Industrial Garnet Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Industrial Garnet Market Size and Share:

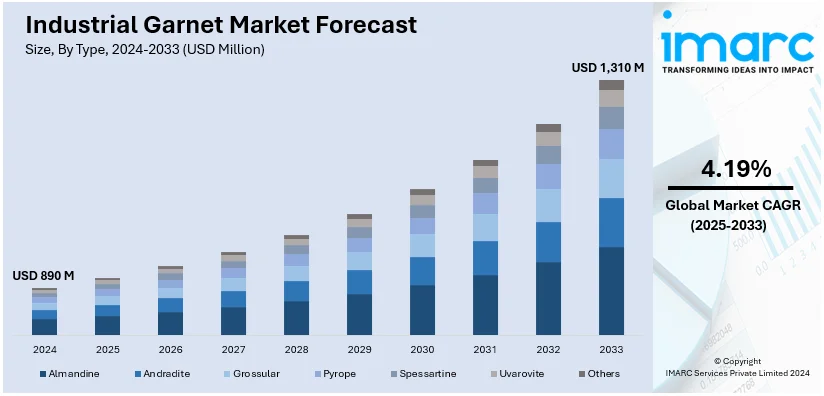

The global industrial garnet market size was valued at USD 890 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,310 Million by 2033, exhibiting a CAGR of 4.19% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 45.4% in 2024. Rapid growth of the manufacturing and construction industries, the increasing demand for high quality abrasive materials, and the rising shift toward sustainable and environment-friendly materials, represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 890 Million |

| Market Forecast in 2033 | USD 1,310 Million |

| Market Growth Rate (2025-2033) | 4.19% |

The global market is growing significantly due to continual technological advancements in precision manufacturing. Automated machinery in aerospace, automotive, and electronics sectors has increased the demand for high-performance abrasives. Garnet provides superior cutting precision and maintains material integrity, making it essential in advanced machining. The transition to renewable energy is also raising garnet use in photovoltaic panel and wind turbine blade production, further fueling market expansion. Investments in infrastructure development in emerging economies are opening new opportunities for surface preparation and coating removal applications. Moreover, the growing oil and gas sector values garnet for its effective filtration capabilities, crucial for process efficiency in water treatment. Furthermore, the integration of advanced photonics and radiation detection technologies is driving market growth as companies focus on developing comprehensive solutions. For example, Luxium Solutions, a leader in high-performance crystals for photonics and radiation detection, acquired Inrad Optics on July 2, 2024, strengthening its position in the optics and photonics industry. The acquisition enhances Luxium's portfolio, which includes industrial garnet substrates, and expands its global capabilities.

The United States is a key regional market that is expanding due to its crucial role in advanced manufacturing. The widespread use of waterjet cutting in industries, including aerospace, defense, and healthcare shows garnet's value in precision fabrication. In electronics, increased semiconductor production has driven up garnet demand for wafer slicing and finishing, aiding the industry's rapid growth. The government's emphasis on infrastructure development, also propels demand, as garnet is essential for surface preparation in construction. Additionally, heightened environmental awareness is increasing garnet use in water treatment due to its excellent filtration properties, aligning with regulatory and sustainability standards. The oil and gas sector also depends on garnet for filtration and blasting, highlighting its versatility. Ongoing advancements in production and supply chains ensure a steady supply, further promoting garnet's use across U.S. industries.

Industrial Garnet Market Trends:

Expansion of Manufacturing and Construction Industries

With the continued expansion of industries, the demand for high-quality abrasive materials, such as industrial garnet increases. According to Deloitte, in 2024, the construction industry's robust growth, marked by a 10% rise in nominal value added, USD 2 Trillion in spending, and employment surpassing 8.3 million has bolstered demand for industrial garnet, leveraging its benefits in abrasive and filtration applications to enhance efficiency and sustainability in construction processes. Industrial garnet significantly boosts productivity and quality in processes like sandblasting, waterjet cutting, and polishing. As industries prioritize efficiency and sustainability, garnet's versatility makes it a vital choice for enhancing manufacturing outcomes and supporting environmental filtration objectives. With the global expansion of industrial operations, the garnet market is poised for growth due to its process optimization capabilities and superior results.

