Intelligent Document Processing Market Size, Share, Trends and Forecast by Component, Technology, Deployment, Organization Size, End Use, and Region, 2025-2033

Intelligent Document Processing Market Size and Share:

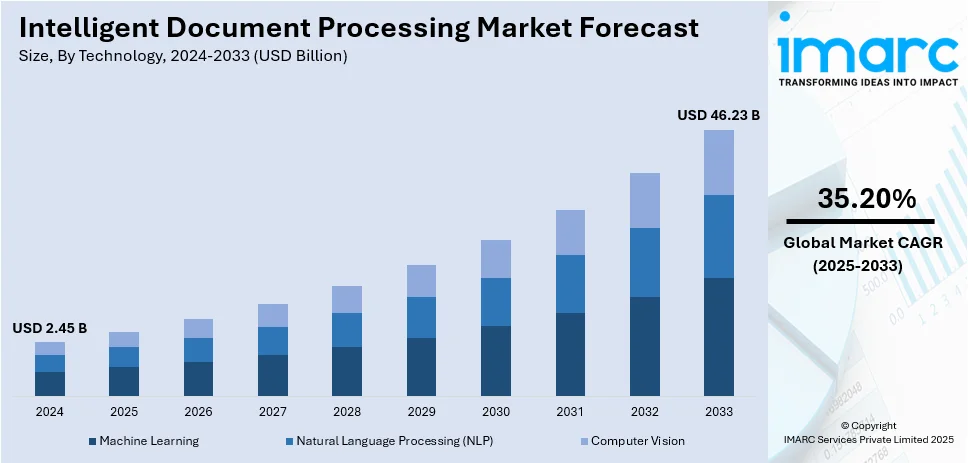

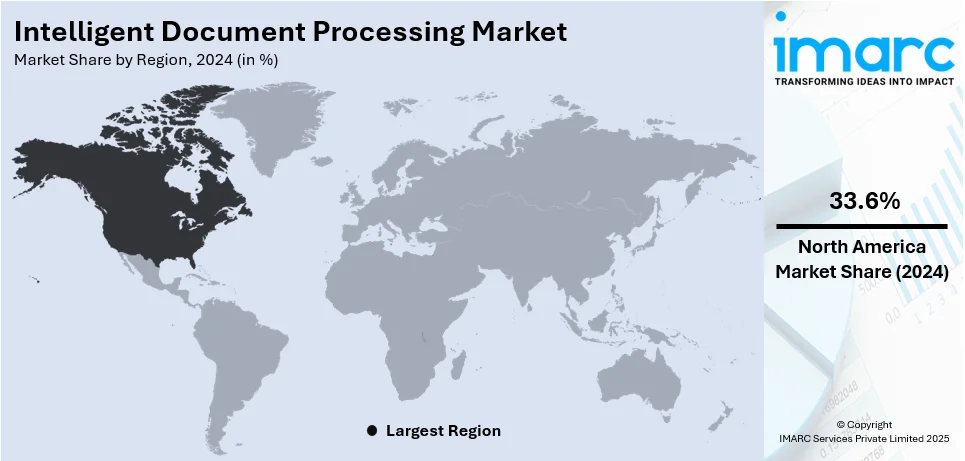

The global intelligent document processing market size was valued at USD 2.45 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 46.23 Billion by 2033, exhibiting a CAGR of 35.20% from 2025-2033. North America currently dominates the market, holding an intelligent document processing market share of over 33.6% in 2024. Market factors like technological advancements, consumer demand, regulatory changes, economic conditions, and shifts in industry trends are influencing the growth and development of this industry in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.45 Billion |

| Market Forecast in 2033 | USD 46.23 Billion |

| Market Growth Rate (2025-2033) | 35.20% |

A key factor driving the intelligent document processing (IDP) market is the increasing use of automation in various industries. Businesses are increasingly leveraging IDP technologies to automate document management, data extraction, and processing tasks that were traditionally manual. This transition is fueled by the demand to improve operational efficiency, minimize human errors, and lower costs. As organizations handle vast amounts of unstructured data, IDP tools powered by AI, machine learning, and optical character recognition (OCR) streamline workflows, improve accuracy, and accelerate decision-making. The growing need for digital transformation solutions is also boosting the intelligent document processing market growth.

