Indonesia Used Car Financing Market Size, Share, Trends and Forecast by Vehicle Type, Financing Providers, and Region, 2026-2034

Indonesia Used Car Financing Market Size and Share:

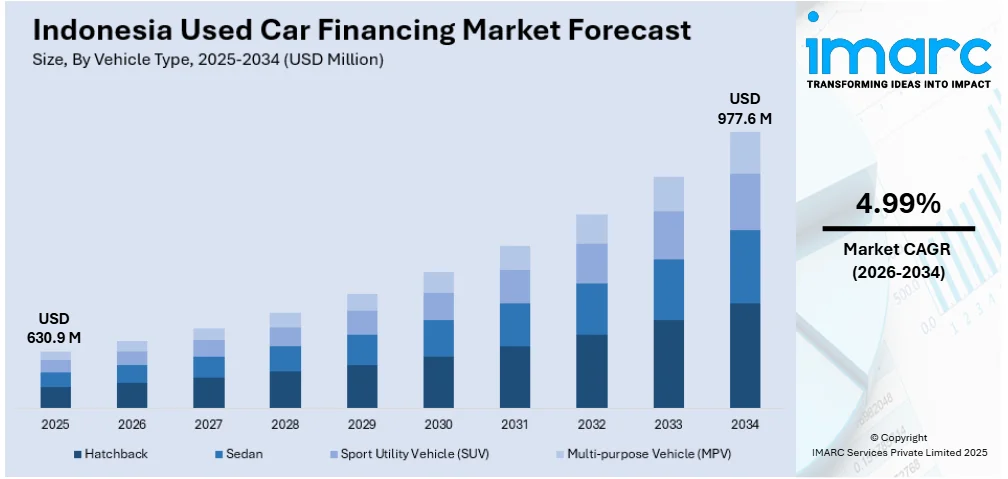

The Indonesia used car financing market size was valued at USD 630.9 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 977.6 Million by 2034, exhibiting a CAGR of 4.99% during 2026-2034. The market is driven by the growing demand for affordable transportation options, as consumers increasingly seek cost-effective alternatives to new car purchases. Additionally, favorable loan interest rates and flexible financing options offered by banks and financial institutions are fueling market growth. Moreover, the rise in disposable income, particularly in urban areas, along with the expanding used car inventory, is further augmenting the Indonesia used car financing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 630.9 Million |

| Market Forecast in 2034 | USD 977.6 Million |

| Market Growth Rate (2026-2034) | 4.99% |

The market is experiencing robust growth driven by the increasing demand for affordable transportation solutions, particularly in urban areas where new car prices are high, making used cars an attractive option for a significant portion of the population. As per industry reports, the country’s per capita disposable income rose 4.7% in 2023, due to the country's economic growth. The steady growth of disposable income, particularly in the younger demographic, plays a significant role in enabling more consumers to seek financing options for used cars. Furthermore, the rise of online car financing platforms and digital services has simplified the application process, making it more accessible for a broader customer base. Additionally, the growing trend of consumer credit acceptance in Indonesia results in a greater confidence in taking out financing for used cars, especially as financial literacy improves across the country.

To get more information on this market Request Sample

In addition to this, the expanding network of dealerships that offer financing facilities further supports the market's development. According to an industry report, the country's internet usage rose from 78.1% in 2023 to 79.5% in 2024. This consistent growth in connectivity is tremendously expanding the e-commerce industry by increasing the online accessibility of pre-owned vehicles. Consumers are increasingly looking towards online platforms to view car choices, compare prices, and buy vehicle products. This transformation is not only revolutionizing the way secondhand vehicles are purchased and sold but is also providing a positive ambiance for the growth of financing options. With more digital connectivity, banks and other fintech operators are gaining new avenues to provide customized credit products, facilitating greater access for consumers to affordable used car financing. Apart from this, government policies aimed at promoting vehicle ownership, such as lower taxes or subsidies for used car purchases, have further bolstered demand for financing.

Indonesia Used Car Financing Market Trends:

Increasing Prices of Automobiles

The increasing cost of new vehicles is one of the key factors contributing to the market expansion. New car prices have been steadily increasing due to inflationary pressures, supply constraints, as well as the imposition of more stringent environmental protection measures. An industry report indicates that car prices in Indonesia have increased by 7.5% annually, outpacing the 3% annual growth in middle-class incomes, highlighting affordability challenges in the automotive market. As a result, consumers are shifting towards the used vehicle segment as a cheaper alternative. Financing already used vehicles, such as loans and lease-to-own options, is becoming more appealing to consumers who no longer have the funds to purchase new vehicles at a higher initial cost. The availability of beneficial financing options and longer payment terms for used cars is fueling market demand. Moreover, this shift is particularly evident among the country's middle-class population, who seek cost-effective car ownership with no sacrifice in quality. This is creating a positive Indonesia used car financing market outlook.

