Isostatic Pressing Market Size, Share, Trends and Forecast by Type, Offering, Application, and Region, 2025-2033

Isostatic Pressing Market Size and Share:

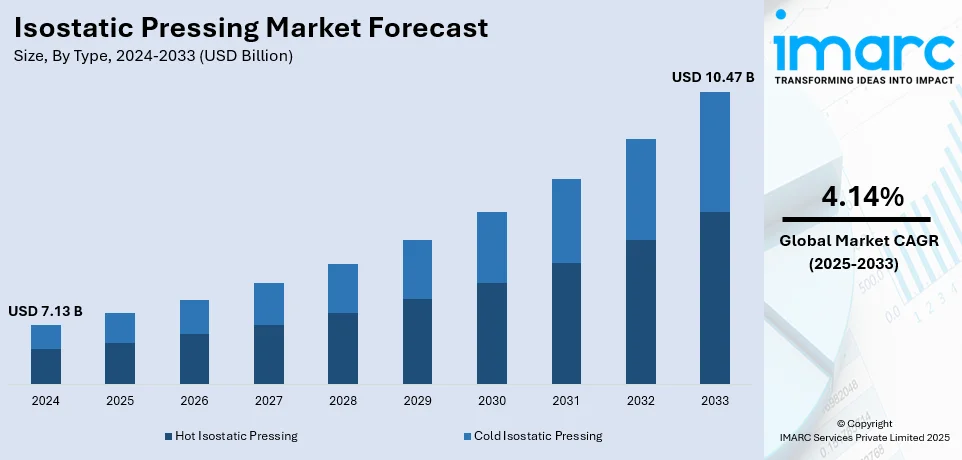

The global isostatic pressing market size was valued at USD 7.13 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.47 Billion by 2033, exhibiting a CAGR of 4.14% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 36.0% in 2024. Significant market share of over 40.2% in 2024. The ongoing advancements in manufacturing technologies, increasing demand for high-performance materials, widespread product adoption in aerospace and automotive industries, and rising investments in research and development (R&D) are some of the major factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.13 Billion |

|

Market Forecast in 2033

|

USD 10.47 Billion |

| Market Growth Rate (2025-2033) | 4.14% |

The global market is expanding due to continual advancements in high-performance material fabrication, particularly for energy, defense, and biomedical applications. In line with this, the increasing adoption of near-net-shape manufacturing enhancing material efficiency and reducing machining costs is expanding the isostatic pressing market share. Furthermore, rapid integration of ceramic and composite components in industrial processes fuels demand for precise densification technologies. The growing need to minimize material porosity and improve mechanical properties in high-stress environments further supports market growth. For instance, on November 19, 2024, Quintus Technologies launched the QIH 200 URC®, a Hot Isostatic Press integrating multiple heat treatments in one cycle, improving efficiency, lowering costs, and enhancing material properties. Besides this, expanding R&D investments in sintering and customized pressure systems continue to drive technological advancements and market expansion.

To get more information on this market, Request Sample

The United States is a key regional market and is expanding due to increasing demand for advanced manufacturing in aerospace, defense, and semiconductor industries. Similarly, higher defense spending supports the use of high-performance metal and ceramic components requiring superior strength and durability. Notably, on November 26, 2024, Oak Ridge National Laboratory (ORNL) researchers advanced Hot Isostatic Pressing (HIP) and Powder Metallurgy to produce large-scale metal components over 4,500 kg, addressing U.S. supply-chain shortages. They integrate Wire Arc Additive Manufacturing, predictive modeling, and in-situ monitoring to enhance precision, reduce shrinkage, and improve HIP efficiency. According to isostatic pressing market trends, growing space exploration is driving demand for high-density materials with superior mechanical properties. Moreover, escalating semiconductor and medical implant production, alongside rising material science research investments, further stimulates market appeal.

