Profitability and Cost Analysis of IV Solutions Manufacturing Plant: A Detailed Cost Model

What is IV Solutions?

Intravenous (IV) solutions represent a critical and ubiquitous component of modern healthcare, playing a fundamental role in patient care and treatment. These sterile, liquid formulations consist of a carefully balanced blend of fluids and electrolytes, administered directly into a patient's bloodstream.

Key Applications Across Industries:

They are tailored to address a wide range of medical needs, from rehydration and medication delivery to nutritional support and blood transfusions. Their precise composition is crucial in maintaining the body's fluid balance and electrolyte levels, making them a cornerstone of medical interventions, surgeries, and emergency care.

What the Expert Says: Market Overview & Growth Drivers

According to an IMARC study, the global IV solutions market was valued at US$ 15.6 Billion in 2024. Looking ahead, the market is expected to grow at a CAGR of approximately 4.5% from 2025 to 2033, reaching a projected value of US$ 23.3 Billion by 2033. IV solutions offer significant advantages and versatile applications in healthcare.

Their primary advantage is the rapid and direct delivery of fluids, medications, and nutrients into the bloodstream, ensuring quick absorption and effectiveness.Applications are vast and include rehydration for patients with dehydration, administering antibiotics and pain relief, and providing essential nutrients to those unable to eat. In emergency medicine, these solutions are used for immediate intervention. In surgical settings, they maintain patient stability during procedures. Chronic conditions, such as diabetes rely on them for insulin delivery. IV solutions play a crucial role in childbirth, anaesthesia, and critical care. The IV solutions market is influenced by several key drivers that reflect the ongoing evolution of healthcare practices and the increasing demand for intravenous therapies. Firstly, the aging global population is a significant factor. As the elderly population grows, so does the prevalence of chronic illnesses and conditions that require intravenous treatments, boosting the demand for IV solutions.

Case Study on Cost Model of IV Solutions Manufacturing Plant:

Objective

One of our clients has approached us to conduct a feasibility study for establishing a mid to large-scale IV solutions manufacturing plant in the United States.

IMARC Approach: Comprehensive Financial Feasibility

We have developed a detailed financial model for the plant's setup and operations. The proposed facility is designed with a production capacity of 133,333 units of IV solutions per day.

