Insurance Fraud Detection Market Size, Share, Trends and Forecast by Component, Deployment Model, Organization Size, Application, End User, and Region,2025-2033

Insurance Fraud Detection Market Size and Share:

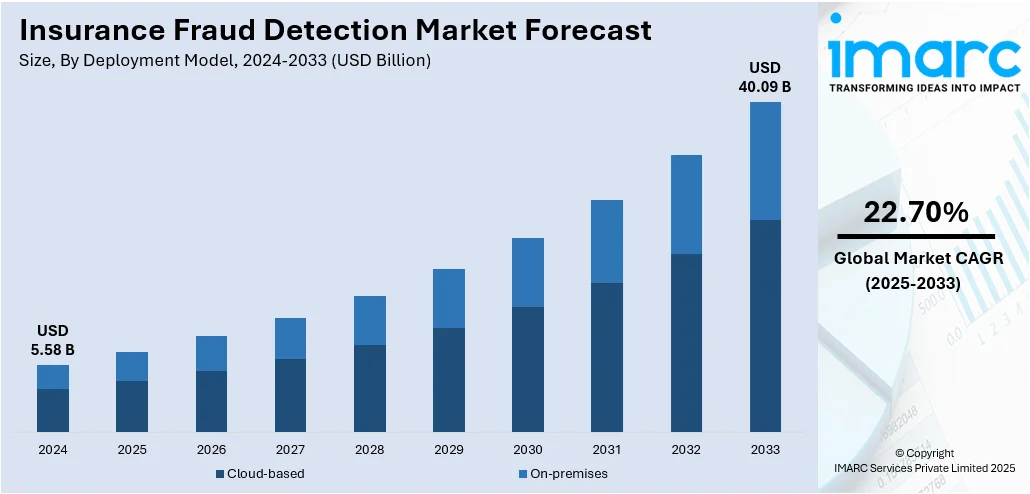

The global insurance fraud detection market size was valued at USD 5.58 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 40.09 Billion by 2033, exhibiting a CAGR of 22.70% during 2025-2033. North America currently dominates the market holding a significant market share of 48.6% in 2024. The market is expanding, driven by the increasing demand for livestock and poultry products. Moreover, the sector continues to grow with a rise in meat consumption and advancements in feed formulations, similar to the trends observed in the Insurance fraud detection market share, which emphasizes growth driven by evolving needs and technological advancements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.58 Billion |

| Market Forecast in 2033 | USD 40.09 Billion |

| Market Growth Rate (2025-2033) | 22.70% |

Insurance companies need immediate insights into suspicious activities to prevent significant financial losses with fraudsters becoming more advanced. Traditional fraud detection methods, which involve post-incident investigations, are no longer adequate in handling the evolving nature of fraud. Real-time fraud detection systems powered by machine learning algorithms and data analytics enable insurers to monitor transactions as they happen and identify fraudulent patterns quickly. The adoption of these systems helps in reducing response times, increasing the speed of claims processing, and minimizing fraudulent payouts. Furthermore, these systems use continuous learning models that adapt over time, improving the detection process with every new claim. Furthermore, the insurance industry is increasingly prioritizing real-time fraud detection solutions, driving the insurance fraud detection market growth.

To get more information on this market, Request Sample

In the United States, the adoption of predictive analytics for fraud prevention is rapidly gaining momentum within the insurance sector. As fraud schemes become more sophisticated, U.S. insurers are turning to predictive models that leverage historical data, machine learning, and advanced statistical techniques to identify potentially fraudulent activities before they happen. These predictive tools help insurers assess the likelihood of fraud in real-time, enabling them to act swiftly and reduce the risk of financial losses. As regulatory pressures continue to increase and the demand for efficient, cost-effective solutions rises, US insurance companies are increasingly relying on predictive analytics to enhance their fraud detection efforts. This shift towards data-driven, anticipatory fraud prevention strategies is expected to play a key role in shaping the future of the Insurance Fraud Detection market in the United States.

