Inflight Catering Market Size, Share, Trends and Forecast by Food Type, Flight Service Type, Aircraft Seating Class, and Region, 2026-2034

Inflight Catering Market Size and Share:

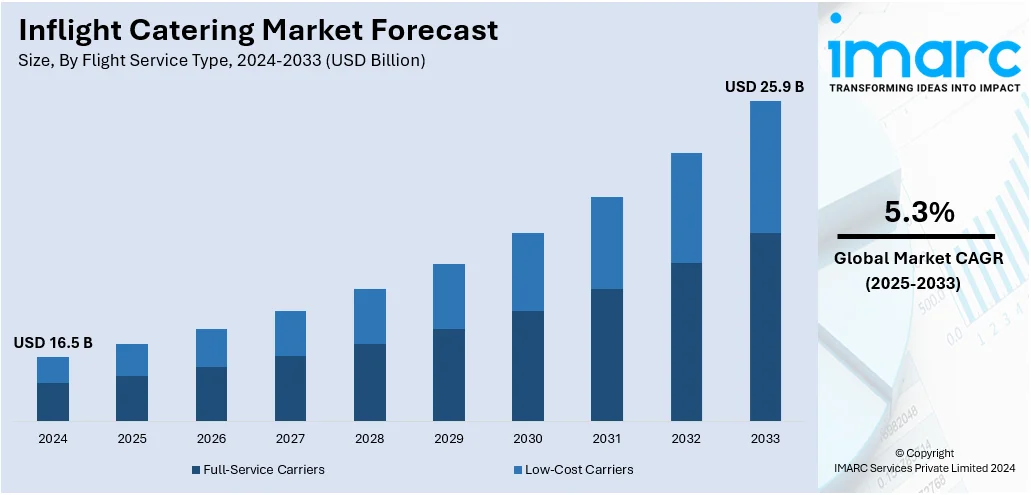

The global inflight catering market size was valued at USD 16.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 25.9 Billion by 2034, exhibiting a CAGR of 5.3% from 2026-2034. Asia Pacific currently dominates the market with 31.6% share in 2024. The market is driven by the massive usage of in-flight catering throughout the aviation sector due to the growing competitiveness of airlines, technological advancements, and rising internet penetration.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 16.5 Billion |

|

Market Forecast in 2034

|

USD 25.9 Billion |

| Market Growth Rate 2026-2034 | 5.3% |

The inflight catering market is increasing due to the expansion of global air travel, rising disposable incomes, and evolving passenger expectations for superior onboard experiences. It is in such segments as the premium economy and business class that the airlines are particularly using inflight catering services for brand differentiation and passenger satisfaction. The market is increasingly catering to diverse dietary preferences, offering vegan, gluten-free, halal, and other specialty meal options to accommodate a global clientele. Long-haul and international flights dominate the market, where high-quality catering services play a critical role in ensuring passenger comfort and loyalty. Most noticeably emerging as a trend in the inflight catering industry is sustainability, whereby airlines are stepping up their ecological game with biodegradable packaging, ingredients locally sourced, and initiatives meant to reduce food waste. Technology advancements, such as smart food management systems and efficient cold chain logistics, are improving the delivery and quality of meals and reducing operational costs. In-flight dining is also being made attractive by partnerships with celebrity chefs and well-known food brands, thereby changing this functional necessity into a memorable feature of air travel. Low-cost carriers are changing the market by making pay-as-you-go meal services in demand. They allow passengers to choose meals based on their preferences.

