Industrial Emission Control Systems Market Size, Share, Trends and Forecast by Equipment Type, Emission Source, and Region, 2025-2033

Industrial Emission Control Systems Market Size and Share:

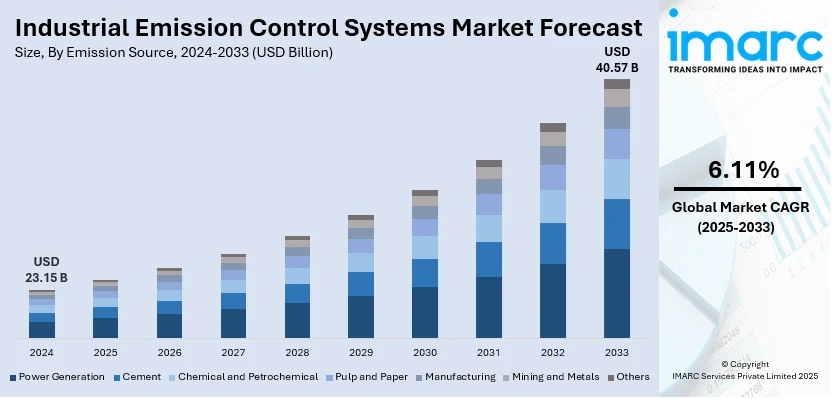

The global industrial emission control systems market size was valued at USD 23.15 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 40.57 Billion by 2033, exhibiting a CAGR of 6.11% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 48.7% in 2024. The market is expanding due to strict environmental regulations, rising industrial emissions and advancements in filtration technologies. Increasing adoption of electrostatic precipitators, scrubbers and catalytic reactors in key industries is driving growth. The shift toward sustainable production and carbon capture solutions further fuels the demand thereby strengthening the industrial emission control systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 23.15 Billion |

|

Market Forecast in 2033

|

USD 40.57 Billion |

| Market Growth Rate (2025-2033) | 6.11% |

The industrial emission control systems market is driven by stringent environmental regulations, increasing awareness of air pollution control and the growing adoption of clean energy solutions. Industries such as power generation, cement, chemicals and manufacturing are investing in advanced filtration, catalytic converters and scrubbers to reduce emissions. Rising concerns over carbon footprint reduction and government initiatives promoting sustainable industrial practices are further boosting market growth. Technological advancements in electrostatic precipitators, bag filters and selective catalytic reduction (SCR) systems enhance efficiency and compliance. For instance, in October 2023, Sterling Generators Private Limited launched the Retrofit Emission Control Device (RECD) in collaboration with Pi Green Innovations. Utilizing filter-less technology the RECD captures over 70% of particulate matter from engine exhaust. It offers an eco-friendly solution for improving air quality requiring no engine modifications and promising minimal maintenance. These advancements are creating a positive industrial emission control systems market outlook across the world.

The United States industrial emission control systems market is driven by stringent EPA regulations including the Clean Air Act and emissions standards for industries such as power generation, oil & gas, cement and chemicals. Increasing concerns over air quality greenhouse gas reduction and carbon neutrality goals are pushing industries to adopt scrubbers, catalytic converters, electrostatic precipitators and bag filters. Government incentives for clean energy technologies along with rising investments in carbon capture and storage (CCS) systems further support market growth. Technological advancements in low-emission manufacturing processes are also accelerating adoption. For instance, in June 2024, Babcock & Wilcox secured over $18 million in contracts to provide wet and dry electrostatic precipitator rebuilds for emissions control in various industries across the U.S. and Europe. These technologies are crucial for helping clients meet stringent environmental regulations.

Industrial Emission Control Systems Market Trends

Adoption of Carbon Capture and Storage (CCS) Technologies

The use of Carbon Capture and Storage (CCS) technologies is on the rise as various industries aim to lower CO₂ emissions and adhere to stringent environmental standards. CCS systems are designed to capture carbon emissions from sources like power plants, cement production, and the oil, gas, and chemical sectors, stopping them from being released into the atmosphere. There is a growing investment in innovative capture methods, including post-combustion and oxy-fuel combustion, supported by government incentives and carbon credit initiatives. Rising corporate commitments to net-zero emissions further drive CCS deployment across industrial sectors. The increasing focus on cost-effective decarbonization solutions is driving significant investments in Carbon Capture and Storage (CCS) technologies. For instance, in February 2025, CarbonQuest secured $20 million in funding from Riverbend Energy Group, Energy Capital Ventures and Aligned Climate Capital to expand its carbon capture technology deployment across North America. This investment aims to enhance system efficiency and support various industries in achieving cost-effective decarbonization solutions addressing growing market demand.

