Isoprene Market Size, Share, Trends and Forecast by Grade, End Use Industry, and Region, 2025-2033

Isoprene Market Size and Share:

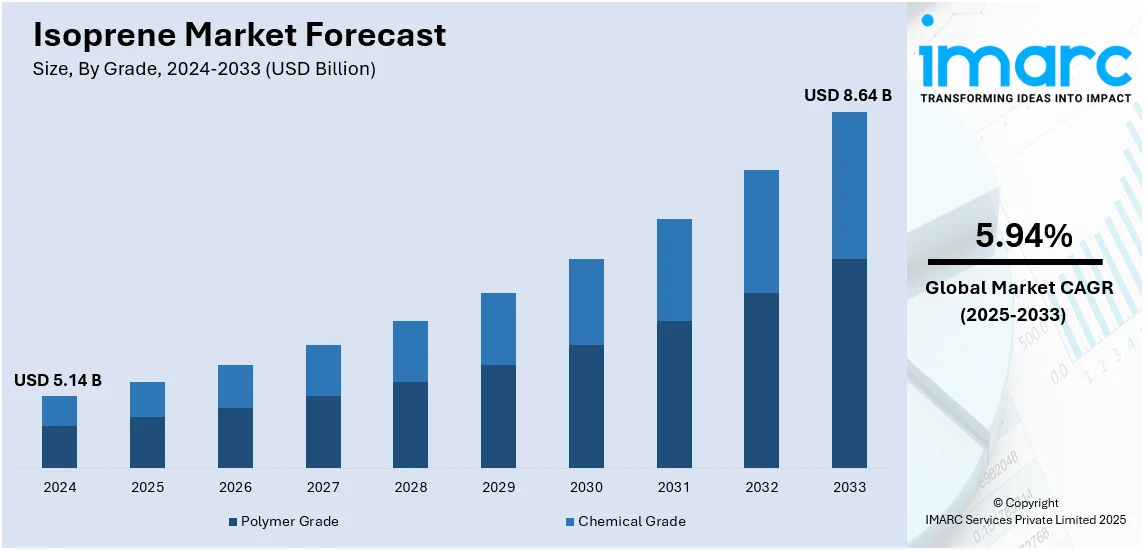

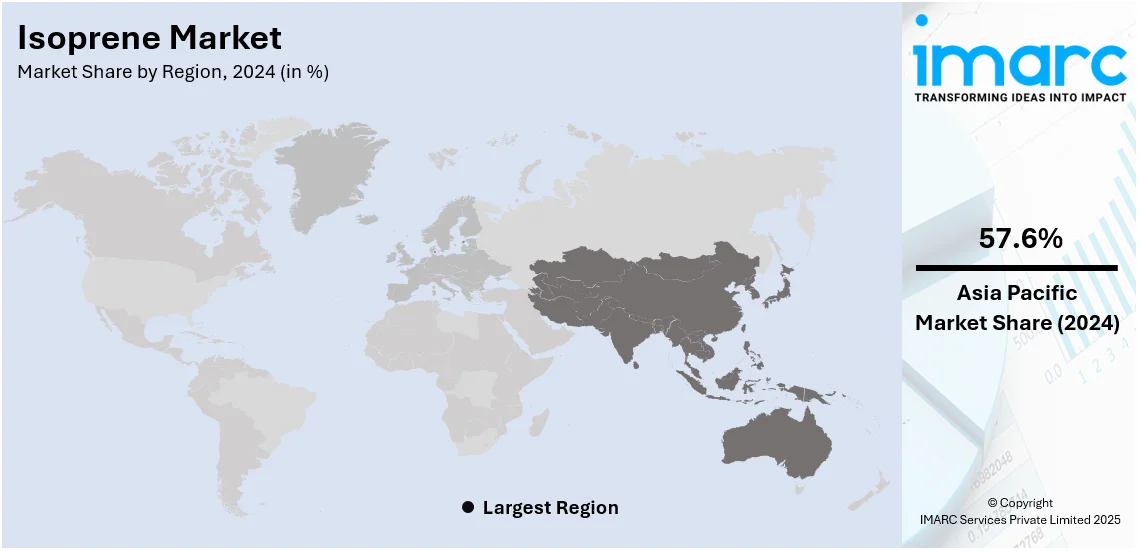

The global isoprene market size was valued at USD 5.14 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.64 Billion by 2033, exhibiting a CAGR of 5.94% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 57.6% in 2024. The rapid expansion of the automotive industry, increasing product applications in the rubber industry, and the utilization of biotechnology to produce isoprene using microorganisms represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.14 Billion |

| Market Forecast in 2033 | USD 8.64 Billion |

| Market Growth Rate (2025-2033) | 5.94% |

The isoprene market is driven by rising demand for synthetic rubber, particularly in tire manufacturing, adhesives, and medical products. The automotive industry maintains a fundamental position because growing vehicle production rates together with replacement tire requirements drive isoprene-based rubber usage. The increased use of isoprene elastomers happens through the concurrent growth of the construction sector, footwear industry and industrial manufacturing operations. Advancements in bio-based isoprene production enhance market sustainability, driven by regulatory pressure to reduce reliance on petrochemical feedstocks. Expanding applications in medical elastomers, sealants, and coatings increase consumption. Rising crude oil prices, affecting isoprene supply from cracking processes, influence market dynamics.

The key U.S. isoprene market trends include strong automotive production, increasing demand for synthetic rubber in tires, adhesives, and medical applications, and advancements in bio-based isoprene production. The replacement tire market fuels continuous demand, supported by rising vehicle ownership. Growth in medical elastomers, sealants, and coatings expands applications. Strict environmental regulations encourage sustainable alternatives, prompting investment in bio-isoprene technologies. Fluctuating crude oil prices impact isoprene supply from petrochemical sources, influencing market dynamics. Expanding construction and industrial sectors boost demand for isoprene-based materials. Innovations in high-performance, fuel-efficient tires further drive adoption, with manufacturers focusing on sustainability and efficiency improvements. For instance, in April 2023, Ginkgo Bioworks, which is building the industry's top platform for