Insulation Market Size, Share, Trends and Forecast by Material Type, Function, Form, End Use Industry, and Region, 2025-2033

Insulation Market 2024, Size and Trends:

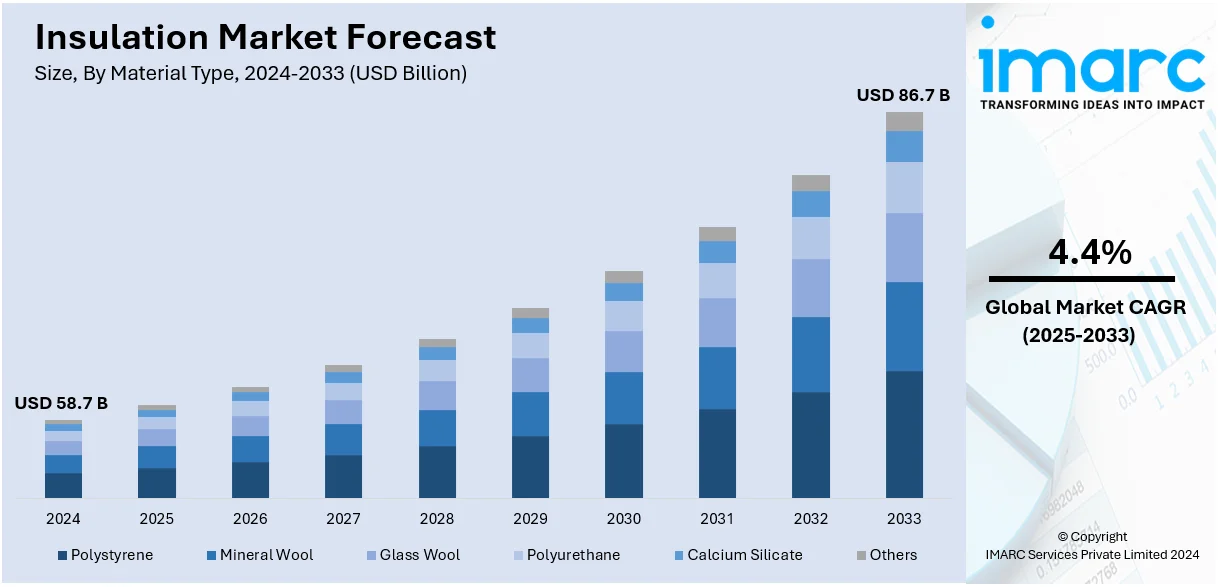

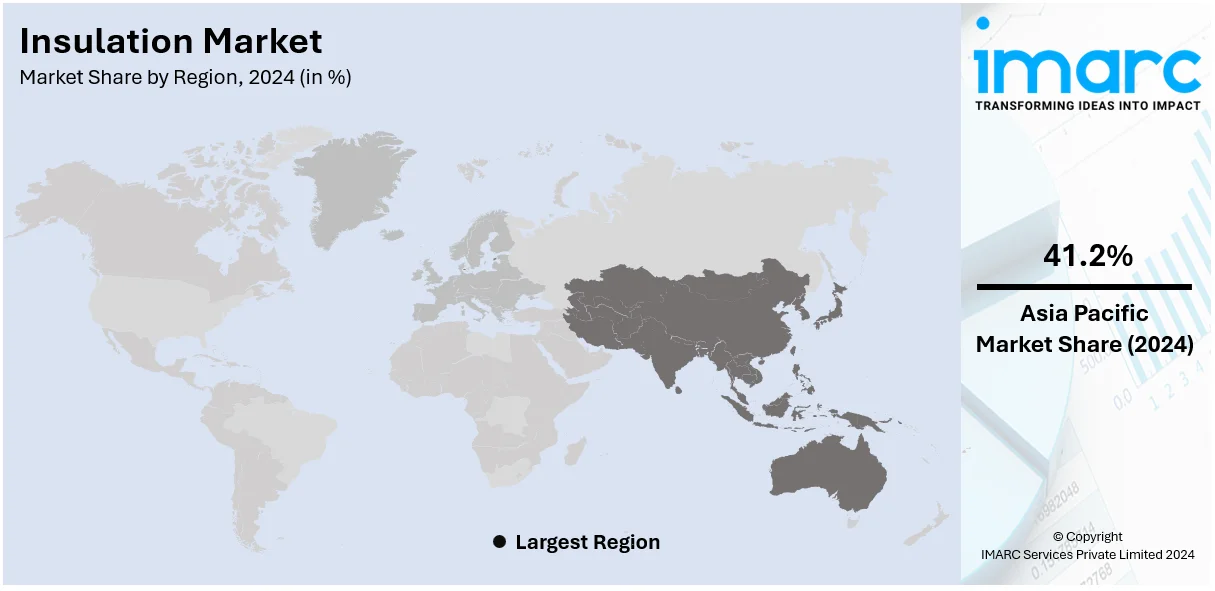

The global insulation market size was valued at USD 58.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 86.7 Billion by 2033, exhibiting a CAGR of 4.4% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 41.2% in 2024. The heightened demand for energy efficiency globally, significant growth in the construction sector, rapid urbanization and industrialization, and the expanding application of insulation across the automotive, aerospace, and electronics industries, are some of the factors propelling the market forward.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 58.7 Billion |

|

Market Forecast in 2033

|

USD 86.7 Billion |

| Market Growth Rate (2025-2033) | 4.4% |

The drive for energy efficiency is a critical factor fueling the growth of the global insulation market. With rising energy costs and the need to reduce greenhouse gas emissions, governments and industries are prioritizing energy-efficient solutions. Insulation plays a pivotal role in minimizing energy loss by maintaining stable indoor temperatures and reducing the load on heating, ventilation, and air conditioning (HVAC) systems. According to the International Energy Agency (IEA), buildings account for nearly 30% of global energy consumption, and around 26% of energy-related emissions. Enhanced insulation in residential, commercial, and industrial buildings can reduce heating and cooling needs by up to 50%, significantly contributing to energy savings and environmental sustainability. In 2023, governments around the world ramped up efforts to improve energy efficiency. For instance, the European Union introduced stringent regulations under the Energy Performance of Buildings Directive (EPBD), requiring all new buildings to be nearly zero-energy by 2024.

The US insulation market is growing fast, holding a 88.90% of the market share. The construction sector's expansion directly boosts insulation demand. In October 2024, U.S. construction spending reached a seasonally adjusted annual rate of $2,174.0 billion, marking a 5.0% increase from October 2023. This growth encompasses both residential and non-residential projects, necessitating extensive insulation applications to meet building codes and energy efficiency standards. Additionally, heightened awareness of energy conservation propels the insulation market. The U.S. Department of Energy's initiatives, such as the Weatherization Assistance Program, aim to improve energy efficiency in low-income households, reducing heating and cooling costs through better insulation. Aside from that, a robust economy enhances market expansion. In the third quarter of 2024, real GDP increased at an annual rate of 2.8%, reflecting economic stability that encourages investment in construction and infrastructure projects, thereby driving insulation demand.