Insurance Fraud Detection Market Trends:

Technological Advancements and Integration of AI

Technological innovations are fundamentally transforming the insurance fraud detection sector. The integration of artificial intelligence (AI), machine learning (ML), and big data analytics enables insurers to detect fraudulent activities more effectively and efficiently. These advanced technologies allow insurers to analyze vast amounts of data at incredibly high speeds, identifying patterns and anomalies that could indicate fraudulent behavior. One example of this advancement is the launch of Neutrinos' Life & Health Claims Automation Suite in June 2025, which uses AI to provide enhanced transparency, speed, and intelligence in fraud detection for life and health insurers. This automation suite streamlines the claims process, leveraging AI-powered capabilities to detect suspicious claims in real-time, reducing response times and minimizing losses. Additionally, AI and ML systems continuously evolve, learning from new data to adapt to emerging fraud tactics. As these technologies become increasingly sophisticated, they enable insurers to stay ahead of fraudsters by offering dynamic fraud detection systems that improve over time. This growing reliance on AI and ML technologies emphasizes their essential role in shaping the future of fraud detection, contributing to substantial market growth as insurers adopt these tools to mitigate risks and reduce financial losses.

Strict Regulatory Compliance and Legal Mandates

The insurance industry is experiencing heightened pressure from regulatory bodies to combat fraud more effectively, which is driving the growth of the fraud detection market. Governments and regulatory agencies are enforcing stricter compliance requirements, mandating that insurance companies adopt advanced fraud detection technologies. These regulations are designed to ensure that insurers implement robust measures to detect and prevent fraudulent activities, which in turn fosters greater trust among policyholders. For instance, the Association of British Insurers (ABI) reported that in 2020, over 96,000 dishonest claims valued at £1.1 Billion were detected, highlighting the magnitude of the problem. Adhering to these regulations not only helps curb fraud but also enhances insurers’ reputations by showcasing their commitment to ethical practices. As regulatory demands evolve, insurance companies must continuously update their fraud detection systems to ensure compliance. This has led to an increased demand for specialized fraud detection solutions, propelling market growth. In January 2025, the Insurance Fraud Bureau (IFB) partnered with Shift Technology to develop an integrated fraud detection platform combining various fraud investigation case management systems into one cohesive solution. Set for launch in 2026, this platform will streamline and strengthen counter-fraud efforts across the industry, offering a comprehensive, unified approach to tackling insurance fraud.

Growing Emphasis on Cost Savings and Operational Efficiency

Cost efficiency and operational effectiveness are increasingly becoming focal points for insurance companies, particularly in relation to the rising costs of fraudulent claims. Fraudulent claims can lead to substantial payouts, resulting in significant financial losses and increased administrative costs. Consequently, insurance companies are turning to advanced fraud detection technologies to identify and address fraudulent claims early, helping to mitigate these risks and reduce their financial impact. Insurers can streamline their operations, reduce manual intervention, and cut operational costs by investing in AI-powered fraud detection systems. For example, in June 2024, CLARA Analytics introduced a cutting-edge fraud detection tool that uses AI and large datasets to analyze workers' compensation claims. This solution helps insurers uncover suspicious claims more quickly, allowing them to resolve issues faster and at a lower cost. The quicker identification of fraudulent activities means that investigators can focus on legitimate claims, reducing workload and improving overall efficiency. Moreover, by reducing fraudulent claims, insurers can enhance customer satisfaction by expediting legitimate claim settlements. The growing emphasis on operational efficiency and cost savings is driving insurers to adopt advanced fraud detection systems, which ultimately helps them remain competitive. These developments are aligned with insurance fraud detection market trends, thereby ensuring resources are effectively allocated toward genuine policyholders and claims.

Insurance Fraud Detection Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global insurance fraud detection market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment model, organization size, application, and end user.