Growing Investments in Renewable Energy

The growing investments in renewable energy are driving industries toward cleaner power sources reducing dependence on traditional fossil fuel-based systems and lowering emissions. According to the data published by IEA, global clean energy investment was projected to reach $2 trillion in 2024 surpassing fossil fuel spending as overall energy investments exceed $3 trillion. Solar PV investments will exceed $500 billion with global clean energy investments in EMDE outside China remaining at roughly 15%. Companies are increasingly adopting solar, wind, hydro and bioenergy solutions to meet sustainability targets and comply with stricter environmental regulations. Government incentives, tax benefits and declining costs of renewable energy infrastructure are further accelerating this transition. As industries shift to low-emission operations the demand for traditional emission control systems is evolving with greater focus on hybrid and energy-efficient technologies.

Technological Advancements in Filtration Systems

Technological advancements in filtration systems are enhancing the efficiency of electrostatic precipitators, bag filters and scrubbers enabling industries to meet stricter emission standards. Innovations include high-efficiency particulate air (HEPA) filters, advanced sorbents and real-time monitoring systems that improve pollutant capture. Hybrid filtration solutions combining mechanical and electrostatic processes are gaining traction for greater dust and gas removal. Additionally, self-cleaning and low-maintenance filter designs reduce operational costs making modern emission control systems more effective, sustainable and adaptable to diverse industrial applications.

Industrial Emission Control Systems Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global industrial emission control systems market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on equipment type and emission source.

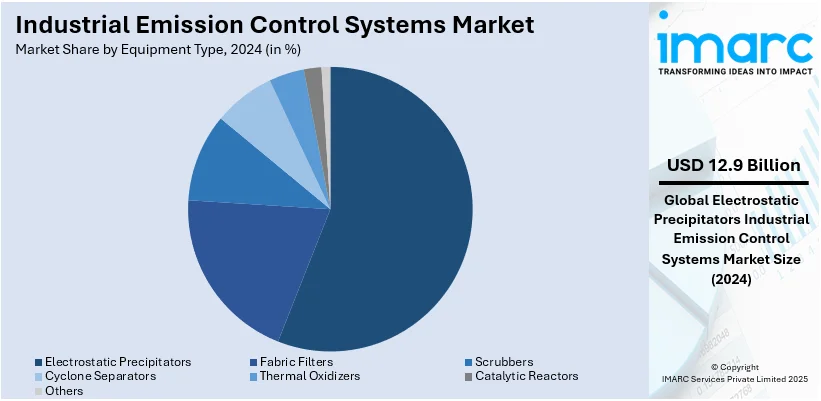

Analysis by Equipment Type:

- Electrostatic Precipitators

- Fabric Filters

- Scrubbers

- Cyclone Separators

- Thermal Oxidizers

- Catalytic Reactors

- Others

Electrostatic precipitators stand as the largest equipment type in 2024, holding around 55.8% of the market. Electrostatic precipitators (ESPs) hold the largest share in the industrial emission control systems market owing to their high efficiency in removing fine particulate matter (PM) from industrial exhaust gases. Widely used in power plants, cement, steel, and chemical industries, ESPs effectively capture dust, smoke, and ash with minimal pressure drop. Advancements in electrode design, automation, and hybrid ESP technologies are enhancing performance and energy efficiency. Growing environmental regulations and demand for cost-effective emission reduction solutions further drive the adoption of ESPs across industrial sectors.

Analysis by Emission Source:

- Power Generation

- Cement

- Chemical and Petrochemical

- Pulp and Paper

- Manufacturing

- Mining and Metals

- Others

Power generation leads the market with around 37.8% of market share in 2024. The power generation sector is at the forefront of the industrial emission control systems market, primarily due to strict environmental regulations and the necessity to mitigate emissions from coal and natural gas power plants. Commonly utilized technologies for managing emissions include electrostatic precipitators (ESPs), flue gas desulfurization (FGD), selective catalytic reduction (SCR), and bag filters, which help control particulate matter, sulfur dioxide (SO₂), and nitrogen oxides (NOₓ). Additionally, increasing investments in carbon capture and storage (CCS) and the shift towards cleaner energy sources are influencing emission control approaches in power generation facilities.

Regional Analysis:

.webp)

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 48.7%. Asia-Pacific holds the largest share in the industrial emission control systems market, driven by rapid industrialization, urbanization, and strict environmental regulations in major economies like China, India, and Japan. Rising emissions from power plants, cement, steel, and chemical industries have led to increased adoption of electrostatic precipitators (ESPs), flue gas desulfurization (FGD), and selective catalytic reduction (SCR) systems. Government initiatives promoting air quality improvement, carbon capture, and industrial sustainability further boost market growth. Expanding infrastructure and energy demand continue to drive emission control investments in the region.

