Indoor Farming Market Size, Share, Trends and Forecast by Facility Type, Crop Type, Component, Growing System, and Region, 2025-2033

Indoor Farming Market Size and Share:

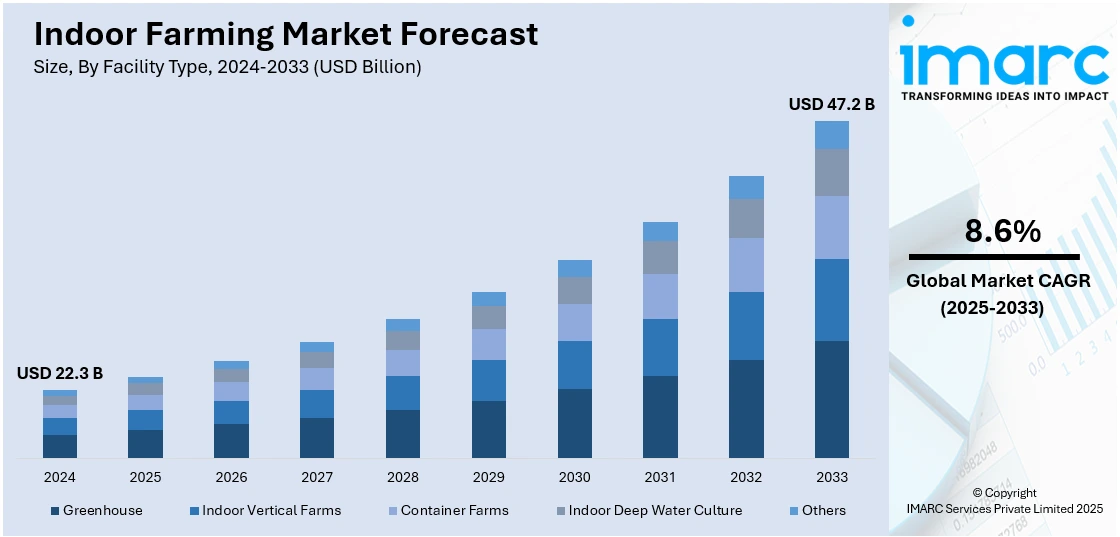

The global indoor farming market size was valued at USD 22.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 47.2 Billion by 2033, exhibiting a CAGR of 8.6% from 2025-2033. North America currently dominates the market, holding a market share of over 36.9% in 2024. The North American region is experiencing steady growth because of rising preferences for sustainable and locally sourced food options, continuous technological advancements in indoor farming practices, and the widespread adoption of automation systems, including robotic arms and conveyor belts.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 22.3 Billion |

|

Market Forecast in 2033

|

USD 47.2 Billion |

| Market Growth Rate 2025-2033 | 8.6% |

Technological advancements and the necessity for sustainable food production are contributing to the growth of the market. As arable land is decreasing and environmental issues like soil degradation and water scarcity are worsening, indoor farming is gaining traction as it provides a controlled setting for efficient food production, serving as a feasible answer to increased demands. Improvements in hydroponics, aeroponics, and aquaponics is also stimulating the market growth since these technologies support soilless crop cultivation, decrease water consumption, and facilitate continuous year-round production despite external weather conditions. Furthermore, incorporating artificial intelligence (AI), Internet of Things (IoT), and automation in indoor farming is enhancing efficiency, cutting labor expenses, and optimizing resource usage. This, along with government initiatives and financial backing in sustainable farming, is facilitating the market expansion. In numerous areas, policies that promote urban farming and provide incentives for sustainable technology adoption are promoting indoor farming operations.

