Interventional Radiology Market Size, Share, Trends and Forecast by Product, Procedures, Application, End Use, and Region, 2025-2033

Interventional Radiology Market Size and Share:

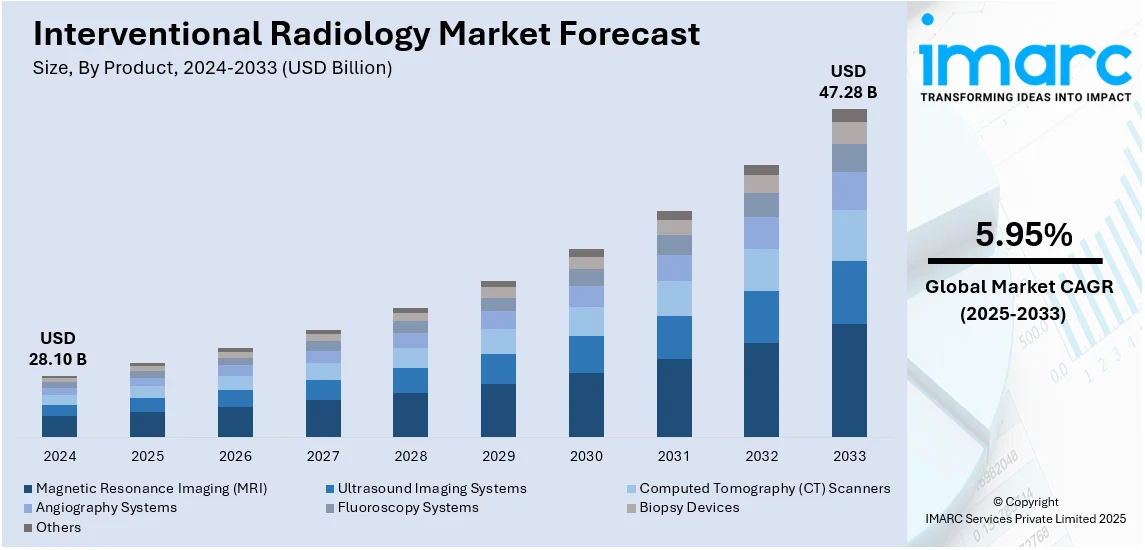

The global interventional radiology market size was valued at USD 28.10 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 47.28 Billion by 2033, exhibiting a CAGR of 5.95% during 2025-2033. North America currently dominates the market, holding a significant market share of 38.5% in 2024. The interventional radiology market share is influenced by increasing preferences for minimally invasive (MI) procedures, rising technological advancements, and growing AI-driven imaging solutions. Besides this, expanding telemedicine capabilities improve access to image-guided treatments, while favorable reimbursement policies encourage patient adoption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 28.10 Billion |

|

Market Forecast in 2033

|

USD 47.28 Billion |

| Market Growth Rate 2025-2033 | 5.95% |

Increasing preferences for minimally invasive (MI) interventions such as catheter-based treatments, offer fewer complications compared to traditional open surgeries. The rising patient awareness about faster recovery and reduced hospital stays is catalyzing the demand for image-guided procedures. Moreover, rising cases of chronic diseases like cardiovascular disorders and cancer is accelerating the adoption of MI techniques. Healthcare providers are investing in advanced interventional radiology systems to expand MI treatment options. Favorable reimbursement policies are encouraging more patients to opt for non-surgical interventional procedures. Expanding telemedicine and remote imaging capabilities are improving access to MI interventions in underserved regions. Regulatory approvals for innovative interventional devices are propelling the market growth and procedural advancements. Hybrid imaging technologies including PET-CT and MRI-guided interventions, are enhancing treatment precision and efficiency. Medical training programs are equipping radiologists with expertise in minimally invasive procedures, supporting market expansion.

