Indonesia Lubricants Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2026-2034

Market Overview:

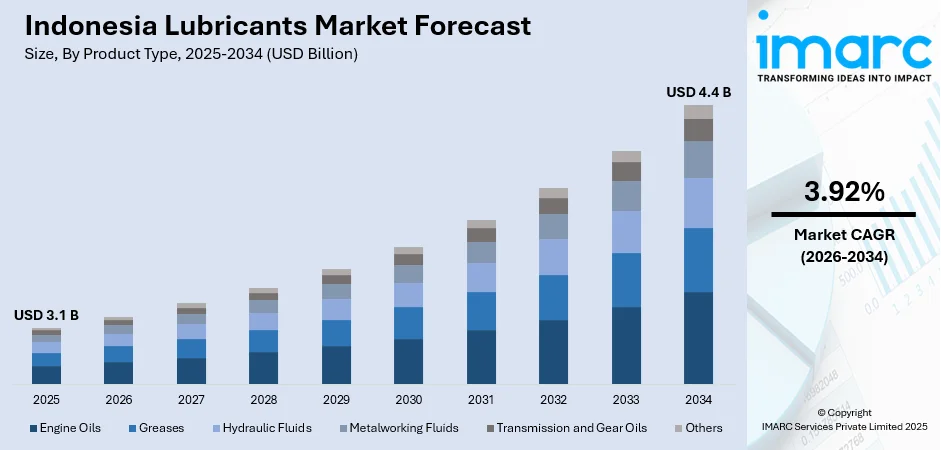

Indonesia lubricants market size reached USD 3.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.4 Billion by 2034, exhibiting a growth rate (CAGR) of 3.92% during 2026-2034. The growing industrial sector in Indonesia, surge in automotive sale and expanding vehicle fleet, rising number of major infrastructure projects, significant growth in the agriculture sector, and recent development of synthetic and bio-based lubricants represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3.1 Billion |

|

Market Forecast in 2034

|

USD 4.4 Billion |

| Market Growth Rate 2026-2034 | 3.92% |

Lubricants are substances designed to reduce friction, heat, and wear between moving surfaces in contact with each other. They are available in various forms, such as oils, greases, and dry powders. Lubricants are manufactured from base oils derived from petroleum, synthetic fluids, or water. They also contain additives to enhance properties like anti-wear, anti-corrosion, and heat resistance. Lubricants are widely used in diverse applications, such as automotive engines, industrial machinery, aerospace, and marine equipment. They are also employed in medical devices, food processing equipment, and household appliances. Lubricants aid in reducing friction and wear, extending equipment lifespan, and improving operational efficiency. In addition to this, they provide multiple advantages, such as better fuel economy, decreased downtime, reduced maintenance costs, improved safety, and environmental benefits.

Indonesia Lubricants Market Trends:

Growing Automotive Industry

One of the primary drivers of Indonesia's lubricants market is the rapidly expanding automotive sector. As Indonesia experiences rising vehicle ownership, fueled by a growing middle class and urbanization, the demand for automotive lubricants continues to increase. For instance, in August 2023, Automobili Lamborghini announced the renewal of the successful partnership with PT Pertamina Lubricants which will continue as the Official Technical Partner of Lamborghini Squadra Corse until 2025. The announcement was made during Indonesia’s largest automotive exhibition, the GAIKINDO Indonesia International Auto Show (GIIAS). Fastron will be the official lubricant for all Lamborghini motorsport cars between 2023 and 2025, including Lamborghini Super Trofeo, GT3 and LMDh races. Moreover, both passenger vehicles and commercial fleets, including trucks and motorcycles, require regular maintenance, boosting lubricant consumption. Additionally, the government’s push for infrastructure development has led to higher demand for commercial vehicles, which, in turn, increases the need for high-performance lubricants. The rise of electric vehicles (EVs) is also beginning to influence the market, as specialized lubricants are needed for EV transmissions and cooling systems.

To get more information on this market, Request Sample

Industrial Growth and Infrastructure Development

Indonesia's rapid industrialization and ongoing infrastructure projects are significantly boosting the demand for industrial lubricants which is expected to increase the overall Indonesia lubricants market share. Sectors such as manufacturing, mining, construction, and transportation rely heavily on machinery and equipment that require lubrication to ensure efficient operation and minimize downtime. The government's focus on infrastructure, including the construction of roads, airports, and power plants, is driving demand for high-quality industrial lubricants that can withstand harsh operating conditions. In addition, Indonesia’s expanding manufacturing base, particularly in sectors like textiles, chemicals, and food processing, requires specialized lubricants for smooth production processes. With the widespread adoption of automation and advanced machinery, there is growing demand for synthetic lubricants that offer superior protection, longer service life, and better performance in extreme conditions, further driving the market toward growth.

