Inhaled Nitric Oxide Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

Inhaled Nitric Oxide Market Size and Share:

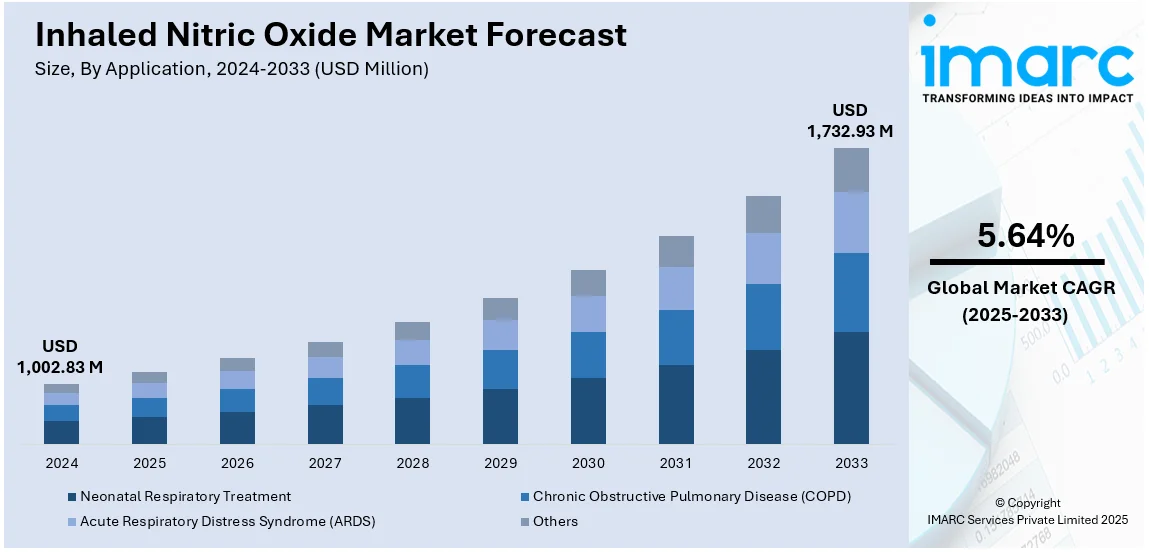

The global inhaled nitric oxide market size was valued at USD 1,002.83 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,732.93 Million by 2033, exhibiting a CAGR of 5.64% from 2025-2033. North America currently dominates the market, holding a market share of over 77.7% in 2024. The inhaled nitric oxide market share is expanding, driven by the rising adoption of clinical guidelines that support the widespread utilization of inhaled nitric oxide in neonatal intensive care units (NICUs), along with increasing investments in healthcare technology to enhance treatment methods, leading to better patient outcomes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,002.83 Million |

|

Market Forecast in 2033

|

USD 1,732.93 Million |

| Market Growth Rate 2025-2033 | 5.64% |

The increasing cases of neonatal complications are fueling the market growth. Hospitals and healthcare providers use inhaled nitric oxide as a critical treatment for newborns with hypoxic respiratory failure and patients suffering from acute respiratory distress syndrome (ARDS). The rising incidence of chronic obstructive pulmonary disease (COPD) and other lung disorders is further catalyzing the demand for inhaled nitric oxide. Besides this, advancements in drug delivery systems improve the efficiency and accessibility of inhaled nitric oxide therapy. Moreover, the growing investments in healthcare infrastructure and research are encouraging innovations, expanding its medical applications. Regulatory approvals and favorable healthcare policies support wider adoption, especially in developed regions.

The United States has emerged as a major region in the inhaled nitric oxide market owing to many factors. The increasing prevalence of respiratory diseases, neonatal complications, and pulmonary hypertension is offering a favorable inhaled nitric oxide market outlook. According to the data published on the official website of the United States government, as of February 2025, 6.5% of people in the US were suffering from respiratory syncytial virus (RSV). Hospitals rely on inhaled nitric oxide to treat newborns with hypoxic respiratory failure and patients with ARDS. Advanced healthcare infrastructure and strong investments in medical research and development (R&D) activities promote innovations, improving drug delivery systems and expanding therapeutic applications. Additionally, the presence of major pharmaceutical companies accelerates product development and availability. With a growing elderly population and rising awareness among the masses about respiratory care, the demand for inhaled nitric oxide in the US continues to strengthen across various healthcare settings.