Growing Focus on Sustainability

The rising emphasis on sustainability and recycling in industry is increasing the demand for reusable, eco-friendly abrasive materials, such as garnet. On October 21, 2024, McDermott received platinum status in GMA Middle East's used garnet return rewards program, recognizing a decade-long partnership. This accolade highlights McDermott's dedication to sustainability and environmental responsibility, having returned approximately 32,000 tons of industrial garnet from its fabrication paint blasting operations. This effort aligns with McDermott's initiatives to divert solid waste from landfills. Businesses are adopting waste-reduction practices, fostering a strong market for garnet recycling efforts. The reusability of garnet in paint blasting helps lower landfill contributions while maintaining cost-effectiveness. This trend is supported by stricter regulations and corporate sustainability commitments, promoting garnet recycling further. Consequently, the industrial garnet market thrives alongside environmental stewardship initiatives.

Rising Investments in Garnet Distribution Infrastructure

The escalating demand for industrial garnet in the Asia Pacific region is driving investments in advanced distribution networks. To meet the growing requirements of sectors like construction, manufacturing, and waterjet cutting, efficient supply chains are crucial. In response to this, companies are enhancing their service and reliability by ensuring timely deliveries. For example, On June 18, 2024, GMA Garnet Group inaugurated a distribution hub in Port Klang, Malaysia, to enhance service and expedite product delivery across the Asia Pacific region. This facility supports GMA's commitment to meeting growing demand and improving supply chain capabilities, ensuring efficient and reliable customer service. This focus on streamlined logistics supports market expansion as it allows businesses to grow while minimizing delays. Development of regional hubs further strengthens the supply chain, facilitating garnet's adoption across various applications in the rapidly growing Asia Pacific market.

Industrial Garnet Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global industrial garnet market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Almandine

- Andradite

- Grossular

- Pyrope

- Spessartine

- Uvarovite

- Others

Almandine stands as the largest component in 2024, accounting for 33.6% share of the market. Almandine garnet is the preferred choice in industrial settings due to its outstanding hardness, chemical stability, and cost-effectiveness. Its high density and toughness provide exceptional performance in demanding tasks such as abrasive blasting, waterjet cutting, and surface preparation. With uniform particle size and low silica content, almandine reduces health risks during use, making it a popular option for eco-conscious industries. Its ability to be reused improves cost efficiency, further driving its widespread use across different sectors. The abundance of almandine in key garnet-producing areas and its ease of processing add to its market prominence. As industries increasingly focus on efficiency and sustainability, almandine garnet continues to fulfill strict industrial standards, reinforcing its leading role in the industrial garnet market.

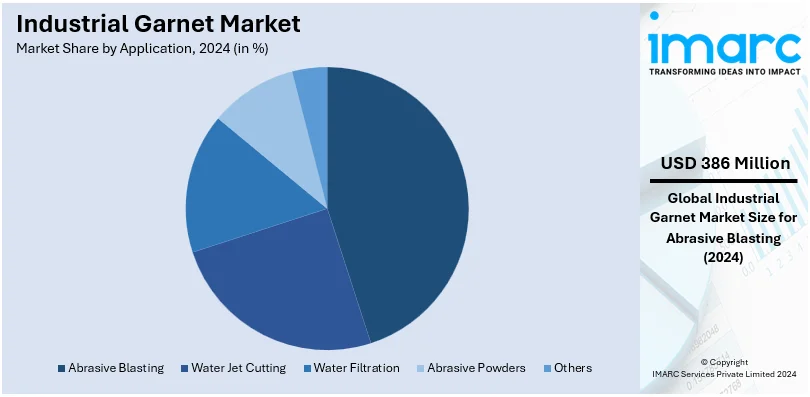

Analysis by Application:

- Water Jet Cutting

- Abrasive Blasting

- Water Filtration

- Abrasive Powders

- Others

Abrasive blasting leads the market with around 43.5% of market share in 2024. Abrasive blasting holds the largest share of the industrial garnet market due to its vital function in surface preparation in various industries. Garnet’s hardness and sharp grains effectively remove rust, paint, and other surface contaminants, providing a clean base for coatings or additional processes. It is extensively utilized in shipbuilding, construction, and industrial maintenance, where precision and efficiency are critical. Moreover, garnet’s minimal dust production during blasting enhances workplace safety and complies with environmental standards, making it a favored alternative to traditional abrasives, such as silica sand. Its recyclability also contributes to cost savings and aligns with sustainability objectives, increasing its demand. The heightened emphasis on infrastructure growth, especially in developing economies, has further strengthened the use of garnet for abrasive blasting, confirming its position as the leading application segment.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 45.4%. The Asia Pacific region dominates the industrial garnet market due to its strong industrial development, particularly in manufacturing, construction, and infrastructure growth. The region benefits from substantial garnet reserves, ensuring a stable supply of raw materials and cost advantages for industrial usage. The rise of waterjet cutting technology in manufacturing, alongside growing demand for garnet in abrasive blasting and filtration systems, enhances its market position. Furthermore, rapid industrialization and urbanization in Asia Pacific have increased infrastructure demands, advancing garnet's applications in surface preparation and coating removal. With heightened environmental regulations and a shift towards sustainable practices, the region's strategic advantages reinforce its leadership in the industrial garnet market.

Key Regional Takeaways:

United States Industrial Garnet Market Analysis

In 2024, the US accounted for around 87.80% of the total North America industrial garnet market. The demand for industrial garnet in the United States is driven by its extensive use in abrasive applications, particularly in industries such as aerospace, automotive, and electronics. According to the reports, the U.S. automotive industry, contributing 3% of GDP, drives demand for industrial garnet, essential for precision applications like abrasive blasting and waterjet cutting, showcasing its critical role in maintaining production efficiency and economic impact. The push for eco-friendly abrasives, which garnet provides due to its low dust emission and reusability, has further accelerated its adoption. Industrial garnet is increasingly used in waterjet cutting technologies, meeting the requirements of precision cutting in manufacturing and construction sectors. The growing emphasis on infrastructural development is supporting its use in blasting operations for steel and concrete surface preparation. Additionally, advancements in the petroleum industry, where garnet is applied in well stimulation processes, have bolstered its demand. Technological innovations in garnet mining and processing have enhanced the quality and consistency of garnet products, further promoting its application. Moreover, the strict environmental regulations are encouraging industries to adopt garnet over silica sand for blasting to mitigate health risks associated with silica dust exposure.

Asia Pacific Industrial Garnet Market Analysis

The Asia-Pacific market is flourishing due to the region's rapid industrialization and infrastructure development. Garnet is increasingly used in waterjet cutting and abrasive blasting in construction projects, including large-scale developments such as smart cities and transportation networks. The region's significant textile industry is also adopting garnet for its role in advanced fabric production, where precision and efficiency are critical. Additionally, the expanding oil and gas industry in countries like India and China is driving the demand for garnet in pipeline maintenance and cleaning. The rise of renewable energy projects in the region has also contributed to garnet's growing adoption in turbine maintenance and other energy-related applications. According to Ministry of Finance, India, India's unified power grid, among the world's largest with a transfer capacity of 118,740 MW and 485,544 circuit kilometres of transmission lines, is set to support the nation's renewable energy expansion, projected to attract investments of approximately USD 360 Billion by 2030, with industrial garnet playing a crucial role in manufacturing efficient renewable technologies to meet the growing energy demands. With a focus on environmentally friendly manufacturing processes, industries are replacing traditional abrasives with garnet for its non-toxic and recyclable attributes. The region's dominance in the shipbuilding and maintenance sector further propels garnet usage in cleaning and surface preparation of vessels. Moreover, the growing mining sector in Asia-Pacific ensures a stable supply of garnet, catering to the increasing regional demand. The competitive pricing of garnet in the region due to local production further strengthens its market position in industrial applications.

