Indonesia Plastics Market Size, Share, Trends and Forecast by Type, Technology, Application, and Region, 2025-2033

Indonesia Plastics Market Overview:

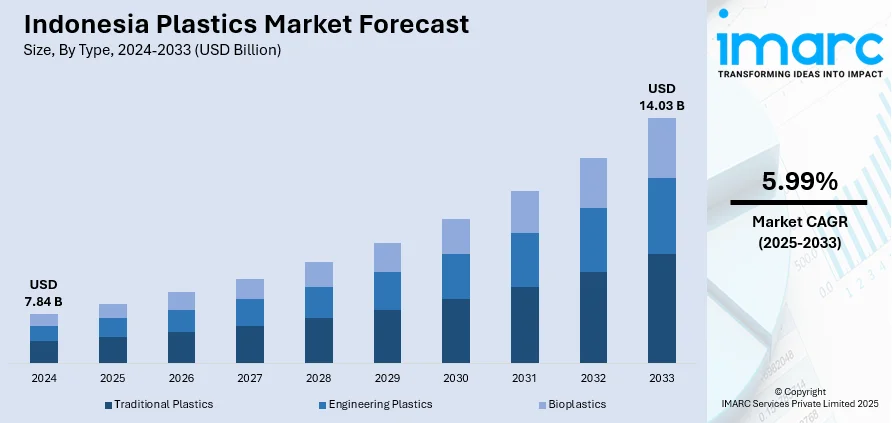

The Indonesia plastics market size was valued at USD 7.84 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.03 Billion by 2033, exhibiting a CAGR of 5.99% during 2025-2033. Java currently dominates the market in 2024. The market is driven by rising demand from diverse end-use industries, particularly packaging, automotive, and consumer goods, owing to plastics’ lightweight, durable, and cost-effective properties. Additionally, the ongoing pace of urbanization and infrastructure development is spurring plastic consumption in construction and housing applications, further augmenting the Indonesia plastics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.84 Billion |

| Market Forecast in 2033 | USD 14.03 Billion |

| Market Growth Rate (2025-2033) | 5.99% |

The Indonesia plastics market is primarily driven by the rising demand from the food and beverage sector for lightweight and durable packaging materials. In line with this, the rapid growth of the e-commerce industry requiring flexible and secure packaging solutions is also providing an impetus to the market. Moreover, the increasing use of plastic components in the construction and automotive sectors is also acting as a significant growth-inducing factor for the market. In addition to this, the expansion of domestic manufacturing capabilities and investment in recycling technologies is resulting in a broader product reach and contributing to the Indonesia plastics market growth. On May 30, 2025, the Indonesian Ministry of Environment launched a nationwide “Stop Plastic Pollution” campaign and reaffirmed its commitment to restricting imports of virgin plastic and enforcing its Extended Producer Responsibility (EPR) roadmap. Indonesia, the world’s second-largest plastic polluter, generates 3.2 Million Tonnes of unmanaged plastic waste annually, with 1.29 Million Tonnes leaking into the ocean. Despite a plastic recycling rate of just 7%, the government aims to cut ocean plastic leakage by 70% by 2025, further shaping the trajectory of the Indonesia plastics market.

To get more information on this market, Request Sample

Besides this, the growing consumer preference for convenience-based packaged goods is creating lucrative opportunities in the market. Also, the introduction of innovative bioplastics for industrial use is impacting the market positively. On July 10, 2025, Indonesia’s Ministry of Industry announced its initiative to promote biodegradable plastics using biotransformation technology as a solution to the country’s mounting plastic waste crisis. Industry Minister Agus Gumiwang Kartasasmita emphasized the development of a national standard, creation of a road map, and potential incentives to support eco-friendly production without jeopardizing food security. The market is further driven by supportive trade policies and regulatory frameworks enhancing production efficiencies. Apart from this, the easy availability of plastic products through organized retail formats is propelling the market. Some of the other factors contributing to the market include infrastructural advancements, evolving consumer lifestyles, and ongoing product innovations tailored to Indonesia’s domestic needs.