In the U.S., the IDP market holds a substantial 73.50% market share, fueled by the fast-paced digital transformation across various industries. Companies are progressively embracing IDP solutions to automate document processes, improve operational efficiency, and cut costs. The U.S. is home to many technology-driven companies investing in Artificial Intelligence (AI), Machine Learning (ML), and natural language processing to improve document management processes. Moreover, stringent regulatory requirements in sectors like finance, healthcare, and legal are pushing organizations to adopt compliant and efficient solutions. The rising volume of unstructured data and the growing need for quicker decision-making are also driving the demand for IDP technologies.

Intelligent Document Processing Market Trends:

Integration with Artificial Intelligence and Machine Learning

One of the prominent trends in IDP is the integration of technologies. These advancements allow IDP systems to go beyond basic document extraction and automate more complex tasks, such as understanding context, processing natural language, and making decisions. AI and ML enable systems to recognize patterns in unstructured data, continuously improve over time, and adapt to new document types. This trend improves the accuracy and efficiency of document processing, minimizing the reliance on human intervention. As organizations seek more intelligent automation solutions, the application of AI and ML in IDP continues to gain traction, aiding the intelligent document processing market outlook toward more advanced, self-learning systems.

Cloud-based IDP Solutions

The adoption of both internal development platforms (IDP) and cloud-based IDP solutions is rapidly increasing, with IDP adoption expected to exceed 90% within the next five years. Cloud platforms provide businesses with the flexibility to scale their document processing requirements while avoiding the high costs of on-premise infrastructure. Similarly, internal development platforms are being actively implemented by organizations seeking efficient platform engineering solutions to streamline workflows. Cloud-based IDP enables businesses to securely store, access, and process large volumes of documents, enhancing collaboration and integration with other systems. Both solutions empower organizations to reduce operational overhead, improve data management, and leverage advanced technologies such as automation, AI, and machine learning, driving greater agility and operational efficiency in document processing and internal development.

Focus on Industry-Specific Solutions

As IDP evolves, a growing intelligent document processing market trends is the development of industry-specific IDP solutions tailored to address the unique challenges of sectors such as healthcare, finance, legal, and insurance. These solutions are designed to comply with industry regulations, streamline complex workflows, and handle specialized documents, such as medical records, contracts, or insurance claims. Customization allows businesses to process highly specific data with increased accuracy, improving compliance and reducing operational risk. This trend reflects a broader move toward personalized technology solutions that not only automate document handling but also align with the unique requirements and standards of individual industries.

Intelligent Document Processing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global intelligent document processing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, technology, deployment, organization size, and end use.