cell programming and biosecurity, announced a partnership with Visolis, a startup that combines cutting-edge bioengineering and chemical catalysis to produce sustainable, carbon-negative materials. To improve an existing microbial strain for the commercial production of a crucial feedstock element required to create bio-based isoprene and sustainable aviation fuels, Visolis plans to take advantage of Ginkgo's vast strain engineering capabilities.

Isoprene Market Trends:

Growing Demand for Synthetic Rubber in Tires

The automotive industry is the largest consumer of isoprene-based synthetic rubber, especially for high-performance tires. For instance, China experienced 14% growth, whereas India's vehicles per 1,000 inhabitants climbed by 10% annually. Rising vehicle production, coupled with the replacement tire market, drives demand for durable, fuel-efficient, and low-rolling-resistance tires. Stringent regulations on emissions and fuel efficiency push manufacturers toward advanced rubber formulations, increasing the need for polymer-grade isoprene. Expanding logistics and transportation sectors further contribute to tire consumption. Innovations in sustainable rubber production, including bio-based isoprene, strengthen market growth. Leading tire manufacturers prioritize quality, durability, and eco-friendly solutions, making isoprene a crucial raw material in the evolving automotive and mobility landscape, thereby contributing to the isoprene market growth.

Advancements in Bio-Based Isoprene Production

The push for sustainability and reducing reliance on petrochemical feedstocks drives investment in bio-based isoprene technologies. Companies are developing fermentation-based processes using renewable resources like biomass and sugars to produce high-purity isoprene. For instance, in August 2023, Sumitomo Riko and LanzaTech Global announced partnership with Sumitomo Rubber Industries and Sumitomo Electric Industries to create recycling technologies that promote a circular economy. Bio-isoprene helps reduce carbon footprints and aligns with global environmental regulations promoting green manufacturing. Leading players, including Bridgestone, Goodyear, and Zeon Corporation, are actively investing in bio-isoprene R&D. The adoption of sustainable tires, adhesives, and medical products boosts market demand. As government incentives and regulatory policies favor renewable alternatives, bio-based isoprene is set to reshape the synthetic rubber and elastomers industry, thereby facilitating the global isoprene market demand.

