Insurance Business Process Outsourcing (BPO) Market Size, Share, Trends and Forecast by Type, Enterprise Size, Application, and Region, 2025-2033

Insurance Business Process Outsourcing (BPO) Market Size and Share:

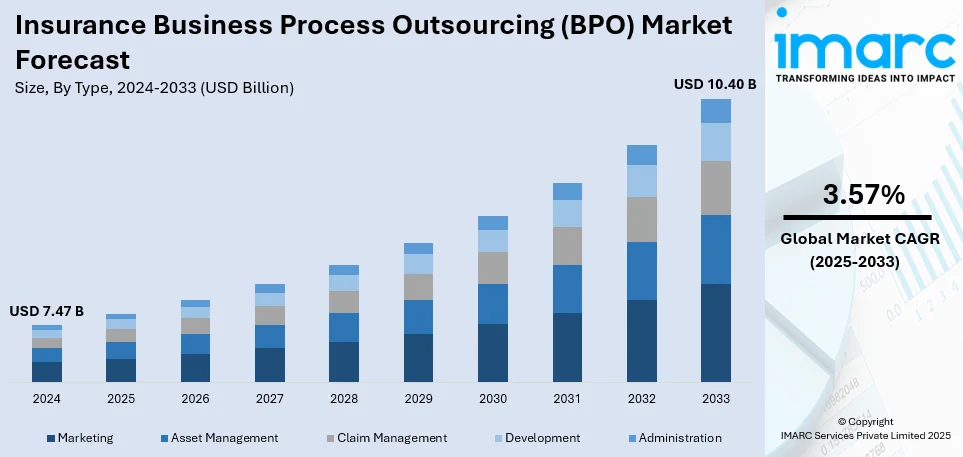

The global insurance business process outsourcing (BPO) market size was valued at USD 7.47 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.40 Billion by 2033, exhibiting a CAGR of 3.57% from 2025-2033. North America currently dominates the market, holding a market share of over 35.8% in 2024. The insurance business process outsourcing (BPO) share is expanding, driven by the growing investments in advanced cybersecurity solutions to provide strong protection against cyber risks, increasing reliance on artificial intelligence (AI) to handle regular queries and duties in call centers, and rising trend of delegating human resources (HR) activities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.47 Billion |

|

Market Forecast in 2033

|

USD 10.40 Billion |

| Market Growth Rate (2025-2033) | 3.57% |

As companies look for ways to cut costs and improve efficiency, the demand for BPO solutions rises. Insurers outsource tasks like claims processing, customer service, and policy management to focus on their core business. With AI and automation, BPO providers help to speed up operations and reduce errors. Besides this, digital transformation is a big driver, as companies shift to cloud-based solutions and need information technology (IT) support. Regulatory compliance is another reason insurers turn to outsourcing, as insurance BPO firms assist in navigating complex laws. Apart from this, outsourcing also offers flexibility, allowing companies to scale operations based on requirements. Fraud detection and risk management are enhanced with advanced analytics employed by BPO companies.

The United States has emerged as a major region in the insurance business process outsourcing (BPO) market owing to many factors. With insurers seeking to reduce expenses and enhance efficiency, the need for BPO operations is high in the country. Companies outsource tasks, such as policy administration to emphasize their core business. Additionally, rising labor costs in the US make outsourcing an attractive option. According to the data published on the official website of the US Bureau of Labor Statistics, in the first quarter of 2024, unit labor costs in the nonfarm business sector rose by 4.0 percent, driven by a 4.2% rise in hourly compensation. Unit labor expenses rose by 0.9 percent during the past four quarters. Moreover, with increasing fraud risks, outsourcing firms use advanced analytics to improve fraud detection and risk management.

