Industrial Lighting Market Report by Product Type (High/Low Bay Lighting, Flood/Area Lighting), Light Source (LED, High-Intensity Discharge (HID) Lighting, Fluorescent Lighting), Offering (Lamps & Luminaries, Control Systems, Services), Type (New Installation, Replacement Installation, Retrofit Installation), Application (Warehouse & Cold Storage, Factory & Production Lines, Outer Premises, Parking Areas, Hazardous Locations, and Others), and Region 2025-2033

Market Overview:

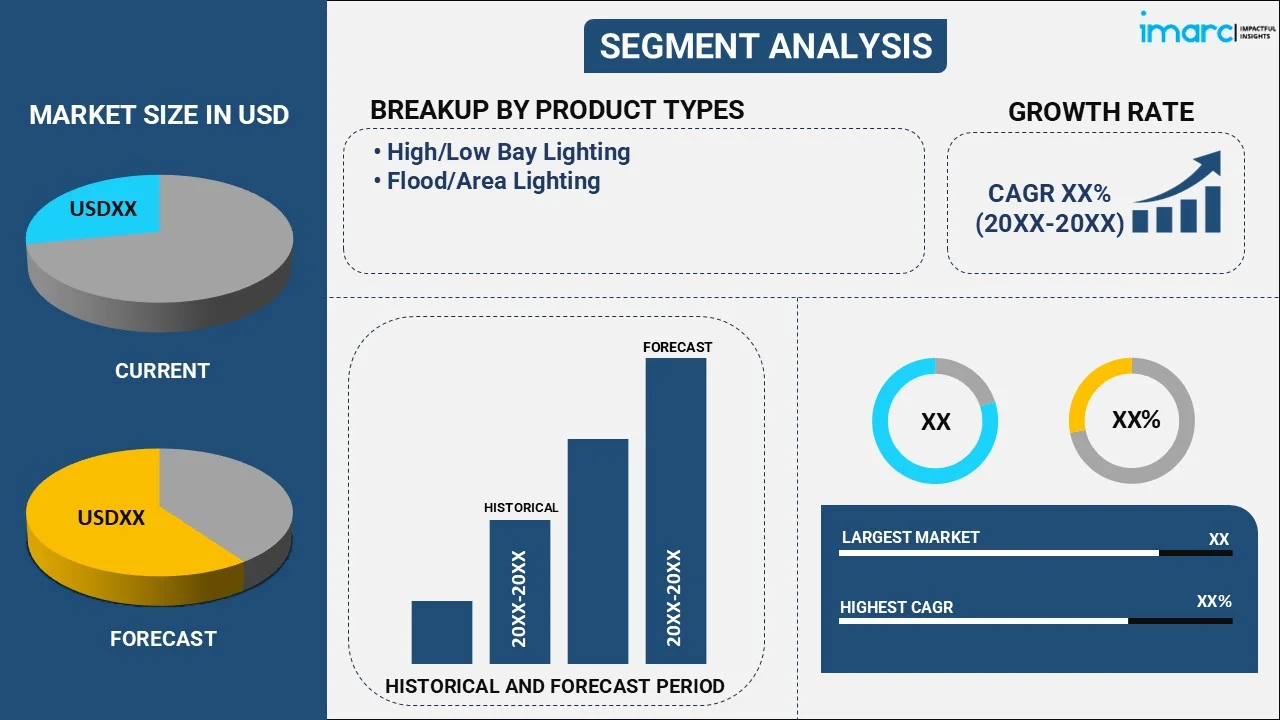

The global industrial lighting market size reached USD 9.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.15% during 2025-2033.The growing installation of LED lights, rising focus on energy efficiency and sustainability, and increasing initiatives to maintain worker safety in various hazardous areas are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.7 Billion |

| Market Forecast in 2033 | USD 14.3 Billion |

| Market Growth Rate 2025-2033 | 4.15% |

Industrial lighting is a crucial component of various industrial settings, providing illumination for optimal visibility and ensuring safe working conditions. It involves the usage of specialized lighting fixtures and technologies designed to meet the unique requirements of industrial environments. It is designed to withstand harsh conditions commonly found in industrial facilities, such as high temperatures, humidity, dust, and vibrations. It often incorporates smart lighting controls to optimize energy usage and enhance functionality. It plays a significant part in enhancing productivity, promoting worker safety, and improving overall operational efficiency.