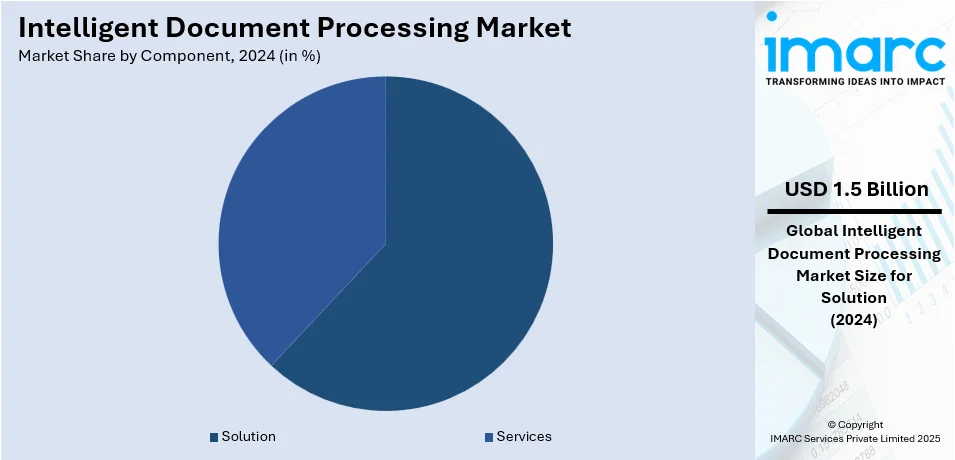

Analysis by Component

- Solution

- Services

Solutions hold the largest share of the intelligent document processing market, accounting for 62.6%, driven by the rising demand for AI-powered platforms that automate document handling and extraction. Organizations across various sectors are progressively adopting IDP solutions to enhance operational efficiency, minimize manual labor, and speed up document processing. These solutions encompass a range of capabilities, including OCR, ML, and natural language processing (NLP), which can handle a variety of document types—structured, semi-structured, and unstructured. The adoption of cloud-based and scalable solutions further drives market growth, offering businesses flexibility and cost-effectiveness. IDP solutions also enable seamless integration with existing information technology (IT) systems, helping enterprises optimize their document workflows, ensure regulatory compliance, and enhance decision-making, making them the preferred choice for companies seeking automation and innovation.

Analysis by Technology

- Machine Learning

- Natural Language Processing (NLP)

- Computer Vision

Machine learning is the largest growth driver, accounting for 47.5% of the technology segment in the IDP market, as it can automate complex document processing tasks with high accuracy and efficiency. The adoption of machine learning enables systems to improve over time, allowing for better handling of unstructured data, such as scanned images and handwritten text. ML models can identify patterns and extract relevant information from diverse document types by using algorithms that learn from historical data. This decreases the reliance on manual intervention and improves decision-making. The increasing demand for AI-driven solutions to streamline workflows, reduce operational costs, and improve document processing speed in industries like banking, healthcare, and legal is fueling the intelligent document processing market demand.

Analysis by Deployment

- Cloud

- On-premises

Cloud-based dominate the IDP market share by 65.7% because of their scalability, flexibility, and cost efficiency. Scalability allows businesses to store and process a large quantity of document data without the needs of expensive on-premises infrastructure. It makes it easy to access the advanced AI technologies like machine learning and natural language processing where appropriate within all types of industries. Not only do cloud-based IDP solutions facilitate easy integration with other enterprise systems, enhancing automated workflow and cross-team collaborations but have a 'pay-as-you-go' pricing model, thereby even reducing the upfront charges. They appeal to smaller businesses through these affordable prices. Cloud solutions enhance data security, ensure, hence compliance with regulatory requirements, and decrease deployment times, further driving this dominance in the IDP market.

Analysis by Organization Size

- Small and Medium Sized Enterprises (SMEs)

- Large Size Enterprises

Based on the intelligent document processing market forecast, large enterprises dominate the due to their vast volume of documents and complex workflows, which drive the need for automation solutions. These organizations frequently handle vast volumes of structured, semi-structured, and unstructured data, requiring efficient and accurate document processing systems. By adopting IDP solutions, large enterprises can streamline operations, reduce manual errors, ensure regulatory compliance, and improve overall productivity. Moreover, these organizations have the financial capacity to invest in advanced AI technologies like machine learning and natural language processing, which are crucial for managing complex document processing tasks. The scalability and customization offered by IDP solutions also align with the diverse needs of large enterprises, further accelerating market growth in this segment.

Analysis by End-Use

- BFSI

- Healthcare

- Manufacturing

- Retail

- Government and Public Sector

- Transportation and Logistics

- IT and Telecom

- Others

The BFSI (Banking, Financial Services, and Insurance) sector dominates the IDP market, accounting for 28.7% of the market growth. This sector's dominance is driven by the increasing volume of financial documents and the need for accurate, efficient document processing. Regulatory compliance, data security, and fraud prevention are major drivers, making IDP solutions vital for automating processes like loan processing, claims management, and compliance reporting. AI-driven technologies, such as OCR and NLP, enable the extraction of valuable insights from structured, semi-structured, and unstructured documents, boosting decision-making and operational efficiency. The BFSI sector's large-scale adoption of IDP solutions supports faster document processing, cost reduction, and improved customer service, further accelerating market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds the leading position in the IDP market with a 33.6% market share due to several factors. The region boasts a robust technological infrastructure, high adoption of advanced AI solutions, and significant investment in automation technologies across industries such as finance, healthcare, legal, and government. The increasing need for businesses to streamline operations, improve data accuracy, and reduce operational costs drives demand for IDP solutions. Besides this, stringent regulatory requirements, particularly in sectors like finance, further promote the adoption of secure and compliant document processing tools. North America’s early adoption of AI-driven automation and the presence of key technology players and startups strengthens its market leadership, making it a hub for IDP innovation and deployment.