Isostatic Pressing Market Trends:

Rising Adoption of Additive Manufacturing (AM)

Additive manufacturing, commonly known as 3D printing, revolutionized the manufacturing landscape by enabling the creation of complex and customized parts with reduced material waste. In 2024, the size of the global 3D printing market was USD 28.5 Billion. However, the mechanical qualities of parts made by AM may be compromised due to their intrinsic porosities and irregular densities. By evenly applying high pressure and temperature around the part, isostatic pressing, in particular, HIP, addresses these problems by removing internal cavities and increasing density. The mechanical qualities and dependability of 3D-printed parts are greatly enhanced by this post-processing method, which qualifies them for crucial uses in sectors including automotive, medical, and aerospace. The need for complementary processes like HIP to improve component quality and performance is anticipated to grow as AM continues to gain pace, improving the isostatic pressing market growth.

Increasing Demand for High-Performance Materials

Advanced materials that provide exceptional strength, endurance, and resilience to harsh environments are constantly sought after by industries like aerospace, defense, and automotive. According to the Aerospace Industries Association (AIA), the U.S. aerospace and defense sector reached a significant milestone in 2023, generating over USD 955 Billion in sales, a 7.1% increase from the previous year. Isostatic pressing techniques, including cold isostatic pressing (CIP) and HIP, enable the production of components with exceptional material properties by applying uniform pressure, resulting in high-density and defect-free materials. For example, HIP is used in the aerospace industry to render structural components and turbine blades out of superalloys that are subjected to high temperatures and mechanical stresses. Moreover, the ability of isostatic pressing to enhance the mechanical properties and reliability of high-performance materials makes it an indispensable technology for producing critical components in demanding applications, thereby contributing to the isostatic pressing market demand.

Advancements in Isostatic Pressing Technologies

Innovations in isostatic pressing equipment, such as the development of larger and more energy-efficient presses, are expanding the range of applications and improving the overall efficiency of the process. Modern isostatic presses are equipped with advanced control systems that allow precise regulation of pressure and temperature, ensuring consistent quality and reproducibility of the pressed components. The global advanced process control market size reached USD 1.8 Billion in 2024. Additionally, the integration of automation and digital monitoring systems enhances process control and reduces operational costs. These technological advancements are making isostatic pressing more accessible and cost-effective for a broader range of industries, including those with stringent quality requirements. Furthermore, the development of novel materials specifically designed for isostatic pressing is opening new avenues for its application, from biomedical implants to cutting-edge electronics, which, in turn, is positively impacting the isostatic pressing market outlook.

Isostatic Pressing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global isostatic pressing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, offering, and application.

Analysis by Type:

- Hot Isostatic Pressing

- Cold Isostatic Pressing

Hot isostatic pressing accounts for 69.8% of the market share due to its ability to significantly enhance the mechanical properties and reliability of materials. HIP involves applying high pressure and temperature uniformly to materials, effectively eliminating internal porosities and improving density. This process is crucial for producing high-performance components required in critical industries such as aerospace, automotive, and medical devices. In addition to this, the superior properties achieved through HIP, such as increased strength, durability, and resistance to extreme conditions, render it indispensable for manufacturing advanced materials and complex parts. Additionally, the growing adoption of additive manufacturing further drives the demand for HIP as a necessary post-processing step to ensure the quality of 3D-printed components.

Analysis by Offering:

- Services

- Systems

Systems hold the largest share of the market in 2024 with 60.0% as they encompass the essential machinery and equipment required to perform isostatic pressing processes, such as HIP and CIP. These systems are essential for many applications in fields where high-performance, flawless components are required, such as manufacturing, medical devices, aerospace, and automotive. Concurrent with this, the demand for advanced, automated, and energy-efficient pressing systems is high due to their ability to improve production efficiency, ensure consistent quality, and reduce operational costs. Moreover, continuous advancements in system technology, such as enhanced control systems and integration with digital monitoring, are further fueling the isostatic pressing market revenue by meeting the stringent requirements of critical applications.