To get more information on this market, Request Sample

The United States has emerged as a key regional market for inflight catering due to the healthy development of its aviation industry, including huge traffic from domestic and international routes. As part of their strategies to differentiate in services, US-based airlines value inflight catering significantly, and premium cabins of business and first class get more priority. The rising demand for healthier, or customized, food choices in vegan, gluten-free, and non-allergenic varieties serves as a reflection of consumer trends being directed toward tailor-made products. Long-haul flights and even transcontinental route segments will influence the market even more, as in-flight travelers across these flight routes tend to demand more enhanced meals and other beverages during journeys. Sustainability is a growing focus in the U.S. inflight catering market, with airlines adopting eco-friendly initiatives such as reducing single-use plastics, sourcing local ingredients, and minimizing food waste. Furthermore, the development of technology, including better food storage and delivery systems, improves meal quality while optimizing costs. As air travel continues to recover post-pandemic, the U.S. inflight catering market is poised for steady growth, driven by innovation and passenger-centric offerings.

Inflight Catering Market Trends:

Rising Popularity of Nutritious and High-End Food Choices in Inflight Catering

The inflight catering market is seeing a surge in demand for healthy, premium food options, driven by health-conscious travelers. In response, airlines are expanding their menu offerings to cater to specific dietary needs like vegan, gluten-free, low-calorie, and allergen-free meals. These options are now common on both short and long-haul flights, aligning with the growing wellness and sustainability trends in aviation. For instance, American Airlines introduced alcohol-free beverages, including five new health-focused mocktails with ingredients like turmeric and elderberry, oat milk creamer, and La Croix sparkling water, catering to the growing demand for alcohol-free lifestyles. The airline’s revamped menu offers diverse dietary options-vegetarian, vegan, kosher, lactose-free, Muslim, Hindu, diabetic, and gluten-free-available for pre-order, promoting hydration and nutrition. Partnering with the FitOn app, American provides in-flight guided stretching and meditation videos to combat discomfort from prolonged sitting. Airlines are using such such initiative to gain a competitive edge, enhancing passenger experience.

Growth in air travel

Population growth, rising levels of urbanization, and shifting demographics, such as the increasing middle class in many parts of the world, are shaping the inflight catering market trends around the world. According to the International Air Transportation Association (IATA) report, January 2024 was a strong start for the global industry. For example, RPK, which is the total revenue passenger-kilometers, was up by 16.6% YoY in January, the industry had reached the closest point ever to monthly recovery, as traffic was at 99.6% of 2019 levels. Also, international traffic continued its growth, with January RPKs at 95.7% of pre-pandemic levels and up 20.8% YoY. Apart from this, various airlines are offering affluent passenger experiences due to the increasing automation of the in-flight catering system and advancements in catering management. Airlines always look for customized services for potential onboard customers, such as advance meal ordering services. Newrest began providing hot meal services on the two-class Air Transat flights from several countries in Europe such as Belgium, England, France, the Netherlands, Portugal, and Spain in March 2022. In addition, airlines are embracing a new fad of continental meal options offered to their clients, which would cater to the individual meal requirements of the customers and increase customer satisfaction. This will, in the future, tend to provide high growth opportunities for the market overall.

Growing competition and differentiation in airlines

Rising competition amongst the airlines is leading to the adoption of some strategies that improve inflight dining services. These strategies range from the process of ordering food to serving. Further, to adapt to the hybrid operational scenarios, airlines are using different service strategies for classes on the same flight to provide service to the customers. For example, while offering top-of-the-line services at a premium price to high-value passengers (in business and first class), airlines also offer cheaper alternatives to economy class passengers, which creates tier-based free onboard services. In line with this, IndiGo, India's low-cost carrier, revealed in November 2021 that it was resuming its meal services that were suspended since the COVID-19 pandemic. This came following the Indian Civil Aviation Ministry allowing airlines to resume in-flight meal services on all domestic flights. In addition to this, the flexibility of cultural dining always contributes to the comfort and interest of travelers. For example, in international flights flying to regions where there is a huge level of diversification in food habits, such as the Middle East, caterers are designing meals by their understanding of the tastes of destination flyers. Such initiatives are projected to boost the inflight catering demand in the coming years.

