Interactive Projector Market Size, Share, Trends, and Forecast by Technology, Projection Distance, Dimension, Resolution, Application, and Region, 2025-2033

Interactive Projector Market Size and Share:

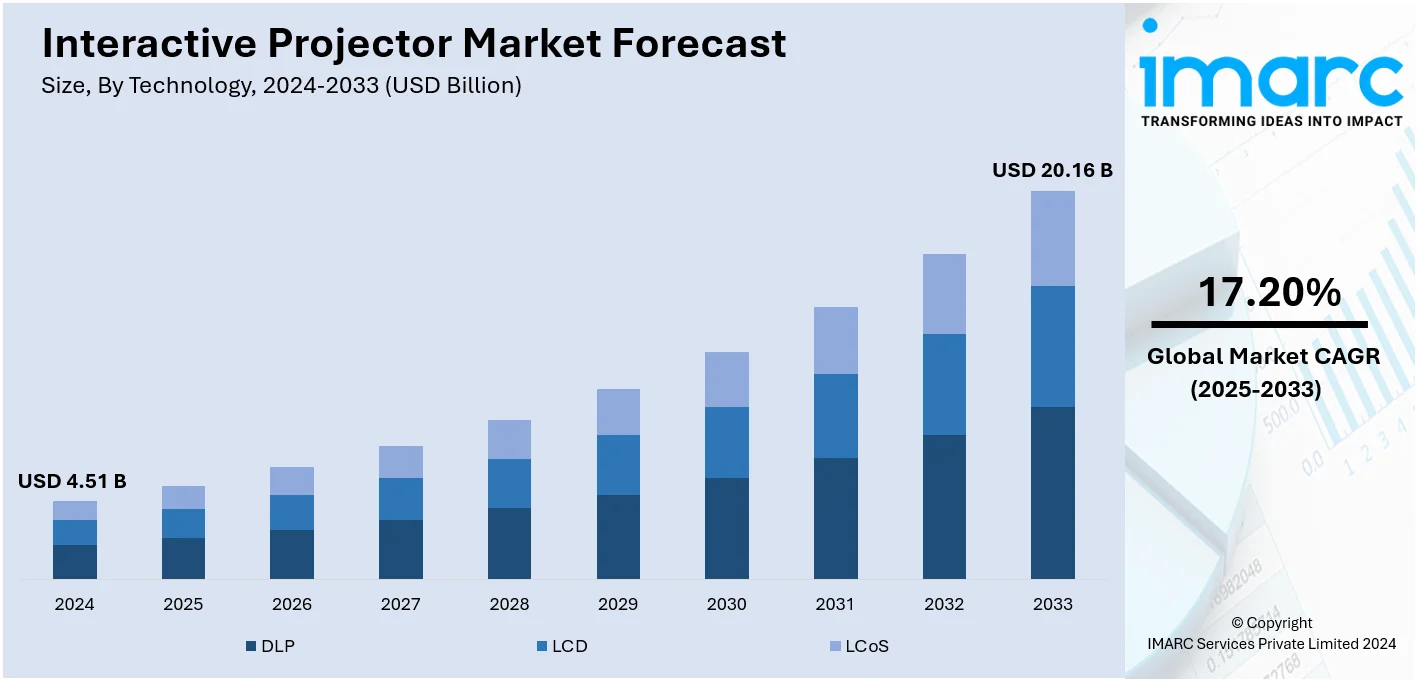

The global interactive projector market size was valued at USD 4.51 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 20.16 Billion by 2033, exhibiting a CAGR of 17.20% from 2025-2033. North America currently dominates the market, holding a market share of over 39.5% in 2024. The interactive projector market share is expanding, driven by the widespread adoption of technology in the education sector, rising demand for real-time annotations, and increasing focus on immersive gaming experiences and interactive entertainment attractions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.51 Billion |

|

Market Forecast in 2033

|

USD 20.16 Billion |

| Market Growth Rate 2025-2033 | 17.20% |

The rising usage of advanced educational tools in schools and universities is impelling the market growth. Interactive projectors enable dynamic and engaging learning experiences. In corporate environments, these projectors facilitate collaborative meetings, presentations, and brainstorming sessions, aligning with the trend of digital transformation. Besides this, the rise of remote and hybrid work further enhances their appeal for virtual team partnerships. Technological advancements, such as ultra-short throw technology and better image quality, improve usability and performance, attracting more users. According to the interactive projector market research report, government initiatives promoting digital classrooms and online education fuel the market growth. Affordability and compatibility with various devices like laptops and smartphones also make these projectors popular.

