Industrial Rubber Market Size, Share, Trends and Forecast by Type, Product, End Use Industry, and Region, 2025-2033

Industrial Rubber Market Size and Share:

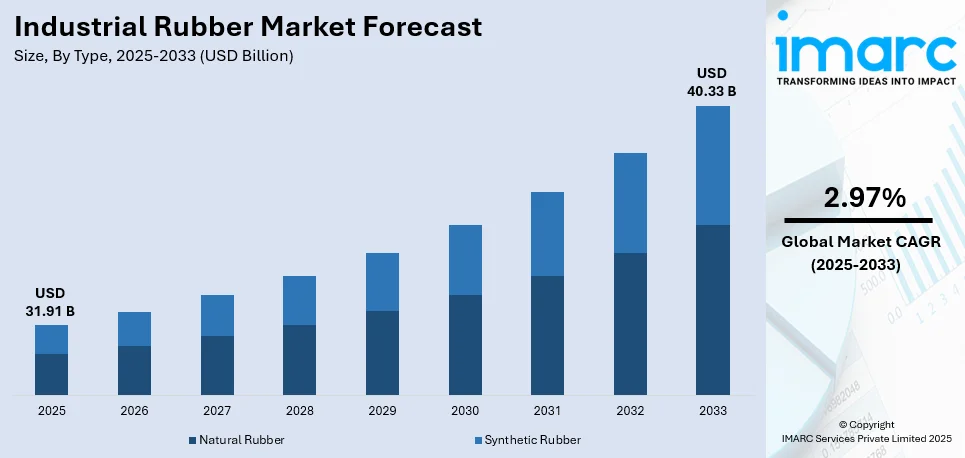

The global industrial rubber market size is anticipated to reach USD 31.91 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 40.33 Billion by 2033, exhibiting a growth rate (CAGR) of 2.97% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 44.5% in 2024. The market is propelled by innovations in polymer technology aimed at creating materials that offer improved durability, heat resistance and chemical resistance. Rising consumer expenditure and growing emphasis on sustainability and durability are influencing efforts to reduce environmental effect and conform with strict regulatory obligations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2025

|

USD 31.91 Billion |

|

Market Forecast in 2033

|

USD 40.33 Billion |

| Market Growth Rate (2025-2033) | 2.97% |

The global market is experiencing significant growth driven by the rising demand in automotive, construction, and manufacturing sectors. Increased use in automotive applications such as tires and seals is a key factor due to expanding vehicle production globally. In line with this, in November 2024, Bridgestone Corporation announced its plans to invest USD 85 million in its Indian operations enhancing production at its Pune and Indore plants. Starting in 2025 the initiative aims to increase tire output in Pune by 1.1 million annually by 2029 and establish a new technology center for advanced tire products. The construction industry’s focus on durability and insulation solutions is boosting the adoption of rubber materials. The rise in industrialization across emerging economies is creating opportunities for rubber products in conveyor belts, hoses, and gaskets. Innovations in synthetic rubber to enhance performance and sustainability further support market growth.

The United States industrial rubber market is driven by the robust demand from the automotive and construction sectors with applications in tires, seals and gaskets playing a significant role. The growing emphasis on infrastructure development and maintenance supports the need for rubber in insulation, roofing and vibration control products. Advancements in synthetic rubber technology are enhancing durability and performance aligning with industry specific requirements. Environmental regulations are pushing the adoption of sustainable and recyclable rubber materials. For instance, in July 2024, Dow launched bio based NORDEL™ REN EPDM. This innovative rubber material aids the automotive and construction sectors in lowering Scope 3 emissions. By using bio residues, it retains the performance of traditional EPDM while advancing carbon neutrality reflecting Dow’s commitment to sustainable solutions. Increased manufacturing activities and the focus on domestic production contribute to the rising demand for industrial rubber across various sectors including aerospace and energy.