Insulation Market Trends:

Significant Growth in the Construction Industry

The thriving construction industry is one of the key factors driving the market growth. According to industry reports, construction spending surged past USD 2 Trillion in 2024, driven by a 10% rise in nominal value added and 12% growth in gross output, boosting demand for insulation to enhance energy efficiency and sustainability in buildings. Along with the robust rise in infrastructure development, particularly in emerging nations, there has been a notable surge in industrial and residential construction projects over time. For example, India’s Smart Cities Mission, which has earmarked substantial funding for urban development and sustainable construction projects, is expected to drive a significant rise in the demand for insulation materials. These materials will be crucial for improving energy efficiency and indoor comfort in both urban housing and commercial spaces. Similarly, China, the world's largest construction market, accounted for over 30% of global construction activity in 2023. Government-driven programs, such as affordable housing schemes and urban renewal projects, are bolstering the need for high-performance insulation products like fiberglass and foam.

Rising Urbanization and Industrialization

The rapid urbanization and population growth have led to a heightened demand for power and energy, driving the widespread use of insulation materials in various construction projects. According to the United Nations, rapid urbanization is set to reshape global landscapes, with 68% of the world population projected to reside in urban areas by 2050. Rapid urban growth demands extensive infrastructure development, including residential, commercial, and industrial buildings, all of which require efficient insulation systems to meet modern energy standards. Industrialization further fuels insulation demand as manufacturing hubs in developing nations grow. Indonesia’s Industrial Estate Program (2023) is developing eco-friendly industrial zones requiring compliance with international energy-efficiency standards. Similarly, Vietnam's manufacturing boom, driven by foreign direct investments in textiles, electronics, and chemicals, necessitates insulated facilities to optimize energy use and reduce operational costs.

