Breaking Down the Grains: Cost Dynamics of Silica Sand Production

What is Silica Sand?

Silica sand is a pure quartz-based material used extensively by many industries.

Key Applications Across Industries:

It is known for its durability, chemical inertness, and resistance to heat, and it is an important raw material in glass production, construction, foundries, electronics, and hydraulic fracturing (fracking). Increasing demand for high-purity silica in semiconductors, solar panels, and filters is fueling market growth. With more infrastructure development and development in silica processing, the applications keep expanding, and it is becoming an essential industrial commodity worldwide.

What the Expert Says: Market Overview & Growth Drivers

According to an IMARC study, the global silica sand market size reached USD 26.6 Billion in 2025. Looking ahead, the market is expected to grow at a CAGR of approximately 4.50% from 2026 to 2034, reaching a projected size of USD 39.3 Billion by 2034. The market for silica sand is spurred by growing demand from a number of industries.

The construction industry drives growth because it is used in glass production, concrete, and coatings. The thriving glass industry—flat glass, container glass, and fiberglass—is dependent on high-quality silica. Silica sand is used in metal casting by the foundry industry, especially in the automotive and industrial industries. Also, the oil & gas industry requires huge volumes for hydraulic fracturing (fracking). The electronics sector propels demand for high-purity silica utilized in semiconductors and solar panels. Increasing infrastructure development, growing renewable energy projects, and technological advancements in silica processing technology also fuel market growth. Further, the growing application of silica in water filtration, paints, coatings, and ceramics also fuels its extensive use. However, political and regulatory issues regarding mining operations and environmental considerations might affect market performance.

Case Study on Cost Model of Silica Sand Manufacturing Plant:

Objective

One of our clients has approached us to conduct a feasibility study for establishing a mid to large-scale silica sand production plant in Saudi Arabia.

IMARC Approach: Comprehensive Financial Feasibility

We have developed a detailed financial model for the plant's setup and operations. The proposed facility is designed with an annual production capacity of 30,000 tons of silica sand.

