Inhalation Anesthesia Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2025-2033

Inhalation Anesthesia Market Size and Share:

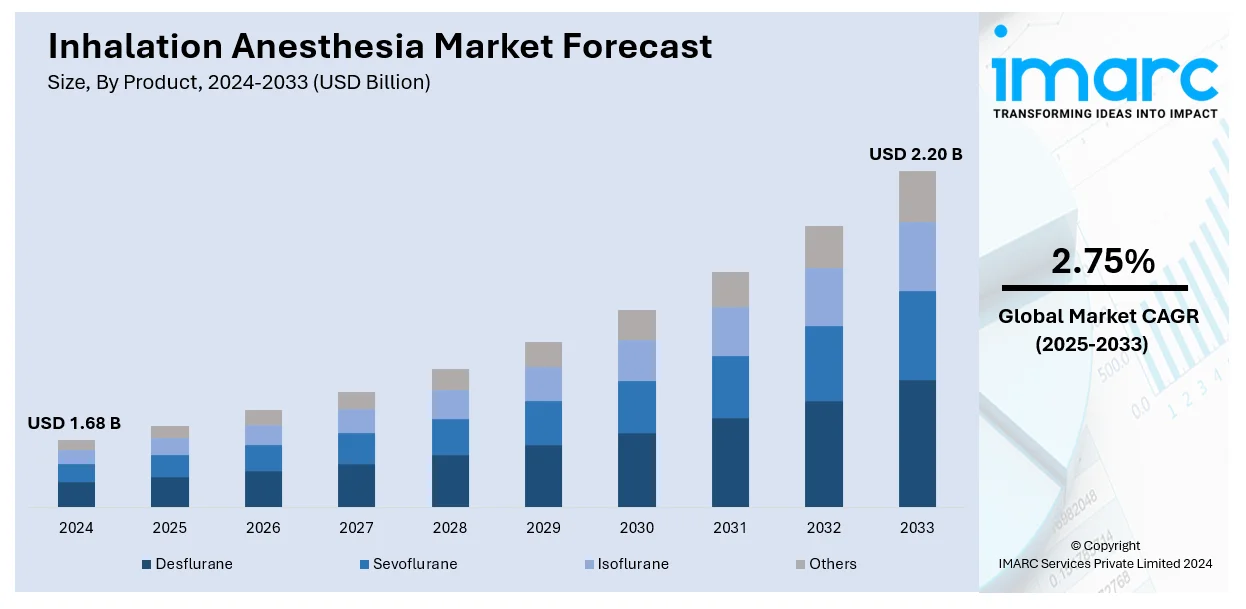

The global inhalation anesthesia market size reached USD 1.68 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.20 Billion by 2033, exhibiting a growth rate (CAGR) of 2.75% during 2025-2033. North America currently dominates the market, holding a market share of 52.8% in 2024. The growing number of people experiencing chronic medical conditions, along with collaborations among pharmaceutical firms, medical device companies, and healthcare institutions, is driving the market forward. Besides this, inhalation anesthesia market share is benefiting from the rising investments in advanced equipment by governments and private healthcare providers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.68 Billion |

|

Market Forecast in 2033

|

USD 2.20 Billion |

| Market Growth Rate 2025-2033 | 2.75% |

Increased government investments in healthcare facilities enhance access to surgical care and modern anesthetic technologies. Construction of new hospitals and surgical centers improves the availability of advanced inhalation anesthetic systems. Training programs for anesthesiologists in developing countries bolster the adoption of safe and effective anesthetics. Rising medical tourism in countries like India and Thailand increases the demand for inhalation anesthesia services. Advanced surgical procedures in emerging markets increases the use of modern anesthetic agents like sevoflurane and desflurane. Expanding health insurance coverage improves affordability and access to surgical treatments requiring inhalation anesthesia. Public-private partnerships (PPP) in healthcare projects promote the integration of advanced anesthetic technologies in underserved areas.

Innovative anesthesia machines allow precise monitoring and controlled delivery of inhalation anesthetics during surgical procedures. Improved pharmacokinetics of agents like sevoflurane enable rapid induction and faster post-operative recovery times. Integrated software systems in anesthesia machines enhance workflow efficiency and reduce risks of human error. Non-invasive monitoring technologies ensure real-time feedback on patient vitals, optimizing anesthesia administration and patient safety. Portable and compact anesthesia devices are increasingly utilized in outpatient settings and ambulatory surgical centers. Development of environmentally friendly anesthetic agents reduces the environmental impact of traditional inhalation anesthetics. Advancements in pediatric and geriatric anesthesia techniques cater to specialized healthcare needs in vulnerable populations. Telemedicine and remote monitoring tools support anesthetic care in underserved and rural areas. Artificial intelligence (AI) integration in anesthesia planning aids in personalized dosing and predictive patient outcome models. In May 2024, Panoramic Health launched a state-of-the-art ambulatory surgery center (ASC) in Tampa, Florida. The new center aims to provide high-quality, efficient outpatient surgical services for various medical procedures. Equipped with the latest technologies, the facility ensures precision, safety, and improved patient outcomes during surgeries.