Expanding Product Applications

Beyond construction, insulation markets are diversifying in forms of applications. Such as automotive, aerospace, and electronics are increasingly using modern insulation materials for meeting energy efficiency, safety, and performance needs. EV manufacturers design thermal insulation to best facilitate battery temperature control and vehicle performance. As the International Energy Agency (IEA) put it, "Global EV sales exceed 2.3 million units in Q1 2023, representing a 25% year-over-year increase." That underlines the requirement for thermal insulation solutions tailored to the needs of EV technology. In the electronics domain, there is increased use of thermal and electrical insulation across the emergence of smart devices, which miniaturizes electronics. High-performance insulation is thus necessary to dissipate heat and ensure operational safety; with rapid growth in the global electronics industry, such demand will only grow.

Insulation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global insulation market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material type, function, form, and end use industry.

Analysis by Material Type:

- Polystyrene

- Mineral Wool

- Glass Wool

- Polyurethane

- Calcium Silicate

- Others

Polystyrene is the kind of insulation that has the greatest usage in the market, having wonderful qualities such as thermal resistance, lightness, and economy. Expanded polystyrene (EPS) and extruded polystyrene (XPS) are commonly used in the construction and packaging industries, from wall insulation to roof applications and much more. The compressive strength and moisture resistance would make it more suitable for use under different weather conditions. Besides, advances in recyclable polystyrene products further align with global sustainability goals, which cement their hold in the market.

Analysis by Function:

- Thermal

- Acoustic

- Electric

- Others

Thermal Insulation accounts for the largest functional segment in the insulation market. Driving demand for this insulation is increased energy efficiency in buildings and industrial applications. Thermal insulation minimizes heating and cooling costs while reducing the emission of greenhouse gases realized through reduced heat transfer. In addition, sectors such as automotive and aerospace sectors apply thermal insulation in improving operational efficiencies and compliance with environmental standards. Sustainable thermal insulation materials, such as aerogels and eco-friendly foam, are also fueling the market growth.

Analysis by Form:

- Blanket

- Foam

- Board

- Pipe

- Others

Blanket insulation has the largest market share based on form, due to ease of installation, cost efficiency, and versatility. The primary materials used in blanket insulation are fiberglass or mineral wool. It is applied extensively in residential and non-residential construction for the purpose of wall, ceiling, and floor insulation. Due to its excellent thermal and acoustic insulation properties, it has become a preferred choice for contemporary building designs. In addition, compatibility with the green building initiatives makes adoption in projects targeting sustainability certifications such as LEED more common. Manufacturer innovations such as pre-cut blanket rolls and higher R-values are aimed at solving changing consumer needs, meaning this segment will likely remain atop.

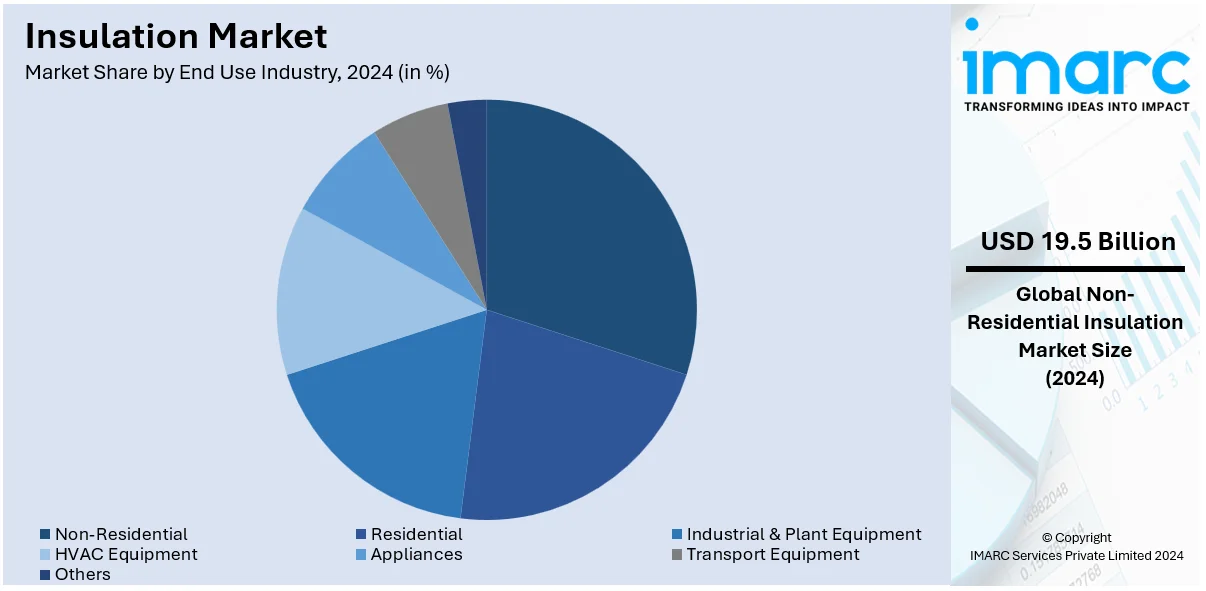

Analysis by End Use Industry:

- Non-Residential

- Residential

- Industrial & Plant Equipment

- HVAC Equipment

- Appliances

- Transport Equipment

- Others

In 2024, non-residential space will be leading the market, with about 33.2% share. The growth in this segment is highly encouraged by more investments in infrastructural improvement and urbanization in developing countries. Insulating non-residential buildings is pertinent to improving energy efficiency, optimizing operational costs, and complying with increasingly rigid environmental regulations. For example, industrial facilities employ high-performance insulation for optimizing processes and conserving energy. Apart from this, the increasing adoption of advanced materials such as spray foam and rigid board insulation further augments growth in this segment.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

Asia-Pacific is dominating the global insulation market in 2024 with 41.2% share, due to high industrialization and urbanization as well as huge growth in construction. Countries such as China, India, and other countries of the Southeast Asian region lead with large-scale infrastructure projects as well as housing demand. Asian Development Bank reported the amount of infrastructure investment needed annually at approximately $1.7 trillion in 2023 and thus opens up a vast market for insulation materials. Government support for energy efficiency coupled with increasing environmental awareness has further energized the growth of the market. The Asia-Pacific region now houses numerous local manufacturers and producers who provide low-cost insulation solutions in the marketplace. As its economy continues to grow and policymakers promote more green building processes, this region is slated to maintain its market dominance in terms of the global insulation industry.

Key Regional Takeaways:

North America Insulation Market Analysis

The insulation market in North America is experiencing a healthy growth phase due to several key factors such as stringent energy efficiency regulations, expansion of construction activities, and growing adoption of sustainable practices. The regional governments are focusing on energy conservation through various policies, including Canada's Energy Efficiency Regulations and the U.S. Department of Energy's Building Energy Codes, which have advanced insulation solutions for residential, commercial, and industrial buildings. Other major growth drivers in North America are rapid urbanization and industrial growth. As cities grow, there is an increasing interest in building long-lasting, thermally efficient structures that are driving the use of insulation materials such as fiberglass, mineral wool, and spray foam. Additionally, green building initiatives, such as LEED certification and Canada's Net Zero Energy Building framework, are promoting the adoption of environmentally friendly insulation products. Technological advancements further support market growth. Superior thermal resistance provided by innovations in materials, such as aerogels and vacuum-insulated panels, caters to the need of modern construction. Demand for thermal insulation in automotive applications is further increased with the growing electric vehicle market, especially in the U.S. All these factors combine to make North America the leading region in the global insulation market.

United States Insulation Market Analysis

The last few years have seen significant developments in HVAC equipment, which have also resulted in increased use of insulation technologies. As an illustration, Mitsubishi Electric is enhancing HVAC development by spending USD 143.5 Million on a retrofit of its U.S. Factory that augments insulation benefits with efficient heat pump compressors to meet increasing demand for energy-saving solutions. As demands for energy-efficient heating, ventilation, and air conditioning systems are gaining, wilted building owners are turning their attention to energy conservation and reduced utility bills. The HVAC system is maintained at the desired temperature and energy loss is reduced significantly. This has contributed to the increased adoption of advanced insulating materials in commercial, residential, and industrial buildings. Another contributory factor into favoring insulation is the advocacy for sustainable energy, energy efficiency, and carbon footprint reduction. Moreover, stricter building codes and incentives for green construction are pushing further the acceptance of insulation even in new and retrofit projects that include superior thermal barriers. Therefore, as the HVAC industry keeps growing, the market for such high-performance insulation solutions will increase because they fit the mold of smarter and energy-efficient buildings.