Technological advancements are significantly driving the United States interventional radiology market demand by enhancing imaging precision and procedural efficiency. Innovations in artificial intelligence (AI)-powered imaging are improving diagnostic accuracy, enabling real-time analysis for interventional radiology procedures. Automation in workflow management is optimizing interventional radiology operations, reducing procedure time and enhancing patient outcomes. In December 2024, Children’s Hospital Los Angeles announced the use of virtual reality (VR) to enhance minimally invasive procedures, improving precision, patient experience, and surgical outcomes. The VR technology helped surgeons visualize complex anatomy in real time, enabling better planning and execution of interventional radiology procedures. Advancements in catheter-based interventions are reducing the need for traditional open surgeries, leading to faster patient recovery. Robotics-assisted interventional radiology systems are enhancing precision in minimally invasive procedures, reducing complications and hospital stays. Cloud-based picture archiving and communication system (PACS) solutions are enabling remote diagnostics and seamless image sharing across healthcare facilities. Regulatory approvals for AI-driven imaging solutions are accelerating the adoption of next-generation interventional radiology technologies. Integration of 3D printing technology is helping radiologists plan and simulate complex interventional procedures with greater accuracy. These innovations are collectively advancing image-guided interventions, improving procedural efficiency, and transforming pediatric and adult healthcare in the US.

Interventional Radiology Market Trends:

Rising prevalence of chronic diseases

The growing occurrence of chronic illnesses, driven by increasing fast-food consumption and sedentary lifestyles, is a crucial factor driving the interventional radiology market. Reports indicate that 66% of consumers consume fast food at least once a week, highlighting rising consumption among youth. This dietary shift, coupled with reduced physical activity, contributes to a higher incidence of cardiovascular diseases, cancer, and neurological disorders, necessitating advanced imaging techniques for precise diagnosis and targeted treatments. Growing cases of coronary artery disease are catalyzing the demand for angioplasty and catheter-based interventions. Rising cancer prevalence is accelerating adoption of interventional radiology techniques like tumor ablation and chemoembolization. Neurological disorders such as stroke require real-time imaging for clot removal and vascular interventions. An aging population, which is more susceptible to chronic illnesses, is further fueling the need for interventional procedures. Minimally invasive interventions, which reduce recovery time and complications, are becoming preferable for managing chronic disease-related conditions. Expanding healthcare facilities are improving accessibility to interventional radiology, enhancing patient outcomes across the globe. Additionally, government initiatives supporting early disease detection and insurance coverage for interventional radiology procedures are making advanced treatments more accessible and affordable.

Increasing utilization of augmented reality (AR)

There is a rise in utilization of augmented reality (AR) technology in interventional radiology, enhancing procedural precision and efficiency. By the end of 2024, an estimated 1.73 billion AR user devices will be in use worldwide, reflecting AR’s expanding role in healthcare. AR overlays digital images onto real-world anatomy, enabling radiologists to navigate complex interventions with greater accuracy. Improved spatial awareness through AR reduces reliance on traditional fluoroscopy, minimizing radiation exposure for both patients and physicians. AR-driven real-time 3D imaging enhances catheter guidance, making minimally invasive procedures safer and more effective. Increasing adoption of AR-assisted navigation systems is improving outcomes in procedures like angioplasty, embolization, and tumor ablation. Integration of AI-powered AR platforms is further refining real-time imaging interpretation and interventional workflow management. Rising demand for precision-guided interventions is accelerating investment in AR technology by healthcare providers and medical device manufacturers. Medical training programs are incorporating AR simulations to improve radiologists' expertise in interventional procedures. Expanding use of AR in telemedicine is enabling remote guidance for complex interventions, improving global healthcare access.

