Industrial Cybersecurity Market Size, Share, Trends and Forecast by Component, Security Type, Industry, and Region, 2025-2033

Industrial Cybersecurity Market Size and Share:

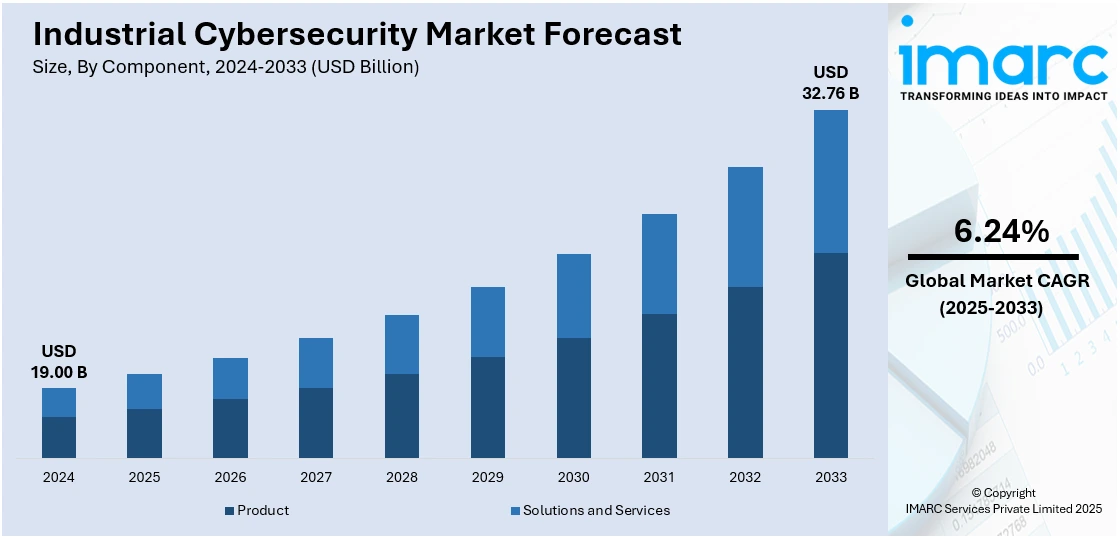

The global industrial cybersecurity market size was valued at USD 19.00 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 32.76 Billion by 2033, exhibiting a CAGR of 6.24% during 2025-2033. North America currently dominates the market, holding a significant market share of 42.0% in 2024. The rising incidence of cyberattacks against critical infrastructures and the escalating demand for cloud-based solutions and the development of advanced cybersecurity solutions are major factors propelling the market growth. Besides this, industrial cybersecurity market share is driven by the increasing utilization of artificial intelligence (AI) and machine learning (ML) techniques.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 19.00 Billion |

|

Market Forecast in 2033

|

USD 32.76 Billion |

| Market Growth Rate 2025-2033 | 6.24% |

Media coverage of high-profile cyberattacks, such as ransomware incidents, is raising public awareness about the cybersecurity. Industrial sectors including manufacturing, energy, and transportation, are realizing the vulnerability of their critical infrastructure. These sectors are becoming prime targets due to their reliance on operational technology (OT) and interconnected systems. As businesses face rising threats, organizations are prioritizing investments in advanced cybersecurity solutions to protect assets. This heightened awareness is leading to more comprehensive risk assessments and proactive security strategies across industries. Companies are increasingly recognizing that the cost of a cyberattack far exceeds the cost of prevention. Insurance providers are also emphasizing cybersecurity measures, offering incentives for companies that implement robust security protocols.

The United States industrial cybersecurity market demand is driven by stringent regulatory and compliance requirements that compel organizations to prioritize cybersecurity measures. Regulations like the NIST Cybersecurity Framework and the Critical Infrastructure Protection (CIP) standards laid by the North American Electric Reliability Corporation (NERC) mandate specific security practices for critical sectors, including energy and utilities. These laws require companies to implement robust cybersecurity systems, determine incident response protocols for minimizing the cyber threat risks and perform risk calculations regularly. The regions increasing focus on securing critical infrastructure has heightened the need for cybersecurity solutions in the US. For example, in January 2025, Cybersecurity & Infrastructure Security Agency issued three advisories addressing vulnerabilities in industrial control systems, covering TCAS II, Siemens SIMATIC S7-1200 CPUs, and ZF Roll Stability Support Plus. These advisories include risks, impacts, and mitigation measures for critical infrastructure. Users are urged to review and implement protections to ensure system security and resilience. Compliance with these standards often requires companies to finance technologically advanced solutions like firewalls, encryption, and intrusion detection systems.

