Indonesia Payments Infrastructure Market Size, Share, Trends and Forecast by Traditional Payment Infrastructure, and Region, 2026-2034

Indonesia Payments Infrastructure Market Overview:

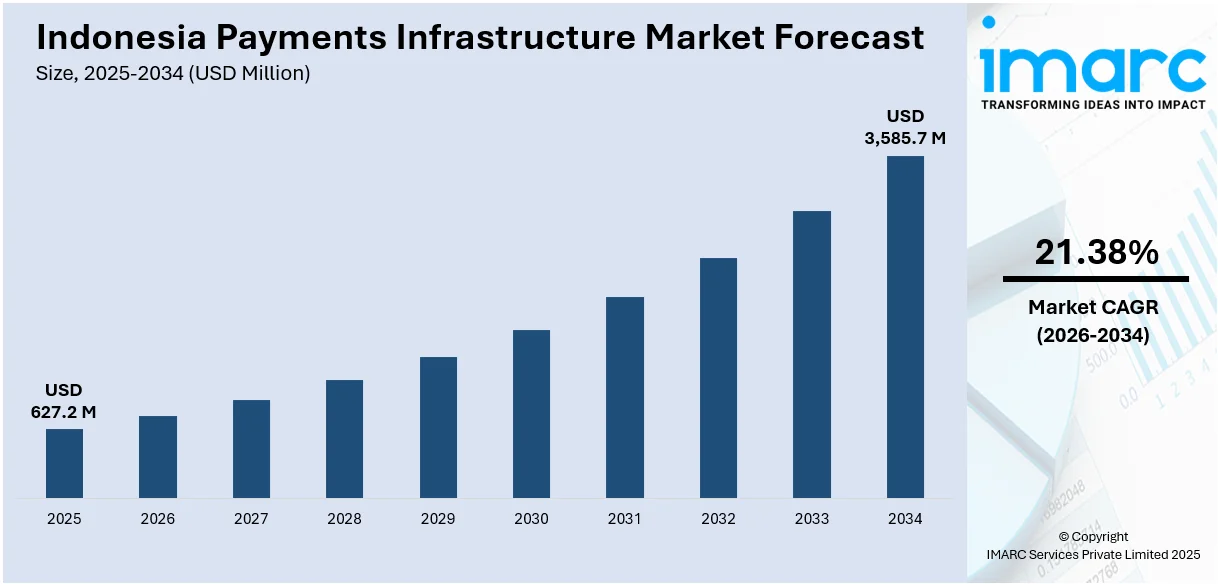

The Indonesia payments infrastructure market size reached USD 627.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,585.7 Million by 2034, exhibiting a growth rate (CAGR) of 21.38% during 2026-2034. The Indonesia payment infrastructure market share is expanding due to increasing digital banking adoption, expansion of real-time payment systems, rising e-wallet usage, regulatory support for fintech, embedded finance integration, e-commerce growth, improved financial inclusion, and advancements in payment security and interoperability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 627.2 Million |

| Market Forecast in 2034 | USD 3,585.7 Million |

| Market Growth Rate 2026-2034 | 21.38% |

Indonesia Payments Infrastructure Market Trends:

Acceleration of Real-Time Payment Adoption

Indonesia’s payment infrastructure market growth is witnessing rapid adoption of real-time payment systems, driven by Bank Indonesia’s BI-FAST initiative. According to President Joko Widodo's announcement on August 13, 2024, Indonesia's digital economy is expected to treble by 2030, reaching between USD 210 Billion to USD 360 Billion. Digital payments are predicted to reach USD 760 Billion, a 2.5-fold increase. To achieve complete integration of the digital economy and finance, Bank Indonesia unveiled the 2030 Indonesia Payment System Blueprint. This system enables instant interbank transfers at lower fees, enhancing financial inclusion and reducing reliance on cash transactions. The rise of mobile payment platforms, such as GoPay, OVO, and Dana, is further accelerating this shift, allowing seamless peer-to-peer transactions and merchant payments. Businesses are integrating real-time payments to streamline supply chains, improve cash flow, and reduce settlement times. The growing digital economy and e-commerce expansion are also contributing to the need for faster, more efficient payment processing. As financial institutions continue to enhance interoperability and security measures, real-time payment adoption is expected to reshape Indonesia’s payment ecosystem significantly.

