Indonesia Life & Non-Life Insurance Market Size, Share, Trends and Forecast by Insurance Type, Distribution Channel, and Region, 2026-2034

Market Overview:

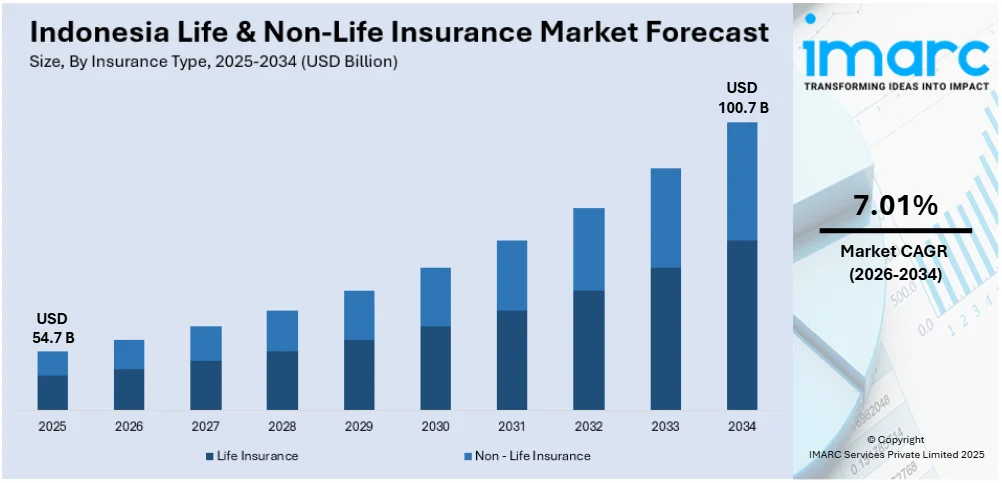

Indonesia life & non-life Insurance market size reached USD 54.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 100.7 Billion by 2034, exhibiting a growth rate (CAGR) of 7.01% during 2026-2034. The increasing government support, the rising urbanization level, the growing awareness of catastrophe risks, the growth of microinsurance, the escalating demand for health insurance, the expanding e-commerce industry, and the changing regulatory landscape are some of the factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 54.7 Billion |

| Market Forecast in 2034 | USD 100.7 Billion |

| Market Growth Rate (2026-2034) | 7.01% |

Life and non-life insurance, or general insurance, are two broad categories within the insurance industry, each serving distinct purposes. Life insurance provides financial protection and support to individuals and their families in the event of the policyholder's death. It is a contract between the insured and the insurance company, where the insurer agrees to pay the beneficiaries a specified sum (the death benefit) upon the insured's death. Life insurance policies can also include additional features, such as savings or investment components, offering financial planning. Common types of life insurance include term life insurance, whole life insurance, and universal life insurance. On the other hand, non-life insurance, or general insurance, covers a wide range of risks other than those associated with human life. It provides financial protection against unforeseen events, such as accidents, property damage, liability, and health-related issues. Common types of non-life insurance include auto insurance, homeowners insurance, health insurance, travel insurance, and business insurance. Unlike long-term life insurance, which provides a payout upon a specific event (death), non-life insurance typically covers a specific period. It provides financial compensation for covered losses or liabilities during that period. Life insurance provides financial protection in the event of the insured's death, with additional features for long-term financial planning. Non-life insurance, on the other hand, encompasses a variety of policies that protect against financial losses arising from specific events, excluding those related to human life. Both types of insurance play crucial roles in managing risks and providing financial security in different aspects of individuals' and businesses' lives.

To get more information on this market Request Sample

Indonesia Life & Non-Life Insurance Market Trends:

The market in Indonesia is majorly driven by the increasing awareness of insurance products. In line with this, the country has witnessed steady economic growth, leading to an expanding middle class with greater disposable income. As individuals and businesses accumulate wealth, there is a rising recognition of the need for financial protection. Life insurance products, in particular, become attractive as tools for wealth preservation, estate planning, and securing dependents' financial futures. Furthermore, the country's large and youthful population is a driving force in the insurance market. With a sizable working-age population, there is a growing awareness of the importance of life and health insurance. Additionally, as the population ages, there is an increasing demand for insurance products that cater to retirement planning and healthcare needs. Moreover, there has been a concerted effort by insurers and the government to raise awareness about the importance of insurance. Educational campaigns and outreach programs have contributed to changing attitudes toward insurance, emphasizing its role in risk mitigation and financial security. Besides, the government has implemented policies to encourage the growth of the insurance sector. Regulatory frameworks that promote innovation, consumer protection, and increased competition have created a conducive environment for insurers to expand their offerings and reach a broader market. The adoption of digital technologies has transformed the insurance landscape. Insurtech solutions, such as online platforms and mobile applications, have made insurance products more accessible and user-friendly. This has particularly resonated with the tech-savvy younger generation. Ongoing infrastructure development in Indonesia has led to increased investments in various sectors. This has created a demand for insurance products to cover infrastructure projects, construction, and transportation risks. Indonesian insurers are exploring partnerships and collaborations with international insurance providers, bringing global expertise and expanding the range of available insurance products. This, in turn, offers numerous opportunities for the market.

Indonesia Life & Non-Life Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on insurance type and distribution channel.

Insurance Type Insights:

- Life Insurance

- Individual

- Group

- Non - Life Insurance

- Home

- Motor

- Health

- Rest of Non-Life Insurance

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes life insurance (individual and group) and non - life insurance (home, motor, health, and rest of non-life insurance).

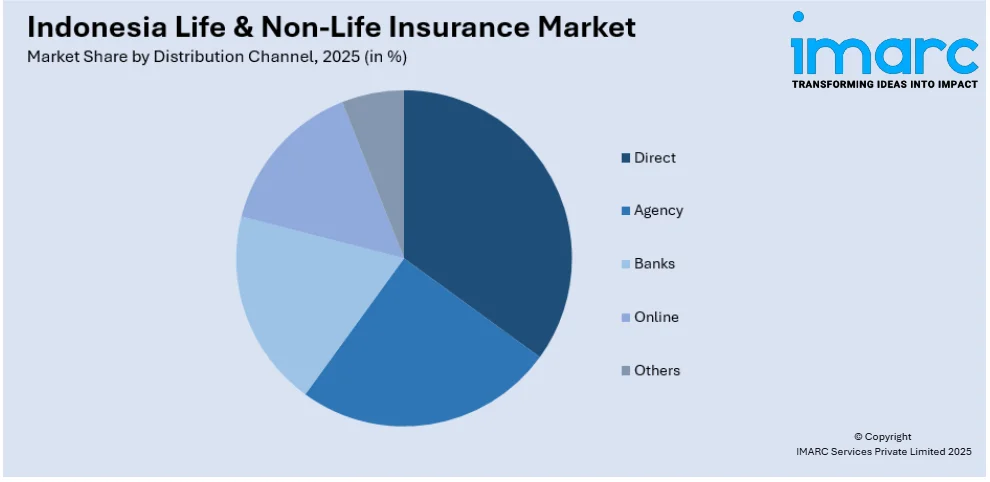

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct

- Agency

- Banks

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes direct, agency, banks, online, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Great Eastern Holdings Limited (OCBC Bank)

- PT Asuransi Tokio Marine Indonesia (Tokio Marine Holdings Inc.)

- PT Bank Negara Indonesia (Persero) Tbk

- PT. Asuransi Jasa Indonesia

- PT. Asuransi Reliance Indonesia

- PT. Fistlight Indonesia

- PT. KB Insurance Indonesia

- The Chubb Corporation

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Indonesia Life & Non-Life Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered |

|

| Distribution Channels Covered | Direct, Agency, Banks, Online, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Companies Covered | Great Eastern Holdings Limited (OCBC Bank), PT Asuransi Tokio Marine Indonesia (Tokio Marine Holdings Inc.), PT Bank Negara Indonesia (Persero) Tbk, PT. Asuransi Jasa Indonesia, PT. Asuransi Reliance Indonesia, PT. Fistlight Indonesia, PT. KB Insurance Indonesia, The Chubb Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia life & non-life insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia life & non-life insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia life & non-life insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Indonesia life & non-life insurance market size reached USD 54.7 Billion in 2025.

The Indonesia life & non-life insurance market is expected to reach USD 100.7 Billion by 2034, exhibiting a CAGR of 7.01% during 2026-2034.

The Indonesia life & non-life insurance market growth is supported by rising awareness about insurance benefits, increasing disposable income, digital transformation in the insurance sector, and supportive regulatory reforms.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)