Industrial Valves Market Size, Share, Trends, and Forecast by Product Type, Functionality, Material, Size, End Use Industry, and Region, 2025-2033

Industrial Valves Market Size, Share And Trends

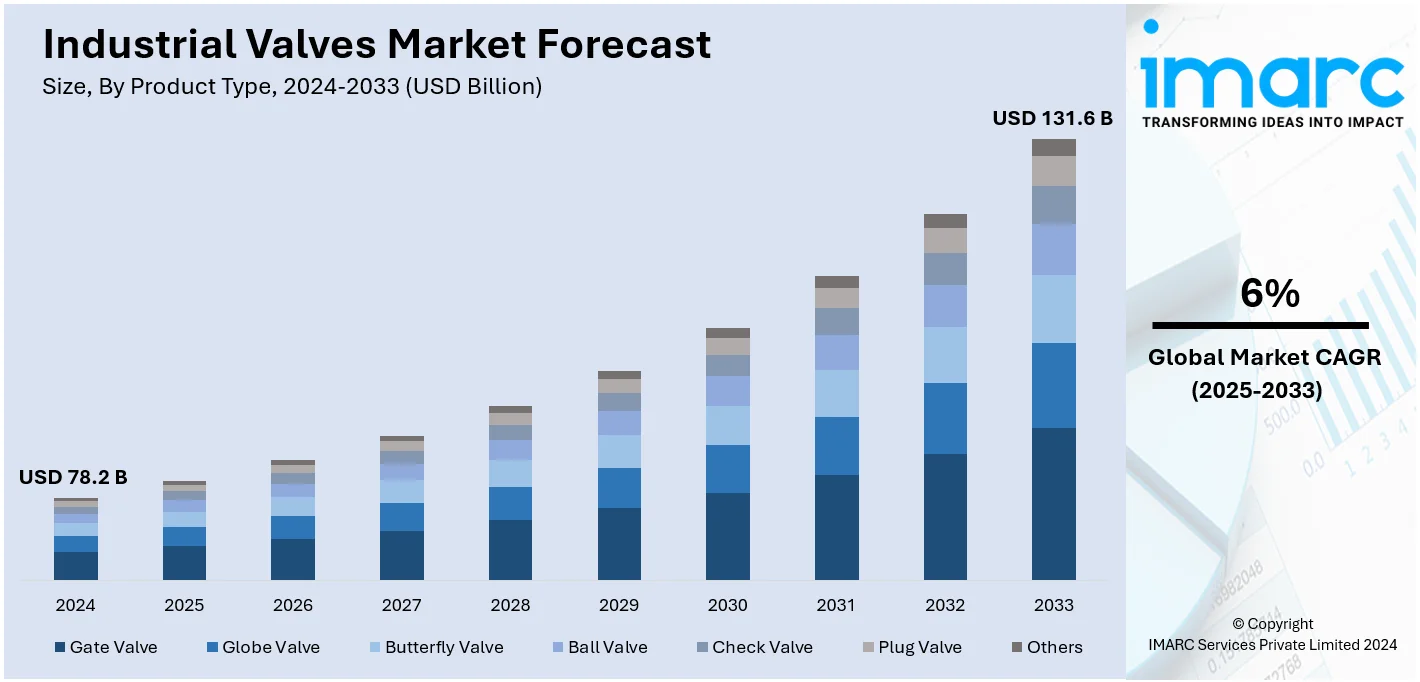

The global industrial valves market size was valued at USD 78.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 131.6 Billion by 2033, exhibiting a CAGR of 6% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 42% in 2024. The market is driven by the expanding sectors like oil and gas, water treatment, and power generation. Increasing automation, heightened demand for energy-efficient systems, rapid innovations in smart valves with the Internet of Things (IoT) integration and a surge in infrastructure projects are also major factors boosting the industrial valve market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 78.2 Billion |

