Isopropyl Alcohol Market Size, Share, Trends and Forecast by Application, Industry, and Region, 2025-2033

Isopropyl Alcohol Market Size and Share:

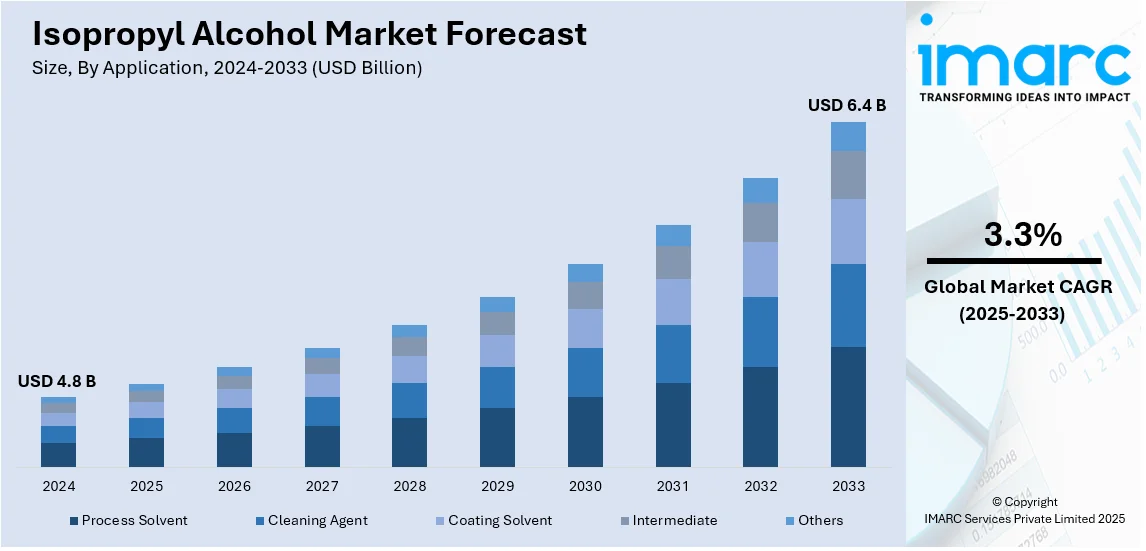

The global isopropyl alcohol market size was valued at USD 4.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.4 Billion by 2033, exhibiting a CAGR of 3.3% during 2025-2033. Asia currently dominates the market, holding a significant market share of over 40.0% in 2024. The growing focus on renewable and sustainable sourcing of raw materials, rising utilization of hand sanitizers to maintain personal hygiene and prevent infections, and increasing production of semiconductors and various electrical components in the electronics industry are some of the major factors propelling the isopropyl alcohol market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 6.4 Billion |

| Market Growth Rate (2025-2033) |

3.3%

|

The isopropyl alcohol (IPA) market is driven by increasing demand from the pharmaceutical, cosmetics, and healthcare sectors due to its antiseptic and disinfectant properties. The COVID-19 pandemic significantly enhanced its use in sanitizers and cleaning products. Growth in the electronics industry, where IPA is used as a solvent, further propels the market. Along with this, rising awareness of hygiene and infection prevention, coupled with expanding healthcare infrastructure, also contributes to demand. Additionally, advancements in production technologies and the availability of raw materials support market expansion. On 9th June 2024, Cepsa and its business initiated the construction of a €75 Million (approximately USD 81.75 Million) isopropyl alcohol (IPA) manufacturing facility in Palos de la Frontera, Spain, with an annual production capacity of 80,000 tons. Due to completion at the end of end-2025, the plant will use green hydrogen to produce sustainable IPA for use in hydroalcoholic gels, cleaning agents, and other use sectors. This program is part of Spain´s goal to achieve its strategic independence of renewable-sourced IPA.

The United States stands out as a key regional market, primarily driven by its versatile applications across industries, including healthcare, electronics, and cleaning products. Rising demand for disinfectants and sanitizers, fueled by increased focus on hygiene and infection control, remains a key growth factor. The pharmaceutical sector relies on IPA for manufacturing and sterilization processes, while the electronics industry uses it as a cleaning agent for precision components. A research report from the IMARC Group indicates that the United States power electronics market exhibits a growth rate (CAGR) of 7.10% during 2024-2032. Expanding industrial activities and technological advancements further enhance demand. Additionally, the availability of raw materials and efficient production methods support market growth.

