Industrial IoT Market Report by Component (Hardware, Software, Services, Connectivity), End User (Manufacturing, Energy and Utilities, Automotive and Transportation, Healthcare, and Others), and Region 2026-2034

Industrial IoT Market Overview:

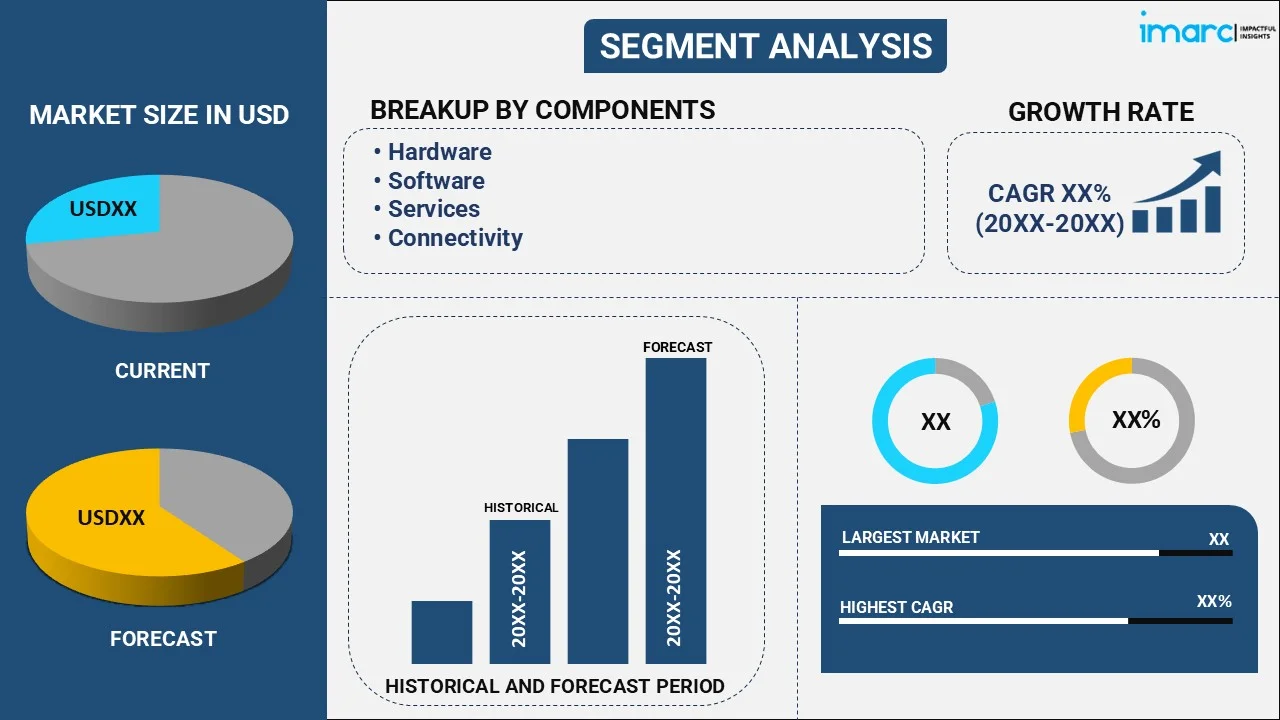

The global Industrial Internet of things (IIoT) market size reached USD 325.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 944.8 Billion by 2034, exhibiting a growth rate (CAGR) of 12.18% during 2026-2034. The market is driven by the growing number of smart cities, as they leverage IIoT to enhance efficiency, sustainability, and quality of life through interconnected systems and real-time data analytics, rising use of edge computing, and increasing reliance on 5G technology.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 325.7 Billion |

| Market Forecast in 2034 | USD 944.8 Billion |

| Market Growth Rate 2026-2034 | 12.18% |

Industrial IoT Market Analysis:

- Major Market Drivers: Rising automation in various industries and increasing need to improve operational competence are bolstering the market growth.

- Key Market Trends: The growing availability of sensors that provide real-time access to information, along with advancements in technology, are strengthening the growth of the market.

- Geographical Trends: Europe holds the largest segment because of its robust manufacturing sector and several government initiatives.