Expanding applications in oncology

Growing usage in oncology is significantly influencing the interventional radiology market outlook by increasing the demand for MI cancer treatments. Rising global cancer prevalence is driving the need for precise, image-guided interventions in oncology care. Techniques like tumor ablation, chemoembolization, and radioembolization are reducing reliance on traditional surgical procedures. For catering to the growing demand, in August 2024, Urology of Indiana opened a new outpatient Interventional Radiology Center in Indianapolis, specializing in advanced treatments for benign prostatic hyperplasia (BPH). Partnering with Prostate Centers USA, the center offers prostatic artery embolization (PAE), a MI procedure that aligns with the 2023 American Urological Guidelines, emphasizing PAE for BPH treatment. Additionally, the growing adoption of percutaneous biopsy and targeted drug delivery is improving cancer diagnosis and treatment outcomes. Advancements in interventional radiology enable real-time tumor visualization, enhancing accuracy in minimally invasive oncology procedures. AI-powered imaging solutions are optimizing treatment planning, enabling personalized and effective cancer therapies. Hybrid imaging techniques like PET-CT and MRI-guided interventions enhance precision in tumor localization. The rising number of specialized oncology centers is expanding access to interventional radiology-based cancer treatments. Government initiatives and research funding are further supporting technological innovations, advancing oncology-focused interventional radiology solutions to improve patient outcomes.

Interventional Radiology Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global interventional radiology market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, procedures, application, and end use.

Analysis by Product:

- Magnetic Resonance Imaging (MRI)

- Ultrasound Imaging Systems

- Computed Tomography (CT) Scanners

- Angiography Systems

- Fluoroscopy Systems

- Biopsy Devices

- Others

Magnetic resonance imaging (MRI) dominates the interventional radiology market due to its superior imaging capabilities and non-invasive nature. It provides high-resolution, detailed images without radiation exposure, making it safer for patients and healthcare providers. The increasing prevalence of neurological, cardiovascular, and musculoskeletal disorders is driving MRI adoption in interventional procedures. Continuous technological advancements such as functional MRI and AI-driven imaging, enhance diagnostic accuracy and procedural efficiency. Growing preference for minimally invasive interventions is catalyzing the demand for MRI-guided therapies in various medical specialties. Hospitals and diagnostic centers are investing heavily in MRI systems to improve patient care and clinical outcomes. Government funding and reimbursement policies are supporting the installation of advanced MRI scanners in healthcare institutions. The growing aging population, which is more susceptible to chronic diseases, is further driving demand for MRI-based interventions. It is widely used in oncology for tumor detection, biopsy guidance, and targeted therapy planning. Ongoing research in molecular imaging is expanding MRI’s applications in personalized and precision medicine.

Analysis by Procedures:

- Angiography

- Angioplasty

- Embolization

- Vertebroplasty

- Thrombolysis

- Nephrostomy Placement

- Others

Angiography leads the market with 31.2% of market share in 2024. It enables precise visualization of blood vessels, aiding in the early detection of cardiovascular diseases and blockages. The rising prevalence of coronary artery disease and stroke is significantly increasing the demand for angiographic procedures. Advancements in digital subtraction angiography (DSA) enhance imaging quality while reducing radiation exposure and procedural risks. Growing preference for minimally invasive techniques is strengthening the adoption of catheter-based angiography over traditional surgeries. Hospitals and specialized cardiac centers are equipping facilities with state-of-the-art angiography systems. Rising aging populations, prone to vascular disorders, are contributing to the increasing volume of angiographic interventions. The widespread use of angiography in interventional cardiology, neurology, and oncology supports its market dominance. Hybrid operating rooms integrating angiography with surgical procedures are improving clinical outcomes and expanding procedural applications. Besides this, favorable reimbursement policies and healthcare funding are supporting patient access to advanced angiographic techniques.

Analysis by Application:

- Cardiology

- Urology and Nephrology

- Oncology

- Gastroenterology

- Others

Interventional radiology plays a crucial role in diagnosing and treating cardiovascular diseases with minimally invasive procedures. Rising cases of coronary artery disease, stroke, and peripheral vascular disorders are driving the demand for advanced imaging techniques. Angiography, stent placement, and embolization procedures rely on high-precision imaging for accurate diagnosis and treatment. Continuous technological advancements like AI-assisted imaging and real-time 3D visualization, enhance procedural success rates. Increasing preference for catheter-based interventions over traditional surgeries is boosting cardiology-focused interventional radiology applications.