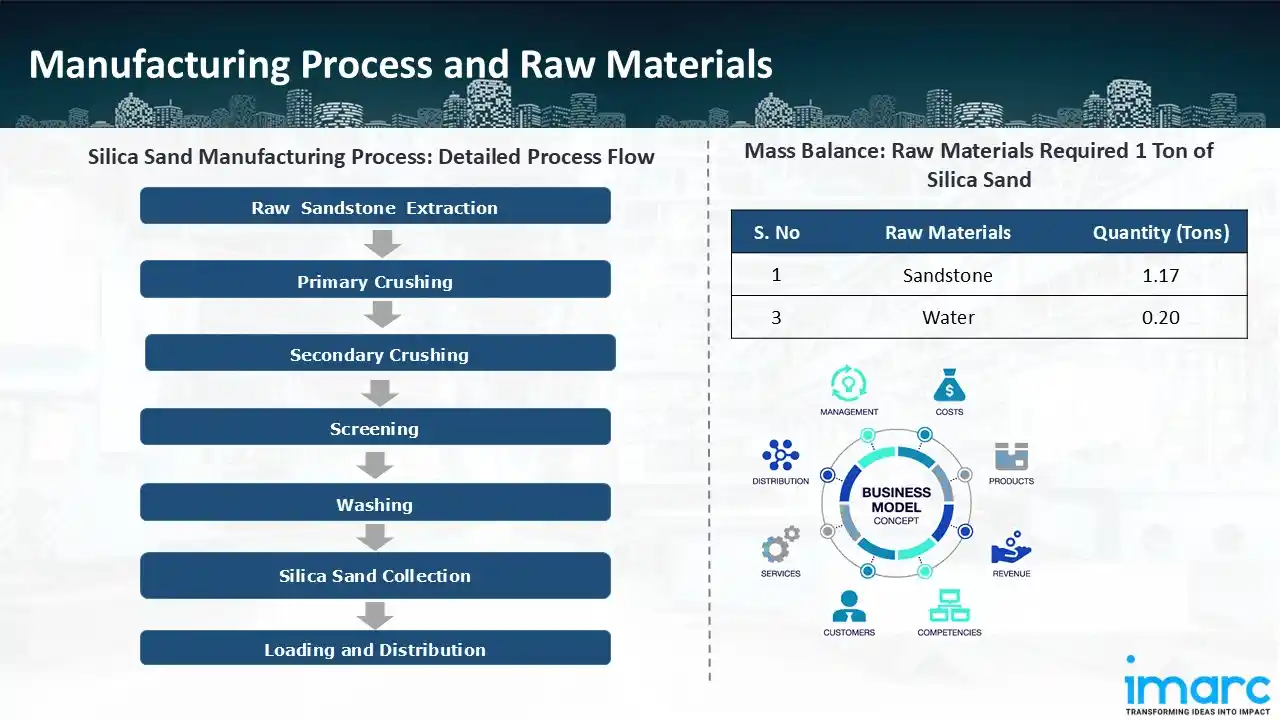

Manufacturing Process: Firstly, extraction is performed by rock blasting involving controlled application of explosives to excavate, disintegrate or eliminate rock. Extraction can also be carried out using other processes such as plasma process. Rock blasting now employs a large number of varieties of explosives with varying compositions and performance characteristics. Higher velocity explosives are utilized for comparatively hard rock to shatter and break the rock. Following the extraction process, the raw material undergoes processing through crushing machines. This is done in two stages- primary crushing, which breaks down the big chunks of sandstone into a size manageable by downstream machinery and secondary crushing – for controlled size and shape reduction of particles as required. Primary crushing is accomplished using a jaw crusher. The broken raw material is transferred to secondary crusher by belt conveyer for secondary breaking performed by a high-efficient fine impact crusher. The broken material is transferred again through a belt conveyer to circular vibrating screen for screening into various grades and the removal of coarser particles. The material is then taken to a sand washing machine for removing waste material and impurities, where water is mixed with the sand and pumped to a cyclone to discharge the small amounts of fines or clay. It is then finally picked up on the ground as a pile by using a belt conveyer. Lastly, the silica sand is gathered in a pile which is subsequently loaded onto bunkers and trucks or big cars to be dispatched to different industries.

Get a Tailored Feasibility Report for Your Project Request Sample

Mass Balance and Raw Material Required: The primary raw materials utilized in the silica sand production plant largely include sandstone, and water. To produce 1 ton of silica sand, we require 1.17 tons of sandstone, and 0.20 tons of water.

List of Machinery:

The following equipment was required for the proposed plant:

- Jaw Crusher (Max. Feeding Size: 165mm)

- Belt Conveyor (Width: 500mm, Length: 12m)

- Highly Efficient Fine Impact Crusher (Max. Feeding Size: 60mm)

- Circular Vibrating Screen (Sieve Size: 3-50 mm)

- Belt Conveyor (Width: 500mm, Length: 20m)

- Sand Washer (Diameter- 2000mm)

- Belt Conveyor (Width: 500mm, Length: 6m)

- Workshop Equipment

- Generator 70 KVA with Anti Vibrating Mounting Pad Freight and Installation

Techno-Commercial Parameter:

- Capital Investment (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

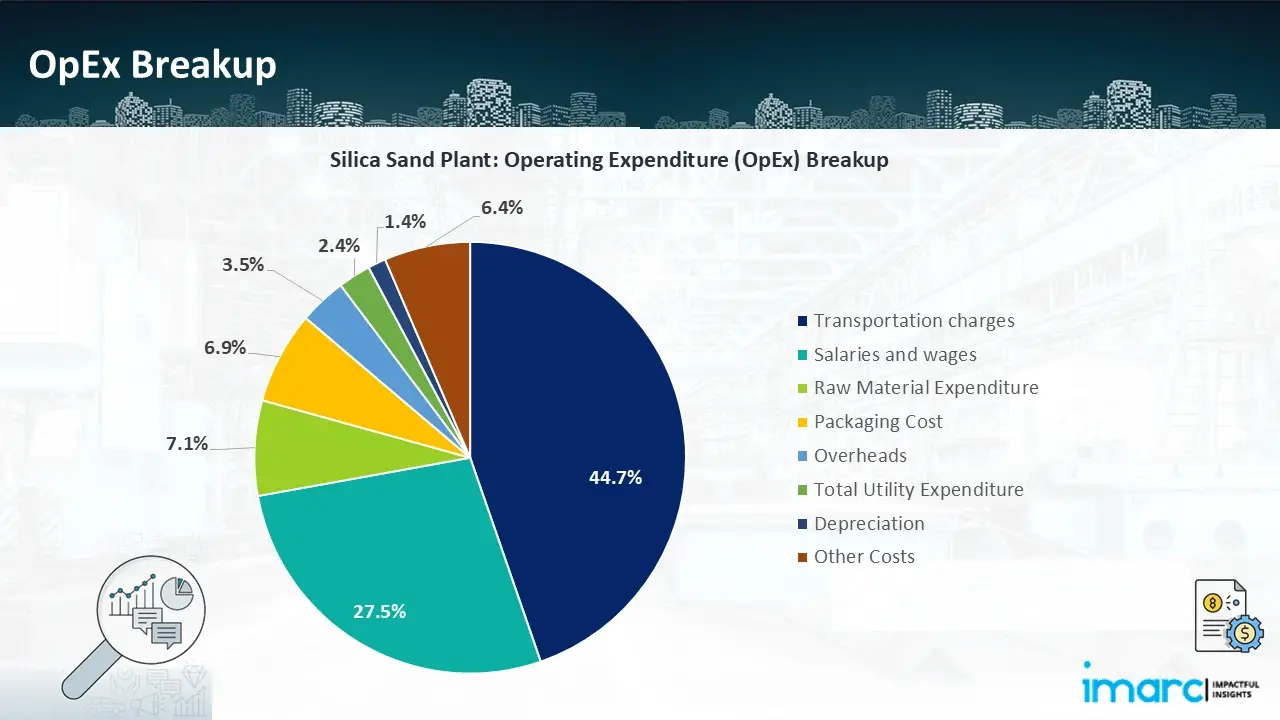

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. Opex in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth.