|

Market Forecast in 2033

|

USD 131.6 Billion |

| Market Growth Rate 2025-2033 | 6% |

A major driver of the industrial valves market growth is the increasing demand for energy infrastructure development, particularly in emerging economies. Expanding oil and gas exploration activities, coupled with the modernization of aging power generation facilities, are significantly boosting the need for advanced valve technologies. Additionally, the shift towards cleaner energy sources, including natural gas and renewables, requires sophisticated valve systems to ensure efficient flow control and operational safety. Industrial valves are also integral to water and wastewater management systems, where rising urbanization and stringent environmental regulations further amplify market growth, underscoring their critical role in diverse industrial applications. For instance, in 2024, Parker Hannifin launched the enhanced TFP throttle valve series with DFplus Gen IV pilot valve, delivering 30% faster response, unmatched flow rates, shorter cycles, stable processes, and reduced scrap rates.

The United States plays a pivotal role in serving the global industrial valves market demand through advanced manufacturing capabilities, technological innovation, and robust supply chain networks. As a leader in valve production, U.S. companies deliver high-quality solutions tailored to industries such as oil and gas, water and wastewater, chemicals, and power generation. For instance, in 2024, SPX FLOW launched CU4plus ASi-5 control unit, with IoT integration, supporting 96 devices, offering 36% more capacity, four times faster response, enhanced connectivity, flexibility, and efficiency for modern valve management. The nation's strong emphasis on research and development fosters innovation in materials, automation, and energy-efficient designs, meeting evolving industry demands. Additionally, strict adherence to international standards and regulatory compliance enhances the global competitiveness of U.S.-manufactured valves, positioning the country as a key supplier in both domestic and international markets.

Industrial Valves Market Trends:

Increasing Industrialization and Infrastructure Development

A growing trend of industrialization and development of infrastructure throughout the world represents one of the major reasons driving the expansion of the international industrial valves market share. As economic activities are undertaken to improve, and the ever-increasing needs of a population that rises every year require industrial facilities, water treatment plants, power plants, and other structures for the support infrastructure, the base is significantly strong. Such developments require high-performance and efficient industrial valves for the regulation of fluids. Additionally, they ensure optimal performance of various operations in the plant. For example, India has the opportunity to be a world manufacturing destination. According to projections, it will be adding over USD 500 Billion annually to the world economy by 2030, says the Indian Brand Equity Foundation (IBEF). Another example is that China has been investing massively in Southeast Asia, especially in manufacturing, as FDI in the region hit USD 24 Billion in 2023, according to industry sources. In addition to this, rapid urbanization and the expansion of manufacturing sectors are major contributors to the increased demand for industrial valves.

Growing Focus on Energy Efficiency

As per the industrial valve market forecast, the global push towards sustainability and energy efficiency is another key driver influencing the industrial valves market. With concerns about environmental impact and the need to reduce energy consumption, industries are increasingly adopting technologies that promote efficiency in fluid handling processes. Modern industrial valves are designed with features such as improved sealing mechanisms, reduced leakage, and enhanced durability, contributing to overall energy conservation. According to the International Energy Agency, global energy efficiency improvements reduced energy demand by 2% annually in 2019. Concurrently, strict regulations and standards related to energy efficiency and environmental impact necessitated investment in advanced valve technologies that could encompass smart control systems as well as automation capabilities so that energy consumption can be better monitored and optimized, thereby creating a bright outlook for market expansion.

Technological Advancements and Innovation

The industrial valves market is experiencing tremendous inflow of technological advancements and innovations. Manufacturers are investing in research and development (R&D) to introduce new product variants with enhanced features, improved performance, and extended lifespan. For example, in December 2022, Emerson launched innovative technologies for the Crosby™ J-Series pressure relief valve (PRV) line, including a Balanced Diaphragm that eliminates bellows, enhancing performance and reducing ownership costs. Additionally, the Bellows Leak Detection technology allows for remote detection of bellows failures, enabling real-time calculation of volumetric emissions. These advancements aim to improve safety, reliability, and operational efficiency while significantly lowering fugitive emissions in industrial applications[PB1] . These technologies are intended to reduce ownership costs and improve the performance of things, which will help in pushing the market forward. In conjunction with this, the integration of digital technologies, like sensors and IIoT into valve systems has led to the evolution of smart valves that provide all kinds of real-time monitoring, remote control, and predictive maintenance features, which is propelling the forward. Additionally, improvement in materials with better corrosion resistance and durability as well as the advancement in valve designs and manufacturing processes facilitated a valve that was durable enough to counter harsh operating conditions, further expanding the market.

