Industrial PC Market Size, Share, Trends and Forecast by Type, Display Type, Sales Channel, End Use Industry, and Region, 2026-2034

Industrial PC Market Size, Share Analysis & Industry Outlook:

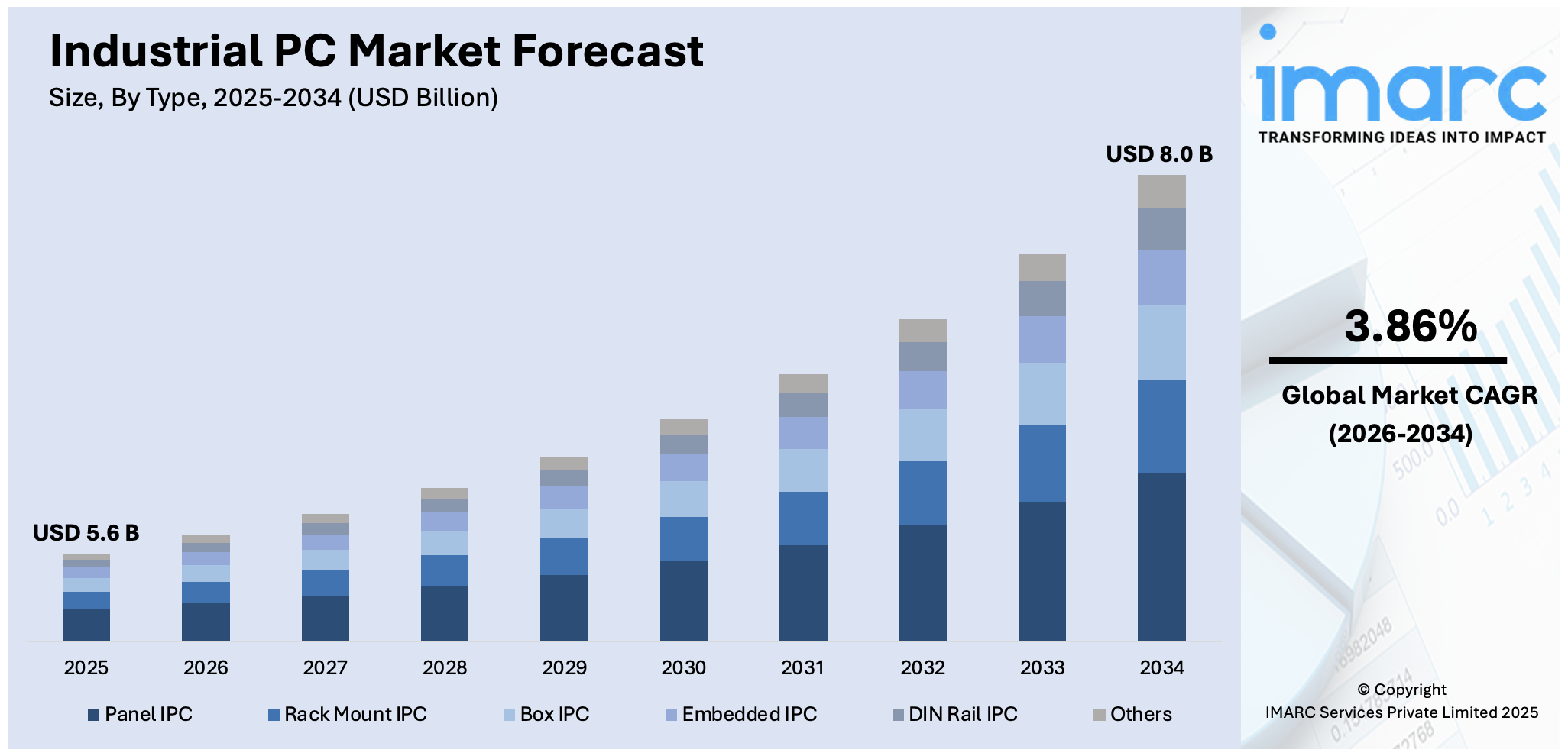

The global industrial PC market size was valued at USD 5.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 8.0 Billion by 2034, exhibiting a CAGR of 3.86% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 38.3% in 2025. The industrial PC market share is majorly driven by the increasing demand for automation, technological advancements enhancing performance and ruggedization, the growing adoption of IoT and connected devices for real-time monitoring, and a rising focus on cybersecurity measures to safeguard vital infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 5.6 Billion |