The United States has emerged as a major region in the interactive projector market owing to many factors. Schools and universities adopt interactive projectors to enhance teaching methods, making learning more engaging and collaborative. The corporate sector also contributes significantly, using these projectors for dynamic presentations, brainstorming, and team meetings. Besides this, the rising trend of hybrid work drives the demand for interactive projectors, as they support seamless collaboration between in-office and remote teams. As per the data published on the official website of the Milken Institute, in June 2024, teleworking across various industries in the United States accounted for more than 20 percent of the workforce, with fields like leisure, hospitality, and construction holding 8 to 9 percent of fully remote or hybrid employees. Apart from this, technological advancements like ultra-short throw projectors, better resolution, and touchscreen capabilities attract more users. Government investments in digital education and smart classrooms further promote their adoption in the education sector. Additionally, the growing awareness among people about interactive projectors’ cost-effectiveness compared to traditional interactive displays is propelling the market growth.

Interactive Projector Market Trends:

Education Technology Adoption

The ongoing adoption of technology in the education sector is fueling the growth of the market. Since schools as well as educational institutions around the world are relying on digital learning, interactive projectors are being preferred for making interactive classrooms. They enable educators to deliver dynamic lessons, thereby enhancing student participation and comprehension. A recent report indicated that the average K-12 school district in the United States utilized 2,591 education technology, or EdTech, tools in the 2022-2023 school year. Moreover, the shift towards hybrid and online learning environments creates the need for interactive projectors. They facilitate a seamless transition between in-person and remote learning, making them indispensable tools for educators. As a result, the education sector represents a substantial portion of the demand of the market. According to the interactive projector market forecast, the continuous need for innovative teaching tools and the integration of interactive projectors into curricula ensure that education represents one of the key factors offering a favorable interactive projector market outlook.

Corporate Collaboration and Presentation Needs

Businesses adopt interactive projectors for meetings, presentations, and collaborative work environments. These projectors facilitate engaging presentations, allowing real-time annotations, interactive data sharing, and seamless communication among team members. A report from the industry reveals that around 30% of US workers are fully remote, while most HR divisions in Fortune 500 companies express no plans to restrict remote work options in the near future. As companies accept remote and hybrid work models, interactive projectors are becoming essential tools for maintaining effective communication and productivity. They enable geographically dispersed teams to collaborate as if they were in the same room, enhancing decision-making and problem-solving processes. Furthermore, interactive projectors are employed in boardrooms, conference centers, and training rooms where they offer versatile and dynamic presentation capabilities. The demand for interactive projectors in the corporate sector is high, as organizations prioritize effective communication in the digital age.

Healthcare and Medical Training

Interactive projectors are employed in medical education as well as training to improve overall learning experiences for healthcare professionals, thereby propelling the interactive projector market growth. They enable interactive anatomy lessons, surgical simulations, and medical presentations, allowing students and practitioners to engage with complex medical concepts effectively. An industry report indicates that an increasing population aids globalization. In the next ten years, India is set to have the world's biggest youth population, with more than 50% of individuals under 35 years old pursuing quality education. Apart from this, the use of interactive projectors in healthcare helps to improve diagnostic and procedural skills, ultimately leading to better patient care. For instance, innovative technologies, such as the 360-degree space hologram projector and 3D holographic projections, are being used in medical schools to create immersive and interactive learning environments. Additionally, in medical conferences and telemedicine applications, interactive projectors facilitate clear and interactive presentations, enabling healthcare professionals to share information and collaborate remotely.

Entertainment and gaming experiences

Interactive projectors are used to create immersive gaming experiences and interactive entertainment attractions. Theme parks, museums, and entertainment venues utilize interactive projectors to engage visitors with interactive exhibits and games. In the gaming industry, interactive projectors are integrated into gaming consoles and arcades, offering players a unique and dynamic gaming environment. Their ability to track gestures and movements enhances gameplay, providing a more immersive and enjoyable experience. The gaming industry has experienced immense developments in projectors, with the BenQ TK700STi being an exceptional model. It features a 4 ms response time at 240 Hz 1080p, or a 16 ms response time at 4K, making it highly favored by gamers. For individuals looking for superior performance and durability, the Optoma UHZ55 offers excellent features and extended lamp life, making it a top choice for premium gaming. Such advancements continue to cater to the high interactive projector market demand.

