IoT Insurance Market Size, Share, Trends and Forecast by Insurance Type, Component, Application, and Region, 2025-2033

IoT Insurance Market Size and Share:

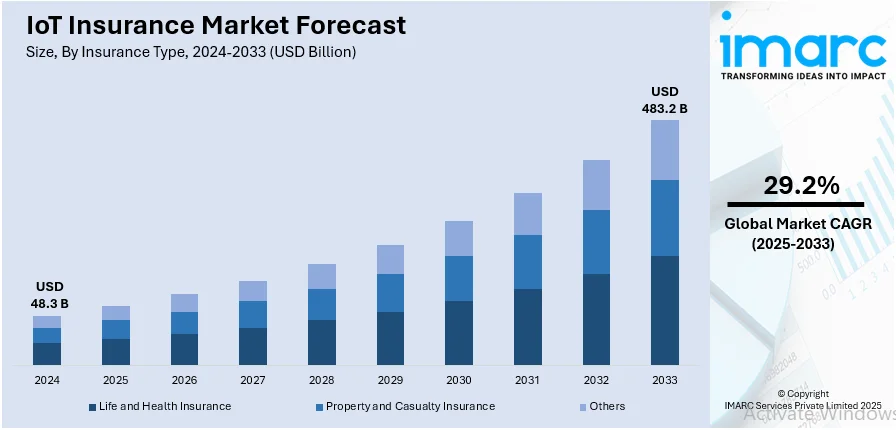

The global IoT insurance market size was valued at USD 48.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 483.2 Billion by 2033, exhibiting a CAGR of 29.2% during 2025-2033. North America currently dominates the market, holding a significant market share of over 36.7% in 2024, driven by telematics adoption, AI-driven risk assessment, smart home monitoring, and strong regulatory support for digital insurance solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 48.3 Billion |

|

Market Forecast in 2033

|

USD 483.2 Billion |

| Market Growth Rate (2025-2033) | 29.2% |

The increasing integration of Internet of Things (IoT) devices in insurance is driving the IoT insurance market growth by enabling real-time data collection for risk assessment, pricing, and claims management. Insurers leverage smart home sensors, telematics, and wearable devices to monitor policyholder behavior, detect anomalies, and reduce fraud. The use of IoT enhances predictive analytics, allowing insurers to offer personalized premiums and proactive risk prevention. For instance, in September 2024, Trigent Software announced the launch of IoT services to transform insurance with tailored solutions, enhancing efficiency and innovation. The IoT insurance market is projected to reach USD 76.73 billion by 2029. With the rising demand for usage-based insurance (UBI) and real-time monitoring in sectors like auto, health, and home insurance, IoT adoption is transforming traditional insurance models, improving operational efficiency, and reducing overall loss ratios.

The U.S. is advancing the IoT insurance market through widespread adoption of connected technologies, regulatory support, and strong insurer-investor collaborations. Major insurers integrate telematics for auto insurance, using real-time driving data for usage-based pricing, which also represents one of the key IoT insurance market trends. Smart home sensors enhance property insurance by preventing losses through early hazard detection. Health insurers leverage wearable devices for personalized policy adjustments. Leading U.S. firms, including Allstate, Progressive, and State Farm, invest in IoT-driven risk assessment and fraud detection. For instance, in January 2024, Lightsmith Group led a $20 million Series C investment in Parsyl, an AI-powered insurer enhancing climate resilience in global cargo. Parsyl insures food, beverage, and pharmaceutical supply chains. With a well-established tech ecosystem and data-driven approach, the U.S. is shaping the global IoT insurance landscape, improving underwriting accuracy and customer engagement.

IoT Insurance Market Trends:

Focus On Risk Mitigation

One of the major factors contributing to the growth of this market is the increasing emphasis on risk mitigation with the application of data analytics. IoT devices such as connected vehicles, wearable fitness trackers, and smart home sensors provide an abundance of data that insurers can use to evaluate and manage those risks. For instance, number of connected IoT devices has grown 13 to 18.8 Billion globally. Also, with this real-time data collection and analytics, insurance companies will obtain deep insights about customer behaviors, driving habits, and lifestyle choices. Consequently, insurers can price their policies more accurately, provide personalized coverage, and encourage safer practices among their policyholders. By monitoring driving behavior via IoT devices in vehicles, details such as speed, acceleration, and braking behavior are tracked. This information allows the insurer to grant discounts to safe drivers, building a larger customer pool. In addition, insurers can be on the lookout for risky behavior and advise their policyholders with incentives or guidance to modify their habits, consequently enhancing the probability of avoiding accidents and claims.