- Competitive Landscape: Some of the major market players in the industrial IoT industry include Cisco Systems, Inc., General Electric, Honeywell International Inc., Intel Corporation, International Business Machines Corporation, ABB Group, Rockwell Automation, Siemens AG, Huawei Technologies Co., Ltd., Bosch, KUKA Robotics, Texas Instruments Incorporated, Dassault Systèmes SE, PTC, Arm Limited, NEC Corporation, among many others.

- Challenges and Opportunities: While the market faces challenges like lack of standardization in IoT protocols, which impacts the market, it also encounters opportunities in the predictive maintenance of machinery.

To get more information on this market Request Sample

Industrial IoT Market Trends:

Rising trend of smart cities

According to the IMARC Group’s report, the global smart cities market reached US$ 1,233.7 Billion in 2023. IIoT enables cities to monitor and optimize critical infrastructure, such as transportation networks and utilities like water, electricity, gas, and waste management systems. It also allows to monitor usage patterns, environmental conditions and performance of the infrastructure through sensors, IoT devices and other tools. Moreover, IIoT is used by smart cities for energy management and energy saving. It additionally improves the strength of IoT devices, the operation and control of distribution networks, and the integration of renewable energy sources to the grid, which implies that power intake stages are decreased, carbon emissions minimized, and sustainability ranges raised, thereby bolstering the industrial IoT market growth.

Increasing reliance on edge computing

Edge computing brings data processing closer to the data source, which reduces latency by minimizing the time it takes for data to travel between devices and centralized cloud servers. In industrial settings, where real-time decision-making is essential for operations such as predictive maintenance or process control, low latency provided by edge computing is crucial. In addition, edge computing increases the robustness and fault tolerance of IIoT systems by shifting reliance on centralized systems. Edge computing ensures that some of the computing services can be done locally in case there is a breakdown of the internet connection or cloud functionality. The IMARC Group’s report shows that the global edge computing market is expected to reach US$ 90.3 Billion by 2032.

Growing 5G connections

5G networks are characterized by higher data transfer rates and lower response time compared to previous generations. This sort of high-speed connection is critical for IIoT applications that need timely data transfer and low latency, such as remote monitoring, autonomous operations, and precision manufacturing, thereby influencing industrial IoT market revenue. In line with this, 5G networks embrace high-end technologies like artificial intelligence (AI), ML, augmented reality (AR), and virtual reality (VR). The smooth functioning of these technologies and using IIoT to foster automation, efficiency, and productivity in industries depend on high-speed, low-latency connection. As per an article published in 2023 on the website of the National Telecommunications and Information Administration U.S. Department of Commerce shows that the global 5G connections are forecasted to reach 5.9 billion by the end of 2027.

Industrial IoT Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2026-2034. Our industrial IoT market report has categorized the market based on component and end user.

Breakup by Component:

To get detailed segment analysis of this market Request Sample

- Hardware

- Software

- Services

- Connectivity

Hardware accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, services, and connectivity. According to the report, hardware represents the largest segment.

IIoT hardware includes many elements like sensors, actuators, and gateways, and the implementation modules and devices for helping communicate with the physical asset or environment. These are the hardware components vital for collecting data in real-time from the involved machines, equipment and structures which are central to IIoT practical applications such as predictive maintenance, remote monitoring and processes enhancement. Moreover, the proliferation of smart sensors and connected devices within industrial settings is driving the demand for robust, reliable hardware solutions that can withstand difficult working environments and integrate efficiently with the existing systems.

Breakup by End User:

- Manufacturing

- Energy and Utilities

- Automotive and Transportation

- Healthcare

- Others

Manufacturing holds the largest share of the industry

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes manufacturing, energy and utilities, automotive and transportation, healthcare, and others. According to the report, manufacturing accounts for the largest market share.

IIoT solutions are crucial in enabling interaction between firms and deployment of progressive manufacturing approaches that utilize sensors, automation systems, together with analytics in the management of real-time equipment monitoring, which allows for remote, condition-based monitoring and predictive maintenance, saves time and money while catalyzing the industrial IoT demand. Additionally, IIoT facilitates agile production systems through enhanced supply chain management, inventory optimization, and quality control. Key players leverage IIoT to implement smart factory initiatives, wherein interconnected machines and structures communicate seamlessly to optimize workflows and enhance normal production output. The need for change in Industry 4.0 capabilities that focus on digital transformation and interconnectivity across manufacturing facilities, propelling the use of the IIoT solutions.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Europe leads the market, accounting for the largest industrial IoT market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Europe, North America, Asia Pacific, Middle East and Africa, and Latin America. According to the report, Europe represents the largest regional market for industrial IoT.

