Ion Exchange Resins Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Ion Exchange Resins Market Size and Share:

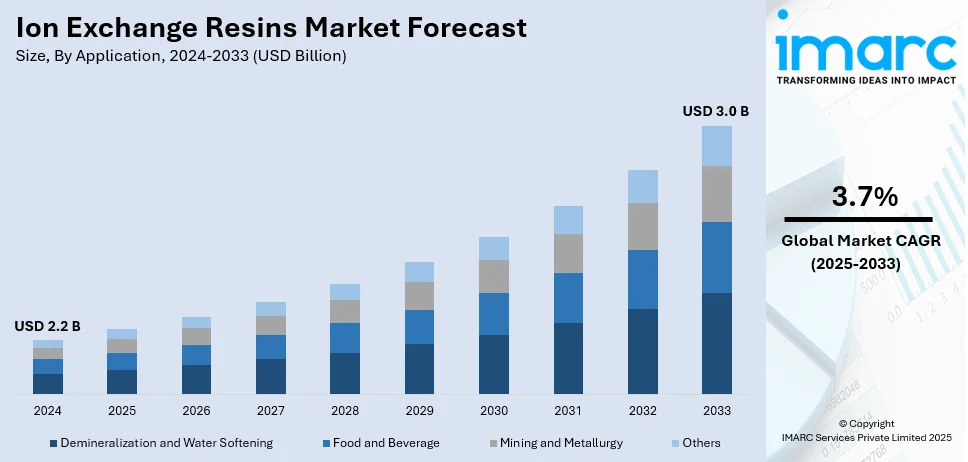

The global ion exchange resins market size reached USD 2.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.7% during 2025-2033. Asia-Pacific currently dominates with a 44.6% share in the ion exchange resins market in 2024. This region's dominance is driven by rapid industrialization, growing water treatment needs, expanding chemical and pharmaceutical industries, and increasing environmental awareness across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.2 Billion |

| Market Forecast in 2033 | USD 3.0 Billion |

| Market Growth Rate (2025-2033) | 3.7% |

One major driver of the ion exchange resins market is the increasing demand for water treatment solutions across industrial, municipal, and residential sectors. With growing concerns over water scarcity and contamination, industries and governments are prioritizing advanced water purification technologies to ensure access to clean and safe water. Ion exchange resins play a critical role in removing impurities, such as heavy metals, salts, and organic compounds, from water, enhancing their quality for various applications. The adoption of stricter environmental regulations globally has further accelerated the use of ion exchange resins in wastewater treatment processes, driving their demand across diverse industries. For instance, in 2024, the Biden-Harris Administration announced $5.8 billion in funding from the Investing in America agenda for drinking water, wastewater, and stormwater infrastructure upgrades. This allocation, part of a $50 billion investment under the Bipartisan Infrastructure Law, focuses on underserved communities with grants and loan forgiveness. Key initiatives include removing lead service lines, upgrading treatment plants, and addressing contaminants like PFAS.

The United States plays a pivotal role in serving the ion exchange resins market through its advanced manufacturing capabilities, robust industrial base, and commitment to environmental sustainability. For instance, in 2024, ResinTech expanded its Camden, NJ headquarters, adding 30,000 square feet to boost U.S. resin production, filter manufacturing, and lab services, reflecting rising demand for domestic goods. With a strong focus on water treatment solutions, the U.S. leads in the production and application of ion exchange resins for municipal, industrial, and residential water purification systems. Key industries, including power generation, pharmaceuticals, and food processing, drive significant demand for these resins due to stringent regulatory standards and the need for high-quality process water. Additionally, the U.S. invests heavily in research and development, fostering innovation in resin technologies to meet evolving environmental and industrial requirements.

Ion Exchange Resins Market Trends:

Growing Petrochemical and Chemical Processing Industry

The growing petrochemical and chemical processing industry is one of the key factors driving the ion exchange resins market. For instance, according to the Department of Chemicals and Petrochemicals, India's chemical and petrochemical (CPC) sector was valued at USD 178 Billion in 2024 and is predicted to expand to over USD 300 Billion by 2025. The petrochemical and chemical processing industries require water for various processes. Ion exchange resins are crucial in water treatment applications within these industries to remove impurities and ensure water quality meets regulatory standards. These factors further contribute to the ion exchange resins market share.