Airline alliances and partnerships

Several airlines and catering service providers are establishing alliances and partnerships to benefit from the increased purchasing power and negotiate better deals with catering suppliers. Bulk purchasing would result in saving costs on food and beverage products and the logistics and distribution of catering services. Such an alliance enables the airlines to standardize catering services, ensuring consistency and quality of the inflight dining experience. For instance, in July 2021, gategroup signed a renewal agreement to partner with LATAM Airlines to provide inflight catering services for another five years. Under the agreement, gategroup will service LATAM Airlines at 16 locations which includes Bogotá, Colombia, and Santiago, Chile. Just recently, in June 2023, health and wellness company Gulf Marketing Group partnered with Emirates Flight Catering to provide a special range of take-to-go meals. These meals are prepared using fresh, quality ingredients and recyclable materials. The food options include vegetarian, vegan, and gluten-free alternatives. The meals can be found at GMG's retail stores throughout the UAE. Such initiatives and the increasing partnerships between caterers and airlines are likely to boost the inflight catering market share over the coming period.

Inflight Catering Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global inflight catering market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on food type, flight service type, and aircraft seating class.

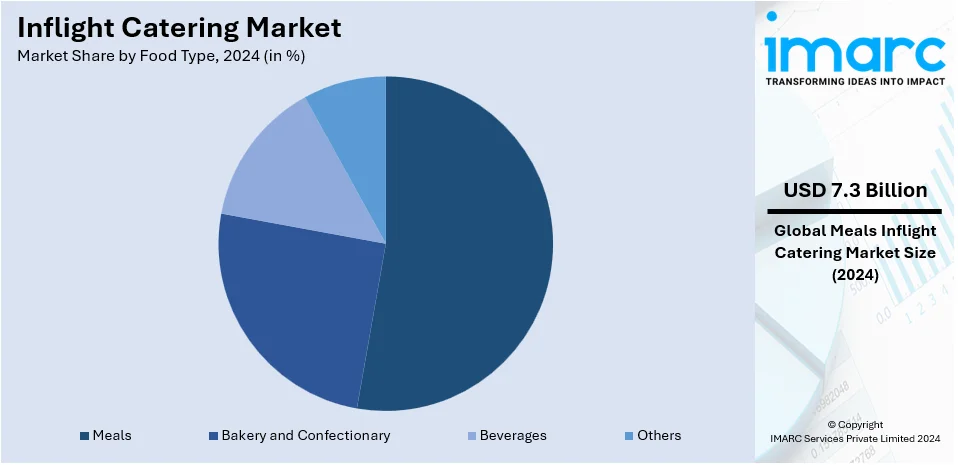

Analysis by Food Type:

- Meals

- Bakery and Confectionary

- Beverages

- Others

Meals dominate the market with 52.5% share in 2024 due to the increased demand for catering services on longer flights requiring nonstop services. Ready-to-eat meals provide convenience and efficiency, especially for airlines handling quick turnaround schedules and high demand. Major companies in the industry are also adapting their offerings to better serve culturally diverse passengers by providing meals that consider the different dietary restrictions and cultural preferences. This inclusiveness increases customer satisfaction and loyalty. Investments in state-of-the-art facilities further enhance the quality of service. For instance, Dnata renewed its contracts with Lufthansa and SWISS in Singapore in June 2023, insisting that they were committing to high-quality catering services from the advanced facility at Changi Airport. Such initiatives highlight the company's commitment to modernizing operations and delivering exceptional inflight dining experiences to passengers. While expanding air travel opportunities, the importance of diverse and convenient high-quality meal options becomes essential for inflight catering market growth.

