Intravenous Solutions Market Size, Share, Trends and Forecast by Type, Nutrients, and Region, 2025-2033

Intravenous Solutions Market Size and Share:

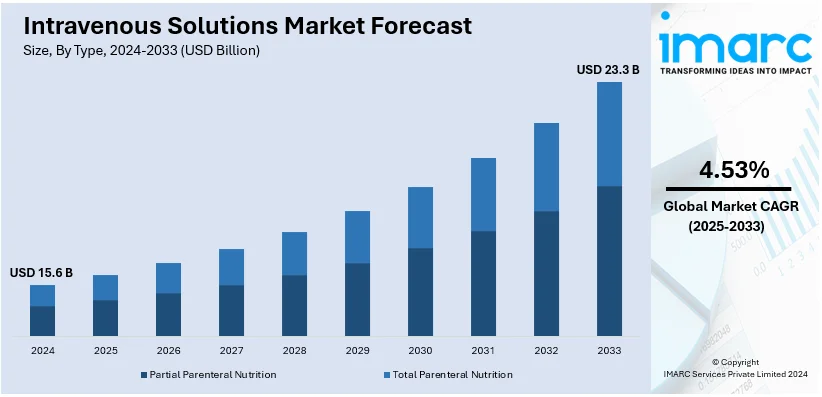

The global intravenous solutions market size was valued at USD 15.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 23.3 Billion by 2033, exhibiting a CAGR of 4.53% from 2025-2033. North America currently dominates the market, holding a market share of over 40.7% in 2024. The growth of the North American region is driven by advanced healthcare infrastructure, rising chronic disease prevalence, and increasing elderly population.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 15.6 Billion |

|

Market Forecast in 2033

|

USD 23.3 Billion |

| Market Growth Rate (2025-2033) | 4.53% |

The rising incidence of chronic diseases such as diabetes, cancer, and kidney issues is driving the demand for intravenous (IV) therapy to provide hydration, nutrients, and medications straight into the bloodstream. These solutions are crucial for handling complications and enhancing patient outcomes in both short-term and long-term care environments. Additionally, the increasing elderly demographic, needing critical care because of age-related issues such as dehydration and compromised immune systems, is catalyzing the demand for IV solutions to tackle these problems efficiently. In addition to this, ongoing advancements in IV therapy, including precision-managed delivery systems, tailored nutrient mixes, and enhanced safety measures, are boosting the effectiveness of treatments. These developments enable customized solutions to address specific patient requirements, enhancing the overall quality of healthcare services. Moreover, patients who cannot eat by mouth, such as those with gastrointestinal issues or serious health conditions, depend on intravenous solutions for full nutrition. This need propels the creation and use of enhanced parenteral nutrition formulations.

The United States is a vital segment in the market, supported by the rising volume of surgeries conducted, which necessitate IV solutions to ensure hydration, administer anesthesia, and aid in post-operative recovery. In addition, occurrences such as natural disasters can interrupt supply chains, emphasizing the significance of a strong IV solution supply. In response, companies boost production capacities and partner with regulatory and government bodies to guarantee a steady supply of essential medical products. These efforts help stabilize market availability, maintain healthcare operations, and meet growing demand effectively. In 2024, B. Braun announced efforts to secure IV fluid supplies in the US after hurricanes disrupted production. The company ramped up manufacturing at facilities in California, Florida, and Pennsylvania, boosting IV fluid production by 20% and IV sets by over 30 million annually. They also collaborated with federal agencies to safeguard and redistribute critical inventory.

Intravenous Solutions Market Trends:

Increasing Prevalence of Chronic Conditions

The increased occurrence of chronic illnesses like diabetes, heart diseases, cancer, and severe conditions requiring IV therapies is a key element driving the growth of the market. As per the International Diabetes Federation, there were 2,680,500 adults diagnosed with diabetes in the UK in 2021. Moreover, the Centers for Disease Control and Prevention reported that in 2021, 1,777,566 individuals in the US population received a cancer diagnosis. Additionally, rising global trends like shifts in lifestyle, environmental influences, and genetic factors that contribute to a rise in chronic diseases serve as another catalyst for growth. Besides this, various chronic and acute conditions necessitate the direct infusion of fluids, nutrients, or medications into the bloodstream. In this regard, IV solutions enable accurate administration of vital nutrients and medications, promoting swift patient recovery. Moreover, they facilitate quicker and more regulated care, especially in urgent circumstances.