Interventional radiology is used in urology and nephrology for procedures like renal angioplasty, embolization, and drainage. Increasing cases of kidney stones, renal artery stenosis, and urinary obstructions are catalyzing the demand for imaging-guided interventions. Minimally invasive procedures reduce the need for open surgeries, leading to faster recovery and lower complications. Growing aging populations, prone to kidney-related disorders, are further fueling market expansion in this segment. Advancements in image-guided biopsies and ablation techniques are improving diagnostic accuracy and treatment efficacy.

Interventional radiology is widely used in oncology for tumor detection, biopsy guidance, and minimally invasive treatments. Growing global cases of cancer is catalyzing the demand for targeted interventions such as radiofrequency ablation and trans arterial chemoembolization (TACE). Advanced imaging modalities enhance precision in tumor localization, improving treatment outcomes and reducing side effects. Integration of AI-driven radiology techniques is enhancing early cancer diagnosis and personalized treatment planning. The growing preference for non-surgical cancer therapies is further influencing the adoption of interventional radiology in oncology care.

Interventional radiology is essential in gastroenterology for procedures like bile duct stenting, gastrointestinal bleeding embolization, and liver biopsies. Rising cases of liver diseases, gastrointestinal cancers, and digestive disorders are driving the need for precise imaging techniques. Minimally invasive interventional procedures are improving patient outcomes by reducing hospital stays and post-operative risks. Technological advancements in fluoroscopy and ultrasound-guided interventions enhance accuracy in diagnosing and treating gastrointestinal conditions. Increasing adoption of percutaneous and endoscopic interventions is reducing dependency on invasive surgical treatments.

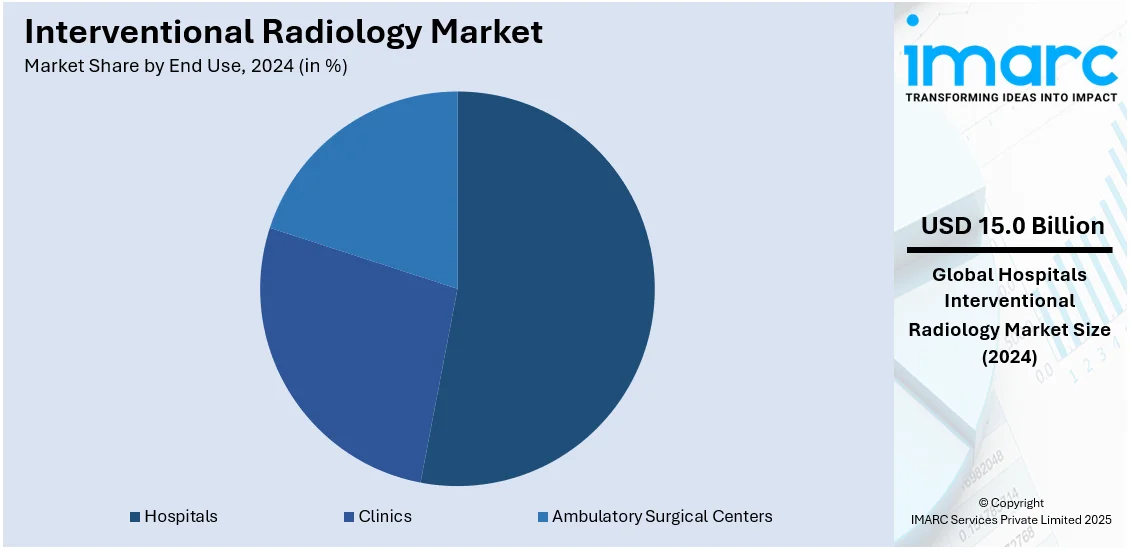

Analysis by End Use:

- Hospitals

- Clinics

- Ambulatory Surgical Centers

Hospitals dominate the market with 53.2% of market share in 2024. They house specialized radiology departments equipped with cutting-edge imaging systems for complex diagnostic and therapeutic interventions. Growing hospital investments in interventional radiology technology enhance procedural accuracy, patient safety, and treatment efficiency. Availability of multidisciplinary medical teams ensures comprehensive patient management and immediate response to complications during interventions. Hospitals serve as primary treatment centers for critical conditions requiring interventional radiology like stroke and cancer. The rising number of minimally invasive procedures performed in hospitals is further driving the demand for imaging technologies. Expanding government and private healthcare funding enables hospitals to adopt state-of-the-art interventional radiology systems. Increasing collaborations between hospitals and key industry players facilitate technology integration and training programs for radiologists. Accreditation and regulatory requirements encourage hospitals to upgrade facilities with high-quality imaging solutions and safety protocols. Hospitals provide 24/7 access to interventional radiology services, ensuring timely diagnosis and treatment for emergency cases.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America represented the largest segment, accounting 38.5% of market share. The presence of leading medical device companies in the region accelerates innovation and expands access to cutting-edge imaging systems. The growing occurrence of cardiovascular diseases and cancer is driving the need for interventional radiology procedures across the region. Favorable reimbursement policies and insurance coverage encourage patients to opt for advanced imaging-guided treatments. Rising healthcare expenditures enable hospitals and diagnostic centers to invest in state-of-the-art radiology technologies, enhancing procedural accuracy. Strong research and development (R&D) initiatives support continuous advancements in interventional imaging techniques and AI-driven diagnostics. In December 2024, Philips introduced the CT 5300 in North America, featuring AI-driven automation to optimize diagnostic and interventional radiology workflows. The system integrates AI-enabled Philips Advanced Visualization Workspace applications, improving efficiency in screening and procedural guidance. Additionally, Philips is partnering with Annalise.ai to enhance workflow management and prioritize time-sensitive interventional radiology cases, strengthening the market growth. The region's aging population, which is more susceptible to chronic illnesses, is further fueling the demand for image-guided interventions. Growing awareness about minimally invasive procedures is increasing patient preference for interventional radiology-based treatments. Expanding telemedicine and remote imaging services are improving access to interventional radiology expertise in rural areas, further reinforces North America’s leadership in the market.

Key Regional Takeaways:

United States Interventional Radiology Market Analysis

The United States hold 89.50% of the market share in North America. The US is witnessing increased demand for interventional radiology as investment in the healthcare sector continues to rise. According to reports, in the US pharmaceutical industry, there were 25 private equity deals announced in Q3 2024, totaling USD 2.3 billion in value. This surge in funding for advanced medical infrastructure, along with expanding hospital networks, is driving the integration of image-guided, minimally invasive procedures into routine care. The growing demand for cost-effective treatment alternatives is encouraging hospitals and diagnostic centers to incorporate interventional radiology solutions, which provide efficient and precise interventions while minimizing recovery time. Enhanced reimbursement policies and expanding public-private collaborations are making these procedures more accessible, further accelerating their adoption. As healthcare providers increasingly focus on improving patient outcomes and reducing hospital stays, they are prioritizing the use of interventional radiology. This is especially true in the face of technological advancements that continue to improve procedural accuracy and ensure better clinical outcomes. These factors collectively support the growing role of interventional radiology in the US healthcare system, improving patient care while keeping costs manageable.

Asia Pacific Interventional Radiology Market Analysis

The Asia-Pacific region is experiencing a significant surge in interventional radiology adoption driven by the rising prevalence of multi-vessel coronary artery disease and cardiovascular diseases (CVDs). According to reports, the annual number of deaths from CVD in India is projected to rise from 2.26 million in 1990 to 4.77 million by 2020, highlighting the growing burden of cardiovascular health issues. The increasing incidence of lifestyle-related diseases is fueling the demand for minimally invasive treatment options, which in turn is driving the expansion of image-guided therapeutic techniques. The region’s aging population, combined with a growing awareness about early disease detection, is encouraging healthcare providers to integrate more advanced imaging-guided interventions. Additionally, the establishment and expansion of specialized cardiology centers and medical institutions are improving access to these innovative interventional radiology solutions. Ongoing clinical research and development (R&D) in procedural techniques continue to enhance patient outcomes, enabling more precise and effective treatments. This growing adoption is positioning the Asia-Pacific region as a key player in the interventional radiology market.