Isopropyl Alcohol Market Trends:

Growing demand in the pharmaceutical and healthcare sector

The growing demand in the pharmaceutical and healthcare sector is currently exerting a profoundly positive influence on the expansion of the isopropyl alcohol market. According to reports, in 2022, the pharmaceutical industry contributed USD 2,295 Billion to global GDP, with USD 755 Billion from direct contributions (0.7% of global GDP). R&D activities alone added USD 227 Billion, accounting for 30% of direct contributions. Besides this, isopropyl alcohol, being a crucial component in the manufacturing of pharmaceuticals and healthcare-related products, is witnessing an uprise in consumption due to the heightened global focus on healthcare infrastructure and medical advancements. Additionally, the continuous research and development activities in the pharmaceutical sector necessitate a steady supply of high-quality isopropyl alcohol, as it serves as an essential solvent in various drug formulation processes. The ongoing innovations and expansions in the pharmaceutical industry are thereby sustaining the heightened demand for isopropyl alcohol.

Rising focus on renewable and sustainable sourcing of raw materials

The rising focus on renewable and sustainable sourcing of raw materials is currently exerting a positive influence on the growth of the isopropyl alcohol market. Besides this, the increasing preference for bio-based or renewable feedstocks in the production of isopropyl alcohol. For instance, in June 2024, BASF introduced biomass-balanced ecoflex (PBAT), reducing the Product Carbon Footprint (PCF) by 60%. Using waste-based renewable feedstocks via a certified biomass balance (BMB) approach, this drop-in solution maintains identical performance, processability, and biodegradation properties, advancing sustainability in packaging and circular economy efforts. Manufacturers are actively exploring alternatives to traditional fossil fuel-derived propylene, the primary raw material for isopropyl alcohol synthesis. This includes utilizing renewable sources, such as biomass, agricultural residues, and waste materials. By embracing these sustainable sourcing options, the isopropyl alcohol industry is aligning itself with the imperative to lessen its carbon footprint and reliance on finite resources. Furthermore, the adoption of sustainable raw materials in isopropyl alcohol production aligns with the sustainability goals of various industries, including pharmaceuticals, cosmetics, and electronics, where IPA serves as a crucial solvent and cleaning agent.

Increasing utilization of hand sanitizers to prevent the spread of infectious diseases

The increasing utilization of hand sanitizers to prevent the spread of infectious diseases is currently exerting a positive influence on the growth of the isopropyl alcohol market. The global hand sanitizer market size reached USD 5.0 Billion in 2024. Besides this, the demand for hand sanitizers directly translates into an increased need for isopropyl alcohol production. Manufacturers of isopropyl alcohol are experiencing a continuous uprise in orders as they strive to meet the escalating demands from hand sanitizer producers and other industries that rely on this essential chemical compound for various applications. Moreover, the persistent emphasis on maintaining stringent hygiene standards in healthcare facilities, public spaces, and households further sustains the demand for hand sanitizers and, by extension, isopropyl alcohol.

Isopropyl Alcohol Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global isopropyl alcohol market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on application and industry.

Analysis by Application:

- Process Solvent

- Cleaning Agent

- Coating Solvent

- Intermediate

- Others

Intermediate stands as the largest component in the market. Isopropyl alcohol is considered an important intermediate in various chemical processes and industries due to its versatility and properties. It is widely used as a solvent in various industries, including pharmaceuticals, cosmetics, and manufacturing. It can dissolve a wide array of organic and inorganic compounds, making it valuable in the production of various chemicals. Isopropyl alcohol is commonly employed as a cleaning agent and disinfectant. It is also used to clean surfaces, medical equipment, and electronic components due to its ability to dissolve oils, grease, and other contaminants. It can also be used as a starting material or solvent in the synthesis of various chemicals and pharmaceuticals. It is often used as a reaction medium in chemical processes.