Expansion Beyond Traditional Insurance Lines

This market growth is attributed to the advent of IoT in agricultural insurance. IoT devices are widely employed to collect data regarding crop conditions, weather patterns, and equipment functioning. Soil sensors, weather stations, and GPS trackers are a few examples. For instance, The Weather Channel app that uses weather sensors to report the condition, had over 55 Million monthly active users in 2020 to see the weather update. Such data can facilitate the offering of customized policies by insurers pertaining to farmers against perils such as drought, flood, or equipment breakdown. Besides, widespread adoption of IoT devices by businesses that want to keep track of the state of their assets-the machinery and vehicles-and inventory- provides a good outlook for the market. The insurers can now write policies to cover damage, theft, or loss of income related to such assets. In addition to that, they can also help the client improve their operations and reduce risks through analyzing the data acquired through their devices. Also, IoT will drive the creation of a new set of products in insurance for the healthcare sector. Insurers could team up with healthcare providers to offer policies that reward healthy behavior from policyholders. Wearables and health apps can track exercising, dieting, and sleeping patterns, thereby enabling insurers to promote rewards like premium discounts or wellness rewards. This, in turn, is facilitating the IoT insurance market demand.

Telematics in Automobile Insurance

The advent of telematics technology is influencing the growth of IoT insurance, particularly in the automobile insurance sector. According to the National Association of Insurance Commissioners, the countrywide average auto insurance expenditure increased 1.4 percent to USD 1,062 in 2021 from USD 1,046 in 2020. Telematics devices, usually fitted into the vehicle, collect data on driving behavior and vehicle performance. This data is sent to insurers for assessing risk and providing the policyholder with feedback. Simultaneously, telematics can monitor behavior related to speeding, harsh braking, and acceleration patterns so that insurers can recognize these risky behaviors. Furthermore, telematics can also help find key facts regarding the situation of an accident: what happened before the crash? Such information might expedite the claims process and provide the insurers with much greater insight into the causation of accidents so that claim assessments can be properly done. Thus, insurers can track down individuals responsible for the accidents quickly and ensure fast payments are made to the policyholders. Data can also be used for accurate accident reconstruction, aiding investigators with the accident and the claims assessment. Lastly, telemetrically-derived data might help insurers determine whether or not the policyholder contributed to the accident.

IoT Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global IoT insurance market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on insurance type, component, and application.

Analysis by Insurance Type:

- Life and Health Insurance

- Property and Casualty Insurance

- Others

Property and casualty insurance stand as the largest insurance type in 2024, driven by the increasing adoption of connected technologies for risk assessment and loss prevention. Insurers are leveraging IoT-enabled devices such as telematics in auto insurance, smart home sensors for property protection, and industrial IoT solutions to monitor commercial assets. These technologies enhance underwriting accuracy, enable proactive risk mitigation, and streamline claims processing. Additionally, the growing impact of climate change-related events, including wildfires, floods, and hurricanes, has fueled demand for IoT-based predictive analytics in catastrophe risk management. With real-time data integration and AI-powered analytics, IoT continues to transform P&C insurance, making it the largest and most rapidly evolving segment in 2024.

Analysis by Component:

- Solution

- Service

Solution leads the market with around 67.5% of the IoT insurance market share in 2024. This leadership is driven by the growing adoption of connected technologies for risk assessment, underwriting, and claims management. Insurers increasingly implement IoT-driven platforms, telematics, smart home monitoring systems, and AI-powered analytics to enhance operational efficiency and customer experience. These solutions enable real-time data collection, predictive analytics, and automated claims processing, reducing fraud and improving accuracy. The rise of usage-based insurance (UBI) in auto and health sectors further supports the dominance of IoT solutions. Additionally, the integration of blockchain and cloud computing in insurance ecosystems is strengthening cybersecurity and data transparency, reinforcing the market's reliance on advanced IoT-based insurance solutions in 2024.

