Insulin Storage Devices Market Size, Share, Trends and Forecast by Product Type, Patient Type, and Region, 2025-2033

Insulin Storage Devices Market Size and Share:

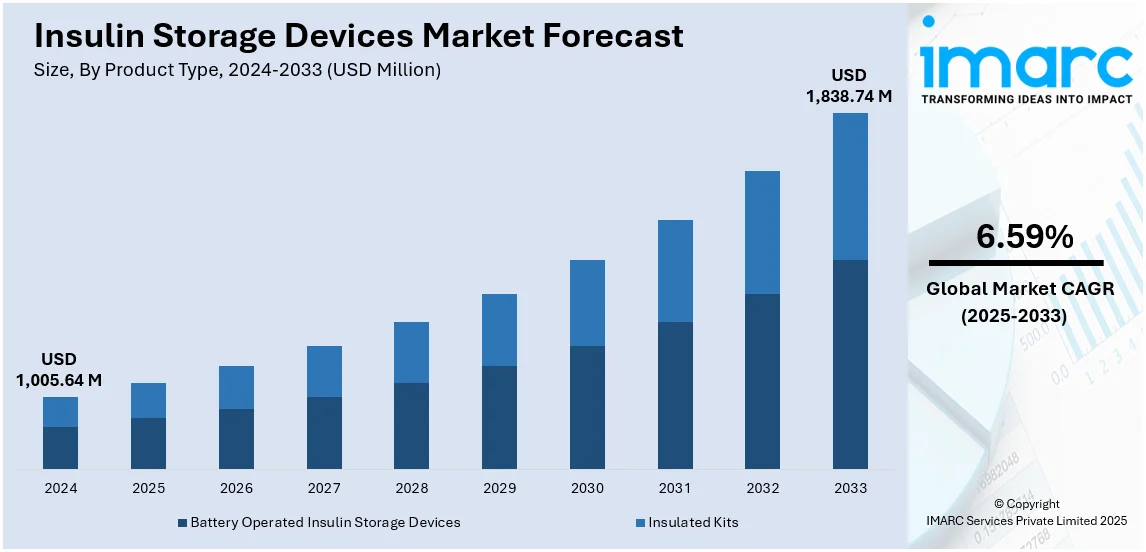

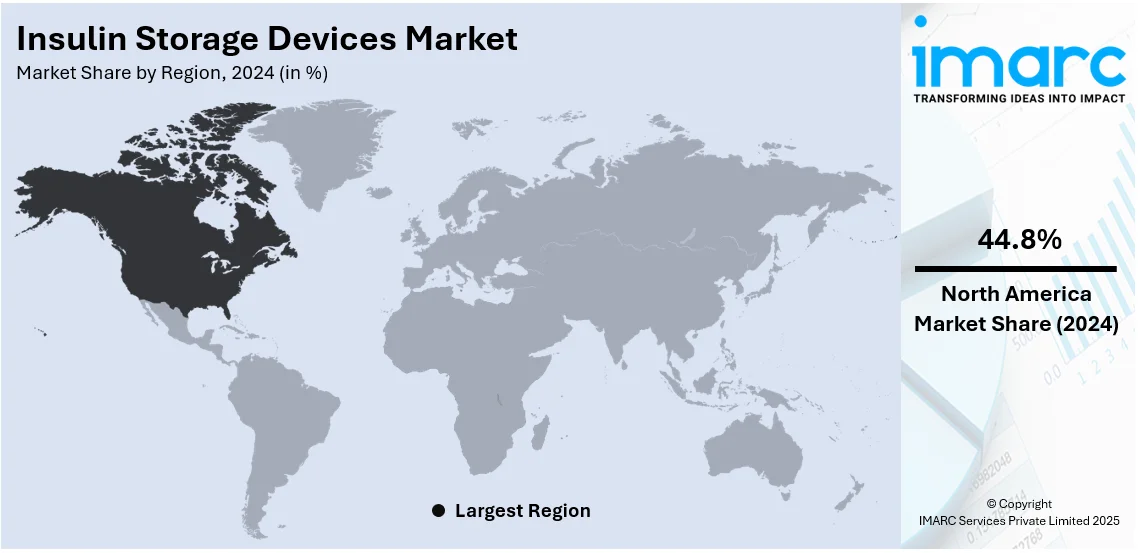

The global insulin storage devices market size was valued at USD 1,005.64 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,838.74 Million by 2033, exhibiting a CAGR of 6.59% from 2025-2033. North America currently dominates the market, holding a market share of over 44.8% in 2024. The market is experiencing steady growth driven by growing prevalence of diabetes, increasing awareness regarding the usage of insulin in diabetes preventive care, rising healthcare expenditures, and continual technological advancements such as smart insulin pens, refrigeration systems, and temperature-controlled storage solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,005.64 Million |