Industrial Cybersecurity Market Trends:

Rising incidence of cyberattacks and threats against critical infrastructures

The rising incidence of cyberattacks and threats against critical infrastructures is one of the primary factors propelling the market growth. Industrial cybersecurity is widely used to safeguard various critical infrastructures, such as power grids, transportation systems, water treatment plants, and healthcare facilities, ranging from malware, ransomware, data breaches, and sabotage attempts. According to industry reports, the number of data breached records in 2023 was 8,214,886,660. Moreover, the rapid proliferation of the Industrial Internet of Things (IIoT) devices to improve operational efficiency is facilitating the demand for robust industrial cybersecurity solutions to secure interconnected devices and enable seamless communication. Apart from this, the growing demand for cloud-based solutions, which offer several benefits like enhanced scalability, accessibility, security, automatic updates, disaster recovery, and real-time data processing, is fueling the market growth.

Growing use of artificial intelligence (AI) and machine learning (ML)

The utilization of AI and ML techniques to enhance threat detection and response, identify anomalies, and automate cybersecurity measures, which aid in reducing response time and improving overall security effectiveness, is strengthening the market growth. As per reports, 70% of cybersecurity professionals say AI proves highly effective for detecting threats that previously would have gone unnoticed. These technologies help identify patterns and anomalies in vast amounts of industrial data, allowing proactive threat mitigation. ML algorithms can continuously learn from new threats, improving the accuracy of security systems over time. AI-powered cybersecurity solutions can automate repetitive tasks like patching vulnerabilities or analyzing network traffic, reducing human error. Besides this, the adoption of blockchain technology to enhance the security of critical transactions, supply chain operations, and data sharing is positively influencing the market growth.

Increased Digital Transformation in Industrial Sectors

The adoption of smart manufacturing, Industrial IoT (IIoT), and automation has created interconnected networks that increase the risk of cyber-attacks. As industrial systems become more digitized, they are more vulnerable to cyberattacks targeting both IT and OT environments. Digital transformation often involves integrating legacy systems with modern technologies, which can introduce new security gaps. This is leading organizations to invest heavily in cybersecurity solutions for safeguarding critical infrastructure from rising threats. The expansion of IIoT devices, which gather and transmit data, further increases potential entry points for cybercriminals. The Ministry of External Affairs Government of India reports that digital transformation in India will create a USD 1 Trillion economy by 2028. Moreover, the use of cloud computing and data analytics in industrial environments requires security measures that help shield sensitive information.

Industrial Cybersecurity Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global industrial cybersecurity market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, security type, and industry.

Analysis by Component:

- Product

- Solutions and Services

Products lead the market due to increased demand for tangible security solutions. Companies are prioritizing physical security measures like access control solutions, intrusion detection systems, and firewalls. These products provide essential protection for critical infrastructure, such as manufacturing plants, utilities, and energy grids. The growing adoption of Industrial IoT (IIoT) devices further increases the need for product-based cybersecurity solutions. As organizations strive to protect their operational technology (OT) environments, hardware-based products offer more direct, integrated protection. Product solutions also help mitigate risks from cyberattacks that target physical systems, ensuring business continuity and preventing financial losses. Manufacturers are continuously innovating to develop more effective products, combining hardware and software features to strengthen cybersecurity software. The high return on investment (ROI) these solutions offer, by preventing costly downtime or data breaches, is another key driver. Organizations often prefer the reliability and scalability that product solutions provide for large-scale operations, which is bolstering the market growth.