Inhalation Anesthesia Market Trends:

Continual advancements in anesthetic agents and delivery systems

Pharmaceutical companies and medical device manufacturers are heavily investing in research and development (R&D) to create more effective and safer anesthetic gases and vapors. These innovations aim to enhance patient outcomes by reducing the risk of adverse effects and improving the overall anesthesia experience. Newer agents are being developed with improved pharmacokinetic profiles, enabling faster induction and emergence from anesthesia, thus shortening the time patients spend in the operating room. The most often used medication to induce general anesthesia is propofol (1 to 2.5 mg/kg IV). Furthermore, the development of sophisticated delivery systems, including precise vaporizers and monitoring technologies, ensures accurate administration and titration of anesthetic agents, minimizing the chances of over or under dosing. These advancements not only contribute to better patient care but also attract healthcare providers to adopt these modern solutions, thus impelling the inhalation anesthesia market growth.

Rising surgical procedures and patient volume

Population growth is normally associated with aging, which calls for increased numbers of surgical operations. The elderly generally require more operations because of conditions like heart diseases, replacements of joints, and treatments of cancer. Surgeon specialties including orthopedic, cardiology, oncology, and general surgery, require inhalation anesthesia for surgeries. Inhalation anesthesia becomes a preferred choice for these interventions because it produces immediate and controllable depth of sedation. It therefore constitutes a balance between the unconsciousness of the patient and stability of vitals. Additionally, the growth of medical knowledge and technology has stretched the scope of possible surgical interventions. As per the National Institute of Health in 2022, 53% of surgical patients were aged 65 years or older. Minimally invasive procedures, robotics-assisted surgeries, and other innovative techniques are emerging that allow for safer and quicker interventions.

Expansion of ambulatory surgical centers

Ambulatory surgical centers (ASCs) provide many benefits, such as cost-effectiveness, shorter patient stays, and reduced risk of hospital-acquired infections. ACS patient volumes exceeded 1.2 billion in June 2023, a 13% increase from pre-pandemic levels, based on data from the Health Industry Distributors Association. Inhalation anesthesia fits well with the needs of ASCs because of its rapid onset and quick recovery profile. Patients who present themselves for various procedures at ASCs opt for inhalation anesthesia because it offers quick recovery. Additionally, post-operative nausea and vomiting that occur after being under anesthesia are less in inhalation type, making it precious in an ambulatory setting. The market of inhalation anesthesia is experiencing substantial growth as more and more ASCs are required to meet the surging requirement of outpatient surgical services. It also encourages producers to create user-friendly and mobile anesthesia delivery devices designed for use in ASC settings.

Inhalation Anesthesia Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global inhalation anesthesia market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on product, application, and end user.

Analysis by Product:

- Desflurane

- Sevoflurane

- Isoflurane

- Others

Sevoflurane is the leading market with 56.0% market share in 2024. Based on the study, sevoflurane is gaining traction, and this is significantly attributed to the favorable pharmacokinetic profile. This agent allows for rapid induction so that anesthesiologists can guide the patient quickly and smoothly into and out of anesthesia. This, in turn, not only makes the process in the medical facilities more efficient but also ensures that patients face minimal delay in the onset and offset of surgical procedures. In addition, the low blood-gas solubility of sevoflurane enables equilibration between the lungs and the bloodstream very quickly, meaning quicker adjustments in the depth of anesthesia, consequently leading to quicker recoveries. This makes sevoflurane less likely to cause organ toxicity or compromise of vital functions and provides some level of reassurance to medical practitioners and patients alike. The safety profile has thus been crucial in making sevoflurane a staple of inhalation anesthesia practice, especially in pediatric and geriatric populations, where safety is of paramount importance.

