Industrial Brakes Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2025-2033

Industrial Brakes Market Size and Share:

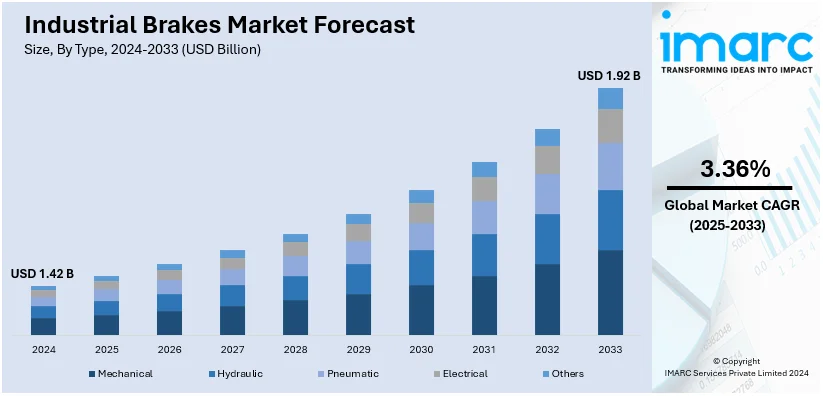

The global industrial brakes market size was valued at USD 1.42 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1.92 Billion by 2033, exhibiting a CAGR of 3.36% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 45.9% in 2024. The market is experiencing significant growth driven by demand for automating manufacturing processes, changing trends of safety and effectiveness in a line of industries, use of renewable energy sources that demand improved braking systems, and ongoing technological advancements in brake technologies to improve their performance and durability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.42 Billion |

|

Market Forecast in 2033

|

USD 1.92 Billion |

| Market Growth Rate (2025-2033) | 3.36% |

One of the key drivers in the industrial brakes market share is technological advancements. Continuous innovation and improvements in technology enable companies to develop more efficient, cost-effective products and solutions. These advancements often lead to enhanced performance, better customer experiences, and reduced operational costs. In industries such as electronics, automotive, and healthcare, the integration of cutting-edge technologies like artificial intelligence (AI), automation, and the Internet of Things (IoT) is reshaping products and services. As a result, businesses can offer higher value to consumers while staying competitive in the market. This constant evolution in technology fuels growth and bolstering demand across various sectors.

The U.S. industrial brakes market is leading the industry with 90.10% of market shares due to their efficiency and advanced integration capabilities. These brakes are widely employed in industries such as automotive, manufacturing, and material handling. In 2023, the U.S. industrial production index showed an upward trend of 1.1% for durable manufacturing, suggesting a favorable environment for energy-efficient solutions like electrical brakes. The increasing focus on automation and IoT integration in sectors such as automotive and aerospace further enhances the demand for electrical braking systems, contributing to their dominance in industrial applications.

Industrial Brakes Market Trends:

Increasing Automation in Manufacturing

Increasing the adoption of automation in manufacturing industries is one of the foremost factors that impact the industrial brakes market growth. Automation implies better means of operation and standardization, measurement, and safety in operations; thus, the call for effective braking of automated machines. According to the International Federation of Robotics (IFR), global industrial robot installations reached approximately 450,000 units in 2022, marking a 6% year-over-year increase. This increase is most evident in vehicle manufacturing, the electronics market, and metallurgical industries where accuracy and safety are paramount. Automated systems make use of industrial brakes to enable movement control and speed regulation and in case of an occurrence, it allows for an instant halting of the system. The rising trend of industries incorporating automation in manufacturing to compete and meet production requirements has escalated the industrial brakes market demand, thus stimulating the market growth.

Rapid growth in Renewable Energy Projects

The increasing renewable power generation, especially the wind generates power that increases the market of industrial brakes. Wind turbines, being an important element in the generation of renewable energy, face high stresses, and hence good braking is necessary for the safety of the entire operation. For instance, the Global Wind Energy Council (GWEC) reports that the new wind power capacity that has been deployed across the global markets amounted to 93 GW in 2022, which demonstrates positive sector development. According to WindEurope's data, 18.3 GW of new wind capacity (gross installations) were added in Europe alone in 2023. 79% of the new installations, or 14.5 GW, were onshore wind. This trend is due to enhanced capital spending and encouragement from governments to cut the emission of carbon and grasp renewable energy. The brakes of wind turbines are very important for rotor speed, handling of emergencies, and the maintenance of the wind turbines for long-term use. An increasing focus on cleaner energy options is thus stimulating the industrial brakes market outlook and driving its growth.