Insurance Business Process Outsourcing (BPO) Market Trends:

Growing number of cyberattacks in the financial sector

According to an article published on the website of the International Monetary Fund (IMF) in 2024, The financial industry experienced over 20,000 cyberattacks, resulting in a loss of 12 billion dollars in the last 20 years. The expertise of BPO providers in cybersecurity benefits insurance firms, as it can assist in protecting sensitive data and systems. BPO companies extensively wager on advanced cybersecurity solutions due to the high number of cybersecurity frauds around the world. Additionally, governing agencies of several countries implement stringent regulations for cybersecurity and data protection. BPO providers help insurance businesses to adhere to these regulations while minimizing the risks of fines and reputational harm. BPO companies can offer prompt and efficient incident response services in the case of a cyberattack, reducing the damage to the company's operations, thereby supporting the insurance business process outsourcing (BPO) market growth.

Rising demand for call center AI

The IMARC Group’s report shows that the global call center AI market size reached US 1.84 Billion in 2023. AI-driven chatbots and virtual assistants can offer 24/7 support, increasing client satisfaction by guaranteeing help is available whenever needed. To improve the user experience, AI is highly beneficial in call centers of insurance BPO companies since it can evaluate client data and provide personalized interactions and solutions to them. It also aids in eliminating the huge workforce, resulting in cost savings for insurance companies, as AI can efficiently handle regular queries and duties. Moreover, the need for intensive training modules for human agents is reduced by AI due to its capability to handle several interactions. AI solutions are also less susceptible to human mistakes, resulting in more accurate and consistent handling of user inquiries and claims processing. AI can generate standardized solutions to typical questions, assuring consistency in customer support, thereby reducing the workload of insurance BPO providers. Companies further employ call center AI systems that can handle many interactions at once, thereby offering a favorable insurance business process outsourcing (BPO) market outlook.

Increasing outsourcing of HR activities

Outsourcing HR functions can be more cost-effective than maintaining an internal HR team, particularly for activities like payroll processing, benefits management, and hiring. To reduce expenses on office space, equipment, and other resources, insurance companies emphasize outsourcing administrative tasks. Delegating HR and administrative tasks enables insurance companies to focus on their core functions, including product innovations, customer support, and market growth. To guarantee that insurance firms adhere to labor laws and regulations, BPO services keep them informed about the new legislation and compliance requirements. Firms are also wagering on partnerships and collaborations to introduce advanced HR solutions. For instance, in 2023, the EY organization and IBM teamed up to launch EY.ai Workforce, an innovative HR solution that enable organizations to assimilate AI into their key HR business processes.

Insurance Business Process Outsourcing (BPO) Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global insurance business process outsourcing (BPO) market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, enterprise size, and application.

Analysis by Type:

- Marketing

- Asset Management

- Claim Management

- Development

- Administration

Claim management stands as the largest component in 2024, holding 36.7% of the market. It is among the most intricate and time-taking activities for insurance firms. Handling claims entails validating documents, evaluating damages, determining payouts, and thwarting fraud, all of which demand considerable resources and skills. By delegating claim management, insurers can expedite the process, cut operational expenses, and enhance precision. BPO companies utilize AI, automation, and data analysis to manage claims effectively, reducing mistakes and waiting times. As insurance claims increase in areas, such as health and property, outsourcing assists companies in handling large volumes while maintaining compliance with regulations. Moreover, BPO companies provide round-the-clock support, expediting claims processing and improving customer satisfaction. Fraud detection is also a big factor, as outsourcing firms utilize modern tools to identify suspicious claims. As insurers aim for cost-effective and reliable operations, claim management remains the top outsourced service, aiding companies in focusing on growth while delivering better service to policyholders.

Analysis by Enterprise Size:

- Small and Medium-sized Enterprise

- Large Enterprise

Small and medium-sized enterprise leads the market with 56.7% of the market share. They rely on outsourcing to remain competitive and control expenses. In contrast to major insurers with their own internal teams, they frequently do not have the means to manage operations, such as claims processing, customer support, and policy management effectively. Through outsourcing, they gain access to expert professionals, cutting-edge technology, and automation without significant investments. BPO providers assist these businesses in optimizing processes, reducing operational costs, and enhancing service quality. Adhering to insurance regulations poses a significant challenge for smaller firms, and outsourcing helps them to fulfill legal obligations without needing to employ extensive compliance teams. Moreover, BPO services make fraud detection, data management, and AI-based analytics more attainable for these businesses. By outsourcing, they can effortlessly adjust operations according to demand, enabling growth without the concern of administrative worries.