Key Regional Takeaways:

North America Industrial Emission Control Systems Market Analysis

The North America industrial emission control systems market is driven by strict environmental regulations and growing efforts to reduce air pollution and greenhouse gas emissions. Government policies mandate industries such as power generation, manufacturing, and oil & gas to adopt advanced emission control technologies to comply with evolving environmental standards. Increasing awareness of the health and environmental impacts of industrial emissions is pushing businesses to invest in innovative filtration, scrubbers, and catalytic reduction systems. The shift towards clean energy, carbon capture, and sustainable industrial processes is further accelerating market growth. Additionally, federal and state-level incentives encourage industries to adopt low-carbon technologies and cleaner production practices, ensuring compliance with environmental goals while maintaining operational efficiency. As emission regulations tighten, industrial emission control systems market demand continues to expand across North America.

United States Industrial Emission Control Systems Market Analysis

The U.S. industrial emission control systems market is driven by stringent environmental regulations, such as the Clean Air Act, which mandates significant reductions in pollutants. According to the EPA, approximately 66 Million Tons of pollution were emitted into the atmosphere in 2023, highlighting the critical need for enhanced emission control technologies. Increased awareness of air pollution's detrimental effects on human health and the environment has led industries to adopt advanced solutions. Key sectors like manufacturing, power generation, and chemicals require these systems to comply with federal and state regulations. Technological advancements, including real-time monitoring and AI-based emissions management, further fuel market growth. Additionally, rising demand for renewable energy and sustainable industrial practices accelerates investments in eco-friendly solutions. Federal incentives and state-level initiatives support the transition to cleaner production processes. As industries focus on reducing their carbon footprints and adhering to evolving EPA guidelines, the demand for emission control systems is set to increase, promoting a cleaner and more sustainable industrial landscape.

Europe Industrial Emission Control Systems Market Analysis

Europe's industrial emission control systems market is strongly influenced by stringent environmental regulations and policies, such as the EU’s Emissions Trading System (ETS), which requires sectors to reduce their emissions to combat climate change. In 2023, the European Commission introduced a set of proposals to align the EU's climate, energy, transport, and taxation policies with the objective of reducing net greenhouse gas emissions by at least 55% by 2030, compared to 1990 levels. This ambitious target is fueling the demand for advanced emission control technologies across industries, particularly in sectors like automotive, power generation, and manufacturing. The European Green Deal and the commitment to achieving net-zero emissions by 2050 further intensify the need for cleaner, more efficient industrial processes. Innovations in emission reduction technologies, such as selective catalytic reduction (SCR) and flue gas desulfurization (FGD), are key to helping industries meet regulatory standards. Moreover, various incentive programs, subsidies, and market-based mechanisms support the transition to low-carbon technologies. As awareness of environmental issues grows and regulatory pressures tighten, industries in Europe are increasingly adopting advanced emission control systems to ensure compliance and promote sustainable practices, driving continued market expansion.

Latin America Industrial Emission Control Systems Market Analysis

The industrial emission control systems market in Latin America is witnessing significant growth, fueled by the region’s urbanization, which has reached approximately 80%, according to reports. This urban expansion is driving increased industrial activities, especially in countries like Brazil and Mexico, leading to higher pollution levels. In response, governments are tightening environmental regulations, prompting industries to adopt emission control technologies to meet compliance standards. Additionally, growing environmental awareness among the population, coupled with a shift towards sustainable industrial practices, is further accelerating the demand for cleaner technologies. Financial incentives and policies promoting green technologies also contribute to the market's expansion. As urbanization continues to rise, the need for effective emission control systems will remain critical in addressing the region's environmental challenges.

Middle East and Africa Industrial Emission Control Systems Market Analysis

The industrial emission control systems market in the Middle East and Africa (MEA) is expanding rapidly, driven by urbanization, which stands at 64%, according to the World Bank. As urban areas grow, industrial sectors, particularly oil and gas, face increasing pressure to reduce emissions and comply with stricter environmental regulations. Governments across the region are introducing policies aimed at mitigating pollution, promoting cleaner production practices, and incentivizing sustainable technologies. Additionally, the region's focus on diversifying economies, transitioning to renewable energy sources, and improving air quality is accelerating the adoption of emission control systems. The rising awareness of environmental concerns, coupled with international pressures for compliance with global climate goals, further propels the demand for advanced emission control technologies in the region.