Analysis by Flight Service Type:

- Full-Service Carriers

- Low-Cost Carriers

The low-cost carriers (LCC) lead the market with 58.9% share in 2024 as they employ a no-frills model to offer low-cost air travel at low operational costs. Catering services for the LCC are usually streamlined in that they usually have limited menu items, such as snacks, sandwiches, and drinks that are prepared and served as fast as possible. This has reduced waste and minimized logistical hassles. Usually, passengers in LCC buy their meals on board, an ancillary source of revenue. This keeps ticket prices low. LCCs, being efficient rather than luxurious, would attract budget travelers. Despite this, many of the LCCs are already seeking ways to upgrade their catering options by forming alliances with local vendors or implementing pre-order meals to better accommodate the changing demands of passengers while not compromising the management of cost. As LCCs continue to dominate short-haul and regional markets, the ability to adapt catering services to meet customer expectations without compromising affordability will remain a critical component of their operational strategy.

Analysis by Aircraft Seating Class:

- Economy Class

- Business Class

- First Class

Economy class represents a significant market share due to the increasing demand for affordable air travel and low-cost carriers. Airlines maximize seat density in economy class to respond to the high volume of budget-conscious travelers. Innovations in lightweight materials and ergonomic designs are making the passenger experience comfortable even in confined spaces, thus further cementing the segment's lead.

The business class segment is growing as corporate travel and high-yielding customers need more premium air travel. Differentiating itself by providing advanced seat technologies, lie-flat beds, and in-seat integrated entertainment systems makes it more accessible to airlines. Therefore, personal services and heightened privacy features provide the added incentives of business-class seating.

First-class captures a niche yet highly profitable space, appealing to ultra-high-net-worth individuals as well as high-end travelers. Airlines in the category focus on exclusivity through private suites, fully reclining seats, and the use of high-quality materials. Although the segment is small in share, profit margins are sizeable, and it remains an important differentiator for premium airlines.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific leads the market with 31.6% share. The iIncreasing air travel in this region, particularly the induction of new destinations and new long-haul flights, is expected to create future opportunities for the Asia-Pacific inflight catering market. Additionally, several key market players in the region are increasing their operations and investing in enhancing customer services, which is generating a positive outlook for the overall market. For example, in September 2022, SATS Ltd. agreed to buy Worldwide Flight Services (WFS) for €1.2 Billion (US$ 1.1 Billion) in a deal that will transform Singapore's catering and gateway services company into the world's biggest handler of airborne freight. In July 2021, SATS declared the company is establishing the first central kitchen in India with an investment of INR 210 crore (USD 25.3 Million) to support the growing customer base of the company across the region. Such investments in the region will continue to contribute toward growth in the market.

Rapid growth in air travel in the Asia Pacific region is mainly driven by an increase in disposable incomes, the growth of the middle-class population, and the rise in tourism. The rise in low-cost carriers and increased international routes boost demand for low-cost and diverse meal options. Airlines are trying to focus on regional cuisines to meet the preferences of the passengers, while technological advancements in food preservation and packaging enhance the efficiency of service. Major regional players and partnerships with catering companies contribute to the market's growth.

The high volume of international and regional flights across the continent makes Europe a prime location for inflight catering. The drive for sustainability, such as food waste reduction and eco-friendly packaging, pushes innovation in inflight meals. Premium airlines emphasize high-quality meals and beverages to attract business and first-class passengers, while low-cost carriers emphasize cost-efficient catering options. High growth in the demand for healthier, allergen-free, and vegetarian food options reflects changing consumer preferences and forms part of the market trend. Strategic partnerships between the airlines and lead catering suppliers enhance their quality of service and efficiency.

The inflight catering market in Latin America is driven by the growth of regional air travel and increased tourism levels in the region, especially in Brazil and Mexico. Air carriers are now increasing their catering services to deliver menus that are culturally relevant to diverse passenger preferences. Low-cost carriers have expanded their services, thus increasing demand for affordable meal options. Premium carriers focus on quality and innovation. Partnerships with local food suppliers and fresh, locally sourced ingredients are the most important trends driving the market forward.

