Indonesia Palm Oil Market Size, Share, Trends and Forecast by Packaging Type, Packaging Material, Pack Size, Application, Distribution Channel, and Region, 2025-2033

Indonesia Palm Oil Market Size and Share:

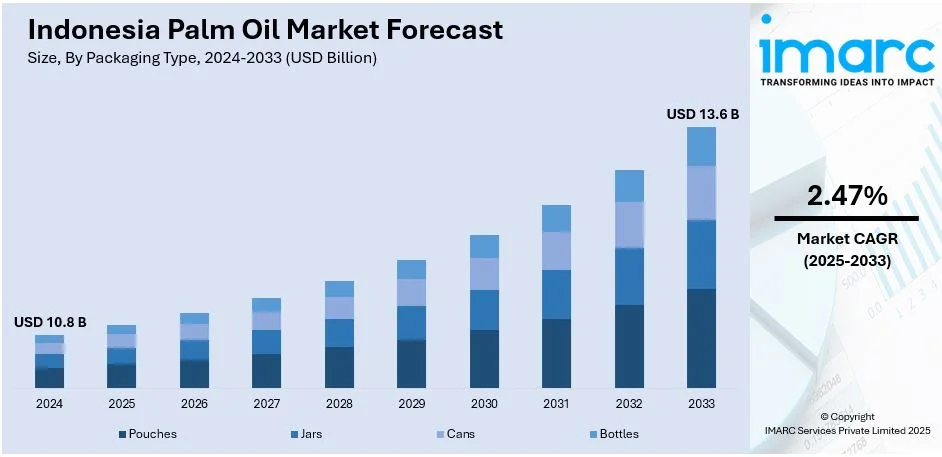

The Indonesia palm oil market size was valued at USD 10.8 Billion in 2024. The market is projected to reach USD 13.6 Billion by 2033, exhibiting a growth rate (CAGR) of 2.47% from 2025-2033. The market growth is attributed to the increasing demand for edible oils globally, the growing use in biodiesel production, low production costs, favorable climatic conditions, and government policies supporting exports.

Market Insights:

- Based on region, Sumatra is the largest market for palm oil production and consumption in Indonesia, benefiting from favorable climatic conditions and well-developed infrastructure.

- Based on packaging type, bottles dominate the palm oil market in Indonesia, preferred for their durability, convenience, and consumer preference.

- Based on packaging material, plastic remains the most preferred material for palm oil packaging due to its cost-effectiveness, versatility, and durability.

- Based on pack size, less than 1-liter packs are widely used by low-income households, while 1-liter packs are popular among the middle class.

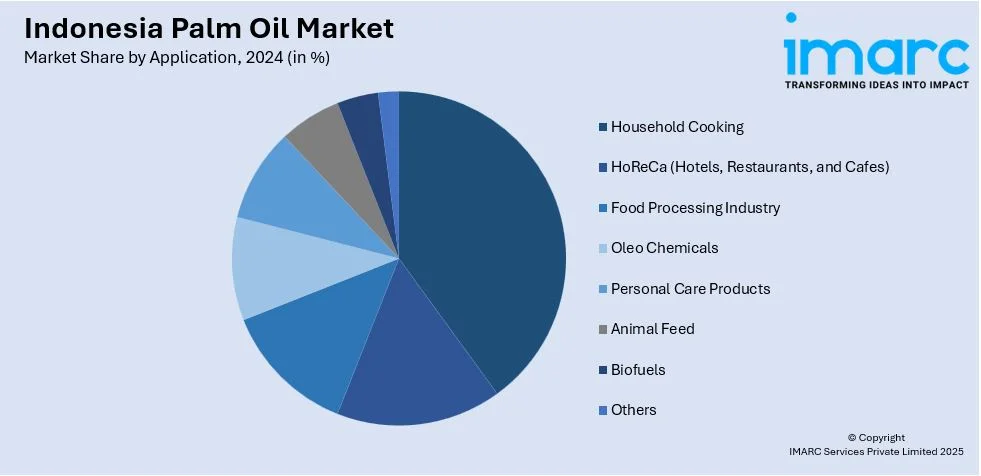

- Based on application, household cooking is the major segment, driven by affordability and versatility.

