Industrial Agitators Market Report by Type (Industrial Stirrer, Paint Mixers, High Speed Stirrers, Chemical Agitators, Others), Mounting Type (Top-mounted, Side-mounted, Bottom-mounted), Distribution Channel (Online, Offline), Industry Vertical (Chemicals and Paints, Material and Construction, Food and Beverages, Pharmaceutical, Consumer Goods, and Others), and Region 2025-2033

Industrial Agitators Market Size:

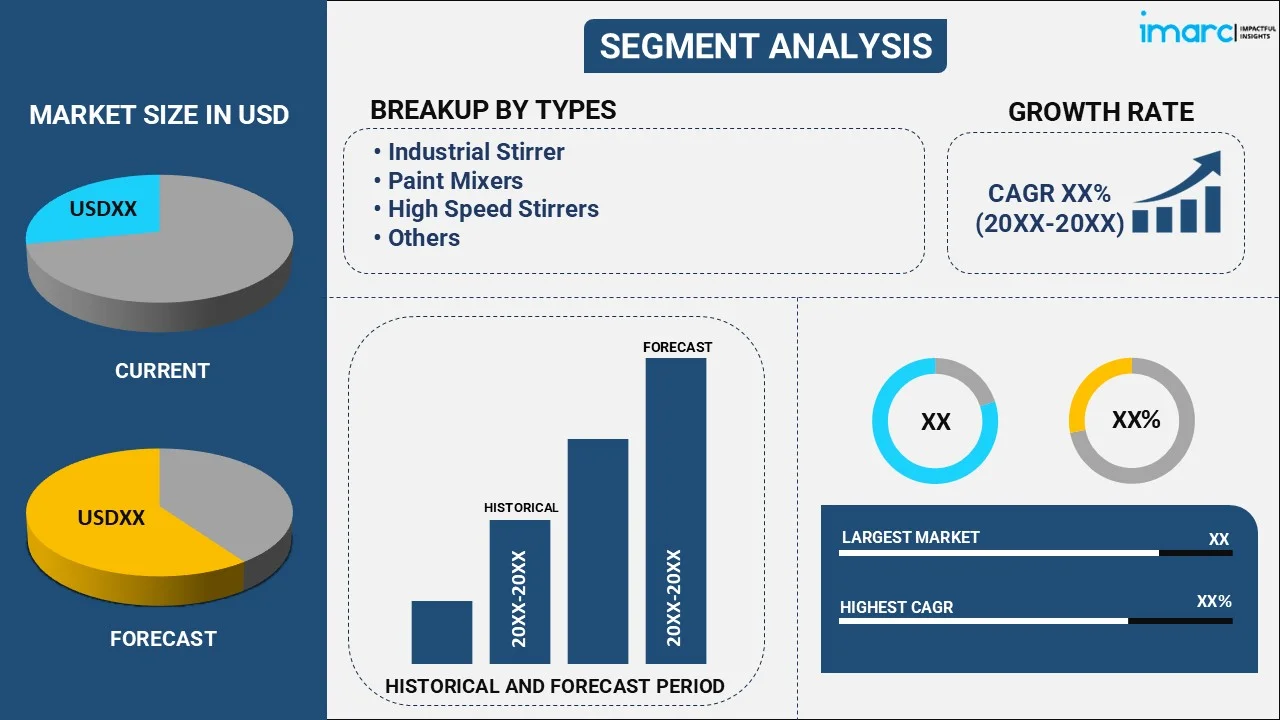

The global industrial agitators market size reached USD 2.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.1 Billion by 2033, exhibiting a growth rate (CAGR) of 3.73% during 2025-2033. The market is expanding significantly due to the heightening demand from key industries, including wastewater treatment, chemicals, and pharmaceuticals. Moreover, advancements in energy-saving designs and customizable solutions are escalating product utilization. Additionally, strict regulations and the drive for upgraded mixing processes are further supporting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.2 Billion |

|

Market Forecast in 2033

|

USD 3.1 Billion |

| Market Growth Rate 2025-2033 | 3.73% |

Industrial Agitators Market Analysis:

- Major Market Drivers: The market is principally driven by the escalating demand in sectors like food and beverage, chemicals, and pharmaceuticals. Such industries demand effective mixing solutions to sustain product quality and adhere to regulatory policies. Moreover, increasing focus on energy-efficient machines and innovations in mixing technologies are fueling market growth. In addition, the inclination towards automation in industrial applications is further spurring the demand for agitators integrated with upgraded control systems, improving operational efficacy, and minimizing energy consumption. Furthermore, the demand for customized industrial agitators across various applications is also contributing to the evolving market.

- Key Market Trends: The market is experiencing a notable inclination towards automated and energy-saving solutions to address the accelerating demand of modern sectors. There is a surge in adoption of smart agitators incorporated with advanced technologies like the Internet of Things (IoT), facilitating the real-time supervision and refinement of mixing methods. Moreover, this trend is especially prominent in industries like pharmaceuticals and chemicals, where accuracy is crucial. In addition, manufacturers are currently emphasizing on modular configurations that provide customization as well as flexibility, addressing the specific industry requirements. Furthermore, such innovations are anticipated to fuel market growth and enhance operational efficiency across varying applications.

- Geographical Trends: North America represents the largest share in the global market, primarily driven by the robust presence of major industries, such as wastewater management, pharmaceuticals, and chemicals. The region’s growing emphasis technological innovations and deployment of automation in industrial workflows is bolstering demand for advanced agitators. Moreover, the U.S., in particular, dominates in leveraging smart and energy-saving agitators to upgrade its manufacturing processes. In addition, strict regulatory standards associated with energy usage and emissions are compelling the industries to opt for cutting-edge agitator systems, positioning North America as the largest regional market for industrial agitators.

- Competitive Landscape: Some of the major market players in the industrial agitators industry include Dynamix Agitators Inc., EKATO Holding Gmbh, Mixer Direct, NOV Inc., Silverson, SPX FLOW Inc., Statiflo International Ltd., Sulzer Ltd, TACMINA CORPORATION, Xylem Inc., among many others.

- Challenges and Opportunities: The market experiences challenges including maintenance intricacies and elevated initial costs of smart equipment, which can significantly discourage medium and small-sized enterprises from product adoption. Nevertheless, such challenges offer notable opportunities for advancements, especially in manufacturing energy-saving, cost-efficient agitators designed for specific sectors. Moreover, manufacturers that emphasize on convenient maintenance and scalability are positioned to attain significant market share. In addition, the intensifying need for sustainable production methods offer opportunities for agitators designed with minimal environmental impact. Such innovations are likely to boost future product adoption and expansion in various industries.

Industrial Agitators Market Trends:

Increasing Demand in Pharmaceutical and Chemical Industries

The industrial agitators market is witnessing escalating demand from both pharmaceutical and chemical industries, primarily driven by heightening production capabilities and the requirement for accurate mixing solutions. Moreover, such sectors demand upgraded agitators for various applications such as homogenizing, blending, and maintaining uniformity in high-volume production. In addition, strict regulatory standards related to product safety as well as quality in these industries are further bolstering demand for advanced agitators. The increasing demand and production of chemicals are also substantially fueling the demand for high-functioning agitators. As per industry reports, in 2023 India's total production of major petrochemicals and chemicals reached 40,580 thousand metric tons. Furthermore, the escalating emphasis on digital monitoring and automation in production methodologies is also supporting the adoption of high-efficiency industrial agitators, facilitating ideal process control and performance.