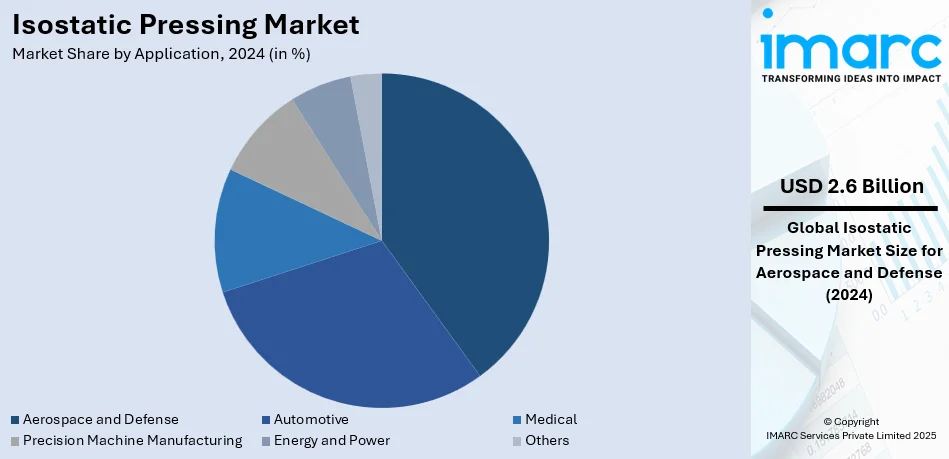

Analysis by Application:

- Automotive

- Aerospace and Defense

- Medical

- Precision Machine Manufacturing

- Energy and Power

- Others

Aerospace and defense sector represents the leading market share in 2024 with 36.8% which can be attributed to the stringent requirements for high-performance, reliable components. HIP is essential in producing critical parts such as turbine blades, structural components, and advanced materials like superalloys and composites that must endure extreme conditions. In line with this, the need for defect-free, high-density materials that offer superior strength, durability, and thermal resistance also drives the adoption of isostatic pressing in this sector. Furthermore, the growing focus on lightweight yet robust materials for fuel efficiency and performance enhancement in aerospace and defense applications is expanding isostatic pressing market size.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific leads the market, accounting for 36.0% of the market share due to strong demand from aerospace, automotive, and medical industries, particularly in China, Japan, and India. The region benefits from advanced manufacturing capabilities, government support for industrial growth, and increasing adoption of powder metallurgy and additive manufacturing. Expanding semiconductor production and defense investments further support market growth. Cost-effective labor, raw material availability, and technological advancements in hot and cold isostatic pressing strengthen regional competitiveness. Additionally, rapid urbanization and infrastructure development drive demand for high-performance materials, reinforcing Asia Pacific’s position as the largest contributor to the global isostatic pressing market demand.

Key Regional Takeaways:

United States Isostatic Pressing Market Analysis

The isostatic pressing market in the United States is driven by several key factors, including the growing need for high-performance materials in sectors like aerospace, automotive, and healthcare. The increasing need for materials with superior properties like density, uniformity, and strength is propelling the adoption of isostatic pressing techniques. Additionally, the booming 3D printing industry, valued at USD 5.5 Billion in 2023, is expected to reach USD 31.0 Billion by 2032, growing at a CAGR of 21.17% during 2024-2032, further fueling demand for high-quality materials processed through isostatic pressing. The ongoing investment in research and development (R&D), particularly within the manufacturing sector, is enhancing production efficiency and expanding the range of materials suitable for isostatic pressing. Moreover, the push for sustainability in production processes is contributing to market growth, as isostatic pressing enables better material utilization, minimizing waste. Regulatory standards demanding higher-quality materials in critical industries are also encouraging businesses to adopt isostatic pressing. As such, the US is positioned to remain a key player in the global market, supported by its robust manufacturing base, technological innovations, and the continued expansion of industries requiring precision materials.