|

Market Forecast in 2033

|

USD 1,838.74 Million |

| Market Growth Rate (2025-2033) | 6.59% |

A key driver of the insulin storage devices market is the increasing population that requires insulin therapy. Due to its highly sensitive nature toward temperature fluctuations, insulin needs to be stored under appropriate conditions so that it is effective. Many regions, mainly developing countries, are now strengthening healthcare infrastructure with proper storage and access to insulin. Innovations in temperature-controlled storage solutions are putting an end to concerns of degeneration of insulin due to mishandling. It is boosting demand for portable and user-friendly insulin storage devices, as more people engage in home-based diabetes management. For example, in January 2025, Insulet Corporation launched the Omnipod 5 Automated Insulin Delivery System, a tubeless system that integrates with continuous glucose monitoring sensors to automatically adjust insulin delivery, helping maintain blood sugar levels. Moreover, heightening awareness of the need for proper insulin storage is propelling the growth of the market, with newer solutions now integrating smart monitoring technologies to maintain insulin integrity. With amplified investments in healthcare innovation and expanding pharmaceutical cold storage supply chain logistics, growing requirements for better insulin storage solutions in both urban and rural areas can be observed.

The U.S. market is exhibiting tremendous growth in the sales of insulin storage devices with technology advancements and growing adoption of smart health care solutions with the share of 88.30% in 2024. The companies are developing advanced storage devices with real-time temperature monitoring, mobile application connectivity, and automated alerts to ensure that the insulin remains within the safe temperature ranges. Intensifying use of wearable insulin pumps and continuous glucose monitoring systems has created the demand for small, high-tech storage solutions specific to modern needs in diabetes management. Regulatory agencies and healthcare associations are supporting programs that promote digital health, motivating the development of user-friendly storage options for insulin. For instance, in March 2024, The MiniMed™ 780G system by Medtronic, recognized by Fast Company as part of its World Changing Ideas, improves diabetes management with automated insulin delivery and continuous glucose monitoring for better patient outcomes. Additionally, the trend of personalized and convenient solutions has led to the development of portable insulin cooling devices for the active lifestyle. The U.S. market continues to evolve with cutting-edge storage technologies that enhance insulin accessibility and safety, given the strong focus on patient-centered care.

Insulin Storage Devices Market Trends:

Increasing Diabetes Prevalence

The rising incidence of diabetes across the globe is one of the main reasons behind the growing demand for these products. According to IDF statistics, by 2045, 783 million adults will suffer from diabetes-1 in 8, and there will be a rise of 46% compared to now. With more people diagnosed with diabetes, there is a growing need for insulin injections as well. Storage devices are somewhat essential to keep the insulin safe as it doesn't spoil as well as it retains its strength and activity of the insulin. Moreover, the surging epidemic of diabetes caused by rising sedentary lifestyle, inappropriate dietary habit, and genetics drive the market further. Moreover, the shift towards home-based care and self-management for patients with diabetes provides them with greater control over their treatment. In this regard, these storage devices are in tandem with this shift, as they offer equipment that makes it easier to administer insulin at home without much hassle and dependency on hospitals. This shift towards patient-centric care contributes to the sustained growth of the market, as it meets the changing needs and preferences of an increasingly informed and engaged patient population.

Rapid Technological Advancements

Advances in technology have significantly impacted these devices, bringing about great improvements in design and feature. The elements of smart insulin pens, refrigeration systems, and temperature-controlled storage solutions in insulin administration have improved the convenience and effectiveness of this drug delivery system. For example, in September 2022, TempraMed launched VIVI Cap 3.0, a product that is designed for safe holding and storage of insulin medication so that the burden on people who use insulin while traveling becomes less. In July 2022, Godrej Appliances unveiled Godrej InsuliCool and Godrej InsuliCool+ products, those designed for insulin holding. These innovations not only cater to the growing demand for user-friendly and efficient insulin storage but also contribute to better patient compliance. These devices integrate IoT (Internet of Things) technologies, which allows for real-time monitoring and data collection, thereby optimizing diabetes management and treatment outcomes.