Industrial Rubber Market Trends:

Eco-friendly and Sustainable Rubber Products

A significant shift toward eco-friendly and sustainable rubber products is a major factor propelling the industrial rubber market growth. Industrial rubber manufacturers are increasingly focusing on developing bio-based and recycled rubber materials to reduce environmental impact and meet stringent regulatory standards. For example, Michelin and Goodyear have introduced tires made from renewable resources and recycled rubber compounds significantly lowering their carbon footprint. This trend is driven by growing consumer awareness and demand for sustainable products and government initiatives aimed at reducing pollution and promoting sustainability. The U.S. Environmental Protection Agency (EPA) reports that rubber and tire recycling in the United States reached approximately 3.4 million tons in 2019 highlighting the growing emphasis on recycling and sustainable practices within the industry. The adoption of green manufacturing practices and the development of advanced rubber recycling technologies further support this trend enabling companies to produce high-quality, durable, and eco-friendly rubber products. As a result, the market is expected to see continued growth in the demand for sustainable rubber solutions providing opportunities for innovation and differentiation for key players in the industry.

Advancements in Polymer Technologies

Advancements in polymer technologies are playing a crucial role in the evolution of the industrial rubber market. Innovations in synthetic rubber compounds have led to the development of materials with superior performance characteristics such as enhanced durability, heat resistance and chemical resistance. These advanced polymers are increasingly being used in high-performance applications across various industries including automotive, aerospace and industrial machinery. For instance, the development of new elastomers has enabled the production of tires and mechanical rubber goods that offer better fuel efficiency, longer lifespan and improved safety. According to the European Commission’s Horizon 2020 program over Euro 80 million (USD 84.64 Million) has been invested in research projects related to advanced polymer materials including high-performance elastomers for industrial applications. These technological advancements are expected to significantly boost industrial rubber market revenue by catering to the growing demand for high-quality strong rubber products in several industries.

Increased Focus on the Electric Vehicle (EV) Market

The rise of electric vehicles is significantly influencing the industrial rubber market leading to an increased focus on developing rubber products specifically designed for EV applications. As the automotive industry shifts toward electrification there is a growing need for high-performance tires, seals and gaskets that can withstand the unique demands of EVs such as higher torque and different weight distributions. Key players in the market including Goodyear and Michelin are investing in the development of specialized rubber compounds and tire designs optimized for electric vehicles. Additionally, the push for lightweight materials to enhance EV efficiency is driving innovation in rubber formulations. This trend is further supported by government incentives and regulations promoting the adoption of electric vehicles particularly in European and Asian regions. The European Environment Agency (EEA) highlights that the share of electric vehicles in new car registrations in the EU reached 10.5% in 2020 with continued growth expected spurring the development of high-performance rubber products for EVs. These advancements and the expanding EV market are expected to significantly boost industrial rubber market revenue.

Industrial Rubber Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, product and end-use industry.

Analysis by Type:

- Natural Rubber

- Synthetic Rubber

Synthetic Rubber leads the market with around 62.3% of market share in 2024. Synthetic rubber dominates the industrial rubber market due to its superior properties and versatility. It offers enhanced durability and resistance to abrasion, heat and chemicals compared to natural rubber making it ideal for demanding applications in automotive, industrial machinery and construction sectors. The consistent quality and availability of synthetic rubber unaffected by natural factors like climate ensure a reliable supply for manufacturers. Additionally, advancements in polymer technologies have led to the development of specialized synthetic rubbers tailored to specific industrial needs further driving its dominance. According to the industrial rubber market research report cost-effectiveness and scalability in production also contribute to the preference for synthetic rubber in the market.

Analysis by Product:

- Mechanical Rubber Goods

- Rubber Hose

- Rubber Belt

- Rubber Roofing

- Others

Mechanical rubber goods lead the market with around 35.8% of market share in 2024. Mechanical rubber goods dominate the industrial rubber market due to their critical role in various industrial applications. These products including seals, gaskets, belts and hoses are essential for maintaining the efficiency and safety of machinery and equipment across sectors such as automotive, aerospace and manufacturing. Their ability to provide excellent resistance to wear, pressure and environmental factors ensures reliable performance and longevity. The ongoing industrialization and modernization of machinery in emerging economies further drive demand. Additionally, advancements in rubber compound formulations enhance the performance and durability of mechanical rubber goods making them indispensable in industrial operations and contributing to their market dominance. According to the industrial rubber market forecast the demand for mechanical rubber goods is expected to remain strong driven by these factors.