Globalization of Trade and Cross-border Investments

The growth of the industrial valves market is further propelled by globalization in trade and a rise in cross-border investments. Industries are expanding their presence into other countries and, therefore, are building new facilities and upgrading existing ones. This expansion around the world calls for standardized and reliable fluid control systems, and hence, it increases the demand for industrial valves. Confluence with this is the rise in cross-border investments in sectors such as oil and gas, petrochemicals, and water infrastructure further propelling demand for industrial valves. For example, the FDI inflows into India rose to a record of USD 84.8 Billion in 2021/22 compared with USD 34.3 Billion in 2012/13, showing fast industrial growth and infrastructure development in emerging markets. As multinational companies seek to establish a global presence and optimize their supply chains, the need for efficient and high-performance industrial valves becomes paramount.

Industrial Valves Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global industrial valves market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, functionality, material, size, and end use industry.

Analysis by Product Type:

- Gate Valve

- Globe Valve

- Butterfly Valve

- Ball Valve

- Check Valve

- Plug Valve

- Others

As per the industrial valve market trends, ball valves lead the market with around 19.5% of market share in 2024. The demand for ball valves in the industrial valves market is propelled by their unique design, offering precise control and shut-off capabilities. Ball valves are preferred in various industries due to their compact structure, low maintenance requirements, and ability to handle high-pressure applications. In line with this, the simplicity of their operation and efficient flow control make them integral in sectors such as oil and gas, where reliable performance and durability are crucial, contributing significantly to the sustained demand for ball valves globally. Additionally, their versatility and adaptability across diverse industrial applications, including water treatment, chemical processing, and power generation, further bolster their demand, solidifying their position as a key product in the global market.

Analysis by Functionality:

- On-Off/Isolation Valves

- Control Valves

Based on the industrial valve market outlook, on-off/Isolation valves lead the market with around 61% of the market share in 2024. The demand for on-off/isolation valves in the industrial valves market is primarily driven by their critical role in providing a reliable shut-off function within a fluid-handling system. Industries, especially in sectors like power generation and chemical processing, rely on these valves to effectively control the flow of liquids or gases by either allowing or halting the passage. Concurrent with this, the growing emphasis on safety and operational efficiency fuels the sustained demand for on-off/isolation valves, ensuring seamless and secure isolation of various process streams. Additionally, the increasing focus on operational safety, maintenance ease, and process efficiency across industrial facilities further drives their adoption. This widespread applicability underscores their significance in meeting global industrial requirements.

Analysis by Material:

- Steel

- Cast Iron

- Alloy Based

- Others

Steel leads the market with around 28.4% of the market share in 2024. The demand for steel-based industrial valves is based on the material's inherent strength, durability, and resistance to corrosion, which makes it ideal for challenging industrial environments. To this end, steel valves are widely used in oil and gas, chemical processing, and power generation sectors where they can face harsh operating conditions. This guarantees them a longer lifespan and durability, fulfilling the strict demands of industries that focus much on safety, long duration, and excellent performance in fluid control systems. Additionally, continuous development in material technology and investment in infrastructure and energy projects are positive factors pushing steel valves' uptake in various global markets.

Analysis by Size:

- Upto 1”

- 1”-6”

- 7”-25”

- 26”-50”

- 51” and Above

1’’-6’’ leads the market with around 27.9% of market share in 2024. The demand for industrial valves in the 1"-6" size range is driven by their versatility and applicability in a wide range of industries. These valves find extensive use in processes where moderate flow rates and precise control are essential. Sectors like water and wastewater treatment, HVAC, and general manufacturing benefit from the compact size and efficient performance of valves in this range. Their flexibility makes them suitable for diverse applications, contributing to sustained demand globally. Furthermore, their ability to adapt to various system requirements ensures widespread adoption, while ongoing industrial growth and infrastructure development globally continue to drive sustained demand for 1’’-6’’ valves in numerous markets.