Implementation of Stringent Safety Regulations

Government-driven safety regulations are fuelling market growth. Governments across the world have tightened safety standards which propels the industrial brakes market. Trade associations and national standards that include the Occupational Safety and Health Administration (OSHA) in the United States and the Machinery Directive 2006/42/EC of the European Union require compliance with safety precautions in industrial applications. These regulations put pressure on industries to incorporate the installation of and or the use of efficient and effective brakes to enhance the safety and productivity of the workers. For instance, OSHA demands proper safeguarding of the machines and sound operations of the emergency stop functions that require high-performance brakes. All these regulations must be adhered to as they will help avoid penalties and create a safe working environment. As industries worldwide prioritize compliance and invest in safer operational practices, the demand for innovative and reliable industrial braking solutions continues to rise, bolstering the industrial brakes market forecast.

Industrial Brakes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global industrial brakes market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end use industry.

Analysis by Type:

- Mechanical

- Hydraulic

- Pneumatic

- Electrical

- Others

Electrical stands as the largest component in 2024, holding around 31.8% of the market due to their energy efficiency, reliability, and compatibility with automated systems. These brakes are widely used in industries like manufacturing, material handling, and automotive, where automation and precision are crucial. Electrical brakes provide faster response times and greater control compared to mechanical or hydraulic alternatives. Additionally, their ability to integrate with modern control systems, such as variable frequency drives and IoT devices, enhances their appeal. The increasing demand for energy-efficient, low-maintenance solutions further boosts the growth of electrical brakes. Their advantages in terms of safety, performance, and cost-effectiveness make them the preferred choice in many industrial applications.

Analysis by Application:

- Holding Brakes

- Dynamic and Emergency Brakes

- Tension Brakes

Holding brakes leads the market with around 56.8% of the market share in 2024 due to their critical role in securing stationary machinery and ensuring operational safety. These brakes are widely used in industrial automation, cranes, wind turbines, and other heavy machinery, where precise positioning and load retention are essential. The increasing adoption of automation in industries such as manufacturing, mining, and material handling further boosted the demand for holding brakes. Their ability to maintain stability during power interruptions or equipment downtime enhances their importance in safety-critical applications. Additionally, significant advancements in brake technology, including improved durability and energy efficiency, have made holding brakes the preferred choice for many end-users, solidifying their market leadership.

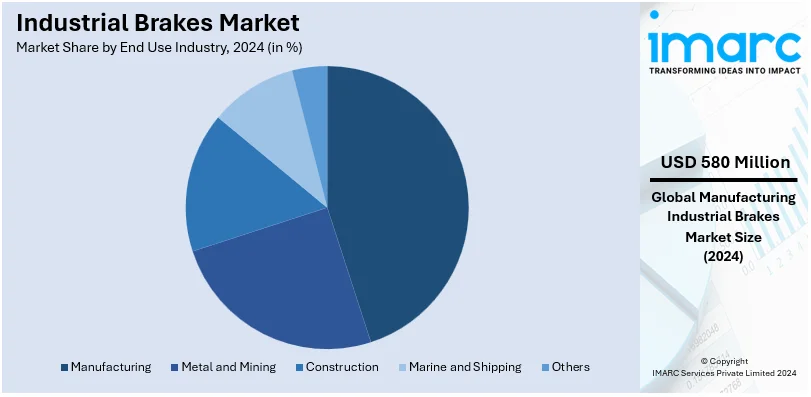

Analysis by End Use Industry:

- Manufacturing

- Metal and Mining

- Construction

- Marine and Shipping

- Others

In 2024, manufacturing accounts for the majority of the market at around 40.9% due to increasing automation, machinery safety standards, and the rapid adoption of advanced braking technologies. Manufacturing facilities rely heavily on braking systems for precision, operational safety, and energy efficiency in automated and semi-automated production lines. Rising industrial output in regions like Asia Pacific and North America, driven by policies such as China’s “Made in China 2025” and the U.S. focus on reshoring production, has amplified the demand for industrial brakes. Additionally, the integration of IoT-enabled and energy-efficient brakes in manufacturing systems has further strengthened this segment’s market dominance. This trend underscores the sector's reliance on innovative safety and performance solutions.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 45.9% driven by growing industrialization, increasing manufacturing sectors, and widespread automation across countries like China, India, and Japan. These nations emphasize infrastructure development and machinery safety, boosting demand for advanced braking solutions. Government initiatives to support industrial growth and energy-efficient technologies further propel the market. For example, China's Made in China 2025 initiative focuses on modernizing industrial practices, including machinery. Similarly, India's manufacturing sector benefits from policies promoting Make in India. The region's vast investments in construction, mining, and material handling also contribute to its dominance, positioning Asia Pacific as a key hub for Industrial Brakes demand and production.