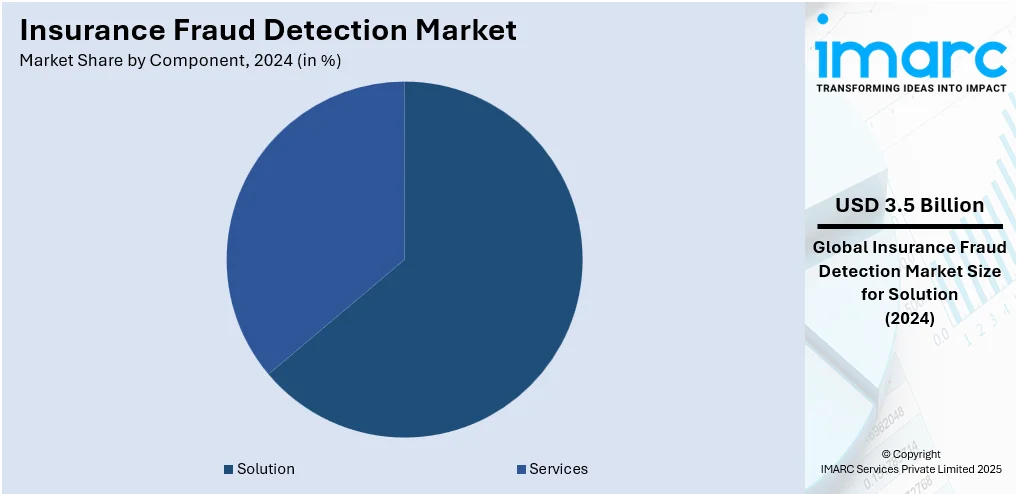

Analysis by Component:

- Solution

- Services

As per the insurance fraud detection market outlook, in 2024, solution segment led the market accounted for the market share of 63.6%, driven by due to the increasing need for advanced technologies to combat fraud. Insurance companies are adopting a range of software solutions such as fraud detection systems, data analytics tools, and machine learning algorithms to streamline fraud identification processes. These solutions offer real-time fraud detection, risk analysis, and more efficient claims processing, significantly reducing losses from fraudulent claims. As fraudsters increasingly use sophisticated tactics, insurers require smarter, automated systems to detect anomalies in data and claims, driving market growth. Furthermore, solutions that integrate artificial intelligence (AI) and machine learning enhance fraud detection by continuously learning from historical fraud patterns and improving accuracy over time. Consequently, the demand for fraud detection solutions is expected to remain strong as insurance companies seek to minimize risk and improve operational efficiency.

Analysis by Deployment Model:

- Cloud-based

- On-premises

Based on the insurance fraud detection market forecast, in 2024, the on-premises segment led the market, as many large enterprises still prefer hosting their fraud detection systems on their own premises due to concerns over security and control. On-premises deployments provide greater control over sensitive data, especially within industries like insurance, where regulatory compliance and data protection are crucial. By using on-premises systems, companies can tailor the fraud detection solutions to their specific requirements and maintain strict oversight of data privacy. This preference is particularly prominent in regions with stringent data protection laws, where businesses are reluctant to move sensitive information to cloud-based platforms. Additionally, on-premises solutions allow for greater customization and integration with existing IT infrastructure, offering insurance companies a more secure and reliable way to detect fraudulent activities. The control and customization advantages offered by on-premises deployments are key drivers in this segment's growth.

Analysis by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

In 2024, the large enterprises led the insurance fraud detection market accounted for the market share of 67.8%, driven by their substantial budgets and complex operational needs. These enterprises often deal with a high volume of claims and transactions, making them prime targets for fraud. They are more likely to invest in advanced fraud detection technologies to secure their operations and protect against substantial losses. Large organizations typically have the resources to implement comprehensive fraud detection systems that incorporate big data analytics, AI, and machine learning. With the ability to invest in robust fraud prevention solutions, large enterprises also benefit from the scalability and flexibility of these technologies to handle growing amounts of data. Furthermore, due to their vast networks and customer bases, large enterprises face significant reputational risks in the event of fraud, which further drives their adoption of sophisticated detection systems to mitigate such risks effectively.

