Industrial Gases Market Size, Share, Trends and Forecast by Type, Application, Supply Mode, and Region, 2026-2034

Industrial Gases Market Size and Share:

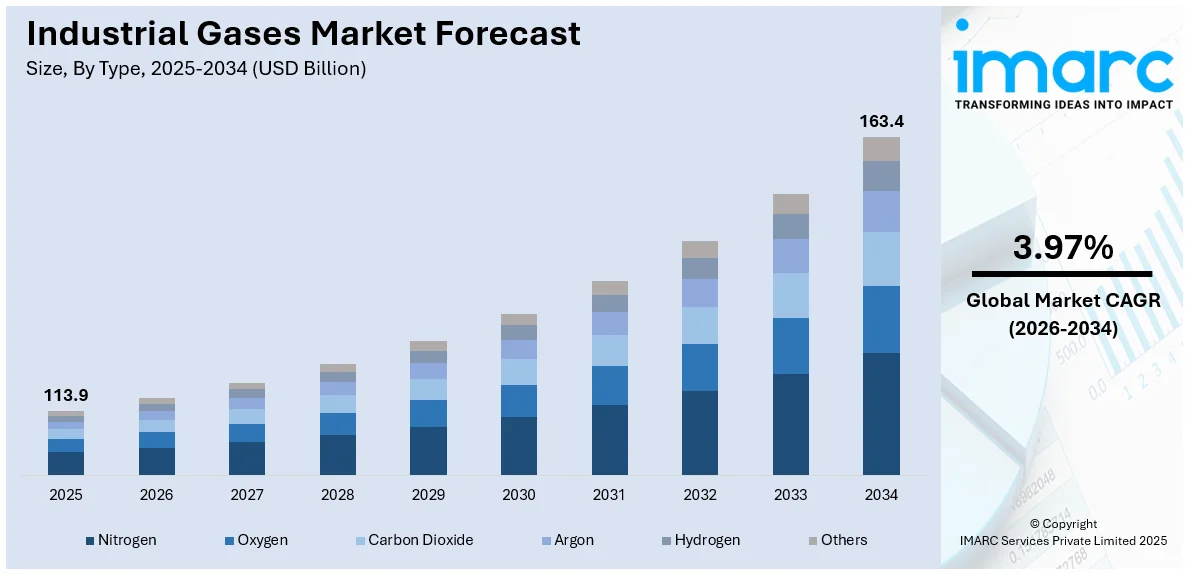

The global industrial gases market size reached USD 113.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 163.4 Billion by 2034, exhibiting a growth rate (CAGR) of 3.97% from 2026-2034. Asia Pacific dominated the market, holding a significant market share of over 36.4% in 2025. The rising product utilization in the food and beverage (F&B) industry and widespread product application in manufacturing activities are significantly propelling the market demand. Further, the recent development of on-site gas generation systems is expanding the industrial gases market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 113.9 Billion |

| Market Forecast in 2034 | USD 163.4 Billion |

| Market Growth Rate 2026-2034 |

3.97%

|

The commitment to green initiatives and cleaner production processes is a key trend, promoting market growth and encouraging other industry players to adopt eco-friendly practices. For example, Linde announced a long-term contract with H2 Green Steel in May 2024 and invested USD 150 Million in an on-site air separation unit in Sweden. This investment is expected to feed H2 Green Steel's big plant with all the required gases, such as oxygen, nitrogen, and argon, further emphasizing Linde's role in supporting sustainable steel production and boosting the industrial gases sector by 2026. Apart from this, safety in the handling and monitoring of industrial gases is a priority and is driving technological advancements in detection systems. Advances in safety technology enhance the reliability and attractiveness of industrial gases to be used across a larger section of the industry.

To get more information on this market Request Sample

The United States is expected to experience strong market demand during the forecast period. The U.S. Environmental Protection Agency (EPA) has set policies in place to reduce greenhouse gas emissions to further promote the use of lean industrial gases. Regulations on hydrofluorocarbons (HFCs) suggest utilizing clean atmospheric gases like CO2 and NH3 as refrigerants and for air conditions. Along with this, processes to limit industrial emissions and improve energy intensity stimulate the use of gases adopted in CCS technologies. These regulations integrate with the overarching national energy and climate change plan to mitigate change and enhance air quality. Furthermore, California’s push for green hydrogen projects demonstrates how industrial gas suppliers are adapting to meet the demand for eco-friendly alternatives in manufacturing and power generation.