Growth in Use of Digital Platforms and Fintech Solutions

The growing adoption of digital platforms and fintech solutions is significantly impacting the market. With increased smartphone penetration and internet connectivity, consumers are more and more likely to shop around, purchase, and finance automobiles online. Furthermore, fintech solutions are making the car financing process more convenient, allowing car buyers to apply for loan products with less documentation and competitive rates. In 2024, Indonesian fintech firms secured USD 141 Million across 23 deals, representing 32% of total equity funding and 27% of deals. This highlights the sector's rapid growth and its strong impact on the country's financial landscape. In addition to this, online platforms also make it possible for lenders to reach more customers, including those residing in remote areas who may not have easy access to traditional banks. Such a changeover to digitization is rewriting the marketplace by making financing of cars easier and more accessible and fueling business in used car financing.

Increasing Use of AI and Machine Learning for Credit Risk Management

The integration of artificial intelligence (AI) and machine learning (ML) models into credit risk management and fraud prevention tools is one of the emerging Indonesia used car financing market trends. Banks and other lenders are employing AI and ML to scrutinize large amounts of data, so they can know with greater precision and speed how creditworthy an individual is over traditional methods. Industry analysis indicated that in Indonesia, the adoption of machine learning credit models is improving loan underwriting accuracy by 10% to 15% and reducing associated review and operational costs by 5% to 10%, supporting more efficient and scalable lending across the country's growing fintech ecosystem. Also, these technologies can recognize patterns and anomalies in customer behavior, reducing fraud and default risk. AI-driven credit scoring models can take into account a greater range of factors, including transaction history and social media activity, and give a more comprehensive understanding. This enhanced risk management benefits not just lenders but also makes consumers confident that the finance process is secure, transparent, and tailored to their financial profiles.

Indonesia Used Car Financing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Indonesia used car financing market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on vehicle type and financing providers.

Analysis by Vehicle Type:

- Hatchback

- Sedan

- Sport Utility Vehicle (SUV)

- Multi-purpose Vehicle (MPV)

Hatchbacks are one of the most sought-after types of cars in the market due to their small size, fuel economy, and value for money. Hatchbacks appeal to city dwellers and working professionals who are looking for convenience and value. The hatchback's flexibility, with both lots of interior space and a relatively small footprint, makes it appealing to those having to drive around congested urban areas. With their dominance in the second-hand market, hatchbacks serve as cost-saving options for first-time buyers of cars and family buyers seeking an affordable yet efficient, economical car, further giving them significance in the finance industry.

Sedans play an important role in the market as they provide a balance between comfort, fashion, and performance. They are notably popular with middle-class families and businesspeople who require a dependable and commodious car. The sedan's greater interior room, comfortable ride, and sophisticated look appeal to a wide demographic. They also retain their resale value and are sometimes regarded as a status symbol, hence contributing to strong demand in the second-hand market. Their significance is also supported by financing packages that suit both individual customers and corporate fleets, ensuring their consistent presence in the market.

Sport Utility Vehicles (SUVs) are increasingly taking over the market, propelled by the emerging need for larger, more durable vehicles that can thrive in urban and rural settings alike. SUVs are particularly favored by families and outdoor enthusiasts who crave off-road capability, generous cargo room, and improved safety features. With their high clearance capabilities and powerful engines, these SUVs prove a perfect match for varied surfaces from urban to country roads. In line with customers' inclination to buy more commodious and use-friendly cars, the SUV range in used automobile sales remains wide open as financiers package specialty deals to satisfy this phenomenon.