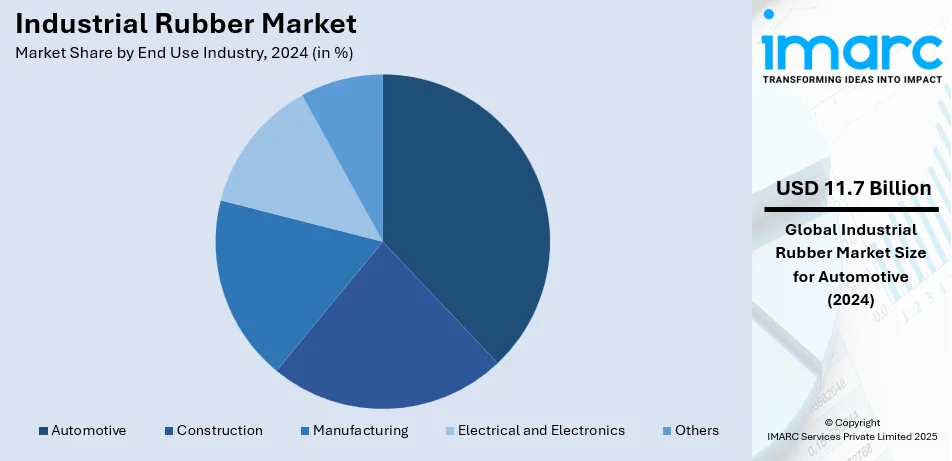

Analysis by End Use Industry:

- Automotive

- Construction

- Manufacturing

- Electrical and Electronics

- Others

Automotive lead the market with around 37.9% of market share in 2024. The automotive industry dominates the industrial rubber market due to its extensive use of rubber in various components, such as tires, seals, gaskets, belts, and hoses. The demand for rubber is driven by the industry's need for durable, flexible and heat resistant materials to ensure vehicle performance and safety. The growth of the global automotive sector especially in emerging markets significantly boosts rubber consumption and contributes to a substantial industrial rubber market share. Additionally, the increasing production of electric vehicles and advancements in automotive technology require specialized rubber products. The ongoing focus on vehicle efficiency, durability and maintenance further fuels the product demand, thereby creating a positive industrial rubber market outlook.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 44.5%. The Asia Pacific region dominates the industrial rubber market due to its robust manufacturing sector particularly in countries including China, India, and Japan. The high industrial rubber market demand is driven by extensive applications in the automotive, construction and industrial machinery sectors. Additionally, rapid urbanization and infrastructure development in emerging economies contribute to the increasing consumption of industrial rubber. The region's large population base also supports a significant automotive industry further boosting rubber demand. Moreover, favourable government policies and investments in industrial projects enhance market growth making Asia Pacific a key player in the global industrial rubber market.

Key Regional Takeaways:

North America Industrial Rubber Market Analysis

The industrial rubber market in North America is driven by robust demand from the automotive, construction and manufacturing sectors. The construction sector remains a key driver supported by increased spending on non-residential infrastructure projects particularly in Canada and the United States where emphasis on sustainability is growing. The automotive industry producing millions of vehicles annually relies on industrial rubber for essential components such as tires, seals and gaskets. Advancements in material technologies including synthetic rubber blends are enhancing the performance and sustainability of rubber products. The shift towards renewable energy infrastructure such as wind and solar power is further propelling the demand for rubber in sealing and vibration isolation applications. The region also sees increasing adoption of ecofriendly and recycled rubber driven by stringent environmental regulations and innovations from major players like Goodyear and Bridgestone.

