sensitive data and comply with data protection regulations. The growing awareness of electronic waste management and the significance of recycling fuels the demand for proper disposal methods to promote environmental sustainability. The rise in government initiatives and stringent regulations aimed at reducing landfill waste further propels the demand for eco-friendly disposal solutions. Moreover, the growing adoption of circular economy principles encourages the recovery and reuse of valuable materials from discarded devices, driving innovation in the recycling and refurbishment sectors.

Analysis by Enterprise Size:

- Small and Medium-sized Enterprise

- Large Enterprise

Based on the IT asset disposition market forecast, large enterprise represents the largest segment in the market in 2024. Large enterprises prioritize secure IT asset disposition to prevent data breaches and comply with regulations, requiring certified processes and documentation for data erasure and destruction. They also seek providers that can handle their scale and global reach, managing large asset volumes and offering services worldwide. In addition to this, corporate social responsibility influences their choice of IT asset disposition providers, favoring those aligned with environmental goals such as recycling and minimizing e-waste.

Analysis by Industry Vertical:

- BFSI

- IT and Telecom

- Education

- Healthcare

- Manufacturing

- Media and Entertainment

- Others

IT and telecom holds a dominant position in the market, in 2024. The IT and telecom sector's rapid technological advancements result in shorter IT asset lifecycles, making proper disposal of outdated assets crucial for accommodating new technologies. Apart from this, data privacy and security concerns drive the need for ensuring secure asset disposition in the IT and Telecom sector, as it handles vast amounts of sensitive consumer data. These are the factors that are impelling the segment of the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America represented the biggest market share with around 35.0% of the total market. The market for IT asset disposition in North America is driven by the region's high level of technological innovation and adoption, along with the presence of numerous technology-driven companies and industries. As these assets become obsolete or reach the end of their lifecycle, there is an increasing demand for proper disposal and management, fueling the need for ITAD services. For instance, in November 2023, Iron Mountain, a global leader in information management, innovative storage, data center infrastructure, and asset lifecycle management announced it has entered into a definitive accordance to obtain Regency Technologies, a major provider of IT asset disposition (ITAD) services in the United States. Building on Iron Mountain's substantial logistics network, which already enables consumers with leading information security in IT Asset Lifecycle Management (ALM), the integrated platform will set up a market-pioneering dispensed footprint for the recycling and remarketing of IT assets. This will create a rise in environmental sustainability and progress in value recovery at the end of the IT asset lifecycle.

Key Regional Takeaways:

United States IT Asset Disposition Market Analysis

The United States IT asset disposition market is growing rapidly with a significant share of 88.00% in the North American market. It grows with the increasing demand from the companies for the disposal of electronic assets in a more environmentally responsible manner. The companies are opening more facilities to meet the rising demand with a focus on data destruction and recycling. For example, in January 2023, ERI, an American ITAD provider, inaugurated its 13th operational facility and 9th full-scale recycling center in Arizona. This expansion highlights the growing need for secure disposal and recycling solutions across the country.

Likewise, in October 2022, NCS Global Services LLC, an IT asset disposition company based in the United States, opened a new facility in Los Angeles to cater to the growing demand on the West Coast. This facility is NAID AAA and ISO certified and places an emphasis on secure data destruction, providing compliance with data security regulations amid the rising concerns of the privacy and cybersecurity of individuals and organizations. These expansions go hand-in-hand with a larger pattern where ITAD companies create specialized facilities to address an increasing volume of electronic waste amidst the heightened emphasis on data security and environmental sustainability. With continued regulatory pressure and greater awareness of the need to secure data, there will be an increasing demand for reliable ITAD solutions that will contribute to the expansion of facilities across the United States. This trend will support continued growth in the U.S. ITAD market, as companies and government agencies seek secure, compliant, and efficient means of handling their outdated IT assets.

Europe IT Asset Disposition Market Analysis

The Europe IT asset disposition market is growing rapidly attributed to strategic partnerships, acquisitions, and increasing demand for sustainable and secure disposal of electronic waste. The consolidation of players is the key trend influencing the market to enhance their service offerings and expand market reach. For example, in May 2022, Irish IT recycling company Vyta Ltd. acquired FGD Solutions Ltd., a UK-based IT asset disposal firm. This purchase, following MML Growth Capital Partners Ireland's EUR 11 Million (USD 11.45 Million) investment in the company, put Vyta Ltd. even more solidly in the marketplace and extended its capacity to offer more extensive and secured IT asset management services from FGD Solutions Ltd., following the acquisition.