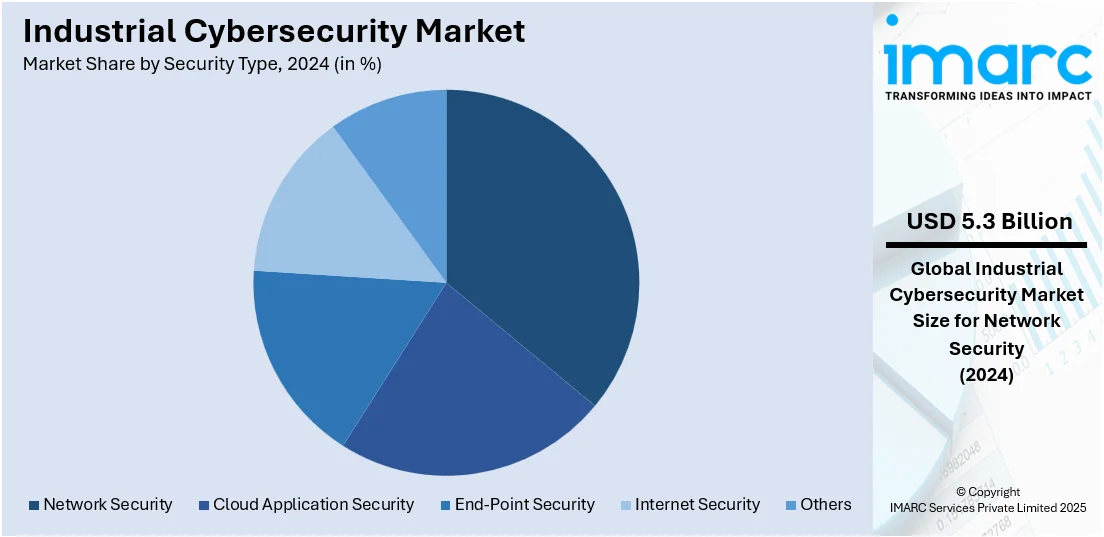

Analysis by Security Type:

- Network Security

- Cloud Application Security

- End-Point Security

- Internet Security

- Others

Network security dominates the market with 27.8% of market share in 2024. The largest market share in the industrial cybersecurity market is attributed to network security due to the increased requirement for the protection of industrial networks. As more industries start to depend on connected systems, network traffic is becoming increasingly critical to secure. Cybercriminals frequently exploit weaknesses in network infrastructure to either sabotage operations or siphon off sensitive information. Industrial networks are more vulnerable because they integrate operational technology and IT systems. These risks can be mitigated to a certain extent through Network security solutions that include firewalls, VPNs, and intrusion prevention systems. Companies should not only ensure seamless data flow between various devices and systems but also maintain secure channels of communication. Network security is becoming increasingly imperative with the ever-expanding Industrial IoT (IIoT) ecosystem. Enhanced remote access to industrial systems escalates the demand for robust network protection. The rise of ransomware attacks, which exploit weak network security protocols, forces the need for securing industrial networks. Regulations like NERC CIP and NIST require full cyber security networks to meet compliance requirements.

Analysis by Industry:

- Process

- Oil and Gas

- Chemical

- Food and Beverages

- Energy and Power

- Others

- Discrete

- Automotive

- Electronics

- Heavy Manufacturing

- Packaging

- Others

Sectors like oil and gas, chemicals, pharmaceuticals, and utilities depend significantly on process control systems that must be safeguarded against cyber risks. These sectors utilize supervisory control and data acquisition (SCADA) systems, which can be susceptible to cyberattacks if not properly secured. The possibility of serious outcomes including operational halts, environmental crises, or safety violations, influences the need for cybersecurity solutions in the processing industry. Due to the essential nature of these sectors, ensuring continuous service is a top priority. Moreover, numerous process industries function within regulated settings, facing strict cybersecurity compliance demands. The existence of legacy systems, which are frequently obsolete and more difficult to protect, increases the need for strong cybersecurity measures. Process industries encounter distinct challenges, including the need to secure both IT and OT environments while maintaining efficiency. With the rise of cyberattacks aimed at essential infrastructure, the process industry requires enhanced security strategies to safeguard its systems against internal and external threats.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America represented the biggest market share at 42.0%. The region has the globe's largest and most advanced industrial sectors like energy, manufacturing, and transportation. These sectors depend on intricate and interrelated systems that are susceptible to cyberattacks. In reaction, organizations in North America are investing heavily in cybersecurity technologies and services. Regulatory demands from security organizations intensify the necessity for strong cybersecurity measures. The regional governing bodies are focusing on cybersecurity for essential infrastructure, enhancing market development for defense against cyber hazards. Industries in North America are experiencing a significant number of cyberattacks, such as ransomware and advanced persistent threats (APTs), heightening the need for enhanced security protocols. The existence of top cybersecurity solution providers in the area promotes innovation and market expansion. For instance, in November 2024, Waterfall Security partnered with GoCloud focusing on implementing unidirectional security technologies at the Port of Miami to enhance maritime cybersecurity. This initiative protects against external and embedded threats targeting operational technologies, especially ship-to-shore cranes. It also aligns with recent US maritime security standards, setting a benchmark for securing critical infrastructure.