Industrial Gases Market Trends:

Significant Growth in the Food and Beverage (F&B) Industry

Industrial gases have emerged as important applications in the food and beverage industry, such as freezing and cooling methods to help keep the structure, nutrients, and freshness of various food products (meat, poultry, seafood, bread, vegetables) almost indefinitely. As per industrial report, in 2024 major transits are being experienced-sustainability, personalization, and technological innovation are expected to transform food and beverage industry, as well as markets reaching a phenomenal high of USD 13,869.79 Billion by the year 2032. These gases find applications in products like carbonated drinks: soft drinks, beer, and sparkling water to include fizz, flavor, and overall sensory effects. Furthermore, with the increased consumption of industrial gases, there are applications in food packaging and preservation to create inert habitats, reduce microbial development, slow down oxidation, prevent spoilage, and maintain the products' flavor and texture. Changing lifestyles of consumers, influenced by lack of time and health needs, are shifting the packaged food trends and offering a favorable industrial gases market outlook.

The Rapid Expansion of Manufacturing Activities

Industrial gases are widely used in the manufacturing of metal products, electronics, glasses, rubbers, automobiles, and chemicals. In line with this, they aid in generating high-temperature flames that are used for efficient welding, brazing, and cutting operations. Furthermore, industrial gases create an inert environment, which prevents oxidation during annealing, hardening, and tempering of metal products. Additionally, they are widely used in the automotive industry to inflate tires, fabricate vehicle components, and enable smooth painting and coating operations. Besides this, industrial gases act as feedstock material in the manufacturing of various chemicals, such as ammonia and methanol. The dynamic growth of the manufacturing industry is also driving the market growth. According to data from the United Nations Industrial Development Organization, the manufacturing sector in most regions continued to experience production losses in the first quarter of 2024 when compared to the previous quarter. China achieved the best performance again, with a quarterly manufacturing expansion of 1.3 %, representing an inter-annual increase of almost 5%.

Recent Technological Advancements

In the recent years, rapid technology advances have taken place within the industrial gases industry to increase efficiency in product use, sustainability, and overall costs. This recent establishment of on-site generation systems to generate industrial gases such as hydrogen, nitrogen, and oxygen directly where they will be utilized, obviating the need for transportation and storage equipment, is expected to positively influence market growth. The incorporation of advanced purification systems such as pressure swing adsorption (PSA) and membrane separation in the new methods of purifying industrial gases, making them free of impurities and contaminants, ensures their high quality and compliance with stringent industry standards favorably influences the market. Supplementary developments such as sustainable methods of hydrogen production such as electrolysis, using renewable electricity to replace fossil fuel supply, go further to boost the industrial gases market growth. To improve efficiency in the operations of industrial gases, AI and IoT technology are also being deployed. In the years to come, the advancements in air separation devices are expected to bring about a 5 to 10% reduction in energy use.

Industrial Gases Market Growth Drivers:

Increasing Oil and Gas Exploration Activities

Growth in the oil and gas, and petrochemical industries is a major driver of the industrial gases market. All these industries are heavy consumers of a wide range of industrial gases across operations like refining, chemical manufacturing, and oil extraction. Industrial gases such as oxygen, nitrogen, and hydrogen are used in processes such as combustion, gasification, and refining to produce energy, chemicals, and fuels. The demand for petrochemical products and oil globally leads to the proportionally increased demand for industrial gases, which helps in the long-term growth of the market.

Heightened Demand for Hydrogen

Hydrogen has been at the forefront of attention over the past few years, especially among the chemical and refining industries, as companies try to decarbonize production. Its position as a clean-burning fuel and a primary ingredient in the production of ammonia and methanol, as well as hydrogenation processes, is critical. As nations and businesses commit to lowering carbon emissions, hydrogen has become a leading alternative energy source. This shift to a hydrogen economy is fueling strong demand for industrial gases, with business organizations increasingly turning to hydrogen due to its value in lowering carbon footprints and enabling sustainable production processes. Therefore, the growing demand for hydrogen is an essential element in positively influencing the market. According to the International Energy Agency on June 5, global investment in clean hydrogen technologies is expected to increase by 70% in 2025, approaching $8 billion, notwithstanding a series of notable project cancellations, as governments continue to provide policy support and developers advance projects that have attained final investment decisions.