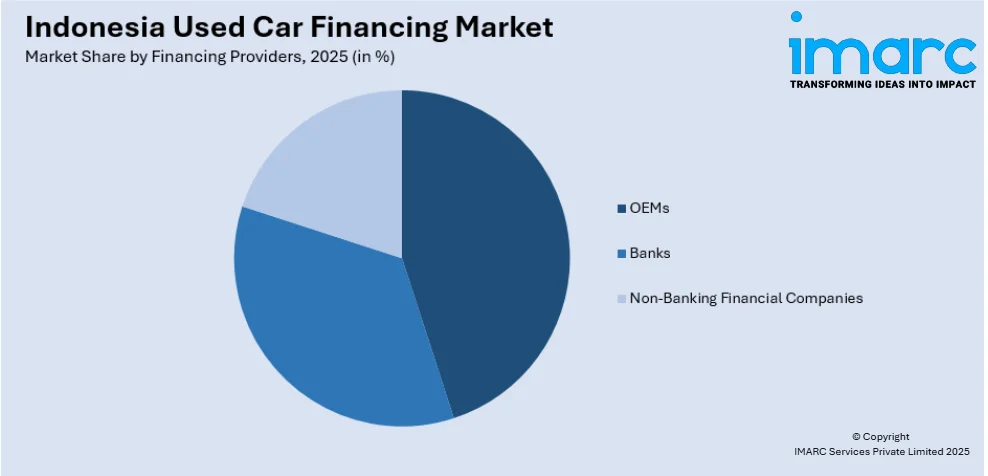

Analysis by Financing Providers:

Access the comprehensive market breakdown Request Sample

- OEMs

- Banks

- Non-Banking Financial Companies

OEMs are important in the market, as they provide financing directly to customers through their authorized dealers. OEMs usually partner with banks to offer favorable interest rates and convenient loan repayment terms to customers buying used cars. OEM financing programs usually entice customers with lucrative benefits, like guarantees or maintenance packages, which increase the value of fresh as well as certified pre-owned cars. The support of well-known brands also increases consumers' confidence, thus guaranteeing consistent demand for their cars in the second-hand segment. Accordingly, OEMs are a key part of making finance options available to used car purchasers.

Banks are major participants in the industry, providing diverse products for both new and second-hand cars. They provide favorable interest rates, longer repayment periods, and more flexible conditions for individual buyers. Banks are viewed as reliable institutions with long-term customer bases, which enhances their attractiveness to used car buyers who seek reliable financing. Most banks also enter into partnerships with dealers to provide pre-approved financing, making purchasing easier. Having their solid capital base and geographical reach, it makes financing more accessible to Indonesian consumers in all urban and rural areas, thereby supporting the Indonesia used car financing market growth.

Non-Banking Financial Companies (NBFCs) have become a key driver for market expansion. This segment provides flexible and niche financial products that reach a broader section of consumers, even those who do not qualify for standard bank loans. NBFCs tend to focus on customers with poor credit, giving them access to used car loans with alternative underwriting procedures. Such entities provide customized financing solutions with quicker approval and more customized customer care. NBFCs serve a multigenerational demographic, including new urban professionals and first-time buyers, which makes them an integral part in deepening access to second-hand car financing throughout the country.

Regional Analysis:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

Java dominates the market with its population density, economic activity, and urbanization. It is the most populous island with key cities such as Jakarta, Surabaya, and Bandung. Therefore, the region contributes to the increased demand for used cars in a variety of segments, including hatchbacks, sedans, and SUVs. The region is also well penetrated by infrastructure, which makes financing easy through banks, OEMs, and NBFCs. Moreover, Java's higher per capita income levels help to create a robust middle class, which in turn results in more frequent purchases of new and used cars. The island's leadership in the used car market makes it a central region for financing providers.

Sumatra is a significant region in the market, fueled by its increasing urban population and industrial activity. Cities such as Medan, Palembang, and Pekanbaru are experiencing growth in ownership of vehicles, specifically used cars, as more individuals look for economical means of transportation. Although the average income in the area is lower than that of Java, there is a strong demand for used cars fueled by the developing middle class and growing infrastructure. Financing companies are increasingly providing customized loan products to address the requirements of Sumatra's consumers, which makes it a critical market for banks, OEMs, and NBFCs looking to expand their presence.

The market in the Kalimantan region is distinctive due to its wide geographical area and comparatively low population density as compared to other parts. However, the demand for automobiles, especially SUVs and trucks, is still high, mainly in the mining, agricultural, and oil industries. With the economy of the region expanding, the requirement for financing services for used vehicles is on the rise. Most inhabitants of Kalimantan, especially in major cities such as Pontianak and Balikpapan, are opting for used cars due to their affordability and utility. With the infrastructure of the region growing rapidly, financing institutions are trying to start their firms in Kalimantan in order to serve its increasing market for used car loans.