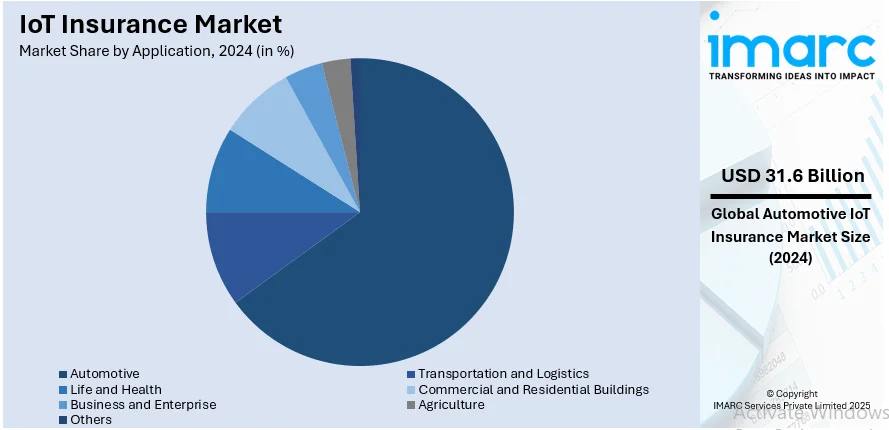

Analysis by Application:

- Automotive

- Transportation and Logistics

- Life and Health

- Commercial and Residential Buildings

- Business and Enterprise

- Agriculture

- Others

Automotive leads the market with around 65.4% of market share in 2024. The rapid adoption of telematics-based insurance policies, such as usage-based insurance (UBI) and pay-as-you-drive (PAYD) models, is driving growth. Insurers leverage IoT-enabled devices, GPS tracking, and in-vehicle sensors to assess driving behavior, optimize premium pricing, and enhance road safety. The increasing penetration of connected and autonomous vehicles further fuels demand for real-time risk monitoring and claims automation. Additionally, regulatory support for road safety and vehicle data standardization is encouraging insurers to integrate IoT technologies. As automotive insurers focus on digital transformation and AI-driven analytics, IoT continues to reshape risk assessment and policy customization in 2024.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.7%. The region's dominance is driven by the widespread adoption of connected technologies, strong regulatory support, and the presence of leading insurers leveraging IoT for risk assessment and policy customization. The growing adoption of telematics in auto insurance, smart home monitoring systems, and AI-powered analytics in underwriting has fueled market expansion. Additionally, increasing climate-related risks, including hurricanes and wildfires, have accelerated the demand for IoT-driven predictive analytics in property insurance. With major players such as Allstate, Progressive, and State Farm investing in digital transformation and real-time data analytics, North America continues to lead in IoT insurance innovation.

Key Regional Takeaways:

United States IoT Insurance Market Analysis

US accounts for 80.50% share of the market in North America. The growing IoT insurance adoption due to growing use of IoT devices by businesses to monitor the condition of their assets is a major factor driving market expansion. Businesses are increasingly integrating IoT-enabled sensors and predictive analytics to assess real-time risks and optimize operational efficiency. For instance, by the end of 2024, the number of IoT devices across the globe is expected to exceed 17 Billion, with 5.4 Billion In North America alone. This adoption is particularly prominent in industries such as manufacturing, logistics, and retail, where asset tracking and risk prevention play crucial roles. The ability to reduce claim costs and improve underwriting accuracy has encouraged insurers to offer customized policies based on real-time data. Companies are leveraging telematics, connected machinery, and smart surveillance systems to monitor risks associated with workplace safety, machinery maintenance, and supply chain disruptions. The integration of IoT devices has also enabled insurance providers to transition from traditional risk assessment models to proactive risk prevention strategies, enhancing customer engagement and reducing fraudulent claims. The adoption of predictive maintenance tools in industrial settings is further boosting the demand for IoT insurance. Additionally, regulatory frameworks supporting data-driven risk management solutions are fostering market growth.