United States Industrial Rubber Market Analysis

In 2024, United States accounted for a share of 88.14% of the North America market. The strong demand from the manufacturing, construction and automotive sectors is the main factor propelling the industrial rubber market in the US. The U.S. automobile industry which produces over 9 million vehicles annually primarily relies on industrial rubber to produce tires, gaskets, seals and other components.

The need for industrial rubber is further supported by the construction sector where it is used in flooring, roofing and vibration damping systems. As per TST Europe a supplier and manufacturer of quick coupling systems the total amount spent on construction in 2023 was USD 1.98 Trillion (with more than USD 1.3 Trillion by private parties) a 7.4% increase over 2022. The main driver of this expansion was non-residential building which increased 17.6% year over year while spending on residential construction fell 3% due to inflation and rising interest rates. Speciality applications like industrial hoses and conveyor belts are also expanding due to developments in material technologies such as synthetic rubber blends. The usage of industrial rubber in vibration isolation and sealing systems is growing because of the push for renewable energy infrastructure especially wind turbines.

Rubber recycling and the creation of environmentally friendly substitutes including bio-based rubber comply with stringent environmental laws and promote market expansion. Important companies like Cooper Tire and Goodyear are coming up with new ideas to improve the performance and durability of their products which has a good effect on market dynamics.

Europe Industrial Rubber Market Analysis

Europe's robust automotive industry which makes up a significant part of the world's total car manufacturing drives the industrial rubber market in the continent. Italy, France, and Germany all make significant contributions. Domestic passenger car production at the end of 2023 reached 264,500 units in December over 1% more than in December of the previous year, according to figures from the German Association of the Automotive Industry. In 2023, 4.1 million cars were produced which is 18% more than 2022. Rubber is in high demand for tires, gaskets, and suspension parts as a result.

Industrial rubber applications in construction, such as roofing and insulation, are supported by the region's emphasis on green building programs and infrastructure development. Furthermore, the use of recycled and environmentally friendly rubber products is being encouraged by the strict environmental regulations of the European Union. The need for industrial rubber in devices like solar panel mounts and turbines is further boosted by the growth of wind and solar energy projects. Advanced manufacturing and export-focused sectors in Europe also contribute to the substantial usage of industrial rubber in consumer goods and healthcare. The industry is growing because major corporations like Continental AG and Michelin are still investing in high-performance and sustainable rubber products.

Latin America Industrial Rubber Market Analysis

Latin America's industrial rubber business is being driven by the growth of the automotive and construction sectors especially in Brazil and Mexico. According to Anfavea, the Brazilian automakers' association Brazil's manufacturing park produced around 2.3 Million units in 2023 and is expected to grow further given multiple automakers are planning to invest BRL 41.4 Billion (USD 6.85 Billion) by 2032. The demand for tires and other automobile components—of which rubber is an essential component—will rise as a result. Government infrastructure initiatives are helping the construction industry grow which raises demand for industrial rubber in building supplies like sealants and roofing. The demand for rubber goods in irrigation systems and machinery is another way that the region's agriculture sector contributes. Rubber is used in Mexico's electronics and appliance manufacturing industry for long-lasting parts like hoses and gaskets which helps the market expand.

Middle East and Africa Industrial Rubber Market Analysis

Growing infrastructure developments especially in the GCC countries are supporting the industrial rubber industry in the Middle East and Africa. The demand for rubber in building materials and mechanical components is driven by Saudi Arabia's and the United Arab Emirates' developments in smart cities and industrial parks. Infrastructure projects like Saudi Arabia's NEOM City and the Red Sea Project which consists of 50 resorts with up to 8,000 hotel rooms and over 1,000 residential units spread across 22 islands and 6 inland areas emphasise sustainable tourism and innovation increasing the region's appeal on a worldwide scale. With rising demand for rubber in tires and industrial hoses the automotive sectors in South Africa and Nigeria also play a role. Rubber is also used in drilling and pipeline equipment in the oil and gas industry in the region which supports market expansion even further. To comply with international environmental regulations sustainable rubber production is becoming more and more popular.