At present, the increasing demand for industrial lighting integrated with occupancy sensors, daylight harvesting systems, and dimming capabilities is impelling the growth of the market. Besides this, the rising focus on maintaining worker safety in various work areas and hazardous zones is contributing to the market growth. In addition, the growing employment of industrial lighting in environments where precision and accuracy are crucial, such as assembly lines or laboratories, is offering a favorable market outlook. Apart from this, the increasing installation of industrial lighting in outdoor areas, parking lots, and loading docks is supporting the growth of the market. Additionally, rising initiatives in retrofitting and upgrading existing lighting infrastructures in industries are bolstering the growth of the market. Moreover, the increasing construction of industries and infrastructure development is strengthening the growth of the market.

Industrial Lighting Market Trends/Drivers:

Rising installation of light-emitting diode (LED) lights

Industries are increasingly choosing to install LEDs as they are energy-efficient compared to traditional lighting systems. They consume significantly less power, which results in substantial cost savings over time. They also have a significantly long operational lifetime which cuts down the cost and inconvenience of having to frequently replace bulbs. LEDs are free of toxic chemicals, recyclable, and can significantly reduce carbon footprint. They are resistant to shock, vibrations, and external impacts, making them great for outdoor lighting systems. They can withstand rough conditions and exposure to weather, wind, rain, or even vandalism actions. LEDs are manufactured and designed to focus their light and can be directed to a specific area without the employment of an external reflector, achieving an efficient application than conventional lighting. Furthermore, LED lights are improving industrial lighting systems as they can be switched on and off without affecting light emission.

Increasing focus on energy efficiency and sustainability

Industrial lighting solutions that consume less energy and have a lower environmental impact are gaining traction in the market as they possess a minimum carbon footprint and help to minimize electricity expenses. Besides this, energy efficiency is becoming a critical factor for industrial lighting applications. Governments and organizations worldwide are implementing stringent energy efficiency regulations and promoting sustainable practices. By investing in energy-efficient lighting, industries can ensure that they are in compliance with these rules. As energy costs continue to rise and become more volatile, industries are seeking energy efficiency solutions to manage their risk. By reducing their energy usage and adopting sustainable industrial lighting solutions they are minimizing their electricity expenditure.

Growing demand for smart lighting solutions

The increasing demand for smart industrial lighting due to enhanced cost savings, operational efficiency, lighting quality, safety, sustainability, and integration with other smart systems. Smart industrial lighting systems, which are LED-based, consume significantly less energy than traditional lighting solutions, leading to substantial reductions in energy costs. They also have a longer lifespan, reducing the frequency of bulb replacement and associated maintenance costs. They can automatically adjust light levels to suit current conditions, using sensors to detect environmental changes, such as ambient light levels or room occupancy. This further reduces energy usage while also ensuring that lighting conditions are always optimal for performing various tasks.

Industrial Lighting Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global industrial lighting market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on product type, light source, offering, type and application.

Breakup by Product Type:

- High/Low Bay Lighting

- Flood/Area Lighting

Flood/area lighting dominates the market

The report has provided a detailed breakup and analysis of the market based on the product type. This includes high/low bat lighting and flood/area lighting. According to the report, flood/area lighting represented the largest segment.

Flood or area lighting is designed to cast a wide spread of light, which makes them suitable for illuminating large areas. Industrial spaces often cover extensive areas, so the broad coverage provided by floodlights and area lights is ideal. They can also deter potential intruders and help security personnel to monitor large areas more effectively. Flood or area lights are specially designed to cast broad swaths of light, making them apt for illuminating expansive industrial spaces, whether warehouses, factories, outdoor storage areas, or construction sites. Moreover, the superior visibility ensured by flood and area lighting plays a crucial role in preventing industrial accidents. By clearly illuminating workspaces, they facilitate better visibility of machinery, equipment, pathways, potential hazards, and colleagues, thereby helping avoid mishaps.

