Indonesia Oral Anti Diabetic Drug Market Size, Share, Trends and Forecast by Drugs, and Region, 2026-2034

Market Overview:

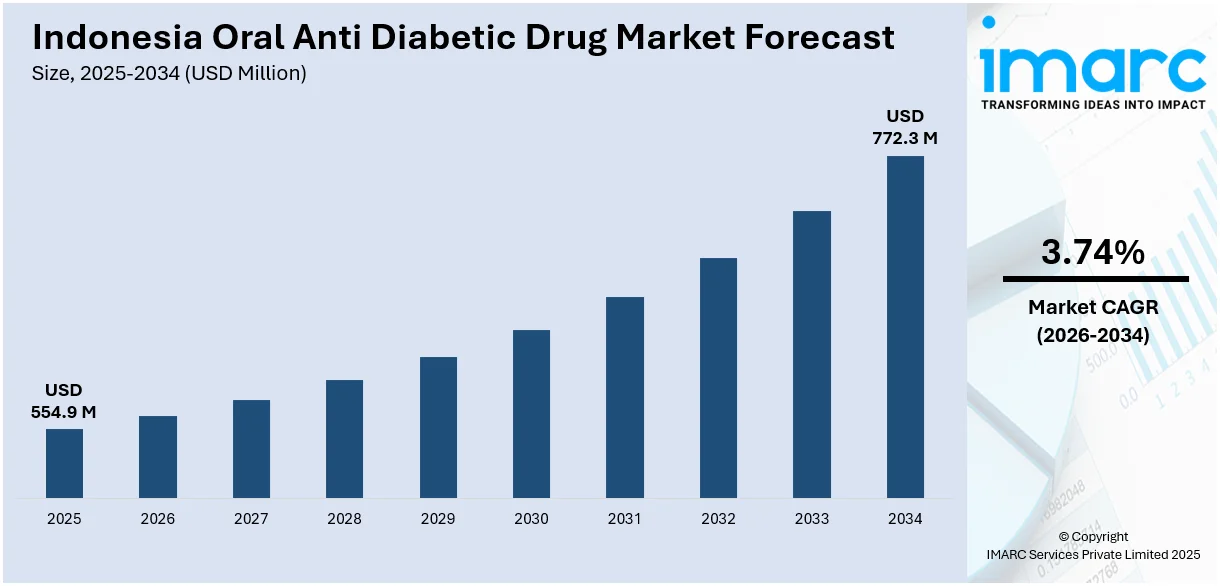

Indonesia oral anti diabetic drug market size reached USD 554.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 772.3 Million by 2034, exhibiting a growth rate (CAGR) of 3.74% during 2026-2034. The growing prevalence of diabetes among the masses, the implementation of favorable government initiatives and policies, rapid urbanization in the country and the developing healthcare infrastructure represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 554.9 Million |

|

Market Forecast in 2034

|

USD 772.3 Million |

| Market Growth Rate 2026-2034 | 3.74% |

Oral anti diabetic drug, commonly referred to as oral hypoglycemic agents, are pharmaceutical medications designed to manage and control high blood sugar levels in individuals diagnosed with diabetes. These drugs are administered orally in the form of tablets or capsules, offering a convenient and non-invasive approach to diabetes management. They play a pivotal role in the treatment of diabetes mellitus, a chronic metabolic disorder characterized by elevated blood glucose levels due to insufficient insulin production or ineffective utilization of insulin by the body. These drugs work through various mechanisms, including enhancing insulin secretion, increasing insulin sensitivity in target tissues, and reducing the absorption of glucose from the gastrointestinal tract. For instance, Sulfonylureas are one of the earliest classes of oral anti-diabetic drugs. They work by stimulating the pancreas to release more insulin, which helps lower blood sugar levels. Examples of sulfonylureas include glipizide, glyburide, and glimepiride. Additionally, there are thiazolidinediones (TZDs) that enhance insulin sensitivity in fat cells and alpha-glucosidase inhibitors that slow down the digestion and absorption of carbohydrates from the digestive tract.

To get more information on this market Request Sample

Indonesia Oral Anti Diabetic Drug Market Trends:

Indonesia is witnessing an increasing prevalence of diabetes in recent years. The country's changing lifestyle patterns, urbanization, and dietary habits have contributed to a higher incidence of diabetes. As a result, the demand for oral anti diabetic drugs has been on a steady rise to meet the needs of a growing diabetic population. In addition, the government of Indonesia has recognized the gravity of the diabetes epidemic and has launched initiatives aimed at improving diabetes management and access to healthcare services. These efforts include awareness campaigns, subsidized healthcare programs, and partnerships with pharmaceutical companies to provide affordable drugs to the population. Besides, the pharmaceutical industry in Indonesia is continually innovating in the formulation and development of oral anti diabetic drugs. This includes the creation of combination therapies that combine multiple drug classes to enhance their effectiveness in managing blood sugar levels. These advanced formulations provide physicians with more options for tailoring treatment plans to individual patient needs. Furthermore, healthcare providers in Indonesia are increasingly adopting a patient-centric approach to diabetes management. This approach emphasizes holistic care, including patient education, lifestyle modification guidance, and personalized treatment plans. Oral anti diabetic drugs are a crucial component of these plans, helping patients achieve better glycemic control. Furthermore, improvements in healthcare infrastructure and accessibility in Indonesia have expanded the reach of medical services to previously underserved areas. This has facilitated greater access to drugs for rural populations, ensuring that individuals across the country have access to essential medications for diabetes management.