Europe Industrial Garnet Market Analysis

In Europe, the market benefits significantly from advancements in industrial cleaning and maintenance processes. The growing manufacturing sector extensively uses garnet abrasives for surface cleaning and polishing, particularly in heavy machinery and equipment maintenance. The region's burgeoning construction and infrastructure refurbishment activities create a steady demand for garnet in surface preparation and finishing. According to EU, The EU has allocated approximately USD 7.6 Billion to 134 transport projects under the Connecting Europe Facility, with 83% aimed at modernizing sustainable infrastructure. Industrial garnet demand rise as railways, waterways, and maritime routes undergo upgrades under the revised TEN-T Regulation. The increasing adoption of garnet in industrial filtration systems, particularly in the pharmaceutical and food processing industries, further boosts its market. These industries utilize garnet for water treatment and chemical purification, which aligns with Europe’s stringent environmental standards. Furthermore, the growth of marine industries in countries like Norway and the Netherlands drives the demand for garnet abrasives in ship cleaning and maintenance. The focus on reducing workplace hazards and the use of eco-friendly materials encourages the adoption of garnet as an alternative to silica-based abrasives. Recycling initiatives and technological advancements in garnet recovery processes add to its sustainability, enhancing market appeal. Garnet is also gaining popularity in decorative stone cutting and polishing, a niche yet growing segment driven by Europe’s aesthetic and architectural trends.

Latin America Industrial Garnet Market Analysis

Latin America’s market is driven primarily by its applications in the oil and gas industry, especially in pipeline cleaning and maintenance processes. The material's effectiveness in providing a high-performance abrasive solution makes it indispensable for regional energy operations. Additionally, the maritime and ship maintenance sectors are adopting garnet for abrasive blasting due to its efficiency and low environmental impact. The mining industry also uses garnet abrasives extensively in mineral processing activities, contributing to the market’s expansion. For instance, mining activities in Latin America, contributing 13–19% of incoming foreign direct investment, drive the industrial garnet market's growth due to its increasing application in abrasive blasting, waterjet cutting, and filtration, aligning with the region's resource-rich potential. Garnet’s chemical stability and versatility as a filtration medium are further supporting its application in water treatment plants, addressing the growing need for clean water resources. The region’s focus on sustainable industrial practices is boosting garnet’s prominence as an eco-friendly alternative to traditional abrasives.

Middle East and Africa Industrial Garnet Market Analysis

The market in the Middle East and Africa is witnessing growth, particularly in the oil and gas industry, where garnet abrasives are used for pipeline cleaning and maintenance. Its application in water filtration systems is also expanding, driven by the need for efficient solutions in arid regions facing water scarcity challenges. For instance, Saudi Arabia, facing a rising population projected to hit 40.1 Million by 2030 and limited natural water resources, is set to generate 2.18 Billion m³/year of desalinated water while consuming 360 L/day per capita. With USD 80 Billion allocated to water projects and 133 wastewater facilities established in 2021, industrial garnet emerges as a key material in desalination and water salinity management, supporting sustainable water initiatives. Garnet’s role in metal fabrication and industrial cleaning processes is growing as industries demand cost-effective and eco-friendly abrasive materials. The material's durability and reusability make it a preferred choice for maintaining heavy industrial equipment in the region. Additionally, as environmental concerns rise, garnet is increasingly replacing silica-based abrasives in various applications, ensuring compliance with stricter safety and health regulations. The adoption of garnet is further supported by its versatility and ability to perform in demanding industrial environments.

Competitive Landscape:

Major players in the market are prioritizing product innovation, improving production capabilities, and forming strategic partnerships to meet the increasing demand from sectors like waterjet cutting, abrasives, and filtration. Companies are investing in sustainable mining practices to meet environmental standards. They are also improving supply chain efficiencies to guarantee steady product availability. These companies are targeting emerging markets, especially in the Asia-Pacific region, where industrialization and infrastructure projects are on the rise. They aim to diversify their product lines to address niche needs, including gemstone production and high-performance coatings. Mergers and acquisitions are key strategies to enhance market presence and broaden global reach. A strong focus on research and development is facilitating the creation of high-grade garnet products to sustain competitive advantages.