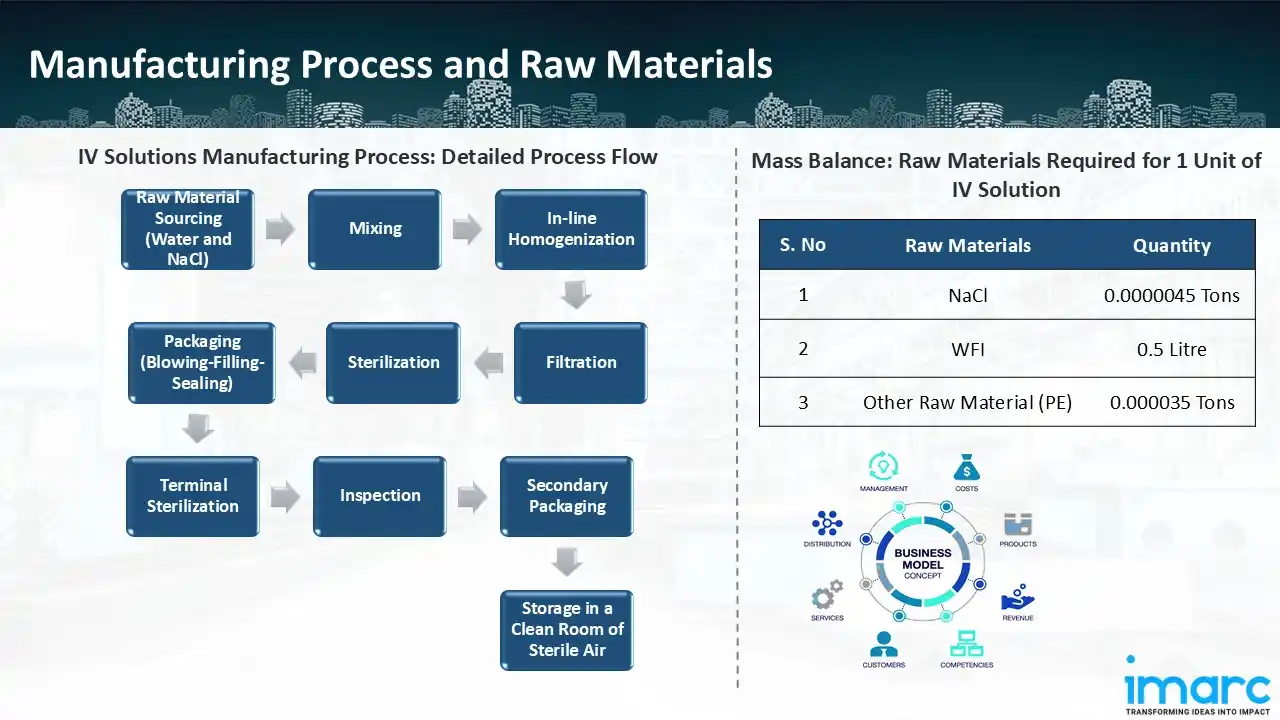

Manufacturing Process: A meticulous procedure is followed throughout the preparation of IV solutions to guarantee sterility, quality, and safety. Purchasing pharmaceutical-grade water and sodium chloride (NaCl) is the first step in the raw material procurement process. To guarantee patient safety, these raw ingredients must adhere to strict purity criteria. To get the required concentration, water and NaCl are next mixed in precisely measured amounts under carefully monitored circumstances during the mixing stage. After mixing, the mixture is homogenised in-line, which keeps the ingredients from separating and guarantees stability and homogeneity. After that, it is filtered through fine membrane filters, which eliminate microbiological pollutants and particles. The solution is sterilised, usually with heat or filtration techniques, to further guarantee sterility. Following sterilisation, the solution moves on to the packaging phase, where sterile containers are created using a blowing-filling-sealing (BFS) technique, filled with the IV solution, and sealed in an aseptic setting. Certain items go through a process called terminal sterilisation, in which any leftover bacteria are destroyed by heating or radiation exposure of sealed containers. After that, the packed IV solutions are inspected to make sure they adhere to legal requirements for volume accuracy, sterility, and clarity. Following inspection, secondary packaging is used, and the finished goods are kept in sterile air-filled clean rooms until they are distributed. High-quality IV solutions for medical usage are guaranteed by this methodical procedure.

Get a Tailored Feasibility Report for Your Project Request Sample

Mass Balance and Raw Material Required: The primary raw materials utilized in the IV solutions manufacturing plant include NaCl, WFI, and other raw materials. To manufacture 1 unit of IV solutions, we require 0.0000045 tons of sodium chloride, 0.5 litre of WFI and 0.000035 tons of other raw materials.

List of Machinery:

The following equipment was required for the proposed plant:

- Water System

- Solution Preparation, Holding, Filter Assembly & Respective Facilities

- BFS Machines

- Terminal Sterilization

- NSP/Pack/Label/Leaktest

- Autoclaves

- Cleanroom

- Trolley & Other

- Physico Chemical Test Lab (Physical & Chemical Test Instruments)

- Instrument Lab (Instrument Lab With Critical Instruments)

- Microbiological Lab (Incubators,Media,Etc)

- BET & LPC Lab (BET KIT, LPC Instruments)

- Sterility Test Lab (LAF Workstation)

- Stability Test Lab (Walk in Stability Chambers-3)

Techno-Commercial Parameter:

- Capital Investment (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

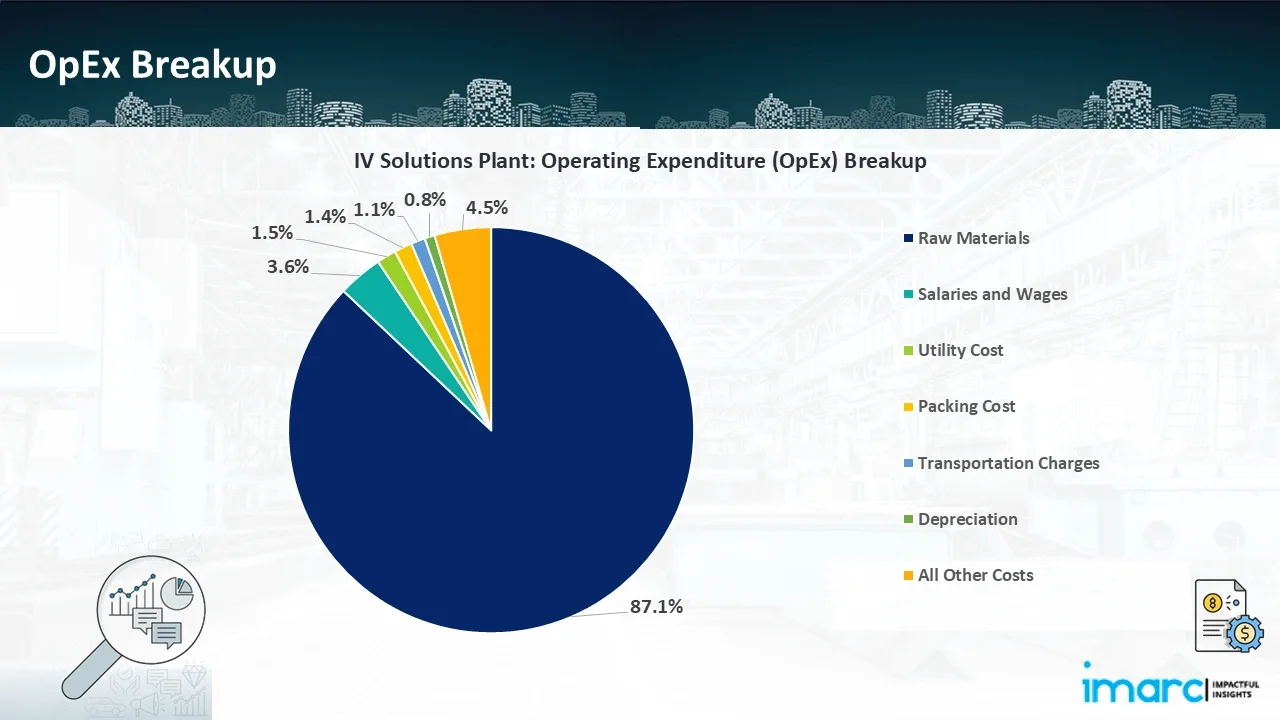

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. OpEx in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth.