Key Regional Takeaways:

United States Intelligent Document Processing Market Analysis

The U.S. IDP market is experiencing rapid growth, fueled by the rising adoption of automation across multiple sectors. Organizations are increasingly leveraging IDP solutions to streamline workflows, boost productivity, and enhance decision-making. The demand for AI-powered document processing tools, including OCR, ML, and natural language processing, is escalating due to the need for accurate data extraction from unstructured documents. The financial, healthcare, legal, and government sectors are among the leading adopters, where compliance, security, and cost reduction are significant drivers. Additionally, businesses are focusing on digital transformation to stay competitive, further accelerating the shift towards IDP. The U.S. market also benefits from a robust tech ecosystem, with leading technology providers offering innovative, scalable, and customizable solutions. Cloud-based platforms are gaining popularity, offering organizations the flexibility to securely manage large volumes of documents. The growing need for regulatory compliance and efficient document management is expected to continue driving the U.S. IDP market forward.

Europe Intelligent Document Processing Market Analysis

In Europe, the IDP market is expanding rapidly, supported by increasing digitization and the demand for automation in industries such as finance, healthcare, legal, and government. The regulatory stringency, more so in financial services, continues to be an impetus in adopting IDP solutions for secured and compliant management of documents. European businesses are deploying AI-based tools for document automation, such as increasing productivity, minimizing the occurrence of errors, and assuring accuracy of data, while cloud-based solutions have more interest due to scalability, low cost, and enhanced collaboration for diverse markets within the region. Companies are also aligning IDP technology with the already existing enterprise systems to automate and streamline document workflow and enhance productivity. Europe, in particular, places a strong emphasis on data privacy and security. Hence, IDP vendors are making every effort to keep up with GDPR as well as other compliances. Given the ongoing and future digital transformations in industries around Europe, there will be a continued growth of the demand for IDP solutions.

Asia Pacific Intelligent Document Processing Market Analysis

Technological advancements happening at a rapid pace and increasing automation in countries like China, India, and Japan are pushing the APAC IDP market to expand. With finance, manufacturing, and the health care industries demanding solutions for enhanced productivity and reducing operational costs, the demand for IDP solutions is growing further. The market is being boosted by the increasingly widespread adoption of AI, ML, and cloud technologies. In addition, the increasing digital transformation initiatives in APAC and large volumes of unstructured data in industries are accelerating the need for efficient document processing solutions. The market is projected to experience substantial growth in the coming years.

Latin America Intelligent Document Processing Market Analysis

In Latin America, the IDP market increases since companies look for efficient automation solutions in managing documents and data. Finances, insurance companies, and even the government are using IDP technologies to heighten the smooth running of their operations and the accuracy of data. The market is driven by digitalization, where many companies tend to demand compliance-driven automation. Cloud-based solutions are also increasingly used in the region, providing businesses with scalable tools that reduce the cost of document processing.

Middle East and Africa Intelligent Document Processing Market Analysis

The Middle East and Africa (MEA) IDP market is evolving as businesses in sectors like finance, healthcare, and government embrace automation for better efficiency. Increasing demand for compliance and secure data management solutions is pushing the adoption of IDP technologies. Cloud-based solutions are gaining momentum in the region, providing both flexibility and scalability. As organizations in MEA move toward digital transformation, the IDP market is expected to experience steady growth with an emphasis on cost-effective, secure document processing solutions.

