Indonesia Mobile Payments Market Size, Share, Trends and Forecast by Type, End User Industry, and Region, 2026-2034

Market Overview:

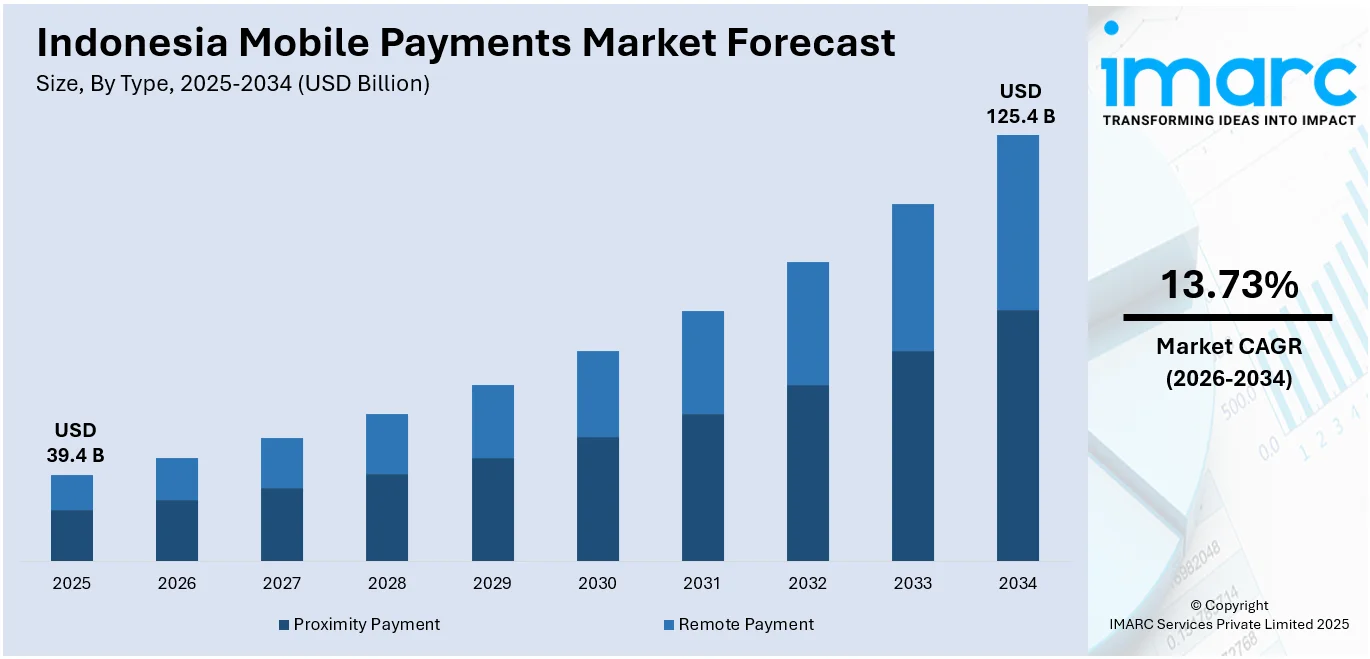

Indonesia mobile payments market size reached USD 39.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 125.4 Billion by 2034, exhibiting a growth rate (CAGR) of 13.73% during 2026-2034. Increasing smartphone penetration in the daily lives of individuals, rising government support for cashless transactions, the rise of e-commerce, the impact of the COVID-19 pandemic, partnerships with merchants, and rapid technological advancements are stimulating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 39.4 Billion |

| Market Forecast in 2034 | USD 125.4 Billion |

| Market Growth Rate (2026-2034) | 13.73% |

Mobile payments refer to the electronic transactions conducted via mobile devices, such as smartphones and tablets. It leverages the capabilities of mobile technology to facilitate seamless financial transactions. Mobile payments operate through various technologies, primarily relying on Near Field Communication (NFC), QR codes, or mobile wallets. The process typically involves a user linking their payment information, such as credit cards or bank accounts, to a mobile payment app or platform. When making a purchase, the user simply authorizes the payment through their mobile device, eliminating the need for physical cash or cards. Mobile payments have demonstrated their adaptability across diverse industries, effectively streamlining operations and enhancing user convenience. In the realm of retail and e-commerce, mobile payments have gained significant prominence as they empower customers to swiftly settle their bills through a quick tap or scan, significantly expediting the checkout process. Additionally, mobile payments are instrumental in the growth of the gig economy, enabling seamless transactions between consumers and service providers in sectors like ridesharing and food delivery. They offer a myriad of benefits, including unparalleled convenience by enabling users to make payments at any time while also diminishing the necessity for physical cash or cards. In terms of types, mobile payments can be categorized into three primary forms: contactless payments using near-field communication (NFC) technology, mobile wallet payments like Apple Pay and Google Pay, and QR code-based payments.

To get more information on this market Request Sample

Indonesia Mobile Payments Market Trends:

The Indonesia mobile payments market is influenced by several key drivers, such as the increasing penetration of smartphone in the daily lives of individuals in the country, which has significantly boosted the adoption of mobile payment solutions. Moreover, the government's initiatives to promote a cashless economy through regulatory support and digital infrastructure development are boosting the market growth. Furthermore, the increasing popularity of e-commerce platforms and the convenience they offer in terms of mobile payments are contributing to the market growth. Besides this, the COVID-19 pandemic has accelerated the shift toward contactless payments, with consumers opting for safer and more hygienic payment methods, which is fueling the market growth. Additionally, the rising awareness of financial inclusion and the growing middle-class population are contributing to the market's expansion. Apart from this, the partnerships between mobile payment providers and various merchants have further facilitated the adoption of digital payment methods, which is propelling the market growth. This is further supported by the continuous innovations and improvement in mobile payment technologies and security measures. Other factors, such as the ease of peer-to-peer transactions and the availability of various payment options that have made mobile payments, are providing a positive environment for the market growth across the country.