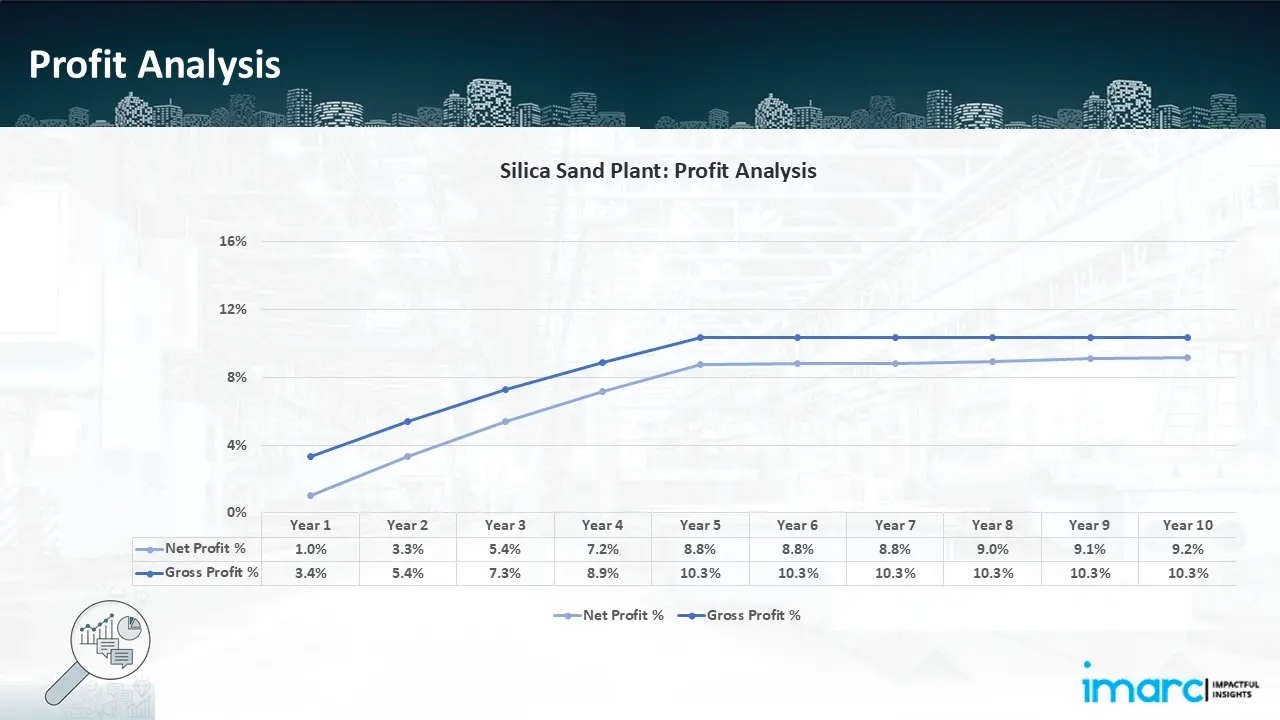

- Profitability Analysis Year on Year Basis: The proposed silica sand plant, with an annual capacity of 30,000 tons of silica sand, achieved an impressive revenue of US$ 1.34 million in its first year. We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the projected period. Moreover, gross profit margins improve from 3.4% to 10.3% by year 5, and net profit rises from 1.0% to 9.2%, highlighting strong financial viability and profitability.

Conclusion & IMARC's Impact:

Our silica sand manufacturing plant's financial model was meticulously modelled to satisfy the client's requirements. It provided a thorough analysis of production costs including capital expenditures, manufacturing processes, raw materials, and operating costs. The model predicts profitability while accounting for market trends, inflation, and any shifts in the price of raw materials. It was created especially to satisfy the demand of producing 30,000 tons of silica sand annually. Our commitment to offering precise, client-cantered solutions that ensure the long-term success of significant industrial projects by giving the client useful data for strategic decision-making is demonstrated by this comprehensive financial model.

Latest News and Developments:

- In December 2024, Konya Silica acquired Southern Ohio Sands and Beaver Pike Enterprises. The firms have been consolidated under a new brand name, Ohio Sands, broadening Konya Silica's operating presence in the area.

- In May 2024, Covia finalized its purchase of Sidley's Thompson, Ohio, silica sand mine. The transaction includes the reserves and quarry as well as the necessary buildings, equipment, and machinery, which enhance Covia's portfolio of leading industry products.

- In April 2024, U.S. Silica Holdings, Inc., a diversified industrial minerals business, signed a definitive merger agreement to be acquired by funds managed by affiliates of Apollo for around $1.85 Billion. The deal will make U.S. Silica a private enterprise that will continue operations under its current name and management.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Brief List of Our Services: Market Entry and Expansion

- Market Entry and Opportunity Assessment

- Competitive Intelligence and Benchmarking

- Procurement Research

- Pricing and Cost Research

- Sourcing

- Distribution Partner Identification

- Contract Manufacturer Identification

- Regulatory Approvals, and Licensing

- Factory Setup

- Factory Auditing

- Company Incorporation

- Incubation Services

- Recruitment Services

- Marketing and Sales

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104