- Based on distribution channel, direct/institutional sales represent the largest channel, driven by high demand from food processing companies, hotels, and restaurants.

Market Size and Forecast:

- 2024 Market Size: USD 10.8 Billion

- 2033 Projected Market Size: USD 13.6 Billion

- CAGR (2025-2033): 2.47%

- Sumatra: Largest market in 2024

There has been an increasing Indonesian palm oil market share due to its expanding applications across industries and its integral role in the renewable energy transition. According to the United States Department of Agriculture Foreign Agricultural Service, as part of the diversification of energy sources, the GOI is placing significant emphasis on palm oil-based biodiesel. The important policy measure is to increase the biodiesel blending rate from 35% to 40% by 2025. This is expected to increase palm oil consumption by an estimated 1.9 Million Metric Tons, thereby strengthening domestic demand and reducing reliance on imported fossil fuels. By exploiting this significant reserve, GOI is going to improve energy security, greenhouse gas emissions, and rural economic development triggered through support extended to smallholder farmers who are the backbone of the palm oil sector.

To get more information on this market, Request Sample

In addition to energy, palm oil is still an indispensable commodity in the global food and non-food industries. A constant market is assured by its usage in all processed foods, cooking oils, personal care products, and industrial goods. Technological improvements such as high-yielding palm varieties, sustainable cultivation techniques, and digital tools for supply chain efficiency have improved productivity and profitability. Strategic infrastructure investments further strengthen the sector's resilience by improving connectivity between plantations and markets. Environmental challenges remain critical, international scrutiny over deforestation and biodiversity loss has motivated efforts to align with sustainability standards like RSPO certification. These measures mitigate ecological concerns and enhance Indonesia's reputation in global markets, ensuring the long-term viability of its palm oil industry and increasing the Indonesia palm oil demand amidst evolving economic and environmental landscapes.

Indonesia Palm Oil Market Trends:

Sustainability and certification push

The Indonesian palm oil market is experiencing a great push toward sustainability. Global consumers and businesses are continuing to give growing importance to environmental responsibility influencing the Indonesia palm oil market trend. Thus, producers are embracing certification schemes like the Roundtable on Sustainable Palm Oil (RSPO) and Indonesian Sustainable Palm Oil (ISPO), to ensure traceability, avoid deforestation, and strengthen labor standards. The provincial government has likewise promulgated policies to aid in sustainable production practices, which include replanting aging palms with more productive varieties. Buyers in the European Union and the United States are increasingly demanding certified palm oil, mainly due to their stringent sustainability requirements. This is part of a general trend toward achieving economic growth without harming the environment.

Growing Domestic Demand for Palm Oil

Indonesia's palm oil market is experiencing high domestic demand growth due to several government initiatives that seek to reduce reliance on imports and strengthen local industries. The government has actively promoted the consumption of palm oil-based alternatives in all consumer products such as cooking oil, cosmetics, and personal care items. The campaigns to encourage the use of palm oil derivatives in the food and beverage sector are further providing a boost to the Indonesia palm oil market share. According to the United States Department of Agriculture Foreign Agricultural Service, the palm oil food sector is likely to reach 7.1 MMT in 2024/25. It is projected to increase by 50,000 MT from 2023/24. This growth is consistent with the expansion of Indonesia's population and the persistent demand from the food services industry, which remains one of the biggest consumers of palm oil.

Digitalization and Technology Adoption

The use of technology in Indonesia's palm oil sector is accelerating due to the efficiency and transparency demands. Technologies such as remote sensing, drones, and artificial intelligence are being applied to monitor plantations, optimize yield, and detect illegal land use. Increasingly, blockchain is used to make tracing easier, aligning it with international standards. Startups and agritech companies are teaming up with producers to digitize supply chains, thus supporting smallholder farmers by enabling them to have mobile applications in crop management and market access. These innovations improve operational efficiency while helping the industry meet global demands for sustainability and ethical practice. As a result, these technological advancements are driving Indonesia palm oil market growth, ensuring its competitive edge in the global industry.