Europe Isostatic Pressing Market Analysis

The market in Europe is driven by a diversified industrial landscape and a strong emphasis on technological advancements. The aerospace, automotive, and medical device sectors are major contributors to the demand for high-quality, precision-engineered materials. The UK's aerospace and defense market, valued at USD 28.7 Billion in 2024, is expected to grow to USD 58.3 Billion by 2033, exhibiting a CAGR of 8.21% from 2025-2033, further bolstering the need for advanced materials processed through isostatic pressing. Additionally, European industries are focusing on reducing material waste and improving production efficiency, and isostatic pressing serves as a solution to meet these demands. The growing trend towards lightweight, high-strength materials in aerospace and automotive is driving the need for isostatic pressing to achieve superior material properties. Europe's strong commitment to research and development (R&D) in manufacturing technologies creates new opportunities for isostatic pressing applications. Furthermore, the region’s push for sustainable manufacturing practices is another significant driver, as isostatic pressing enhances material utilization and reduces waste. With these combined factors, Europe is set to continue its growth in the global isostatic pressing market in the coming years.

Asia Pacific Isostatic Pressing Market Analysis

The isostatic pressing market in the Asia-Pacific (APAC) region is growing at a rapid pace. According to S&P Global, the APAC manufacturing outlook is still quite healthy, augmented by recoveries in electronics exports, semiconductors, and renewable energy sectors. This region accounts for nearly 48.5% of global manufacturing output, drawing companies to the region due to cost advantages, skilled workforce, and government incentives. These rewards promote high-end manufacturing based on highly engineered quality. Given the stringent needs for such advanced properties within industries of aerospace, automotive, and electronics regarding higher strength, density, and homogeneity in their final materials, there has been growing interest in isostatic pressing. As APAC takes up the positioning as an ultimate manufacturing powerhouse, isostatic pressing becomes even more essential in meeting the demand for durable, high-performance components, and therefore APAC positions itself as a key player in the global isostatic pressing market moving forward.

Latin America Isostatic Pressing Market Analysis

Latin America remains a growing market, with heightened demand for the use of high-performance materials for automotive, energy, and manufacturing industries. A total of 622 million people in 20 countries offer huge potential for producers of consumer electronics and other companies that need performance materials. Its industrial base in Brazil and Mexico is also leading to an upsurge in the demand for precision-engineered components. Additionally, government efforts to modernize manufacturing technologies and promote sustainability are further encouraging the adoption of isostatic pressing, positioning Latin America as a key growth region in the market.

Middle East and Africa Isostatic Pressing Market Analysis

The isostatic pressing market in the Middle East and Africa is gaining momentum due to the growing demand for high-quality materials in industries like oil and gas, aerospace, and manufacturing. The UAE oil and gas market, projected to grow at a CAGR of 6.30% during 2025-2033, further strengthens the need for precision-engineered materials. As the region continues to invest in industrial diversification, particularly in the UAE and South Africa, the demand for advanced production techniques like isostatic pressing is rising. Government initiatives aimed at enhancing industrial processes and material performance are expected to drive market expansion in the region.

Competitive Landscape:

The competitive landscape presents a number of key players combined with large international companies and specific regional companies that specialize in providing isostatic pressing solutions. Based on this isostatic pressing market research report, they invest heavily into R&D on innovation and enhancements to ensure better quality and higher performance in isostatic pressing solutions. On this basis, strategic collaborations and mergers with acquisitions are used as common strategy to expand into the market with enhanced technological competencies. Regional players, and smaller firms, significantly contribute to the market by specializing in services offered or by catering to local demands. The market can be considered highly competitive due to the continuous pursuit of technological advancement and given the need for both energy-efficient and cost-effective solutions, especially in applications where high-quality, defect-free materials are required, such as in aerospace, automotive and medical devices.