Key Regional Takeaways:

United States Industrial Cybersecurity Market Analysis

In the US, demand for industrial cybersecurity is seeing an upswing due to the advanced industrial ecosystem coupled with an increasing adoption of automation technologies like Industrial Internet of Things (IIoT). As more and more industries get digitized, the vulnerabilities related to an interconnected system grow which mandatorily becomes a 'Call of the Hour' for strong cybersecurity measures. The federal government's attention towards cybersecurity too is not behind. Initiatives, such as the Cybersecurity and Infrastructure Security Agency (CISA) programs and the implementation of the Cybersecurity Framework by the National Institute of Standards and Technology (NIST), encourage organizations to adopt stringent security measures. The higher cases of ransomware attacks and high-profile data breaches targeting critical infrastructure like energy grids, manufacturing plants, and healthcare systems is increasing awareness about potential threats. Reports indicate that ransomware directly affected all 2,207 US hospitals, schools and governments in 2023. More than this, the administration's order improving the nation's cybersecurity creates a further impetus towards securing industrial systems, especially through true-time monitoring and response of threats. Moreover, the expansion of smart factories and cloud-based solutions is another driver. Cloud technologies in manufacturing enhance efficiency but also increase risks. This is leading to significant investments in endpoint protection, network security, and advanced threat detection.

Asia Pacific Industrial Cybersecurity Market Analysis

The market in the Asia Pacific region is propelled by swift industrial growth, digital advancements, and the increasing number of connected devices in nations like China, Japan, India, and South Korea. According to the PIB, it is anticipated that by 2030, over 40% of India's population will reside in urban regions. The rising adoption of Industry 4.0 practices is greatly promoting the implementation of smart manufacturing technologies, generating an urgent demand for sophisticated cybersecurity solutions to safeguard these systems against cyber threats. In addition to this, regional governing bodies are enforcing strict regulations to guarantee industrial safety. For instance, China’s Cybersecurity Law requires businesses to improve their network security, whereas India’s National Cyber Security Policy aims at bolstering the country’s essential infrastructure. The increasing regulatory landscape forces businesses to emphasize investments in cybersecurity. Moreover, the increase in specific assaults on crucial infrastructure areas, such as energy, transportation, and manufacturing is hastening the need for strong threat detection systems. Enhanced persistent threats (APTs) have risen, with aggressors focusing on supply chains, crucial to the region's international trade activities. The rising number of multinational firms and expanded investments in technology centers throughout APAC enhance the region's cybersecurity framework, fostering a vibrant market for industrial solutions.

Europe Industrial Cybersecurity Market Analysis

The market for industrial cybersecurity in the Europe is being shaped by its focus on digital transformation and compliance with stringent data protection laws. With the European Union’s General Data Protection Regulation (GDPR) serving as a benchmark, organizations are compelled to adopt robust cybersecurity practices to protect operational and customer data. The EU Cybersecurity Act and the NIS Directive underpin further requirements to protect critical infrastructure. On top of that, the push for automation and smart manufacturing, which has taken shape through the likes of Germany's Industries 4.0 and the UK's Made Smarter initiative, is increasingly driving demand for sophisticated cybersecurity measures. These initiatives integrate IoT, robotics, and cloud computing, creating complex networks that require constant monitoring and protection against sophisticated cyberattacks. Cyber threats targeting Europe’s energy and transportation sectors are escalating. The rise of cyber-physical systems and vulnerabilities in connected industrial systems is making endpoint security and threat intelligence solutions essential. Recent incidents like ransomware attacks on critical infrastructure is accelerated investments in preventive technologies. According to reports, 50% of UK businesses experienced some form of cyber-attack in 2023. Moreover, Europe’s growing reliance on renewable energy sources and smart grid technology presents additional challenges. Cybersecurity measures are crucial for safeguarding these interconnected networks, ensuring uninterrupted operations.

Latin America Industrial Cybersecurity Market Analysis

In Latin America, increasing digitalization in sectors like energy, manufacturing, and mining is driving demand for industrial cybersecurity solutions. Brazil invested USD 30.1 Billion in digital transformation, as stated by the Brazilian NR. The region is observing a surge in ransomware and malware attacks targeting critical infrastructure, leading to heightened awareness among enterprises. Governing authorities in countries like Brazil, Mexico, and Chile are introducing cybersecurity policies and frameworks to safeguard industrial operations. The expansion of IoT-enabled devices and cloud computing platforms in Latin America is contributing to the need for robust cybersecurity solutions. These technologies improve operational efficiency but expose industries to potential breaches. Investment in threat detection and incident response tools is becoming a priority for regional businesses. International collaborations and investments from global technology companies are helping to strengthen the market growth across the region.

Middle East and Africa Industrial Cybersecurity Market Analysis

The expanding 5G network infrastructure across the region is facilitating the integration of connected devices, IoT platforms, and smart grids. In the Middle East and Africa region, there were 30 Million 5G connections as of November 2023, as per reports. While this drives industrial efficiency, it also exposes systems to potential breaches, spurring demand for endpoint and network security solutions. Regional industries are also increasingly adopting AI-powered cybersecurity tools for real-time threat identification. In addition, government initiatives, including the UAE’s National Cybersecurity Strategy and Saudi Arabia’s Vision 2030, emphasize strengthening cybersecurity frameworks. These strategies encourage investments in advanced technologies like AI-powered threat detection and incident response systems. Moreover, collaborations backed by research funding and partnerships with technology providers, is further influencing advancements in industrial cybersecurity solutions.