|

Market Forecast in 2034

|

USD 8.0 Billion |

| Market Growth Rate 2026-2034 | 3.86% |

The global market is experiencing substantial growth driven by the growing adoption of automation and Industry 4.0 practices across manufacturing, energy, and logistics sectors. Moreover, the fast-paced development of the internet of things (IoT) and artificial intelligence (AI) technologies require the use of industrial PCs in real-time data processing, machine-to-machine communication, and predictive maintenance. Besides this, the increased adoption in industries due to digital transformation is encouraging and creating a need for specifically customized and robust computing operations. Some of the other industrial PC market growth drivers include the rising global spending on infrastructure development and strategic partnerships between companies expand the opportunities for market growth. For example, on November 11, 2024, Siemens announced the integration of NVIDIA GPUs to its Industrial PCs (IPCs) to accelerate AI adoption in industrial automation. This collaboration enhances Siemens Industrial Operations X portfolio and provides up to 25 times faster AI execution, improving efficiency and innovation across industries.

To get more information on this market Request Sample

The United States is a key regional market and is primarily driven by the increasing focus on energy efficiency and sustainable operations in renewable energy sectors, such as wind and solar power. Moreover, the aerospace and defense industries in the U.S. are thriving and dependent on industrial PCs for mission-critical applications. The development of advanced manufacturing technologies, including additive manufacturing and robotics, which require high computational load, is leading to a higher need for industrial PCs. Also, cybersecurity measures integrated into the industrial systems indicate an important role of industrial PCs in protecting the data and maintaining their operations in intact condition. Apart from this, the increasing applications of 5G are making it possible to offer even faster and more reliable connections and thus improve functionalities and deployment of industrial PCs in various sectors. On February 21, 2024, Emerson launched the PACSystems IPC 2010, a compact, rugged industrial PC designed for demanding environments. The new solution is intended for OEM machine makers and manufacturing sites that require a ruggedized, small, and robust IPC to support their digital transformation projects and the industrial internet of things (IIoT) at a reasonable cost. The IPC features advanced processing capabilities, enabling real-time data processing and improved decision-making for industrial automation.

Industrial PC Market Trends

Growing Adoption of IoT and Connected Devices

IPCs serve as central hubs for collecting, processing, and transmitting data from sensors, actuators, and other internet of things (IoT) devices. According to reports, there is an 18% growth in global IoT connections in 2022, reaching 14.3 Billion active endpoints. This data-driven approach enables real-time monitoring, predictive maintenance, and optimization of industrial processes, leading to improved productivity and cost savings. Furthermore, IPCs also ensure smooth communication between different components of the industrial ecosystem, allowing for effective collaboration and coordination between production lines, supply chains, and distribution networks. With industries adopting digital transformation programs to gain actionable insights and achieve operational excellence, the demand for robust connectivity-equipped IPCs continues to rise, further propelling the growth of the industrial PC market share.

Increasing Focus on Cybersecurity

With the rising connectivity of industrial networks and the adoption of Industry 4.0 technologies, IPCs are becoming prime targets for cyberattacks. For instance, cybercrime is projected to cost the global economy USD 10.5 Trillion annually by 2025. Leading industrial PC manufacturers are increasingly investing in cybersecurity solutions such as encryption, firewalls, intrusion detection systems, and secure boot mechanisms to safeguard IPCs and prevent unauthorized access, data breaches, and operational disruptions. Additionally, industry standards and regulations mandating cybersecurity requirements further drive the adoption of secure IPC solutions. As cybersecurity threats continue to improve in sophistication and frequency, the demand for IPCs with robust built-in security features and support for secure communication protocols is expected to grow, shaping the dynamics of the market.