Competitive Landscape:

The market highly competitive with numerous companies focusing on technological advancements, regulatory compliance and sustainability-driven solutions. Key players invest in research and development to enhance the efficiency of filtration systems, scrubbers and catalytic converters while integrating real-time monitoring and AI-based emissions management. The market is witnessing increasing mergers, acquisitions and strategic partnerships to expand capabilities and global reach. Government regulations and environmental policies drive continuous innovation pushing manufacturers to develop cost-effective and high-performance solutions. With industries transitioning to cleaner production processes competition intensifies encouraging the adoption of low-carbon and energy-efficient emission control technologies.

The report provides a comprehensive analysis of the competitive landscape in the industrial emission control systems market with detailed profiles of all major companies, including:

- Air Clear LLC

- Babcock & Wilcox Enterprises Inc.

- BASF SE

- CECO Environmental

- Ducon Environmental Systems Inc.

- Durr AG

- Fujian Longking Co. Ltd.

- General Electric Company

- Hamon Group

- John Wood Group PLC

- Mitsubishi Heavy Industries Ltd.

- Thermax Limited

Latest News and Developments:

- December 2024: Hyundai Motor Company and Kia Corporation introduced the Integrated Greenhouse Gas Information System (IGIS), a platform aimed at monitoring and managing carbon emissions throughout the lifecycle of vehicles. By employing Life Cycle Assessment (LCA) methodology, IGIS delivers comprehensive emissions data and tracks energy usage across global production and supplier sites. The system utilizes blockchain technology to ensure data integrity and aligns with Hyundai and Kia’s commitment to achieving carbon neutrality by 2045.

- September 2024: Cummins India unveiled the Retrofit Aftertreatment System (RAS), a solution for clean air compliant with CPCBII and CPCBI gensets, which significantly lowers emissions of Particulate Matter, Carbon Monoxide, and Hydrocarbons by up to 90%. This compact and cost-effective system guarantees adherence to emission standards while reducing operational and maintenance costs.

- August 2024: Mahindra Logistics Limited released the ‘Emission Analytics Report’ to assist customers in monitoring and decreasing carbon emissions in their supply chains. This platform provides real-time data on Scope 3 emissions, including analysis of emissions intensity, fuel consumption, and transportation mode emissions, offered through a subscription model. As part of Mahindra’s green logistics initiative, it integrates smoothly with existing systems and carries accreditation from the Global Logistics Emission Council and ISO certification.

- June 2024: IBM introduced Maximo Emissions Management, an AI-driven solution tailored for asset-heavy industries to oversee and control emissions. Integrated with IBM’s ESG platform, it facilitates real-time tracking of operational and fugitive emissions, aiding in sustainability reporting. This solution enhances asset lifespan, productivity, and reliability while supporting decarbonization efforts.

- March 2023: Honeywell launched the Emissions Management Solution (EMS), an automated system crafted to measure, track, and mitigate methane emissions in industrial facilities. EMS integrates wireless gas leak detection, automated data gathering, and software to pinpoint methane leaks, simplify reporting, and back sustainability goals.

Industrial Emission Control Systems Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Electrostatic Precipitators, Fabric Filters, Scrubbers, Cyclone Separators, Thermal Oxidizers, Catalytic Reactors, Others |

| Emission Sources Covered | Power Generation, Cement, Chemical and Petrochemical, Pulp and Paper, Manufacturing, Mining and Metals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Air Clear LLC, Babcock & Wilcox Enterprises Inc., BASF SE, CECO Environmental, Ducon Environmental Systems Inc., Durr AG, Fujian Longking Co. Ltd., General Electric Company, Hamon Group, John Wood Group PLC, Mitsubishi Heavy Industries Ltd. and Thermax Limited. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the industrial emission control systems market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global industrial emission control systems market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industrial emission control systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial emission control systems market was valued at USD 23.15 Billion in 2024.

IMARC estimates the industrial emission control systems market to reach USD 40.57 Billion by 2033, exhibiting a CAGR of 6.11% during 2025-2033.

Key factors driving the industrial emission control systems market include stringent government regulations on environmental protection, increasing public awareness of air pollution, technological advancements in emission control technologies, and the growing demand for sustainable industrial practices. Additionally, industries are focusing on reducing carbon footprints and improving energy efficiency.

Asia-Pacific accounted for the largest market share in the industrial emission control systems market. This region's dominance is driven by rapid industrialization, stringent environmental regulations, and growing investments in pollution control technologies, particularly in countries like China and India, where industrial emissions are a major concern.

Some of the major players in the industrial emission control systems market include Air Clear LLC, Babcock & Wilcox Enterprises Inc., BASF SE, CECO Environmental, Ducon Environmental Systems Inc., Durr AG, Fujian Longking Co. Ltd., General Electric Company, Hamon Group, John Wood Group PLC, Mitsubishi Heavy Industries Ltd. and Thermax Limited., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)