Europe boasts of a strong industrial economy ranging from manufacturing to automobiles, healthcare to energy. These industries are being integrated IIoT technology in their operations in order to improve their efficiency as well as reduce the costs of operation. In addition, the focus on sustainable development and energy efficiency within the region is a major factor that promotes the development of IIoT solutions for smart grid management, renewable energy integration, and environmental monitoring. In addition, key manufacturers in Germany are focusing on leveraging IIoT technologies to enhance automation, connectivity, and data exchange across the manufacturing value chain. An article published in 2023 on the website of the International Trade Administration (ITA) shows that by 2025, 84% of German manufacturers will invest EUR 10 billion annually into smart manufacturing technologies.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major industrial IoT companies have also been provided. Some of the major market players in the industrial IoT industry include Cisco Systems, Inc., General Electric, Honeywell International Inc., Intel Corporation, International Business Machines Corporation, ABB Group, Rockwell Automation, Siemens AG, Huawei Technologies Co., Ltd., Bosch, KUKA Robotics, Texas Instruments Incorporated, Dassault Systèmes SE, PTC, Arm Limited, and NEC Corporation.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players are continuously improving IIoT platforms for scalability, interoperability, and security. They are also increasing integration of edge computing capabilities to process data closer to the source. Key players are exploring blockchain technology for secure and transparent data transactions and supply chain management in IIoT applications. Moreover, they are developing robust cybersecurity solutions to protect IIoT infrastructures. Many companies are advancing artificial intelligence (AI) and analytics for real-time data processing and predictive insights. In addition, the industrial IoT market recent developments, such as advanced algorithms and tools for predictive maintenance are done by key players. They are also improving integration with cloud computing platforms for scalable storage, data analytics, and remote access to IIoT data. For instance, in 2023, Rockwell Automation launched FactoryTalk Optix as a new addition to their visualization portfolio. It is a modern, cloud-enabled human-machine interface (HMI) platform that allows users to design, test and deploy applications directly from a web browser anywhere, anytime.

Industrial IoT Market News:

- February 7, 2023: Cisco Systems added new products to its cloud tools to provide further visibility and control over networks. The new cloud management tools are designed for industrial IoT (IIoT) apps to simplify IT and OT operations dashboards and provide flexible network intelligence for industrial assets.

- July 7, 2023: ABB Ltd. and Microsoft collaborated to bring generative AI capabilities into industrial digital solutions for safer, smarter, and more sustainable operations.

Industrial IoT Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Industrial IoT Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services, Connectivity |

| End Users Covered | Manufacturing, Energy and Utilities, Automotive and Transportation, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Cisco Systems, Inc., General Electric, Honeywell International Inc., Intel Corporation, International Business Machines Corporation, ABB Group, Rockwell Automation, Siemens AG, Huawei Technologies Co., Ltd., Bosch, KUKA Robotics, Texas Instruments Incorporated, Dassault Systèmes SE, PTC, Arm Limited, NEC Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, industrial IoT market forecasts, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industrial IoT industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global industrial IOT market was valued at USD 325.7 Billion in 2025.

We expect the global industrial IOT market to exhibit a CAGR of 12.18% during 2026-2034.

The rising adoption of IIoT for enhancing employee productivity, along with integrating and adapting business models to save time and money, is primarily driving the global industrial IOT market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing deployment of IIoT to improve operational efficiencies, monitor, and control business operations remotely, during the lockdown scenario.

Based on the component, the global industrial IOT market has been segregated into hardware, software, services, and connectivity. Among these, hardware component currently holds the largest market share.

Based on the end-user, the global industrial IOT market can be bifurcated into manufacturing, energy and utilities, automotive and transportation, healthcare, and others. Currently, the manufacturing industry exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America, where Europe currently dominates the global market.

Some of the major players in the global industrial IOT market include Cisco Systems, Inc., General Electric, Honeywell International Inc., Intel Corporation, International Business Machines Corporation, ABB Group, Rockwell Automation, Siemens AG, Huawei Technologies Co., Ltd., Bosch, KUKA Robotics, Texas Instruments Incorporated, Dassault Systèmes SE, PTC, Arm Limited, and NEC Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)