Shift towards Edge Computing

The IPC market trends are driven by a shift towards edge computing architectures, wherein data processing and analysis are performed closer to the data source, such as the manufacturing floor or field environment, rather than relying solely on centralized cloud infrastructure. According to reports, global spending on edge computing is projected to reach USD 228 Billion in 2024, reflecting a 14% growth from 2023. IPCs play a crucial role in edge computing by enabling real-time data processing, analytics, and decision-making at the edge of the network, thereby reducing latency, bandwidth requirements, and dependence on cloud connectivity. This enables faster response times, improved reliability, and enhanced autonomy for industrial systems and applications. Moreover, edge computing facilitates the deployment of artificial intelligence (AI) and machine learning algorithms directly onto IPCs, enabling advanced capabilities such as predictive maintenance, quality control, and autonomous operations. The need for IPCs tailored for edge deployment is anticipated to rise as industries seek to capitalize on edge computing's advantages for increased productivity, scalability, and agility, which is further enhancing the industrial PC market outlook.

Industrial PC Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global industrial PC market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, display type, sales channel, and end use industry.

Analysis by Type:

- Panel IPC

- Rack Mount IPC

- Box IPC

- Embedded IPC

- DIN Rail IPC

- Others

Panel IPC leads the market with around 28.6% of the market share in 2025. Panel industrial PCs bridge high-performance computing capabilities and industrial applications. They offer robust touch interfaces combined with high-performance processing, which is essential for industries such as manufacturing, energy, automotive, and healthcare. Panel IPCs are sought after for their compact design, reliability, and user-friendly interface, which enables seamless human-machine interaction in challenging environments. These IPCs are integrated with automation systems that enhance operational efficiency and support real-time data processing and visualization. The adoption of Industry 4.0 is increasing the demand for smart factories and the increasing need for industrial digitization, which are driving growth in the market for panel IPCs.

Analysis by Display Type:

- Resistive

- Capacitive

- Others

Capacitive leads the market with around 54.0% of the market share in 2025. Industrial PCs with capacitive displays offer exact touch sensitivity, multi-touch capabilities, and high endurance. Resistive touch counterparts are slower and less precise as the input is detected based on electrical properties in the human touch. This makes them highly suitable for applications requiring swift interaction, such as in the manufacturing, healthcare, transportation, and energy sectors. The capacitive display is gaining more popularity in industrial settings due to its simple interfaces and robust performance. Their ability to deliver superior visibility, even in outdoor or brightly lit conditions, and withstand wear and tear enhances their appeal. As industries embrace automation, smart systems, and digital transformation, capacitive displays play an important role in making human-machine interaction seamless while further contributing to the growth of the industrial PC market on a global scale.