To get more information on this market, Request Sample

The United States has emerged as a key regional market for indoor farming because of technological advancements, sustainability goals, and a shift in preferences towards locally produced, high-quality, and pesticide-free food. The market in the country is expanding because of the rising demand for locally grown, fresh produce. People are encouraged to look for locally grown food as they are becoming more conscious about the negative impact of long-distance shipping on the environment and the advantages of cutting down on food miles. This demand can be met by indoor farming operations located close to metropolitan areas, which provide fresh, high-quality vegetables with a lower carbon footprint. Additionally, the industry is expanding due to preferences for organic, pesticide-free, and non-genetically modified organism (GMO) goods, as indoor farming technologies allow production in controlled, chemical-free environments. As per the predictions of the IMARC Group, the United States organic food market is expected to reach US$ 158.2 Billion by 2032.

Indoor Farming Market Trends:

Increasing Demand for Sustainable and Local Food Production

There is presently a rise in the demand for sustainable and locally sourced food items. This represents a major trend fueling the market growth. Growing food indoors reduces the environmental impact of food production. A recent global study carried out by the Economist Intelligence Unit (EIU), on behalf of WWF, shows a significant 71% increase in searches for sustainable products in the last five years. Conventional farming mainly includes transporting products over long distances, using excessive amounts of water, pesticides and herbicides. In addition, the growing emphasis on indoor farms located nearby to decrease the requirement for extended transportation distances and lower carbon emissions linked to food distribution is providing a positive market prospect. Furthermore, indoor farming allows for the continuous production of crops throughout the year despite harsh weather conditions. This continual provision of fresh fruits and vegetables tackles the difficulties generated by changes in seasons and lack of food. Areas with challenging weather conditions or minimal farmable land like the Middle East can reduce their dependence on import of food by putting resources into indoor agriculture. Additionally, in PwC's 2024 Voice of the Consumer Survey, individuals are willing to spend more on sustainability despite facing continuous cost-of-living challenges. Typically, they are willing to pay an extra 9.7% for products that are sustainably made or obtained. This tendency is impacted by the fact that close to 85% of consumers have directly felt the disruptive impacts of climate change in their everyday experiences.

Technological Advancements

Technological advancements taking place in indoor farming practices are improving their efficiency and promoting crop yield. The increasing adoption of automation systems, including robotic arms and conveyor belts is reducing labor costs and making indoor farming more economically viable. The latest USDA Farm Labor Survey reports a 7% increase in gross farm wages last year. Robots can perform tasks, such as planting, harvesting, and sorting. In addition, the rising utilization of sensors and cameras to collect real-time data on crop health, environmental conditions, and nutrient levels is strengthening the growth of the market. Machine learning (ML) algorithms analyze this data to optimize growing parameters, resulting in higher yields and quality. In line with this, the increasing popularity of vertical farming, facilitated by automated vertical racks for maximum space utilization is creating a positive outlook for the market. This innovation allows for the cultivation of crops in layers, further increasing production efficiency. In addition, several researchers and growers are experimenting with light recipes tailored to specific crops.

Investment and Expansion

Continuous investments and expansion efforts from various stakeholders, including startups, established agriculture companies, and governments, are influencing the market positively. According to the May 2023 Pitchbook report, VC investments in indoor farms plummeted by over 90% year-over-year. Startup companies are hubs of innovation, driving the development of cutting-edge indoor farming technologies. They receive substantial venture capital funding to support their research and commercialization efforts. Along with this, several well-funded startups are expanding rapidly, setting up indoor farms in urban areas to supply fresh produce to local markets, which is contributing to the increased adoption of indoor farming. Furthermore, established agricultural companies are entering the indoor farming market through acquisitions or partnerships with startups. This trend leverages their existing expertise and resources to scale indoor farming operations. Apart from this, governing authorities of several countries are offering financial incentives, tax breaks, and grants to encourage indoor farming for promoting local food production, creating jobs, and promoting sustainability. They are also providing funds for research initiatives to improve indoor farming techniques, making them more accessible and cost-effective. Moreover, they are developing regulatory frameworks to ensure the safety and quality of indoor-farmed products.

Indoor Farming Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global indoor farming market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on facility type, crop type, component, and growing system.