Breakup by Light Source:

- LED

- High-Intensity Discharge (HID) Lighting

- Fluorescent Lighting

LED holds the largest share in the market

A detailed breakup and analysis of the market based on the light source have also been provided in the report. This includes LED, high-intensity discharge (HID) lighting, and fluorescent lighting. According to the report, LED accounted for the largest market share.

Industries are increasingly adopting LED lights due to their superior energy efficiency, longevity, environmental friendliness, and robustness. LEDs consume significantly less power compared to traditional lighting systems, providing substantial cost savings over time. This reduction in energy consumption aligns with global efforts to minimize carbon footprints and embrace greener practices, further enhancing the appeal of LEDs. LED lights do not contain toxic components like mercury found in conventional fluorescent bulbs, making them an environmentally responsible choice. They can withstand rough conditions, exposure to weather, wind, rain, or vandalism, thus reducing replacement and maintenance costs. They also offer instant lighting, reaching full brightness immediately upon being powered on.

Breakup by Offering:

- Lamps & Luminaries

- Control Systems

- Services

A detailed breakup and analysis of the market based on the offering have also been provided in the report. This includes lamps and luminaries, control systems, and services.

Lamps and luminaires play a crucial role in industrial lighting systems. Industrial lighting is designed to provide efficient and effective illumination in large-scale environments, such as factories, warehouses, production facilities, and outdoor industrial areas.

Control systems play a crucial role in industrial lighting by providing flexible and efficient management of lighting installations. These systems allow for automated control, energy savings, enhanced functionality, and increased safety. They comprise manual switches, occupancy sensors, daylight sensors, time-based scheduling, dimming controls, network lighting controls, and emergency lighting systems.

Services in industrial lighting refer to the various offerings and support provided by lighting manufacturers, distributors, and service providers to ensure effective implementation, maintenance, and optimization of industrial lighting systems. These services encompass a range of activities aimed at assisting industrial facilities in achieving their lighting objectives.

Breakup by Type:

- New Installation

- Replacement Installation

- Retrofit Installation

A detailed breakup and analysis of the market based on the type has also been provided in the report. This includes new installation, replacement installation, and retrofit installation.

New installations in industrial lighting involve the design, planning, and implementation of lighting systems in industrial environments. These installations are typically carried out in new construction projects or when upgrading existing facilities. New installations in industrial lighting require careful planning, collaboration with lighting professionals and electrical engineers, and adherence to safety regulations. Furthermore, engaging with experienced lighting manufacturers, suppliers, or service providers can ensure that the installation is properly executed, resulting in a well-designed and efficient lighting system for the industrial facility.

Replacement installations in industrial lighting involve upgrading or replacing existing lighting systems in industrial environments. It is necessary to improve energy efficiency, enhance lighting quality, comply with updated regulations, or address maintenance issues. It begins with an assessment of the existing lighting system. Lighting professionals evaluate the current lighting performance, energy consumption, maintenance requirements, and the overall suitability of the system for the industrial facility. This assessment helps identify areas for improvement and determine the most appropriate replacement strategy.

Retrofit installations in industrial lighting involve upgrading existing lighting systems with more efficient technologies to improve energy efficiency, lighting quality, and maintenance requirements.

Breakup by Application:

- Warehouse & Cold Storage

- Factory & Production Lines

- Outer Premises

- Parking Areas

- Hazardous Locations

- Others

Factory and production hold the maximum share in the market

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes warehouse and cold storage, factory and production lines, outer premises, parking areas, hazardous locations, and others. According to the report, factory and production lines accounted for the largest market share.

Factories and production lines necessitate industrial lighting, as proper lighting is vital for the safety of the workers. Efficient lighting can help prevent accidents caused by poor visibility and illuminates hazards, such as moving machinery, obstacles, or areas where careful handling of materials is required. Besides this, industrial lighting allows workers to perform tasks more easily, accurately, and quickly, reducing the likelihood of errors or defects in the production process. Inspecting products for quality assurance also requires good lighting, as faults, defects, or inconsistencies in products are easier to spot under proper illumination. Furthermore, occupational safety and health regulations in many regions mandate specific standards of lighting in industrial environments to ensure the safety and well-being of workers.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest industrial lighting market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

Asia Pacific held the biggest market share due to the rising construction of various industrial projects. Besides this, the increasing focus on maintaining the safety of workers is propelling the growth of the market.