Interactive Projector Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global interactive projector market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, projection distance, dimension, resolution, and application.

Analysis by Technology:

- DLP

- LCD

- LCoS

DLP represents the largest segment. DLP stands for digital light processing technology and is widely recognized due to its superior performance and versatility. DLP projectors deliver sharper and more detailed images with vibrant colors, thereby creating an ideal educational, corporate, and entertainment setting. Their reliability and ability to function well in various lighting conditions enhance their appeal. DLP projectors also enable rapid response times and smooth video playback, crucial for interactive applications. Their compact design and low maintenance requirements, such as sealed chipsets that prevent dust accumulation, make them a preferred choice over other technologies like LCD or LCoS. Additionally, advancements in DLP technology enable features like ultra-short throw projection and 3D compatibility, meeting the diverse needs of users. With these advantages, DLP continues to dominate the interactive projector market, offering high-quality solutions across multiple industries.

Analysis by Projection Distance:

- Standard Throw

- Short Throw

- Ultra-Short Throw

Ultra-short throw leads the market with 66.0% of market share in 2024. Ultra-short throw is favored for its capacity to display large and sharp images from a minimal distance. This feature eliminates shadow interference and glare, ensuring a seamless and engaging user experience, especially in classrooms and small meeting rooms. These projectors save space and are ideal for compact environments where traditional projectors may not be practical. Their easy installation and ability to deliver high-quality visuals enhance their appeal. Ultra-short throw projectors also reduce eye strain by minimizing direct exposure to light, making them a safer choice for interactive use. Additionally, advancements in this technology, such as better resolution and touch-enabled functionality, cater to the high demand for interactive and immersive solutions in education and corporate sectors. These factors solidify ultra-short throw projectors as the preferred choice.

Analysis by Dimension:

- 2D Interactive Projectors

- 3D Interactive Projectors

The 2D interactive projector segment inculcates projectors designed for two-dimensional interactivity. These projectors are employed in education and business settings for interactive presentations, collaborative work, and digital whiteboard applications. 2D interactive projectors allow users to write, draw, and interact with content directly on the projection surface in real time. They are valued for their ease of use, affordability, and versatility. 2D interactive projectors have been a staple in classrooms, meeting rooms, and training centers, enabling educators and professionals to engage with audiences and convey information effectively.

The 3D interactive projector segment caters to users who require three-dimensional interactivity in their presentations and content. These projectors create immersive 3D visuals, allowing individuals to interact with 3D models, simulations, and virtual environments. They find applications in fields, such as scientific research, engineering, medical training, and certain educational contexts where a deeper level of engagement and spatial understanding is necessary.

Analysis by Resolution:

- XGA (Extended Graphis Display)

- WXGA (Wide- XGA)

- WUXGA (Wide- Ultra XGA)

- HD (High Definition)

XGA (extended graphis display) interactive projectors offer a resolution of 1024x768 pixels, providing a balance between affordability and image clarity. They are commonly used in educational settings where cost-effectiveness is a consideration and the primary focus is on textual content and basic graphics. They are suitable for classrooms and small meeting rooms, to deliver clear and legible presentations, making them a practical choice for budget-conscious buyers.

WXGA (wide-XGA) interactive projectors provide a resolution of 1280x800 pixels, offering a wider aspect ratio compared to XGA. This resolution is popular for interactive presentations and content due to its ability to display more detailed visuals, making it a preferred choice for businesses and educators. WXGA projectors are versatile, accommodating both standard and widescreen content, and they strike a balance between image quality and affordability.

WUXGA (wide-ultra XGA) interactive projectors feature a resolution of 1920x1200 pixels, providing high-definition quality for detailed and crisp visuals. These projectors are favored for applications where image clarity is paramount, such as design, engineering, and medical imaging. They can display intricate graphics, charts, and diagrams with precision.

HD (high definition) interactive projectors offer a resolution of 1920x1080 pixels, providing full high-definition quality. These projectors are particularly well-suited for multimedia presentations, home theaters, and applications where vibrant colors and sharp visuals are critical. HD projectors deliver immersive viewing experiences, making them popular for home entertainment setups.