Key Regional Takeaways:

North America Industrial Brakes Market Analysis

The North America industrial brakes market is driven by the region's robust manufacturing and industrial sectors. The U.S. Department of Energy (DOE) highlights that industrial motor systems, which include brake components, accounted for 23% of U.S. electricity consumption in 1994, showcasing their widespread use in machinery and equipment. Additionally, automation advancements in industries such as mining, construction, and material handling have increased the demand for reliable braking solutions. In 2020, the U.S. industrial automation market exported approximately $24 billion worth of equipment, reflecting the region's dominance. Regulatory frameworks promoting safety and efficiency further bolster market growth, with government initiatives encouraging the adoption of energy-efficient and high-performance industrial braking systems.

United States Industrial Brakes Market Analysis

The growing mining, construction, and manufacturing industries in the US are driving the market for industrial brakes. According to industry reports, the construction sector in the United States, valued at USD 2 Trillion in 2023, created a significant need for industrial braking systems in machinery including excavators, cranes, and hoists. Additionally, the minerals industry, which produces mineral commodities worth more than USD 90 Billion annually, according to data at the USGS National Minerals Information Center, relies heavily on reliable braking systems to stay operational and safe.

Moreover, the growth in mechanization of manufacturing plants is also contributing to market influence, especially in the automotive and aerospace companies. The existence of industrial brakes for automatic systems has been the way to hold onto precision and make operations much safer. Statistics released by the International Renewable Energy Agency point to the United States as leading in the use of wind energy with an installed capacity of 6.3 GW increase in 2023. This means more braking systems are in demand within the operational processes of wind turbines, aimed at controlling rotational speed and ensuring safety during operations. Advanced braking technologies have become the adoption of industries due to the increased attention of OSHA on worker safety standards. Innovators like Eaton, Svendborg Brakes, and Carlisle Brake & Friction have accelerated intelligent braking systems in various fields.

Europe Industrial Brakes Market Analysis

Europe's strong manufacturing base and emphasis on renewable energy are propelling the industry. Major automotive production centers are based in the region; in 2023, according to the statistics by The German Association of the Automotive Industry, Germany manufactured more than 3 Million cars, which means that high-performance brakes need to be used in robotic systems and assembly line equipment. A number of investments have been made in the renewable energy sector, particularly in wind energy. As per the data by the Global Wind Energy Council, 78 GW of additional capacity was added in 2022 globally making the total installed capacity increased to 906 GW. In nations like Germany, Spain, and the UK, this has raised demand for braking mechanisms in wind turbines. High-quality braking systems are required by the region's stringent safety and environmental rules under the EU Machinery Directive in order to guarantee operational safety and energy efficiency. Another key factor that drives the demand for industrial brakes is Europe's fast-growing construction sector. The European Union database reports that housing constituted 5.6% of the GDP in the EU in 2021.

Asia Pacific Industrial Brakes Market Analysis

The Asia-Pacific region now dominates the global market for industrial brakes due to the fast industrialisation and urbanisation of nations like China, India, and Japan. In the year 2023, the manufacturing production of China surpassed USD 3.5 Trillion, as per an industrial report, causing a massive demand for industrial machinery along with its braking systems. Another trend affected the application of brakes in cranes and hoists as Indian's building sector expands. During this study period, this sector grew with a CAGR of 6% by 2025. Regionally, growth in renewable energy projects such as the ambition set by China to reach 1,200 GW in terms of solar and wind power by 2030 which China achieved recently is augmenting the demand in braking systems for wind turbines.

Precision braking solutions are also becoming more and more necessary as automated systems are being used in manufacturing plants, especially in South Korea and Japan. Twiflex and Hilliard Corporation, among the leading manufacturers, benefit from the increasing market prospects in the region.

Latin America Industrial Brakes Market Analysis

The growing mining and construction industries in Latin America are largely driving the market for industrial brakes. Strong braking systems are critical to the safety and performance of the region's mining industry, where minerals worth over USD 120 Billion will be produced by 2030, according to figures from the International Energy Agency. Mexico and Brazil account for large proportions; this year, with Brazil, which invested over USD 38 Billion in infrastructure projects during 2023-2027. The region is also becoming increasingly mechanized and thus requires advanced braking systems in the factories. Wind turbine braking systems have become necessary due to renewable energy projects, mainly in Brazil and Chile. Companies are investing in long-lasting, low-maintenance brakes to meet the requirements of the challenging industrial conditions in the region.

Middle East and Africa Industrial Brakes Market Analysis

Mining activities and infrastructure development are boosting the demand for industrial brakes in the Middle East and Africa. Braking systems for cranes, hoists, and other machinery are needed by the construction industry of the GCC region, which is said to be valued more than USD 1.6 Trillion in 2023 according to industry reports. And then there is Africa's mining industry, holding for 30% of all mineral reserves, which drives the demand for industrial brakes that one can trust. Renewable energy projects such as South Africa's wind energy projects and Saudi Arabia's NEOM are driving the demand for wind turbine braking systems. The region's pursuit of industrialisation and the need to comply with safety regulations further expand the market.