Government Support and Infrastructure Development

According to the Indonesia palm oil market analysis, the industry is witnessing a significant transformation due to increased government support and investments aimed at improving infrastructure and logistics within the sector. The government has made palm oil a key focus in its long-term agricultural development plans, creating policies that enhance plantation management, increase productivity, and offer smallholder farmers improved access to financing and technical assistance. Additionally, investments are being directed toward modernizing palm oil mills, upgrading transportation networks, and ensuring that palm oil exports meet stringent international quality standards. This push not only strengthens Indonesia’s position as the world’s largest palm oil exporter but also promotes the development of value-added products, such as biofuels and oleochemicals. By diversifying the applications of palm oil and improving industry efficiency, these efforts are making the sector more competitive and sustainable in the global market and creating a positive Indonesia palm oil market outlook.

Indonesia Palm Oil Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Indonesia palm oil market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on packaging type, packaging material, pack size, application, and distribution channel.

Analysis by Packaging Type:

- Pouches

- Jars

- Cans

- Bottles

The packaging segment in the palm oil market in Indonesia is dominated by bottles. These are preferred mainly due to their durability, convenience, and consumer preference. Widespread retail packaging of cooking oil with bottles provides ease of storage, handling, and precise portion control, making bottles a favorite choice for households as well as food service establishments. Flexibility in providing size options, from small bottles for individual consumers to larger ones for bulk buyers, is a factor that enhances appeal. Additionally, improvements in the bottle design that include ergonomic shape and spill-proof caps enhance the popularity of these bottles. Companies use bottles to brand and advertise their products, which are well-printed, colorful, and attractive. This also increases productivity and lowers the cost of production.

Analysis by Packaging Material:

- Metal

- Plastic

- Paper

- Others

Plastic is still the most preferred material for packaging palm oil due to its versatility, cost-effectiveness, and durability. Its lightweight nature makes transportation and handling easier, reducing logistics costs, which is crucial for the price-sensitive Indonesian market. Plastic's flexibility allows manufacturers to produce a variety of packaging formats, including bottles, pouches, and caps, catering to diverse consumer and industrial needs. Advances in recyclable and biodegradable plastics cater to the demand for sustainability issues. Plastic packaging is also an excellent choice to prevent contamination or oxidation of the palm oil itself, thereby reducing shelf life or quality deterioration. Moreover, its use allows the incorporation of tamper evident well as reseal ability features that instill consumer trust and convenience at the same time. With the surge in organized retail and increasing consumption of packaged palm oil, plastic continues to remain the dominant form of packaging material. According to the IMARC Group, the size of the Indonesian plastic packaging market is expected to grow at a CAGR of 2.7% from 2024 to 2032, due to the consistent demand for plastic-based packaging solutions across various industries, including palm oil. This growth underscores plastic's crucial role in meeting the increasing market demand and supporting the efficiency of the palm oil supply chain.

Analysis by Pack Size:

- Less than 1 Liter

- 1 Liter

- 1 Liter – 5 Liters

- 5 Liters – 10 Liters

- 10 Liters and Above

Less than 1-liter packs are widely used by low-income households and individuals with limited daily consumption needs, as they are cost-effective and handy. 1-liter packs are in high demand among Indonesia's middle class, projected to grow to 135 Million by 2030, as per the Food Export. It accommodates the daily cooking of the middle class by making available the right amount in a value-for-money package. The category of 1 liter to 5 liters has demand among middle-class families and small food businesses that belong to the rising purchasing power class. Medium-sized businesses, along with HoReCa operators and food processors, prefer 5-liter–10-liter pack sizes for high supply and cost savings. 10 liters and above pack sizes are preferred in wholesale purchases to cater to large-scale industries such as food processing, biofuels, and HoReCa for large volume demand.