Analysis by Facility Type:

- Greenhouse

- Indoor Vertical Farms

- Container Farms

- Indoor Deep Water Culture

- Others

Greenhouse stands as the largest component in 2024, holding 47.0% of the market share. Greenhouses are controlled-environment structures that allow for year-round cultivation. They utilize natural sunlight while maintaining a controlled climate. Greenhouses are versatile, accommodating various crops and extending growing seasons. They are known for energy efficiency and sustainability due to reduced pesticide use and water conservation. Indoor vertical farms are innovative facilities that stack crops in vertical layers, utilizing artificial lighting and controlled environments. They maximize space efficiency and minimize water usage. Vertical farms are suitable for leafy greens, herbs, and some fruits, offering consistent yields and minimizing transportation costs. Container farms are compact and mobile units housed in shipping containers. They are easily deployable and ideal for urban farming. Container farms can grow a variety of crops and provide local, fresh produce. They are popular for their modular design and scalability. Indoor deep-water culture involves suspending plant roots in nutrient-rich water. This method is highly efficient and commonly used for growing lettuce, herbs, and leafy greens.

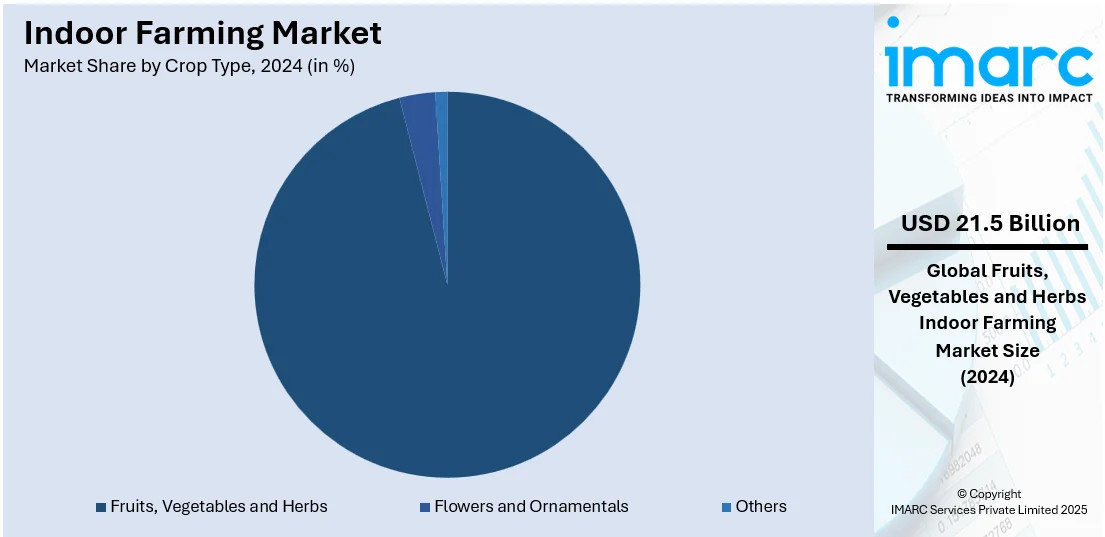

Analysis by Crop Type:

- Fruits, Vegetables and Herbs

- Lettuce

- Spinach

- Kale

- Tomato

- Herbs

- Bell and Chilli Peppers

- Strawberry

- Cucumber

- Others

- Flowers and Ornamentals

- Annuals

- Perennials

- Ornamentals

- Others

- Others

Fruits, vegetables, and herbs (lettuce, spinach, kale, tomato, herbs, bell and chilli peppers, strawberry, cucumber, and others) lead the market with 96.5% of the market share in 2024. Indoor farming allows for the cultivation of fruits like strawberries and tomatoes in controlled environments, ensuring year-round availability of fresh produce. Leafy greens, such as spinach and kale, along with cucumbers and bell peppers, thrive in indoor farms due to controlled conditions and efficient space utilization. Indoor cultivation is ideal for herbs like basil, cilantro, and oregano, which require precise environmental control for optimal flavor and growth. Chilli peppers are also increasingly grown indoors for their controlled heat levels. Indoor farming extends the growing season for annual flowers like petunias and marigolds. Controlled conditions result in vibrant and healthy blooms, catering to the floral industry. In addition, perennial ornamentals like roses and lavender benefit from year-round cultivation, ensuring a constant supply for the landscaping and decorative plant market. Furthermore, the ornamental category includes various decorative plants used in landscaping, interior decoration, and gardening, which can thrive in indoor farming setups.

Analysis by Component:

- Hardware

- Structure

- LED Lights

- HVAC

- Climate Control System

- Irrigation Systems

- Others

- Software

- Web-based

- Cloud-based

Hardware (structure, LED lights, HVAC, climate control system, irrigation systems, and others) leads the market with 89.2% of the market share in 2024. The physical infrastructure includes greenhouse structures, vertical farming racks, and grow rooms. These provide the foundation for indoor farming, ensuring optimal environmental control and space utilization. LED lighting systems aid in providing the necessary light spectrum for plant growth. They are energy-efficient and customizable, mimicking natural sunlight for photosynthesis. Heating, ventilation, and air conditioning (HVAC) systems regulate temperature, humidity, and air circulation within indoor farming facilities. They are essential for maintaining optimal growing conditions year-round. This encompasses sensors, controllers, and automation technologies that fine-tune environmental parameters, including temperature, CO2 levels, and humidity, ensuring ideal growing conditions. Irrigation systems deliver water and nutrients to plants.

Analysis by Growing System:

- Aeroponics

- Hydroponics

- Aquaponics

- Soil-based

- Hybrid

Soil-based leads the market with 41.6% of the market share in 2024. Traditional soil-based indoor farming employs natural soil as the growing medium. This method is favored for crops with deep roots and is often used for root vegetables like carrots and potatoes. While it requires more space and water compared to soil-less systems, it retains the familiarity of conventional agriculture practices. One of the main advantages of traditional soil-based indoor farming is its ability to produce high-quality crops without relying on synthetic nutrient solutions. Soil serves as a natural reservoir of essential nutrients and beneficial microorganisms, creating a more organic growing environment compared to soilless methods. This is particularly appealing to growers who aim to meet the increasing consumer demand for organic and chemical-free produce. Soil-based systems also offer a lower barrier to entry since they do not require complex infrastructure or advanced technology, making them an accessible option for individuals and businesses with limited budgets.

Regional Analysis:

- Asia Pacific

- China

- Japan

- Singapore

- South Korea

- Others

- North America

- United States

- Canada

- Europe

- Netherlands

- Germany

- United Kingdom

- France

- Italy

- Others

- Latin America

- Mexico

- Brazil

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 36.9%. North America is witnessing substantial growth in indoor farming. The United States is a major player, with a focus on salad greens, herbs, and microgreens. Moreover, the increasing adoption of controlled environment agriculture, especially in urban centers, is contributing to the market growth. In line with this, Canada, with its harsh climate, is also embracing indoor farming for year-round crop production. Sustainability is a central theme driving the indoor farming market in the United States. The agricultural sector faces mounting pressure to address issues such as water scarcity, land degradation, and greenhouse gas emissions. Indoor farming systems address these challenges by using less water than traditional farming methods and minimizing the need for arable land. Additionally, advancements in energy-efficient light emitting diode (LED) lighting and renewable energy integration are assisting to mitigate the environmental impact of indoor farming operations. As per the IMARC Group’s predictions, the North America LED lighting market is expected to reach US$ 43.2 Billion by 2032. This will further enhance the usage of LED lighting in indoor farming.