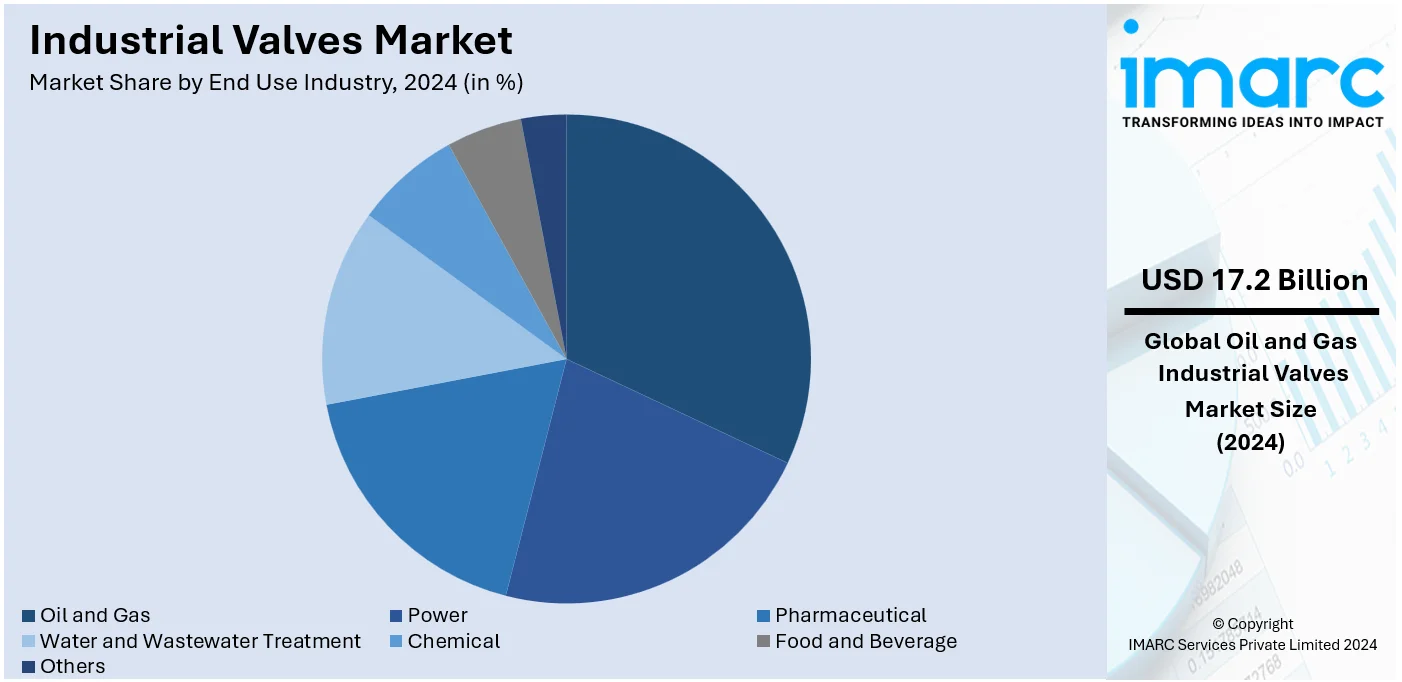

Analysis by End Use Industry:

- Oil and Gas

- Power

- Pharmaceutical

- Water and Wastewater Treatment

- Chemical

- Food and Beverage

- Others

Oil and gas leads the market with around 22% of the market share in 2024. This dominance is driven by the industry's complex processes that demand precise flow control, exceptional reliability, and durability. Industrial valves are integral to various stages of operations, including exploration, production, refining, and distribution, where they ensure seamless and safe functioning. Applications such as wellhead control, pipeline transportation, and refining processes rely heavily on advanced valve technologies to manage extreme pressures, temperatures, and corrosive environments. As the sector continues to expand globally, alongside a growing emphasis on operational efficiency and safety, the demand for robust, high-performance industrial valves remains critical in supporting the industry's evolving requirements.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 42%. The region's demand is fueled by rapid industrialization, significant infrastructural development, and a growing emphasis on energy-efficient technologies. Countries such as China and India are at the forefront, experiencing substantial growth in industries like manufacturing, power generation, oil and gas, and water treatment, all of which require advanced and reliable valve systems. Additionally, the globalization of industrial operations and increasing cross-border investments have amplified the need for high-performance industrial valves in this region. These factors, coupled with government initiatives to modernize infrastructure and enhance industrial capabilities, solidify Asia Pacific's leadership in the global market.

Key Regional Takeaways:

United States Industrial Valves Market Analysis

US accounts for 85.9% share of the market in North America. The growth of the industrial valves market in the United States is highly propelled by rising demand in the oil & gas sector, renewable energy development, and the adoption of advanced valve technologies. The U.S. continues to experience increased oil production, with the EIA reporting that in 2023, U.S. crude oil production averaged at 12.9 million barrels per day (b/d). Moreover, this record far eclipses the previous global record, reaching 12.3 million b/d in 2019, making high-performance valves an inevitable result of increased production and industrial growth, serving to regulate flow, pressure, and temperature in energy production and processing systems.

Another significant growth driver is the increasing adoption of smart, interconnected valve systems in industries such as oil & gas, chemicals, and water treatment. The integration of IIoT and automation technologies in valve systems is enhancing operational efficiency and reducing downtime. Another driving initiative will come from such bills as the Bipartisan Innovation Act and the "Make More in America" plan established by EXIM that is bound to foster new U.S. manufacturing, boosting growth prospects for industrial valves further ahead in the U.S.

North America Industrial Valves Market Analysis

The North America industrial valves market is driven by the region's advanced industrial infrastructure and focus on energy efficiency and safety. The oil and gas sector remains a key contributor, supported by ongoing shale gas exploration and pipeline projects. Growth in water and wastewater treatment facilities, driven by stringent environmental regulations, further fuels demand for industrial valves. Additionally, the chemical and power generation industries heavily rely on high-performance valves to ensure operational reliability. For instance, in 2024, Tomoe Valve plans US expansion after securing a £1.6 million contract in Washington to supply 80 valves for a leading silicon battery factory, supporting electric vehicle production and global decarbonization efforts. The increasing adoption of automation and smart valve technologies is enhancing efficiency across industries, solidifying North America's position as a significant player in the global industrial valves market.

Europe Industrial Valves Market Analysis

Europe's industrial valves market is witnessing significant growth due to the strict environmental regulation in the region, mainly focusing on energy efficiency and sustainable practices. Such a regulatory environment compels the industries to adapt to higher valve technologies that ensure higher control, improved performance, and compliance with environmental standards. The need for energy efficiency among industries requires technologically advanced valves capable of smart control systems and automation.

Other than regulatory pressures, the increase in industrial projects across Europe is another factor boosting the market. For instance, Bechtel, a leading construction and project management company, has begun fieldwork for the first nuclear power plant in Poland. This marked an important development in the energy infrastructure of the region and started in April 2024. Exxon Mobil Corporation, for example, is set to complete an expansion project worth USD 1 Billion for the production of diesel at its Fawley oil refinery in the UK by 2024. Such expansion projects and ongoing exploration of oil and gas reserves and refineries contribute to the high demand for industrial valves in Europe.

Asia Pacific Industrial Valves Market Analysis

The Asia-Pacific industrial valves market is witnessing considerable growth in this industry with new constructions and the modernization of present ones. In December 2023, the state council of China agreed upon adding four new nuclear reactors into operation. This, therefore increases further demand for valves because, besides cooling, it is highly required in regulating temperature control as well as in controlling the fuel overheating at large. The expanding nuclear energy sector and the region's strong manufacturing and power generation industries are boosting significant demand for advanced valve technologies.

