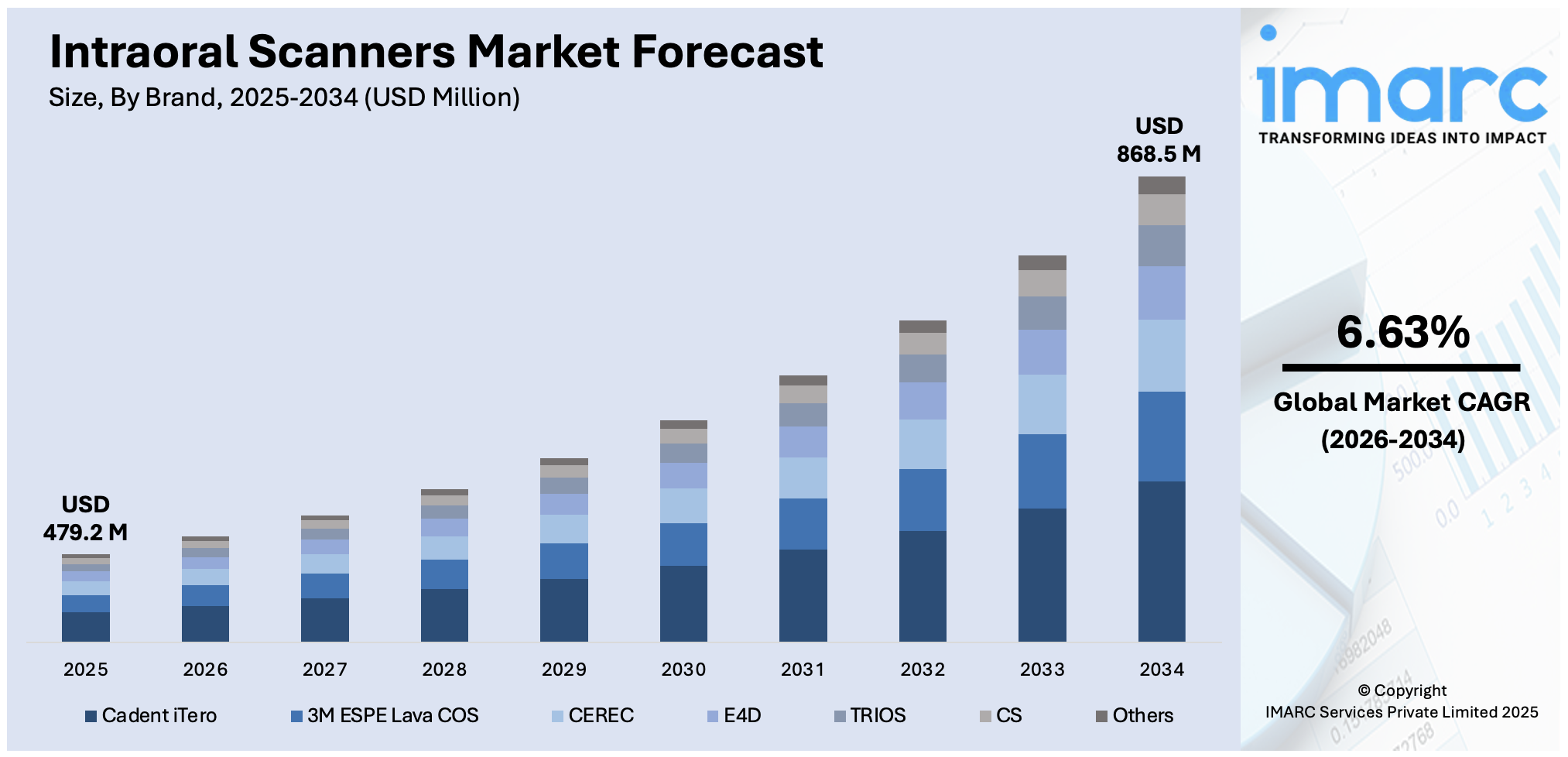

Intraoral Scanners Market Report by Brand (Cadent iTero, 3M ESPE Lava COS, CEREC, E4D, TRIOS, CS, and Others), Type of Modality (Standalone, Portable, and Others), End User (Hospitals, Dental Clinics, and Others), and Region 2026-2034

Intraoral Scanners Market Overview:

The global intraoral scanners market size reached USD 479.2 Million in 2025. The market is projected to reach USD 868.5 Million by 2034, exhibiting a growth rate (CAGR) of 6.63% during 2026-2034. The growing interest in digital dentistry, increasing demand for cosmetic dental procedures, rapid technological advancements, and the presence of key companies driving innovations for enhanced accuracy and patient satisfaction are key factors impelling market growth. With a projected market value in the intraoral scanners market share continues to expand steadily, supported by the adoption in clinics and laboratories aiming to streamline workflows and improve diagnostic precision.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 479.2 Million |

| Market Forecast in 2034 | USD 868.5 Million |

| Market Growth Rate 2026-2034 | 6.63% |

Intraoral Scanners Market Analysis:

- Major Market Drivers: The market is experiencing moderate growth owing to the rising focus on patient convenience and efficient dental treatments. Intraoral scanners remove the necessity for conventional impressions that can frequently cause discomfort to patients. Additionally, advances in technology that improve the precision and velocity of these devices are increasing the attractiveness of scanners for dentists and orthodontists seeking accuracy in dental restoration projects.

- Key Market Trends: The incorporation of advanced software solutions for improved workflow efficiency is a prominent trend. This integration enables smooth digital imaging and modeling for the direct creation of dental fixtures. Furthermore, the growing shift towards portable and compact intraoral scanners that cater to mobile dentistry services is broadening the accessibility and convenience of dental care.

- Geographical Trends: North America dominates the market attributed to the high adoption rates of new technologies in dental practices and significant investments in healthcare infrastructure.

- Competitive Landscape: Some of the major market players in the industry include 3Shape A/S, Align Technology, Inc., densys Ltd, Dentsply Sirona, Guangdong Launca Medical Device Technology Co. Ltd., Institut Straumann AG, Medit Corp., Ormco Corporation, Owandy Radiology, Planmeca Oy, Shining 3D Tech Co., Ltd., among many others.

- Challenges and Opportunities: The high expenses of purchasing and using advanced intraoral scanners, especially in markets sensitive to costs, are influencing the intraoral scanners market revenue. There are considerable opportunities in emerging areas where dental offices are shifting from traditional approaches to digital options, increasing the need for intraoral scanners.

To get more information on this market Request Sample

Intraoral Scanners Market Trends:

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations between scanner makers and important players such as dental offices and schools are bolstering the market growth. Collaborating directly with dental professionals allows manufacturers to obtain important perspectives on the specific requirements and obstacles encountered in clinical environments. This feedback is crucial to improve the technology and guarantee that intraoral scanners are efficient and easy to use. Moreover, collaborations with dental schools and universities help incorporate these advanced tools into educational curricula, encouraging future dentists to become knowledgeable and skilled in their use. This educational strategy not only readies future dentists to utilize such technologies but also encourages their widespread adoption and innovation, ultimately expanding the market reach. In line with the intraoral scanners market recent developments, Dentsply Sirona and A-dec expanded their partnership to combine the Primescan Connect intraoral scanner with A-dec 500 and 300 delivery systems in 2024, improving workflow efficiency. This integration was designed to provide dental professionals with additional digital impression options and enhance overall practice efficiency.

Technological Advancements in Software Platforms

Technological advancements and enhancements in the software platforms associated with intraoral scanners are driving their adoption in the dental industry. Modern intraoral scanners are equipped with advanced imaging technologies that offer high-quality 3D digital impressions. These developments provide unparalleled precision and meticulousness, which are essential for fabricating accurate dental restorations and orthodontic devices. Furthermore, software platforms are becoming more advanced by integrating artificial intelligence (AI) and machine learning (ML) algorithms to improve image analysis and diagnostic abilities. Advanced software is able to identify and rectify abnormalities, while scanning helps to minimize mistakes and enhance the accuracy of outcomes. For instance, in November 2023, Dentsply Sirona included upgraded communication features and a consolidated ordering system to DS Core in order to facilitate smooth collaboration and patient interaction. The enhancement enhanced data format compatibility for intraoral scanners and guaranteed dental practices and labs can easily access and use the software.

Innovation in Intraoral Scanner Technology

Ongoing innovation in scanner technology, which concentrates on improving scanning speed, accuracy, and user comfort, is driving the intraoral scanners demand. Modern intraoral scanners come with user-friendly touch controls and ergonomic designs, which make them more lightweight and manageable during dental treatments. This change enhances the usability of dental professionals and reduces patient discomfort during scans. For example, in April 2024, Medit Corp released the i900 intraoral scanner, which included cutting-edge technology to improve scanning speed, precision, and user experience. The i900 featured user-friendly touch controls and a lightweight build, running on Medit Link software to enhance patient care and productivity. Furthermore, the incorporation of these scanners with advanced software systems improves data organization and workflow effectiveness, leading to enhanced patient care and productivity in dental offices. Technological innovations are addressing the rising need for faster and more accurate dental care solutions, leading to wider use of intraoral scanners in dental offices.