Europe Insulation Market Analysis

In Europe, the transportation sector's expansion has become a key driver of insulation adoption. With a growing emphasis on improving energy efficiency in vehicles and reducing emissions, insulation plays a pivotal role in enhancing both thermal and acoustic comfort. As the automotive industry shifts toward electric vehicles (EVs), insulating materials are being used to optimize battery performance, prevent energy waste, and improve vehicle aerodynamics. According to reports, electric vehicle adoption in Europe is surging, with EVs accounting for 23.6% of new car registrations in 2023, highlighting their role in boosting demand for advanced insulation technologies. This shift supports energy efficiency and sustainable infrastructure growth. Additionally, insulation helps reduce road noise and improve cabin comfort in commercial and passenger vehicles. Similarly, the railway and aviation sectors are adopting advanced insulation technologies to enhance energy efficiency, reduce noise pollution, and maintain passenger comfort. As Europe continues its push towards more sustainable transportation solutions, insulation materials are becoming integral in the development of energy-efficient vehicles and infrastructure, driving industry-wide adoption.

Asia Pacific Insulation Market Analysis

The rapid growth of various industries in the Asia-Pacific region is contributing to the increased adoption of insulation technologies. Expanding manufacturing sectors, such as automotive, chemicals, and electronics, require efficient temperature control and soundproofing for their facilities. Insulation helps minimize energy consumption, reduce heat loss, and protect equipment from overheating, thereby improving overall productivity. For instance, India's Index of Industrial Production (IIP) grew by 3.5% in October 2024, with key sectors like basic metals and electrical equipment boosting industrial expansion, supporting increased demand for insulation in manufacturing and energy efficiency. Additionally, the construction industry is undergoing significant expansion due to urbanization and increased infrastructure development, leading to heightened demand for building materials, including insulation. The adoption of energy-efficient building practices in both residential and commercial developments further support insulation growth. The combined need for industrial efficiency, sustainable development, and improved worker comfort is driving the demand for advanced insulating materials across various sectors, ensuring long-term growth in the insulation market.

Latin America Insulation Market Analysis

In Latin America, the growing residential housing is significantly influencing insulation adoption. For instance, Brazil's urban population grew by 0.73% in 2022, following a 0.81% rise in 2021, highlighting increasing urbanization that drives demand for insulation solutions to enhance energy efficiency in densely populated areas. As urban populations increase and housing demands grow, insulation technologies are being integrated into residential buildings to ensure better energy efficiency and thermal comfort. The need for cost-effective climate control solutions, especially in regions experiencing extreme weather conditions, has led to greater adoption of insulation. Furthermore, the shift toward sustainable and green building practices encourages the use of insulation materials that reduce energy consumption and enhance environmental performance. As the residential construction industry expands, insulation becomes a vital component in creating homes that offer improved comfort while reducing long-term energy costs.

Middle East and Africa Insulation Market Analysis

The expansion of the oil and gas sector, coupled with the growth of real estate development, is driving the adoption of insulation technologies in the Middle East and Africa. In the oil and gas industry, insulation is crucial for managing high-temperature environments, reducing energy loss, and ensuring safety in pipelines and equipment. According to International Trade Administration, Saudi Arabia holds about 17% of the world's proven petroleum reserves and ranks second globally in oil reserves. The increasing oil sector growth, driven by Saudi Aramco's expansion, is expected to boost demand for energy-efficient insulation solutions. In the real estate sector, rapid urbanization and the construction of energy-efficient buildings are promoting the use of insulation in both commercial and residential projects. As energy efficiency and sustainability become key priorities, insulation solutions are increasingly being incorporated into new developments, ensuring long-term energy savings and environmental benefits across the region.

Competitive Landscape:

Leading players in the insulation market are focusing on innovation, sustainability, and strategic expansions to strengthen their market position. They are investing heavily in research and development (R&D) to introduce advanced materials with improved thermal resistance, fire safety, and environmental performance. For example, the development of eco-friendly insulation products, such as recycled fiberglass and bio-based foam, reflects the industry’s commitment to sustainability and aligns with global green building trends. To meet rising demand, major companies are expanding their manufacturing capacities and establishing facilities in high-growth regions such as Asia-Pacific and North America. These expansions aim to ensure efficient supply chains and reduce costs associated with logistics. Additionally, collaborations and partnerships with construction firms and energy-efficiency organizations are helping companies to penetrate new markets and increase adoption of their products.

The report provides a comprehensive analysis of the competitive landscape in the insulation market with detailed profiles of all major companies, including:

- 3M Company

- Atlas Roofing Corporation

- BASF SE

- Cellofoam North America, Inc.

- Covestro AG

- Dow Inc.

- Evonik Industries AG

- GAF Materials LLC

- Huntsman International LLC

- Johns Manville (Berkshire Hathaway Inc.)

