Indonesia Motor Insurance Market Size, Share, Trends and Forecast by Insurance Type, Distribution Channel, and Region, 2026-2034

Market Overview:

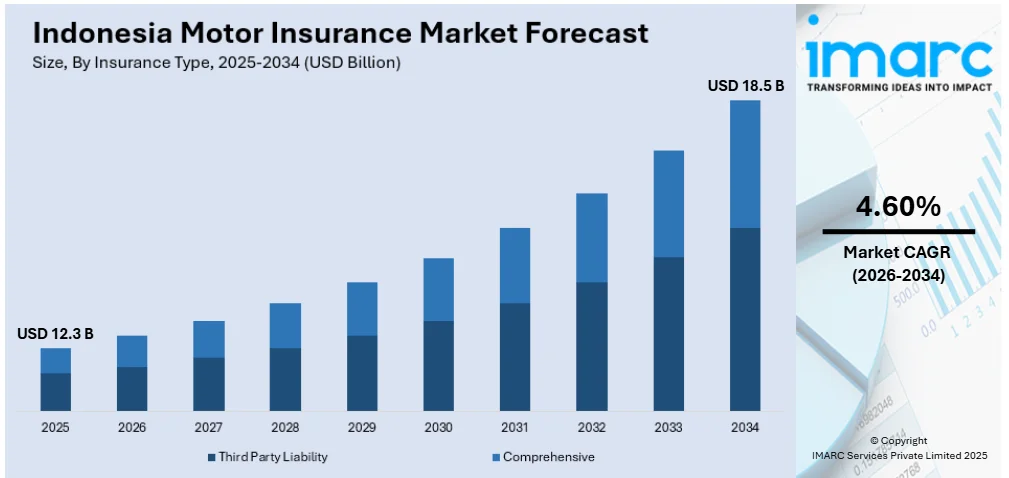

Indonesia motor insurance market size reached USD 12.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 18.5 Billion by 2034, exhibiting a growth rate (CAGR) of 4.60% during 2026-2034. The growing integration of telematics and the internet of things (IoT) into vehicles, rising prevalence of vehicle theft and vandalism, necessitating innovative anti-theft and security solution, and increasing demand for ridesharing services represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 12.3 Billion |

| Market Forecast in 2034 | USD 18.5 Billion |

| Market Growth Rate (2026-2034) | 4.60% |

Motor insurance, often known as auto insurance, is a contractual agreement between an individual or organization and an insurance company to provide financial protection against losses or damages arising from the operation of a motor vehicle. It comprises liability insurance, which covers the legal liability of the policyholder for bodily injury and property damage to third parties. It also consists of collision and comprehensive insurance, which covers damage to the insured vehicle caused by theft, vandalism, natural disasters, or hitting an animal. It includes personal injury protection (PIP) insurance, which provides coverage for medical expenses, lost wages, and other related costs in the event of an accident, regardless of fault. It can provide various coverages that can serve a specific purpose and can be tailored to individual needs. It requires a certain amount of premium payment, which is typically paid in regular installments, such as monthly or annually, and the amount is determined by various factors, including the model of the insured vehicle, the history of the driver, and the coverage chosen. Motor insurance policies can also be customized to suit individual needs and budgets, allowing individuals to select the coverage that best fits their specific circumstances.

To get more information on this market Request Sample

Indonesia Motor Insurance Market Trends:

At present, the increasing integration of telematics and the internet of things (IoT) into vehicles is allowing insurers to collect real-time data on driver behavior and vehicle performance, enabling more accurate risk assessment and personalized pricing models in Indonesia. Additionally, the rise of autonomous vehicles is driving the demand for comprehensive motor insurance as it introduces a new dimension of liability and risk distribution, prompting insurers to adapt and innovate. Regulatory pressures and consumer demand for eco-friendly options are increasing the popularity of electric vehicles (EVs), which present unique challenges and opportunities for insurers. Moreover, key market players are developing new coverage products tailored to the specific needs and risks associated with these emerging technologies while also aligning with the efforts to reduce carbon emissions. Besides this, the adoption of green practices, such as paperless policies and sustainable business operations, is becoming a competitive advantage and a driver of customer trust. In addition, the escalating demand for ridesharing services, putting pressure on insurers to adapt their coverage models to accommodate shared mobility, is supporting the market growth in the country. Apart from this, the rising prevalence of vehicle theft and vandalism, necessitating innovative anti-theft and security solutions, is strengthening the growth of the market. Furthermore, as modern individuals are increasingly seeking personalized, on-demand, and flexible insurance solutions, insurtech companies are providing digital platforms that streamline the purchase and claims processes and employing artificial intelligence (AI) for risk assessment.

Indonesia Motor Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on insurance type and distribution channel.

Insurance Type Insights:

- Third Party Liability

- Comprehensive

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes third party liability and comprehensive.

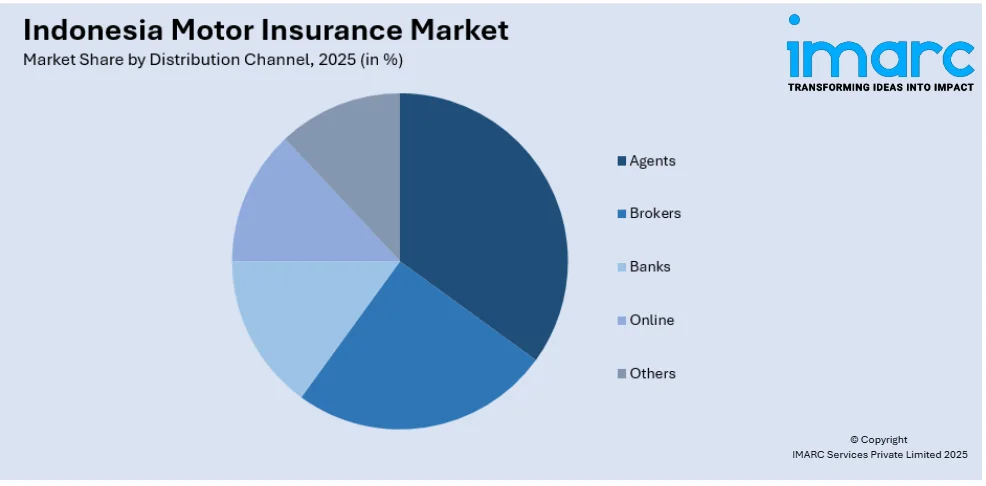

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Agents

- Brokers

- Banks

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes agents, brokers, banks, online, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Motor Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered | Third Party Liability, Comprehensive |

| Distribution Channels Covered | Agents, Brokers, Banks, Online, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia motor insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia motor insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia motor insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Indonesia motor insurance market was valued at USD 12.3 Billion in 2025.

The Indonesia motor insurance market is projected to exhibit a CAGR of 4.60% during 2026-2034, reaching a value of USD 18.5 Billion by 2034.

The Indonesia motor insurance market is driven by rising vehicle ownership, growing awareness about financial protection, and government efforts to promote insurance penetration. Urbanization, improved road infrastructure, and digital platforms offering easy policy access also support market growth, especially among younger consumers seeking convenience and comprehensive coverage options.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)