Indonesia Oral Anti Diabetic Drug Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on drugs.

Drugs Insights:

Access the comprehensive market breakdown Request Sample

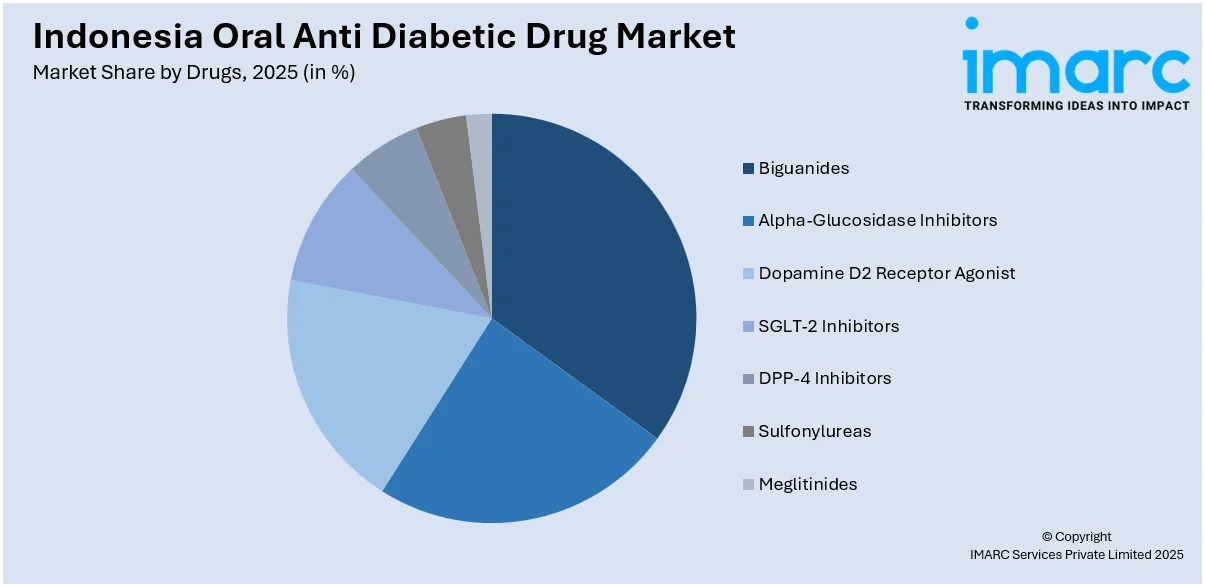

- Biguanides

- Metformin

- Alpha-Glucosidase Inhibitors

- Dopamine D2 Receptor Agonist

- Bromocriptin

- SGLT-2 Inhibitors

- Invokana (Canagliflozin)

- Jardiance (Empagliflozin)

- Farxiga/Forxiga (Dapagliflozin)

- Suglat (Ipragliflozin)

- DPP-4 Inhibitors

- Onglyza (Saxagliptin)

- Tradjenta (Linagliptin)

- Vipidia/Nesina (Alogliptin)

- Galvus (Vildagliptin)

- Sulfonylureas

- Meglitinides

The report has provided a detailed breakup and analysis of the market based on the drugs. This includes biguanides (metformin), alpha-glucosidase inhibitors, dopamine D2 receptor agonist (bromocriptin), SGLT-2 inhibitors (invokana (canagliflozin), jardiance (empagliflozin), farxiga/forxiga (dapagliflozin), and suglat (ipragliflozin)), DPP-4 inhibitors (onglyza (saxagliptin), tradjenta (linagliptin), vipidia/nesina(alogliptin), and galvus (vildagliptin)), sulfonylureas, and meglitinides.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Oral Anti Diabetic Drug Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Drugs Covered |

|

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia oral anti diabetic drug market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia oral anti diabetic drug market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia oral anti diabetic drug industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The oral anti diabetic drug market in Indonesia was valued at USD 554.9 Million in 2025.

The Indonesia oral anti diabetic drug market is projected to exhibit a CAGR of 3.74% during 2026-2034, reaching a value of USD 772.3 Million by 2034.

Rapid rise in diabetes prevalence, growing healthcare infrastructure, and improved diagnostic screening are key drivers. Increasing public awareness about diabetes management, expanding reimbursement coverage, and greater access to pharmacies and clinics contribute to stronger demand for oral anti-diabetic therapies across Indonesia.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)