Europe Interventional Radiology Market Analysis

Europe is witnessing increased adoption of interventional radiology, influenced by the growing integration of AI for detecting abnormalities in medical images. According to reports, 13.48% of EU enterprises utilized AI technologies in 2024, highlighting its growing role in healthcare. AI-driven advancements in image processing and decision support are optimizing the accuracy of interventional procedures, reducing diagnostic errors, and improving patient care. The focus on early disease detection and precision-guided interventions is accelerating the use of AI-assisted radiology solutions in healthcare facilities. AI-powered automation is enhancing workflow efficiencies, reducing procedural time, and supporting real-time decision-making. The ongoing evolution of medical imaging technologies continues to increase reliance on interventional radiology, improving diagnostic and therapeutic outcomes. These developments are reshaping the landscape of medical procedures across Europe, positioning AI as a critical enabler of enhanced healthcare delivery.

Latin America Interventional Radiology Market Analysis

Latin America is experiencing a rise in interventional radiology adoption, driven by growing urbanization and increasing disposable income. In 2024, 85.2% of the Latin American population (approximately 565 million people) lives in urban areas, which is expanding access to advanced healthcare facilities. This shift is promoting a move towards minimally invasive medical procedures. As purchasing power rises, affordability and accessibility to specialized interventional treatments are improving, driving the demand for image-guided therapies. Increasing healthcare awareness and a growing preference for non-surgical interventions are prompting hospitals and diagnostic centers to incorporate interventional radiology into their offerings. Additionally, ongoing advancements in imaging technologies are further supporting the widespread adoption of interventional radiology in clinical settings, enhancing treatment outcomes and patient care.

Middle East and Africa Interventional Radiology Market Analysis

The Middle East and Africa are witnessing a growing reliance on interventional radiology, driven by the expansion of healthcare facilities. According to the Dubai Healthcare City Authority report, Dubai’s healthcare sector saw rapid growth, with 4,482 private medical facilities and 55,208 licensed professionals by 2022. The sector was projected to grow further by 3-6% in facilities and 10-15% in professionals in 2023. The establishment of new hospitals, specialized diagnostic centers, and medical institutions is leading to the integration of image-guided therapeutic techniques. Increasing investments in healthcare infrastructure are placing a stronger emphasis on advanced medical imaging solutions to improve diagnosis and treatment precision. Furthermore, the expansion of specialized medical training programs is equipping healthcare professionals with the expertise needed to perform interventional procedures, ensuring better patient care across the region.

Competitive Landscape:

Key players are continuously innovating advanced diagnostic solutions to improve procedural accuracy and efficiency in interventional radiology. Companies are expanding product portfolios by launching cutting-edge imaging systems and minimally invasive devices for global adoption. For instance, in 2025, Esaote Group unveiled AI-powered medical imaging solutions, including the e-SPADES AI platform for MRI, Augmented Insight AI for ultrasound, and the MyLab C30 ultrasound system, at ECR 2025. The company also introduced SUITESTENSA ZEfiRO, a cloud-native PACS system for remote diagnostics, improving efficiency in interventional radiology workflow. Besides this, strategic collaborations and partnerships with healthcare institutions are strengthening market presence and accelerating technology adoption. Leading manufacturers are integrating AI-driven imaging analysis to optimize real-time decision-making and automate interventional radiology workflows. Market players are investing in training programs to enhance radiologists' expertise in operating advanced imaging tools effectively. Expanding manufacturing facilities and distribution networks is helping companies improve accessibility in emerging healthcare markets. Mergers and acquisitions (M&A)are enabling key players to expand market share and technological capabilities. Regulatory approvals and adherence to quality standards are ensuring the safety and efficacy of new interventional products. Increasing investments in digital healthcare solutions are further streamlining interventional radiology procedures and patient management systems.