Indonesia Plastics Market Trends:

Economic Growth Accelerating Multi-Sector Plastic Demand

Indonesia’s steady economic expansion continues to fuel the rising need for plastic materials across a broad spectrum of industries. According to BPS-Statistics Indonesia, the country’s economy recorded a year-on-year growth rate of 4.87% in the first quarter of 2025 compared to the same period in 2024. This economic upturn has led to increasing investments and consumption in packaging, construction, automotive, and consumer goods sectors, all of which rely heavily on plastics. As companies scale up operations to meet growing domestic demand, plastics are increasingly favored for their cost-efficiency, moldability, and adaptability to complex manufacturing processes. The construction sector, in particular, depends on plastic pipes, insulation, and coatings for infrastructure and housing projects. In consumer goods, plastics enable the mass production of lightweight, durable products suited to Indonesia’s price-sensitive market, which is creating favorable Indonesia plastics market outlook. Meanwhile, the automotive and electronics sectors use plastics extensively for vehicle components, casings, and wiring, helping manufacturers meet global quality and design standards. Overall, Indonesia’s macroeconomic stability is generating sustained momentum in domestic consumption, industrial growth, as well as capital expenditure, all of which contribute to the country’s rising plastic consumption and support its evolving role in regional plastic manufacturing supply chains.

Rapid Urbanization Stimulating Structural and Lifestyle Applications

The rapid urban expansion in Indonesia is one of the major Indonesia plastics market trends, reshaping infrastructure needs and consumption behavior and creating significant growth opportunities for plastic materials across residential and commercial applications. According to an industry report, 56% of Indonesia's population lived in urban areas in 2022, approximately three times the share recorded in 1960. This figure is expected to exceed 70% by 2040. Such a large-scale demographic shift has increased demand for housing, transportation, utilities, and packaged goods, all of which require plastic-based solutions. For instance, construction activities now incorporate plastic products like PVC pipes, sealants, roofing membranes, and insulation materials due to their durability and ease of installation. Simultaneously, rising urban incomes and consumption levels are driving demand for plastic-packaged food, personal care items, and household products. Plastics also support waste management systems, water distribution networks, and urban furniture, making them essential in building modern cities. Additionally, the government’s infrastructure push has heightened the need for lightweight and cost-effective construction materials that plastics readily provide. As the country’s cities continue to grow and modernize, plastics are expected to remain at the forefront of both structural utility and consumer lifestyle upgrades, offering scalable and efficient material solutions to meet Indonesia’s evolving urban challenges.

E-Commerce Expansion Fueling Demand for Innovative Plastic Packaging

The rapid growth of Indonesia’s e-commerce sector is revolutionizing its packaging industry and driving a robust increase in demand for advanced plastic solutions. An industry analysis reported that in 2024, e-commerce made up 26.5% of total retail sales in Indonesia, highlighting a significant shift toward online shopping. This transition has intensified the need for durable, lightweight, and visually appealing packaging materials that can ensure product safety during storage and delivery. According to Indonesia plastics market forecast, plastics, particularly flexible varieties, are emerging as the material of choice, offering manufacturers design flexibility, reduced weight for shipping cost savings, and effective barriers against moisture and contaminants. Online sellers and logistics providers rely on plastic packaging to preserve brand value while minimizing damage during transport. Furthermore, the rising popularity of subscription models and direct-to-consumer delivery formats has boosted demand for custom and single-use packaging formats, further embedding plastics in the digital commerce value chain. As consumer expectations evolve toward convenience and sustainability, manufacturers are also developing recyclable and bio-based plastic alternatives to align with environmental standards. This packaging evolution, driven by e-commerce and digital retail adoption, is anticipated to play a pivotal role in shaping Indonesia’s plastics sector in the coming years.

Indonesia Plastics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Indonesia plastics market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on type, technology, and application.