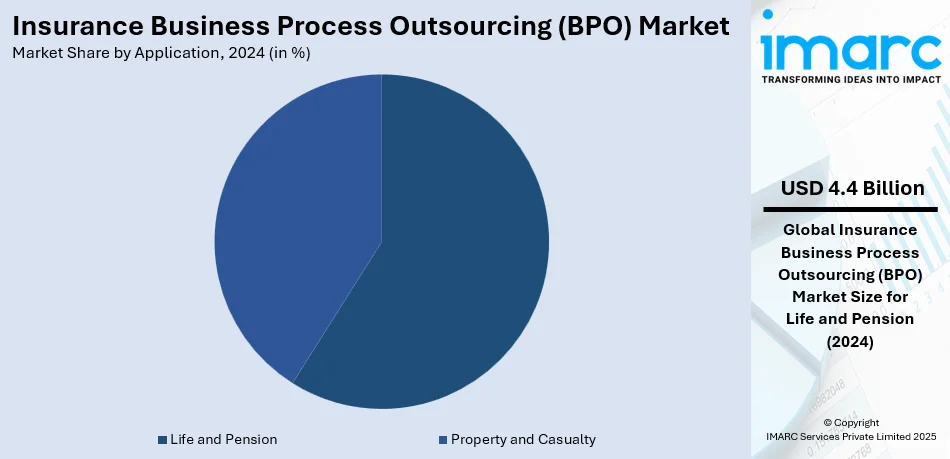

Analysis by Application:

- Property and Casualty

- Life and Pension

Life and pension lead the market with 58.9% of the market share. They involve long-term policies that require constant management, documentation, and customer support. Insurance companies might delegate complex and labor-intensive tasks like handling life insurance claims, renewing policies, and updating beneficiary information to optimize their workforce. The ongoing oversight and evaluation of pension plans, along with data management, is typically automated by the BPO service providers. An increasingly aging population is also creating a high demand for retirement plans, leading insurers to take on heavier workloads. Therefore, it becomes important to delegate these functions. BPOs help life and pension insurance companies to handle large volumes of customer inquiries, policy changes, and payouts while strictly adhering to regulatory standards. Moreover, fraud detection is vital in life and pension insurance. Outsourcing companies utilize AI-driven tools to oversee dubious activities. Due to BPO solutions, life and pension insurance companies can focus on product innovations, customer service, and streamlined and efficient operations.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for 35.8%, enjoys the leading position in the market. It is recognized for its extensive and developed insurance sector, significant operational expenses, and a strong emphasis on digital innovations. In the US and Canada, insurance firms delegate functions, such as claims handling, customer support, and policy management to cut costs and enhance efficiency. Due to elevated labor expenses and stringent regulations, insurers rely on BPO providers for managing compliance, fraud detection, and data administration. This area also excels in embracing AI, automation, and cloud solutions, making outsourcing a preferred option for insurers aiming to upgrade their operations. Moreover, the rising need for life, health, and property insurance expands workloads, rendering outsourcing crucial for market growth. As per the information provided on the official website of the National Library of Medicine, 92.3 percent of the US population, totaling 316 million people, had insurance coverage in 2024, based on the Congressional Budget Office's projections for health insurance. In addition to this, North America maintains robust outsourcing alliances with nations like India and the Philippines where skilled individuals provide premium services at reduced prices. As insurance companies emphasize cost-saving methods and enhanced customer experiences, BPO solutions remain a driving force for growth, ensuring North America leads the market.