Intraoral Scanners Market Segmentation:

IMARC Group provides an analysis of the key intraoral scanners market trends in each segment, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on brand, type of modality, and end user.

Breakup by Brand:

- Cadent iTero

- 3M ESPE Lava COS

- CEREC

- E4D

- TRIOS

- CS

- Others

The report has provided a detailed breakup and analysis of the market based on the brand. This includes Cadent iTero, 3M ESPE Lava COS, CEREC, E4D, TRIOS, CS, and others.

Cadent iTero scanners are well-known for their precise accuracy and intricate imaging features, leading to their widespread use in orthodontic and general dentistry environments. They provide a smooth process for generating digital patterns necessary for producing aligners, crowns, and bridges. The brand is popular for its easy-to-use interface and regular software updates that improve functionality and integration with other dental systems, ultimately enhancing treatment efficiency. In February 2024, Carestream Dental introduced integration between Align Technology's iTero intraoral scanners and CS Imaging version 8 and Sensei Cloud, resulting in improved workflow efficiency and decreased errors. This integration facilitated automatic transfer of data and centralized storage of dental images, which streamlined case management and enhanced patient comprehension of oral health.

3M ESPE Lava chairside oral scanner (COS) offers precise digital impression technology, which is essential for making top-notch dental restorations. This particular brand is distinguished by its authentic color scanning and meticulous texture mapping, offering dentists lifelike and precise images for their procedures. Its ability to work well with Lava milling solutions makes the restoration process more efficient, catering to dental practices seeking to handle all operations in-house.

E4D are known for their flexibility and user-friendly interface, allowing dentists to complete scanning, designing, and milling dental restorations in one visit. The accurate digital impressions produced by the system's laser scanning technology are essential for the proper fit and appearance of the final restorations. E4D's ongoing software improvements and extensive training assistance continue to make it attractive in ever-changing dental environments.

Breakup by Type of Modality:

- Standalone

- Portable

- Others

Standalone holds the largest intraoral scanners market share

A detailed breakup and analysis of the market based on the type of modality have also been provided in the report. This includes standalone, portable, and others. According to the report, standalone accounted for the largest market share.

As per intraoral scanner market report, standalone represents the largest segment because of its widespread adoption in established dental facilities and hospitals. These scanners are preferred for their strong capabilities, precise accuracy, and effectiveness in managing numerous patient cases all day long. Standalone units usually have more features, providing better image quality and quicker scanning speeds, essential for intricate dental restorations and orthodontic treatments. Furthermore, their incorporation into dental operatory systems helps to create a more efficient process, enabling dental professionals to conduct scans and review results seamlessly in a clinical environment. The reliability and integration capabilities of standalone intraoral scanners make them a preferred choice for many dental practices.