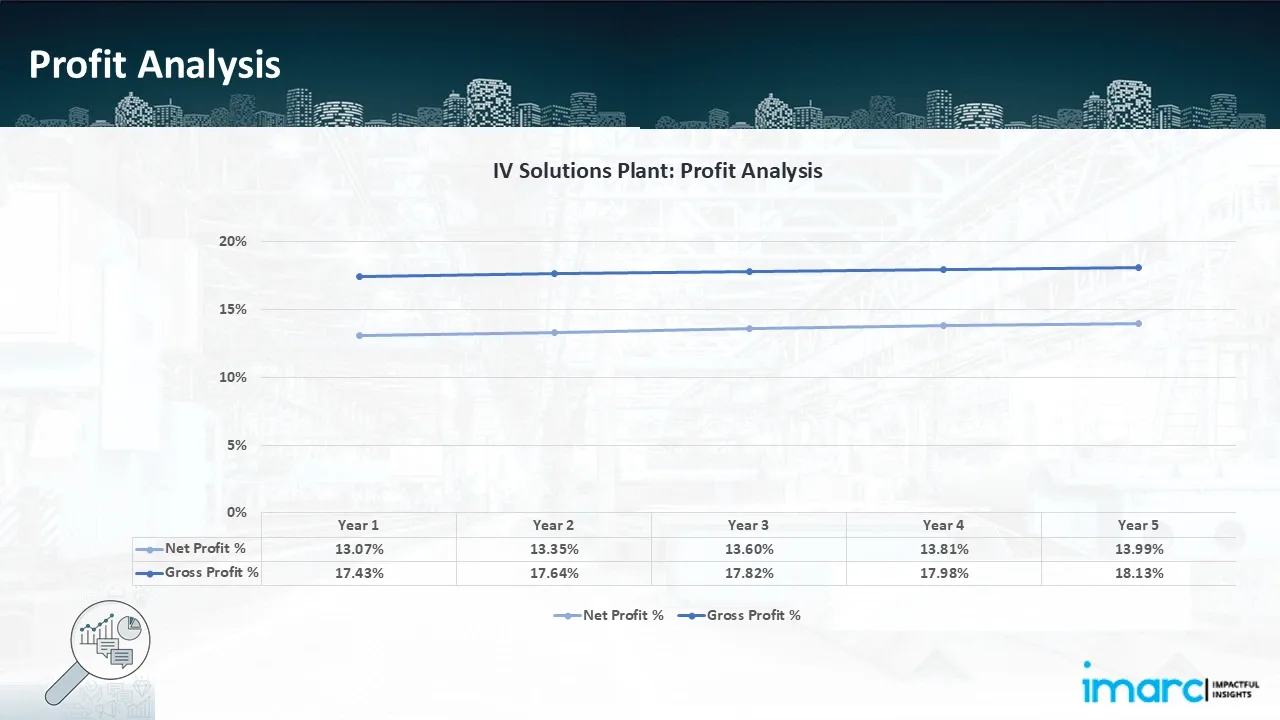

- Profitability Analysis Year on Year Basis: The proposed IV solutions plant, with a capacity of 133,333 units of IV solutions per day, achieved an impressive revenue of US$ 150.00 million in its first year. We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the projected period. Moreover, gross profit slightly improved from 17.43% to 18.13%, and net profit rise from 13.07% to 13.99%, highlighting strong financial viability and operational efficiency.

Conclusion & IMARC's Impact:

Our IV solutions manufacturing plant's financial model was meticulously modelled to satisfy the client's requirements. It provided a thorough analysis of production costs including capital expenditures, manufacturing processes, raw materials, and operating costs. The model predicts profitability while accounting for market trends, inflation, and any shifts in the price of raw materials. It was created especially to satisfy the demand of producing 133,333 units of IV solutions per day. Our commitment to offering precise, client-cantered solutions that ensure the long-term success of significant industrial projects by giving the client useful data for strategic decision-making is demonstrated by this comprehensive financial model.

Latest News and Developments:

- In December 2024, Baxter has announced an increase in the allocation of specific intravenous (IV) products to meet growing demand and improve supply chain stability. This decision is intended to assist hospitals and healthcare providers in continuing to deliver patient care in the face of persistent issues with healthcare supplies. This action demonstrates Baxter's dedication to improving the dependability and accessibility of essential medical supplies.

- In November 2024, Otsuka Pharmaceutical Factory, a subsidiary of Otsuka that provides IV solutions, is attempting to enter the North American market with the assistance of ICU Medical, a new partner. The two businesses will collaborate to increase the supply of IV solutions in the face of continuous supply chain difficulties.

- In October 2024, B. Braun Medical announced that it would increase intravenous saline fluid output by 20% at its Daytona Beach, Florida, and Irvine, California, plants. This project intends to solve statewide shortages made worse by recent natural catastrophes by increasing yearly IV set manufacturing by more than 30 million units.

- In September 2024, Viyash Life Sciences and Sequent Scientific have announced a INR 8,000 crore merger, forming a major participant in the animal health and pharmaceutical industries. Through the use of manufacturing, R&D, and worldwide market access synergies, the combination seeks to improve its standing in both home and foreign markets. It is anticipated that this consolidation will boost future growth and operational efficiencies, especially in the veterinary and active pharmaceutical ingredients (API) sectors.

- In November 2023, Astellas Pharma Inc. and Propella Therapeutics, Inc. declared that they have a merger agreement wherein Astellas will buy Propella through a US subsidiary. Propella is a privately held biopharmaceutical business that has developed new oncology medications by utilising a fully owned proprietary platform that blends medicinal chemistry with lymphatic targeting.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Brief List of Our Services: Market Entry and Expansion

- Market Entry and Opportunity Assessment

- Competitive Intelligence and Benchmarking

- Procurement Research

- Pricing and Cost Research

- Sourcing

- Distribution Partner Identification

- Contract Manufacturer Identification

- Regulatory Approvals, and Licensing

- Factory Setup

- Factory Auditing

- Company Incorporation

- Incubation Services

- Recruitment Services

- Marketing and Sales

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104