Growing Geriatric Population

The rising elderly population is playing a major role in the growth of the IV solutions market. The Administration for Community Living (ACL) reported that from 2021 to 2022, 1.6 million Americans were noted to be aged 65 or older. The increased vulnerability of the elderly to numerous health problems and chronic ailments, which frequently necessitate intricate medical treatments like IV therapy, is supporting the market growth. In addition, the existence of a compromised immune system, diminished organ performance, and other age-associated physiological alterations that increase the vulnerability of elderly individuals to infections and illnesses are contributing to the market growth. In this context, IV solutions are crucial for delivering necessary hydration, nutrients, and medications, making certain that the treatments are precise and effective. Additionally, the extensive use of IV solutions to correct imbalances in electrolytes like sodium, potassium, calcium, and magnesium is serving as another catalyst for growth.

Technological Advancements

Improvements in medical technology and the manufacturing of IV solutions are strengthening the growth of the market. In this regard, emerging technologies are facilitating the development of more tailored solutions that address particular patient requirements while improving the efficiency and safety of IV treatments. Moreover, the latest advancements in infusion pumps and delivery systems, enabling healthcare professionals to provide treatments with enhanced accuracy and control, are benefiting the market expansion. Furthermore, advancements in technology for overseeing and administering IV therapies to reduce the risk of complications and enhance patient outcomes are serving as another factor driving growth. In addition, considerable research and development (R&D) initiatives concentrating on biocompatibility, tailored treatment strategies, and the incorporation of technology like artificial intelligence (AI) to enhance care are propelling the market growth.

Intravenous Solutions Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global intravenous solutions market, along with forecast at the global and regional levels from 22025-2033. The market has been categorized based on type and nutrients.

Analysis by Type:

- Partial Parenteral Nutrition

- Total Parenteral Nutrition

Total parenteral nutrition stands as the largest segment in 2024, holding 77.7% of the market share. Total parenteral nutrition (TPN) is leading the market as it addresses all the dietary needs of patients unable to consume or absorb sufficient food through normal digestive processes. Moreover, it has wide-ranging uses in several medical areas, such as oncology, gastroenterology, and intensive care units (ICUs). Besides this, the increasing prevalence of chronic illnesses like cancer and gastrointestinal disorders that require TPN for nutritional assistance is driving market expansion. Additionally, the rising use of TPN to address the nutritional requirements of patients undergoing significant surgical operations is driving market expansion. In addition, the advancements in TPN formulation and delivery technology, which provide safer and more individualized nutritional support, are contributing to the market growth.

Analysis by Nutrients:

- Carbohydrates

- Salts and Electrolytes

- Minerals

- Vitamins

- Amino Acids

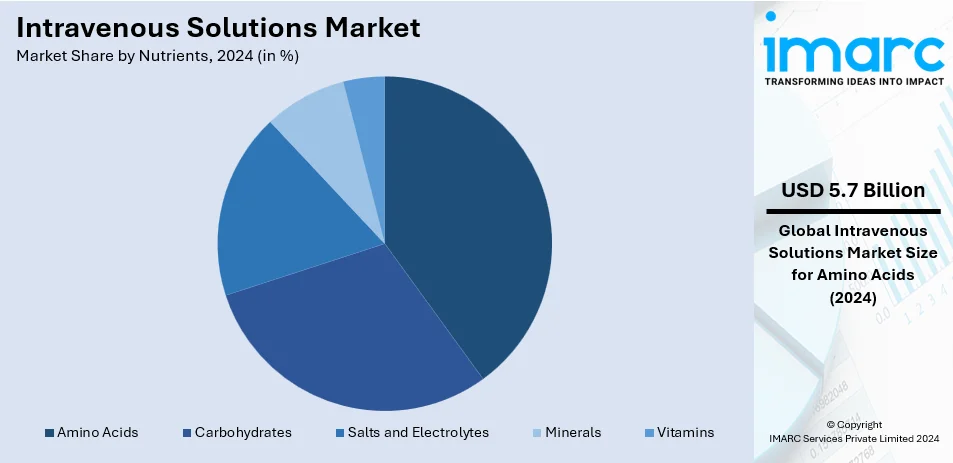

Amino acids lead the market with 36.8% of market share in 2024. Amino acids represent the largest segment, primarily due to their critical role in supporting protein synthesis, wound healing, and overall metabolic function. These essential nutrients are particularly vital for patients unable to consume adequate protein through oral or enteral routes, such as those undergoing major surgeries, suffering from trauma, or dealing with chronic illnesses like cancer and renal disorders. Amino acid-based IV solutions are widely used in TPN where they ensure the delivery of essential building blocks for maintaining muscle mass, immune function, and cellular repair. Advances in formulations tailored for specific patient needs, including pediatric and geriatric care, have further bolstered demand for amino acid solutions. Additionally, the increasing focus on personalized nutrition in clinical settings ensures that amino acids remain a cornerstone in intravenous therapy, making them the dominant choice among nutrients in the segment. This trend reflects their indispensable role in critical care and recovery.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