The Middle East and Africa inflight catering market is driven by the region's status as a global aviation hub, with major carriers offering premium services on long-haul flights. Increasing tourism and business travel further fuel demand. Airlines emphasize high-quality, luxury dining experiences to cater to affluent travelers, particularly in business and first class. Additionally, cultural considerations, such as offering halal-certified meals, play a significant role in menu design. Strengthening the market through strategic collaboration with international catering companies and investments in onboard food innovation.

Key Regional Takeaways:

United States Inflight Catering Market Analysis

The expansion in inflight catering within the United States is significantly shaped by the growing investments within the aviation industry, which have been associated with an increasing number of airplanes and airports. According to the U.S., as of 2023, the U.S. airports consist of 1,251 airports. While the air travel market is continuously growing, airlines are shifting their focus more toward the holistic passenger experience, and catering plays a very vital role in that. At the same time, the improvements in airport infrastructure and services make it possible for airlines to increase their catering capacity in proportion to the increasing demand for air travel. With more flights, there is a greater potential for more diverse passenger needs, and passengers expect better quality services, such as meal variety. Increasing regional flights accompanied by international flights has further driven the focus on catering diversity among passengers, leading to further innovations and catering solutions suited to specific needs. Airlines are utilizing partnerships with catering providers, streamlining their practices to achieve passenger expectations and meet regulatory standards. With investments in the aviation sector being on an upward trend, inflight catering will be an important factor that helps the travel industry maintain its competitive edge.

Europe Inflight Catering Market Analysis

In Europe, the inflight catering adoption rate is strongly linked to the rapidly developing food and beverage industry. The growing European food and beverage businesses, such as 445k companies in the food & drink wholesaling industry, are now increasingly enjoying the inflight catering services as they meet the demand. As the demand for varied and high-quality meals on airplanes increases, airlines are collaborating more closely with specialized F&B providers to offer fresh and innovative meal options. Gourmet and locally sourced foods have become a growing trend in the aviation industry, with airlines working to deliver culinary experiences that mirror the food culture of their respective regions. Along with this, the growth of low-cost carriers across Europe has further fueled the demand for varied catering options, as budget airlines seek ways to add value to the passenger experience without sacrificing cost-effectiveness. The growth of premium services among legacy carriers also fuels inflight catering innovation, as airlines compete to offer high-quality meals and exclusive dining options for higher-paying passengers. With the steady growth of F&B, an abundance of newer opportunities has cropped up for airlines, which they will be able to offer as being more customized as well as posh onboard.

Asia Pacific Inflight Catering Market Analysis

The soaring adoption of inflight catering in the Asia-Pacific region is driven by the huge expansion in the economy class segment. For instance, the growing middle class in India, expanding at 6.3% annually and reaching 338 Million by 2021, is significantly benefiting the economy class segment in airplanes. As more people in the region have access to affordable air travel, airlines are increasingly catering to the needs of economy-class passengers, who constitute the largest segment of air travelers. As most countries witness rising middle classes demanding air travel services, airlines find an increased demand with customers seeking different menu options that correspond to these segments. This fact, among other reasons, such as new market entrants or the growth in the size of older ones, largely contributes to influencing the inflight catering market. These airlines are targeting providing a wide range of meal choices according to the cultural preferences and tastes of passengers coming from different cultures. Additionally, competition in the region among airlines has resulted in more innovative service delivery, with most carriers launching more creative inflight menus to differentiate themselves and give passengers a better experience during travel.

Latin America Inflight Catering Market Analysis

Increased implementation of inflight catering in Latin America is primarily credited to increased travel by air, mainly due to rising disposable incomes among the public. For example, an increase in disposable income in Latin America, growing by nearly 60% during 2021-2040, is seen to positively affect inflight catering through increased consumer spending power. As more individuals in the region gain access to air travel, airlines are opening their catering services to increase the number of passengers. The growing middle class has led to higher demand for air travel and improved services, including onboard meals. This trend has been an impetus for airlines to invest in catering solutions that would make the experience during a flight worthwhile, particularly on long-haul flights. Many inflight catering providers have started offering food that aligns with regional tastes, making use of local flavors and options for better meeting culturally relevant demands on food choices. This trend is also driven by the growing airline network in the region, which raises competition and forces airlines to upgrade their catering services.