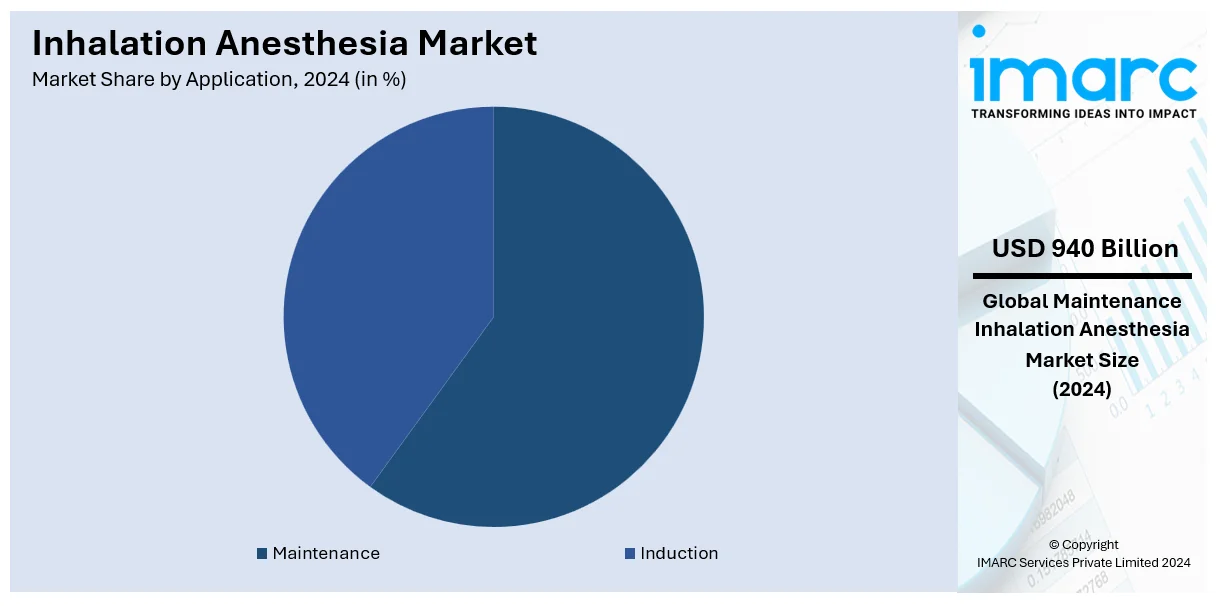

Analysis by Application:

- Induction

- Maintenance

Maintenance dominates the market with 55.7% of market share in 2024. According to the report, maintenance ensuring patient comfort, surgical precision, and optimal outcomes. Once the patient is induced into anesthesia and the initial surgical incisions are made, maintaining the appropriate anesthetic depth becomes paramount. Anesthesia providers carefully titrate inhalation anesthetic agents to balance the patient's need for complete insensitivity to pain while avoiding over-sedation, which could lead to complications or lengthened recovery times. This dynamic balance requires continuous monitoring and adjustment throughout the procedure, highlighting the importance of skilled anesthesiologists. Moreover, the maintenance phase is directly linked to surgical efficacy and precision. Surgeons rely on patients being adequately anesthetized and immobilized to perform delicate procedures with accuracy. Any fluctuation in the anesthesia depth during the maintenance phase could lead to patient movement or awareness, potentially compromising the surgery's success.

Analysis by End User:

- Hospitals

- Ambulatory Surgical Centers

- Others

Hospitals hold the largest market share with 67.8% of market share in 2024. Hospitals are a comprehensive healthcare provider that offer the full spectrum of medical services including routine surgeries, emergency interventions, and specialized procedures in various specialties. The sheer volume and variety of surgical interventions conducted in hospitals create a significant demand for anesthesia services. Inhalation anesthesia, which is capable of rapid induction and adjustable levels of sedation, fits seamlessly into the changing hospital operating rooms' environment. They are also equipped with advanced operating theaters, high technology monitoring systems, and experienced teams of anesthetists for handling a variety of cases. Such a well-established infrastructure allows the hospitals to effectively handle all the complexities arising with different kinds of surgeries that demand inhalation anesthesia. Besides, the fact that there exist separate units like pediatric and cardiac surgery departments within hospitals reflects the applicability of inhalation anesthesia to varied patient groups and different kinds of surgical interventions.