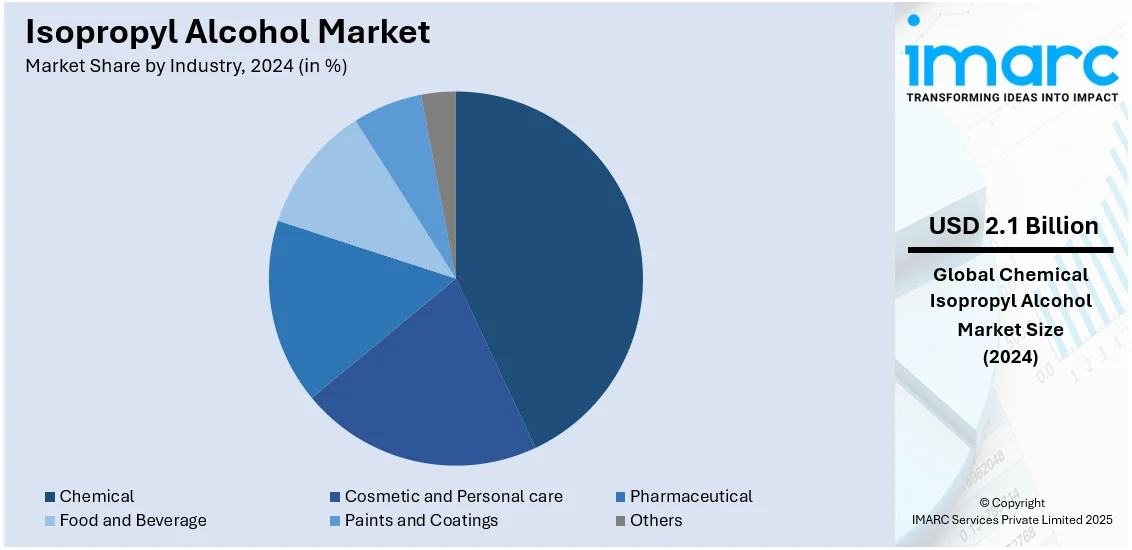

Analysis by Industry:

- Cosmetic and Personal care

- Pharmaceutical

- Food and Beverage

- Paints and Coatings

- Chemical

- Others

Chemical leads the market with around 43.2% of market share in 2024. Isopropyl alcohol is a widely employed solvent for a variety of chemical processes. It can dissolve a wide array of organic compounds, making it useful for extraction, purification, and as a cleaning agent in labs and manufacturing facilities. It is an effective cleaning component for removing contaminants, oils, greases, and residues from equipment, glassware, and surfaces in chemical laboratories and production environments. Its fast evaporation rate and low residue make it a preferred choice. Isopropyl alcohol can serve as an intermediate or starting material in the synthesis of other chemicals. It can be used to produce acetone, isopropyl acetate, and other compounds through various chemical reactions.

Regional Analysis:

- Asia

- North America

- Europe

- South America

- Others

In 2024, Asia accounted for the largest market share of over 40.0% due to the increasing awareness about the significance of maintaining personal hygiene. Besides this, rising improvements in the healthcare sector to provide quality treatment to patients are contributing to the growth of the market. Apart from this, the increasing development and production of pharmaceuticals, including vaccines, is supporting the growth of the market. Additionally, the rising emphasis on cleanliness in various commercial and public settings is strengthening the growth of the market.

Key Regional Takeaways:

United States Isopropyl Alcohol Market Analysis

The United States isopropyl alcohol market remains a vital part of the chemical industry, driven by pharmaceuticals, personal care, and industrial manufacturing. The pharmaceutical sector holds a significant share, as IPA serves as a key solvent in antiseptics, disinfectants, and hand sanitizers, with FDA regulations and rising hygiene awareness further fueling market demand. Similarly, the electronics industry also relies on high-purity IPA for semiconductors and circuit board cleaning, supporting market growth. The CHIPS for America program are reinforcing this trend, with Sumika (Baytown, TX) receiving USD 52.1 Million to manufacture ultra-high purity IPA for advanced chip production, alongside major semiconductor investments such as Bosch (USD 225 Million, CA), Micron (USD 275 Million, VA), and Analog Devices (USD 105 Million, MA/OR/WA). Furthermore, industrial applications in coatings, paints, and adhesives add to consumption, while supply chains remain influenced by domestic petrochemical production and Asian imports. Production costs fluctuate due to crude oil and propylene price volatility, but bio-based IPA alternatives are emerging for sustainability. Apart from this, leading market players, compete in a fragmented yet growing industry, positioning the U.S. market for continued expansion and technological advancements.

