Indonesia Power Generation EPC Market Size, Share, Trends and Forecast by Source, and Region, 2025-2033

Market Overview:

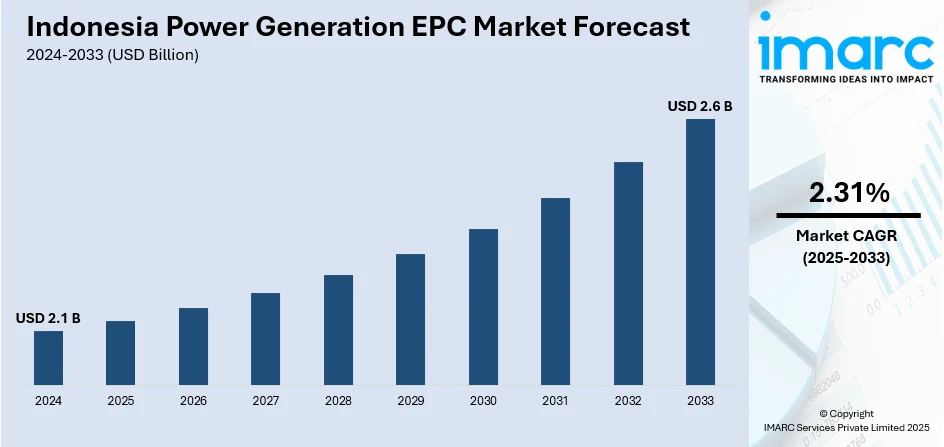

Indonesia power generation EPC market size reached USD 2.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.6 Billion by 2033, exhibiting a growth rate (CAGR) of 2.31% during 2025-2033. The expanding infrastructural development, emerging trends toward energy diversification, increasing foreign direct investments (FDI), government-backed projects, and the rising energy demand represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 2.6 Billion |

| Market Growth Rate (2025-2033) | 2.31% |

Power generation engineering, procurement, and construction (EPC) is a comprehensive approach to developing power generation projects. It encompasses the entire lifecycle of a power generation project, from its conceptualization to its final operational stage. EPC contractors are responsible for designing, procuring all necessary equipment and materials, and constructing the power generation facility, ensuring that it meets the required technical specifications and quality standards. This approach is widely utilized in various power generation sectors, including thermal, renewable, nuclear, and hydroelectric power plants. Power generation EPC projects consist of numerous phases, such as initial feasibility studies, detailed engineering and design, the selection of appropriate technologies and suppliers, procurement and logistics, construction, and commissioning. Power generation EPC minimizes risks, reduces development time, and ensures that the completed power generation facility operates efficiently and safely. Consequently, it plays an essential role in meeting the world's growing energy demands and transitioning to more sustainable and environmentally friendly power generation solutions.

To get more information on this market, Request Sample

Indonesia Power Generation EPC Market Trends:

The Indonesia power generation EPC market is experiencing robust growth due to the country's surging population and urbanization rates fueling the demand for electricity. Besides this, the government's strong commitment to achieving energy self-sufficiency and diversifying the energy mix has propelled investments in various energy sources, including coal, natural gas, renewable energy, and nuclear power, impelling the adoption of power generation EPC. Moreover, the growing emphasis on environmental sustainability and the reduction of greenhouse gas (GHG) emissions has spurred investments in renewable energy projects, thereby creating a favorable outlook for market expansion. In confluence with this, improving access to financing options and foreign investments, combined with a favorable regulatory environment, is making it easier to secure funding for large-scale power generation projects, boosting the EPC market's growth. Concurrently, the aging infrastructure of existing power plants necessitates rehabilitation, modernization, and repowering is aiding in market expansion. In confluence with this, Indonesia's geographic diversity and complex terrain are driving the need for specialized EPC off-grid and microgrid solutions for power projects in challenging locations, such as remote islands and mountainous areas, thereby contributing to the market growth. Additionally, the country's vulnerability to natural disasters like earthquakes and volcanic eruptions emphasizes the need for resilient, disaster-resistant power infrastructure, which is furthering the demand for EPC services. Furthermore, significant technological advancements and innovations in power generation and distribution, including smart grids and digitalization, are pushing the EPC sector towards more sophisticated and efficient solutions, bolstering market expansion. Apart from this, the burgeoning global interest in energy transition and sustainability projects, combined with Indonesia's position as an emerging market, is attracting international EPC firms looking to tap into the country's expanding power generation sector, which, in turn, is propelling the market toward growth.

Indonesia Power Generation EPC Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on source.

Source Insights:

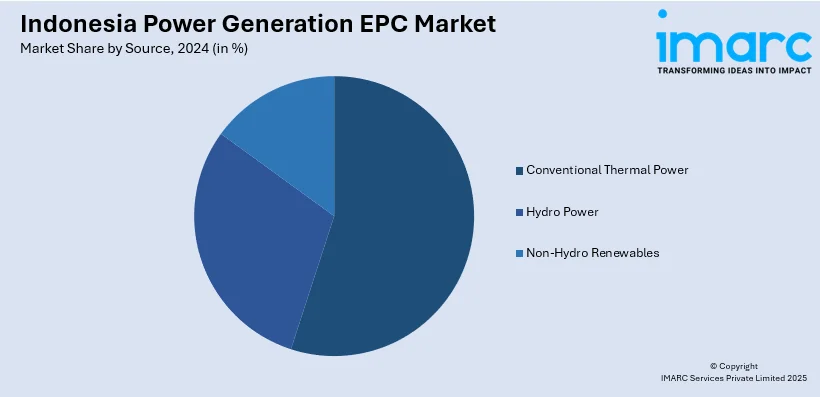

- Conventional Thermal Power

- Oil

- Coal

- Natural Gas

- Hydro Power

- Non-Hydro Renewables

- Geothermal

- Bioenergy

The report has provided a detailed breakup and analysis of the market based on the source. This includes conventional thermal power (oil, coal, and natural gas), hydro power, and non-hydro renewables (geothermal and bioenergy).

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Power Generation EPC Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Sources Covered |

|

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia power generation EPC market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia power generation EPC market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia power generation EPC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Indonesia power generation EPC market was valued at USD 2.1 Billion in 2024.

The Indonesia power generation EPC market is projected to grow at a CAGR of 2.31% during 2025-2033, reaching USD 2.6 Billion by 2033.

Rising energy demand from widespread urbanization, rapid expansion in renewable energy investments, regulatory support, growing foreign direct investment, and infrastructure modernization are some of the major growth drivers for the EPC market in Indonesia.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)