Key Regional Takeaways:

United States Indoor Farming Market Analysis

In 2024, the United States accounted for 92.8% of the total North America indoor farming market, driven by rising investments, favorable regulatory developments, and strong consumer demand for fresh, locally sourced produce. The U.S. District Court for Northern California ruled in March that hydroponic farming qualifies under the National Organic Program (NOP), significantly enhancing market potential by enabling indoor farmers to pursue organic certification and premium pricing. The growing focus on healthy lifestyle adoption post-pandemic has catalyzed significant momentum in fresh and high-quality food consumption. The heavy import dependence has created opportunities for domestic indoor farming operations positioned near metropolitan consumption centers to provide fresh produce with lower carbon footprints and reduced transportation costs. According to IMARC Group predictions, the United States organic food market is expected to reach $158.2 billion by 2032, providing substantial growth runway for indoor farming operators specializing in organic, pesticide-free production. Technological leadership represents another crucial growth driver, with U.S. companies pioneering AI-driven farm management systems, robotic harvesting solutions, and advanced climate control technologies that improve yields while reducing operating costs.

Europe Indoor Farming Market Analysis

Europe has emerged as a dynamic hub for indoor farming innovation, though the sector faced challenges in 2024 with European indoor farming companies raising approximately $102 million in disclosed funding rounds, significantly below historical peaks. The region's growth is driven by strong financial ecosystems, favorable government policies, and deep commitment to sustainability aligned with European Union environmental objectives. The European Commission emphasizes sustainable food systems, positioning vertical farming as a key contributor to meeting the European Green Deal targets. Despite funding challenges, several success stories demonstrate sectoral resilience. Avisomo secured $2.5 million for development, while Skytree raised $6 million to enhance direct air capture technology for climate change mitigation. In April 2023, the European Union announced plans to invest approximately $200 million in breakthrough digital technologies, supporting the controlled environment agriculture sector's technological advancement. According to Le Monde, over 50% of seed investments in the region are directed toward companies contributing to the UN's Sustainable Development Goals, underscoring Europe's focus on sustainability-driven agriculture. The Netherlands holds particular significance as a global greenhouse technology hub, with Priva alone equipping roughly 50% of the world's high-tech greenhouses with automation systems. The Dutch greenhouse cluster in Westland serves as an innovation ecosystem where climate-tech suppliers, growers, and R&D laboratories collaborate on advancing controlled environment agriculture technologies. Germany is experiencing robust growth with municipalities fast-tracking zoning approvals for urban farming installations and state-backed financing covering substantial portions of capital investment. The UK leads the European indoor farming market with a 25.0% revenue share in 2024, benefiting from advanced technology accessibility, large-scale vertical farm presence, and government encouragement for sustainable farming practices through innovation and research support.

Asia Pacific Indoor Farming Market Analysis

The Asia-Pacific region is witnessing transformative growth in indoor farming, driven by rapid urbanization, severe land scarcity, and aggressive government food security initiatives. Sky Greens, Singapore's largest vertical farm, produces approximately 1 metric ton of vegetables daily—ten times more than traditional farming—using advanced techniques like 9-meter-high A-shaped towers that save 95% of the water required for field planting while dramatically reducing transportation costs. South Korean startups such as N.Thing, NEXTON, and Farm 8 are emerging as regional leaders in the vertical farming sector, focused on supplying fresh, sustainable, locally produced food year-round. NEXTON has transformed an abandoned highway tunnel into a high-tech vertical farm utilizing LED lighting and hydroponic systems to cultivate diverse crops, demonstrating innovative space utilization. In July 2024, Sky Greens expanded beyond Singapore by establishing a pilot vertical farm in Kuala Lumpur, Malaysia, demonstrating the feasibility of high-density urban farming in tropical climates. China is rapidly scaling controlled environment agriculture to address food demand in densely populated urban centers, with companies co-developing customized aeroponic systems suited for local vegetable consumption patterns, marking strategic market entry and expansion across the mainland.