The report provides a comprehensive analysis of the competitive landscape in the industrial garnet market with detailed profiles of all major companies, including:

- Barton International

- GMA Garnet Group

- Industrial Minerals NZ Ltd.

- IREL (India) Limited

- Opta Group LLC

- RZG Garnet Inc.

- Transworld Garnet India Private Limited

- Trimex Sands Pvt Ltd. (Trimex Group)

- V.V. Mineral Pvt. Ltd.

Latest News and Developments:

- December 2024: Pure Resources announced successful funding to acquire the Reedy Creek high-grade garnet project. The site is set to produce premium garnet for industrial applications, including abrasives. This initiative aligns with the growing demand for eco-friendly garnet alternatives. The project strengthens Pure Resources' position in the mineral resource sector.

- August 2024: Jebsen & Jessen Group finalized the acquisition of GMA Garnet Group, the world's largest garnet supplier. The deal bolsters its industrial minerals portfolio and ensures global supply chain efficiency. GMA Garnet's premium abrasives will strengthen Jebsen & Jessen's offerings across industries. This strategic move secures leadership in the garnet market.

- May 2023: Rosco Procom launched high-performance GMA Garnet abrasives for enhanced industrial applications. The product ensures superior cutting speed and efficiency while being eco-friendly. It caters to industries requiring precision blasting and waterjet cutting. GMA Garnet’s quality guarantees optimal performance and long-term durability for end-users.

- July 2023: The GMA Garnet Group inaugurated its renovated Coos Bay processing facility, marking a significant milestone with the arrival of a deep draft vessel for the first time in 25 years. Rod Liebeck, president of GMA Americas, led the celebration alongside his team. This upgrade enhances the facility's operational capacity and efficiency, boosting its industrial garnet processing capabilities. The remodeled port is set to strengthen GMA's position in the global abrasives market.

- May 2023: Mineral Commodities secured key offtake and financing agreements with Garnet International Resources, a subsidiary of GMA Group. Through the agreement, Mineral Sands Resources (MSR) will supply Garnet with processed garnet products, ensuring a steady production flow. This partnership highlights the strategic focus on enhancing garnet availability for industrial use. It represents a pivotal step in fostering global trade and resource optimization within the garnet industry.

Industrial Garnet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Almandine, Andradite, Grossular, Pyrope, Spessartine, Uvarovite, Others |

| Applications Covered | Water Jet Cutting, Abrasive Blasting, Water Filtration, Abrasive Powders, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Barton International, GMA Garnet Group, Industrial Minerals NZ Ltd., IREL (India) Limited, Opta Group LLC, RZG Garnet Inc., Transworld Garnet India Private Limited, Trimex Sands Pvt Ltd. (Trimex Group), V.V. Mineral Pvt. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the industrial garnet market from 2019-2033.

- The industrial garnet market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industrial garnet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Industrial garnet refers to a naturally occurring mineral used as an abrasive material in applications such as abrasive blasting, waterjet cutting, surface preparation, and filtration. Its high hardness, chemical stability, and eco-friendly nature make it a preferred choice across various industries, including construction, manufacturing, and water treatment.

The global industrial garnet market was valued at USD 890 Million in 2024.

IMARC estimates the global industrial garnet market to exhibit a CAGR of 4.19% during 2025-2033.

Key drivers include the rapid growth of manufacturing and construction industries, rising demand for high-quality abrasives, emphasis on sustainable and eco-friendly materials, and the adoption of advanced manufacturing technologies like waterjet cutting. The increasing use of garnet in renewable energy production and water filtration further fuels market growth.

Almandine garnet leads the market due to its high hardness, chemical stability, and cost-efficiency.

Abrasive blasting represents the largest application segment driven by its critical role in surface preparation.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, with Asia Pacific holding the largest market share in 2024.

Some of the major players in the global Industrial Garnet market include Barton International, GMA Garnet Group, Industrial Minerals NZ Ltd., IREL (India) Limited, Opta Group LLC, RZG Garnet Inc., Transworld Garnet India Private Limited, Trimex Sands Pvt Ltd., and V.V. Mineral Pvt. Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)