Healthcare Sector Innovation

The healthcare industry is another important driver of industrial gas demand. Oxygen, nitrogen, and medical air are some gases used in many medical procedures such as respiratory therapy, anesthesia, and cryogenics. Oxygen, for example, plays a critical role in lifesaving procedures and finds wide applications in hospitals and clinics. Nitrogen due to its inert nature is utilized in cryogenic freezing, and medical air is utilized for ventilation systems. With the healthcare market enhancing operations and advancements in medical treatments on the rise, the use of industrial gases for patient care, diagnostics, and surgery is bound to grow more, also increasing the demand for industrial gases.

Industrial Gases Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global industrial gases market report, along with forecasts at the global and regional levels from 2026-2034. The report has categorized the market based on type, application, and supply mode.

Analysis by Type:

- Nitrogen

- Oxygen

- Carbon Dioxide

- Argon

- Hydrogen

- Others

Nitrogen leads the market with 28.2% market share in 2025. As per the industrial gas industry overview, nitrogen is a cost-effective, safe, and abundantly available gas that is widely used in preserving, purging, and blanketing applications. It also aids in preventing oxidation, corrosion, and spoilage in different industries. Furthermore, nitrogen provides a reliable and safe option for various processes, owing to its non-flammable and non-toxic nature, which assists in ensuring the well-being of workers and preventing potential hazards. Apart from this, the incorporation of advanced production technologies to increase yield and provide a high level of purity is expanding the industrial gases market scope.

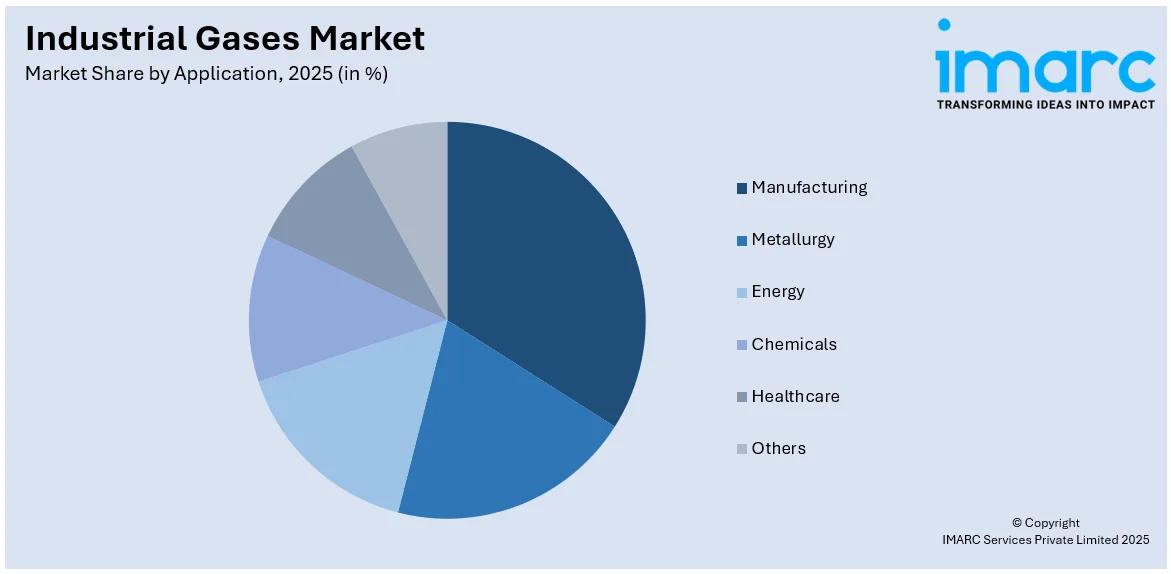

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Metallurgy

- Energy

- Chemicals

- Healthcare

- Others

Manufacturing leads the market with a 27% market share in 2025. Industrial gases are widely used in manufacturing activities for various applications, such as welding, cutting, heat treatment, metal fabrication, chemical production, food processing, and electronics manufacturing. In addition, they aid manufacturers in optimizing processes, improving efficiency, streamlining operations, reducing costs, and increasing overall productivity.

Analysis by Supply Mode:

- Packaged

- Bulk

- On-site

Packaged supply mode held a significant market revenue in 2025. Packaged industrial gases are delivered in compressed and liquified forms in cylinders and tanks, which enhances convenience, increases portability, and allows easy transportation, storage, and handling across various industries. Furthermore, the widespread utilization of packaged industrial gases for multiple applications, such as welding and cutting operations, laboratory analysis, food and beverage processing, healthcare, metal fabrication, automotive repairs, and electronics manufacturing, is providing an impetus to the market growth.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East and Africa

In 2025, Asia Pacific accounted for the largest market share of 36.4%. Asia Pacific holds the largest market share, owing to the rapid economic growth and increasing industrialization and infrastructural development activities. Furthermore, Asia Pacific is a lucrative manufacturing destination that allows companies to establish cost-effective production facilities for automobiles, electronics, chemicals, semiconductors, and machinery. These production facilities heavily rely on industrial gases for welding, cutting, heat treatment, and metal fabrication operations. Moreover, the rapid expansion of the healthcare industry in the Asia Pacific region, owing to the rising geriatric population, increasing health awareness, and growing investment in healthcare infrastructure, is facilitating the demand for industrial gases.

