Indonesia Residential Real Estate Market Size, Share, Trends and Forecast by Type, and Region,2026-2034

Market Overview:

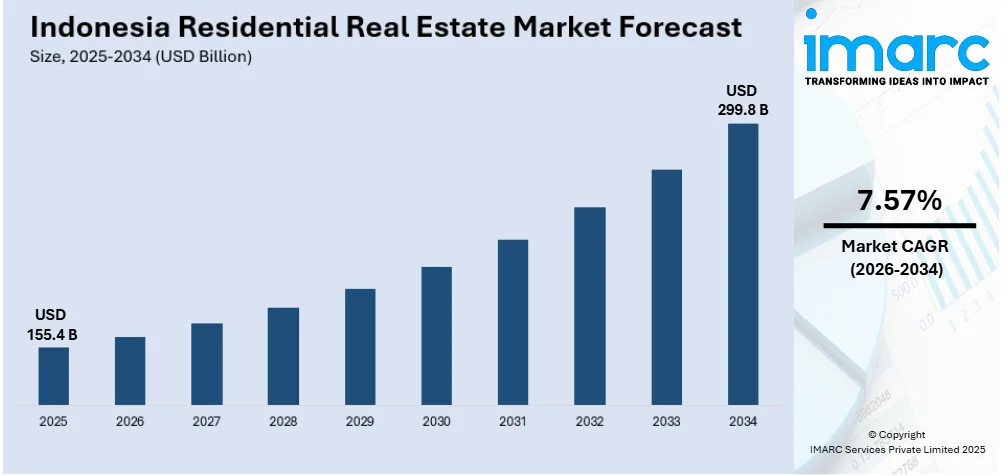

Indonesia residential real estate market size reached USD 155.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 299.8 Billion by 2034, exhibiting a growth rate (CAGR) of 7.57% during 2026-2034. The inflating disposable incomes of individuals, the rapid urbanization, the increasing government-led infrastructure projects, the favorable interest rates on housing loans, the growth of the tourism and hospitality sector, the emergence and growth of Real Estate Investment Trusts, and the digitalization of real estate services are some of the factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 155.4 Billion |

| Market Forecast in 2034 | USD 299.8 Billion |

| Market Growth Rate (2026-2034) | 7.57% |

Residential real estate refers to properties designed and utilized for human habitation, embodying spaces where individuals and families live. These properties encompass a broad spectrum, ranging from single-family homes and condominiums to apartments and townhouses. The residential real estate market is characterized by the buying, selling, and leasing of these dwellings, often influenced by factors such as location, amenities, and the overall quality of life. Residential properties serve as physical shelters and investments, with individuals purchasing homes for personal use or building equity and financial stability. Market trends, economic conditions, and the demand for housing influence residential real estate valuation. Residential real estate transactions involve complex legal and financial processes, including mortgages, property inspections, and negotiations. As a cornerstone of the real estate industry, residential properties play a pivotal role in shaping communities, contributing to urban development, and reflecting societal preferences for living spaces. The residential real estate market is dynamic, responding to demographic shifts, lifestyle changes, and economic fluctuations. It is a key sector that intertwines with the broader landscape of housing and lifestyle choices.

To get more information on this market Request Sample

Indonesia Residential Real Estate Market Trends:

The market in Indonesia is primarily driven by the robust economic growth. This is fostering an expanding middle class with increased purchasing power. As income levels rise, the demand for housing and property ownership grows, driving investments in residential real estate. Additionally, rapid urbanization is a key factor influencing the market. As more Indonesians migrate to urban centers for employment opportunities and improved living standards, there is a heightened demand for urban housing solutions, including apartments and condominiums. Demographic shifts also play a crucial role, with a youthful population contributing to the demand for first-time home purchases. As young adults enter the workforce and establish families, there is a natural inclination towards homeownership, further stimulating the residential real estate market. Government initiatives, such as affordable housing programs and policies promoting property ownership, further bolster market growth by making homeownership more accessible. Furthermore, the escalating infrastructure development activities are catalyzing market growth. Improved infrastructure often correlates with increased property values, attracting investors and homebuyers. The growing trend of real estate technology adoption, including online property platforms and digital transactions, facilitates smoother transactions and broadens market access. Besides, foreign direct investment (FDI) in real estate is an additional factor contributing to market expansion. Indonesia's attractiveness to foreign investors seeking real estate opportunities has increased capital inflow, spurring development and positively influencing property values. Moreover, environmental and sustainability considerations are gaining prominence, with eco-friendly and energy-efficient residential developments becoming more popular. Developers incorporating green building practices and sustainable features align with the growing awareness of environmental responsibility, attracting environmentally-conscious homebuyers. This, in turn, is creating a positive outlook for the market.