Analysis by Type:

- Traditional Plastics

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Polystyrene

- Engineering Plastics

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polycarbonates (PC)

- Styrene Polymers (ABS and SAN)

- Fluoropolymers

- Polyoxymethylene (POM)

- Polymethyl Methacrylate (PMMA)

- Polyamide (PA)

- Others

- Bioplastics

Traditional plastics stand as the largest component in 2024, holding around 73.7% of the market. Traditional plastics dominate the market due to their cost-effectiveness, broad availability, and well-established manufacturing infrastructure. Materials like polyethylene, polypropylene, and PVC are widely used across essential sectors such as packaging, construction, and consumer goods. These resins are easy to process, compatible with various molding technologies, and offer favorable mechanical and chemical properties. In a price-sensitive market like Indonesia, traditional plastics remain the preferred choice for mass production. Import reliance on engineering plastics and the slower adoption of bioplastics have further solidified the dominance of conventional resins. Additionally, government policies have yet to strongly enforce transitions to sustainable alternatives, allowing traditional plastics to maintain a large footprint in both industrial and everyday applications.

Analysis by Technology:

- Injection Molding

- Extrusion Molding

- Blow Molding

- Others

Injection molding leads the market in 2024, due to its versatility, speed, and suitability for mass production of complex parts. It supports a broad range of plastic types, especially traditional plastics like PP and PE, making it ideal for high-volume manufacturing. Industries such as packaging, electronics, and automotive rely heavily on this method because it offers precision and repeatability at scale. The relatively lower cost of labor in Indonesia further enhances the economics of injection molding operations. Many local manufacturers have invested in injection molding due to its efficiency and compatibility with both imported and domestic machinery. The growing demand for consumer goods, appliances, and automotive components continues to drive expansion in this segment across the country.

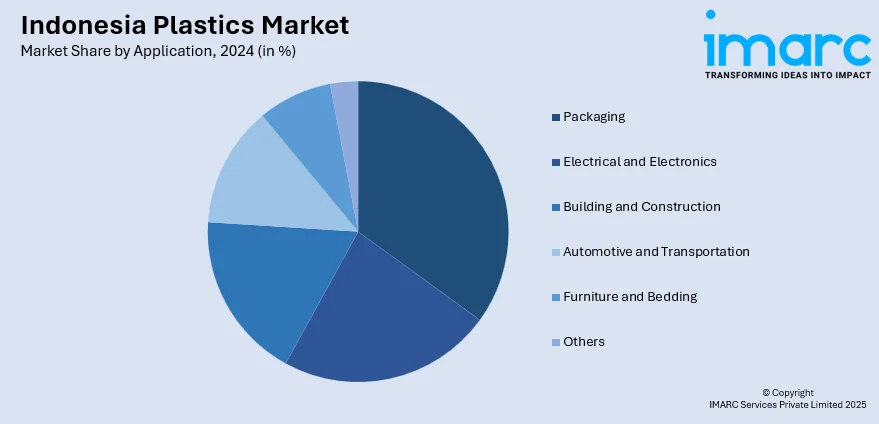

Analysis by Application:

- Packaging

- Electrical and Electronics

- Building and Construction

- Automotive and Transportation

- Furniture and Bedding

- Others

Packaging leads the market in 2024, driven by rapid urbanization, booming e-commerce, and the expanding FMCG sector. Plastic’s lightweight, durability, and flexibility make it the material of choice for food packaging, household products, and transport materials. Retail chains, online shopping platforms, and delivery services have increased demand for plastic films, containers, and bottles. Traditional plastics such as polyethylene and polypropylene are widely used for flexible and rigid packaging due to their barrier properties and low cost. Additionally, packaging requires high throughput manufacturing, which aligns well with injection and blow molding technologies. Limited enforcement of single-use plastic regulations and a large informal recycling sector have also contributed to the continued dominance of plastic packaging.