Middle East and Africa Inflight Catering Market Analysis

In the Middle East and Africa, inflight catering adoption is highly associated with the increasing tourism industry. For instance, Dubai had 14.96 Million visitors from January to October 2024, marking an 8% increase compared to the same period in 2023, reflecting rising tourism. As the region experiences an influx of tourists, airlines are focusing on delivering enhanced services, including inflight catering, to meet the demands of international travelers. With the increasing number of tourists, airlines have been forced to diversify their catering options to cater to a wide range of tastes, dietary preferences, and cultural needs. This trend is most visible on flights to major tourist destinations, where the need for region-specific cuisine is growing. This sector, with tourism being such a critical activity in it, sees an inflight catering service increasingly become an inherent part of their travel. There are many more different things that an airplane provides, offering meals of an assortment for ensuring great satisfaction among those traveling on planes and subsequently resulting in more allegiance toward an airliner.

Competitive Landscape:

Market players in the inflight catering industry are focusing on innovation, sustainability, and partnerships to meet evolving passenger expectations and optimize operational efficiency. Airlines are increasingly collaborating with leading catering providers to offer personalized meal options, catering to dietary preferences such as vegan, gluten-free, and allergen-free meals. The largest trend is sustainability, with players focusing on environmental best practices, including reducing food waste, using biodegradable packaging, and using local ingredients to minimize carbon footprints. Premium carriers are raising the bar on inflight dining by introducing gourmet menus, curated by famous chefs, and regional cuisine to cater to various passenger demographics. Technological innovations are changing operations, and players are using AI and data analytics to predict passenger preferences and optimize meal production. A few airlines also introduce pre-order meal services to minimize waste and maximize customer satisfaction. The growth of low-cost carriers has increased demand for cost-effective meal solutions, which has encouraged catering companies to innovate with modular and pre-packaged meals. In addition, mergers and acquisitions and strategic partnerships among the market players strengthen supply chains and expand service capabilities across the globe, allowing them to address rising demand and competition in the industry.

The report provides a comprehensive analysis of the competitive landscape in the inflight catering market with detailed profiles of all major companies, including:

- AAS Catering Co., Ltd.

- Abby's Catering

- ANA Catering Service Co., Ltd.

- Cathay Pacific Catering Services (H.K.) Ltd. (Cathay Pacific Airways)

- DO & CO Aktiengesellschaft

- Emirates Flight Catering

- Flying Food Group

- Gategroup

- Jetfinity, Inc

- KLM Catering Services Schiphol

- LSG Group

- SATS Ltd

- Saudi Airlines Catering

- Universal Weather and Aviation, Inc.

Latest News and Developments:

- April 2025: Scandinavian Airlines (SAS) announced the launch of “Flavors by SAS” on October 1, 2025, a new inflight dining concept expanding beyond its New Nordic roots to offer globally inspired cuisine influenced by Europe, the U.S., Asia, the Middle East, and the Mediterranean. This innovative approach features tiered meal services tailored to flight length, flexible meal combinations, rolling menu rotations, and elevated Business Class presentation using reusable porcelain tableware. SAS aims to enhance variety, freshness, and sustainability by reducing food waste, prioritizing local sourcing, and minimizing plastic packaging for a premium, adaptable dining experience.

- April 2025: Everybody Eats, partnered with Air Culinaire Worldwide, a global leader in in-flight catering, to enhance private aviation dining with chef-driven, restaurant-quality meals. This collaboration integrates Everybody Eats' innovative culinary brands-including Cicci di Carne, TOMA, Katsuya, Casa Dani, and MXO-into Air Culinaire’s network of 30+ kitchens across North America, Europe, and beyond. The partnership aims to deliver exclusive menus and tailored experiences, elevating food quality and service standards for private aviation travelers worldwide by combining culinary artistry with aviation expertise.

