Indonesia Pet Food Market Size, Share, Trends and Forecast by Product Type, Animal Type, Distribution Channel, and Region, 2025-2033

Indonesia Pet Food Market Size and Share:

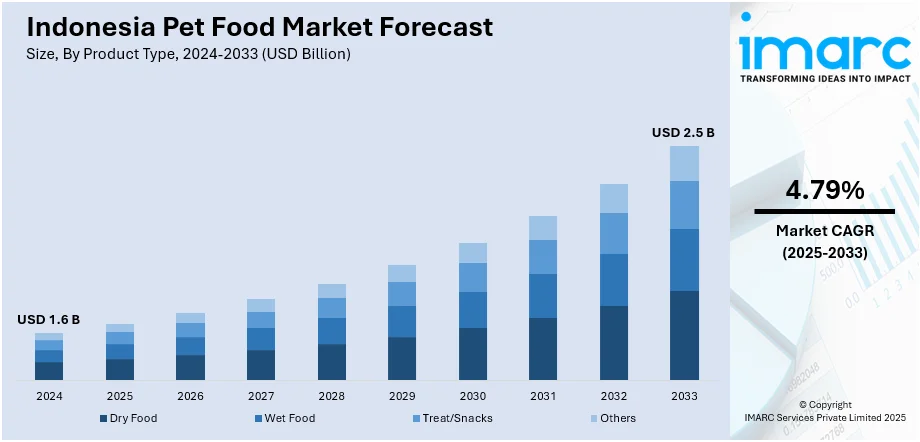

The Indonesia pet food market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.79% during 2025-2033. The market share is growing due to the increasing pet ownership, rising disposable incomes, humanization of pets, demand for premium, organic, and functional food, increasing e-commerce, government regulations on pet nutrition, and rising health awareness about pets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.6 Billion |

| Market Forecast in 2033 | USD 2.5 Billion |

| Market Growth Rate (2025-2033) | 4.79% |

The Indonesia pet food market growth is increasing due to the growing pet ownership trend within the country. The increasing middle-class population together with growing disposable incomes has enabled a larger number of people to be able to afford premium pet care products., The middle class and those approaching middle class status comprise 66.35% of Indonesia's population in 2024, according to BPS-Statistics Indonesia, providing evidence for an expanding consumer base with higher spending power. This economic change has also fueled the trend of the humanization of pets. Owners consider pets as part of the family and thus highly influence the purchase decision. The demand for premium quality, healthy, and specific pet food has been on the rise. Increasing knowledge about the health and nutrition of pets has increased the preference for functional and organic pet food containing vitamins, minerals, and probiotics. The competition by local brands to innovate new formulations such as grain-free, protein-rich, and breed-specific diets further boosted the market's growth.

To get more information on this market, Request Sample

The growth of social media and pet influencers also helped increase pet owners' knowledge and encouraged them to invest in better pet nutrition. The fast expansion of e-commerce and online retail platforms made pet food easily accessible across Indonesia. With the increasing penetration of digital payments and mobile commerce, consumers can shop for pet food online, avail discounts, subscriptions, and even doorstep delivery. The modern retail sector, covering supermarkets and specialty pet shops, is expanding as well to improve product access. Government initiatives to promote high-quality and safety standards for pet food have created an impetus for manufacturers to upgrade their product offerings, fostering consumer confidence. Furthermore, exotic and companion animals other than dogs and cats, which are also increasingly adopted by people, further boosting the Indonesia pet food demand. Rising pet ownership, alongside urbanization, will fuel long-term Indonesia's pet food market growth due to economic expansion and changing consumer lifestyles and preferences.

Indonesia Pet Food Market Trends:

Premium and functional pet food

The most prominent Indonesia pet food market trend is the increasing demand for premium and functional pet food. As pets are being humanized, owners are willing to spend more on high-quality nutrition that enhances their pets' health and well-being. Functional pet food is growing in demand as consumers focus on digestive health, joint care, and skin and coat maintenance for their pets. Grain-free and high-protein diets and breed-specific diets are gaining popularity among health-conscious pet owners. The tendency toward organic, natural ingredients without artificial preservatives and fillers fuels further expansion of the market. This trend is likely to continue with a gain to boost disposable incomes and improve recognition of the importance of proper pet nutrition. With regards to pet ownership and humanization in Indonesia, Pet Fair Southeast Asia predicted that these have now stabilized with a 6% increase in value and volume sales in 2024. Local brands are innovating intensively to meet changes in preferences, launching specialized formulations consistent with worldwide quality standards. Consumer expenditure on pet care is rising further, and it is seen to be the largest factor propelling market growth in Indonesia by seeking premium health-based pet food.