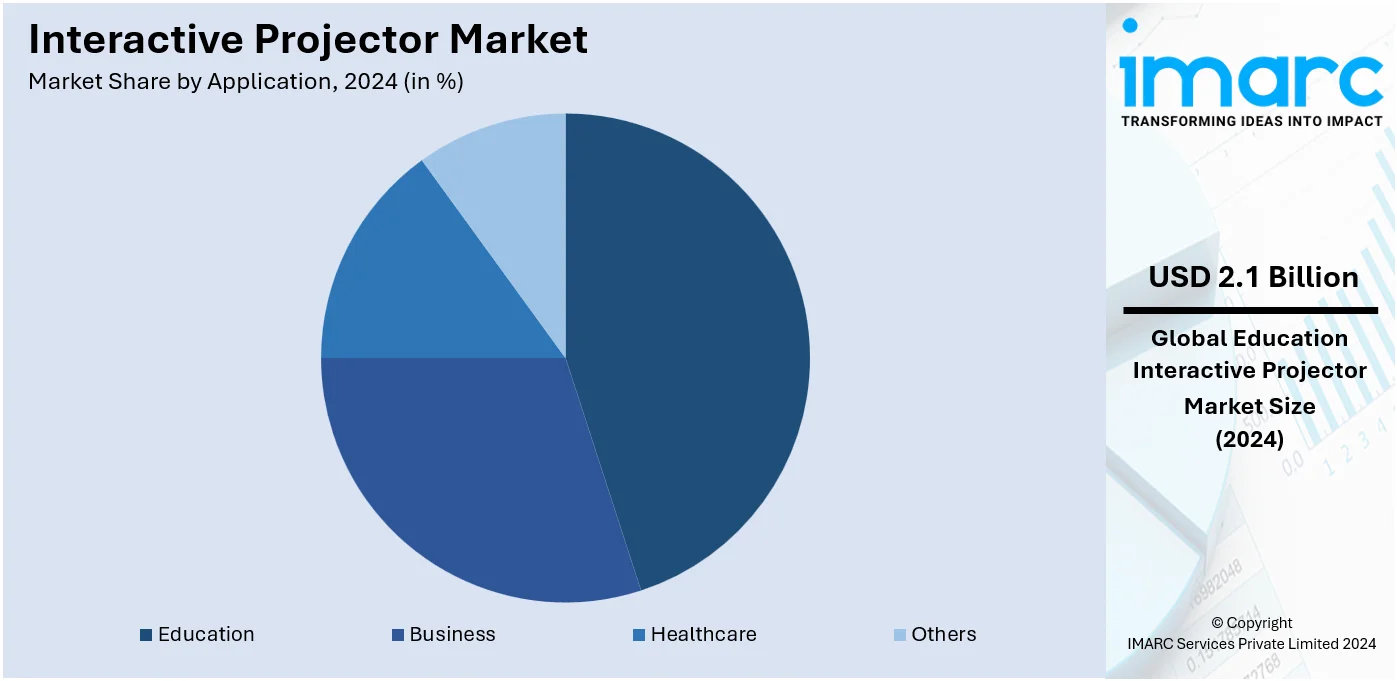

Analysis by Application:

- Education

- Business

- Healthcare

- Others

Education accounts for 46.0% of the market share, driven by its transformative impact on learning environments. Schools, colleges, and universities widely adopt these projectors to create engaging and interactive classrooms, replacing traditional teaching methods with more dynamic approaches. Interactive projectors enable real-time collaboration, cooperative lessons, and multimedia presentations, enhancing student participation and comprehension. Additionally, the shift towards digital education, especially in smart classrooms, drives the demand for these devices. Teachers use interactive projectors to display complex concepts visually, making learning more accessible and effective for students. Moreover, government initiatives and funding for modernizing educational infrastructure increase the adoption in the education sector. The affordability and versatility of interactive projectors compared to other interactive display technologies make them an ideal choice for educational institutions, ensuring they remain the leading application in this market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 39.5%. The market is driven by several factors. The region is noted for its rising proliferation of internet and smartphones, which support the employment of interactive projectors. As per the information provided on the official website of the Pew Research Center, 96% percent of adults in the US report that they use the internet. The region’s strong focus on digital education promotes the high adoption of interactive projectors in schools and universities where interactive projectors enhance student engagement and collaboration. The corporate sector also contributes significantly, using these projectors for dynamic presentations, training sessions, and team meetings. Innovations, backed by key players in the region, ensure the availability of advanced projectors with features like ultra-short throw technology and high resolution. Additionally, the growing trend of hybrid work and online learning creates the need for devices that enable seamless interaction. Robust government funding for education and technological upgrades further encourages the usage of projectors. With high awareness, strong infrastructure, and continuous improvements, North America maintains its leadership in the interactive projector market, meeting the needs of educational and corporate users effectively.