Inhaled Nitric Oxide Market Trends:

Growing prevalence of respiratory diseases in newborns

The increasing prevalence of respiratory and other subsequent diseases in newborns is propelling the market growth. Many premature babies suffer from hypoxic respiratory failure and persistent pulmonary hypertension, conditions where inhaled nitric oxide helps to improve oxygen levels and reduce the need for invasive procedures like extracorporeal membrane oxygenation (ECMO). According to the NIH, lower respiratory infections in children under five accounted for 37.8 Million cases, 501,910 deaths, and 44.8 Million disability-adjusted life years worldwide. As preterm births rise globally, hospitals and neonatal care units rely more on this therapy to reduce complications. Regulatory approvals and clinical guidelines further support its widespread use in NICUs. Additionally, ongoing R&D efforts are assisting in exploring new applications for inhaled nitric oxide in treating other neonatal conditions, increasing its adoption. With high healthcare investments and enhanced neonatal care, the demand for inhaled nitric oxide is rising, making it a crucial treatment for newborn respiratory disorders.

Rising geriatric population

The growing geriatric population is positively influencing the market. Older adults are more susceptible to hypertension, atherosclerosis, peripheral artery disease, heart failure, and thrombosis, all of which require inhaled nitric oxide for vasodilation. As per a 2024 MDPI report, heart failure prevalence rose with age, annually affecting about 1% of individuals under 55 and exceeding 10% in those over 70. The elderly population is also relatively more prone to conditions like COPD, pulmonary hypertension, and ARDS, creating the need for effective oxygen therapy. Inhaled nitric oxide helps to improve oxygen flow and reduce lung pressure, making it a crucial treatment for elderly patients. As life expectancy rises, healthcare systems focus on advanced respiratory treatments, leading to higher adoption of inhaled nitric oxide in hospitals and long-term care facilities. With the increasing number of elderly individuals requiring respiratory support, the demand for inhaled nitric oxide is rising.

Increasing investments in advanced healthcare infrastructure

The rising investments in advanced healthcare infrastructure are fueling the inhaled nitric oxide market growth. According to the information provided on the official website of the International Trade Administration (ITA), in 2024, the Indian Government launched five new All India Institute of Medical Sciences (AIIMS) centers and introduced a total of 202 healthcare infrastructure initiatives throughout the country to promote progress in healthcare technologies. Well-equipped hospitals, specialized neonatal care units, and modern intensive care facilities widely employ inhaled nitric oxide for treating conditions like hypoxic respiratory failure, pulmonary hypertension, and ARDS. The availability of advanced medical equipment improves the efficiency of inhaled nitric oxide therapy, making it more effective for both newborns and adults with respiratory disorders. Strong investments in healthcare technology and R&D activities further enhance treatment methods, leading to better patient outcomes. Regulatory bodies also support innovations, encouraging the development of improved inhalation devices and drug delivery systems.

Inhaled Nitric Oxide Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global inhaled nitric oxide market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on application.

Analysis by Application:

- Neonatal Respiratory Treatment

- Chronic Obstructive Pulmonary Disease (COPD)

- Acute Respiratory Distress Syndrome (ARDS)

- Others

Neonatal respiratory treatment held 86.1% of the market share in 2024. It is the primary therapy for newborns with hypoxic respiratory failure and persistent pulmonary hypertension. Inhaled nitric oxide helps to improve oxygen levels by relaxing blood vessels in the lungs, reducing the need for invasive procedures like ECMO. Hospitals widely adopt this treatment due to its effectiveness and safety in managing neonatal respiratory distress. The increasing number of preterm births and rising cases of neonatal lung disorders further drive the demand for inhaled nitric oxide. Regulatory approvals and clinical guidelines support the employment of inhaled nitric oxide in neonatal care, ensuring its availability in healthcare settings. Additionally, ongoing research focuses on expanding its applications in premature infants, increasing its market dominance. With advancements in neonatal care and better access to specialized treatments, the requirement for inhaled nitric oxide in neonatal respiratory therapy is growing, keeping it at the forefront of the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for 77.7%, enjoys the leading position in the market. The region is noted for its strong healthcare infrastructure, high prevalence of respiratory diseases, and increasing neonatal complications. The region has a well-developed hospital network that widely adopts inhaled nitric oxide therapy for conditions like hypoxic respiratory failure in newborns and ARDS in adults. The rising cases of COPD and pulmonary hypertension further drive the demand for inhaled nitric oxide. As per the information provided on the official website of the National Library of Medicine, as of April 2024, a sum of 29,445 male and 14,693 female cases of COPD were registered in workers in Canada. The ongoing R&D efforts by pharmaceutical companies contribute to continuous innovations in drug delivery systems and treatment protocols. Favorable regulatory policies and approvals from government agencies are supporting the market growth by ensuring safety. Additionally, high healthcare spending and reimbursement policies make inhaled nitric oxide treatments more available to patients.