Rising Demand for Electricity

The growing demand for electricity in industries and households is significantly driving the ion exchange resins market. For instance, according to IEA, global electricity demand is predicted to accelerate during the upcoming years, rising by an average of 3.4% per year through 2026. Similarly, according to another article published by Down to Earth, between 2024 and 2026, India's electricity demand will increase by an annual average of 6.5%. Ion exchange resins are used in power generation processes such as nuclear power plants and some types of renewable energy systems (like geothermal and biofuels). In nuclear power plants, resins are used to purify and treat coolant water and remove radioactive ions, ensuring safe and efficient operation. These factors further positively influence the ion exchange resins industry forecast.

Surging Demand for Water Treatment

With increasing global population and industrialization, the demand for clean and safe water is growing. For instance, according to the United Nations, in 2022, around 2.2 Billion people needed safe drinking water, including 703 Million who did not have access to basic water services. Ion exchange resins are essential for treating water from various sources, such as municipal supplies, industrial wastewater, and even groundwater contaminated with heavy metals, nitrates, and other pollutants. This is further bolstering the ion exchange resins market revenue.

Ion Exchange Resins Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global ion exchange resins market report, along with forecast at the global and regional levels for 2025-2033. Our report has categorized the market based on type and application.

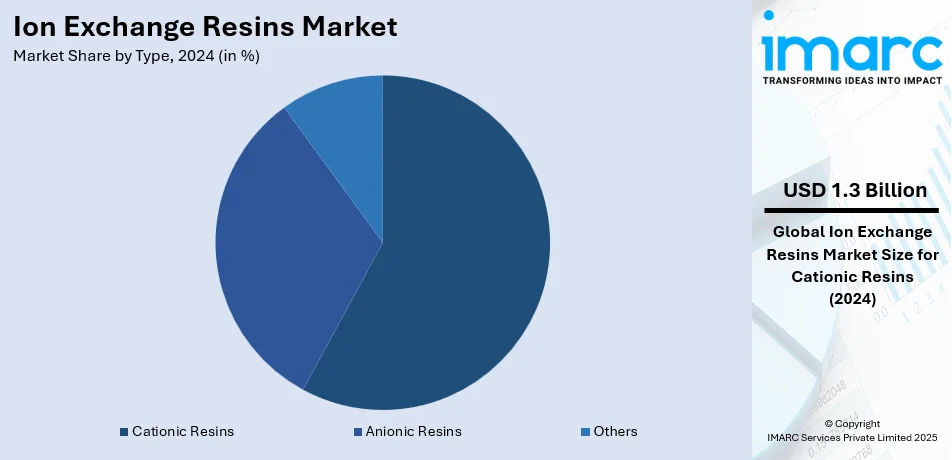

Analysis by Type:

- Cationic Resins

- Anionic Resins

- Others

Cationic resins lead the market with around 57.8% of the market share in 2024. These resins are integral to water softening, demineralization, and industrial water treatment processes, making them indispensable for sectors such as power generation, chemicals, and food and beverages. Their ability to efficiently remove positively charged ions like calcium, magnesium, and heavy metals enhances the quality of water and other treated substances. The growing emphasis on sustainable and efficient water management solutions further fuels their demand. Additionally, advancements in resin technologies, coupled with rising environmental regulations, have solidified cationic resins as a preferred choice for industries aiming to meet stringent quality and compliance standards.

Analysis by Application:

- Demineralization and Water Softening

- Food and Beverage

- Mining and Metallurgy

- Others

Demineralization and water softening are key applications in the ion exchange resins market, addressing the removal of impurities and hardness from water. These processes are essential in industries like power generation, pharmaceuticals, and municipal water treatment, where purified water enhances operational efficiency, reduces equipment scaling, and ensures compliance with stringent quality standards.

The food and beverage sector represents a significant application segment for ion exchange resins, supporting processes such as decolorization, purification, and stabilization of products. These resins are integral to ensuring high product quality, enhancing taste, and meeting regulatory standards, particularly in sugar refining, beverage production, and water purification within the industry.