Diversification in pet ownership and specialty pet food

A diversification of pet ownership can be observed in Indonesia, where household ownership of exotics like rabbits, birds, reptiles, and fish alongside conventional pets such as dogs and cats has been rising further. This trend has developed a new appetite for niche foods specifically formulated for these unique creatures. The increase in the number of hobbyists engaging in the activity of ornamental fish and planted aquariums, commonly referred to as aqua scaping, has particularly influenced the market demand for premium-quality fish food. Reptile and bird lovers also demand diets that are appropriate for the respective species, causing niche segments for pet foods to grow. The pet stores and manufacturers are reacting with specific products. There is a demand for insect-based protein sources for reptiles and fortified birdseed mixes. More focus is on age-specific and medically formulated pet foods, which now also include foods for seniors and allergy-sensitive pets. Throughout the diversification of pet ownership, innovation will be stimulated in the realm of pet food and create various branding opportunities that will create a positive Indonesia pet food market outlook.

Online retailing and e-commerce development

E-commerce has greatly altered the pet food market in Indonesia due to the speedy rise of e-commerce. Indonesia pet food market prices are at competitive level through online platforms such as Shopee, Tokopedia, and Lazada making pet food accessible, with an extensive range of brands, flavors, and formulations. The convenience of home delivery, discounts, and subscription-based models has made more consumers purchase pet food online. The fact is that social media and influencer marketing also drive sales of pet food online as pet owners go by recommendations from popular pet bloggers and veterinarians. This shift toward digital shopping is further supported by Indonesia's booming digital economy. The International Trade Administration reports that Indonesia's digital economy is among the quickest growing in Southeast Asia, with a projected value of over $130 Billion by 2025. The penetration of smartphones and the widespread adoption of digital payment systems have made online transactions smoother. Local and international pet food brands are strengthening their digital presence, optimizing direct-to-consumer sales strategies, and partnering with e-commerce platforms to enhance visibility. With improving internet connectivity and changing consumer preferences, e-commerce is expected to continue to be a major driver of pet food sales in Indonesia in the coming years.

Indonesia Pet Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Indonesia pet food market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, animal type, and distribution channel.

Analysis by Product Type:

- Dry Food

- Wet Food

- Treat/Snacks

- Others

The dry section remains the popular one due to its cost-efficiency, ease of stock, and higher shelf life. It is loved by many who own pets, mainly due to it's good for a pet's dentition and storage purposes as well. At the same time, wet products are growing steadily, mainly toward those consumers wanting high-moisture value and enhanced pet palatability. Wet sections are particularly useful for digestion-sensitive animals, and for pets having a diet demanding high protein rates. Such a diversification of consumers makes for differing tastes and demand for specialized food for pets. Treats and snacks are among the fastest growing, as people are buying more for training purposes, rewards, and dental care. Functional treats, which come with vitamins and minerals, become more popular with added benefits. The premiumization trend and rising demand for natural, grain-free, and organic pet food options further fuel the expansion of these product categories, shaping Indonesia’s dynamic pet food market.

Analysis by Animal Type:

- Dogs

- Cats

- Birds

- Others

The dog segment is particularly flourishing due to the increasing adoption of pet dogs across both urban and rural households. This has resulted in an increasing demand for breed-specific, functional, and high-protein dog food, with a strong preference for dry kibble and premium formulations. Similarly, the cat segment is growing as more people adopt cats, which has fueled the demand for both dry and wet cat food. Wet cat food is especially favored for its high moisture content, which is crucial for hydration and urinary health. Birds, though a niche segment, are also seeing increased demand, particularly among hobbyists. Pet owners are demanding species-specific bird food, enriched seed mixes, and fortified diets to ensure quality nutrition for their feathered friends. With pet ownership increasing, coupled with an awareness about balanced diets, the demand is continuously growing across all pet categories in Indonesia.

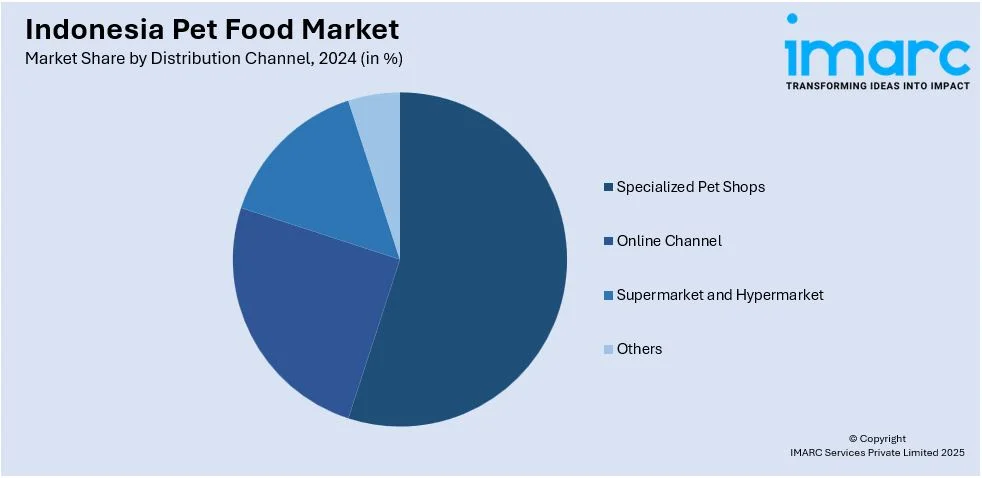

Analysis by Distribution Channel:

- Specialized Pet Shops

- Online Channel

- Supermarket and Hypermarket

- Others

Specialized pet shops are a very important segment as they offer the widest variety of options, expert advice, and personalized consultations to pet owners. These stores normally sell high-value, prescription-only pet foods designed for specific diets. However, the online channel is growing very rapidly, and it is headed by Shopee and Tokopedia. This growth is largely driven by the penetration of e-commerce by consumer preference for convenience, competitive pricing, and subscription-based models that ensure regular delivery of pet food. Supermarkets and hypermarkets are also instrumental in bringing pet food closer to the wider market through extensive sales offerings of well-known commercial brands and discounting and promotional sales. Retail in Indonesia reported June 2024 sales as up 2.7% year on year, according to Samuel Sekuritas Indonesia, after rising 2.1% year on year in May. This growth in retail sales further solidifies the expansion of physical and online retail outlets in the pet food market. The steady shift to online shopping and the development of new modern retail formats will continue to define the landscape of distribution for the pet food space, which is emerging in Indonesia at an extreme pace.

Regional Analysis:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

Java is still the most popular area for Indonesia's pet food market, given the high population density and increasing number of pet owners, and better retail infrastructure. Major urban areas such as Jakarta and Surabaya are prime drivers of demand for functional and premium pet food. According to the BTI Transformation Index, Indonesia's urban population has reached 57.9% of the country's total population. This fact creates a potential for gathering pets and pet-related consumption there. Sumatra represents an interesting growth opportunity, growing disposable incomes combined with increasing awareness about pet nutrition fuel the growth of the pet care industry in the region. Kalimantan, which includes areas like Surabaya, also has significant urban growth potential, especially with modern trends in pet care. The expansion of e-commerce platforms also helps to make access to pet food in remote areas much easier. This will enable many pet owners in these areas to obtain a wider variety of products. Sulawesi is the next developing market, driven by the growth of pet ownership and the urbanization process of mid-range consumers who require economical and mid-range options for pet food. The expansion of the retail sector within the region supports the upward direction in pet food sales.

Competitive Landscape:

Market players are aggressively expanding in the Indonesia pet food industry with product innovation, strategic partnerships, and digital transformation. The high-end, functional, and organic pet food brands are being offered by leading domestic and international companies to match emerging consumer preferences. Companies are trying to capture more market share for high-protein, grain-free, and breed-specific formulations of pet food in response to an increasing demand for specialized pet nutrition. E-commerce is an emerging trend, and most of the giants are partnering with online platforms like Shopee and Tokopedia to expand accessibility and create subscription-based models. The International Trade Administration says that the Indonesia e-commerce market size will reach USD 86.81 Billion by 2028 at a CAGR of 10.4%. This further supports the importance of digital channels for the pet food industry. Pet food manufacturers are investing in environmentally friendly, sustainable packaging as concerns over the environment continue to rise. Local brands are seeing an increased level of merger and acquisition and combining efforts to strengthen market competition. Pet care chains and specialty pet stores are springing up more often and catalyzing further expansion into the market. Rising pet humanization and awareness will likely lead market players to continue innovating and diversifying their product portfolios to capture the growing demand in Indonesia.

The report provides a comprehensive analysis of the competitive landscape in the Indonesia pet food market with detailed profiles of all major companies.

Latest News and Developments:

- October 2024: By establishing its fifth production plant in Purwodadi, Central Java, De Heus has increased its footprint in Indonesia even more. With a monthly production capacity of 15,000 tons, the new facility strengthens De Heus' dedication to producing high-quality animal feed while promoting sustainable livestock farming, enhancing local economies, and empowering independent farmers.

- December 2023: Indonesian pet nutrition company Compawnion raised funding from East Ventures to expand its distribution, R&D, and product portfolio. The company, which has been successful with its Pawmeals brand, launched UGO, a preservative-free dog food.

- May 2023: OzPro launched its first range of therapeutic pet food in Indonesia, consisting of its raw meat freeze-dried diets under the Booster and Holistic brands for dogs and cats. Made with human-grade ingredients, the products emphasize holistic health and preventive nutrition, looking to improve the general health status of pets with proper nutrition.

- October 2023: Unicharm Indonesia released "Deli-Joy" cat treats containing 100% real fish, free from preservatives, colorants, and pork. Using Japanese technology, the products cater to the growing demand for pet food. The company aimed to promote pet health and sustainability as it expanded its presence in the pet market in Indonesia.

Indonesia Pet Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dry Food, Wet Food, Treat/Snacks, Others |

| Animal Types Covered | Dogs, Cats, Birds, Others |

| Distribution Channels Covered | Specialized Pet Shops, Online Channel, Supermarket and Hypermarket, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia pet food market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Indonesia pet food market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia pet food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Indonesia pet food market is driven by the increasing pet ownership, rising disposable incomes, humanization of pets, demand for premium, organic, and functional food, increasing e-commerce, government regulations on pet nutrition, and rising health awareness about pets.

The Indonesia pet food market is estimated to exhibit a CAGR of 4.79% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)