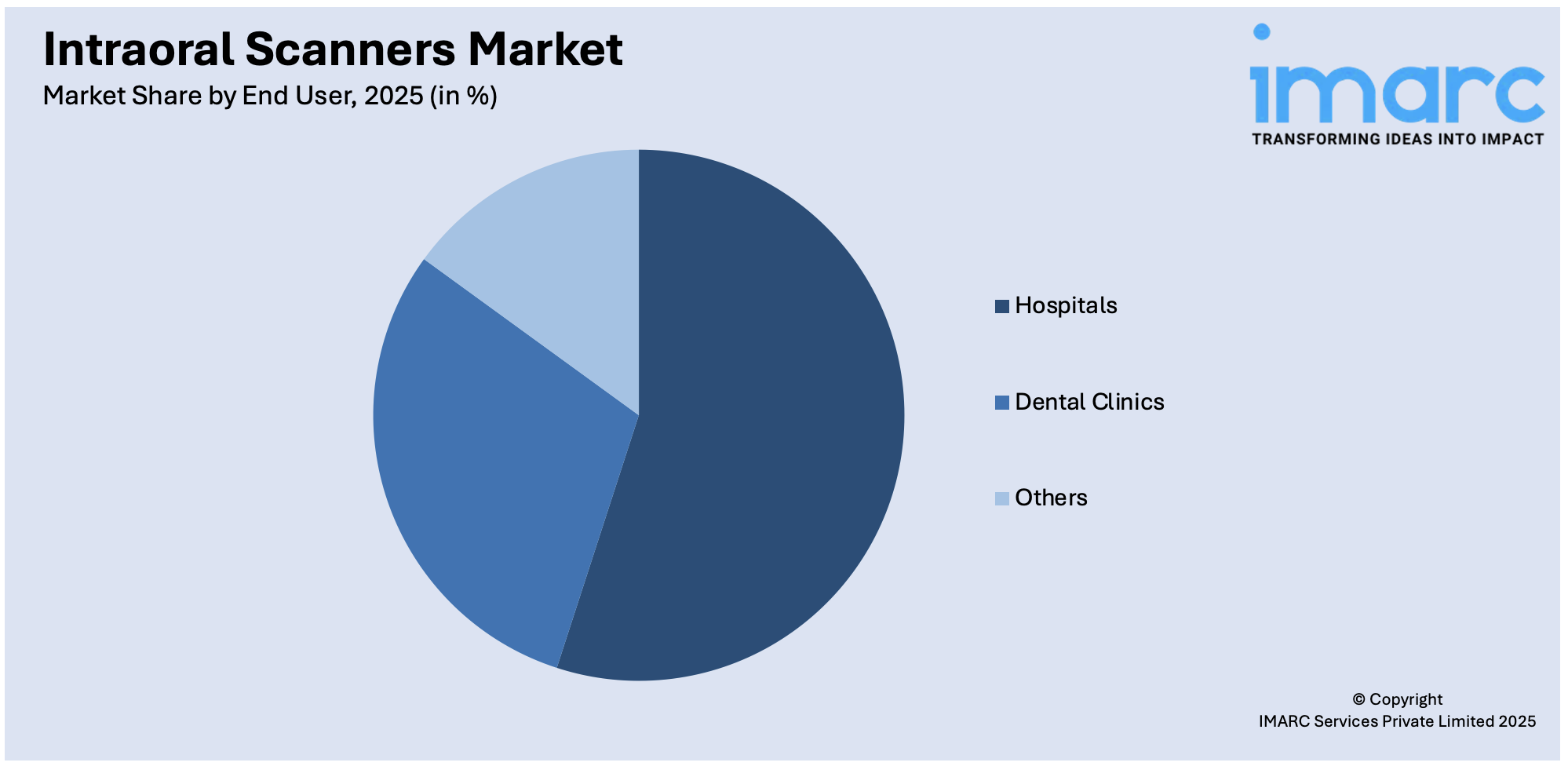

Breakup by End User:

Access the comprehensive market breakdown Request Sample

- Hospitals

- Dental Clinics

- Others

Dental clinics represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, dental clinics, and others. According to the report, dental clinics represented the largest segment.

Dental clinics holds the biggest market share as per the intraoral scanners market outlook. The dominance is driven by the extensive use of these devices in dental clinics around the world, where they play a vital role in daily dental procedures like diagnosing, planning treatment, and observing oral health. In dental clinics, the use of intraoral scanners improves the accuracy of dental treatments such as restorations, orthodontics, and prosthetics, leading to better patient results and happiness. Their capacity to rapidly generate precise dental impressions not just improves the efficiency for dentists, but also lessens the discomfort and duration of sessions for patients. The growing use of scanner technology and the rise in interest in aesthetic dentistry are resulting in the popularity of intraoral scanners in dental clinics.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for intraoral scanners.

North America dominates the market, primarily because of its strong healthcare system, widespread use of advanced dental technologies, and rising investments in dental care. The dominance is also supported by the existence of top dental equipment manufacturers and a significant emphasis on aesthetic and restorative dentistry. Dental offices in the United States and Canada are using intraoral scanners to improve the effectiveness and precision of dental procedures, leading to better results for patients and more efficient workflows in dental practices. Furthermore, the rising recognition of the advantages of digital impressions compared to traditional techniques by both dentists and patients is contributing to the intraoral scanners market growth. North America is positioned as a leader in the adoption and advancement of intraoral scanners due to favorable reimbursement policies and a growing number of cosmetic dental procedures. During the 2024 Midwinter Meeting, Dentsply Sirona, a US-based company that manufactures dental equipment and produces dental consumables, presented improvements to DS Core, with a focus on better integration with intraoral scanners.

Competitive Landscape:

Intraoral scanners companies are working to improve their technological products and increase their market reach by forming strategic partnerships and making acquisitions. These corporations dedicate significant resources to research and development (R&D) in order to bring forth advancements, like enhanced scanning speed, precision, and the ability to seamlessly integrate with other digital dentistry devices. Moreover, their focus is on creating designs that are easy for users and meet the ergonomic requirements of dental professionals, making it easier to adopt and enhancing workflow efficiency. In November 2023, Angelalign Technology and Medit Corporation smoothly merged their software, integrating Medit's intraoral scanning technology with Angelalign Technology's iOrtho treatment planning software, improving clinicians' workflow. This partnership, dedicated to quality, allowed healthcare professionals around the globe to provide exceptional orthodontic treatment utilizing advanced intraoral scanning technology.