Key Regional Takeaways:

United States Insurance Business Process Outsourcing (BPO) Market Analysis

The United States hold 80.00% of the market share in North America. The market is driven by several factors, with technological advancements being at the forefront. The high adoption of automation, AI, blockchain, cloud technology, and data analytics by insurance companies creates the need for specialized BPO services. As of February 2023, 98% of US organizations adopted cloud technology for business operations, according to reports. These technologies enhance operational efficiency, reduce human error, and speed up claims processing, which is crucial for the viable US insurance industry. They help insurance companies to not only enhance efficiency and customer experience but also stay competitive by enabling them to respond quickly to market changes and emerging risks. As a result, there is a growing demand for specialized BPO services that can assist insurance providers in integrating these technologies into their operations, allowing them to concentrate on their primary operations while gaining from cutting-edge solutions. Additionally, rising operational costs and the need to scale business operations without heavy capital investment are motivating insurers to outsource non-core functions, such as customer service, claims management, and policy administration. Adhering to strict regulations like the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA) and also encourages outsourcing to third-party providers who are equipped to navigate these complex frameworks.

Europe Insurance Business Process Outsourcing (BPO) Market Analysis

In Europe, the market is being influenced by the high need for cost reduction and efficiency optimization amid economic challenges. Insurance companies throughout Europe are delegating essential tasks, including claims handling and customer assistance, to reduce operational expenses while improving service delivery. The swift transition to digitalization is another significant element. The report states that in 2023, 59% of all businesses in the EU reached a basic level of digital intensity. Digitalization enables insurance firms to employ modern technologies, such as cloud computing and robotic process automation (RPA) to remain competitive. In line with this, the complex regulatory structure of the European Union encourages the use of specialized BPO providers capable of ensuring adherence to regulations like Solvency II and GDPR. Moreover, the rising need for customer-focused services, such as tailored policy management and quick claims handling, is prompting insurers to implement more adaptable outsourcing strategies. This enables them to concentrate on their main strengths while using specialized BPO services to fulfill user needs. Additionally, personalized policy management that provides clients with customized suggestions and services necessitates flexible systems and effective procedures. Moreover, fast claim resolution, an essential element of customer satisfaction, requires reliable operations with little to no delays.

Asia-Pacific Insurance Business Process Outsourcing (BPO) Market Analysis

The Asia-Pacific region is witnessing rapid growth in the market because of various factors, such as the high middle-class population and increasing demand for insurance services. As per the information released on the official website of the IBEF in October 2024, India is the fifth biggest life insurance market among emerging insurance landscape globally, expanding at a percentage of 32-34% annually. Insurance firms employ BPO services to effectively handle the rising volume of claims, policy processing, and customer service. In countries like India and the Philippines, the availability of skilled labor at a lower cost presents a significant advantage, making outsourcing an attractive option. Apart from this, the need for digital transformation is a key driver, as insurance companies are integrating advanced technologies like AI, machine learning (ML), and blockchain to enhance their offerings. These technologies not only streamline operations but also enable insurers to offer innovative items, improve customer engagement, and stay viable in the market. As a result, digital transformation is essential for long-term business success.

Latin America Insurance Business Process Outsourcing (BPO) Market Analysis

The rising need for cost efficiency and access to a skilled labor force is impelling the market growth in this region. Many insurance firms in this area are turning to BPO firms to manage non-core operations like customer service and claims processing. Outsourcing enables insurers to reduce overhead costs while maintaining high service standards. Additionally, the region is experiencing a digital transformation, with companies embracing advanced technologies to improve customer experiences and optimize operational workflows. In September 2024, Brazil invested R$ 186.6 Billion (USD 32.16 Billion) in digital transformation, as reported by the Brazilian NR. This trend is driving the demand for specialized BPO services that can support digital initiatives and help insurers to navigate the regulatory landscape. Besides this, the area’s increasing insurance penetration and the high requirement for personalized services are further promoting the adoption of outsourcing in the sector.