Regional Analysis:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

In 2024, Java accounted for the largest market share due to its role as the country’s economic and industrial hub. Home to the capital Jakarta and major manufacturing centers like Surabaya and Bandung, Java houses the bulk of Indonesia’s plastic converters, distributors, and end-user industries. Its dense population fuels demand across key segments including packaging, construction, and electronics. Infrastructure and logistics in Java are more advanced compared to other islands, enabling better supply chain efficiency and access to raw materials. Ports and distribution networks are also heavily concentrated in this region, supporting both imports and exports. Government incentives, skilled labor availability, and proximity to major consumer markets further reinforce Java’s dominance in the national plastics landscape.

Competitive Landscape:

Key players in the Indonesian plastics market are focusing on capacity expansion, localization of production, and product diversification to meet rising domestic demand and reduce import reliance. Companies are investing in modern manufacturing technologies like advanced injection and extrusion molding to improve efficiency and meet quality standards across sectors such as packaging, automotive, and electronics. There’s also a push toward sustainability, with select firms exploring bioplastics and recycled materials in response to environmental pressures and shifting consumer preferences. Strategic partnerships with global suppliers and downstream industries are helping local producers enhance their value chain integration. Additionally, players are optimizing logistics and distribution, particularly in Java, to streamline operations and reach wider markets across Indonesia’s archipelago, where infrastructure remains a limiting factor in some regions.

The report provides a comprehensive analysis of the competitive landscape in the Indonesia plastics market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Dow signed a second MOU with Indonesia’s Pan Era Group to boost the supply of high-quality post-consumer recycled (PCR) polyethylene resins. This partnership supports Indonesia’s circular economy goals by advancing recycling technologies, expanding PCR applications, and leveraging both companies’ expertise in sustainable plastic solutions and local waste management.

- April 2025: CSEAS Indonesia launched Phase II of the "Breaking the Plastic Habit in Asia" project, using nudging theory to reduce single-use plastics. The initiative, piloted at Darunnajah Islamic Boarding School, promotes behavior-based strategies and innovation in plastic waste management across several ASEAN countries, including Indonesia.

- February 2025: GGGI and Bappenas launched a USD 60 Million initiative to build a sustainable plastics value chain in Indonesia. Supported by Korea’s Green New Deal Fund, the project aligns with Indonesia’s Circular Economy Roadmap and aims to enhance recycling infrastructure, investment, and regulation for long-term environmental and economic sustainability.

- December 2024: ADB and LEAP launched a USD 44.2 Million blue loan with PT ALBA Tridi to build a PET recycling facility in Central Java, Indonesia. The project supports circular economy goals, reduces marine plastic pollution, and advances Indonesia’s targets for 70% waste reduction by 2025 and net-zero emissions by 2060.

- November 2024: YIZUMI showcased its UN550D1S and UN160SKIII injection molding machines at Plastics & Rubber Indonesia 2024, highlighting energy efficiency and precision. Collaborating with CHESO, YIZUMI expanded its Indonesian market presence with new service offices, supporting sustainable plastic solutions amid growing industry demand and environmental policies.

Indonesia Plastics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Technologies Covered | Injection Molding, Extrusion Molding, Blow Molding, Others |

| Applications Covered | Packaging, Electrical and Electronics, Building and Construction, Automotive and Transportation, Furniture and Bedding, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia plastics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Indonesia plastics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia plastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The plastics market in Indonesia was valued at USD 7.84 Billion in 2024.

The Indonesia plastics market is projected to exhibit a (CAGR) of 5.99% during 2025-2033, reaching a value of USD 14.03 Billion by 2033.

The Indonesia plastics industry is growing as demand in the packaging, construction, automotive, and consumer goods industries increases. Urbanization, middle-class consumption growth, and government-supported petrochemical infrastructure development drive market expansion. Moreover, ecofriendly initiatives encourage the development of recyclable and biodegradable plastics, creating wider opportunities across sectors while reducing sustainability issues and regulatory burdens.

Java holds the largest share of the plastics market in Indonesia, supported by its concentration of manufacturing facilities, distribution networks, population density, and established industrial infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)