Latin America Indoor Farming Market Analysis

The growth of indoor farming in Latin America is primarily driven by increasing need to enhance food security, reduce import dependency, and address climate variability challenges affecting traditional agriculture. Climate variability and extreme weather events have made traditional farming less reliable in many Latin American nations, encouraging adoption of controlled environment agriculture as a more predictable production method. Countries like Brazil and Mexico are investing substantially in advanced hydroponics and vertical farming technologies to address urbanization challenges and rising demand for fresh, high-quality produce. The World Economic Forum (2024) identifies Latin America as a critical player in tackling global food scarcity, emphasizing the region's control over 15% of the world's land area, geopolitically neutral stance, and large labor force exceeding 300 million people. These attributes position the region as an agro-industrial superpower with significant export potential for fruits and vegetables globally. However, despite this agricultural capacity, Latin America continues struggling with food security for its population, creating domestic opportunities for indoor farming expansion. Government initiatives and private sector partnerships are fostering innovation, with urban farming solutions becoming critical in densely populated cities. Brazil leads as the largest market in the region, followed by Mexico, Argentina, and Colombia, with growing consumer demand for organic foods complemented by rising disposable incomes and expanding urban populations. The feasibility of applying technological advancements in vertical farming to bring down production costs represents a major factor contributing to anticipated market growth in the foreseeable future, as economies of scale and learning curve effects progressively improve project economics across the region.

Middle East and Africa Indoor Farming Market Analysis

Indoor farming in the Middle East and Africa is propelled by the region's arid climate, extreme water scarcity, limited arable land, and heavy reliance on food imports, creating urgent imperatives for controlled environment agriculture adoption. The Middle East and North Africa region has only 4.7% arable land compared to 10.7% worldwide, with Saudi Arabia at 1.6%, the United Arab Emirates at 0.7%, and Oman at 0.3%, far below even regional averages. The region is also the most water-scarce on earth, making indoor farming's 90-95% water reduction compared to traditional methods particularly compelling. Governments in the UAE and Saudi Arabia are heavily investing in vertical farming and hydroponic systems as strategic food security initiatives. The UAE's Food Security Strategy 2051 and Saudi Arabia's Vision 2030 both prominently feature indoor agriculture as critical components. Saudi Arabia's Agricultural Development Fund has allocated USD 220 million for disbursement to vertical farm development by 2025, while the country's Public Investment Fund announced plans in 2023 to construct multiple indoor vertical farms across the region. The July 2024 partnership between Plenty Unlimited and Mawarid (Alpha Dhabi Holdings subsidiary) represents the largest investment at $680 million, establishing a joint venture to develop a network of indoor farms across the Middle East with five facilities planned over five years. The initial Abu Dhabi facility expects to produce over 4.5 million pounds of premium strawberries annually for local consumption and export to Gulf Cooperation Council countries. The growing expatriate population in the UAE serves as a key demand driver, generating significant need for fresh produce to cater to diverse global cuisines.

Competitive Landscape:

Key market players are implementing a range of strategic initiatives to enhance their competitiveness, expand their market presence, and improve operational efficiency. These strategies include adopting advanced technologies, forming strategic partnerships, scaling up production capabilities, and diversifying their product offerings to meet evolving consumer demands. The increasing pressure to address food security, sustainability, and efficiency is driving innovation and shaping the activities of major players in the indoor farming market. One of the most prominent strategies is the integration of advanced technologies, such as AI, IoT, robotics, and automation. Leading companies are leveraging AI-driven analytics to monitor plant health, optimize resource utilization, and improve crop yields. IoT-enabled sensors are being used to collect real-time data on environmental conditions like temperature, humidity, and light, which allows for precise control of the indoor farming environment. Automation, including robotic systems for planting, harvesting, and packaging, is reducing labor costs and improving scalability. In September 2024, world’s first AI-powered vertical berry farm opened in Richmond, Virginia, United States. The Plenty Richmond Farm is the world's first indoor, vertically farmed berries facility at a scale where they are harvested and preserved.