Sulawesi, being a blend of urban and rural populations, is an emerging market for used car financing in the country. Makassar and Manado cities are experiencing higher demand for affordable means of transportation, with more opting for used cars because of value-for-money consideration. The region's agricultural and tourism sectors also contribute to vehicle demand, especially for utility vehicles like SUVs and trucks. While Sulawesi has a lower per capita income compared to Java, the expanding middle class and improved access to financial services have made it an important market for financing providers. As the region continues to develop, Sulawesi's used car market is expected to experience steady growth.

Competitive Landscape:

The market is highly competitive and dominated by different types of participants, from conventional banks to newly emerging digital platforms and non-bank financial institutions. The market is characterized by established players offering a variety of loan products with competitive interest rates and flexible tenures to reach a large number of customers. Automobile dealerships play a significant role in the market by forming partnerships with banking organizations to provide in-dealership financing options, thereby making loan application and approval easier for customers. Greater adoption of internet-based interfaces and fintech companies has introduced a new dimension to the market, offering more personalized and efficient loan products, with quicker processing and more convenience to consumers. This shift to online financing has boosted competition, and customer service, speed, and transparency are now key competitive differentiators. According to the Indonesia used car financing market forecast, the competition in the market is expected to intensify in the next five years, driven by increasing demand for used vehicles and the continued evolution of online financing options.

The report provides a comprehensive analysis of the competitive landscape in the Indonesia used car financing market with detailed profiles of all major companies, including:

- Astra Credit Companies (Astra International)

- Dipo Star Finance

- PT BFI Finance Indonesia Tbk

- PT JACCS Mitra Pinasthika Mustika Finance Indonesia (JACCS Co. Ltd.)

- Suzuki Finance Indonesia

Latest News and Developments:

- May 2025: Toyota Motor Asia acquired a 40% stake in PT Astra Digital Mobil (ADMO) for USD 120 million, strengthening its partnership with Astra in Indonesia's used car market. ADMO owns OLXmobbi, a platform offering used car sales, financing, insurance, and aftersales services. This collaboration aims to modernize the fragmented used car sector, enhancing accessibility and affordability for Indonesian consumers.

- December 2024: CarDekho SEA raised USD 60 Million from Navis Capital and Dragon Fund to expand used car and motorcycle financing in Indonesia and the Philippines. With over USD 1 billion in loans disbursed since 2020, the firm partners with 40+ financiers and reportedly holds a 3% market share in Indonesia.

- October 2024: Broom raised USD 25 Million in a Series A+ round led by Openspace to expand digital and financing solutions for Indonesia’s used car sector. With services like Buyback and Broom Leasing Channeling, Broom has supported 7,000+ dealers and disbursed USD 72.5 Million to enhance inventory and liquidity.

- July 2024: Indonesia-based Moladin secured USD 50 Million in debt financing from Lendable to expand used car financing and support MSMEs. Operating across 150 cities with 10,000+ agents, Moladin has disbursed over USD 500 Million in auto loans since 2023, including USD 300 Million to used car dealers.

Indonesia Used Car Financing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchback, Sedan, Sport Utility Vehicle (SUV), Multi-purpose Vehicle (MPV) |

| Financing Providers Covered | OEMs, Banks, Non-Banking Financial Companies |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Companies Covered | Astra Credit Companies (Astra International), Dipo Star Finance, PT BFI Finance Indonesia Tbk, PT JACCS Mitra Pinasthika Mustika Finance Indonesia (JACCS Co. Ltd.), Suzuki Finance Indonesia, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia used car financing market from 2020-2034.

- The Indonesia used car financing market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia used car financing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The used car financing market in Indonesia was valued at USD 630.9 Million in 2025.

The growth of the Indonesia used car financing market is driven by increasing consumer demand for affordable vehicles, improved access to financing options, low-interest rates, and the growing middle class. Additionally, rising disposable incomes, ease of loan approval, and a shift towards digital platforms for financing are encouraging more consumers to purchase used cars through financing schemes.

The used car financing market in Indonesia is projected to exhibit a CAGR of 4.99% during 2026-2034, reaching a value of USD 977.6 Million by 2034.

Some of the major players in the Indonesia used car financing market include Astra Credit Companies (Astra International), Dipo Star Finance, PT BFI Finance Indonesia Tbk, PT JACCS Mitra Pinasthika Mustika Finance Indonesia (JACCS Co. Ltd.), Suzuki Finance Indonesia, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)