Patient Convenience and Adherence

Another driving factor for the insulin storage devices market is the focus on enhancing patient convenience and adherence to insulin therapy. Industry reports suggest that more than 60% of people suffering from diabetes are found in Asia. Nearly half of them are dwellers in China and India. With escalating personalized treatment regimens, the need for storage solutions to suit patients' lifestyles is increasing. Insulin pens and pumps, for instance, are compact and portable, providing patients with an opportunity to administer their insulin injections discreetly and efficiently. Additionally, some of these features include pre-filled insulin cartridges, easy-to-use interfaces, which improve adherence among patients so they can strictly adhere to the recommended insulin regimens, hence attaining better glycemic control and health outcomes.

Insulin Storage Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type and patient type.

Analysis by Product Type:

- Battery Operated Insulin Storage Devices

- Insulated Kits

- Insulin Cooling Wallets

- Insulated Cooler Bags

- Insulin Cooling Pouches

Battery operated insulin storage devices leads the market with around 62.5% of market share in 2024. The dominance of battery-operated insulin storage devices stems from their ability to provide efficient temperature control, ensuring the optimal preservation of insulin. These devices often incorporate advanced cooling technologies, such as thermoelectric cooling or compressor-based systems, allowing users to maintain insulin within recommended temperature ranges. The portability and user-friendly features of battery-operated devices make them a preferred choice for individuals managing diabetes. Moreover, the integration of smart functionalities, such as temperature monitoring and connectivity with mobile apps, enhances the overall user experience, contributing significantly to the sustained growth of this segment within the market.

On the other hand, insulated kits represent a crucial segment in the market, offering a versatile solution for the safe transportation and storage of insulin. These kits typically include insulated bags or cases that provide thermal protection to insulin vials or pens, safeguarding them from temperature variations during travel or daily activities. The demand for insulated kits is fueled by the increasing emphasis on active lifestyles and the need for diabetes management on the go. The convenience and durability of insulated kits make them an essential accessory for individuals who require insulin therapy, thereby propelling the growth of this segment within the market.

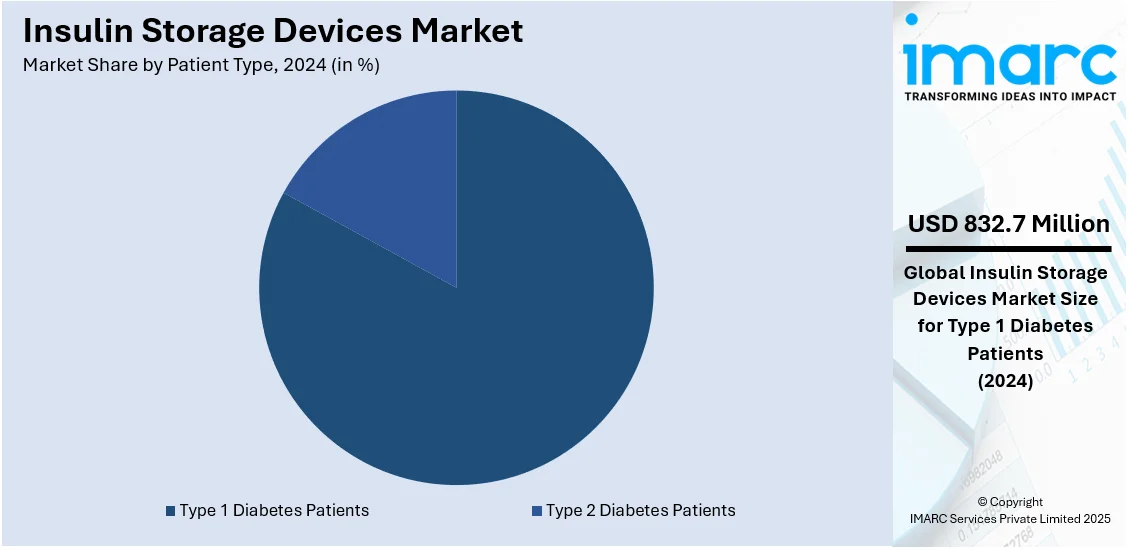

Analysis by Patient Type:

- Type 1 Diabetes Patients

- Type 2 Diabetes Patients

Type 1 diabetes patients lead the market with around 82.8% of market share in 2024. The market experiences significant growth driven by the needs of Type 1 diabetes patients, constituting the largest segment. Individuals with Type 1 diabetes rely heavily on insulin therapy as their primary treatment, necessitating consistent and precise storage solutions. Insulin pumps, pens, and other advanced storage devices cater to the specific requirements of Type 1 diabetes patients, offering not only convenient administration but also effective temperature control to maintain insulin efficacy. The rising incidence of Type 1 diabetes, coupled with the continuous advancements in insulin delivery technologies, propels this segment’s dominance in the market.