To get more information on this market Request Sample

Expansion of Digital Banking and Embedded Finance

Indonesia is experiencing a surge in digital banking and embedded finance, driven by increased internet penetration, smartphone usage, and regulatory support for fintech innovation. For instance, Ant International launched an Embedded Finance division on December 6, 2024, expanding its ecosystem with AI-powered solutions for inclusive lending, treasury management, and foreign exchange. More than 11 million underprivileged individuals and SMEs in Southeast and South Asia, including Indonesia, are to be assisted by this program. Furthermore, Ant International's Alipay+ service now connects 1.6 billion user accounts in 66 markets by working with 35 mobile payment partners. Digital banks like Bank Jago, SeaBank, and Line Bank are gaining traction by offering seamless, app-based financial services with competitive interest rates and low fees. Embedded finance, integrating financial services within non-financial platforms such as e-commerce, ride-hailing, and social media, is reshaping consumer behavior by providing frictionless transactions. Companies like Grab and Shopee are embedding payment solutions within their ecosystems, enhancing convenience for users, which in turn is creating positive impact on the Indonesia payment infrastructure market outlook. This trend is also fostering financial inclusion by extending banking services to underserved populations. As technology advances, digital banking and embedded finance will play a pivotal role in modernizing Indonesia’s payment infrastructure.

Indonesia Payments Infrastructure Market Segmentation:

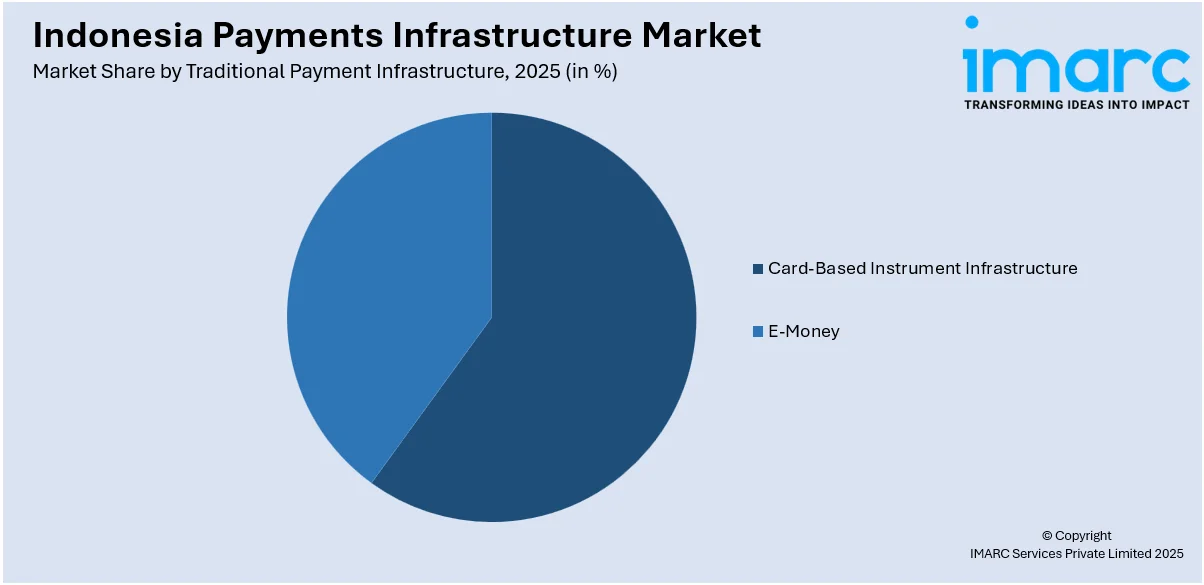

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on traditional payment infrastructure.

Traditional Payment Infrastructure Insights:

Access the comprehensive market breakdown Request Sample

- Card-Based Instrument Infrastructure

- E-Money

The report has provided a detailed breakup and analysis of the market based on the traditional payment infrastructure. This includes card-based instrument infrastructure and e-money.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Payments Infrastructure Market News:

- On September 17, 204, Indosat Ooredoo Hutchison (Indosat, IDX: ISAT) and Accenture collaborated, to create a sovereign AI cloud platform that will boost digital transformation in Indonesia, especially in the financial services sector. Indosat provides data centers, fiber to the home (FTTH), cellular services, ICT solutions, and electronic payment services with the goal of being Indonesia's go-to digital telecommunications provider. This program guarantees sovereign data governance and AI-driven commercial solutions, which are in line with Indonesia's 2045 digital vision.

- As of July 2, 2024, the Bank for International Settlements (BIS) and its partner central banks have finished the third phase of "Project Nexus," which aims to create a comprehensive plan for connecting domestic instant payment systems (IPS) around the world. With the Reserve Bank of India included in phase four, the potential user base will reach 1.7 billion. With the Bank of Indonesia serving as a special observer, BIS will support central banks and IPS operators in India, Malaysia, the Philippines, Singapore, and Thailand as they strive for live implementation in the upcoming phase.

Indonesia Payments Infrastructure Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Traditional Payments Infrastructures Covered |

Card-Based Instrument Infrastructure, E-Money |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi and Others. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia payments infrastructure market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia payments infrastructure market on the basis of traditional payments infrastructure?

- What are the various stages in the value chain of the Indonesia payments infrastructure market?

- What are the key driving factors and challenges in the Indonesia payments infrastructure market?

- What is the structure of the Indonesia payments infrastructure market and who are the key players?

- What is the degree of competition in the Indonesia payments infrastructure market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia payments infrastructure market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia payments infrastructure market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia payments infrastructure industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)