In 2024, North America accounted for the largest market share of 40.7%. North America holds the biggest share in the market, supported by its sophisticated healthcare system and a significant incidence of chronic illnesses like diabetes, cancer, and heart diseases. The increasing elderly demographic in the area, who are more susceptible to dehydration and need essential medical care, greatly drives the need for intravenous therapies. Hospitals, outpatient clinics, and home care services depend on IV therapy to provide vital nutrients, medications, and hydration, thereby enhancing the market. Moreover, the extensive use of advanced technologies in IV solutions, including precision-controlled delivery systems, improves their application in intricate medical therapies. Collaborations among major industry stakeholders facilitate the sharing of resources, knowledge, and technologies to address increasing demand and enhance production efficiency. These collaborations also foster innovation in IV formulations, addressing evolving healthcare needs across the region. In November 2024, ICU Medical and Otsuka Pharmaceutical Factory announced a joint venture to enhance IV solutions manufacturing in North America, combining their expertise to produce 1.4 billion units annually. This partnership aims to strengthen supply chain resiliency and accelerate innovation in IV solutions for the region.

Key Regional Takeaways:

United States Intravenous Solutions Market Analysis

In North America, the United States accounted for 92.80% of the total market share. The increasing prevalence of chronic diseases across the nation such as diabetes, hypertension, and cancer are driving the demand for IV fluids. According to the International Diabetes Federation, in 2021, 237,306,100 number of the American population is suffering from diabetes. Additionally, according to the Centers for Disease Control and Prevention, between 2021 and 2023, 47.7% of the adults suffered from hypertension in USA. Moreover, the rate of hypertension was higher among men than among women. 50.8% of men and 44.6% of women had hypertension. In line with this, the growing number of elderly people who are often requiring IV treatments for hydration and nutrition is propelling the market for it. According to Censes Bureau, over the past century, from 1920 to 2020, the U.S. population aged 65 and above expanded at a rate nearly five times faster than the overall population. In 2020, the geriatric demographic reached 55.8 Million, accounting for 16.8% of the total U.S. population.

Europe Intravenous Solutions Market Analysis

The intravenous solutions market across the European region is largely driven due to rising requirement of intravenous fluid administration for dehydration or illnesses like diarrhea or gastroenteritis, leading to significant demand for IV solutions especially among children. Additionally, the expanding healthcare infrastructure, especially in Eastern Europe, is contributing to the market growth. According to the European Commission, Germany boasts one of the largest hospital inpatient sectors in the EU, with 7.9 hospital beds per 1,000 people—significantly surpassing the EU average of 5.3 beds by 50%. In line with this, the increasing focus on providing nutritional support to patients who are unable to consume food orally is driving the demand for parenteral nutrition solutions across the region, which are being delivered intravenously. With the growing preference for home-based healthcare, especially in managing chronic conditions or post-surgical recovery, there is an increase in demand for home IV therapy solutions that are being delivered intravenously.

Asia Pacific Intravenous Solutions Market Analysis

Due to fast urbanization and rising healthcare requirements, especially in India and China, there is a strong demand for intravenous solutions in hospitals and clinics, particularly in rural and remote locations. For example, the International Trade Administration reports that by 2021, China set up a network of 36,570 hospitals, offering over 7.4 million beds and serving around 3.88 billion patient visits. Additionally, in nations like India and Southeast Asia, IV fluids are utilized for treating dehydration from infectious diseases like diarrhea and cholera, which are common in these areas. For example, the CDC states that travelers' diarrhea is the most prevalent illness associated with travel. These have the greatest risk in areas like Asia (excluding Japan and South Korea) and also the Middle East, Africa, Mexico, and Central and South America, consequently increasing the need for intravenous solutions.

Latin America Intravenous solutions Market Analysis

In urban areas of Brazil, IV solutions are widely utilized in emergency departments, intensive care units, and trauma services. The rising incidence of chronic conditions such as diabetes and heart diseases is driving the need for IV solutions for hydration and medication delivery. The International Diabetes Federation reports that in 2021, 149,916,800 individuals in Brazil are affected by diabetes. In this context, the thriving medical tourism sector is promoting the utilization of IV solutions for numerous treatments, such as recovery after surgery and wellness therapies.