On the other hand, the market also experiences growth from the expanding population of Type 2 diabetes patients. As lifestyle changes, genetic factors, and aging contribute to the increasing prevalence of Type 2 diabetes, there is a growing demand for insulin storage solutions tailored to the needs of these individuals. User-friendly insulin pens, coupled with innovations in temperature-controlled storage options, address the diverse requirements of Type 2 diabetes patients. The market’s responsiveness to the unique challenges faced by Type 2 diabetes patients contributes to the overall growth and diversity of insulin storage device offerings.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 44.8%. North America dominates the market, constituting the largest segment. The region’s prevalence of diabetes, coupled with high awareness and advanced healthcare infrastructure, fuels the demand for innovative insulin storage solutions. The adoption of cutting-edge technologies, coupled with a robust regulatory framework, encourages the development and utilization of state-of-the-art devices. Additionally, a proactive approach to diabetes management and a higher disposable income contribute to the region’s leadership in driving market growth, making North America a pivotal hub for insulin storage device advancements.

Key Regional Takeaways:

United States Insulin Storage Devices Market Analysis

The rising prevalence of diabetes and prediabetes in the United States is a robust growth driver for the insulin storage devices market. According to an industry report, every year, it is estimated that 1.2 million Americans are diagnosed with diabetes, further increasing the demand for effective management of insulin solutions. The American Diabetes Association also reported in 2021 that an estimated 97.6 million American adults had prediabetes, and this population represents a huge vulnerable population that might develop type 2 diabetes. As these patients deteriorate to pure diabetes or as they need intensification of control, the level of demand will be for various storage devices on insulin, the pen, and pump, also smart storage ones. These can help in a right preservation mode of insulin for diabetes care and with home based and self- management, will increasingly require handy, portable devices, and comfortable in use as well. The U.S. is experiencing a full-fledged diabetes epidemic, and patient convenience and adherence to the prescribed regimen would require good insulin storage devices.

Europe Insulin Storage Devices Market Analysis

The aging of the European population and an increase in the prevalence of risk factors are fueling the growing burden of diabetes, insulin storage devices are expected to play a crucial role in the growth of this market. According to the World Health Organization, 1 in 10 Europeans will be suffering from diabetes by 2045. This is directly a result of diabetes management solutions. Incidences of chronic conditions due to aging, such as obesity and sedentary lifestyles, have contributed to the increasing prevalence of diabetes across the continent. Insulin storage devices will continue to increase in demand with an aging population as a better management approach is needed to improve treatment effectiveness. Preserving the efficacy of insulin and supporting adherence to treatment protocols require innovative storage solutions like pens, pumps, and high-performance temperature control systems. With an increasing focus on home-based care and self-management, especially in the elderly population, market growth in Europe is likely to be supplemented by continued advances in user-friendly and portable insulin storage devices.

Asia Pacific Insulin Storage Devices Market Analysis

The Asia-Pacific region is the most significant growth driver for the insulin storage devices market, given the high prevalence of diabetes. According to the National Institutes of Health (NIH), that 60% of people suffering from diabetes are in Asia, half of whom live in China and India. Diabetes cases in the region have been on the rise due to an increase in urbanization, sedentary lifestyles, and unhealthy diets. This means the need for insulin storage devices in this region is also on the rise. According to a recent report, Asia alone holds over 100 million people diagnosed with diabetes; it is thereby adding up on the demand of good insulin storage methods like using pens, pumps, and latest advanced temperature-regulated devices. With the shift of healthcare in many Asia-Pacific countries toward home-based management and self-care, the focus is also on providing convenient, portable, and user-friendly solutions to patients. This is expected to drive the demand for insulin storage devices across the region.

Latin America Insulin Storage Devices Market Analysis

The key growth factor behind the growth in the demand for insulin storage devices is rising cases of diabetes within the South America, Central America, and Caribbean region, otherwise known as SACA. According to reports, this would translate to an increase in diabetes cases by 48% in the region to reach 49 million cases by 2045. The prevalence of diabetes is expected to be at 11.9% by 2045, with an increase of 25%. This rise in diabetes cases will be due to aging populations, urbanization, and lifestyles-baseline facts which point towards the increasing need for effective solutions in diabetes management, including devices for insulin storage. As the healthcare systems in the region are focusing on home-based care and self-management, the need for portable, reliable, and temperature-controlled insulin storage solutions is increasing. The proper preservation and administration of insulin depend on insulin pens, pumps, and advanced storage devices, which lead to better patient outcomes. Thus, the increasing demand for insulin storage devices is going to propel market growth in the region.