Competitive Landscape:

Key players are developing innovative solutions that address the increasing complexity and scope of cyber threats. Leading cybersecurity providers focus on offering comprehensive services, from threat detection to incident response, tailored for industrial environments. They integrate advanced technologies like artificial intelligence (AI) and machine learning (ML), to enhance security measures. By combining AI and ML, key players can automate threat detection and improve response times. In August 2024, IBM introduced a generative AI-powered Cybersecurity Assistant to enhance threat detection and response services. Built on its watsonx AI platform, the tool streamlines security operations by accelerating threat investigations and automating operational tasks. It supports analysts with historical threat correlation, proactive recommendations, and real-time conversational capabilities to improve cybersecurity efficiency. Major corporations also collaborate with industries to ensure their solutions meet specific regulatory and compliance standards. They offer knowledge in safeguarding operational technology (OT) systems, essential for industrial processes. Their work assists companies in safeguarding essential infrastructure, like energy grids and manufacturing facilities, from cyber threats. Additionally, industry leaders emphasize the importance of ongoing monitoring and instant reporting to avert possible security breaches, thus enhancing market expansion.

The report provides a comprehensive analysis of the competitive landscape in the industrial cybersecurity market with detailed profiles of all major companies, including:

- ABB Ltd.

- AO Kaspersky Lab

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Honeywell International Inc.

- International Business Machines Corporation

- OPSWAT Inc.

- Proofpoint Inc.

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

Latest News and Developments:

- January 2025: Dragos Inc. that leads the cybersecurity for operational technology (OT) environments globally, declared a partnership with Yokogawa Electric Corporation, which is a major provider of industrial instrumentation and automation solutions to the process and manufacturing industries.

- January 2025: The European Commission unveiled a European Union action plan designed to strengthen the cybersecurity of hospitals and healthcare providers. This initiative marks a significant advancement in protecting the healthcare sector from cyber threats. By improving threat detection, preparedness, and response capabilities, the plan focuses on making a safer and secure environment for patients and healthcare professionals.

- March 2024: Microsoft introduced its Copilot for Security, which is the first generative AI solution that will assist security and IT professionals in getting updated with what others are missing, thereby moving faster, and improving team expertise.

Industrial Cybersecurity Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Product, Solutions and Services |

| Security Types Covered | Network Security, Cloud Application Security, End-Point Security, Internet Security, Others |

| Industries Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | ABB Ltd., AO Kaspersky Lab, Check Point Software Technologies Ltd., Cisco Systems Inc., Dell Technologies Inc., Honeywell International Inc., International Business Machines Corporation, OPSWAT Inc., Proofpoint Inc., Rockwell Automation Inc., Schneider Electric SE, Siemens AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, industrial cybersecurity market outlook, and dynamics of the market from 2019-2033.

- The industrial cybersecurity market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industrial cybersecurity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial cybersecurity market was valued at USD 19.00 Billion in 2024.

The industrial cybersecurity market is projected to exhibit a CAGR of 6.24% during 2025-2033, reaching a value of USD 32.76 Billion by 2033.

The industrial cybersecurity market growth is driven by the growing adoption of Industrial IoT (IIoT), which increases network vulnerabilities. Rising cyberattacks targeting critical infrastructure, such as energy and manufacturing, also fuel demand for security solutions. Stringent regulatory requirements, like those from NIST and NERC, compel companies to adopt robust cybersecurity measures to comply with safety standards. Additionally, the need for data protection, operational continuity, and risk mitigation in increasingly digitalized industries further fuels market growth.

North America holds the majority of the market share because of the regions advanced industrial sectors including energy, manufacturing, and utilities, which are prime targets for cyberattacks. Stringent regulations, such as the NIST Cybersecurity Framework and NERC CIP standards, compel organizations to invest heavily in cybersecurity. Moreover, high cybersecurity awareness, government initiatives, and ongoing investments in digital transformation further strengthens the market growth.

Some of the major players in the industrial cybersecurity market include ABB Ltd., AO Kaspersky Lab, Check Point Software Technologies Ltd., Cisco Systems Inc., Dell Technologies Inc., Honeywell International Inc., International Business Machines Corporation, OPSWAT Inc., Proofpoint Inc., Rockwell Automation Inc., Schneider Electric SE, Siemens AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)