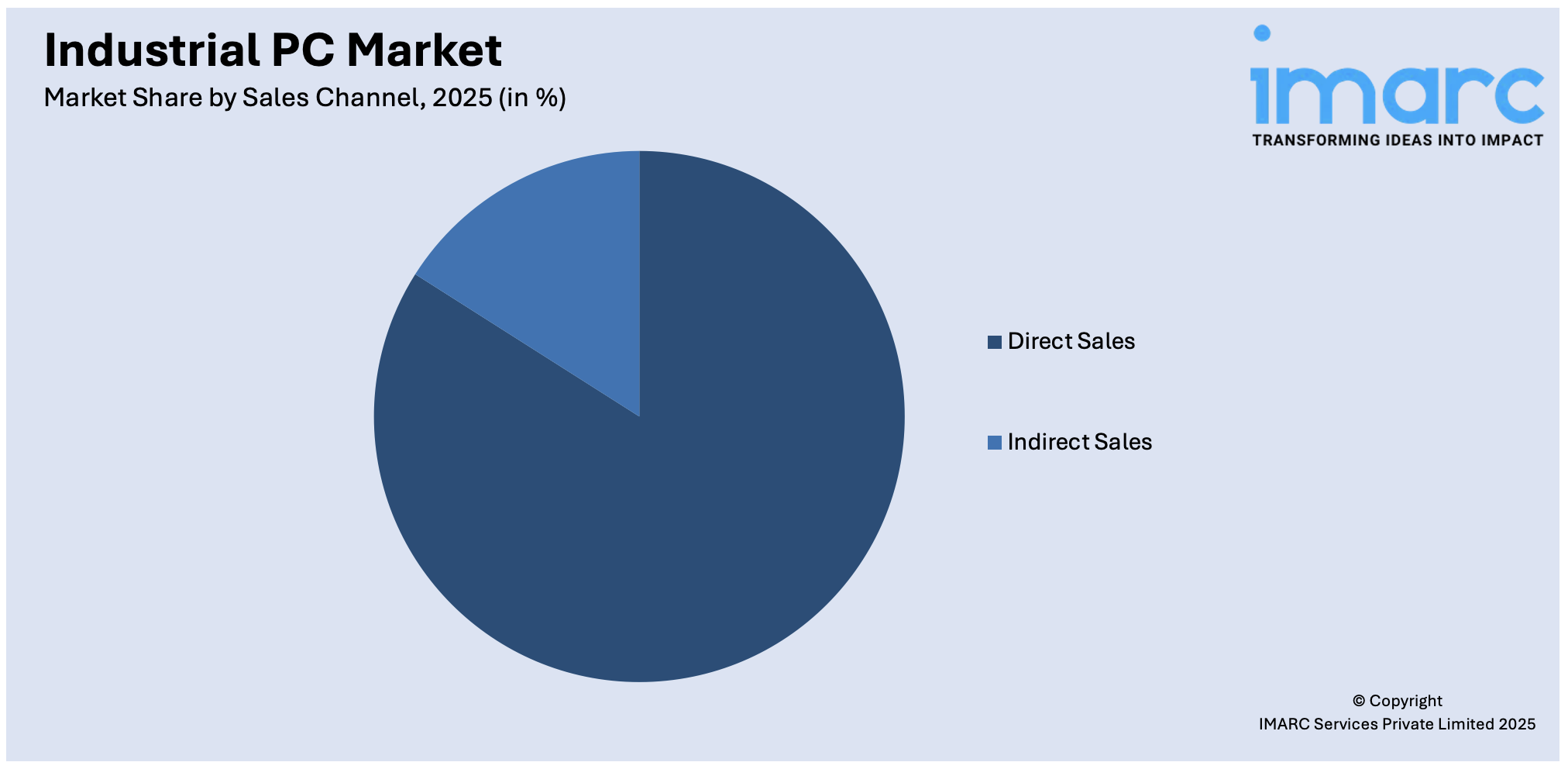

Analysis by Sales Channel:

Access the comprehensive market breakdown Request Sample

- Direct Sales

- Indirect Sales

Direct sales lead the market with around 83.4% of the market share in 2025. Direct sales channels provide personalized, relationship-driven approaches that cater to the specific needs of the industrial client. Manufacturers can provide customized solutions, technical support, and in-depth product knowledge through direct sales, resulting in stronger customer relationships and trust. This channel communicates the benefits of the product better by addressing complex industrial requirements effectively. Direct sales are highly important for industries such as manufacturing, health care, and energy as they require customized solutions to ensure operation. Direct sales also help the manufacturers gather useful customer feedback that can help in improving the product. As industries focus on accurate and efficient procurement processes, direct sales channels continue to be a prime driver in the growth of the market worldwide.