Expansion of Medical, Adhesives, and Industrial Applications

Beyond tires, isoprene-based elastomers play a key role in medical devices, adhesives, and industrial sealants. The increasing demand for latex-free medical gloves, catheters, and tubing drives the need for isoprene rubber, which offers high flexibility, purity, and biocompatibility. According to India Brand Equity Foundation, India's hospital market was valued at USD 98.98 Billion in 2023, projected to grow at a CAGR of 8.0% from 2024 to 2032, reaching an estimated value of USD 193.59 Billion by 2032. The construction and packaging industries rely on isoprene adhesives for durability, elasticity, and weather resistance. Growth in sealants, coatings, and specialty rubber applications supports long-term demand. Rising investments in infrastructure, healthcare, and consumer goods further propel isoprene consumption, with manufacturers focusing on custom formulations to meet specific industry requirements across multiple end-use markets.

Isoprene Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global isoprene market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on grade, and end use industry.

Analysis by Grade:

- Polymer Grade

- Chemical Grade

Polymer grade stand as the largest component in 2024, holding around 62.0% of the market. Polymer-grade isoprene holds the largest share of the isoprene market because it functions as the primary material for manufacturing synthetic rubber, especially for styrene-isoprene-styrene (SIS) and isoprene rubber (IR). The market demands these materials extensively because they find practical use in tires and adhesives, medical goods and automotive parts which need elastic properties and extended durability. The expanding automotive and construction sectors create increasing demand for synthetic rubber that stimulates the consumption of polymer-grade isoprene. Additionally, stringent quality requirements in manufacturing favor polymer-grade purity over chemical-grade alternatives. Increasing applications in medical elastomers, footwear, and industrial goods sustain its dominance, with major producers focusing on high-purity, efficient production processes to meet expanding market needs.

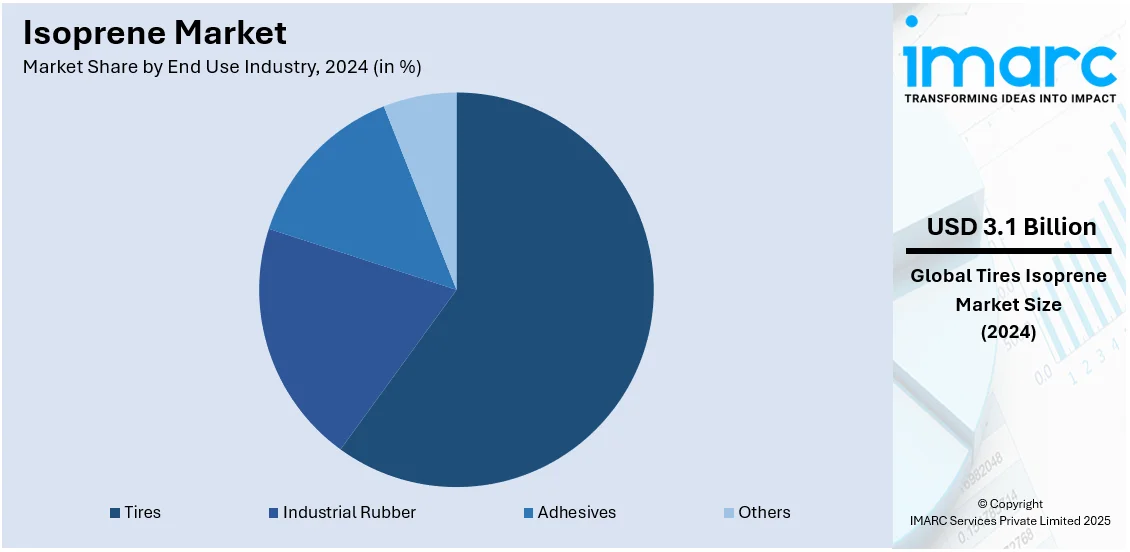

Analysis by End Use Industry:

- Tires

- Industrial Rubber

- Adhesives

- Others

Tires leads the market with around 59.8% of the market share in 2024. Tires hold the largest share of the isoprene market due because synthetic isoprene rubber (IR) finds extensive application in tire production. The high level of flexibility along with excellent durability and good resistance to wear makes isoprene-based rubber a vital material for tires used in automobiles of all classes. The automotive sector expansion together with rising requirements for efficient and high-performance tires stimulates market development. Rising vehicle production, replacement tire demand, and stringent regulations for eco-friendly materials further boost consumption. Isoprene-based rubber enhances grip, rolling resistance, and longevity, making it a preferred choice for manufacturers. Continuous innovations in tire technology and sustainability initiatives sustain isoprene’s dominance in this segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest isoprene market share of over 57.6%. In the Asia-Pacific region, isoprene adoption is increasing due to the rapid expansion and investment in the automotive industry. According to India Brand Equity Foundation, the automobile sector received a cumulative equity FDI inflow of about USD 35.65 Billion between April 2000 - December 2023. With automotive manufacturing growing at a fast pace, the demand for isoprene is rising to meet the production needs of automotive components, such as tires, seals, and gaskets. The automotive industry's continued growth in emerging markets, where automotive production is seeing significant surges, directly impacts isoprene demand. Additionally, the increasing focus on producing more durable, high-performance materials has prompted manufacturers to seek better solutions, further driving the adoption of isoprene in automotive applications. The push for sustainability in the automotive industry also encourages the use of bio-based isoprene, which aligns with the broader goals of reducing carbon footprints. As automotive manufacturing continues to thrive in the region, isoprene will play a critical role in meeting the increasing production demands.

Key Regional Takeaways:

North America Isoprene Market Analysis

The North American isoprene market exists through strong automotive production rates combined with expanding synthetic rubber demand for tires and technological developments in bio-based isoprene production methods. The automotive industries of the U.S. and Canada need high-performance isoprene-based rubber for fuel-efficient and durable tires which promotes market development. The market demand increases because of the growing replacement tire sector. Sustainability regulations have compelled manufacturers to create bio-based isoprene which enables them to decrease their dependency on petroleum products. The rubber manufacturing companies Goodyear and Bridgestone engage in investments for renewable feedstocks in synthetic rubber production. The medical industry expansion through latex-free gloves, catheters and medical adhesives drives up the demand for isoprene elastomers. Petroleum cracking procedures for producing isoprene suffer from fluctuating crude oil prices which leads manufacturers to invest in other raw materials and recycling systems. The rising construction and industrial sectors increase demand for adhesives and sealants made from isoprene. The isoprene market in North America continues as a primary market force because of sustained research and development and sustainability efforts.

United States Isoprene Market Analysis

In 2024, the United States accounted for the largest market share of over 85.0% in North America. The United States has witnessed growing isoprene adoption, primarily driven by the expansion and investments in the chemical industry. According to reports, the U.S. chemical manufacturing industry's total FDI in the industry was USD 766.7 Billion in 2023. The increasing demand for synthetic rubber and chemicals, coupled with technological advancements, has significantly boosted the need for isoprene in the region. The rise in the production of tires, adhesives, and coatings in various industries has further augmented isoprene's importance as a key chemical building block. Moreover, the consistent demand for isoprene-derived products, such as synthetic rubber and plastics, is fuelling its adoption across diverse sectors. The growth of renewable sources and bio-based alternatives also aligns with the growing interest in sustainable solutions, propelling the adoption of isoprene in the chemical industry. As the chemical industry continues to expand and innovate, the role of isoprene will likely become more central, driving further demand for its production and usage across various applications.