- Kingspan Group PLC

- Knauf Insulation

- Owens Corning

- Rockwool A/S

- Saint-Gobain S.A.

Latest News and Developments:

- December 2024: Rovanco Piping Systems, in partnership with a Swiss firm, is set to open a new pipe manufacturing plant in the Joliet area by 2025. The facility will specialize in producing pre-insulated piping, a critical but often overlooked infrastructure product. Business partners and cousins Chad Godeaux and Todd Stonitsch are realizing a vision inspired by their fathers through this venture. The company, known for its global reach, aims to strengthen local manufacturing capabilities. The milestone underscores Rovanco's dedication to innovation and economic growth in the region.

- December 2024: ROCKWOOL A/S has announced a USD 100 Million investment in a new production line at its Marshall, Mississippi facility. This expansion aims to meet increasing demand for industrial insulation products in the Gulf of Mexico region. The facility will feature WR-Tech™ and CR-Tech™ technologies, offering advanced water repellency and corrosion resistance. The location strategically supports the industrial sector in the southern United States. This move highlights ROCKWOOL’s commitment to innovation and market growth in North America.

- December 2024: Shedstore has launched a detailed guide on shed insulation to help homeowners explore energy-saving solutions. The guide addresses increasing interest in innovative ways to tackle rising energy costs. Shed insulation is gaining attention as a versatile method for enhancing energy efficiency in outdoor spaces. This move reflects Shedstore's commitment to supporting sustainable practices. The guide is now available to assist homeowners in optimizing their garden buildings.

- November 2024: Knauf Insulation has reopened its expanded St Helens glass wool insulation facility in Merseyside, increasing capacity by 25,000t per year. The upgrade features a larger furnace using locally sourced glass cullet and enables production of higher-thickness products. Merseyside Mayor Steve Rotheram highlighted the plant’s role in preserving St Helens' glass manufacturing heritage. The expansion reinforces Knauf Insulation’s commitment to innovation and sustainability.

- November 2024: Swiss-based BRUGG Pipes is set to launch its first North American production facility for flexible, pre-insulated PEX piping systems in Joliet, Illinois, by Spring 2025. This move aims to enhance service efficiency, reduce delivery times, and meet the growing demand for advanced energy infrastructure solutions in the U.S.

Insulation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Polystyrene, Mineral Wool, Glass Wool, Polyurethane, Calcium Silicate, Others |

| Functions Covered | Thermal, Acoustic, Electric, Others |

| Forms Covered | Blanket, Foam, Board, Pipe, Others |

| End Use Industries Covered | Non-Residential, Residential, Industrial & Plant Equipment, HVAC Equipment, Appliances, Transport Equipment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | 3M Company, Atlas Roofing Corporation, BASF SE, Cellofoam North America, Inc., Covestro AG, Dow Inc., Evonik Industries AG, GAF Materials LLC, Huntsman International LLC, Johns Manville (Berkshire Hathaway Inc.), Kingspan Group PLC, Knauf Insulation, Owens Corning, Rockwool A/S, Saint-Gobain S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the insulation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global insulation market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the insulation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Insulation refers to materials or systems designed to reduce the transfer of heat, sound, or electricity between spaces or objects. It works by creating a barrier that minimizes the exchange of energy, thereby maintaining desired conditions within an environment.

The insulation market was valued at USD 58.7 Billion in 2024.

IMARC estimates the global insulation market to exhibit a CAGR of 4.4% during 2025-2033.

The heightened demand for energy efficiency globally, significant growth in the construction sector, rapid urbanization and industrialization, and the expanding application of insulation across the automotive, aerospace, and electronics industries, are some of the factors propelling the market forward.

In 2024, polystyrene represented the largest segment by material type due to its superior thermal resistance, lightweight properties, and cost-effectiveness.

Thermal leads the market by function owing to the need to enhance energy efficiency in buildings and industrial applications.

The blanket is the leading segment by form due to its ease of installation, cost-efficiency, and versatility.

The non-residential is the leading segment by end use industry, driven by increased investments in infrastructure development and urbanization, particularly in emerging economies.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global insulation market include 3M Company, Atlas Roofing Corporation, BASF SE, Cellofoam North America, Inc., Covestro AG, Dow Inc., Evonik Industries AG, GAF Materials LLC, Huntsman International LLC, Johns Manville (Berkshire Hathaway Inc.), Kingspan Group PLC, Knauf Insulation, Owens Corning, Rockwool A/S, Saint-Gobain S.A., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)