Middle East and Africa Insurance Business Process Outsourcing (BPO) Market Analysis

The increasing demand for operational efficiency and the growing complexity of insurance regulations are offering a favorable market outlook. As insurers in these regions seek to streamline their processes and improve customer service, outsourcing non-core functions like policy administration and claims handling has become an attractive option. Furthermore, the push for digital transformation across the region is driving the demand for BPO services that can support the integration of AI, ML, and automation. The requirement for compliance with regulatory standards, particularly in markets like South Africa and the UAE, also contributes to the rise of BPO partnerships. With the expanding insurance market in the region, companies are seeking flexible and cost-effective solutions to scale their operations while maintaining high-quality services. As per reports, the Saudi insurance sector witnessed 14.6% growth in Q3 2023.

Competitive Landscape:

Key players in the market offer advanced technology, cost-effective solutions, and specialized expertise to cater to the high insurance business process outsourcing (BPO) market demand. Major BPO firms provide AI-driven automation, data analytics, and fraud detection tools to optimize operations for insurers. They handle tasks like claims processing, policy management, customer support, and regulatory compliance, allowing insurance companies to focus on core business functions. Big companies also help insurers to scale operations quickly, adapting to changing requirements, without heavy investments in infrastructure or manpower. With rising insurance fraud and strict regulations, BPO firms ensure accuracy and security in data handling. Additionally, many key players have worldwide delivery centers, providing 24/7 support and multilingual services. As digital transformation reshapes the industry, these companies continue to innovate, making insurance processes more reliable, affordable, and user friendly. For instance, in October 2023, Accenture, a well-known multinational professional services company, acquired ON Service GROUP, a foremost supplier of business process amenities, focused on insurance operations. This agreement by ON Service GROUP increases Accenture’s proficiency in insurance operations, broadening the service options accessible to clients in Germany for insurance business activities like sales and policy management.

The report provides a comprehensive analysis of the competitive landscape in the insurance business process outsourcing (BPO) market with detailed profiles of all major companies, including:

- Accenture plc

- Cognizant

- Genpact

- Infosys Limited

- Invensis Technologies Pvt Ltd

- Mphasis Limited

- WNS Limited

Latest News and Developments:

-

June 2024: EXL, a prominent company in digital operations and solutions and data analytics, declared its acknowledgement as a ‘Pioneer in the 2024 Gartner Magic Quadrant for Finance and Accounting (F&A) BPO’. The firm employs AI, data analytics, and extensive sector insight for revolutionizing tasks for top worldwide companies in sectors, such as insurance, banking and financial services, media and retail, and healthcare, etc.

Insurance Business Process Outsourcing (BPO) Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Marketing, Asset Management, Claim Management, Development, Administration |

| Enterprise Sizes Covered | Small and Medium-sized Enterprise, Large Enterprise |

| Applications Covered | Property and Casualty, Life and Pension |

| Regions Covered | North America, Asia-Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Accenture plc, Cognizant, Genpact, Infosys Limited, Invensis Technologies Pvt Ltd, Mphasis Limited, WNS Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the insurance business process outsourcing (BPO) market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global insurance business process outsourcing (BPO) market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the insurance business process outsourcing (BPO) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The insurance business process outsourcing (BPO) market was valued at USD 7.47 Billion in 2024.

The insurance business process outsourcing (BPO) market is projected to exhibit a CAGR of 3.57% during 2025-2033, reaching a value of USD 10.40 Billion by 2033.

Insurance companies outsource processes like claims management and user support to reduce operational costs and focus on core business activities. Besides this, by outsourcing back-office tasks, insurers can emphasize product development, risk assessment, and customer acquisition, thereby impelling the market growth. Moreover, advancements in AI and automation improve efficiency, reduce human errors, and speed up BPO operations.

North America currently dominates the insurance business process outsourcing (BPO) market, accounting for a share of 35.8% in 2024, driven by its large insurance industry, high labor costs, and strong focus on digital transformation. Insurers outsource tasks to cut costs, improve efficiency, handle compliance, and adopt AI-driven solutions, ensuring smooth operations and better customer service.

Some of the major players in the insurance business process outsourcing (BPO) market include Accenture plc, Cognizant, Genpact, Infosys Limited, Invensis Technologies Pvt Ltd, Mphasis Limited, WNS Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)