Key Regional Takeaways:

North America Industrial Gases Market Analysis

This market for industrial gases in North America is growing steadily, primarily driven by the manufacturing, healthcare, and energy sectors. Manufacturing has remained the biggest end-user of industrial gases, specifically for oxygen and nitrogen, which are used in a variety of applications such as metal production and welding, as well as chemical processing. Medical-grade gases such as oxygen and carbon dioxide are experiencing rising demand from the healthcare sector due to the rapidly aging population. Besides, hydrogen's growing demand for applications in fuel cell and energy production is due to the shift toward cleaner energy solutions. Furthermore, technological advancements and innovations and environmental sustainability initiatives in the USA and Canada also propel the market's growth.

United States Industrial Gases Market Analysis

United States accrued a market share of 88.9% in 2025 in the North America market. The US market for industrial gases is fuelled by a variety of sectors, including manufacturing, healthcare, electronics, and energy. Because of the rise in surgeries and improvements in medical technology, the healthcare industry has a substantial expanding demand for industrial gases such as carbon dioxide, nitrogen, hydrogen, and oxygen. Approximately 30% of the entire industrial gas demand in 2023 came from the U.S. healthcare sector, which uses oxygen substantially for respiratory assistance and life-saving procedures.

The use of high-tech procedures like welding and metal fabrication, which significantly rely on gases like carbon dioxide and argon, is driving expansion in the industrial sector. The US electronics industry is growing substantially and requires ultra-high-purity gases for the fabrication of semiconductors, especially in Silicon Valley. Furthermore, the usage of hydrogen in clean energy applications like fuel cells and hydrogen-powered cars has increased because of the move toward renewable energy sources. According to the US Department of Energy, the hydrogen value chain will generate USD 140 Billion/year by 2030 and USD 750 Billion/year by 2050 in revenues. This will create 700,000 new jobs by 2030 and a cumulative 3.4 Million jobs by 2050.

Europe Industrial Gases Market Analysis

The strong focus on sustainability, the region's strong healthcare system, and developments in food and beverage production are the main factors propelling the industrial gases market in Europe. The use of industrial gases in clean technologies, such as carbon capture and storage (CCS) and hydrogen energy systems, has been encouraged by the European Union's stringent emission regulations and green energy projects. The Clean Hydrogen Partnership and the European Union identified 476 operational hydrogen production plants around Europe as of the end of 2022, with a combined hydrogen production capacity of about 11.30 Million Tons. Due to the considerable demand for nitrous oxide and oxygen for medical procedures and treatments, the European healthcare industry holds a sizable portion of the industrial gases market.

Latin America Industrial Gases Market Analysis

The food and beverage, metal fabrication, and healthcare sectors are the main drivers of the industrial gases market in Latin America. Because of their robust manufacturing and agricultural sectors, Brazil and Mexico use the most industrial gas in the region. The World Bank forecasts that Latin America and the Caribbean (LAC) regional GDP will expand by 1.6 percent in 2024. GDP growth of 2.7 and 2.6 are expected for 2025 and 2026. These rates are the lowest compared to all other regions in the world, and insufficient to drive prosperity Gases like carbon dioxide and nitrogen are widely employed in the food sector for carbonation, packaging, and food preservation.

Middle East and Africa Industrial Gases Market Analysis

The energy sector, healthcare requirements, and water treatment procedures are the main drivers of the industrial gases market in the Middle East and Africa. Industrial gases like carbon dioxide and nitrogen are used by the oil and gas sector, which is a major contributor to the region's economy, for improved oil recovery and refining procedures. As part of their diversification plans, nations like Saudi Arabia and the United Arab Emirates are also making significant investments in the production of hydrogen. Oxygen and nitrous oxide demand is rising in Africa's healthcare system, especially in cities where medical facilities are becoming better. Furthermore, industrial gases like ozone are used in water treatment procedures in dry areas to sterilize water.