Analysis by Application:

- Claims Fraud

- Identity Theft

- Payment and Billing Fraud

- Money Laundering

In 2024, the payment and billing fraud led the insurance fraud detection market, driven by the increasing sophistication of fraudsters in manipulating billing systems and payment processes. In the insurance sector, billing fraud can include activities such as overcharging, false claims, and manipulation of premium rates, which can significantly impact a company’s revenue. Fraudulent billing practices have become more difficult to detect as payment methods have evolved and digital transactions have surged. As insurance companies increasingly move toward digital platforms, the opportunities for fraudsters to exploit vulnerabilities in payment systems also grow. To counter these threats, insurers are focusing on advanced fraud detection tools that integrate transaction monitoring, anomaly detection, and machine learning to identify suspicious payment activities in real-time. The need to safeguard revenue streams and ensure accurate billing practices is a major factor in driving the growth of the payment and billing fraud segment within the market.

Analysis by End User:

- Insurance Companies

- Agents and Brokers

- Insurance Intermediaries

- Others

In 2024, the insurance companies led the insurance fraud detection market, as they face mounting challenges from fraudulent activities that threaten their profitability and customer trust. Fraudulent claims, such as exaggerated medical expenses or staged accidents, have been a persistent issue for insurers, prompting them to adopt cutting-edge fraud detection technologies. Insurance companies are increasingly implementing AI-powered tools and machine learning algorithms to analyze claims and identify patterns of fraudulent behavior. By leveraging predictive analytics, insurers can detect suspicious activities early in the process, reducing the risk of paying out fraudulent claims. Additionally, as insurance fraud becomes more sophisticated, companies are looking for solutions that offer a proactive approach, allowing them to take preventive actions rather than just responding to fraud after it occurs. The need for continuous improvement in fraud detection and claims management is the key driver behind insurance companies' dominance in this market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the North America led the insurance fraud detection market accounted for the market share of 48.6%, driven by the region's advanced technological infrastructure, high insurance penetration, and increasing regulatory pressures. North America, particularly the United States and Canada, has long been a key adopter of innovative technologies to improve fraud detection and prevention in the insurance sector. The demand for fraud detection solutions in the region is spurred by the rising number of fraudulent claims, along with stringent regulations requiring insurers to implement robust fraud detection measures. With a large number of insurance companies operating in the region, the market is highly competitive, leading insurers to seek out advanced solutions that offer real-time fraud detection and reduce operational costs. Moreover, the growth of digital transactions, coupled with the rise in cybercrime, has made advanced fraud detection technologies more essential in North America. As a result, the region remains at the forefront of adopting AI, machine learning, and data analytics solutions for fraud prevention.

Key Regional Takeaways:

United States Insurance Fraud Detection Market Analysis

In 2024, the United States accounted for 85.20% of the insurance fraud detection market in North America, driven by multiple factors. The United States insurance fraud detection market is primarily driven by technological advancements, rising instances of fraudulent claims, and growing regulatory pressures. As insurance fraud continues to evolve in complexity, insurers are increasingly adopting advanced analytics, artificial intelligence (AI), and machine learning (ML) technologies to proactively detect and prevent fraud. These tools enable faster processing of large volumes of claims data, helping insurers identify patterns, anomalies, and suspicious behaviors more accurately and in real time. Moreover, the financial impact of fraud, which costs the U.S. insurance industry billions annually, is propelling companies to invest heavily in sophisticated detection systems to minimize losses and maintain profitability. According to the United States Coalition Against Insurance Fraud, approximately USD 308.6 Billion is lost in financial losses to insurance fraud annually in the country. Furthermore, in 2023, financial fraud cases accounted for 15.2% of cases reported to the United States Sentencing Commission. Of these, 17.4% accounted for financial losses of less than USD 15,000. 10.5% accounted for financial losses greater than USD 550,000. Other than this, the increasing digitization of the insurance process, including online policy applications and claims submissions, also exposes insurers to new types of fraud, further emphasizing the need for robust detection solutions and supporting innovation in the industry.

Asia Pacific Insurance Fraud Detection Market Analysis

The Asia Pacific insurance fraud detection market is expanding due to rapid market expansion, the growing complexity of cross-border fraud schemes, and increased investment in digital infrastructure. As insurance penetration grows in emerging economies, carriers are facing a significant rise in fraudulent activity, ranging from false claims, premium diversion, and identity theft to organized scams targeting new digital insurance channels. For instance, the domestic insurance market in India experienced a compound annual growth rate (CAGR) of 17% over the last twenty years, as per the India Brand Equity Foundation (IBEF). The sector is expected to reach USD 222.0 Billion by FY26. Additionally, rising consumer awareness and higher expectations for efficient service delivery are prompting insurers to adopt automated fraud detection systems that minimize claim processing delays. The proliferation of insurtech ventures collaborating with traditional insurers is also propelling innovation in behavioral analytics, network intelligence, and real-time monitoring tools, collectively driving rapid adoption of fraud detection technologies throughout the Asia Pacific region.