Middle East and Africa Intravenous Solutions Market Analysis

Due to various factors, the need for intravenous solutions is increasing throughout the Middle East and Africa region. Increasing quantity of intravenous solutions are majorly used across the Gulf Cooperation Council (GCC) countries for the management of diabetes and renal diseases. According to the International Diabetes Federation, in 2021, 8,057,100 number of adults in the United Arab Emirates were diagnosed with diabetes. Moreover, 73 Million people are already diagnosed with diabetes across the MENA region. In line with this, intravenous solutions are increasingly used in conflict-affected and disaster-prone areas across the region for rehydration and medication.

Competitive Landscape:

Key players in the market are focusing on expanding their product portfolios through innovation and advanced formulations tailored to diverse medical needs. They are investing in research operations to improve solution stability, enhance nutrient delivery, and address specific patient conditions. Companies are also optimizing manufacturing processes to meet stringent regulatory requirements while ensuring cost-efficiency. Additionally, they are leveraging digital technologies for precision delivery and monitoring systems, aiming to improve patient outcomes. Market leaders are actively targeting emerging regions to capture growth opportunities and expand their user base. Strategic partnerships, mergers, and acquisitions are enhancing their worldwide presence and supply chain strengths. In May 2023, Intellego Technologies and HAI Solutions were pleased to announce a strategic partnership that aimed to enhance the quality and safety of intravenous (IV) vascular access. This partnership brought Intellego's patented UV-sensitive ink as an integral indicator into HAI Solutions' QIKcap™ technology, providing visible and reliable verification of IV port protection. The combined solution ensures confidence in the disinfection of needle-free connectors.

The report provides a comprehensive analysis of the competitive landscape in the intravenous solutions market with detailed profiles of all major companies, including:

- Ajinomoto

- B. Braun Melsungen

- Baxter International Inc.

- Grifols

- Otsuka Pharmaceutical

Latest News and Developments:

- November 2024: Baxter International released its first IV solutions manufactured at its North Cove facility after Hurricane Helene disruptions. The facility, which supplies hospital IV fluids and peritoneal dialysis solutions, resumed 50% of pre-hurricane production and expects full restoration by year-end. The company also activated nine worldwide plants to mitigate supply shortages.

- July 2024: Amneal Pharmaceuticals has obtained FDA approval for its preservative-free Potassium Phosphates Injection IV Bags, a ready-to-use product that streamlines administration and addresses hypophosphatemia. This marks the company's third 505(b)(2) injectable introduction in 2024, broadening its range of cutting-edge injectable offerings.

- January 2024: Milla Pharmaceuticals, an A.forall company, launched a generic version of Sodium Acetate Injection 4 mEq/mL, which was approved by the FDA under a priority review because of its shortage status. This product aims to address hyponatremia and improve intravenous fluid formulations in hospitals.

Intravenous Solutions Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Partial Parenteral Nutrition, Total Parenteral Nutrition |

| Nutrients Covered | Carbohydrates, Salts and Electrolytes, Minerals, Vitamins, Amino Acids |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Ajinomoto, B. Braun Melsungen, Baxter International Inc., Grifols, Otsuka Pharmaceutical, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the intravenous solutions market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global intravenous solutions market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the intravenous solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Intravenous solutions are sterile fluids administered directly into veins to provide hydration, nutrients, medications, or electrolytes. They are essential in treating dehydration, maintaining blood volume, or delivering drugs in emergencies. These solutions ensure rapid and controlled delivery, supporting critical medical care and recovery.

The global intravenous solutions market was valued at USD 15.6 Billion in 2024.

IMARC estimates the global intravenous solutions market to exhibit a CAGR of 4.53% during 2025-2033.

The global intravenous solutions market is driven by rising incidences of chronic illnesses, increasing hospitalizations, and a growing elderly population requiring critical care. Enhanced demand for parenteral nutrition, advancements in IV therapy technology, and the prevalence of dehydration-related conditions further support the market growth. Additionally, expanding healthcare infrastructure in emerging economies supports the adoption of intravenous solutions worldwide.

In 2024, total parenteral nutrition represented the largest segment by type, driven by increasing cases of malnutrition, rising prevalence of gastrointestinal disorders, and growing demand for specialized nutritional support in critical care settings.

Amino acids lead the market by nutrients owing to their crucial role in tissue repair, muscle maintenance, and metabolic processes, alongside rising demand for balanced nutritional formulations in healthcare and critical care settings.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global intravenous solutions market include Ajinomoto, B. Braun Melsungen, Baxter International Inc., Grifols, Otsuka Pharmaceutical, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)