Europe Isoprene Market Analysis

In Europe, the growing adoption of industrial rubber, driven by the expansion of industrial production, is fuelling the demand for isoprene. According to reports, the EU's industrial production in 2021 is increased by 8.5% compared with 2020. It continued with an increase in 2022 by 0.4% compared with 2021. As the industrial sector continues to evolve, the need for high-performance materials such as industrial rubber has surged. Industrial rubber, widely used in machinery, conveyor belts, and seals, requires isoprene as a key raw material to maintain its strength, elasticity, and durability. The increasing emphasis on sustainable production and the shift towards bio-based materials have further amplified the demand for bio-based isoprene, which is derived from renewable sources. The expansion in industrial productions, including those in automotive and manufacturing industries, has also accelerated the adoption of isoprene to meet growing needs for advanced industrial rubber products. As European industries continue to expand, isoprene's role in supporting industrial rubber production will only become more significant.

Latin America Isoprene Market Analysis

In Latin America, the agricultural sector’s growth is contributing to the rising demand for bio-based isoprene, produced from renewable sources such as biomass and agricultural waste. According to World Bank Group, agriculture is important for the region’s economies, accounting for 5-18% of GDP in 20 countries in Latin America and the Caribbean (LAC). As agriculture continues to expand, the need for sustainable solutions and bio-based chemicals has become more critical. Bio-based isoprene, being an eco-friendly alternative to conventional petrochemical-derived isoprene, is gaining traction due to its potential to reduce environmental impact. The increasing focus on sustainable agriculture practices, such as the use of biomass and agricultural waste for chemical production, supports the broader adoption of bio-based isoprene in various applications, particularly in the agricultural and chemical sectors.

Middle East and Africa Isoprene Market Analysis

The healthcare industries in the Middle East and Africa are contributing to the growing adoption of isoprene, particularly for its use in producing medical products like catheters, cohesive bandages, surgical gloves, medical stoppers, tube connectors, and drug delivery systems. As healthcare facilities and infrastructure continue to expand in the region, there is a rising demand for medical devices and supplies that require high-quality, durable materials. Isoprene, with its excellent elasticity and biocompatibility, is becoming a preferred material for these applications. According to Dubai Healthcare City Authority report, Dubai's healthcare sector saw rapid growth, with 4,482 private medical facilities and 55,208 licensed professionals by 2022, projected to expand further by 3-6% in facilities and 10-15% in professionals in 2023. The healthcare sector's growth and the increasing focus on improving medical standards are key factors driving the adoption of isoprene in the production of essential medical products. As healthcare needs continue to grow, isoprene’s role in medical manufacturing will continue to expand.

Competitive Landscape:

The isoprene market operates under major global companies that concentrate on producing synthetic rubber and developing bio-based solutions while strengthening their supply chains. Several top companies in the isoprene market include Goodyear, Bridgestone, ExxonMobil, LyondellBasell and Zeon Corporation, Kraton Corporation and Sinopec. Petrochemical isoprene production controls major market shares for both ExxonMobil and Sinopec and Goodyear and Bridgestone invest in bio-isoprene technology to advance sustainable tire production. The core elements of competitive competition in this market are the availability and quality of feedstocks and the efficiency and regulatory compliance of operations. Organizations are implementing bio-based manufacturing together with recycling practices along with circular economic systems to minimize their use of petroleum. The market develops through M&A transactions and R&D investments in high-performance elastomers and medical-grade isoprene and adhesive products. Asia-Pacific maintains the largest production capacity for sustainable tires while Europe and North America lead the implementation of sustainable technologies to fulfill their sustainability targets.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- ENEOS Materials Trading Co. Ltd.

- Kuraray Europe GmbH (Kuraray Co. Ltd.)

- Lyondellbasell Industries Holdings B.V.

- Ningbo Jinhai ChenguangChemical Corporation

- Pon Pure Chemicals Group

- Shandong Yuhuang Chemical Group Co. Ltd.

- Shell Plc

- Zibo Luhua Hongjin New Material Group Co. Ltd.