Key Regional Takeaways:

United States Interactive Projector Market Analysis

The United States hold 83.80% of the market share in North America. The market in the United States is increasing significantly, especially because of educational technology adoption within K-12 schools. A recent report indicated that the average K-12 school district in the United States utilized 2,591 education technology or EdTech, tools during the 2022-2023 school year, showing a significant rise from the 300 EdTech tools per district reported in the 2016-2017 school year. The drastic increase is seen as a greater incorporation of digital learning tools into the classroom. Interactive projectors are an important component of this shift and are in demand to create a more interactive learning environment that promotes dynamic learning environments. The transition towards digital tools mirrors a wider movement towards making education more technologically based due to the rising demand for interactive, flexible, and personalized learning. As a result of this continued investment from federal and state initiatives, the US is continuing to attract money into educational technology, encouraging the usage of interactive projectors and other similar digital tools.

Europe Interactive Projector Market Analysis

The market in Europe is growing steadily, as educational and business sectors call for the modernization of learning and collaboration solutions. In fact, several European countries, such as the UK, Germany, and France, are increasing their investment in digital education, according to the European Commission. In 2023, Germany dedicated EUR 5 Billion (USD 5.5 Billion) to its AI strategy, which involves enhancing digital infrastructure in educational institutions. Apart from this, the education sector is robust, with an emphasis on smart classrooms and advanced digital tools. Additionally, the hybrid working model is catalyzing the demand from businesses looking for advanced meeting and presentation tools. Major players leading to technological innovations are companies like NEC and Optoma. High environmental and sustainability concerns, with people seeking eco-friendly projectors with lower energy usage, are promoting their utilization. Government funding also helps to ensure that interactive technologies become widespread.

Asia-Pacific Interactive Projector Market Analysis

The market in the Asia-Pacific region is growing with high rates. It mainly has increased the rate of technology adoption in the educational and business sectors. The Ministry of Education of the People's Republic of China states that by the conclusion of 2023, 519,000 educational institutions in China had accessed the Smart Education Platform (SEC), an e-platform benefiting 18.8 million teachers and 293 million learners. Initiated at the start of 2022, the firm experienced favorable effects via digital technology, amassing over 100 million registered users from 200 nations and achieving 36.7 Billion visits. India also gives priority to smart education and wagers on tools for digital learning, which enhances the adoption of interactive projectors. The need for smart education in this area creates the need for advanced teaching tools. The adoption of interactive projectors is expected to increase because of high investments in digital education and the collaboration of local and international players.

Latin America Interactive Projector Market Analysis

Increasing defense budgets, civilian firearm ownership rates, and security issues propel the market growth in the Latin American region. The International Trade Administration stated that the Brazilian Ministry of Education assigned approximately USD 24 Billion to its 2022 budget, which was anticipated to rise to USD 29 Billion in 2023. Such allocation supports various educational tools and, therefore, digital learning tools. Mass usage is also highly necessary for an interactive projector that also depends much on liberalized regulations on guns because over 1.6 million firearm licenses have been accredited to civilians, as per reports. Mexican and Columbian nations with their investments in respective advancements in technologies enhance their nations’ educational services. The uprising middle and increasing smartphone population assist digital platforms in selling technology, even in regions of Latin America. Companhia Brasileira de Cartuchos (CBC) in Brazil is the global leader due to its innovative solutions being exported to more than 100 nations.

Middle East and Africa Interactive Projector Market Analysis

The Middle East and Africa region also experiences a good influence of high government investments in education and digital technologies. In the official portal of the UAE, it was observed that the total federal budget for 2023 amounts to AED 63.066 Billion (USD 17.15 Billion), including public and university education programs totaling AED 9.8 Billion (USD 2.67 Billion), which represents 15.5% of the budget. Such investment caters to many educational initiatives wherein digital learning tools are being included in the classroom. The other countries in the region also wager on educational modernization and significant investments in digital classrooms and interactive technologies. Governments are focusing on technological advancements, such as interaction projectors to improve learning environments and to have access to quality education.

