Indonesia Rigid Plastic Packaging Market Size, Share, Trends and Forecast by Material Type, Product Type, End Use Industry, and Region, 2026-2034

Market Overview:

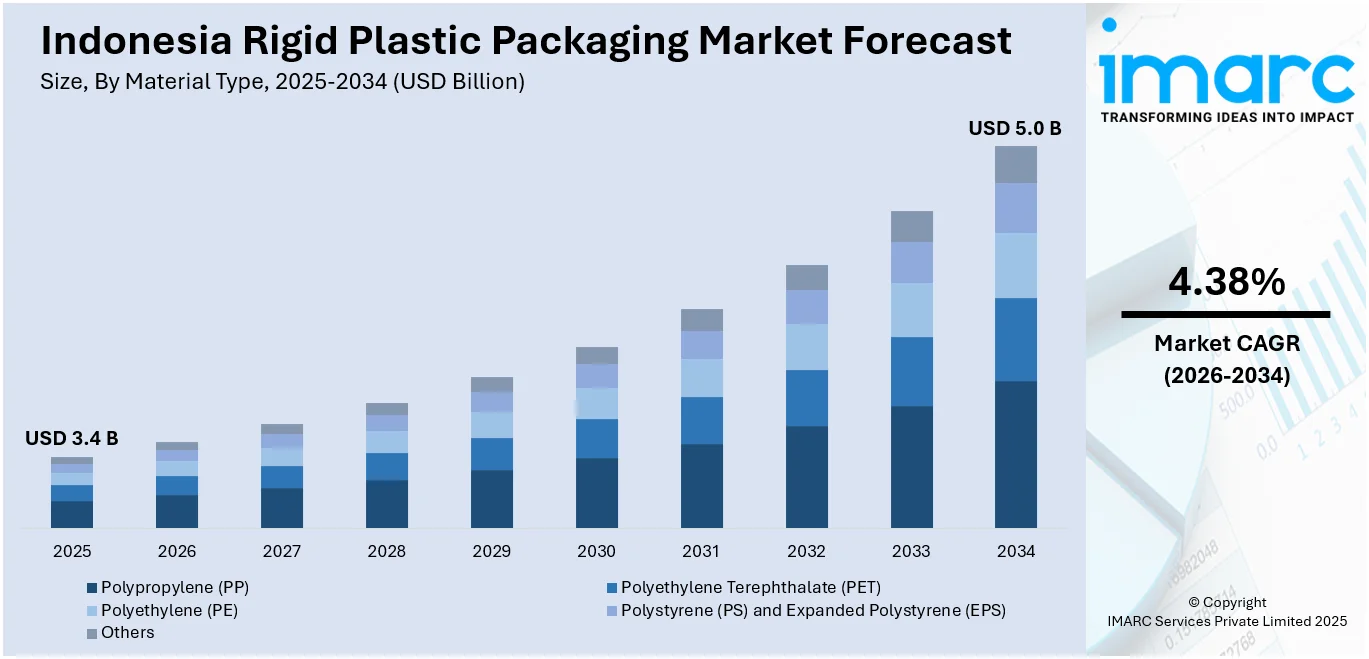

Indonesia rigid plastic packaging market size reached USD 3.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 5.0 Billion by 2034, exhibiting a growth rate (CAGR) of 4.38% during 2026-2034. Significant expansion of the food and beverage, pharmaceutical, and personal care industries across the country, ongoing advancements in recycling technologies, rising focus on sustainability, and supportive government regulations represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.4 Billion |

| Market Forecast in 2034 | USD 5.0 Billion |

| Market Growth Rate (2026-2034) | 4.38% |

Rigid plastic packaging plays a significant role in safeguarding a wide array of products across various industries. Composed of materials that retain their shape, this form of packaging is distinct from flexible plastic packaging, which can easily change form. It is known for its excellent strength, durability, lightweight properties, and ease of transportation. It is primarily constructed using polymers, such as Polyethylene Terephthalate (PET), High-Density Polyethylene (HDPE), and Polyvinyl Chloride (PVC). Rigid plastic packaging is commonly used in the food and beverage sector, where it serves as bottles, jars, and food containers. In the healthcare industry, it is favored for its ability to maintain sterility, leading to its extensive use for pharmaceutical products and medical devices. The personal care sector also utilizes rigid plastic packaging for products like shampoos and lotions, given its ability to preserve the integrity of the content inside. As a result, rigid plastic packaging has gained immense traction as a reliable option for the preservation, protection, and transportation of goods across diverse industries.

To get more information on this market Request Sample

Indonesia Rigid Plastic Packaging Market Trends:

The Indonesia rigid plastic packaging market is experiencing significant growth, fueled by a combination of factors. One primary driver is the rapid growth of the food and beverage industry in the country. With the expanding population and inflating consumer disposable incomes, there has been a rise in the demand for packaged foods and drinks, propelling the need for rigid plastic packaging solutions. The growing middle-class population, in particular, is exhibiting a preference for convenient, ready-to-eat products, which often rely on rigid plastic containers for preservation and presentation. Additionally, the expanding healthcare sector in Indonesia represents another major growth-inducing factor. As medical facilities expand and the demand for pharmaceuticals rises, there is a heightened need for rigid plastic packaging that can maintain product sterility and integrity. In line with this, significant growth in the personal care industry has augmented the demand for rigid plastic containers for items such as lotions, shampoos, and cosmetics. Furthermore, rigid plastic packaging presents environmental challenges owing to its limited biodegradability, leading to a heightened emphasis on recycling initiatives to manage its lifecycle. Continual advancements in recycling technologies and an increasing focus on sustainability are making rigid plastic packaging more appealing. Along with this, the rising efforts to produce bio-based and recyclable rigid plastics are helping to mitigate environmental concerns, thereby accelerating the product adoption rate among consumers and corporates. Moreover, favorable government policies and regulations aimed at ensuring food safety and reducing contamination are encouraging the use of high-quality, rigid plastic packaging solutions, further propelling the market growth.