Key Regional Takeaways:

United States Inhaled Nitric Oxide Market Analysis

The United States holds 93.20% of the market share in North America. The market in the United States is significantly driven by the increasing incidence of neonatal hypoxic respiratory failure, pulmonary hypertension (PAH), and ARDS. The Pulmonary Hypertension Association Registry anticipated that in 2022, the mortality rates for patients with PAH at 1, 2, and 3 years were 8%, 16%, and 21%, respectively, in the US. In 2011, the estimated prevalence of PAH was 109 per Million in commercially insured individuals and 451 per Million in Medicare patients, whereas in 2022, projections suggested approximately 40,000 adult PAH patients in the country. The high adoption of inhaled nitric oxide therapy in NICUs and post-cardiac surgery patients is driving the demand. The market is witnessing significant innovations, with companies developing advanced inhaled nitric oxide delivery systems that eliminate bulky gas cylinders, improving hospital efficiency and patient care. Regulatory approvals for portable and home-use inhaled nitric oxide devices are expanding accessibility beyond hospital settings. Increased competition is accelerating advancements in cost-effective and safer inhaled nitric oxide therapies. Moreover, the rising focus on digital health integration and precision dosing is supporting the market growth.

Europe Inhaled Nitric Oxide Market Analysis

The European market is expanding due to the strong healthcare infrastructure, rising cases of chronic lung diseases, and increasing preterm births requiring respiratory support. According to the European Environment Agency, in 2021, respiratory diseases were the third leading cause of death in its member countries, accounting for approximately 420,000 fatalities annually, with over 60% due to chronic respiratory diseases (CRDs). Environmental factors contributed to one-third of these deaths, nearly 80,000 preventable fatalities each year. Air pollution (14%), extreme temperatures (11%), occupational exposures (8%), and second-hand smoke (3%) were major risk causes. Regulatory frameworks, including CE Mark approvals, ensure high standards for inhaled nitric oxide therapy, promoting its use in hospitals and specialized clinics. Research into inhaled nitric oxide’s role in treating PAH and post-operative care is driving the demand. Increased investments in precision medicine and artificial intelligence (AI)-based monitoring systems are improving therapy efficiency. Collaborations between healthcare institutions and pharmaceutical companies are leading to innovations.

Asia-Pacific Inhaled Nitric Oxide Market Analysis

The Asia-Pacific market is seeing a rapid rise attributed to increasing healthcare investments, rising neonatal respiratory disorders, and the growing awareness about advanced respiratory treatments. According to the India Brand Equity Foundation, India’s healthcare sector was valued at USD 372 Billion in 2024, employing 7.5 Million people. Public healthcare spending reached 1.9% of GDP in FY24, while the hospital market, worth USD 98.98 Billion in 2023, is set to attain USD 193.59 Billion by 2032. China, Japan, and India are leading in inhaled nitric oxide adoption, driven by government initiatives to improve neonatal and pulmonary care. The expansion of tertiary hospitals and research centers is catalyzing the demand for advanced inhaled nitric oxide delivery systems. Industry leaders are investing in localized production and cost-effective solutions to refine market penetration.

Latin America Inhaled Nitric Oxide Market Analysis

In Latin America, the market is experiencing growth on account of the improved healthcare infrastructure, neonatal care awareness, and rising respiratory illness cases. An NIH review of 3,627 ARDS patients in 32 studies found 52% mortality rate in Latin America in 2023, varying by study type and region. Brazil and Mexico lead inhaled nitric oxide adoption through government pediatric and critical care initiatives. Investments in cost-effective respiratory therapies are enhancing local production and distribution. Portable inhaled nitric oxide delivery systems are expanding access in remote areas. Moreover, private-sector investments and worldwide collaborations are improving inhaled nitric oxide availability. Research into inhaled nitric oxide for respiratory infections and pulmonary conditions is further creating new market opportunities across Latin America.

Middle East and Africa Inhaled Nitric Oxide Market Analysis

The market in the Middle East and Africa is experiencing growth driven by rising investments in neonatal and critical care, particularly in GCC countries. Increasing respiratory diseases, premature births, and ARDS cases are driving hospital demand for inhaled nitric oxide therapy. During Q1 2024, the Dubai Health Authority (DHA) reported a 9% increase in healthcare settings and a 7% rise in professionals, licensing 12,319 specialists and 150 centers, totaling 5,020 facilities and 59,509 healthcare workers. Partnerships with international healthcare providers are promoting inhaled nitric oxide technology adoption.