The general trend of consolidation is also an industry-wide shift by firms toward more provision of fully integrated, end-to-end IT asset disposition services. Regulation and pressure on data security issues as well as environmental issues force growing demand for ITAD. In the coming years, there is an increasing number of responsible and proper management of e-wastes which would be driven by partnering and acquisition in the market for ITAD in Europe.

Asia Pacific IT Asset Disposition Market Analysis

The Asia Pacific IT asset disposition (ITAD) market is expected to have a huge growth rate, which is attributed to the ever-growing generation of e-waste in the region. In 2019, Asia Pacific accounted for more than 45% of global e-waste production, as per an industry report. This is mainly due to China and India, which significantly contributed to the increasing volumes. As e-waste continues to rise, fueled by rapid technological advancement and huge consumption of electronics, the urgent need for secure and sustainable solutions in IT asset disposal intensifies. For example, China, India, and Japan have a tremendous growth of the number of electronic devices in circulation, creating huge pool of outdated IT equipment for responsible disposal.

The awareness of data security and environmental sustainability, along with stricter regulations on e-waste management, is driving the adoption of ITAD services in the region. Governments and industries are increasingly focused on ensuring compliance with e-waste recycling standards, which further accelerates market growth. With a shift towards responsible recycling practices and greater collaboration among businesses, the ITAD market in Asia Pacific is anticipated to expand significantly.

Latin America IT Asset Disposition Market Analysis

Brazil is the largest e-waste producer in Latin America, generating 2.1 Million tons a year; its average in 2019 was 10.2 kg per capita-according to MDPI, which also says that whereas there is this large scale of e-waste produced, only 3.6% is recycled every year, while about 77,000 tons annually are processed. This is a huge growth opportunity for the Latin American IT asset disposition market as businesses and governments are increasingly being forced to responsibly manage their e-waste. The growing demand for safe, sustainable, and responsible disposal and recycling of electronic devices and IT equipment should drive the ITAD market in the region. The market should see growth with increasing awareness towards data security, environmental regulation, and responsible recycling. Moreover, more government initiatives and industry partnerships are likely to trigger increased demand for IT asset disposal services in Latin America, ensuring a more sustainable approach to e-waste management.

Middle East and Africa IT Asset Disposition Market Analysis

The Middle East and Africa IT asset disposition market is growing robustly due to several key factors. In Q1 2024, the UAE witnessed a rise of 28.2% in mobile phone shipments that stood at about 1.68 Million devices valued at USD 744 Million, as per an industry report. This uptick in electronic devices points to growing demand for secure and sustainable solutions for IT asset disposal. Moreover, it has the largest amount of e-waste producers in the Arab world. As per an industry report, Saudi Arabia alone is responsible for producing 595,000 tons of e-waste, that is, 16.3 kg per person, accounting for 21% of the total of this waste in the region. An increased generation of e-waste combined with more emphasis on data security, sustainability, and compliance increased demand for ITAD services in the region. As companies and governments seek responsible disposal of old IT equipment, the market for IT asset management and recycling services will continue to grow in the Middle East and Africa.

Competitive Landscape:

The competitive landscape of the IT asset disposition (ITAD) market is highly competitive with various key players. These companies offer comprehensive services like data destruction, e-waste recycling, and asset recovery. The market landscape is characterized by a focus on security, regulatory compliance, and sustainability- along with strategic collaborations and mergers. For instance, in November 2023, circular economy-focused investment firm Closed Loop Partners joined forces with leading IT asset management and disposition provider, Sage Sustainable Electronics, as a majority shareholder in the company. Closed Loop Partners’ buyout private equity fund, the Closed Loop Leadership Fund, is investing at a pivotal moment marked by the surge in electronic waste, growing corporate focus on e-waste management, and heightened demand for transparency and data security in the IT Asset Disposition (ITAD) sector. This strategic collaboration seeks to drive the expansion of Sage Sustainable Electronics and bolster its role as a top provider of sustainable ITAD solutions in North America.