Analysis by End-Use Industry:

- Automotive

- Healthcare

- Chemical

- Aerospace and Defense

- Semiconductor and Electronics

- Energy and Power

- Oil and Gas

- Others

Automotive leads the market with around 21.2% of the market share in 2025, as it increases its dependence on advanced computing solutions for manufacturing and operational processes. Industrial PCs are crucial in automotive applications, such as assembly line automation, quality control, diagnostics, and robotics integration. Their ability to withstand harsh environments, process data in real-time, and support machine-to-machine communication enhances productivity and precision in vehicle manufacturing. The adoption of Industry 4.0 technologies, such as internet of things (IoT) and artificial intelligence (AI), further fuels the demand for industrial PCs in this sector as automakers prioritize smart factories and connected systems. The trend toward electric and autonomous vehicles leads to higher requirements for high-performance computing to manage complex testing and design processes. Such a trend underlines the crucial role of the automotive industry in speeding up innovation and driving the industrial PC market globally.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of over 38.3%, due to rapid industrialization, advances in technology, and the presence of key manufacturing hubs. Countries like China, Japan, South Korea, and India have been leading the way, applying industrial PCs to enhance automation, efficiency, and implementation of Industry 4.0 practices. The growing automotive, electronics, and semiconductor sectors in the region increase the need for strong computing solutions with the ability to work in a harsh environment. The implementation of government initiatives for smart factories and digital transformation also supports market growth. Increasing investments in infrastructure development and renewable energy projects expand industrial PC adoption for monitoring and control applications. The Asia-Pacific region is one of the significant contributors to the growth of the global market due to its rapid economic growth and emphasis on innovation.

Industrial PC Market Regional Takeaways:

United States Industrial PC Market Analysis

In 2025, the United States held 88.90% of the North America industrial PC market share. The significant industrial PC market growth driver in the United States is the increasing adoption of industrial PCs in sectors such as aerospace and defense. For instance, the U.S. defense industry thrives with an annual budget surpassing USD 850 Billion, fueling demand for industrial PC. This strong defense spending provides stability and profitable investment opportunities for related technologies. Computing solutions are widely in demand with the advancement and expansion of operations in the current industrial domain. Industrial computers serve the requirement of operating conditions where ordinary computing devices collapse. Industrial PCs can serve avionics, flight control systems, and other military applications requiring much higher tolerance for extreme temperature variation and robust tolerance for vibrational and electromagnetic interference. Furthermore, the continuous advancements in the aerospace and defense sector in the region are augmenting the need for the integration of cutting-edge technologies into operational systems. This drives the demand for industrial PCs with enhanced features such as real-time data processing, precise control capabilities, and secure communications, all of which are essential in ensuring optimal performance and mission success.

Asia Pacific Industrial PC Market Analysis

In the Asia-Pacific region, the growing adoption of industrial PCs is closely linked to the rapid expansion of online commerce and the increasing number of small and medium-sized enterprises (SMEs). As digital platforms continue to thrive, businesses are relying on automated solutions to manage inventory, process transactions, and streamline logistics. According to India Brand Equity Foundation, Indian e-commerce is projected to grow at a 27% CAGR, reaching USD 163 Billion by 2026, strengthening demand for industrial PCs as businesses seek efficient, scalable solutions. This growth in online platforms is driving greater adoption of Industrial PCs for enhanced operational efficiency and connectivity. Industrial PCs, with their high reliability and scalability, are becoming integral in the operations of warehouses, distribution centers, and e-commerce fulfilment hubs. Moreover, SMEs, which play a vital role in the economic growth of the region, are increasingly adopting industrial PCs to enhance their manufacturing processes, improve product quality, and boost operational efficiency. The ability to interface these systems with supply chain management software and support smart factory initiatives is propelling the shift towards automation, thereby increasing demand for industrial PCs in the region.