Middle East and Africa Insulin Storage Devices Market Analysis

Type 2 diabetes is a major global public health concern and is said to be one of the most common public health problems in the region, as reported by NIH, with a prevalence rate of 12.2% in 2019. The rapidly boosting burden of diabetes in this region due to factors such as urbanization, sedentary lifestyle, and dietary changes, requires a gradual increase in supply of insulin storage devices. High prevalence of diabetes in MENA and associated morbidity and mortality requires effective diabetes management solutions. The insulin storage devices include insulin pens, pumps, and advanced temperature-controlled systems. All these devices are essential to ensure the efficacy and potency of insulin and proper administration. With the shift towards home-based care and self-management in healthcare across the MENA region, there is growing interest in user-friendly, portable, and reliable insulin storage devices. This trend is likely to continue fueling growth in the market for insulin storage devices throughout the region.

Competitive Landscape:

Key players in the market are driving growth through strategic initiatives, technological innovations, and market expansion. The investment in research and development for introducing advanced storage solutions, such as smart insulin pens and temperature-controlled devices, remains a cornerstone of their strategy. These innovations not only enhance the user experience but also contribute to better insulin efficacy and patient compliance. Additional market presence and robustness of these companies comes through collaborations and partnerships with health providers, diabetes associations, and technology companies for the comprehensive management of diabetes care. The leading companies also work towards geographical expansion across regions of high prevalence and where the potential is untapped, and with commitment to regulation, they provide products that are safe and efficacious, both to the doctors and patients. Marketing efforts based on education and awareness contribute to the widespread adoption of these devices in addition to changing the needs of the patient population of diabetes.

The report provides a comprehensive analysis of the competitive landscape in the insulin storage devices market with detailed profiles of all major companies, including:

- Arkray Inc.

- COOL Sarl

- Cooluli

- DISONCARE

- Medicool Inc.

- ReadyCare LLC

- TAWA Outdoor (Xiamen Tawa Enterprise Co. Ltd.)

- Zhengzhou Dison Electric Co. Ltd.

- Zhengzhou Olive Electronic Technology Co. Ltd.

Latest News and Developments:

- November 2024: Insulet Corp has updated the outlook on annual revenue growth, and that will now come in at a rise of 16% to 19%. This is because of the strength experienced in the sales of Omnipod insulin delivery systems.

- January 2024: Zhengzhou Dison Electric Co. Ltd has unveiled an infant radiant warmer that had been launched in Neonatal Care Unit in Kenya that was its BB-100 baby incubators and BN-100.

- September 2023: Arkray Inc. released the new service on the salivary testing instrument that "visualizes the oral environment.".

Insulin Storage Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Patient Types Covered | Type 1 Diabetes Patients, Type 2 Diabetes Patients |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Thailand, Malaysia, Vietnam, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico, Argentina, Turkey, South Africa, Saudi Arabia, UAE |

| Companies Covered | Arkray Inc., COOL Sarl, Cooluli, DISONCARE, Medicool Inc., ReadyCare LLC, TAWA Outdoor (Xiamen Tawa Enterprise Co. Ltd.), Zhengzhou Dison Electric Co. Ltd., Zhengzhou Olive Electronic Technology Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the insulin storage devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global insulin storage devices market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the insulin storage devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The insulin storage devices market was valued at USD 1,005.64 Million in 2024.

The insulin storage devices market is projected to exhibit a CAGR of 6.59% during 2025-2033, reaching a value of USD 1,838.74 Million by 2033.

The insulin storage devices market is driven by the rising prevalence of diabetes, increasing adoption of insulin therapy, advancements in cold chain logistics, growing awareness about proper insulin storage, and technological innovations in temperature-controlled storage solutions. Additionally, government initiatives and healthcare investments further boost market growth.

North America currently dominated the market due to growing diabetes prevalence, advanced healthcare, innovative technologies, robust regulations, proactive management strategies, and higher disposable income levels.

Some of the major players in the insulin storage devices market include Arkray Inc., COOL Sarl, Cooluli, DISONCARE, Medicool Inc., ReadyCare LLC, TAWA Outdoor (Xiamen Tawa Enterprise Co. Ltd.), Zhengzhou Dison Electric Co. Ltd., Zhengzhou Olive Electronic Technology Co. Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)