Indonesia Rigid Plastic Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on material type, product type, and end use industry.

Material Type Insights:

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- Polystyrene (PS) and Expanded Polystyrene (EPS)

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes polypropylene (PP), polyethylene terephthalate (PET), polyethylene (PE), polystyrene (PS) and expanded polystyrene (EPS), and others.

Product Type Insights:

- Bottles and Jars

- Trays and Containers

- Caps and Closures

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes bottles and jars, trays and containers, caps and closures, and others.

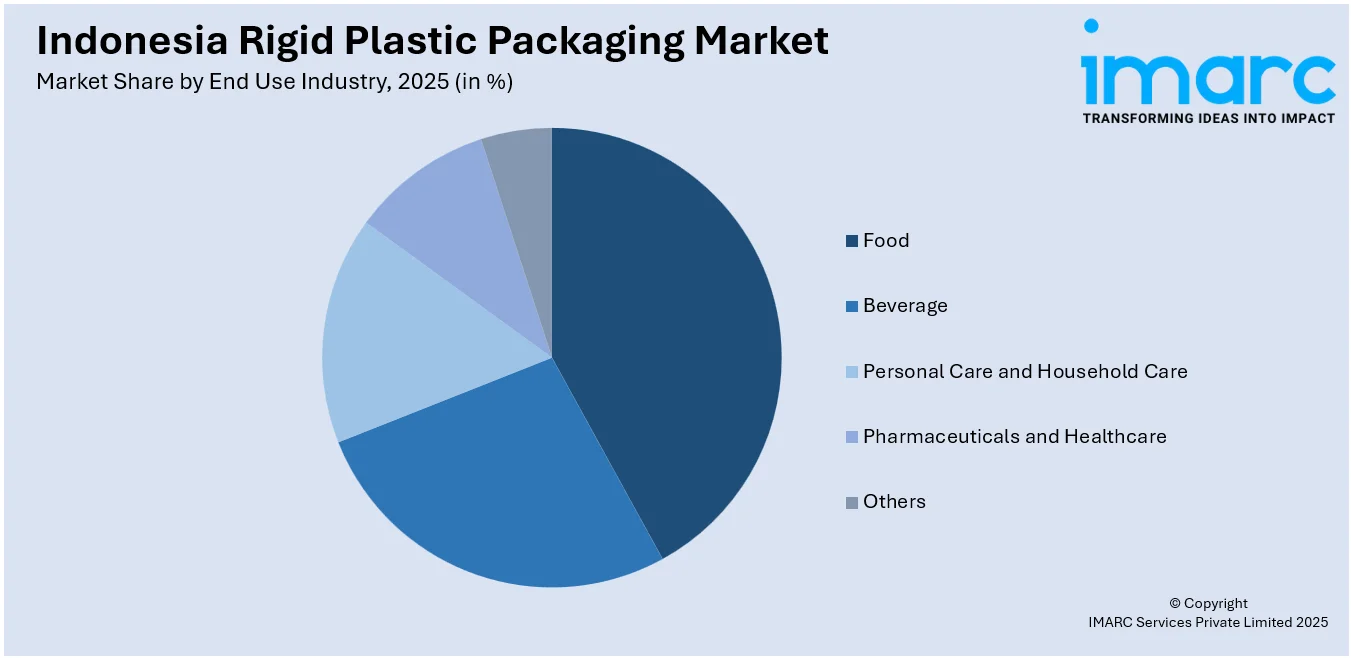

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Food

- Fresh Foods

- Baked Food

- Frozen Food

- Others

- Beverage

- Carbonated Soft Drinks (CSDs)

- Bottled Water

- Dairy Products

- Others

- Personal Care and Household Care

- Pharmaceuticals and Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes food (fresh foods, baked food, frozen food, and others), beverage (carbonated soft drinks (CSDs), bottled water, dairy products, and others), personal care and household care, pharmaceuticals and healthcare, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Rigid Plastic Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Material Types Covered | Polypropylene (PP), Polyethylene Terephthalate (PET), Polyethylene (PE), Polystyrene (PS) and Expanded Polystyrene (EPS), Others |

| Product Types Covered | Bottles and Jars, Trays and Containers, Caps and Closures, Others |

| End Use Industries Covered |

|

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia rigid plastic packaging market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia rigid plastic packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia rigid plastic packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The rigid plastic packaging market in Indonesia was valued at USD 3.4 Billion in 2025.

The Indonesia rigid plastic packaging market is projected to exhibit a CAGR of 4.38% during 2026-2034, reaching a value of USD 5.0 Billion by 2034.

The Indonesia rigid plastic packaging market is propelled by rapid urbanization and rising packaged food/beverage industries, driving demand for durable containers. E-commerce growth requires sturdy transit-friendly packaging. Expansion in the healthcare and personal care sectors, and sustainability concerns further boost recyclable, eco-friendly rigid plastic adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)