Another contributing aspect is the growing e-commerce sector due to the rising online shopping activities of consumers. Apart from this, the widespread adoption of LED lighting is supporting the growth of the market.

North America is estimated to expand further in this domain due to the increasing demand for energy-efficient lighting solutions in industries. Besides this, the growing focus on creating productive work environments in warehouses and industries is offering a favorable market outlook.

Competitive Landscape:

Key market players are investing in research operations to innovate and improve their lighting products. They are focusing on developing more energy-efficient lighting solutions, enhancing durability and reliability, improving light quality, and incorporating smart features, such as advanced controls and connectivity options. Top companies are introducing new lighting fixtures, systems, and accessories that target specific industrial applications, such as high-bay lighting, outdoor lighting, or explosion-proof lighting. They are also optimizing LED lighting solutions by improving efficacy, reducing costs, and enhancing performance. Leading companies are integrating sensors, connectivity, and advanced controls into lighting systems, which allows for energy optimization through automatic dimming, occupancy sensing, daylight harvesting, and remote management.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Acuity Brands Inc.

- Bajaj Electricals Ltd. (Bajaj Group)

- Dialight plc

- Eaton Corporation PLC

- Elba SA

- Emerson Electric Co.

- GE Current, a Daintree Company

- LSI Industries Inc.

- OSRAM Opto Semiconductors GmbH (OSRAM GmbH)

- Panasonic Corporation

- Wipro Lighting

- Zumtobel Group

Recent Developments:

- In January 2022, Acuity Brands Inc. declared that it is expanding its collaboration with Microsoft to present new capabilities for smart lighting, lighting controls, and building automation solutions.

- In May 2023, Dialight plc announced the launch of ProSite High Mast, an extension of its highly popular ProSite Floodlight series, which is precision engineered to support mounting heights of up to 130 feet for a variety of outdoor industrial applications.

- In 2020, Elba SA announced its decision to focus on environment protection and design solely green lighting fixtures utilizing state-of-the-art LED technology for all its industrial, street, pedestrian, and architectural lighting solutions.

Industrial Lighting Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | High/Low Bay Lighting, Flood/Area Lighting |

| Light Sources Covered | LED, High-Intensity Discharge (HID) Lighting, Fluorescent Lighting |

| Offerings Covered | Lamps and Luminaries, Control Systems, Services |

| Types Covered | New Installation, Replacement Installation, Retrofit Installation |

| Applications Covered | Warehouse and Cold Storage, Factory and Production Lines, Outer Premises, Parking Areas, Hazardous Locations, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acuity Brands Inc., Bajaj Electricals Ltd. (Bajaj Group), Dialight plc, Eaton Corporation PLC, Elba SA, Emerson Electric Co., GE Current a Daintree Company, LSI Industries Inc., OSRAM Opto Semiconductors GmbH (OSRAM GmbH), Panasonic Corporation, Wipro Lighting, Zumtobel Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the industrial lighting market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global industrial lighting market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industrial lighting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial lighting market was valued at USD 9.7 Billion in 2024.

The industrial lighting market is projected to exhibit a CAGR of 4.15% during 2025-2033.

The industrial lighting market is driven by increasing demand for energy-efficient lighting solutions, advancements in LED technology, and the growing focus on sustainability. Additionally, the expansion of industrial sectors, including manufacturing, construction, and mining, along with government regulations promoting energy conservation, further fuel the market's growth.

Asia Pacific currently dominates the market, driven by the rising construction of various industrial projects and the increasing focus on maintaining the safety of workers.

Some of the major players in the industrial lighting market include Acuity Brands Inc., Bajaj Electricals Ltd. (Bajaj Group), Dialight plc, Eaton Corporation PLC, Elba SA, Emerson Electric Co., GE Current a Daintree Company, LSI Industries Inc., OSRAM Opto Semiconductors GmbH (OSRAM GmbH), Panasonic Corporation, Wipro Lighting, Zumtobel Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)