Latest News and Developments:

- November 2024: DL Chemical has launched the world's largest polyisoprene latex plant in Singapore, marking a significant expansion in the medical materials sector. The 480 Billion-won Cariflex facility on Jurong Island will produce essential materials for surgical gloves. This milestone strengthens DL Chemical's position as the global leader in polyisoprene latex. The company's acquisition of Cariflex in 2020 further solidifies its dominance in the market.

- April 2024: Zeon Corporation has signed a memorandum of understanding with Visolis, Inc. to commercialize bio-isoprene monomers and sustainable aviation fuel (SAF), advancing its sustainability goals. This agreement follows Zeon’s investment in Visolis and aims to accelerate the development of eco-friendly products. Bio-isoprene monomers, used in bio-isoprene rubber and bio-SIS, will be produced through a combination of biological and chemical catalysis. This partnership supports Zeon’s efforts toward carbon neutrality and a circular economy.

- February 2024: QatarEnergy and Chevron Phillips Chemical have begun construction on a USD 6 Billion integrated polymers complex in Ras Laffan Industrial City, Qatar. The project includes a 2,080 KTA ethane cracker, the largest in the Middle East, and two high-density polyethylene derivative units. His Highness the Amir of Qatar, Sheikh Tamim bin Hamad Al Thani, laid the ceremonial foundation stone. The project also focuses on the production of isoprene.

- February 2023: Kuraray announced the establishment of a new plant in Thailand dedicated to isoprene-related businesses. This facility aims to enhance the production capacity of isoprene and its derivatives. The investment reflects Kuraray's commitment to expanding its operations in Southeast Asia, responding to growing market demand, and strengthening its global supply chain. The plant is expected to commence operations in 2025.

- October 2023: Goodyear Tire & Rubber Company and Visolis announced a collaboration to produce isoprene by upcycling biobased materials. This initiative, supported by a Small Business Innovation Research (SBIR) grant, aims to create high-quality isoprene from non-edible biomass and agricultural materials. The partnership reflects a commitment to sustainability, with goals to reduce carbon footprints and achieve net-zero emissions by 2050.

Isoprene Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Polymer Grade, Chemical Grade |

| End Use Industries Covered | Tires, Industrial Rubber, Adhesives, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Chevron Phillips Chemical Company LLC, China Petrochemical Corporation, ENEOS Materials Trading Co. Ltd., Kuraray Europe GmbH (Kuraray Co. Ltd.), Lyondellbasell Industries Holdings B.V., Ningbo Jinhai ChenguangChemical Corporation, Pon Pure Chemicals Group, Shandong Yuhuang Chemical Group Co. Ltd., Shell Plc, Zibo Luhua Hongjin New Material Group Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the isoprene market from 2019-2033.

- The isoprene market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the isoprene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The isoprene market was valued at USD 5.14 Billion in 2024.

The isoprene market is projected to exhibit a CAGR of 5.94% during 2025-2033, reaching a value of USD 8.64 Billion by 2033.

The isoprene market is driven by rising demand for synthetic rubber in tires, advancements in bio-based isoprene, expanding medical and industrial applications, and fluctuating crude oil prices. Automotive growth, sustainability initiatives, and regulatory pressures further shape market trends, pushing manufacturers toward eco-friendly alternatives and innovative production technologies to ensure supply stability. The factors, collectively, are creating the positive isoprene market outlook across the globe.

Asia Pacific currently dominates the isoprene market, accounting for a share of 57.6%. Rising tire demand, expanding automotive sector, synthetic rubber production growth, industrialization, infrastructure projects, and increasing adhesives and sealants applications.

Some of the major players in the isoprene market include Chevron Phillips Chemical Company LLC, China Petrochemical Corporation, ENEOS Materials Trading Co. Ltd., Kuraray Europe GmbH (Kuraray Co. Ltd.), Lyondellbasell Industries Holdings B.V., Ningbo Jinhai ChenguangChemical Corporation, Pon Pure Chemicals Group, Shandong Yuhuang Chemical Group Co. Ltd., Shell Plc, Zibo Luhua Hongjin New Material Group Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)