Rising Focus on Sustainability and Advanced Lubricant Solutions

As environmental regulations become stricter, there is a growing emphasis on developing eco-friendly and energy-efficient lubricants in Indonesia which is acting as one of the major factors driving the Indonesia lubricants market growth. The government’s commitment to reducing carbon emissions and promoting sustainability is pushing industries to adopt lubricants that contribute to lower energy consumption and reduced environmental impact. Manufacturers are increasingly focusing on bio-based and synthetic lubricants that offer enhanced performance while being environmentally sustainable. These lubricants not only extend machinery life but also help reduce energy consumption by minimizing friction and wear. Additionally, advancements in lubricant technology are allowing for the development of products with longer oil change intervals, which is particularly attractive to industrial and automotive customers seeking to reduce maintenance costs. The increasing awareness of the environmental impact of conventional lubricants and the shift toward green alternatives are expected to drive innovation and growth in Indonesia’s lubricant market.

Indonesia Lubricants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Engine Oils

- Greases

- Hydraulic Fluids

- Metalworking Fluids

- Transmission and Gear Oils

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes engine oils, greases, hydraulic fluids, metalworking fluids, transmission and gear oils, and others.

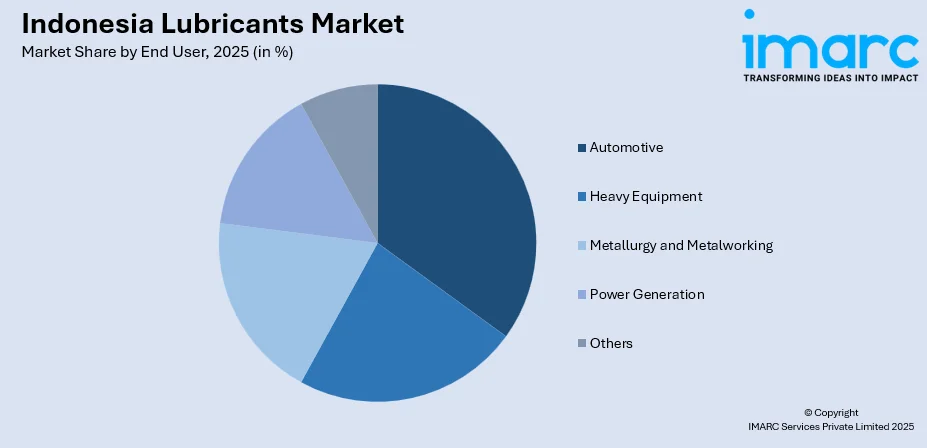

End User Insights:

- Automotive

- Heavy Equipment

- Metallurgy and Metalworking

- Power Generation

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes automotive, heavy equipment, metallurgy and metalworking, power generation, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- BP p.l.c.

- Chevron Corporation

- Exxon Mobil Corporation

- Fuchs Petrolub SE

- Idemitsu Kosan Co. Ltd.

- PT Pertamina

- Shell plc

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Indonesia Lubricants Market News:

- In May 2023, PT Pertamina Lubricants (PTPL), Pertamina's Commercial & Trading Subholding’s subsidiary, inaugurated the Lubricants Technology Center (LTC). LTC is the largest lubricant research and innovation center in Indonesia, located in Plumpang, North Jakarta. Covering an area of 12,500 m², LTC is equipped with modern facilities and a team of professional human resources to fulfill the lubricant needs in the Indonesian market and 14 countries worldwide, including Australia, Thailand, and South Africa.

- In February 2024, PT TotalEnergies Marketing Indonesia announced the launch of its renowned ELF lubricant brand in the Indonesian automotive aftermarket. The launch took place during the Indonesia International Motor Show (IIMS) 2024 in Jakarta, one of the country’s biggest annual automotive shows in Indonesia.

- In March 2024, Shell Indonesia announced plans to establish its inaugural grease manufacturing plant (GMP) in the country, set to increase the capabilities of its existing Marunda Lubricants Oil Blending Plant (LOBP) in Bekasi, Indonesia. Situated within the Marunda Lubricants Oil Blending Plant (LOBP) complex in Bekasi, the addition of this plant follows the November 2022 expansion of the LOBP, which doubled its lubricant production capacity to 300 million liters annually, up from 136 million liters.

Indonesia Lubricants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Engine Oils, Greases, Hydraulic Fluids, Metalworking Fluids, Transmission and Gear Oils, Others |

| End Users Covered | Automotive, Heavy Equipment, Metallurgy and Metalworking, Power Generation, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Companies Covered | BP p.l.c., Chevron Corporation, Exxon Mobil Corporation, Fuchs Petrolub SE, Idemitsu Kosan Co. Ltd., PT Pertamina, Shell plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia lubricants market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia lubricants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia lubricants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The market in Indonesia was valued at USD 3.1 Billion in 2025.

The lubricants market in Indonesia is projected to exhibit a CAGR of 3.92% during 2026-2034, reaching a value of USD 4.4 Billion by 2034.

The growing industrial sector, surge in automotive sales and expanding vehicle fleet, rising number of major infrastructure projects, significant growth in agriculture, and recent development of synthetic and bio-based lubricants are driving the market growth.

Some of the major players in the lubricants market in Indonesia include BP p.l.c., Chevron Corporation, Exxon Mobil Corporation, Fuchs Petrolub SE, Idemitsu Kosan Co. Ltd., PT Pertamina, and Shell plc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)