Indonesia Mobile Payments Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and end use industry.

Type Insights:

- Proximity Payment

- Remote Payment

The report has provided a detailed breakup and analysis of the market based on the type. This includes proximity payment and remote payment.

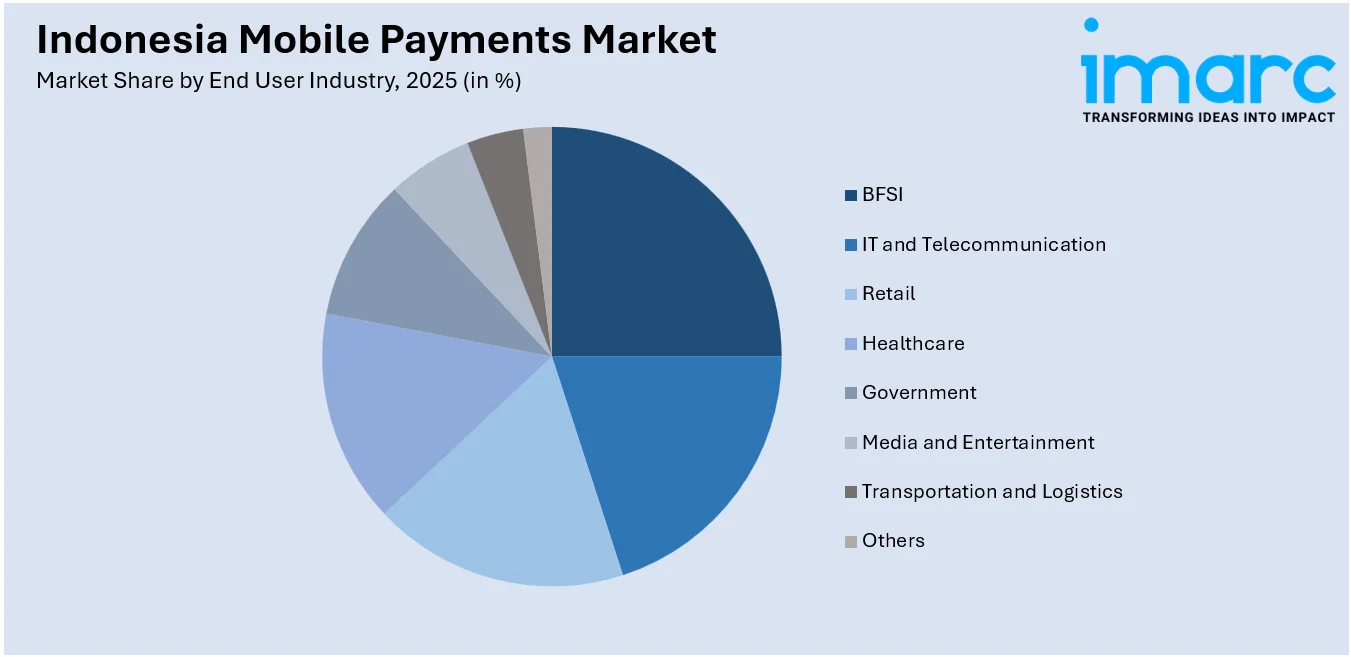

End User Industry Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- IT and Telecommunication

- Retail

- Healthcare

- Government

- Media and Entertainment

- Transportation and Logistics

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes BFSI, IT and telecommunication, retail, healthcare, government, media and entertainment, transportation and logistics and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- DANA Indonesia

- PT Fintek Karya Nusantara

- PT GoTo Gojek Tokopedia Tbk

- PT Nusa Satu Inti Artha (DOKU)

- PT. Veritra Sentosa Internasional

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Indonesia Mobile Payments Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Proximity Payment, Remote Payment |

| End User Industries Covered | BFSI, IT and Telecommunication, Retail, Healthcare, Government, Media and Entertainment, Transportation and Logistics, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Companies Covered | DANA Indonesia, PT Fintek Karya Nusantara, PT GoTo Gojek Tokopedia Tbk, PT Nusa Satu Inti Artha (DOKU), PT. Veritra Sentosa Internasional, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia mobile payments market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia mobile payments market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia mobile payments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The market in Indonesia was valued at USD 39.4 Billion in 2025.

The mobile payments market in Indonesia is projected to exhibit a CAGR of 13.73% during 2026-2034, reaching a value of USD 125.4 Billion by 2034.

Increasing smartphone penetration, rising government support for cashless transactions, the rise of e-commerce, the impact of the COVID-19 pandemic, partnerships with merchants, and rapid technological advancements are driving the Indonesia mobile payments market growth.

Some of the major players in the Indonesia mobile payments market include DANA Indonesia, PT Fintek Karya Nusantara, PT GoTo Gojek Tokopedia Tbk, PT Nusa Satu Inti Artha (DOKU), and PT Veritra Sentosa Internasional.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)