Europe Isopropyl Alcohol Market Analysis

The European market is shaped by strict regulations, sustainability goals, and advanced industrial demand, with pharmaceutical and cosmetic industries driving consumption, particularly in Germany, France, and the United Kingdom. According to reports, European per capita spending on cosmetics reached EUR 169 in 2023, growing at an 8.3% annual rate since 2021. The region is a global leader in cosmetics production and exports, with cosmetic manufacturing valued at EUR 11 Billion and exports totaling EUR 28.2 Billion in 2023. Furthermore, regulatory bodies including the European Chemicals Agency (ECHA) and REACH enforce high safety standards, influencing the market dynamics. The growing focus on green chemicals accelerating research into bio-based IPA alternatives, aligning with Europe’s sustainability goals, is impelling the market. Similarly, rising industrial applications in coatings, automotive, and electronics are sustaining steady market demand, though feedstock price fluctuations and changing trade policies introduce market volatility. Moreover, leading chemical manufacturers, ensuring stable supply chains, and reinforcing regional production are stimulating the market appeal. While post-pandemic IPA consumption in hygiene products has normalized, demand in healthcare and industrial cleaning sectors remains robust, securing long-term market stability amid shifting environmental and regulatory trends.

Asia Pacific Isopropyl Alcohol Market Analysis

The Asia Pacific isopropyl alcohol market is the largest and fastest-growing, driven by pharmaceuticals, electronics, and automotive manufacturing in China, India, Japan, and South Korea. China dominates IPA production due to cost-effective petrochemical feedstocks and a strong manufacturing base, while India’s consumption is rising in pharmaceuticals and personal care, backed by government initiatives. The Government of India supports chemical and petrochemical growth through PCPIRs, Plastic Parks, and research and development (R&D) investments, with INR 2.6 Lakh Crore deployed in Andhra Pradesh, Gujarat, and Odisha, generating 3.7 lakh jobs. FDI inflows of INR 42,641 Crore augment manufacturing, exports, and skill development. Furthermore, Japan and South Korea require high-purity IPA for semiconductor and electronic manufacturing, further driving market demand. However, crude oil volatility and environmental regulations challenge supply chains. Besides this, leading firms increasingly invest in capacity expansion, ensuring continued market growth despite shifting global trade patterns.

Latin America Isopropyl Alcohol Market Analysis

In Latin America, the market is propelled by the growing pharmaceuticals, personal care, and industrial applications, with Brazil and Mexico as key consumers. As per reports, Brazil’s wellness economy, valued at USD 96 Billion (5% of GDP), ranks 12th, with strong demand in personal care and beauty. The region heavily relies on imports from North America and Asia, impacting pricing and supply stability. Additionally, industrial growth in automobiles and paint & coatings further fuels consumption, while regulatory inconsistencies and economic volatility create challenges. Local manufacturers focus on cost-effective solutions, while multinational corporations dominate distribution in the market. Despite challenges, expanding local industries and changing regulatory frameworks offer growth opportunities for the regional IPA market.

Middle East and Africa Isopropyl Alcohol Market Analysis

The Middle East and Africa isopropyl alcohol market is expanding gradually, propelled by pharmaceuticals, industrial cleaning, and petrochemicals. For example, in February 2024, Saudi Advanced Petrochemical Company awarded a USD 191.25 Million EPC contract for a 70,000-tonne IPA plant in Jubail Industrial City, supporting industrial, medical, and electronics sectors under Vision 2030. Additionally, Saudi Arabia and the UAE dominate regional consumption and production, leveraging advanced petrochemical infrastructure, while Africa, led by South Africa and Nigeria, sees rising demand from healthcare and hygiene applications. The market remains import-dependent, with Asia and Europe as key suppliers, though local investments aim to reduce reliance on imports. Moreover, growing high-purity production for electronics and medical use, alongside sustainability initiatives promoting bio-based solvents, is shaping the region’s long-term market trend.