The report provides a comprehensive analysis of the competitive landscape in the isostatic pressing market with detailed profiles of all major companies, including:

- American Isostatic Presses Inc

- Bodycote

- DORST Technologies GmbH

- EPSI

- FREY & Co. GmbH

- Hiperbaric

- Höganäs AB

- Kobe Steel Ltd.

- MTI Corporation

- Nikkiso Co. Ltd.

- Pressure Technology Inc

- PTC Industries Limited

- Sandvik AB

Latest News and Developments:

- November 2024: Quintus Technologies introduced the QIH 200 URC Hot Isostatic Press (HIP), integrating multiple heat treatment processes into a single cycle to enhance productivity. HIP is widely used to improve the ductility and fatigue resistance of high-performance materials, particularly in additive manufacturing, aerospace, and energy industries.

- January 2024: The Wallwork Group expedited its expansion plans by ordering a second Hot Isostatic Press (HIP) from Quintus Technologies in Västerås, Sweden, two years ahead of schedule. This decision follows the successful commissioning of their first HIP in Q3 2023 at the newly opened EUR 10 Million (USD 10.4 Million) Wallwork HIP Centre.

- August 2023: TWI, based in Cambridge, UK, invested in new facilities for Powder Metallurgy Hot Isostatic Pressing (PM HIP) and has recently acquired advanced equipment for powder outgassing operations. Powder outgassing is essential in the PM HIP process as it reduces gaseous species and moisture content in powder-filled canisters before HIP consolidation, ensuring higher quality in the final product.

- June 2023: TWI launched an exploratory project, "Effect of Outgassing on Structural Integrity of Powder Hot Isostatic Pressing Materials," under its Exploratory Programme. The study focuses on optimizing powder outgassing regimes, a critical step in near net shape powder metallurgy hot isostatic pressing (NNS PM HIP), to reduce moisture and trapped gases in powder-filled canisters.

- July 2022: Bodycote plc expanded its Hot Isostatic Pressing (HIP) capacity with two additional vessels at its Greenville, South Carolina, facility, which became operational by late 2022. The site, holding Nadcap accreditation and key OEM approvals, supports aerospace, defense, medical, and industrial sectors in the Southeastern U.S.

Isostatic Pressing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hot Isostatic Pressing, Cold Isostatic Pressing |

| Offerings Covered | Services, Systems |

| Applications Covered | Automotive, Aerospace and Defense, Medical, Precision Machine Manufacturing, Energy and Power, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Isostatic Presses Inc, Bodycote, DORST Technologies GmbH, EPSI, FREY & Co. GmbH, Hiperbaric, Höganäs AB, Kobe Steel Ltd., MTI Corporation, Nikkiso Co. Ltd., Pressure Technology Inc, PTC Industries Limited, Sandvik AB, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the isostatic pressing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global isostatic pressing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the isostatic pressing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The isostatic pressing market was valued at USD 7.13 Billion in 2024.

The isostatic pressing market is projected to exhibit a CAGR of 4.14% during 2025-2033, reaching a value of USD 10.47 Billion by 2033.

The global market is majorly driven by significant advancements in high-performance material fabrication, increasing adoption in aerospace, defense, and semiconductor industries, rising demand for additive manufacturing post-processing, growing investments in R&D, and the need for high-density materials with superior mechanical properties in critical applications.

Asia Pacific currently dominates the isostatic pressing market, accounting for a share exceeding 36.0%. This dominance is fueled by strong demand from aerospace, automotive, and medical industries, government support for industrial growth, expanding semiconductor production, and increasing adoption of powder metallurgy and additive manufacturing.

Some of the major players in the isostatic pressing market include American Isostatic Presses Inc, Bodycote, DORST Technologies GmbH, EPSI, FREY & Co. GmbH, Hiperbaric, Höganäs AB, Kobe Steel Ltd., MTI Corporation, Nikkiso Co. Ltd., Pressure Technology Inc, PTC Industries Limited, and Sandvik AB, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)