The report provides a comprehensive analysis of the competitive landscape in the global intraoral scanners market with detailed profiles of all major companies, including:

- 3Shape A/S

- Align Technology, Inc.

- densys Ltd

- Dentsply Sirona

- Guangdong Launca Medical Device Technology Co. Ltd.

- Institut Straumann AG

- Medit Corp.

- Ormco Corporation

- Owandy Radiology

- Planmeca Oy

- Shining 3D Tech Co., Ltd.

Intraoral Scanners Market News:

- April 2025: Medit unveiled the i900 Classic and SmartX at IDS 2025, showcasing innovations in intraoral scanners and digital workflows. These advancements enhanced scanning speed, accuracy, and AI integration, significantly strengthening intraoral scanners market development by improving clinical efficiency and expanding same-day dentistry capabilities.

- March 2025: Medit launched SmartX, an All-on-X intraoral scanning solution enhancing implant workflow efficiency. It offered compatibility with multiple scan bodies and improved accuracy, simplifying digital dentistry processes. This development boosted market adoption by supporting flexible, precise, and user-friendly scanning technologies.

- September 2024: Straumann launched the SIRIOS intraoral scanner, leveraging Alliedstar’s AS 200E technology with new software and cloud integration. This strategic move marked Straumann’s return to the intraoral scanners market, enhancing digital workflows and expanding its digital dentistry portfolio to boost market competitiveness.

- September 2024: Dentsply Sirona launched Primescan 2, the first cloud-native wireless intraoral scanner, enabling scans on any internet-connected device. This innovation improved workflow flexibility and patient care, driving market growth by promoting remote collaboration and advancing digital dentistry practices globally.

- January 2024: Condor Technologies unveiled a pre-production model of a revolutionary dental scanner that uses trays, created in collaboration with Invis'Art, with the goal of making in-mouth scanning easier. The company also looked for strategic alliances to speed up market entry and planned to resume trading on Euronext.

- September 2023: Dentsply Sirona and 3Shape broadened their workflow integrations to create more efficient connections among intraoral scanners, milling, and printing solutions, allowing dental professionals to deliver high-quality care. The goal of the integration, which utilized DS Core and 3Shape Unite, was to simplify procedures and improve communication between dental offices and laboratories.

Intraoral Scanners Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Brands Covered | Cadent iTero, 3M ESPE Lava COS, CEREC, E4D, TRIOS, CS, Others |

| Types of Modalities Covered | Standalone, Portable, Others |

| End Users Covered | Hospitals, Dental Clinics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3Shape A/S, Align Technology, Inc., densys Ltd, Dentsply Sirona, Guangdong Launca Medical Device Technology Co. Ltd., Institut Straumann AG, Medit Corp., Ormco Corporation, Owandy Radiology, Planmeca Oy, Shining 3D Tech Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, intraoral scanners market forecast, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the market and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the intraoral scanners industry.

Key Questions Answered in This Report

An intraoral scanner is a handheld dental device that captures 3D digital impressions of a patient’s teeth and gums, enhancing accuracy and comfort in diagnostics.

The global intraoral scanners market was valued at USD 479.2 Million in 2025.

We expect the global intraoral scanners market to exhibit a CAGR of 6.63% during 2026-2034.

The rising incidences of oral diseases, along with the increasing integration of Artificial Intelligence (AI) with intraoral scanners for a more streamlined, intuitive, and simplified scanning process to produce more accurate and precise results, are primarily driving the global intraoral scanners market.

The sudden outbreak of the COVID-19 pandemic had led to the postponement of elective oral treatment procedures to reduce the risk of the coronavirus infection upon hospital visits and interaction with medical equipment, thereby negatively impacting the global market for intraoral scanners.

Based on the type of modality, the global intraoral scanners market has been segmented into standalone, portable, and others. Among these, standalone currently holds the largest market share.

Based on the end user, the global intraoral scanners market can be divided into hospitals, dental clinics, and others. Currently, dental clinics exhibit a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global intraoral scanners market include 3Shape A/S, Align Technology, Inc., densys Ltd, Dentsply Sirona, Guangdong Launca Medical Device Technology Co. Ltd., Institut Straumann AG, Medit Corp., Ormco Corporation, Owandy Radiology, Planmeca Oy, and Shining 3D Tech Co., Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)