Competitive Landscape:

Key players work on developing efficient solutions to meet the high inhaled nitric oxide market demand. They are investing in R&D activities to improve drug delivery systems and expand the medical applications of inhaled nitric oxide. They focus on creating modern inhalation devices that enhance treatment efficiency and patient outcomes. Strategic partnerships with healthcare providers and research institutions help to strengthen distribution networks and accelerate innovations. Regulatory approvals and compliance with safety standards ensure widespread adoption in hospitals and clinics. Key companies also wager on clinical trials to explore new therapeutic uses, increasing market potential. Marketing efforts and awareness campaigns educate healthcare professionals on the benefits of inhaled nitric oxide therapy, driving the demand. Additionally, broadening production capabilities and improving supply chain efficiency are making treatments more accessible. For instance, in February 2024, Third Pole Therapeutics reported the successful conclusion of a preliminary feasibility study for eNOfit, a portable delivery system for inhaled nitric oxide aimed at treating pulmonary hypertension linked to interstitial lung disease. The two-pound appliance enabled use at home and while on the go. This achievement promoted clinical trials and activated the final financing of Third Pole’s USD 32 Million Series B funding round.

The report provides a comprehensive analysis of the competitive landscape in the inhaled nitric oxide market with detailed profiles of all major companies, including:

- Air Liquide S.A

- Bellerophon Therapeutics

- Beyond Air Inc.

- Linde plc

- Mallinckrodt plc

- Merck KGaA

- Novoteris LLC

- Nu-Med Plus

- VERO Biotech LLC

Latest News and Developments:

- January 2025: Beyond Air declared that its LungFit PH device was granted market approval in Australia. Employing Ionizer technology, it produced nitric oxide from the surrounding air for patients on ventilation. LungFit PH removed the necessity for NO cylinders, enhancing sustainability in hospitals. It was approved by the FDA in the US and marked with a CE in Europe.

- February 2025: Linde Gas & Equipment Inc. filed a 510(k) application with the FDA for NOXBOX I PLUS, an enhanced inhaled nitric oxide delivery system for NOXIVENT treatment. Improvements featured better compatibility, ergonomic adjustments, and simplified installation. The company persisted in its dedication to nitric oxide therapy, with NOxBOXi currently utilized in over 40 countries.

- December 2024: Beyond Cancer revealed that the Israeli Ministry of Health approved a Phase 1b clinical trial of LV UNO, an ultra-high concentration nitric oxide treatment, alongside anti-PD-1 for solid tumors. Carried out at four locations, the study was intended to evaluate effectiveness, immune reaction, and safety in 20 individuals.

- October 2024: Mallinckrodt declared the launch of the FDA-approved INOmax EVOLVE DS in the United States. It was an advanced nitric oxide delivery system for NICU patients. With AI-based automation, mini-cylinders, and EMR integration, it aimed to boost efficiency and safety. Having been in clinical use for more than 20 years, INOmax provided treatment for over 875,000 patients worldwide.

Inhaled Nitric Oxide Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Neonatal Respiratory Treatment, Chronic Obstructive Pulmonary Disease (COPD), Acute Respiratory Distress Syndrome (ARDS), Others |

| Regions Covered | North America, Asia-Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Air Liquide S.A, Bellerophon Therapeutics, Beyond Air Inc., Linde plc, Mallinckrodt plc, Merck KGaA, Novoteris LLC, Nu-Med Plus, VERO Biotech LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the inhaled nitric oxide market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global inhaled nitric oxide market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the inhaled nitric oxide industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The inhaled nitric oxide market was valued at USD 1,002.83 Million in 2024.

The inhaled nitric oxide market is projected to exhibit a CAGR of 5.64% during 2025-2033, reaching a value of USD 1,732.93 Million by 2033.

The rising prevalence of COPD and other lung disorders is catalyzing the demand for inhaled nitric oxide. Besides this, advancements in medical technology improve drug delivery systems, making inhaled nitric oxide therapy more effective and accessible. Moreover, the growing investments in healthcare infrastructure and research are helping to expand the applications of inhaled nitric oxide in various medical conditions.

North America currently dominates the inhaled nitric oxide market, accounting for a share of 77.7% in 2024, due to its strong healthcare infrastructure, high prevalence of respiratory diseases, advanced research, and favorable regulatory policies. Key industry players, high healthcare spending, and widespread hospital adoption are further fueling the market growth in the region.

Some of the major players in the inhaled nitric oxide market include Air Liquide S.A, Bellerophon Therapeutics, Beyond Air Inc., Linde plc, Mallinckrodt plc, Merck KGaA, Novoteris LLC, Nu-Med Plus, VERO Biotech LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)