The market expansion also depends on the presence of developing countries such as China, India, and Japan. In February 2024, Japan extended approximately USD 1,532.8 Million in loans for nine infrastructure projects in India, showing growing investment in industrial development, as per industry report. Similarly, Toshiba's decision to increase the production of power semiconductors in Hyogo Prefecture, Japan, will add fuel to the demand for industrial valves. Additionally, India's fast-growing automobile industry, which accounted for 25.9 million units in 2023 and contributed 7.1% to the country's GDP, is also a big driver. As industrial activities and infrastructure projects multiply, the need for high-performance valves is likely to increase in the Asia-Pacific region.

Latin America Industrial Valves Market Analysis

The Latin American industrial valves market is growing as it is driven by the growth of key industrial sectors in mining, oil and gas, energy, and water management. The increasing focus on process and resource optimization across these sectors fuels demand for advanced valve technologies. For example, in May 2024, Aura Minerals Inc. acquired exploration rights for two gold projects in Brazil, which is anticipated to strengthen mining activities within the region and, subsequently, industrial valve demand. Further, the ever-increasing oil and gas exploration activities in countries like Brazil and the requirement for better energy and water management system is further boosting market growth. With industries continually developing and updating their infrastructural setups, the demand for efficient, high-performance valves for controlling fluid flow and guaranteeing optimal working will increase further; therefore, the Latin American industrial valves market will keep thriving.

Middle East and Africa Industrial Valves Market Analysis

The Middle East and Africa industrial valves market is witnessing healthy growth, mainly due to surging industrial activities and landmark infrastructure projects. Emerson further expanded its valve manufacturing facility at Jubail, Saudi Arabia, in January 2024 to address the region's growing demand for industrial valves, especially in oil and gas. This will further enhance local production capability to support critical industries within the region. For example, in August 2023, Metso Outotec won a major order of valves for a greenfield nitrogen fertilizer complex in Egypt, thereby highlighting the increasing demand for more sophisticated valve technologies in such areas as petrochemicals and fertilizers. This also further increases the pressure of rising energy efficiency, sustainability, and infrastructure development in all sectors, such as oil, gas, and water management, which further propels the demand for valves. These developments indicate a strong market potential and place the Middle East and Africa as significant growth regions for industrial valves.

Competitive Landscape:

The competitive landscape of the global industrial valves market is characterized by a diverse array of players vying for market share. Key industry participants include well-established companies as well as emerging players. Intense competition compels companies to focus on technological innovation, product differentiation, and strategic collaborations to gain a competitive edge. The market also witnesses mergers and acquisitions as a means for companies to expand their product portfolios and geographical presence. Additionally, a growing emphasis on sustainability and energy efficiency has led to the development of eco-friendly valve solutions. Overall, the competitive dynamics in the global industrial valves market are shaped by a combination of technological advancements, strategic initiatives, and a commitment to meeting the evolving demands of diverse industries. For instance, in 2024, Crane Company acquired Technifab Products, a leading provider of cryogenic vacuum-insulated pipe systems and valves, for $40.5 million on a cash-free, debt-free basis.

The report provides a comprehensive analysis of the competitive landscape in the industrial valves market with detailed profiles of all major companies, including:

- Alfa Laval

- Bray International

- Crane Company

- Curtiss-Wright Corporation

- Emerson Electric Co.

- Flowserve Corporation

- IDEX India

- IMI Process Automation

- KITZ Corporation

- KLINGER Group

- SLB

- Spirax Sarco Limited

- Valmet

- Walworth

Latest News and Developments:

- February 2024: Beijer Tech, a subsidiary of Beijer Alma, has acquired 100% of AVS Power Oy, a Finnish wholesaler and manufacturer specializing in pneumatics, industrial valves, and compressors. This strategic move aligns with Beijer Tech's goal to enhance its market position and expand its offerings in Finland's industrial sector.