Competitive Landscape:

The industrial rubber market is highly competitive with key players like Asahi Kasei Corporation, Braskem, Bridgestone Corporation, Denka Company Limited and Lanxess AG driving innovation and market growth. Industrial rubber companies such as Asahi Kasei focus on advanced materials and sustainability thereby enhancing product performance. Braskem leverages its expertise in biopolymers and green initiatives to meet market demands. Bridgestone Corporation a leader in tire and rubber products invests heavily in R&D for high-performance materials. Denka Company Limited specializes in synthetic rubber and advanced polymer technologies catering to diverse industrial applications. Denka Company Limited announced its investment in expanding the production capacity of its chloroprene rubber plant in Omi, Japan. Lanxess AG emphasizes specialty chemicals and high-quality rubber products ensuring a strong global market presence.

The global industrial rubber market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Asahi Kasei Corporation

- Braskem

- Bridgestone Corporation

- Denka Company Limited

- Lanxess AG

- LG Chem Ltd.

- The Goodyear Tire and Rubber Company

- Trinseo PLC

- TSRC Corporation

- UBE Corporation

- Yokohama Rubber Co. Ltd.

- Zeon Corporation.

Latest News and Developments:

- December 2024: International Conveyor and Rubber (ICR) has been acquired by Motion Industries, Inc. a prominent distributor of industrial technology solutions and maintenance, repair and operation (MRO) replacement components. Conveyor belt sales, installation, maintenance and repair are the areas of expertise for Blairsville, Pennsylvania-based ICR. For specialised solutions they also provide engineering and design services.

- Nov 2024: The Yokohama Rubber Co. Ltd. (YRC) recently announced its decision to close its manufacturing plant located at Hadera, Israel. The plant which is one of 30+ manufacturing sites in the YRC global network has been operating for 70+ years. It will cease operations effective December 31, 2024.

- May 2024: Hyderabad-based rubber products maker Deesawala Rubber Industries is setting up two more manufacturing units taking the number of its facilities in and around the city to five.

- May 2024: All India Rubber Industries Association has renewed its demand for higher import duty on rubber-finished products to promote the interests of local producers and farmers.

Industrial Rubber Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Natural Rubber, Synthetic Rubber |

| Products Covered | Mechanical Rubber Goods, Rubber Hose, Rubber Belt, Rubber Roofing, Others |

| End Use Industries Covered | Automotive, Construction, Manufacturing, Electrical and Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Asahi Kasei Corporation, Braskem, Bridgestone Corporation, Denka Company Limited, Lanxess AG, LG Chem Ltd., The Goodyear Tire and Rubber Company, Trinseo PLC, TSRC Corporation, UBE Corporation, Yokohama Rubber Co. Ltd., Zeon Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, industrial rubber market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global industrial rubber market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the industrial rubber industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial rubber market was valued at USD 31.91 Billion in 2025.

The industrial rubber market is projected to exhibit a CAGR of 2.97% during 2025-2033, reaching a value of USD 40.33 Billion by 2033.

The market is majorly driven by rising automotive production, expanding construction activities, increasing demand for durable materials, growth in infrastructure projects, advancements in manufacturing technologies, rapid industrialization, urbanization, growth of e-commerce, rising demand for consumer goods, and increasing investments in renewable energy projects.

Asia Pacific currently dominates the market, accounting for a share of over 44.5%, driven by rapid industrialization, booming automotive production, robust construction activities, growing infrastructure investments, increasing population, and expanding manufacturing sectors.

Some of the major players in the industrial rubber market include Asahi Kasei Corporation, Braskem, Bridgestone Corporation, Denka Company Limited, Lanxess AG, LG Chem Ltd., The Goodyear Tire and Rubber Company, Trinseo PLC, TSRC Corporation, UBE Corporation, Yokohama Rubber Co. Ltd., and Zeon Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)