The report provides a comprehensive analysis of the competitive landscape in the interventional radiology market with detailed profiles of all major companies, including:

- Boston Scientific Corporation

- Cook Group Incorporated

- Esaote SpA

- Fujifilm Holdings Corporation

- General Electric Company

- Hologic Inc

- Koninklijke Philips N.V.

- Medtronic plc

- Nipro Corporation

- Shimadzu Corporation

- Siemens Aktiengesellschaft

- Teleflex Incorporated

Latest News and Developments:

- November 2024: Philips India launched the new Azurion interventional radiology system to enhance neurovascular procedures across cardiology, neurology, vascular, and surgery. The system featured advanced C-arm rotation, seamless transitions from 2D to 3D imaging, and table-side control, improving both procedural efficiency and patient outcomes. Additionally, AI-powered remote monitoring through the Philips Service Hub ensured optimal system performance while minimizing downtime.

- October 2024: The VA Boston Healthcare System opened a state-of-the-art interventional radiology suite at its West Roxbury campus to enhance Veteran care. Interventional radiology enabled minimally invasive procedures, reducing hospitalization rates and recovery times. The new facility aimed to improve patient outcomes by offering advanced imaging-guided treatments with fewer complications.

- June 2024: GE HealthCare and MediView XR Inc. installed the first OmnifyXR interventional suite at North Star Vascular and Interventional, expanding their interventional radiology portfolio. This innovative technology improved precision and visualization for minimally invasive procedures. The launch aimed to attract a wider customer base in the radiology sector.

- June 2024: Royal Philips successfully performed the first implantation of the Duo Venous Stent System to treat venous outflow obstruction in chronic venous insufficiency patients. This advancement in interventional radiology, following FDA premarket approval, reinforced Philips’ leadership in vascular treatment solutions. The milestone enhanced its industry presence and market competitiveness.

Interventional Radiology Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Magnetic Resonance Imaging (MRI), Ultrasound Imaging Systems, Computed Tomography (CT) Scanners, Angiography Systems, Fluoroscopy Systems, Biopsy Devices, and Others |

| Procedures Covered | Angiography, Angioplasty, Embolization, Vertebroplasty, Thrombolysis, Nephrostomy Placement, and Others |

| Applications Covered | Cardiology, Urology and Nephrology, Oncology, Gastroenterology, and Others |

| End Uses Covered | Hospitals, Clinics, Ambulatory Surgical Centers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Boston Scientific Corporation, Cook Group Incorporated, Esaote SpA, Fujifilm Holdings Corporation, General Electric Company, Hologic Inc, Koninklijke Philips N.V., Medtronic plc, Nipro Corporation, Shimadzu Corporation, Siemens Aktiengesellschaft and Teleflex Incorporated. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, interventional radiology market outlook, and dynamics of the market from 2019-2033.

- The interventional radiology market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the interventional radiology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The interventional radiology market was valued at USD 28.10 Billion in 2024.

The interventional radiology market is projected to exhibit a CAGR of 5.95% during 2025-2033, reaching a value of USD 47.28 Billion by 2033.

The interventional radiology market growth is driven by increasing occurrence of chronic illnesses like cardiovascular disorders and cancer, which boosts demand for minimally invasive treatments and rising awareness about the benefits of non-surgical interventions and faster recovery times further fuels adoption. Additionally, technological innovations such as AI integration and augmented reality enhance procedural precision.

North America currently dominates the interventional radiology market, accounting for a share of 38.5% in 2024. The region's focus on early disease detection, along with increasing prevalence of chronic conditions like cardiovascular diseases and cancer, drives adoption. Technological advancements such as AI integration and hybrid imaging systems, enhance procedural precision. Moreover, favorable reimbursement policies, strong research and development (R&D) initiatives, and a large aging population strengthens market growth.

Some of the major players in the interventional radiology market include Boston Scientific Corporation, Cook Group Incorporated, Esaote SpA, Fujifilm Holdings Corporation, General Electric Company, Hologic Inc, Koninklijke Philips N.V., Medtronic plc, Nipro Corporation, Shimadzu Corporation, Siemens Aktiengesellschaft and Teleflex Incorporated, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)