Europe Insurance Fraud Detection Market Analysis

The growth of the Europe insurance fraud detection market is largely propelled by evolving regulatory demands and technological innovations. Insurers across European countries are increasingly embracing advanced technologies such as artificial intelligence (AI), machine learning (ML), big data analytics, and automated workflows to rapidly analyze vast quantities of claims and policy information, enabling real-time detection of unusual patterns and anomalies. For instance, in June 2025, German multinational insurance company Munich Re established a partnership with Instnt to enhance Instnt’s unique Fraud Loss Insurance product's reinsurance capabilities. This first-of-its-kind solution from Instnt helps businesses offload fraud risk and recover swiftly from losses by combining insurance-backed protection with AI-driven insurance fraud detection and authentication of identity. As fraudulent activities such as staged accidents, inflated claims, identity theft, and ghost brokering continue to grow in both frequency and complexity, insurers are increasingly investing in cutting-edge detection platforms that can adapt and learn from emerging trends. Stricter regulations and heightened oversight across European jurisdictions, including directives focused on anti-money laundering and consumer protection, are also driving demand for sophisticated compliance-oriented fraud solutions. Other than this, market consolidation and cross-border operations among insurers are also increasing the need for interoperable systems capable of sharing intelligence and coordinating fraud efforts across national boundaries.

Latin America Insurance Fraud Detection Market Analysis

The Latin America insurance fraud detection market is significantly influenced by escalating claim abuse, growing digitalization, and the urgent need to control growing loss ratios. Insurers are witnessing a rise in fraudulent behavior, such as exaggerated accident claims and organized schemes exploiting weak verification procedures. This is increasing the need for automated fraud detection tools. The expansion of mobile-based insurance platforms and online policy enrollment channels has also widened fraud exposure. For instance, as per a 2024 survey by the Global Anti-Scam Alliance (GASA) in Brazil, 94% of respondents reported experiencing an online fraud attempt at least once a month, recording an increase of 9% in comparison to 2023. Moreover, financial losses due to scams amounted to approximately USD 54 Billion in the country, accounting for nearly 2.5% of Brazil’s GDP. Besides this, regional regulatory bodies are tightening compliance mandates around fraud reporting and anti‑money laundering, motivating firms to deploy structured detection frameworks and supporting industry expansion.

Middle East and Africa Insurance Fraud Detection Market Analysis

The Middle East and Africa insurance fraud detection market is experiencing robust growth due to rising awareness among insurers about operational risks and the rapid expansion of health and motor insurance. For instance, the motor insurance market in Saudi Arabia reached USD 4,192.6 Million in 2024 and is forecasted to reach USD 9,280.3 Million by 2033, growing at a CAGR of 9.28% from 2025-2033, according to a report published by the IMARC Group. As healthcare and auto insurance sectors expand, they are experiencing higher volumes of claims, making them prime targets for fraud involving inflated bills, staged accidents, and duplicate claims. As a result, insurers are prioritizing automation and integrating machine learning algorithms to filter out suspicious activity and reduce manual oversight, supporting overall market growth.

Competitive Landscape:

The global insurance fraud detection market is experiencing significant growth due to the incorporation of artificial intelligence, machine learning, and data analytics to develop systems capable of detecting complex and evolving fraud patterns. Along with this, strategic alliances with technology providers, financial institutions, and other stakeholders allow companies to broaden their offerings and reach. Collaborations often lead to integrated solutions that provide more comprehensive fraud detection capabilities. In addition, the development of secure solutions that align with legal requirements to protect sensitive data and maintain the integrity of the financial ecosystem is significantly supporting the market. Apart from this, providers are customizing their solutions to cater to various insurance segments to facilitate transparent and efficient claim processing. Therefore, it is positively influencing the market. With the ever-changing nature of fraud, insurance fraud detection companies are continually monitoring market trends, adapting their strategies and solutions to meet new challenges and opportunities.