- February 2024: NDL Industries unveiled its largest-diameter stainless-steel ball valve for transcritical CO2 systems, measuring DN65 (2.5 inches) and rated for 120 bar (1,740 psi) with a temperature range of −40 to 150°C (−40 to 302°F). This valve, showcased at AHR Expo 2024, is the first CRN-approved for such applications, capable of withstanding five times its maximum pressure.

- October 2023: AVK Holding A/S acquired 100% interest in the Bayard and Belgicast Groups, known for their hydrants, gate valves, butterfly valves, pressure control, and regulation valves.

- October 2023: Crane Company announced the acquisition of Baum Lined Piping GmbH. This acquisition is expected to bolster Crane’s portfolio in the Process Flow Technologies segment, further strengthening its position in the industrial valves market.

- February 2023: announced an all-cash transaction to acquire Velan Inc., a leading manufacturer of industrial valves with a strong presence in the nuclear, cryogenic, and defense markets. This acquisition is expected to add significant value to Flowserve’s existing valves portfolio and enhance its aftermarket potential.

Industrial Valves Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Gate Valve, Globe Valve, Butterfly Valve, Ball Valve, Check Valve, Plug Valve, Others |

| Functionalities Covered | On-Off/Isolation Valves, Control Valves |

| Materials Covered | Steel, Cast Iron, Alloy Based, Others |

| Sizes Covered | Upto 1”, 1”-6”, 7”-25”, 26”-50”, 51” and Above |

| End Use Industries Covered | Oil and Gas, Power, Pharmaceutical, Water and Wastewater Treatment, Chemical, Food and Beverage, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alfa Laval, Bray International, Crane Company, Curtiss-Wright Corporation, Emerson Electric Co., Flowserve Corporation, IDEX India, IMI Process Automation, KITZ Corporation, KLINGER Group, SLB, Spirax Sarco Limited, Valmet, Walworth, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the industrial valves market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global industrial valves market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industrial valves industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Industrial valves are mechanical devices used to regulate, direct, or control the flow of liquids, gases, or slurries within a system. They are critical components in industries like oil and gas, water treatment, power generation, and manufacturing, ensuring operational safety, efficiency, and precise process control through various valve types and configurations.

The industrial valves market size was valued at USD 78.2 Billion in 2024.

IMARC estimates the global industrial valves market to exhibit a CAGR of 6% during 2025-2033.

IMARC Group estimates the industrial valve market will reach USD 131.6 Billion by 2033.

The global industrial valves market is driven by increasing investments in oil and gas exploration, rapid industrialization, expanding water and wastewater treatment infrastructure, and growing demand for automation in manufacturing processes. Enhanced focus on energy efficiency, modernization of aging infrastructure, and rising adoption of smart valves further contribute to market growth.

According to the report, ball valve represented the largest segment by product type, driven by their versatility, reliability, and ability to provide tight shutoff, making them ideal for applications across industries such as oil and gas, water treatment, and chemical processing.

On-Off/Isolation valves leads the market by functionality owing to their critical role in ensuring complete flow shutoff, reliability in high-pressure and high-temperature environments, and widespread use in industries such as oil and gas, power generation, and water treatment for process safety and operational efficiency.

Steel is the leading segment by material, driven by its durability, high strength, corrosion resistance, and suitability for extreme temperature and pressure conditions, making it a preferred choice across industries like oil and gas, chemical processing, and power generation.

1’’-6’’ is the leading segment by size, driven by its versatility and widespread use in various applications, including industrial processes, water distribution, and oil and gas systems, where medium-sized valves are essential for managing flow efficiently in pipelines and equipment.

Oil and gas is the leading segment, driven by the industry's high demand for valves to ensure safety, control flow, and manage pressure in exploration, production, refining, and transportation processes, along with ongoing investments in new projects and infrastructure upgrades globally.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global industrial valves market include Alfa Laval, Bray International, Crane Company, Curtiss-Wright Corporation, Emerson Electric Co., Flowserve Corporation, IDEX India, IMI Process Automation, KITZ Corporation, KLINGER Group, SLB, Spirax Sarco Limited, Valmet, Walworth, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)