Analysis by Application:

- Household Cooking

- HoReCa (Hotels, Restaurants, and Cafes)

- Food Processing Industry

- Oleo Chemicals

- Personal Care Products

- Animal Feed

- Biofuels

- Others

Household cooking is a major segment, driven by the affordability and versatility of palm oil, especially in middle-class households, which are growing significantly in size and purchasing power. The HoReCa sector relies majorly on palm oil for frying and cooking, as it is cost-effective and has high heat stability. Palm oil is considered an essential input in the food processing industry, such as snacks, bakery items, and confectionery. The personal care products segment, according to East Ventures, is currently at $7 Billion and expected to reach $10 Billion by 2027 with a strong annual growth rate of 10% and is increasingly using palm oil for its emollient properties in skincare and cosmetics. Animal feed manufacturers are benefiting from the cost-efficient fat content in palm oil, while the biofuels sector is expanding as governments promote renewable energy.

Analysis by Distribution Channel:

- Direct/Institutional Sales

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Direct and institutional sales represent the largest distribution channel for Indonesia palm oil market, driven by the high demand from food processing companies, hotels, restaurants, and catering services. Bulk buyers prefer this channel for its cost-effectiveness, as direct transactions eliminate intermediaries, reducing pricing volatility. Institutional sales also ensure a steady supply chain, which is critical for large-scale operations that rely on consistent quality and volume. Producers often establish long-term contracts with institutional clients to secure stable revenue streams. The direct distribution model allows manufacturers to provide customized solutions, such as bulk packaging or tailored blends, catering to specific industrial requirements. In addition, government and private partnerships often allow biodiesel producers and other industries dependent on palm oil derivatives to sell directly.

Regional Analysis:

Sumatra is the largest market for palm oil production and consumption in Indonesia. This is due to its strategic role as a key palm oil-producing region. The region benefits from fertile land, favorable climatic conditions, and extensive plantation areas, particularly in provinces like Riau, North Sumatra, and South Sumatra. Its well-developed infrastructure with ports like Dumai and Belawan supports an efficient export process, making Sumatra a major distribution center for its domestic market and for export. The growing population and urbanization within key cities like Medan and Pekanbaru, where palm oil is mainly used for the cooking and manufacturing of processed food industries, supplement local demand. Proximity to industrial hubs and biodiesel refineries also contributes to the increasing demand for raw palm oil and its derivatives. Government programs for improving smallholder productivity and sustainability also contribute to Sumatra's leadership, thus maintaining its top position in Indonesia's palm oil market.

Competitive Landscape:

To stay ahead of competitors, market players are driving significant activities across the spectrum of production, sustainability, and expansion in the global market. All efforts are underway to produce more yields from the land, using advanced agriculture practices and emerging technologies, aiming at increasing yield with a minimal ecological footprint. To meet increasing global demand and environmental challenges, market players invest in infrastructure improvements, such as modernizing processing facilities to boost efficiency and the quality of products. There is a growing momentum toward downstream product diversification, biodiesel, specialty chemicals, and other added-value products are being pursued. Further strengthening of Indonesia's palm oil sector is happening through collaborative efforts with government bodies and adherence to sustainability policies for economic growth alongside responding to expectations from the international market and higher environmental standards.

The report provides a comprehensive analysis of the competitive landscape in the Indonesia palm oil market with detailed profiles of all major companies, including:

- Asian Agri

- Astra Agro Lestari (Astra International)

- Bumitama Agri Ltd.

- Permata Group

- PT Dharma Satya Nusantara Tbk

- PT Salim Ivomas Pratama Tbk

- PT. Bakrie Sumatera Plantations Tbk (Bakrie Group)

- PT. Mahkota Group Tbk

Latest News and Developments:

- July 2025: AAK renewed its partnership with Musim Mas and Nestlé for the fourth consecutive year to support sustainable palm oil production in Indonesia. This collaboration, which began in 2021, focuses on training smallholder farmers and Village Extension Officers (VEOs) in sustainable practices and the No Deforestation, No Peat, No Exploitation (NDPE) principles, with plans to enroll an additional 500 smallholders in 2025, bringing the total to 1,750.

- July 2025: The Indonesian Palm Oil Association (IPOA) and the Indian Vegetable Oil Processors Association (IVPA) signed a three-year MoU to strengthen collaboration in the palm oil sector. The agreement aims to enhance sustainability, improve productivity, and ensure food security by stabilizing supply chains and supporting smallholder farmers. This partnership reflects their shared commitment to sustainable growth and addressing climate and food security challenges.