Competitive Landscape:

Key players in the market are actively engaged in innovations and product development to maintain their competitive edge. They work on enhancing their interactive projector offerings by integrating advanced technologies, such as laser projection, touch sensitivity, and interactive software. These companies also focus on improving the user experience by creating user-friendly interfaces and providing compatibility with various devices and platforms. Moreover, they are expanding their global presence through strategic partnerships and distribution networks to reach a wider user base. Additionally, efforts are being made to address sustainability concerns by designing energy-efficient interactive projectors and implementing eco-friendly manufacturing processes, aligning with the growing emphasis on environmentally responsible technology solutions. For instance, in January 2024, Panasonic unveiled its most eco-friendly projector, the MZ882 Series, during ISE 2024. Boasting brightness of up to 8,200 lumens, the projector incorporates 10% recycled materials, recyclable parts, and energy-efficient technologies. The series promises to enhance brightness and efficiency by as much as 8.7%, decreases waste, and lowers carbon footprint, aiding sustainability objectives.

The report provides a comprehensive analysis of the competitive landscape in the interactive projector market with detailed profiles of all major companies, including:

- BenQ Corporation (Qisda Corporation)

- Boxlight

- Casio Computer Co. Ltd.

- Dell Technologies Inc.

- Delta Electronics Inc.

- Hitachi Digital Media Group

- NEC Display Solutions Ltd. (NEC Corporation)

- Optoma Technology Inc. (Coretronic Corporation)

- Panasonic Corporation

- Seiko Epson Corp.

- Touchjet Inc.

Latest News and Developments:

- July 2024: Optoma introduced its Wave series of laser projectors in India, featuring the Wave110R, Wave110S, and Wave120R models. The projectors provide vivid and clear visuals with accurate colors, with brightness levels between 3,500 and 4,300 lumens and a dynamic contrast ratio of 2,200,000:1.

- January 2024: Delta's Digital Projection unveiled two laser projectors:-E-Vision 16000i WU and E-Vision 10000i. The 16000i features a brightness of 18,000 lumens utilizing ColorBoost + Red Laser technology, whereas the 10000i offers a brightness of 9,600 lumens. Both are equipped with improved features like source redundancy and automatic white balance adjustment.

Interactive Projector Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | DLP, LCD, LCoS |

| Projection Distances Covered | Standard Throw, Short Throw, Ultra-Short Throw |

| Dimensions Covered | 2D interactive projectors, 3D interactive projectors |

| Resolutions Covered | XGA (Extended Graphis Display), WXGA (Wide- XGA), WUXGA (Wide- Ultra XGA), HD (High Definition) |

| Applications Covered | Education, Business, Healthcare, Others |

| Regions Covered | North America, Asia-Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | BenQ Corporation (Qisda Corporation), Boxlight, Casio Computer Co. Ltd., Dell Technologies Inc., Delta Electronics Inc., Hitachi Digital Media Group, NEC Display Solutions Ltd. (NEC Corporation), Optoma Technology, Inc. (Coretronic Corporation), Panasonic Corp., Seiko Epson Corp., Touchjet Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the interactive projector market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global interactive projector market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the interactive projector industry and its attractiveness.

Key Questions Answered in This Report

The interactive projector market was valued at USD 4.51 Billion in 2024.

IMARC estimates the interactive projector market to exhibit a CAGR of 17.20% during 2025-2033.

Technological advancements, like ultra-short throw projection, touchscreen capabilities, high resolution, and 3D support are impelling the market growth. Besides this, investments in smart classrooms and digital education encourage the utilization of interactive projectors in the education sector. Moreover, interactive projectors are more affordable and versatile compared to interactive flat panels, increasing their popularity across various industries.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market because of the proliferation of smartphones.

Some of the major players in the interactive projector market include BenQ Corporation (Qisda Corporation), Boxlight, Casio Computer Co. Ltd., Dell Technologies Inc., Delta Electronics Inc., Hitachi Digital Media Group, NEC Display Solutions Ltd. (NEC Corporation), Optoma Technology, Inc. (Coretronic Corporation), Panasonic Corp., Seiko Epson Corp., Touchjet Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)