Asia Pacific IoT Insurance Market Analysis

The growing IoT insurance adoption due to growing demand of life and health insurance in Asia-Pacific is significantly influencing market expansion. According to India Brand Equity Foundation, India is the fifth largest life insurance market in the world's emerging insurance markets, growing at a rate of 32-34% each year. The increasing prevalence of connected health devices, wearable fitness trackers, and smart home monitoring systems is driving insurers to provide policies that reward policyholders for maintaining healthy lifestyles. The region's rising middle-class population and urbanization trends are accelerating the demand for personalized health coverage, with insurers leveraging IoT-enabled diagnostics and remote patient monitoring for dynamic policy adjustments. The adoption of IoT-based underwriting tools is enhancing risk assessment capabilities, allowing insurers to develop preventive healthcare solutions. The increasing use of telemedicine and AI-driven predictive analytics in health insurance is improving claims processing and fraud detection, contributing to market growth. Additionally, the growing elderly population in countries such as Japan and China are driving demand for IoT-enabled health monitoring solutions that provide real-time data to insurers, enabling them to tailor policies accordingly.

Europe IoT Insurance Market Analysis

The growing IoT insurance adoption due to growing automobile insurance sector due to growing vehicle ownership in Europe is accelerating market growth. According to the International Council on Clean Transportation, about 10.6 Million new cars were registered in the 27 Member States in 2023, 14% more than in 2022. With the rising number of connected vehicles, insurers are increasingly utilizing telematics and usage-based insurance models to offer personalized premium rates. The demand for real-time vehicle tracking and driver behavior analysis is prompting insurance providers to integrate IoT sensors into vehicles, allowing them to monitor factors such as speed, braking patterns, and mileage. The increasing consumer preference for pay-as-you-drive and pay-how-you-drive insurance policies is reshaping the auto insurance landscape, encouraging greater adoption of IoT-driven solutions. The rapid development of autonomous and electric vehicles is also fueling demand for IoT-enabled insurance models that assess risk based on real-time vehicle performance data. Insurers are leveraging AI-powered analytics and predictive maintenance alerts to enhance claim processing efficiency and fraud detection. Additionally, stringent regulatory mandates across Europe are promoting the implementation of IoT-based vehicle safety systems, further driving the expansion of IoT insurance in the automotive sector.

Latin America IoT Insurance Market Analysis

The growing IoT insurance adoption due to growing agriculture sector in Latin America is shaping new risk management models for farmers and agribusinesses. For instance, annual crop production area in Brazil occupies 69 Million ha. The increasing use of IoT-enabled sensors, smart irrigation systems, and weather monitoring devices is enabling insurers to offer data-driven policies that assess crop health, soil moisture levels, and climate risks. Farmers are adopting IoT solutions to optimize resource allocation and prevent losses from unpredictable weather conditions, which is increasing the demand for customized insurance coverage. The expansion of precision agriculture practices, supported by IoT-powered analytics, is enhancing the accuracy of risk assessments, allowing insurers to provide tailored coverage based on real-time environmental data. Insurers are collaborating with agritech companies to develop parametric insurance models that automate claim payouts based on predefined environmental triggers.

Middle East and Africa IoT Insurance Market Analysis

The growing IoT insurance adoption due to growing investments in commercial and residential buildings in Middle East and Africa is driving demand for smart risk management solutions. For instance, in 2023, foreign investors accounted for 45% of total commercial property transactions in Dubai. The integration of IoT-enabled security systems, energy management devices, and predictive maintenance tools in buildings is enhancing insurers’ ability to assess structural risks and optimize policy pricing. The increasing adoption of smart building technologies is allowing insurers to offer real-time risk mitigation strategies, reducing claims related to fire, water damage, and structural failures. Insurers are leveraging IoT data to enhance underwriting accuracy and provide customized coverage based on occupancy patterns and building usage. Additionally, the rising focus on sustainable construction and energy-efficient buildings is promoting the adoption of IoT-driven insurance models that monitor environmental impact and operational efficiency.

Competitive Landscape:

The IoT insurance market is highly competitive, with key players leveraging connected technologies for risk assessment and personalized pricing. Leading insurers, smart home sensors, and wearables to enhance underwriting accuracy and claims efficiency. Insurtech firms like Lemonade and Root Insurance disrupt traditional models with AI-driven, IoT-based policies. Strategic partnerships between insurers and tech providers, including IoT device manufacturers and data analytics firms, drive innovation. With rising investments in predictive analytics and real-time monitoring, competition intensifies as companies seek to differentiate through customized policies and superior customer engagement. For instance, in February 2025, a survey by Economist Impact and SAS found that 78% of insurance executives see closing the $1.8 trillion protection gap as an ethical duty, with technology as the key solution.