Competitive Landscape:

The global industrial gases market is experiencing steady growth due to rapid industrialization activities across the globe. The top producers of industrial gases are focusing on expanding their global footprint by establishing new production facilities, distribution networks, and partnerships with local players. In addition, the increasing focus on sustainability has prompted several companies to develop energy-efficient production technologies that aid in attracting environmentally conscious customers, reducing environmental pollution, and contributing to greener industrial facilities. Furthermore, several top companies are incorporating automation and digital technologies to optimize operations, increase supply chain efficiency, and enhance customer experience.

The report provides a comprehensive analysis of the competitive landscape in the global industrial gases market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Air Liquide S.A.

- Linde Group

- Air Products and Chemicals Inc.

- Airgas Inc.

Latest News and Developments:

- September 2025: QatarEnergy signed a long-term helium supply deal with Germany's Messer, committing to deliver 100 million cubic feet of helium annually from its Ras Laffan facility. This agreement strengthens Qatar's position as a leading helium producer, supporting industries like healthcare, manufacturing, and space exploration.

- September 2025: Linde completed its acquisition of Airtec, increasing its stake to over 90%. This move expands Linde's presence across the GCC region, including Kuwait, UAE, Qatar, Bahrain, and Saudi Arabia. The acquisition strengthens Linde's integrated industrial gases business, enhancing supply chain reliability and customer service.

- September 2025: Linde India began commercial production at its new gas facility in Unnao, Lucknow, aimed at boosting the supply of medical and industrial gases. The plant enhances regional storage and distribution, supporting both hospitals and industries. Despite a revenue dip in Q2, the company saw improved margins due to cost efficiencies.

- July 2025: AHG Group announced a $20 million investment in a new industrial gas production facility in Dammam, Saudi Arabia. This expansion aligns with Saudi Arabia's Vision 2030, aiming to boost local production, enhance supply chains, and support the kingdom's industrial transformation. The facility will play a key role in meeting the growing demand for industrial gases in the region.

- March 2025: gasworld Intelligence launched "Atom," a next-generation data intelligence platform for the industrial gas sector. Debuted at the European CO₂ Summit 2025 in Rotterdam, Atom offers forecasted analytics and interactive tools, initially focused on CO₂ markets. It aims to enhance strategic decision-making across the industry.

- March 2025: Saudi Aramco finalized its acquisition of a 50% stake in Blue Hydrogen Industrial Gases Co. (BHIG), a joint venture with Air Products Qudra. This strategic move supports the development of a low-carbon hydrogen network in Jubail Industrial City and aligns with Saudi Arabia’s Vision 2030 and net-zero goals. BHIG will focus on producing blue hydrogen through carbon capture and storage.

- February 2025: Air Liquide expanded its presence in Japan with the start-up of a new air separation unit in Kyushu. This facility would produce oxygen and nitrogen to support the growing demand from the semiconductor, automotive, and other manufacturing sectors. The investment reflects rising energy-efficient gas needs and reinforces Air Liquide’s long-term partnerships with Japanese industries, ensuring a stable supply and advancing local production capabilities aligned with future market requirements.

Industrial Gases Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Nitrogen, Oxygen, Carbon Dioxide, Argon, Hydrogen, Others |

| Applications Covered | Manufacturing, Metallurgy, Energy, Chemicals, Healthcare, Others |

| Supply Modes Covered | Packaged, Bulk, On-site |

| Regions Covered | Asia Pacific, North America, Europe, Middle East and Africa, Latin America |

| Companies Covered | Air Liquide S.A., Linde Group, Air Products and Chemicals Inc., Airgas Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, industrial gases market forecast, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global industrial gases market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Industrial Gases industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial gases market was valued at USD 113.9 Billion in 2025.

The industrial gases market is projected to exhibit a CAGR of 3.97% during 2026-2034, reaching a value of USD 163.4 Billion by 2034.

The industrial gases market is driven by rising demand from healthcare, manufacturing, and energy sectors, growing applications in food preservation and electronics, technological advancements, and increased steel and chemical production. Environmental regulations promoting cleaner energy and expanding industrialization in emerging economies also significantly contribute to market growth.

Asia Pacific dominated the industrial gases market in 2025, accounting for a share of 36.4%. This is due to rapid industrialization, expanding healthcare and manufacturing sectors, rising infrastructure projects, and growing demand for electronics and clean energy across emerging economies like China and India.

Some of the major players in the industrial gases market include Air Liquide S.A., Linde Group, Air Products and Chemicals, Inc., Airgas, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)