Technological Advancements in Agitator Design

The industrial agitators market is notably profiting from innovations in agitator design, with advancements emphasizing on lowered maintenance demands, energy efficiency, and enhanced mixing capabilities. According to a research article published in the International Journal of Heat & Technology in December 2023, a major innovation in agitator design is the development of turbine-like configurations that lower power consumption while enhancing mixing capability. Such designs improve axial as well as tangential velocities, facilitating secondary flows and substantially enhancing energy efficiency. Manufacturers are currently integrating advanced features such as digital monitoring solutions, variant speed drives, and upgraded impeller designs, to significantly improve performance across numerous applications. Moreover, such advancements are especially requisite for sectors where energy consumption as well as accurate mixing are crucial factors. In addition, the incorporation of IoT-based agitators and automation is also reshaping process control, making operations more effective and lowering downtime, resultantly fueling overall production efficacy.

Rising Emphasis on Industry-Specific Solutions and Customization

A notable trend in the global industrial agitators market is the escalating demand for customized agitators specifically designed to cater to industry-specific demands. Industries such as wastewater management, food and beverage, and cosmetics have specific mixing requirements, compelling manufacturers to provide agitators that address the distinct operational, material, and volume, conditions. For instance, in June 2024, Tetra Pak, a major food packaging and processing solutions company, introduced an industrial agitator/mixer, particularly designed to mitigate the foam formation issue during the mixing of liquid food. Moreover, this trend towards customization is significantly boosting the market growth as companies re actively seeking tailored components that can effectively enhance both product quality and mixing efficiency. In addition, increasing concerns regarding environmental safety and the demand for energy-saving solutions are prompting the key sectors to leverage customized agitators that align with sustainability objectives.

Industrial Agitators Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, mounting type, distribution channel, and industry vertical.

Breakup by Type:

- Industrial Stirrer

- Paint Mixers

- High Speed Stirrers

- Chemical Agitators

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes industrial stirrer, paint mixers, high speed stirrers, chemical agitators, and others.

Industrial stirrers are essential equipment in the global industrial agitator market, designed for effective blending and mixing of slurries as well as liquids. Such stirrers are generally leveraged in sectors such as chemicals, pharmaceuticals, and food and beverages, to facilitate product homogeneity. Moreover, their capability to manage big volumes and fluctuating viscosities establish them as an integral component in numerous manufacturing phases. In addition, industrial stirrers are available in various designs to address to specific operational demands, contributing to their extensive adoption in industrial applications around the globe.

Paint mixers, a major segment of the industrial agitator market, are specialized in blending additives, pigments, and solvents, to attain uniformity in paint mixtures. Such mixers are requisite in the development of paints and coatings, facilitating precise dispersion of both texture and color. In addition, paint mixers are developed to handle high viscosity materials and function effectively at varying speeds to accommodate various formulations. Furthermore, their application extends to industrial, automotive, and construction industry, where efficient and accurate mixing is critical to adhere to the quality standards. For instance, in March 2024, ROSS Mixers launched reconditioned paint mixtures, including DPM-4 model, for high-viscosity applications. These mixers are incorporated with high-viscosity blades and can efficiently blend thick semi-solids.

High-speed stirrers dominate applications requiring rapid and thorough mixing, particularly in industries such as pharmaceuticals, chemicals, and cosmetics. These stirrers operate at elevated speeds to quickly blend liquids, emulsions, and slurries, enhancing process efficiency. Moreover, they are commonly used where fine dispersions and homogeneity are critical. Additionally, the ability to adjust speed and customize performance for specific processes contributes to their significant demand in industrial settings. Furthermore, high-speed stirrers help reduce mixing time while maintaining product quality, driving their importance in the global industrial agitator market.

Chemical agitators play a crucial role in the global industrial agitator market, specifically designed for mixing and handling corrosive and hazardous chemicals. These agitators are engineered to withstand harsh environments, ensuring safety and efficiency in chemical processing. In addition, they are widely used in petrochemical, pharmaceutical, and water treatment industries, where precise control over mixing processes is required. Furthermore, chemical agitators can be customized to meet the demands of different chemical compositions, making them vital for maintaining consistent product quality and operational efficiency in various industries.

Breakup by Mounting Type:

- Top-mounted

- Side-mounted

- Bottom-mounted

Top-mounted holds the largest share of the industry

A detailed breakup and analysis of the market based on the mounting type have also been provided in the report. This includes top-mounted, side-mounted, and bottom-mounted. According to the report, top-mounted accounted for the largest market share.