Indonesia Residential Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type.

Type Insights:

Access the comprehensive market breakdown Request Sample

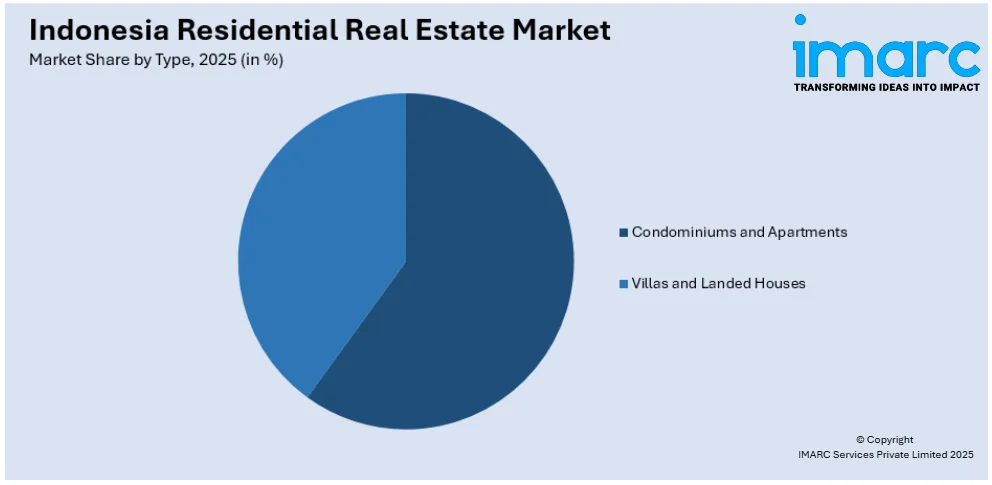

- Condominiums and Apartments

- Villas and Landed Houses

The report has provided a detailed breakup and analysis of the market based on the type. This includes condominiums and apartments and villas and landed houses.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Agung Podomoro Land

- Lippo Homes

- Sinar Mas Land

- Ciputra Group

- Duta Anggada Realty,tbk

- PP Properti

- Tokyu Land Indonesia

- JABABEKA

- PT Pakuwon Jati

- Binakarya Propertindo Group

Indonesia Residential Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Condominiums and Apartments, Villas and Landed Houses |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Companies Covered | Agung Podomoro Land, Lippo Homes, Sinar Mas Land, Ciputra Group, Duta Anggada Realty,tbk, PP Properti, Tokyu Land Indonesia, JABABEKA, PT Pakuwon Jati, Binakarya Propertindo Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia residential real estate market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia residential real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia residential real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The residential real estate market in Indonesia was valued at USD 155.4 Billion in 2025.

The Indonesia residential real estate market is projected to exhibit a CAGR of 7.57% during 2026-2034, reaching a value of USD 299.8 Billion by 2034.

The Indonesia residential real estate market is driven by population growth, rising urban migration, and increased demand for affordable housing. Supportive government policies, low-interest mortgage options, and expanding infrastructure also contribute to growth. Additionally, a growing middle class fuels demand for modern housing developments.

Some of the major players in the Indonesia real estate market include Agung Podomoro Land, Lippo Homes, Sinar Mas Land, Ciputra Group, Duta Anggada Realty,tbk, PP Properti, Tokyu Land Indonesia, JABABEKA, PT Pakuwon Jati, Binakarya Propertindo Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)