Europe Industrial PC Market Analysis

In Europe, the rise in industrial PC adoption is closely tied to the growing automotive sector. According to Eurostat, in 2023, the EU's passenger car fleet grew by 6.5%, surpassing 256 Million vehicles, driving the demand for industrial PCs to enhance automotive manufacturing efficiency. This growth presents a significant opportunity for Industrial PC adoption in the automotive sector. As the automotive industry increasingly integrates automation and digitalization into production lines, there is a significant demand for rugged computing systems that can support these advancements. Industrial PCs play a crucial role in monitoring assembly lines, controlling robotic systems, and ensuring quality control across production processes. The automotive sector's efforts at improving the manufacturing of cars, standards of safety, and less environmental degradation create a requirement for robust computing solutions with high performance. Moreover, with electric car production on the increase, industrial PCs are used in optimizing powertrain testing, battery development, and charging infrastructure to render them the most essential component of moving towards a sustainable future with automotive technologies. This ongoing change in the automotive industry keeps driving industrial PC adoption in Europe.

Latin America Industrial PC Market Analysis

In Latin America, the growing healthcare sector is fueling the adoption of industrial PCs across various facilities. According to International Trade Administration, Brazil, the largest healthcare market in Latin America, allocates 9.47% of its GDP to healthcare, totaling USD 161 Billion. With 62% of its 7,191 hospitals being private, the growing healthcare facilities are driving the adoption of Industrial PCs in the sector. With the expansion of healthcare infrastructure and the increasing need for efficient patient data management systems, hospitals, and clinics are integrating industrial PCs to streamline operations. These systems are essential for handling complex medical applications such as imaging, diagnostics, and patient monitoring in real time. Moreover, industrial PCs provide the reliability needed in medical environments, ensuring uninterrupted service and data accuracy. As governments and private healthcare institutions modernize their facilities and adopt advanced technologies, industrial PCs help to meet regulatory standards, improve patient care, and facilitate the integration of healthcare data. This shift towards digitalization in healthcare is a significant driver for the adoption of industrial PCs in the region.

Middle East and Africa Industrial PC Market Analysis

The oil and gas sector in the Middle East and Africa is experiencing substantial growth, which is driving the increased adoption of industrial PCs in the region. According to International Trade Administration, Saudi Arabia, holding 17 percent of the world’s proven petroleum reserves, continues to dominate global oil exports, driving growth in its oil sector. This expansion is fostering increased demand for industrial PCs, enhancing efficiency across energy and chemical operations. As exploration and extraction activities become more complex and require real-time monitoring, the need for durable and high-performance computing solutions has intensified. Industrial PCs are used to monitor drilling operations, manage control systems, and ensure compliance with safety protocols in hazardous environments. These systems also play a critical role in optimizing production, improving efficiency, and reducing operational costs. With the increasing demand for energy resources and the shift towards automation in the sector, the usage of industrial PCs has become essential in this region for maintaining continuous and secure operations across oil fields and refineries.

Top Industrial PC Manufacturers:

The global industrial PC market is highly competitive, with various global and regional companies offering different solutions to varying industry needs. Companies are competing on product reliability, customizations, technological innovation, and after-sales support. The advancement in automation and the IoT is driving the market and resulting in research and development (R&D) investments. Emerging players focus on niche applications and cost-effective solutions, whereas established firms focus on further expansion of their product portfolio and strengthening distribution networks to maintain market share. Key players in the IPC market are highly concentrating on strategic initiatives that aim to enhance their product offerings, expand market presence, and innovate according to changing customer needs. Partnerships, mergers, and acquisitions are considered strategic steps toward increasing market share, broadening their portfolios of products, and seeking new growth opportunities within the targeted industry verticals and regions.

The industrial PC market forecast report provides a comprehensive analysis of the competitive landscape in the market with detailed profiles of all major companies, including:

- ABB Ltd

- Advantech Co. Ltd

- American Portwell Technology Inc. (Posiflex Technology, Inc.)