Regional Analysis

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 52.8%. North America is characterized by its emphasis on medical advancements and innovation. The presence of renowned research institutions, academic medical centers, and cutting-edge pharmaceutical companies fosters an environment conducive to the development of new anesthetic agents, delivery methods, and monitoring technologies. For example, in April 2024, Commons Clinic invested $9.75 million in launching an advanced spine surgery center in the United States. The center will feature a next-generation ambulatory surgical platform designed to enhance surgical efficiency. This commitment to innovation not only enhances patient care but also attracts healthcare professionals to adopt state-of-the-art anesthesia practices, including inhalation anesthesia techniques. The region's regulatory landscape and adherence to stringent safety standards further contribute to its dominance. Regulatory agencies such as the US Food and Drug Administration (FDA) play a pivotal role in ensuring the safety and efficacy of anesthesia agents and equipment. This rigorous oversight augments the confidence of healthcare providers and patients in the use of inhalation anesthesia, solidifying North America's position as a leader in the field. Also, North America's focus on medical education and training ensures that anesthesia providers are well-equipped to administer inhalation anesthesia safely and efficiently.

Key Regional Takeaways:

United States Inhalation Anesthesia Market Analysis

The United States hold 84.80% of the market share in North America. The main factors driving the inhalation anesthesia market demand in the United States are the increasing count of surgical procedures, the aging population, and improvements in healthcare infrastructure. According to paper published in ResearchGate, nearly 310 million major surgeries are conducted every year, with a big share going to the United States due to its developed healthcare system and high demand for surgery. According to the American Heart Association, over 121 million people suffering from chronic conditions that include cardiovascular disorders, which increases the demand for inhaled anesthesia systems, which can ensure safety, efficacy, of such anesthetic anesthesia delivery. The increasing demand for minimal invasive surgical practices, which boast shorter recovery time and fewer postoperative complications, further fuels this demand for inhalation anesthesia. Significant US manufacturers and increased interest in the need for balanced anesthesia also help propel the growth within the market.

Europe Inhalation Anesthesia Market Analysis

The market in Europe is driven by a robust healthcare system and the demographic of an ageing population. Europe has an aging population with 20% being 65 years or older as revealed by Eurostat. Long-term illnesses, such as cancer and neurological diseases require surgery hence, there is a considerable growth in demand for this medical procedure. More than 3.9 million cancer cases are reported in Europe, as per an industry report. Thus, it is important to have efficient solutions for anesthesia during surgeries. In addition, the European Union's emphasis on raising the healthcare standards and promoting minimally invasive surgical methods aids in market expansion. The government initiatives to enhance surgical treatment accessibility also increases the demand for inhalation anesthetics, such as desflurane and isoflurane. The extensive surgery volume and state-of-the-art medical facilities in countries like Germany, France, and the UK make them major contributors.

Asia Pacific Inhalation Anesthesia Market Analysis

Increasing populations, demand for surgeries, and healthcare infrastructural development drive the market for inhalation anesthesia in the Asia-Pacific. According to reports growing population with surgery demands in a country like China and India, comprising more than 36% of world population. Along with this, growing chronic diseases burden, especially the among diabetic population and the risk of cardiovascular problems, are leading to more surgeries in the region. For instance, according to an industry report, China documented more than 4.8 million new cancer cases in 2022 alone, which is the driving factor to promote the demand for effective anesthesia. The market is therefore expanding due to the increasing medical tourism sites in countries like Malaysia, Singapore, and Thailand. Moreover, the increasing adoption of advanced anesthesia delivery systems and government initiatives to expand access to quality healthcare ensure the high adoption of inhalation anesthetics, such as halothane and sevoflurane.

Latin America Inhalation Anesthesia Market Analysis

Increasing surgical procedures and improvement in healthcare facilities are driving the market in Latin America. Based on the 2019 estimates from the Global Procedure Volume Tracker of LSI, the three procedure types with the greatest volume in Brazil, includes obstetrical and gynecological procedures (4.4 million); general surgical procedures (3.2 million); and aesthetic, dermatological and plastic surgery related procedures (1.7 million). Increasing trends of lifestyle-associated disorders, obesity, and other cardiovascular diseases accelerate the adoption rate of inhalation anesthetics due to heightened surgical needs. In countries like Costa Rica and Colombia, affordable surgical procedures attract the inflow of patients from overseas. Medical tourism is also picking up in these regions. Additional incentives are emerging due to this region's heightened emphasis on improving safety when utilizing anesthesia and incorporating advanced technologies for its administration. Additionally, collaborations between global medical technology firms and local healthcare providers facilitate access to high-quality anesthesia products.

Middle East and Africa Inhalation Anesthesia Market Analysis

Growing investments in healthcare infrastructure and increased focus on surgical treatment are fueling the market growth in the Middle East and Africa. The Gulf Cooperation Council (GCC) countries including the United Arab Emirates and Saudi Arabia, lead the region in modern surgical capabilities with more than 1.8 million surgeries in 2022, as per reports. The region is experiencing more cases of chronic diseases like diabetes and cancer, which requires surgical interventions. The modernization of healthcare systems is being made by governments by investing in cutting-edge anesthesia equipment. Increased access to surgical treatment is through international collaborations and assistance initiatives in Africa, hence rising the demand for inhalation anesthetics, such as halothane and isoflurane.