Competitive Landscape:

The competitive landscape of the isopropyl alcohol market is characterized by intense rivalry among key players, who are focusing on strategic initiatives to strengthen their market position. Companies are investing in expanding production capacities to meet growing demand, particularly from healthcare and electronics sectors. Many players are also prioritizing research and development to improve product quality and develop sustainable manufacturing processes. Strategic partnerships, mergers, and acquisitions are common as firms aim to enhance their geographic reach and customer base. Additionally, players are emphasizing compliance with environmental regulations and adopting eco-friendly practices to align with global sustainability trends. Competitive pricing and innovative product offerings further drive market differentiation and customer loyalty.

The report provides a comprehensive analysis of the competitive landscape in the isopropyl alcohol market with detailed profiles of all major companies, including:

- The Dow Chemical company

- Exxon Mobil

- Shell Chemicals Europe B.V.

- INEOS Enterprises Group Limited

- Super Chemical Technology Co. Ltd.

Latest News and Developments:

- January 2025: The US Department of Commerce will provide USD 52.1 Million to Sumitomo Chemical for a semiconductor-grade isopropyl alcohol (IPA) plant in Baytown, Texas. Announced under the CHIPS and Science Act, the deal is part of USD 246 Million in funding to strengthen the semiconductor supply chain for chip manufacturing.

- August 2024: Eastman introduced a new electronic-grade isopropyl alcohol (IPA) to its EastaPure solvents portfolio, aiming to meet stringent semiconductor purity and reliability standards. This high-purity IPA serves as an effective wet-clean solvent in wafer fabrication and throughout semiconductor production processes.

- June 2024: Cepsa begins constructing Spain’s first isopropyl alcohol (IPA) plant in Palos de la Frontera, investing EUR 75 Million. With an 80,000-ton capacity, it will use green hydrogen and renewable energy, supporting medical, pharmaceutical, and industrial sectors while enhancing Spain’s supply autonomy and sustainability under the Positive Motion strategy.

- April 2024: India lifts safeguard measures on isopropyl alcohol (IPA) imports, effective April 1, 2024, per DGFT Trade Notice (April 18, 2024). The removal of country-wise quantitative restrictions (QR) under HS code 29051220 facilitates free trade, benefiting pharmaceuticals, cosmetics, and sanitization industries, enhancing import ease and industry growth.

Isopropyl Alcohol Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons, Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Applications Covered | Process Solvent, Cleaning Agent, Coating Solvent, Intermediate, Others |

| Industries Covered | Cosmetic and Personal care, Pharmaceutical, Food and Beverage, Paints and Coatings, Chemical, Others |

| Regions Covered | Asia, North America, Europe, South America, Others |

| Companies Covered | The Dow Chemical Company, Exxon Mobil, Shell Chemicals Europe B.V., INEOS Enterprises Group Limited, Super Chemical Technology Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the isopropyl alcohol market from 2019-2033.

- The isopropyl alcohol market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the isopropyl alcohol industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The isopropyl alcohol market was valued at USD 4.8 Billion in 2024.

IMARC estimates the isopropyl alcohol market to exhibit a CAGR of 3.3% during 2025-2033, reaching a value of USD 6.4 Billion by 2033.

The isopropyl alcohol market is driven by growing demand in the pharmaceutical, cosmetics, and healthcare sectors due to its antiseptic and disinfectant properties, increased use of hand sanitizers, rising demand from the electronics industry, and advancements in production technologies. The shift toward sustainable raw materials also supports market growth.

Asia currently dominates the isopropyl alcohol market, accounting for a share exceeding 40.0% in 2024. This dominance is fueled by growing demand for hygiene products, developments in the healthcare sector, and the increasing production of pharmaceuticals, including vaccines.

Some of the major players in the isopropyl alcohol market include The Dow Chemical Company, Exxon Mobil, Shell Chemicals Europe B.V., INEOS Enterprises Group Limited, and Super Chemical Technology Co. Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)