The report provides a comprehensive analysis of the competitive landscape in the IT asset disposition market with detailed profiles of all major companies, including:

- Apto Solutions Inc

- Cascade Asset Management

- CDW Corporation

- CompuCom Systems Inc

- Dell Technologies Inc

- DMD Systems Recovery Inc.

- Ingram Micro

- Iron Mountain Incorporated

- LifeSpan International Inc

- Sims Limited

- TES (SK Ecoplant Co Ltd)

Latest News and Developments:

- April 2024: Compucom, a prominent technology sourcing and services firm, was honored as Solution Integrator Client Partner of the Year for its key role in supporting Intel’s Raptor Lake and Meteor Lake processors. This partnership played a crucial part in the advancement of the AI PC category.

- January 2024: Iron Mountain, a global leader in information management and data storage, announced its acquisition of Regency Technologies, a top provider of IT asset disposition (ITAD) services in the United States. This acquisition strengthens Iron Mountain’s IT asset lifecycle management platform, leveraging its robust logistics network to enhance environmental sustainability and maximize value recovery from retired IT assets.

- August 2023: Hewlett Packard Enterprise (HPE) joined forces with Cyxtera to provide Asset Upcycling Services, offering organizations a secure and sustainable way to recover value from outdated hardware. This collaboration enables HPE to assist customers in trading in older equipment while transitioning to more efficient infrastructure with Cyxtera’s support.

- March 2023: Redington Limited (India) teamed up with Dell Inc. to promote sustainability initiatives in India. Through this partnership, Redington offers Dell's Asset Resale and Recycling Services (ARRS), helping businesses manage their legacy IT equipment in an environmentally responsible and secure manner.

IT Asset Disposition Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | De-Manufacturing and Recycling, Remarketing and Value Recovery, Data Destruction/Data Sanitation, Logistics Management and Reverse Logistics, Others |

| Asset Types Covered | Computers and Laptops, Servers, Mobile Devices, Storage Devices, Others |

| Enterprise Sizes Covered | Small and Medium-sized Enterprise, Large Enterprise |

| Industry Verticals Covered | BFSI, IT and Telecom, Education, Healthcare, Manufacturing, Media and Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Apto Solutions Inc, Cascade Asset Management, CDW Corporation, CompuCom Systems Inc, Dell Technologies Inc, DMD Systems Recovery Inc., Ingram Micro, Iron Mountain Incorporated, LifeSpan International Inc, Sims Limited, TES (SK Ecoplant Co Ltd), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the IT asset disposition market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global IT asset disposition market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the IT asset disposition industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

IT asset disposition (ITAD) refers to the secure and environmentally responsible process of disposing of outdated or unwanted IT equipment, including computers, servers, and storage devices. It ensures data security, regulatory compliance, and material recovery through recycling, refurbishment, or resale, promoting sustainability and efficient resource management.

The IT asset disposition market was valued at USD 18.02 Billion in 2024.

IMARC estimates the global IT asset disposition market to exhibit a CAGR of 7.05% during 2025-2033.

The increased regulatory compliance requirements, growing awareness of environmental sustainability, and advancements in recycling technologies are some of the key trends driving the ITAD market in 2024.

The global market is primarily driven by stringent e-waste regulations aimed at reducing environmental impact, rising concerns over data security breaches, stringent corporate sustainability initiatives promoting eco-friendly practices, ongoing technological advancements requiring frequent IT upgrades, and the growing demand for secure data destruction and responsible disposal methods.

In 2024, data destruction/data sanitation represented the largest segment by service, driven by growing data security concerns and regulatory compliance requirements.

Computers and laptops lead the market by asset type attributed to frequent upgrades driven by technological advancements and data security needs.

The large enterprises are the leading segment by enterprise size, driven by their need for global-scale ITAD services and compliance with strict regulations.

In 2024, IT and telecom represented the largest segment by industry vertical, driven by rapid technological advancements and high data privacy demands.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global IT asset disposition market include Apto Solutions Inc, Cascade Asset Management, CDW Corporation, CompuCom Systems Inc, Dell Technologies Inc, DMD Systems Recovery Inc., Ingram Micro, Iron Mountain Incorporated, LifeSpan International Inc, Sims Limited, and TES (SK Ecoplant Co Ltd), among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)