Top-mounted agitators hold the largest market share by mounting type in the global industrial agitator market due to their versatility and widespread use across various industries, including chemicals, pharmaceuticals, and food and beverages. Moreover, their ability to handle large volumes and provide efficient mixing in deep tanks makes them a preferred choice for heavy-duty applications. In addition, advancements in energy-efficient technologies and ease of maintenance further enhance their adoption. Furthermore, the robust performance and adaptability of top-mounted agitators drive their dominant position in the market.

Breakup by Distribution Channel:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

The online distribution channel in the global industrial agitator market is expanding due to increased digitalization and the convenience it offers to buyers. Manufacturers and suppliers are utilizing e-commerce platforms and direct websites to reach a broader audience, providing detailed product information and technical specifications. Moreover, online channels enable easy comparison of prices and features, streamlining the procurement process for customers. In addition, the growing preference for online purchasing is driven by faster delivery times, access to a wider range of products, and global reach.

The offline distribution channel remains a significant segment in the global industrial agitator market, primarily catering to industries requiring direct consultations and customized solutions. Through physical stores, distributors, and agents, companies can offer personalized services, on-site demonstrations, and technical support, which are crucial for high-value industrial equipment. In addition, offline channels are preferred for building long-term relationships with clients and ensuring the reliability of product quality. Furthermore, this channel continues to serve customers seeking hands-on experience with products before making purchasing decisions.

Breakup by Industry Vertical:

- Chemicals and Paints

- Material and Construction

- Food and Beverages

- Pharmaceutical

- Consumer Goods

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes chemicals and paints, material and construction, food and beverages, pharmaceutical, consumer goods, and others.

The chemicals and paints industry is a key distribution channel for the global industrial agitator market, driven by the need for precise and consistent mixing of complex substances. Industrial agitators are essential for blending chemicals, solvents, pigments, and additives, ensuring product uniformity and quality. Additionally, the sector’s reliance on agitators for efficient and large-scale mixing processes makes it a significant contributor to market demand. Furthermore, the industry's stringent regulatory requirements for safety and product standards further reinforce the need for reliable, high-performance agitator systems.

In the material and construction sector, industrial agitators play a vital role in the production of cement, adhesives, and coatings. These agitators ensure homogenous mixing, which is critical for achieving the desired properties of construction materials. Moreover, the growing demand for sustainable construction solutions is increasing the need for advanced mixing technologies that can efficiently handle viscous and abrasive materials. Furthermore, as this industry expands globally, the need for durable, energy-efficient agitators capable of continuous operation in demanding environments drives the market for industrial agitators in this segment.

The food and beverages industry is a prominent distribution channel for industrial agitators, particularly for applications such as mixing, homogenizing, and blending ingredients in large volumes. Agitators are essential in maintaining product consistency and meeting stringent hygiene standards required in food processing. Additionally, with the rising demand for processed and packaged foods, the need for efficient agitators that can handle a wide range of viscosities and ensure uniformity in production is growing. Moreover, agitators contribute to optimizing production processes, improving operational efficiency across the food and beverage sector.

The pharmaceutical industry relies heavily on industrial agitators for critical applications such as mixing active ingredients, suspensions, and emulsions. Agitators ensure precise blending in the formulation of drugs and vaccines, where accuracy is crucial. Moreover, the increasing focus on biopharmaceuticals and the demand for high-quality production in compliance with regulatory standards drive the adoption of specialized agitators in this sector. In addition, industrial agitators used in the pharmaceutical industry must meet stringent hygiene and quality requirements, further increasing demand for high-performance, customizable mixing solutions in this market segment.