The report provides a comprehensive analysis of the competitive landscape in the indoor farming market with detailed profiles of all major companies, including:

- AeroFarms

- Autogrow

- BrightFarms

- Certhon

- Freight Farms, Inc

- Fujian Sananbio Technology Co., Ltd

- iFarm

- Logiqs B.V.

- Plenty Unlimited, Inc.

- Sky Greens Canada

- Urban Crop Solutions

- Vertical Growth

- Voeks Inc.

Latest News and Developments:

- July 2024: US vertical farming startup Plenty formed a joint venture with Mawarid, a subsidiary of Alpha Dhabi Holding, in a $680 million deal to develop a network of indoor farms in the Middle East. This partnership aims to build five farms over the next five years, starting with a $130 million indoor farm in Abu Dhabi, which are expected to be operational by 2026. The initial facility plans to produce over 4.5 million pounds of premium strawberries annually for local consumption and export within Gulf Cooperation Council member countries. This collaboration underscores the growing investment in sustainable agriculture and food security in the region.

- January 2024: Forever Feed Technologies has revealed a final agreement with Dr. Greenhouse, Inc., to develop the controlled environment for a large-scale indoor feed mill at the River Ranch Dairy located in Hanford, California. The feed mill will cultivate Automated Sprouted Grain (ASG) to enhance the nutrition of more than 5,000 dairy cows. FFT expects the indoor feed mill to start production in late 2024.

Indoor Farming Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Facility Types Covered | Greenhouse, Indoor Vertical Farms, Container Farms, Indoor Deep Water Culture, Others |

| Crop Types Covered |

|

| Components Covered |

|

| Growing Systems Covered | Aeroponics, Hydroponics, Aquaponics, Soil-Based, Hybrid |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Netherlands, Germany, United Kingdom, France, Italy, China, Japan, Singapore, South Korea, Brazil, Mexico |

| Companies Covered | AeroFarms, Autogrow, BrightFarms, Certhon, Freight Farms, Inc, Fujian Sananbio Technology Co., Ltd, iFarm, Logiqs B.V., Plenty Unlimited, Inc., Sky Greens Canada, Urban Crop Solutions, Vertical Growth, Voeks Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the indoor farming market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global indoor farming market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the indoor farming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Indoor farming refers to the practice of cultivating crops within controlled environments such as greenhouses, vertical farms, or container farms. This method utilizes technologies like hydroponics, aeroponics, and climate control systems to optimize growing conditions, enabling year-round production with minimal water and land usage.

The global indoor farming market was valued at USD 22.3 Billion in 2024.

IMARC estimates the global indoor farming market to exhibit a CAGR of 8.6% during 2025-2033.

The global indoor farming market is driven by technological advancements such as AI and IoT integration, increasing demand for sustainable and locally sourced food, rising environmental challenges like water scarcity, and supportive government initiatives promoting sustainable agricultural practices.

Fruits, vegetables, and herbs lead the market by crop type, owing to their high demand, year-round cultivation capabilities, and suitability for controlled environments, including leafy greens and strawberries.

Fruits, vegetables, and herbs lead the market by crop type, owing to their high demand, year-round cultivation capabilities, and suitability for controlled environments, including leafy greens and strawberries.

The hardware segment is the leading category by component, driven by the dominance of structures, LED lights, and HVAC systems, which form the foundation of indoor farming facilities.

The soil-based growing system is the leading segment by growing method, driven by its familiarity with traditional farming practices and suitability for organic and chemical-free crop production.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global indoor farming market include AeroFarms, Autogrow, BrightFarms, Certhon, Freight Farms, Inc, Fujian Sananbio Technology Co., Ltd, iFarm, Logiqs B.V., Plenty Unlimited, Inc., Sky Greens Canada, Urban Crop Solutions, Vertical Growth, Voeks Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)