Competitive Landscape:

In the IDP market, one would observe an overlapping space among well-established tech vendors and disruptive start-ups, all in constant pursuit of competing leadership positions. Competitors tend to dominate this domain with full suites that bring AI and machine learning integration for document automation processes, primarily aimed at automating end-to-end business document processes for large corporations and enterprise segments. Startups offer agile, innovative solutions tailored to niche applications or specific industry requirements. Competition is driven by technological innovation, mainly in AI-powered data extraction, natural language processing, and OCR capabilities. It is common for organizations to employ partnerships and acquisitions to strengthen product offerings and reach a wider market. In short, competition will drive rapid developments in IDP technologies and customer-centric solutions.

The report provides a comprehensive analysis of the competitive landscape in the intelligent document processing market with detailed profiles of all major companies, including:

- ABBYY

- AntWorks

- Appian

- Automation Anywhere, Inc.

- Datamatics Global Services Limited

- International Business Machines Corporation

- Open Text Corporation

- UiPath

Latest News and Developments:

- In April 2024, the company, UiPath, was placed at the leadership level for the second consecutive year on the Everest Group Intelligent Document Processing (IDP) Products PEAK Matrix® Assessment 2024. This is where UiPath obtained leading positions regarding its vision, abilities, and market impact. With UiPath, enterprise environments enjoy maximum business results from improved document processing that uses AI-powered OCR, NLP, and machine learning capabilities for extracting information from structured, semi-structured, and unstructured documents.

- In March 2024, DeepInsights Doc AI, a generative AI-powered intelligent document processing solution, was introduced by Mphasis. Regardless of the format, this platform assists businesses in extracting context-specific information from documents and integrating it with IT systems to produce insights that can be put to use. With features like information extraction, discovery, context-aware search, and insight generation, DeepInsights Doc AI provides scalable and adaptable solutions. It guarantees flexibility, cost-effectiveness, and substantial savings for companies managing high document volumes because it is self-hosted on enterprise clouds.

- In February 2024, AND Global, a Singapore-based FinTech company, launched Mindox, an intelligent document processing (IDP) software designed to streamline document processing for financial institutions. The software ensures accuracy and speed, helping businesses optimize operations. Initially available in the Philippines, Mindox plans to expand globally. AND Global, dedicated to promoting financial inclusion in Southeast Asia, continues to innovate with solutions that address the region's financial challenges.

- In February 2024, Duco, a data automation company, acquired Metamaze, an AI-powered intelligent document processing startup based in Antwerp, Belgium. Metamaze offers a no-code SaaS platform that automates document data extraction, improving corporate insights and decision-making. With a strong focus on banking and insurance, Metamaze’s technology will be integrated into Duco’s data automation suite to enhance global scalability. The acquisition aims to further advance AI-driven automation in document processing.

Intelligent Document Processing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Technologies Covered | Machine Learning, Natural Language Processing (NLP), Computer Vision |

| Deployments Covered | Cloud, On-premises |

| Organization Sizes Covered | Small and Medium Sized Enterprises (SMEs), Large Size Enterprises |

| End Uses Covered | BFSI, Healthcare, Manufacturing, Retail, Government and Public Sector, Transportation and Logistics, IT and Telecom, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABBYY, AntWorks, Appian, Automation Anywhere, Inc., Datamatics Global Services Limited, International Business Machines Corporation, Open Text Corporation, UiPath, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the intelligent document processing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global intelligent document processing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the intelligent document processing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The intelligent document processing market was valued at USD 2.45 Billion in 2024.

The intelligent document processing market was valued at USD 46.23 Billion in 2033.

IMARC estimates the intelligent document processing market to exhibit a CAGR of 35.20% during 2025-2033.

Key factors driving the IDP market include the increasing need for automation to streamline document workflows, enhance operational efficiency, reduce manual errors, and ensure regulatory compliance. Also, ongoing advancements in AI technologies like machine learning and natural language processing, along with rising data volumes, are fueling market growth.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the intelligent document processing market include ABBYY, AntWorks, Appian, Automation Anywhere, Inc., Datamatics Global Services Limited, International Business Machines Corporation, Open Text Corporation, UiPath, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)