Mining and metallurgy are prominent application segments for ion exchange resins, utilized in metal recovery, separation, and purification processes. These resins enhance the efficiency of extracting precious and rare earth metals while minimizing waste and environmental impact. Their role is crucial in refining operations and supporting sustainable resource management practices.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of over 44.6%. This dominance is driven by rapid industrialization and urbanization across major economies like China, India, and Japan. The region's significant growth in water treatment infrastructure, supported by government initiatives to address water pollution and scarcity, has been a major factor boosting the demand for ion exchange resins. Additionally, the expansion of industries such as power generation, pharmaceuticals, food and beverages, and chemicals further contributes to the increasing adoption of these resins. Rising environmental concerns and stricter regulatory frameworks aimed at ensuring water quality have also propelled the use of advanced purification technologies, where ion exchange resins play a critical role. This robust growth highlights Asia-Pacific’s pivotal role in shaping the global ion exchange resins market dynamics.

Key Regional Takeaways:

United States Ion Exchange Resins Market Analysis

US accounts for 80% of the market share in North America. The principal driver of the ion exchange resins market in the US is the increasing demand for water treatment solutions in the residential, commercial, and municipal sectors. Effective water filtration techniques such as ion exchange resins are necessary since over 40% of Americans depend on surface water sources and the rest on groundwater sources, according to data from the Bureau of Reclamation California-Great Basin. The U.S. Environmental Protection Agency's (EPA) water quality standards, which push the adoption of advanced technologies for removing pollutants such as heavy metals, nitrates, and arsenic, are a strong support to the market. The pharmaceutical sector, which contributed around USD 550 Billion in 2021, according to industry accounts, is also a huge contributor. These industries use a lot of ion exchange resins for procedures such as catalysis, purification, and separation. A power generation industry, specifically a nuclear power reactor that utilizes an ion exchange resin for its coolant purification, is increasing its growth in the market. On top of that, the food and beverages market of the United States is now rising in demand for demineralized water. To maintain the leadership of the global market for ion exchange resins, DuPont, Purolite, and Lanxess are investing heavily in research and development to develop specialty resins for specific applications.

Europe Ion Exchange Resins Market Analysis

The market for ion exchange resins in Europe is driven by strict environmental requirements found in directives such as REACH and the European Water Framework Directive. These resins are crucial in the water treatment industry. The European Union indicates that for 2021, this water supply, sewerage, waste management, and remediation activities industry had 79,700 businesses at a net turnover of Euro 290.5 Billion (USD 306.4 Billion). In industrial applications, these resins are used for chemical processing and wastewater treatment and in Germany, France, and the UK. The pharmaceuticals sector is among the major customers of resins since they incorporate them in drug formulation and purify drugs. Additionally, the renewable energy industry such as wind and solar plants requires demineralized water systems based on ion exchange resins. Resins are also being used for deionization and cleaning purposes in food and beverage industries. Businesses such as Dow, Thermax, and Mitsubishi Chemical are increasing their presence in the European market through some of the latest solutions that are rightly suited to the differing industrial requirements of the region.

Asia Pacific Ion Exchange Resins Market Analysis

The Asian Pacific region dominates the ion exchange resins market, mainly due to fast industrialization and urbanization of countries like China, India, and Japan. Despite the fact that the numbers in Asia and the Pacific improve, 600 Million in the cities and 1.5 Billion in rural locations still have no proper water and sanitation, data published by the Asian Development Bank, and for that reason alone, is putting a fuel to demand for innovative treatment technologies of water. Another driver would be the chemical industry. The Asia-Pacific chemical industry is the sector's largest contributor to GDP and employment, accounting for 45% of the industry's total yearly economic value and 69% of all jobs supported. South Korea's semiconductor industry as well as Japan's focus on nuclear energy increase the demand for high-end ion exchange resins. Local manufacturers, such as Purolite and Thermax, capitalize on growing demand for eco-friendly solutions that are at the same time affordable for a variety of applications.