- July 2025: Indonesia transferred nearly 400,000 hectares of seized palm oil plantations to Agrinas Palma Nusantara, a fast-growing state palm oil company. This land, previously controlled by 232 companies and seized due to illegal operations in designated forest areas, will increase Agrinas' total plantation area to over 833,000 hectares. Agrinas is assessing the status of these plantations, with some 271,000 hectares deemed productive, while the rest require restoration.

- December 2024: Asian Agri distributed over US$147.24 in premiums to 40 cooperatives in Jambi, Indonesia, to 12,500 smallholders. This was a payment from the sale of certified sustainable palm oil. Asian Agri highlighted its sustainability and partnership commitments in the production of palm oil.

- November 2024: Indonesia unveiled plans to expand palm oil production to support its biodiesel growth, aiming to raise the mandatory biodiesel blend from 35% (B35) to 40% (B40) by 2025. This initiative seeks to lower fossil fuel reliance, enhance energy security, and support the palm oil sector.

- July 2024: The Indonesian Peasants Union (SPI) launched the SPI Oil Palm Plantation Cooperative in North Sumatra, aiming to advance agrarian reform and rural development. The cooperative, supported by government and agricultural institutions, promotes smallholder rejuvenation and enhances palm oil productivity.

- May 2024: Dabeeo launched an AI-powered palm oil farm monitoring project in Indonesia, covering 765 square kilometers, exceeding the size of Seoul. Partnering with Tunas Sawa Erma Group, the project utilizes advanced satellite imagery and AI to improve farm management, health assessments, and disease detection. This initiative enhances operational efficiency and supports the Indonesian palm oil industry’s growth.

- October 2023: Indonesia launched its first commercial flight utilizing palm oil-blended jet fuel, signifying an important achievement in its efforts to integrate palm oil into sustainable energy solutions. The fuel, a 2.4% palm oil blend, was produced by state energy company PT Pertamina. This initiative aligns with Indonesia's goal to reduce fossil fuel reliance and promote eco-friendly aviation practices.

Indonesia Palm Oil Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Types Covered | Pouches, Jars, Cans, Bottles |

| Packaging Materials Covered | Metal, Plastic, Paper, Others |

| Pack Sizes Covered | Less Than 1 Liters, 1 Liters, 1 Liters – 5 Liters, 5 Liters – 10 Liters, 10 Liters and Above |

| Applications Covered | Household Cooking, Horeca, Food Processing Industry, Oleo Chemicals, Personal Care Products, Animal Feed, Biofuels, Others |

| Distribution Channels Covered | Direct/institutional Sales, Supermarkets and Hypermarkets, Convenience Stores, Online, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Companies Covered | Asian Agri, Astra Agro Lestari (Astra International), Bumitama Agri Ltd., Permata Group, PT Dharma Satya Nusantara Tbk, PT Salim Ivomas Pratama Tbk, PT. Bakrie Sumatera Plantations Tbk (Bakrie Group), PT. Mahkota Group Tbk, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia palm oil market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Indonesia palm oil market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia palm oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Indonesia palm oil market was valued at USD 10.8 Billion in 2024.

IMARC estimates the Indonesia palm oil market to exhibit a CAGR of 2.47% during 2025-2033, reaching a value of USD 13.6 Billion by 2033.

Key factors driving the Indonesia palm oil market include strong domestic and global demand for palm oil, its use in food products, cosmetics, and biofuels. Indonesia’s favorable climate for large-scale palm plantations, government support for the industry, and growing export opportunities also contribute significantly to the market growth.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Sumatra currently dominates the market.

Some of the major players in the Indonesia palm oil market include Asian Agri, Astra Agro Lestari (Astra International), Bumitama Agri Ltd., Permata Group, PT Dharma Satya Nusantara Tbk, PT Salim Ivomas Pratama Tbk, PT. Bakrie Sumatera Plantations Tbk (Bakrie Group), PT. Mahkota Group Tbk, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)