The consumer goods sector, including personal care and household products, represents another significant distribution channel for industrial agitators. These products often require careful mixing of ingredients to achieve the desired consistency and efficacy, making agitators an essential component in their production processes. In addition, from lotions to cleaning products, the ability to blend diverse materials efficiently is critical. Furthermore, the growing demand for consumer goods globally, especially in emerging markets, continues to fuel the need for industrial agitators that can deliver consistent quality and meet large-scale production requirements.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest industrial agitators market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for industrial agitators.

North America has emerged as the dominant region in the global industrial agitators market chiefly due to its prominent industrial sectors, which include wastewater treatment, chemical, and pharmaceuticals. As per industry reports, the United States is the largest pharmaceutical market worldwide, accounting for 41% of total global pharmaceutical expenditure. The region’s robust focus on technological advancements, combined with early adoption of automated and energy-efficient solutions, propels market growth. In addition, strict regulatory implementations related to energy consumption and sustainability further accelerate the demand for smart agitators. Furthermore, the U.S. is heavily investing in precision production as well as industrial automation, fostering the region’s leadership in the global industrial agitators market.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the industrial agitators industry include Dynamix Agitators Inc., EKATO Holding Gmbh, Mixer Direct, NOV Inc., Silverson, SPX FLOW Inc., Statiflo International Ltd., Sulzer Ltd, TACMINA CORPORATION, and Xylem Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The global industrial agitators market is witnessing intense competition, with major companies emphasizing on customization as well as advancements to address the sector-specific demand. Key players are sustaining their robust market share through strategic collaborations and constant product innovations. Moreover, the heightening demand for advanced and energy-efficient agitators has spurred technological innovations, further accelerating competition. In addition, new firms are focusing on niche sectors with specialized equipment, while established companies are striving to expand their product portfolio and upgrade their maintenance offerings to gain a competitive benefit in this dynamic global market. For instance, in June 2023, INOXPA launched DINAMIX SMX, its new range of side-entry agitators. This product is developed based on a modular concept, making it highly adaptable to cater to the specific demands, and can be deployed in cosmetic, pharmaceutical, and food industries for homogenization processes.

Industrial Agitators Market News:

- In March 2023, Milton Roy expanded its HELISEM agitator series by launching five different mixer series, including VRG, VDA, FRH, VRH, and VRP series, suitable for dissolution, homogenization, dilution, and flocculation processes in water treatment and chemical sectors.

- In July 2023, SEW-EURODRIVE, a leading automation company, launched its new X.e series agitator gear design, featuring upgraded gear and motor technology, elevated permissible forces, and modular design. With digital twin incorporation for design optimization, the unit improves dependability and efficacy in industrial agitator applications.

Industrial Agitators Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Industrial Stirrer, Paint Mixers, High Speed Stirrers, Chemical Agitators, Others |

| Mounting Types Covered | Mounted, Side-Mounted, Bottom-Mounted |

| Distribution Channels Covered | Online, Offline |

| Industry Verticals Covered | Chemicals and Paints, Material and Construction, Food and Beverages, Pharmaceutical, Consumer Goods, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Dynamix Agitators Inc., EKATO Holding Gmbh, Mixer Direct, NOV Inc., Silverson, SPX FLOW Inc., Statiflo International Ltd., Sulzer Ltd, TACMINA CORPORATION, Xylem Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the industrial agitators market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global industrial agitators market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industrial agitators industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global industrial agitators market was valued at USD 2.2 Billion in 2024.

We expect the global industrial agitators market to exhibit a CAGR of 3.73% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in the temporary closure of numerous-end use industries for industrial agitators.

The increasing adoption of industrial agitators across the pharmaceutical industry for improving the overall performance and reducing the production cost of medicines, is primarily driving the global industrial agitators market.

Based on the mounting type, the global industrial agitators market can be divided into top-mounted, side-mounted, and bottom-mounted. Currently, top-mounted holds the majority of the total market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global industrial agitators market include Dynamix Agitators Inc., EKATO Holding Gmbh, Mixer Direct, NOV Inc., Silverson, SPX FLOW Inc., Statiflo International Ltd., Sulzer Ltd, TACMINA CORPORATION, and Xylem Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)