Competitive Landscape:

Pharmaceutical and medical device companies are heavily investing in research and development (R&D) to create advanced anesthetic agents, delivery systems, and monitoring technologies. Moreover, companies are frequently introducing new inhalation anesthesia products and equipment to cater to the evolving needs of healthcare providers and patients. These products often incorporate the latest technological advancements, such as more precise vaporizers, integrated monitoring systems, and user-friendly interfaces. Additionally, leading players are focusing on developing innovative technologies that enhance the administration and monitoring of inhalation anesthesia. This includes the integration of electronic medical records (EMR) systems, real-time data analysis, and remote monitoring capabilities to ensure optimal patient care and safety. Additionally, numerous companies are providing training and educational programs to healthcare professionals, including anesthesiologists, nurse anesthetists, and operating room staff. These programs help ensure that healthcare providers are well-versed in the latest techniques, technologies, and safety measures related to inhalation anesthesia.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Abbvie Inc.

- Baxter International Inc.

- Fresenius SE & Co. KGaA

- Halocarbon Products Corporation

- Hikma Pharmaceuticals PLC

- Lunan Pharmaceutical Group Co. Ltd

- Merck KGaA

- Piramal Enterprises Ltd.

- Troikaa Pharmaceuticals Ltd.

Latest News and Developments:

- May 2024: Phoenix Micron unveiled a cutting-edge animal stand that incorporates anesthesia delivery to improve veterinarian treatments' accuracy and safety. The technology offers better usefulness for researchers and veterinarians by fusing ergonomic design with effective anesthesia management. With an emphasis on animal welfare and operational convenience, this invention seeks to optimize processes in animal care and research environments.

- January 2024: Boryung signed a sales agreement with Baxter Korea to put up inhalation anestesia Suprane Solution and Plasma Lyte 148 Inj 1,000ml up for sale in the domestic market. Suprane (desflurane), the initial medication created by Baxter, is a prominent inhalational anesthetic utilized for the induction and maintenance of anesthesia throughout surgical procedures.

- July 2024: Sentara hospitals are planning to lower greenhouse gas emissions of anesthesia by employing less-damaging gasses instead of desflurane.

- February 2024: VERO Biotech Inc. declared the FDA approval of its unique second generation GENOSYL® Inhaled Nitric Oxide (iNO) delivery system for the adoption with rebreathing anesthesia in the operating room setup.

- January 2023: Sedana Medical AD has reported that the FDA has awarded Fast Track Designation (FTD) for isoflurane measurement using the Sedaconda ACD-S device for the sedation of patients on mechanical ventilation in the intensive care unit (ICU).

Inhalation Anesthesia Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Desflurane, Sevoflurane, Isoflurane, Others |

| Applications Covered | Induction, Maintenance |

| End Users Covered | Hospitals, Ambulatory Surgical Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbvie Inc., Baxter International Inc., Fresenius SE & Co. KGaA, Halocarbon Products Corporation, Hikma Pharmaceuticals PLC, Lunan Pharmaceutical Group Co. Ltd, Merck KGaA, Piramal Enterprises Ltd., Troikaa Pharmaceuticals Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, inhalation anesthesia market outlook, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global inhalation anesthesia market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the inhalation anesthesia industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The anesthesia market was valued at USD 1.68 Billion in 2024.

IMARC estimates the anesthesia market to reach USD 2.20 Billion by 2033, exhibiting a growth rate (CAGR) of 2.75% during 2025-2033.

The inhalation anesthesia market growth is driven by the rising number of surgeries due to chronic diseases and aging populations, increasing demand for rapid induction and recovery times, and advancements in anesthetic agents like sevoflurane and desflurane. Expanding healthcare infrastructure, especially in Latin America, Asia-Pacific and other emerging markets, has improved access to surgical care, improving adoption. Additionally, growing demand for pediatric and geriatric anesthesia, where inhalation agents are favored for their safety and adjustability, further supports the market growth.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the anesthesia market include Abbvie Inc., Baxter International Inc., Fresenius SE & Co. KGaA, Halocarbon Products Corporation, Hikma Pharmaceuticals PLC, Lunan Pharmaceutical Group Co. Ltd, Merck KGaA, Piramal Enterprises Ltd., Troikaa Pharmaceuticals Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)