The report provides a comprehensive analysis of the competitive landscape in the IoT insurance market with detailed profiles of all major companies, including:

- Accenture plc

- Allerin

- Capgemini SE

- Cognizant

- Concirrus

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- Sas Institute Inc.

- Telit

- Verisk Analytics Inc.

- Wipro Limited

Latest News and Developments:

- February 2025, Allstate finds that AI-generated emails are more empathetic than human-written ones and improve customer interaction. The insurer employs OpenAI’s GPT models to make its messages less accusatory and jargony. Through the AI, most emails sent to claimants regarding their claims are handled with more communication and a calmer tone. The AI—frozen in data and code—is more empathetic than human representatives.

- December 2024: Adroit Auto collaborates with the leading PSU insurers to modernize vehicle claims settlement amidst India's digital insurance transition. The resolution of motor accident claims to the tune of Rs. 50,000 is expedited and achieved economically using AI-powered assessment tools. Together with insurers like New India Assurance and United India Insurance, they create a climate of transparency and efficiency. In this manner, trust is established as a result of unbiased evaluation and streamlined processes.

- December 2024: Nationwide expands its IoT-driven insurance programs by partnering with Phyn for water leak detection and extending its Ting fire prevention initiative. New policyholders with high-value homes receive a 15% discount on Phyn’s services, while Ting provides free fire hazard monitoring. These initiatives aim to reduce costly claims and enhance home safety. Nationwide reinforces its commitment to innovative insurance solutions through IoT advancements.

- October 2024: Tata AIG General Insurance rolls out five new riders in health insurance that collectively cover over 60 benefits. The riders offer industry-first preventive coverage for mental health and specialized plans for women's health, cancer care, and outpatient expenses. It provides flexibility to the policy and addresses the evolving needs of healthcare. The move is a testament to Tata AIG's commitment toward growth in the health insurance space.

- September 2024: Trigent Software has unveiled IoT-driven innovations that would transform the insurance industry with enhanced risk assessment and fraud detection. Its solutions ensure seamless connectivity for optimizing operational efficiency of insurers. Emphasizing data sharing, Trigent is advocating collaboration as a way to unlock richer insights while upholding privacy. This move away from frozen data silos emboldens new innovations and opportunities in business.

- October 2023: Accenture plc acquired Germany-based ON Service GROUP, thus strengthening its foothold in insurance operations. Thus, Accenture can better manage its supply chain as it has been set to. Henceforth, its clients will enjoy ever-increasing flexibility and growth in terms of digital services offered. The acquisition has helped cement Accenture's standing on the frozen landscape of shifting and evolving business demand.

IoT Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered | Life and Health Insurance, Property and Casualty Insurance, Others |

| Components Covered | Solution, Service |

| Applications Covered | Automotive, Transportation and Logistics, Life and Health, Commercial and Residential Buildings, Business and Enterprise, Agriculture, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture plc, Allerin, Capgemini SE, Cognizant, Concirrus, Intel Corporation, International Business Machines Corporation, Microsoft Corporation, Sas Institute Inc., Telit, Verisk Analytics Inc., Wipro Limited., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the IoT insurance market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global IoT insurance market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the IoT insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The IoT insurance market was valued at USD 48.3 Billion in 2024.

IMARC estimates the IoT insurance market to reach USD 483.2 Billion by 2033, exhibiting a CAGR of 29.2% during 2025-2033.

Key factors driving the IoT insurance market include rising adoption of connected devices, demand for real-time risk assessment, growth of telematics-based policies, AI-driven analytics, regulatory support, and increasing climate-related risks. Insurers leverage IoT for personalized pricing, fraud prevention, automated claims processing, and improved underwriting accuracy, enhancing operational efficiency and customer experience.

North America currently dominates the market with a 36.7% share, driven by widespread adoption of telematics, smart home monitoring, and AI-powered risk assessment. Strong regulatory frameworks, increasing climate-related risks, and major insurers investing in IoT-driven underwriting, fraud detection, and claims automation further strengthen the region’s market dominance.

Some of the major players in the IoT insurance market include Accenture plc, Allerin, Capgemini SE, Cognizant, Concirrus, Intel Corporation, International Business Machines Corporation, Microsoft Corporation, Sas Institute Inc., Telit, Verisk Analytics Inc., Wipro Limited., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)