- Beckhoff Automation GmbH & Co. KG

- DFI (Diamond Flower Inc)

- General Electric Co.

- Kontron S&T AG

- Omron Corporation

- Rockwell Automation, Inc

- Schneider Electric SE

- Siemens AG

Latest News and Developments:

- December 2024: Ricoh announced the formation of RICOH PFU COMPUTING Co., Ltd., a new company set to manage embedded and industrial personal computer (IPC) businesses in Japan. The company will integrate parts of Ricoh Industrial Solutions Inc. and PFU Limited to optimize planning, development, and sales functions. Starting operations in April 2025, Ricoh aims to enhance its market share and capitalize on the growing IPC market, leveraging its leading domestic position in the edge computing sector.

- December 2024: C&T Solution launched the KCO Series, a new line of semi-rugged, fanned industrial PCs designed for high-performance edge applications. These certification-ready systems offer seamless scalability for OEM deployments without re-certification. Tailored for industries like factory automation and AI analytics, the KCO Series features advanced computing power and UL certification.

- December 2024: Aaeon, a subsidiary of Asus, launched a new industrial-grade mini PC featuring dedicated Intel Arc graphics and four Ethernet ports. Featuring the Intel i7 13700TE CPU and Arc A350E/A370E GPU, it delivers robust performance and improved networking features. This new system caters to industrial applications requiring high graphics and robust connectivity. The mini PC is designed for demanding environments, ensuring both reliability and performance.

- November 2024: Adlink Technology introduced the EMP100 Mini PC, tailored for smart retail and industrial use. This compact, fanless device (13 x 10.7 x 2.8 cm) is powered by Intel Celeron processors and supports dual 4K displays. With an optional Wi-Fi 6, Bluetooth 5.2, and a GbE LAN port, it provides IoT connectivity. The EMP100 also includes expansion options with M.2 slots for storage and wireless modules.

Industrial PC Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Panel IPC, Rack Mount IPC, Box IPC, Embedded IPC, DIN Rail IPC, Others |

| Display Types Covered | Resistive, Capacitive, Others |

| Sales Channels Covered | Direct Sales, Indirect Sales |

| End Use Industries Covered | Automotive, Healthcare, Chemical, Aerospace and Defense, Semiconductor and Electronics, Energy and Power, Oil and Gas, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | ABB Ltd, Advantech Co. Ltd, American Portwell Technology Inc. (Posiflex Technology, Inc.), Beckhoff Automation GmbH & Co. KG, DFI (Diamond Flower Inc), General Electric Co., Kontron S&T AG, Omron Corporation, Rockwell Automation, Inc, Schneider Electric SE, Siemens AG., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the industrial PC market from 2020-2034.

- The industrial PC market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industrial PC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial PC market was valued at USD 5.6 Billion in 2025.

The industrial PC market is projected to exhibit a CAGR of 3.86% during 2026-2034, reaching a value of USD 8.0 Billion by 2034.

The market is driven by increasing automation in manufacturing, rising demand for real-time data analytics, and the need for robust computing solutions in harsh environments. Additionally, advancements in artificial intelligence (AI), internet of things (IoT) integration, and rising investments in smart factories further propel the market's growth.

Asia Pacific currently dominates the industrial PC market, accounting for a share of 38.3% in 2025. The dominance is fueled by the rapid industrialization, the growth of manufacturing sectors, increasing adoption of automation technologies, and significant investments in smart factory initiatives across countries like China, Japan, and India.

Some of the major players in the industrial PC market include ABB Ltd, Advantech Co. Ltd, American Portwell Technology Inc. (Posiflex Technology, Inc.), Beckhoff Automation GmbH & Co. KG, DFI (Diamond Flower Inc), General Electric Co., Kontron S&T AG, Omron Corporation, Rockwell Automation, Inc, Schneider Electric SE, and Siemens AG., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)