- March 2025: Swiss International Air Lines introduced "SWISS Senses," a comprehensive upgrade for long-haul Economy and Premium Economy travelers. The revamp includes enhanced dining (welcome aperitifs, upgraded meals on reusable tableware, Swiss wines/Rivella, bento boxes), expanded snacks, and new comfort amenities like recycled-material bedding and upgraded headphones.

- March 2025: Air Culinaire Worldwide launched a new digital portal designed to streamline in-flight catering management for business aviation operators. The platform simplifies ordering, scheduling, and customization of catering services, enhancing operational efficiency. This innovation aims to reduce administrative burdens and improve accuracy in meal planning for flights. The portal reflects the company’s commitment to leveraging technology to meet evolving industry demands, offering a user-friendly solution for clients to manage catering needs seamlessly.

- February 2025: Innovative Food Holdings (IVFH) announced the expansion of its airline business with a new first-class cheese program for a major international airline, offering precision-cut portions to streamline service. The initiative leverages automated cutting equipment to enhance efficiency and expects $700K in first-year revenue. IVFH combines artisanal sourcing, custom packaging, and 3PL logistics to target airline menu planning cycles for future growth, diversifying sales channels and enhancing its specialty foods platform.

- January 2025: Dnata Catering & Retail is investing AUS$50 million to expand its Melbourne Airport facility by 5,700m², increasing its total size to over 16,000m², making it Victoria’s largest airline catering center. The upgraded facility will produce 25 million meals annually, serving 20 airlines and supporting over 60,000 flights yearly. Scheduled to open in September 2026, the expansion will create 300+ jobs and boost local supplier partnerships. This move aligns with Melbourne Airport’s growth and dnata’s broader AUS$80 million Australian investment to enhance inflight catering and retail services.

Inflight Catering Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Food Types Covered | Meals, Bakery and Confectionary, Beverages, and Others |

| Flight Service Types Covered | Full-Service Carriers, Low-Cost Carriers |

| Aircraft Seating Classes Covered | Economy Class, Business Class, First Class |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AAS Catering Co., Ltd., Abby's Catering, ANA Catering Service Co., Ltd., Cathay Pacific Catering Services (H.K.) Ltd. (Cathay Pacific Airways), DO & CO Aktiengesellschaft, Emirates Flight Catering, Flying Food Group, Gategroup, Jetfinity, Inc, KLM Catering Services Schiphol, LSG Group, SATS Ltd, Saudi Airlines Catering, Universal Weather and Aviation, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the inflight catering market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global inflight catering market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the inflight catering industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Inflight catering refers to the preparation and provision of meals, drinks, and refreshments served aboard an aircraft on a flight. It is an effort to offer various services within the flight duration with passengers' tastes and dietary necessities in mind to make flying as comfortable and pleasurable an experience as possible.

The inflight catering market was valued at USD 16.5 Billion in 2024.

IMARC estimates the global inflight catering market is expected to exhibit a CAGR of 5.3% during 2025-2033.

The market is driven by the massive usage of inflight catering throughout the aviation sector due to the growing competitiveness of airlines, technological advancements, and rising availability of various food options.

In 2024, meals represented the largest segment due to the increased demand for catering services on longer flights requiring nonstop services.

Low-cost carriers (LCCs) lead the market as they employ a no-frills model to offer low-cost air travel at low operational costs.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global inflight catering market include AAS Catering Co., Ltd., Abby's Catering, ANA Catering Service Co., Ltd., Cathay Pacific Catering Services (H.K.) Ltd. (Cathay Pacific Airways), DO & CO Aktiengesellschaft, Emirates Flight Catering, Flying Food Group, Gategroup, Jetfinity, Inc, KLM Catering Services Schiphol, LSG Group, SATS Ltd, Saudi Airlines Catering, Universal Weather and Aviation, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)