The report provides a comprehensive analysis of the competitive landscape in the insurance fraud detection market with detailed profiles of all major companies, including:

- ACI Worldwide Inc

- BAE Systems plc

- Equifax Inc.

- Experian plc

- Fair Isaac Corporation

- Fiserv Inc.

- FRISS

- International Business Machines Corporation

- Lexisnexis Risk Solutions Inc. (RELX Group plc)

- SAP SE

- SAS Institute Inc.

Latest News and Developments:

- July 2025: Medi Assist Insurance TPA Pvt. Ltd. successfully acquired Paramount Health Services & Insurance TPA. As part of this acquisition, Medi Assist intends to improve policyholder services under the Paramount portfolio and expedite health insurance workflows by utilizing its AI-driven features, including fraud detection and predictive analytics.

- May 2025: Shelter Insurance officially selected Shift Technology’s Shift Claims Fraud Detection solution in order to strengthen defenses against fraud in property and car insurance. The company mainly aims to enhance the detection and inspection of fraudulent insurance claims.

- May 2025: Sedgwick reported that it has officially adopted Verint Trust Bot, a revolutionary AI-driven insurance fraud detection solution. Verint Trust Bot analyzes discussions between insurance claims managers and claimants using explainable AI and patented behavioral analytics to provide actionable information. It accurately determines if fraud risks are present or not, enabling clients to make more informed decisions and expedite the resolution of insurance claims.

- February 2025: Charles Taylor Specialist Investigation Services introduced a forensic document examination solution for detecting manipulated photos and fake papers generated by AI that are employed in fraudulent insurance claims. The program, called Detect, intends to tackle the growing problem of fraudsters utilizing sophisticated AI to produce convincingly fraudulent documents for insurance fraud.

- February 2025: Sompo Japan Insurance Inc. announced the official adoption of EIS’s AI insurance fraud detection solutions, ClaimGuard, to support its attempts regarding the prevention of false claims in vehicle insurance. The adoption of ClaimGuard aims to support the company’s new insurance fraud-focused unit, which is scheduled for launch in April 2025.

Insurance Fraud Detection Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployment Models Covered | Cloud-Based, On-Premises |

| Organization Sizes Covered | Small and Medium-Sized Enterprises, Large Enterprises |

| Applications Covered | Claims Fraud, Identity Theft, Payment and Billing Fraud, Money Laundering |

| End Users Covered | Insurance Companies, Agents and Brokers, Insurance Intermediaries, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ACI Worldwide Inc, BAE Systems plc, Equifax Inc., Experian plc, Fair Isaac Corporation, Fiserv Inc., FRISS, International Business Machines Corporation, Lexisnexis Risk Solutions Inc. (RELX Group plc), SAP SE, SAS Institute Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the insurance fraud detection market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global insurance fraud detection market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the insurance fraud detection industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The insurance fraud detection market was valued at USD 5.58 Billion in 2024.

The insurance fraud detection market is projected to exhibit a CAGR of 22.70% during 2025-2033, reaching a value of USD 40.09 Billion by 2033.

Key factors driving the insurance fraud detection market include the rising incidence of fraudulent claims, advancements in AI and machine learning for real-time detection, increasing regulatory pressures, the need for data security, and growing digital transformation in the insurance sector.

In 2024, North America dominated the insurance fraud detection market accounted for the market share of 48.6%, driven by its advanced technological infrastructure, high insurance penetration, stringent regulations, and increasing incidences of fraud. The region's focus on AI and machine learning further drives market growth.

Some of the major players in the global insurance fraud detection market include ACI Worldwide Inc, BAE Systems plc, Equifax Inc., Experian plc, Fair Isaac Corporation, Fiserv Inc., FRISS, International Business Machines Corporation, Lexisnexis Risk Solutions Inc. (RELX Group plc), SAP SE, SAS Institute Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)