Competitive Landscape:

The industrial brake companies are using technology and acquisition strategies to improve their standing in the market. These companies make a substantial amount of expenditure on research and development (R&D) projects to launch better braking technologies and systems with enhanced performance. For instance, Eaton has developed effective Electro-hydraulic braking systems for improved performance in the automation and renewable energy industries. The U. S. Department of Energy has noted that the ERE investments continue to rise, and especially wind energy capacity has exceeded 135GW in 2022. Moreover, the market leader is also entering into new growth opportunities through acquisitions as Asia-Pacific and Latin America are newly industrialized economies that have significant infrastructure development projects so they are emerging as growing regions for this market.

The report provides a comprehensive analysis of the competitive landscape in the industrial brakes market with detailed profiles of all major companies, including:

- Akebono Brake Industry Co. Ltd

- Altra Industrial Motion Corporation

- AMETEK Inc.

- Antec SA

- Coremo Ocmea S.p.A.

- Eaton Corporation PLC

- Hilliard Corporation

- Kobelt Manufacturing Co. Ltd.

- Kor-Pak Corporation

- RINGSPANN GmbH

- SIBRE - Siegerland Bremsen GmbH

- Tolomatic Inc.

Latest News and Developments:

- In August 2024, Sibre (Siebtechnik Brakes), a German brake producer, is expanding significantly to meet the growing demand for its cutting-edge braking systems worldwide. The company has been expanding its product portfolio and increasing its manufacturing capacity in a variety of industrial areas, including wind energy, cranes, and material handling. In order to increase productivity and satisfy the rising demand for dependable, high-performance brake systems, Sibre is making investments in new facilities and automation technology.

- In June 2024, A joint venture (JV) is being formed by Brakes India and ADVICS Co. Ltd., a division of the massive Japanese auto component company Aisin Corporation, to produce cutting-edge braking equipment in India. The goal of this collaboration is to take advantage of Brakes India's extensive knowledge of the home market and ADVICS' state-of-the-art expertise in sophisticated braking systems.

- In May 2024, The Raytheon Technologies (RTX) company Collins Aerospace announced a large investment to increase its production capacity in Spokane, Washington. The program is a component of RTX's strategy plan to satisfy the growing demand for its cutting-edge defence and aerospace products. New manufacturing lines and improvements to current facilities are part of this development, which focuses on cutting-edge technology to increase output and operating efficiency.

- In January 2023, Brakes India announced plans to expand its market share by focusing on innovation and introducing new products. The company aims to enhance its product offerings to meet evolving industry demands and improve safety and performance standards.

Industrial Brakes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mechanical, Hydraulic, Pneumatic, Electrical, Others |

| Applications Covered | Holding Brakes, Dynamic and Emergency Brakes, Tension Brakes |

| End Use Industries Covered | Manufacturing, Metal and Mining, Construction, Marine and Shipping, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Akebono Brake Industry Co. Ltd, Altra Industrial Motion Corporation, AMETEK Inc., Antec SA, Coremo Ocmea S.p.A., Eaton Corporation PLC, Hilliard Corporation, Kobelt Manufacturing Co. Ltd., Kor-Pak Corporation, RINGSPANN GmbH, SIBRE - Siegerland Bremsen GmbH, Tolomatic Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the industrial brakes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global industrial brakes market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industrial brakes industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial brakes market was valued at USD 1.42 Billion in 2024.

The industrial brakes market is projected to exhibit a CAGR of 3.36% during 2025-2033, reaching a value of USD 1.92 Billion by 2033.

The market is driven by the rising adoption of automation in manufacturing and material handling, increasing safety regulations, and the growing demand for energy-efficient braking systems. Industries such as construction and mining also fuel growth, requiring advanced braking solutions for heavy machinery and operational safety.

Asia Pacific currently dominates the industrial brakes market, accounting for a share of 45.9% in 2024. The dominance is fueled by rapid industrialization, expanding manufacturing sectors, increasing infrastructure development, and rising investments in automation technologies.

Some of the major players in the industrial brakes market include Akebono Brake Industry Co. Ltd, Altra Industrial Motion Corporation, AMETEK Inc., Antec SA, Coremo Ocmea S.p.A., Eaton Corporation PLC, Hilliard Corporation, Kobelt Manufacturing Co. Ltd., Kor-Pak Corporation, RINGSPANN GmbH, SIBRE - Siegerland Bremsen GmbH, and Tolomatic Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)