Latin America Ion Exchange Resins Market Analysis

Expanding investment in water and wastewater treatment boosts Latin American demand for ion exchange resins. The industrial sector in the region is significant, especially in Brazil and Mexico. Ion exchange resins are used in mining operations, which shall be worth over USD 120 Billion and will be produced by 2030, according to figures from the International Energy Agency. Resins are also required for water deionization and sugar refinement in food and beverages. Increased adoption rates of ion exchange resins are further factored in by governments across the region who are also enforcing stronger regulations regarding water quality.

Middle East and Africa Ion Exchange Resins Market Analysis

Ion exchange resins are in high demand in the Middle East and Africa due to desalination projects and water constraints. Resins are required for water treatment in the GCC nations, which have invested more than USD 300 Billion in desalination between 2012-2022, as per an industrial report. Resins are used to treat process water in South Africa's industrial sector, which encompasses mining and power generating. The region's oil and gas sector also uses ion exchange resins for separation and purification procedures. The market is growing due to companies developing high-capacity, long-lasting resins that are tailored to regional needs, as well as increased focus on wastewater recycling and adherence to environmental regulations.

Competitive Landscape:

The competitive landscape of the ion exchange resins market is marked by the presence of key global players focused on innovation, product quality, and expanding applications. Leading companies dominate the market by utilizing cutting-edge production methods and widespread supply chains. These firms emphasize research and development to introduce resins with enhanced performance characteristics, catering to industries like water treatment, pharmaceuticals, and food processing. For instance, in 2024, LANXESS's Lewatit UltraPure ion exchange resins enable efficient PEM electrolysis for renewable hydrogen production, ensuring low TOC through continuous process water purification for sustainable megawatt-scale operations. Moreover, businesses frequently engage in collaborations, mergers, and acquisitions to enhance their competitive standing within the market and expand geographically to meet the rising global demand.

The report provides a comprehensive analysis of the competitive landscape in the ion exchange resins market with detailed profiles of all major companies, including:

- Lanxess

- Mitsubishi Chemical Holdings

- The Dow Chemical Company

- Purolite

- Thermax Ltd.

- Ion Exchange (India) Ltd.

- Resintech Inc.

- Novasep Holding S.A.S.

- Samyang Corporation

- Jiangsu Suqing Water Treatment Engineering Group Company Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Recent Developments:

- June 2024: Ecolab in partnership with Repligen Corporation launched a Purolite’s DurA Cycle, a protein A chromatography resin for large-scale purification processes.

- May 2024: LANXESS showcased its ion exchange resins from the Lewatit product family and adsorbers from the Bayoxide at IFAT.

- February 2024: DuPont launched the AmberLite EV2X resin, which is intended to increase the life of electric car coolants.

Ion Exchange Resins Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Cationic Resins, Anionic Resins, Others |

| Applications Covered | Demineralization and Water Softening, Food and Beverage, Mining and Metallurgy, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Lanxess, Mitsubishi Chemical Holdings, The Dow Chemical Company, Purolite, Thermax Ltd., Ion Exchange (India) Ltd., Resintech Inc., Novasep Holding S.A.S., Samyang Corporation, Jiangsu Suqing Water Treatment Engineering Group Company Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ion exchange resins market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global ion exchange resins market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ion exchange resins industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ion exchange resins market was valued at USD 2.2 Billion in 2024.

The ion exchange resins market is projected to exhibit a CAGR of 3.7% during 2025-2033, reaching a value of USD 3.0 Billion by 2033.

The key factors driving the market include increasing demand for water treatment solutions, stringent environmental regulations, growing industrialization, and the need for advanced water purification technologies to address water scarcity and contamination. Industries such as power generation, pharmaceuticals, and chemicals also contribute significantly to the market growth.

Asia Pacific currently dominates the ion exchange resins market, accounting for a share exceeding 44.6%. This dominance is fueled by rapid industrialization, growing water treatment needs, and expanding chemical and pharmaceutical industries in major economies like China, India, and Japan.

Some of the major players in the ion exchange resins market include Lanxess, Mitsubishi Chemical Holdings, The Dow Chemical Company, Purolite, Thermax Ltd., Ion Exchange (India) Ltd., Resintech Inc., Novasep Holding S.A.S., Samyang Corporation, and Jiangsu Suqing Water Treatment Engineering Group Company Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)